- 2023 Revenue Covenant tied to percentage of Company’s annual

operating plan and substantially waived if Company raises $15

million of new funding

- Liquidity Covenant reduced to $5 Million

- Option to pay a portion of loan interest “in kind” to provide

additional flexibility

Vapotherm, Inc. (NYSE: VAPO), (“Vapotherm” or the “Company”), a

global medical technology company focused on the development and

commercialization of its proprietary Vapotherm high velocity

therapy® products, which are used to treat patients of all ages

suffering from respiratory distress, today announced that, on

November 21, 2022, the Company entered into Amendment No. 3 to its

Loan and Security Agreement (the “Third Amendment,” with SLR

Investment Corp. (“SLR”), as Collateral Agent, and the lenders

party thereto.

“We appreciate SLR’s continued confidence in the strength of our

business as we continue our drive towards profitability and

growth,” said Joseph Army, President and CEO. “This amendment will

provide additional balance sheet flexibility, allow us to be

patient as we consider the need for additional capital, and ease

concerns about our ability to meet our loan covenants.”

Third Amendment to the Loan and Security Agreement

In February 2022, the Company entered into its Loan and Security

Agreement (the “Loan and Security Agreement”), which provided the

Company with a term A loan facility (the “Term A Loan Facility”) of

$100 million, funded at closing, and a term B loan facility of $25

million (the “Term B Loan Facility”), available in 2023 upon the

achievement of a revenue milestone. The Loan and Security Agreement

matures on February 1, 2027 (the “Maturity Date”).

In October 2022, the Company amended its Loan and Security

Agreement. The Second Amendment included the modification of the

Company’s minimum revenue covenant for the remainder of 2022, the

addition of a minimum liquidity covenant equal to $20 million, the

Replacement of LIBOR with the Secured Overnight Financing Rate, an

increase of the exit fee from 6.95% to 7.45% of the aggregate

principal amount of the Amended Loan and Security Agreement, which

is payable at the earliest of (i) the Maturity Date, and (ii)

Prepayment of the Amended Loan and Security Agreement, elimination

of the Term B Loan Facility and its related facility fee equal to

$225,000, and a reset of the exercise price of warrants to purchase

107,373 shares of the Company’s common stock issued to the lenders

on February 18, 2022 in connection with the Term A Loan Facility

funding to a new exercise price of $1.63 per share.

On November 21, 2022 (the “Effective Date”), the Company entered

into the Third Amendment, which includes:

- A reduction in the Company’s minimum liquidity covenant to $5

million from $20 million;

- A modification of the Company’s minimum revenue covenant for

2023;

- The introduction of, at the Borrower’s option and subject to a

monthly election by the 20th of the month prior to each payment

date on the 1st of each month, the ability to PIK monthly interest

(the “PIK Amount”) in an amount equal to up to 8%, in increments of

1.00%, for 2023 only (PIK option to extend through 2024 at the sole

discretion of SLR);

- In conjunction with the introduction of the PIK, a PIK Fee

equal to 10% of the PIK Amount, and payable upon the earlier of (a)

any Prepayment Date and (b) the Maturity Date;

- In conjunction with the introduction of the PIK, additional

Warrants equal to 5% of each PIK Amount (5% times the PIK Amount

divided by the exercise price), with the Strike Price equal to the

lower of the Borrower’s closing stock price for (a) the 10-day

trailing average closing price ending on the day before the PIK

date and (b) the day before the PIK date, and;

- A reset of the exercise price of outstanding warrants to

purchase 107,373 shares of the Company’s common stock issued to the

lenders on February 18, 2022 in connection with the Term A Loan

Facility funding to the lower of (a) the 10-day trailing average

closing price of the day before the Amendment Closing Date and (b)

the day before Amendment Closing Date.

Website Information

Vapotherm routinely posts important information for investors on

the Investor Relations section of its website,

http://investors.vapotherm.com/. Vapotherm intends to use this

website as a means of disclosing material, non-public information

and for complying with Vapotherm’s disclosure obligations under

Regulation FD. Accordingly, investors should monitor the Investor

Relations section of Vapotherm’s website, in addition to following

Vapotherm’s press releases, Securities and Exchange Commission

filings, public conference calls, presentations and webcasts. The

information contained on, or that may be accessed through,

Vapotherm’s website is not incorporated by reference into, and is

not a part of, this document.

About Vapotherm

Vapotherm, Inc. (NYSE: VAPO) is a publicly traded developer and

manufacturer of advanced respiratory technology based in Exeter,

New Hampshire, USA. The Company develops innovative, comfortable,

non-invasive technologies for respiratory support of patients with

chronic or acute breathing disorders. Over 3.6 million patients

have been treated with the use of Vapotherm high velocity therapy®

systems. For more information, visit www.vapotherm.com.

Vapotherm high velocity therapy is mask-free noninvasive

ventilatory support and is a front-line tool for relieving

respiratory distress—including hypercapnia, hypoxemia, and dyspnea.

It allows for the fast, safe treatment of undifferentiated

respiratory distress with one tool. The Precision Flow system’s

mask-free interface delivers optimally conditioned breathing gases,

making it comfortable for patients and reducing the risks and care

complexities associated with mask therapies. While being treated,

patients can talk, eat, drink and take oral medication.

Legal Notice Regarding Forward-Looking Statements

This press release contains forward-looking statements under the

Private Securities Litigation Reform Act of 1995, including

statements about the strength of the Company’s business, its

profitability, its growth, the Company’s ability to add flexibility

to its balance sheet, its ability to raise additional capital, and

the Company’s ability to meet its loan covenants In some cases, you

can identify forward-looking statements by terms such as

‘‘expect,’’ “continue,” “plan,” “intend,” “will,” “outlook,”

“guidance,” or “typically,” or the negative of these terms or other

similar expressions, although not all forward-looking statements

contain these words, and the use of future dates. Each

forward-looking statement is subject to risks and uncertainties

that could cause actual results to differ materially from those

expressed or implied in such statement. Applicable risks and

uncertainties include, but are not limited to the following:

Vapotherm has incurred losses in the past and may be unable to

achieve or sustain profitability in the future or achieve its 2022

financial guidance; risks associated with the move of its

manufacturing operations to Mexico; Vapotherm’s ability to raise

additional capital to fund its existing commercial operations,

develop and commercialize new products, and expand its operations;

Vapotherm’s ability to comply with its $20 million minimum cash

covenant, execute on its path-to-profitability initiative, convert

$20 million of excess inventory into cash, fund its business

through 2023 and get it to Adjusted EBITDA positive in the fourth

quarter of 2023; Vapotherm’s dependence on sales generated from its

Precision Flow systems, competition from multi-national

corporations who have significantly greater resources than

Vapotherm and are more established in the respiratory market; the

ability for Precision Flow systems to gain increased market

acceptance; Vapotherm’s inexperience directly marketing and selling

its products; the potential loss of one or more suppliers and

dependence on its new third party manufacturer; Vapotherm’s

susceptibility to seasonal fluctuations; Vapotherm’s failure to

comply with applicable United States and foreign regulatory

requirements; the failure to obtain U.S. Food and Drug

Administration or other regulatory authorization to market and sell

future products or its inability to secure, maintain or enforce

patent or other intellectual property protection for its products;

the impact of the COVID-19 pandemic on its business, including its

supply chain, and the other risks and uncertainties included under

the heading “Risk Factors” in Vapotherm’s Annual Report on Form

10-K for the fiscal year ended December 31, 2021, as filed with the

Securities and Exchange Commission on February 24, 2022 and

Vapotherm’s most recent Quarterly Report on Form 10-Q for the

quarter ended September 30, 2022 as filed with the Securities and

Exchange Commission on November 2, 2022, and in any subsequent

filings with the Securities and Exchange Commission. The

forward-looking statements contained in this press release reflect

Vapotherm’s views as of the date hereof, and Vapotherm does not

assume and specifically disclaims any obligation to update any

forward-looking statements whether as a result of new information,

future events or otherwise, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221122005321/en/

Investor Relations Contacts: Mark Klausner or Mike

Vallie, Westwicke, an ICR Company, ir@vtherm.com, +1 (603) 658-0011

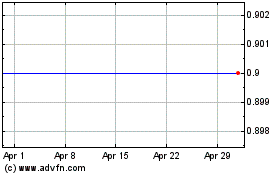

Vapotherm (NYSE:VAPO)

Historical Stock Chart

From Aug 2024 to Sep 2024

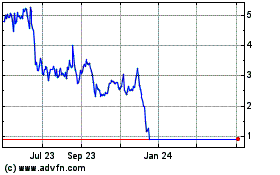

Vapotherm (NYSE:VAPO)

Historical Stock Chart

From Sep 2023 to Sep 2024