Current Report Filing (8-k)

November 01 2022 - 4:32PM

Edgar (US Regulatory)

0001166003FALSE00011660032022-10-312022-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 31, 2022

XPO LOGISTICS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

Delaware | | 001-32172 | | 03-0450326 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer

Identification No.) |

Five American Lane, Greenwich, Connecticut 06831

(Address of principal executive offices)

(855) 976-6951

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading

symbol(s) | Name of each exchange on which registered |

| Common stock, par value $0.001 per share | XPO | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Introductory Note

This Current Report on Form 8-K is being filed in connection with the closing on November 1, 2022 at 12:01 a.m. Eastern Time of the previously announced separation (the “Separation”) of the tech-enabled brokered transportation platform of XPO Logistics, Inc. (“XPO” or the “company”) from the company’s less-than-truckload transportation segment and European transportation business. The Separation was effected by the transfer of the company’s North American truck brokerage business, as well as its services for managed transportation, last mile and freight forwarding, from the company to RXO, Inc. (“RXO”) and the distribution of all of the outstanding shares of RXO common stock to the company’s stockholders (the “Distribution”). The company’s stockholders of record as of the close of business on October 20, 2022 (the “Record Date”) received one share of RXO common stock for every one share of the company’s common stock held as of the Record Date. The company did not issue fractional shares of RXO common stock in the Distribution.

As a result of the Distribution, RXO is now an independent public company trading under the symbol “RXO” on the New York Stock Exchange.

Item 1.01. Entry into a Material Definitive Agreement.

In connection with the Distribution, the company entered into several agreements with RXO that govern the relationship of the parties following the Distribution, including a Separation and Distribution Agreement, a Transition Services Agreement, a Tax Matters Agreement and an Employee Matters Agreement (each entered into on October 31, 2022), and an Intellectual Property License Agreement (entered into on October 24, 2022, as disclosed in the company’s Current Report on Form 8-K filed with the Securities and Exchange Commission (“SEC”) on October 25, 2022).

A summary of the material terms of the Separation and Distribution Agreement, Transition Services Agreement, Tax Matters Agreement and Employee Matters Agreement can be found in the section entitled “Certain Relationships and Related Party Transactions” in the Information Statement, dated October 17, 2022, furnished as Exhibit 99.1 to the company’s Current Report on Form 8-K filed with the SEC on October 20, 2022, which summary is incorporated herein by reference. The summary is qualified in its entirety by reference to the Separation and Distribution Agreement, Transition Services Agreement, Tax Matters Agreement and Employee Matters Agreement filed as Exhibits 2.1, 10.1, 10.2, and 10.3, respectively, to this Current Report on Form 8-K, each of which is incorporated herein by reference.

Item 2.01. Completion of Acquisition or Disposition of Assets.

The disclosure set forth in the “Introductory Note” above is incorporated by reference into this Item 2.01.

A copy of the press release issued by the company on November 1, 2022 announcing the completion of the Separation and the Distribution is filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Resignation and Appointment of Directors and Officers

As previously announced by the company, effective as of the completion of the Distribution, AnnaMaria DeSalva, Adrian Kingshott and Mary Kissel resigned from the company’s board of directors and joined the board of directors of RXO, and Bella Allaire, Mario Harik and Irene Moshouris were each appointed as a director of the company. In addition, as previously announced by the company, Mario Harik was appointed chief executive officer of the company and Brad Jacobs was appointed executive chairman of the company’s board of directors, each effective as of the completion of the Distribution.

Certain Equity Award Modifications

Contingent upon and effective as of the completion of the Distribution, the outstanding performance-based restricted stock unit (“PSU”) awards granted in both 2018 and 2019 to each of Brad Jacobs, Mario Harik and Troy Cooper were modified by converting the 2018 PSU award and 2019 PSU award held by each individual into a single time-based vesting restricted stock unit (“RSU”) award. For Brad Jacobs and Mario Harik (i) the RSU award vests on December 31, 2024 generally subject to continued employment by the executive (or in the case of Brad Jacobs, continued service on the company’s board of directors) through the vesting date and (ii) the after-tax shares received upon settlement of the RSU awards are subject to a lock up which prohibits transfers of such shares through December 31, 2025. For Troy Cooper, the RSU award vests upon the completion of the Distribution and the lock up is through December 31, 2024.

Item 9.01. Financial Statements and Exhibits.

(b) Pro Forma Financial Information

The unaudited pro forma consolidated financial information of the company giving effect to the Separation and the Distribution, including the unaudited pro forma combined balance sheet as of June 30, 2022 and the unaudited pro forma combined statement of operations for the six months ended June 30, 2022 and the years ended December 31, 2021, 2020 and 2019, are attached hereto as Exhibit 99.2 and incorporated herein by reference.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 2.1 | | |

| 10.1 | | |

| 10.2 | | |

| 10.3 | | |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this Current Report on Form 8-K to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Date: November 1, 2022 | XPO LOGISTICS, INC. |

| | |

| By: | /s/ Ravi Tulsyan |

| | Ravi Tulsyan |

| | Chief Financial Officer |

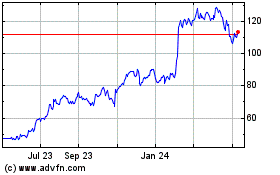

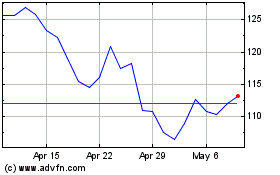

XPO (NYSE:XPO)

Historical Stock Chart

From Aug 2024 to Sep 2024

XPO (NYSE:XPO)

Historical Stock Chart

From Sep 2023 to Sep 2024