Vishay Intertechnology Prices Offering of $600 Million of 2.25% Convertible Senior Notes

June 08 2018 - 12:18AM

Vishay Intertechnology, Inc. (NYSE:VSH) today announced the pricing

of its offering of $600 million aggregate principal amount of

2.25% convertible senior notes due 2025 in a private placement to

qualified institutional buyers pursuant to Rule 144A under the

Securities Act of 1933, as amended. The base size of the offering

was increased from the previously announced $525 million in

aggregate principal amount to $600 million, and there will be no

option for the initial purchasers to purchase additional notes. The

sale is expected to close on June 12, 2018, subject to customary

closing conditions.

The notes will be Vishay’s general unsecured obligations and

subordinated in right of payment to Vishay’s senior secured debt,

including amounts borrowed under its senior secured credit

facility. Interest will be payable on the notes semi-annually at a

rate of 2.25% per annum on June 15 and December 15 of each year,

beginning on December 15, 2018. The notes will mature on June 15,

2025, unless earlier converted or repurchased. The notes will be

convertible, subject to certain conditions, into cash, shares of

Vishay’s common stock or a combination thereof, at Vishay’s

election, at an initial conversion rate of 31.7536 shares of common

stock per $1,000 principal amount of notes. This represents an

initial conversion price of approximately $31.49 per share. This

initial conversion price represents a premium of 27.5% to the last

reported sale price of Vishay’s common stock on The New York Stock

Exchange on June 7, 2018, which was $24.70 per share.

Vishay may not redeem the notes prior to maturity and no

“sinking fund” is provided for the notes. If Vishay undergoes a

“fundamental change,” holders of the notes may require Vishay to

repurchase all or any portion of their notes at a repurchase price

equal to 100% of the principal amount of the notes to be

repurchased, plus accrued and unpaid interest. Vishay will pay cash

or, in certain circumstances, stock or a combination of cash and

stock, for all notes so repurchased. In addition, upon certain

corporate transactions, Vishay will, under certain circumstances,

increase the conversion rate for holders who convert notes in

connection with such corporate transactions.

The sale of the notes is expected to result in approximately

$584 million in net proceeds to Vishay after deducting the initial

purchasers’ discount and estimated offering expenses payable by

Vishay. Concurrently with this offering, in separate transactions,

Vishay intends to use all of the net proceeds from this offering to

repurchase $220 million aggregate principal amount of its existing

2.25% convertible senior debentures due 2040 and $69 million

aggregate principal amount of its existing 2.25% convertible senior

debentures due 2042 through individually negotiated agreements with

a limited number of holders of such outstanding debentures.

This announcement is neither an offer to sell nor a solicitation

of an offer to buy any of these securities and shall not constitute

an offer, solicitation or sale in any jurisdiction in which such

offer, solicitation or sale is unlawful. The notes and any shares

of Vishay’s common stock that may be issued upon conversion of the

notes have not been, and will not be, registered under the

Securities Act of 1933, as amended, or any state securities laws

and may not be offered or sold in the United States absent

registration or an applicable exemption from, or in a transaction

not subject to, the registration requirements of the Securities Act

and other applicable securities laws.

Forward-Looking Statements

This press release contains certain forward-looking statements

that are subject to known and unknown risks and uncertainties that

could cause actual results to differ materially from those

expressed or implied by such statements. Such risks and

uncertainties include, but are not limited to, whether or not

Vishay consummates the offering and the fact that the anticipated

use of the proceeds of the offering and any purchases of Vishay’s

outstanding debentures could change as a result of market

conditions or for other reasons. Vishay does not undertake any

obligation to publicly update any forward-looking statements to

reflect events or circumstances occurring after the date of this

press release.

CONTACT: Vishay Intertechnology, Inc. Peter Henrici Senior Vice

President, Corporate Communications +1-610-644-1300

Vishay Intertechnology (NYSE:VSH)

Historical Stock Chart

From Oct 2024 to Nov 2024

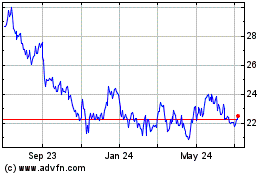

Vishay Intertechnology (NYSE:VSH)

Historical Stock Chart

From Nov 2023 to Nov 2024