Condor Energies Inc. (“Condor” or the “Company”) (TSX:CDR), a

Canadian based, internationally focused energy transition company

focused on Central Asia is pleased to announce the release of its

unaudited interim condensed consolidated financial statements for

the three and nine months ended September 30, 2024 together with

the related management’s discussion and analysis. These documents

will be made available under Condor’s profile on SEDAR+ at

www.sedarplus.ca and on the Condor website at

www.condorenergies.ca. Readers are invited to review the latest

corporate presentation available on the Condor website. All

financial amounts in this news release are presented in Canadian

dollars, unless otherwise stated.

HIGHLIGHTS

- Production in

Uzbekistan for the third quarter of 2024 averaged 10,010 boe/d

comprised of 58,638 Mcf/d (9,773 boe/d) of natural gas and 237 bopd

of condensate.

- In June 2024, the

Company initiated a multi-well workover campaign on the eight

gas-condensate fields it operates in Uzbekistan. A second workover

rig began operations in late October 2024.

- Production in

Uzbekistan for the past seven days from November 5, 2024 through

November 11, 2024 has averaged 10,706 boe/d due to continued

workover successes and the partial commissioning of the first

in-field flowline water separation system in early November.

- Uzbekistan gas and

condensate sales for the third quarter of 2024 was $19.14

million.

- In July 2024,

Condor signed its first LNG Framework Agreement for the production

and utilization of liquefied natural gas (“LNG”) to fuel

Kazakhstan’s rail locomotives.

- In August 2024, the

Company received a second natural gas allocation in Kazakhstan to

be used as feed gas for the Company’s second modular LNG production

facility.

MESSAGE FROM CONDOR’S CEO

Don Streu, President and CEO of Condor

commented: “We are very excited by the positive impacts the early

workover and optimization activities are making on production

volumes and revenue streams. During the third quarter, production

averaged 10,010 boe/d and we estimate the baseline production rate

could have been approximately 2,800 boe/d lower without the success

of our program, which is more than offsetting the natural reservoir

production declines. We’ve started to realize production increases

due to continued workover successes and the partial commissioning

of the first in-field flowline water separator system.

Our workover inventory is continuously

expanding, and the two workover rigs will continue perforating

newly identified, non-depleted and bypassed pay intervals, while

also installing artificial lift equipment. This program is a very

capital-efficient means of growing production. Preliminary results

from our reprocessed 3D seismic data are providing higher vertical

and lateral seismic resolutions that should allow us to more

accurately characterize the reservoirs and identify new targets in

preparation for a 2025 infill drilling program.

In addition, we will increase the number of

in-field flowline water separation systems in the coming

months.

In parallel with our production enhancement

activities, we’ve implemented our safety culture through ongoing

employee and contractor training which has resulted in zero lost

time incidents since the start of the project.

Finally, we are very honored to have been

invited to present the Company’s energy transition initiatives at

the 2024 United Nations Climate Change Conference (“COP29”) that

will convene from November 11 to 22, 2024 in Baku, Azerbaijan. At

COP29, we’ll highlight some of the technological advances and

operating innovations we are implementing to increase the

sustainability of low carbon fuels as a responsible and stable

bridge for the energy transition to net-zero energy.”

Production in Uzbekistan

Production for the third quarter of 2024

averaged 10,010 boe/d, comprised of 58,638 Mcf/d (9,773 boe/d) of

natural gas and 237 bopd of condensate, despite production being

restricted in August for 4 days due to downstream infrastructure

maintenance at non-Company operated facilities. Since assuming

operations on March 1, 2024, the Company has been able to flatten

the natural production decline rates, which previously exceeded

twenty percent annually.

In late June 2024, the Company initiated a

multi-well workover campaign for the eight fields which includes

installing proven artificial lift equipment, perforating newly

identified pay intervals, performing downhole stimulation

treatments, and installing new production tubing. Based on early

successes, a second workover rig was contracted and began operating

in late October 2024.

In early November 2024, the Company partially

commissioned Uzbekistan’s first in-field flowline water separation

system which separates water from the gas streams at the field

gathering network rather than at the production facility. This

reduces pipeline flow pressure that can lead to higher reservoir

flow rates. Additional separation units have been ordered and will

be installed in the coming months. The existing pipeline and

facilities infrastructure are also being evaluated to optimize

water-handling, determine long term field compression requirements,

and to enhance in-field gathering networks. Production during the

past seven days from November 5, 2024 to November 11, 2024 has

averaged 10,706 boe/d due to continued workover successes and the

partial commissioning of the first in-field flowline water

separator.

Extensive geological evaluations that have been

performed, coupled with recent workover results, suggest that

material untapped hydrocarbon potential exists within the carbonate

formations of the Company’s 279 km2 license area. These carbonate

platforms contain thick reservoir sections interbedded with

laterally extensive evaporite layers, creating ideal conditions for

hydrocarbon trapping. The reservoirs are analogous to carbonate

formations in Canada’s Western Canada Sedimentary Basin, such as

Charlie Lake and Midale, which continue to be successfully

monetized. By leveraging this geological similarity, the Company is

maturing the potential of horizontal and multi-lateral drilling, a

proven method in Canada to enhance deliverability and maximize

recovery from these reservoirs. The Company is also reprocessing

previously acquired 3-D seismic data and integrating preliminary

results into these evaluations, with plans to conduct infill

drilling and well deepening programs commencing in 2025.

LNG in Kazakhstan

Condor is planning to develop Kazakhstan’s first

LNG facilities and produce, distribute, and sell LNG to offset

industrial diesel usage. LNG applications include rail locomotives,

long-haul truck fleets, marine vessels, mining equipment, municipal

bus fleets, agricultural machinery, and other heavy equipment and

machinery with high-horsepower engines. These applications have all

successfully used LNG fuel in other Countries.

In August 2024, the Company received a second

natural gas allocation in Kazakhstan to be used as feed gas for the

Company’s second modular LNG production facility that will be

located near the Kuryk Port on the Caspian Sea. This second gas

allocation will supply the Company’s planned Kuryk LNG facility

which will produce the energy-equivalent volume of 565,000 litres

of diesel fuel per day and is sufficient to power 155 mainline rail

locomotives. When combined with the first gas allocation disclosed

in January 2024 for the Alga LNG facility, the total LNG fuel

produced will have an energy-equivalent volume of over one million

litres of diesel daily, while also reducing CO2 emissions

equivalent to removing more than 38,000 cars from the road

annually.

In July 2024, the Company signed its first LNG

Framework Agreement (the “Framework Agreement”) for the production

and utilization of LNG to fuel Kazakhstan’s rail locomotives. The

Framework Agreement was also signed by Kazakhstan Temir Zholy

National Company JSC (“KTZ”), the national railway operator of

Kazakhstan and Wabtec Corporation (“Wabtec”) (NYSE: WAB), a U.S.

based locomotive manufacturer with existing facilities in

Kazakhstan. KTZ and Wabtec previously signed a memorandum of

understanding which includes modernization work to retrofit KTZ’s

mainline locomotive fleet for LNG usage and incorporate LNG into

new-build locomotives. The Framework Agreement introduces Condor

into this locomotive fleet modernization strategy as the supplier

and distributor of the LNG.

The Framework Agreement also provides a detailed

framework whereby the three parties will coordinate efforts to

ensure that Condor’s LNG production volumes coincide with the

delivery of new and converted LNG-powered rail locomotives from

Wabtec. A working group comprised of members from each of the

parties is responsible to identify and monitor the key performance

indicators associated with this initiative.

The Framework Agreement is critical to supplying

a stable, economic and more environmentally friendly fuel source

for the Transcaspian International Transport Route (“TITR”)

expansion, which is currently the shortest, fastest and most

geopolitically secure transit corridor for moving freight between

Asia and Europe. The Government of Kazakhstan and KTZ are making

significant investments in TITR infrastructure, including expanding

the rail network, constructing a new dry port at the Kazakhstan –

China border, and increasing the container-handling capacities at

various Caspian Sea ports.

The planned first modular LNG facility will be

constructed near the town of Alga and produce 120,000 metric tons

of LNG annually, which is the energy equivalent volume of 450,000

litres of diesel per day. Phase 1 of the first facility is

currently scheduled to commence LNG production in the second half

of 2026. The Company is also advancing project funding

alternatives.

Lithium License in

Kazakhstan

The Company holds a 100% working interest in the

contiguous 37,300-hectare area which provides the subsurface

exploration rights for solid minerals for a six-year term (the

“Lithium License”). Given its strategic access to Asian and

European lithium markets, this region is ideally suited for the

rapid deployment of emerging Direct Lithium Extraction (“DLE”)

technologies to generate lithium for EV batteries and other

electricity storage applications.

The initial development plan for the Lithium

License includes drilling and testing two wells to verify

deliverability rates, confirm the lateral extension and

concentrations of lithium in the tested and untested intervals,

conduct preliminary engineering for the production facilities, and

prepare a mineral resources or mineral reserves report compliant

with National Instrument 43-101 Standards of Disclosure for Mineral

Projects.

RESULTS OF OPERATIONS

|

Production

|

|

|

For the three months ended September 30 |

2024 |

|

|

2023 |

|

|

Change |

|

|

|

Natural gas (Mcf) |

|

|

|

|

|

|

|

|

|

|

Uzbekistan |

5,394,729 |

|

|

- |

|

|

5,394,729 |

|

|

|

Türkiye |

5,929 |

|

|

6,021 |

|

|

(92 |

) |

|

|

|

5,400,658 |

|

|

6,021 |

|

|

5,394,637 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Condensate (barrels) |

|

|

|

|

|

|

|

|

|

|

Uzbekistan |

21,771 |

|

|

- |

|

|

21,771 |

|

|

|

Türkiye |

- |

|

|

- |

|

|

- |

|

|

|

|

21,771 |

|

|

- |

|

|

21,771 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the nine months ended September 30 |

|

|

|

|

|

|

|

|

|

|

Natural gas (Mcf) |

|

|

|

|

|

|

|

|

|

|

Uzbekistan |

12,794,678 |

|

|

- |

|

|

12,794,678 |

|

|

|

Türkiye |

27,324 |

|

|

33,564 |

|

|

(6,240 |

) |

|

|

|

12,822,002 |

|

|

33,564 |

|

|

12,788,438 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Condensate (barrels) |

|

|

|

|

|

|

|

|

|

|

Uzbekistan |

49,845 |

|

|

- |

|

|

49,845 |

|

|

|

Türkiye |

- |

|

|

10 |

|

|

(10 |

) |

|

|

|

49,845 |

|

|

10 |

|

|

49,835 |

|

|

|

|

Operating Netback – Uzbekistan

|

2024 Operating netback –

Uzbekistan1,2($000’s) |

Natural Gas |

|

Q1 |

|

Q2 |

|

Q3 |

|

Total2 |

|

|

Natural gas sales |

6,565 |

|

17,420 |

|

17,419 |

|

41,404 |

|

|

Royalties |

(1,203 |

) |

(3,186 |

) |

(3,215 |

) |

(7,604 |

) |

|

Production costs |

(2,288 |

) |

(7,394 |

) |

(7,394 |

) |

(17,076 |

) |

|

Transportation and selling |

(228 |

) |

(619 |

) |

(625 |

) |

(1,472 |

) |

|

Operating netback 1,2 |

2,846 |

|

6,221 |

|

6,185 |

|

15,252 |

|

|

|

Condensate |

|

Condensate sales |

647 |

|

1,534 |

|

1,717 |

|

3,898 |

|

|

Royalties |

(128 |

) |

(304 |

) |

(339 |

) |

(771 |

) |

|

Production costs |

(37 |

) |

(141 |

) |

(146 |

) |

(324 |

) |

|

Transportation and selling |

(3 |

) |

(7 |

) |

(9 |

) |

(19 |

) |

|

Operating netback 1,2 |

479 |

|

1,082 |

|

1,223 |

|

2,784 |

|

| |

- Operating netback is a non-GAAP

measure and is a term with no standardized meaning as prescribed by

GAAP and may not be comparable with similar measures presented by

other issuers. See “Non-GAAP Financial Measures” in this news

release. The calculation of operating netback is aligned with the

definition found in the Canadian Oil and Gas Evaluation

Handbook.

- Amounts are only presented for the

Uzbekistan segment.

|

| |

NON-GAAP FINANCIAL MEASURES

The Company refers to “operating netback” in

this news release, a term with no standardized meaning as

prescribed by GAAP and which may not be comparable with similar

measures presented by other issuers. This additional information

should not be considered in isolation or as a substitute for

measures prepared in accordance with GAAP. Operating netback is

calculated as sales less royalties, production costs and

transportation and selling on a dollar basis and divided by the

sales volume for the period on a per Mcf basis for natural gas and

per boe basis for condensate. This non-GAAP measure is commonly

used in the oil and gas industry to assist in measuring operating

performance against prior periods on a comparable basis and has

been presented to provide an additional measure to analyze the

Company’s sales on a per unit basis and the Company’s ability to

generate funds.

BARRELS OF OIL EQUIVALENT ADVISORY

References herein to barrels of oil equivalent

(“boe”) are derived by converting gas to oil in the ratio of six

thousand standard cubic feet (“Mcf”) of gas to one barrel of oil

based on an energy conversion method primarily applicable at the

burner tip and does not represent a value equivalency at the

wellhead. Given the value ratio based on the current price of crude

oil as compared to natural gas is significantly different from the

energy equivalency of 6 Mcf to 1 barrel, utilizing a conversion

ratio at 6 Mcf to 1 barrel may be misleading as an indication of

value, particularly if used in isolation.

FORWARD-LOOKING STATEMENTS

Certain statements in this news release

constitute forward-looking statements under applicable securities

legislation. Such statements are generally identifiable by the

terminology used, such as “expect”, “plan”, “estimate”, “may”,

“will”, “should”, “could”, “would”, “increase”, “introduce”,

“provide”, “generate”, “envision”, “apply”, “include”, “conduct”,

“prepare”, “require”, “continue”, “reduce”, or other similar

wording. Forward-looking information in this news release includes,

but is not limited to, information concerning: the timing and

ability to execute the Company’s growth and sustainability

strategies including the financing for these growth and

sustainability strategies; the timing and ability to operate and

increase production and overall recovery rates at eight gas fields

in Uzbekistan; the timing and ability to increase domestic gas

supply and contribute to carbon emissions reductions; the timing

and ability to conduct production enhancement services, produce

natural gas and realize domestic gas sales proceeds; the timing and

ability to increase production by implementing artificial lift,

workover and drilling programs; the timing and ability to estimate

the baseline production rate and offset the natural reservoir

production declines; the timing and ability to continue perforating

newly identified, non-depleted and bypassed pay intervals; the

timing and ability to increase the sustainability of low carbon

fuels as a responsible and stable bridge for the energy transition

to net-zero energy; the timing and ability to increase the number

of in-field flowline water separation systems; the timing and

ability to investigate deeper horizons; the timing and ability to

reprocess 3-D seismic data and conduct a 3-D seismic program; the

timing and ability to collect reservoir and production data; the

timing and ability to evaluate existing pipeline and facilities

infrastructure for optimization of water handling, field

compression and the in-field gathering network; the timing and

ability of the Company to conduct infill drilling and well

deepening programs in 2025; the timing and ability to provide

production guidance; the timing and ability to use the two natural

gas allocations from the Government of Kazakhstan as feed gas for

the Company’s modular LNG production facilities; the timing and

ability to liquefy the gas to produce LNG; the timing and ability

to fuel LNG powered rail locomotives and large mine haul trucks;

the timing and ability to contribute to carbon emissions reductions

by displacing diesel fuel usage; the timing and ability to conduct

detailed engineering; the timing and ability to confirm LNG volume

commitments with end-users; the Company’s expectations in respect

of the future uses of LNG; the timing and ability to obtain funding

and proceed with construction of LNG production facilities; the

sufficiency of the second natural gas allocation to power mainline

rail locomotives; the potential for the Lithium License area to

contain commercial deposits; future lithium testing results; the

material untapped hydrocarbon potential in the carbonate formations

of the Company’s license area; the timing and ability to fund,

permit and complete planned activities including drilling two

additional wells and conduct preliminary engineering for the

production facilities; the timing and ability to optimize the

planned method for direct lithium extraction; the timing and

ability to generate a report in compliance with National Instrument

43-101 Standards of Disclosure for Mineral Projects; the timing and

ability to produce the lithium by utilizing closed-looped DLE

production technologies; the timing and ability to have a much

smaller environmental footprint than existing lithium production

operations; the timing and ability to commence exploration mining

activities to evaluate the potential for commercial lithium brine

deposits; projections and timing with respect to natural gas and

condensate production; expected markets, prices and costs for

future gas and condensate sales; the timing and ability to obtain

various approvals and conduct the Company’s planned exploration and

development activities; the timing and ability to access natural

gas pipelines; the timing and ability to access domestic and export

sales markets; anticipated capital expenditures; forecasted capital

and operating budgets and cashflows; anticipated working capital;

sources and availability of financing for potential budgeting

shortfalls; the timing and ability to obtain future funding on

favourable terms, if at all; general business strategies and

objectives; the timing and ability to obtain exploration contract,

production contract and operating license extensions; the potential

for additional contractual work commitments; the ability to meet

and fund the contractual work commitments; the satisfaction of the

work commitments; the results of non-fulfilment of work

commitments; projections relating to the adequacy of the Company’s

provision for taxes; the expected impacts of adopting amendments to

IFRS accounting policies; and treatment under governmental

regulatory regimes and tax laws.

This news release also includes forward-looking

information regarding health risk management including, but not

limited to: travel restrictions including shelter in place orders,

curfews and lockdowns which may impact the timing and ability of

Company personnel, suppliers and contractors to travel

internationally, travel domestically and to access or deliver

services, goods and equipment to the fields of operation; the risk

of shutting in or reducing production due to travel restrictions,

Government orders, crew illness, and the availability of goods,

works and essential services for the fields of operations;

decreases in the demand for oil and gas; decreases in natural gas,

condensate and crude oil prices; potential for gas pipeline or

sales market interruptions; the risk of changes to foreign currency

controls, availability of foreign currencies, availability of hard

currency, and currency controls or banking restrictions which

restrict or prevent the repatriation of funds from or to foreign

jurisdiction in which the Company operates; the Company’s financial

condition, results of operations and cashflows; access to capital

and borrowings to fund operations and new business projects; the

timing and ability to meet financial and other reporting deadlines;

and the inherent increased risk of information technology failures

and cyber-attacks.

By its very nature, such forward-looking

information requires Condor to make assumptions that may not

materialize or that may not be accurate. Forward-looking

information is subject to known and unknown risks and uncertainties

and other factors, which may cause actual results, levels of

activity and achievements to differ materially from those expressed

or implied by such information. Such risks and uncertainties

include, but are not limited to: regulatory changes; the timing of

regulatory approvals; the risk that actual minimum work programs

will exceed the initially estimated amounts; the results of

exploration and development drilling and related activities; prior

lithium testing results may not be indicative of future testing

results or actual results; imprecision of reserves estimates and

ultimate recovery of reserves; the effectiveness of lithium mining

and production methods including DLE technology; historical

production and testing rates may not be indicative of future

production rates, capabilities or ultimate recovery; the historical

composition and quality of oil and gas may not be indicative of

future composition and quality; general economic, market and

business conditions; industry capacity; uncertainty related to

marketing and transportation; competitive action by other

companies; fluctuations in oil and natural gas prices; the effects

of weather and climate conditions; fluctuation in interest rates

and foreign currency exchange rates; the ability of suppliers to

meet commitments; actions by governmental authorities, including

increases in taxes; decisions or approvals of administrative

tribunals and the possibility that government policies or laws may

change or government approvals may be delayed or withheld; changes

in environmental and other regulations; risks associated with oil

and gas operations, both domestic and international; international

political events; and other factors, many of which are beyond the

control of Condor. Capital expenditures may be affected by cost

pressures associated with new capital projects, including labour

and material supply, project management, drilling rig rates and

availability, and seismic costs.

These risk factors are discussed in greater

detail in filings made by Condor with Canadian securities

regulatory authorities including the Company’s Annual Information

Form, which may be accessed through the SEDAR+ website

(www.sedarplus.ca).

Readers are cautioned that the foregoing list of

important factors affecting forward-looking information is not

exhaustive. The forward-looking information contained in this news

release are made as of the date of this news release and, except as

required by applicable law, Condor does not undertake any

obligation to update publicly or to revise any of the included

forward-looking information, whether as a result of new

information, future events or otherwise. The forward-looking

information contained in this news release is expressly qualified

by this cautionary statement.

ABBREVIATIONS

The following is a summary of abbreviations used in this news

release:

|

3-D |

Three dimensional |

|

Mcf |

Thousands of standard cubic feet |

|

Mcf/D |

Thousands of standard cubic feet per day |

|

boe |

Barrels of oil equivalent |

|

boe/d |

Barrels of oil equivalent per day |

|

bopd |

Barrels of oil per day |

|

CAD |

Canadian Dollars |

|

USD |

United States Dollars |

|

LNG |

Liquefied Natural Gas |

|

DLE |

Direct Lithium Extraction |

|

EV |

Electric Vehicle |

|

|

The TSX does not accept responsibility

for the adequacy or accuracy of this news release.

For further information, please contact Don Streu, President and

CEO or Sandy Quilty, Vice President of Finance and CFO at

403-201-9694.

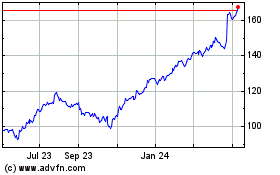

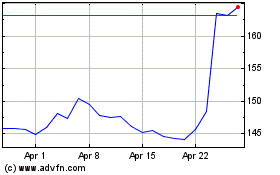

Wabtec (NYSE:WAB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Wabtec (NYSE:WAB)

Historical Stock Chart

From Dec 2023 to Dec 2024