0000077543false00000775432024-11-062024-11-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): November 6, 2024

Tutor Perini Corporation

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | |

| Massachusetts | 1-6314 | 04-1717070 |

(State or Other Jurisdiction

of Incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

15901 Olden Street, Sylmar, California 91342-1093

(Address of Principal Executive Offices, and Zip Code)

(818) 362-8391

(Registrant’s Telephone Number, Including Area Code)

None

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $1.00 par value | TPC | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| | | | | | | | |

| Emerging growth company | | ☐ |

| | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | | ☐ |

Item 2.02. Results of Operations and Financial Condition

On November 6, 2024 Tutor Perini Corporation issued a press release announcing its financial results for the quarter ended September 30, 2024. A copy of that press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information in this Current Report on Form 8-K, including Exhibit 99.1 hereto, is being furnished to the Securities and Exchange Commission and shall not be deemed “filed” for any purpose, including for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of such section. The information in this Current Report on Form 8-K shall not be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, regardless of any general incorporation language in such filing.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

| Exhibit Number | Description |

| |

| 104 | The cover page from this Current Report on Form 8-K formatted in Inline XBRL (included as Exhibit 101). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | |

| | TUTOR PERINI CORPORATION |

| | |

| Date: | November 6, 2024 | By: | /s/ Ryan J. Soroka |

| | Ryan J. Soroka |

| | Senior Vice President and Chief Financial Officer |

News Release

Tutor Perini Reports Third Quarter 2024 Results

•Strong year-to-date operating cash flow of $174.0 million through September 30, 2024

•Expecting record full-year 2024 operating cash flow in the range of $425 million to $575 million

•Planning to utilize anticipated strong 2024 cash collections to prepay $100 million to $150 million of Term Loan B debt by December 31, 2024 ($50 million of which has already been prepaid in Q4 2024), with further prepayments of $50 million to $75 million expected in Q1 2025

•Record backlog of $14.0 billion at the end of Q3 2024, up 35% compared to the end of Q2 2024 and substantially higher than the previous record of $11.6 billion set in Q1 2019, with the potential for significant further growth by year-end pending owners' decisions and awards for various large projects

•The Company's considerable progress in resolving seven of its largest disputed matters is expected to generate approximately $180 million of future operating cash flow, however these resolutions also resulted in net charges that drove a diluted loss of $1.92 per share in Q3 2024

•Expecting to return to profitability in 2025, with even stronger earnings anticipated in 2026 and beyond

LOS ANGELES – (BUSINESS WIRE) – November 6, 2024 – Tutor Perini Corporation (the "Company") (NYSE: TPC), a leading civil, building and specialty construction company, reported results today for the third quarter of 2024. The Company generated $174.0 million of cash from operating activities in the first nine months of 2024. As previously announced, the Company expects to generate new record operating cash flow for the full year of 2024 in the range of $425 million to $575 million from collections related to project execution activities for new and existing projects, as well as from the resolution of various disputed matters. This would represent the third consecutive year that the Company has generated record operating cash flow. The Company also anticipates continued strong operating cash flow in 2025.

With the significant operating cash flow expected in the fourth quarter of 2024, the Company anticipates prepaying $100 million to $150 million of its outstanding Term Loan B debt prior to December 31, 2024. Of this amount, $50 million has already been prepaid in the fourth quarter. The Company also estimates that it will prepay an additional $50 million to $75 million of the Term Loan B debt in the first quarter of 2025 with cash generated from operations.

Revenue for the third quarter of 2024 was $1.1 billion, up slightly compared to the third quarter of 2023. The growth was primarily driven by increased project execution activities on various Building and Civil segment projects in California and New York, as well as certain Civil segment projects in the Northern Mariana Islands and British Columbia, largely offset by the impact of certain current-quarter net charges discussed below.

Loss from construction operations for the third quarter of 2024 was $106.8 million compared to a loss of $12.6 million for the same period in 2023. Net loss attributable to the Company for the third quarter of 2024 was $100.9 million, or a $1.92 diluted loss per share ("EPS"), compared to net loss attributable to the Company of $36.9 million, or a $0.71 diluted loss per share, for the third quarter of 2023. The higher loss was primarily due to previously announced net charges now totaling approximately $152 million ($111.6 million after tax, or $2.13 per diluted share) that the Company recorded in the third quarter of 2024 related to the resolution of various matters, including seven of its largest outstanding disputed balances.

The financial impacts of those resolutions masked otherwise solid operational performance in the third quarter of 2024, driven by increased project execution activities in the Building and Civil segments. While the net charges resulted in a net loss for the third quarter of 2024, these resolutions are expected to result in a substantial net cash inflow to the Company of approximately $180 million, most of which is anticipated to be received in the fourth quarter of 2024.

The Company's loss from construction operations for the third quarter of 2024 was also negatively impacted by $16.5 million ($0.23 per diluted share) of share-based compensation expense, as compared to $3.5 million ($0.05 per diluted share) in the third quarter of 2023. The higher expense in the current-year period was primarily due to a substantial increase in the Company’s stock price during 2024, which increased the expense recognized for certain long-term incentive compensation awards with payouts that are indexed to the Company's stock price.

Management Remarks

Ronald Tutor, Chairman and Chief Executive Officer, commented, “We have tremendous momentum with several large new project wins in the third quarter that resulted in a new record backlog of $14 billion. This backlog provides us a solid foundation upon which we expect to build a profitable, multi-year revenue stream, with the potential for significant continued growth over the next few months as we look to finalize the contract for the multi-billion-dollar Manhattan Jail, as we announced this morning, and pursue other large projects. We are pleased to put many of our largest disputes behind us, and expect to return to profitability in 2025, with even stronger earnings anticipated in 2026 and beyond, as various newer projects progress to advanced design and enter the construction phase.”

Gary Smalley, President, added, “We are on track to shatter our previous annual operating cash flow record this year due to strong anticipated cash collections from new and existing projects, as well as from recent dispute resolutions. We have already paid down $50 million of our Term Loan B debt in the fourth quarter, and we plan to utilize the record cash flow to further deleverage our balance sheet, delivering on what we previously indicated would be a key capital allocation objective. These are truly exciting times for Tutor Perini and we expect to continue generating significant cash flow, reducing debt, and winning new major projects to ensure a much brighter future than ever before.”

Backlog Update

As noted above, backlog grew to $14.0 billion as of September 30, 2024, up 35% compared to $10.4 billion as of June 30, 2024, setting a new record for the Company that far exceeded its previous record backlog of $11.6 billion reported for the first quarter of 2019. The Civil and Building segments were the primary contributors to the new awards activity in the third quarter of 2024.

The largest new awards and contract adjustments during the third quarter of 2024 included:

•$1.66 billion mass-transit project in Hawaii;

•$1.1 billion water conveyance tunnel project in New York;

•$1 billion-plus healthcare campus project in California;

•$138 million of additional funding for certain mass-transit projects in California; and

•$113 million military facility project in Guam.

In the fourth quarter of 2024, the Company announced the following:

•The multi-billion-dollar Manhattan Jail project in New York, for which a joint venture led by the Company has been identified as the Apparent Selected Proposer; and

•$330.6 million (with up to $230 million of options) for the award of the Apra Harbor Waterfront Repairs project in Guam.

In addition, the Company is anticipating owners' decisions and potential awards in the fourth quarter of 2024 for other large projects that it has recently bid or will be bidding on shortly, including the $1.5 billion Newark AirTrain and the $550 million Raritan River Bridge Replacement. The Company also plans to bid on the $2.2 billion Midtown Bus Terminal Replacement project in New York during the first quarter of 2025.

Outlook and Guidance

As previously announced on October 21, 2024, the Company withdrew its 2024 guidance due to the adverse earnings impact of the net charges recorded in the third quarter of 2024 related to several dispute resolutions as described above. The Company expects a return to profitability in 2025 and anticipates issuing its initial guidance for 2025 in February, when it reports its results for the full year of 2024.

Third Quarter 2024 Conference Call

The Company will host a conference call at 2:00 PM Pacific Time on Wednesday, November 6, 2024, to discuss the third quarter 2024 results. To participate in the conference call, please dial 877-407-8293 five to ten minutes prior to the scheduled time. International callers should dial 1-201-689-8349.

The conference call will be webcast live over the Internet and can be accessed by all interested parties on Tutor Perini's website at www.tutorperini.com. For those unable to participate during the live call, the webcast will be available for replay on the website shortly after the call.

About Tutor Perini Corporation

Tutor Perini Corporation is a leading civil, building and specialty construction company offering diversified general contracting and design-build services to private customers and public agencies throughout the world. We have provided construction services since 1894 and have established a strong reputation within our markets by executing large, complex projects on time and within budget, while adhering to strict quality control measures. We offer general contracting, pre-construction planning and comprehensive project management services, including planning and scheduling of manpower, equipment, materials and subcontractors required for a project. We also offer self-performed construction services including site work, concrete forming and placement, steel erection, electrical, mechanical, plumbing and heating, ventilation and air conditioning (HVAC).

Forward-Looking Statements

The statements contained in this release, including those set forth in the section “Outlook and Guidance,” that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including without limitation, statements regarding the Company’s expectations, hopes, beliefs, intentions or strategies regarding the future and statements regarding future guidance or estimates and non-historical performance. These forward-looking statements are based on the Company’s current expectations and beliefs concerning future developments and their potential impacts on the Company. While the Company’s expectations, beliefs and projections are expressed in good faith and the Company believes there is a reasonable basis for them, there can be no assurance that future developments affecting the Company will be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond the control of the Company) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to: unfavorable outcomes of existing or future litigation or dispute resolution proceedings against us or customers (project owners, developers, general contractors, etc.), subcontractors or suppliers, as well as failure to promptly recover significant working capital invested in projects subject to such matters; revisions of estimates of contract risks, revenue or costs, economic factors such as inflation, the timing of new awards, or the pace of project execution, which has resulted and may continue to result in losses or lower than anticipated profit; contract requirements to perform extra work beyond the initial project scope, which has and in the future could result in disputes or claims and adversely affect our working capital, profits and cash flows; risks and other uncertainties associated with estimates and assumptions used to prepare our financial statements; failure to meet contractual schedule requirements, which could result in higher costs and reduced profits or, in some cases, exposure to financial liability for liquidated damages and/or damages to customers, as well as damage to our reputation; an inability to obtain bonding, which could have a negative impact on our operations and results; possible systems and information technology interruptions and breaches in data security and/or privacy; inability to attract and retain our key officers, and to adequately plan for their succession, and hire and retain personnel required to execute and perform on our contracts; the impact of inclement weather conditions, disasters and other catastrophic events outside of our control on projects; risks related to our international operations, such as uncertainty of U.S. government funding, as well as economic, political, regulatory and other risks, including risks of loss due to acts of war, labor conditions, and other unforeseeable events in countries where we do business, which could adversely affect our revenue and earnings; increased competition and failure to secure new contracts; a significant slowdown or decline in economic conditions, such as those presented during a recession; decreases in the level of federal, state and local government spending for infrastructure and other public projects; client cancellations of, or reductions in scope under, contracts reported in our backlog; risks related to government contracts

and related procurement regulations; significant fluctuations in the market price of our common stock, which could result in substantial losses for stockholders and potentially subject us to securities litigation; failure of our joint venture partners to perform their venture obligations, which could impose additional financial and performance obligations on us, resulting in reduced profits or losses and/or reputational harm; violations of the U.S. Foreign Corrupt Practices Act and similar worldwide anti-bribery laws; failure to meet our obligations under our debt agreements (especially in a high interest rate environment); downgrades in our credit ratings; public health crises, such as COVID-19, which have adversely impacted, and could in the future adversely impact, our business, financial condition and results of operations by, among other things, delaying the timing of project bids and/or awards and the timing of dispute resolutions and associated collections; physical and regulatory risks related to climate change; impairment of our goodwill or other indefinite-lived intangible assets; the exertion of influence over the Company by our chairman and chief executive officer due to his position and significant ownership interest; and other risks and uncertainties discussed under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023 filed on February 28, 2024 and in other reports that we file with the Securities and Exchange Commission from time to time. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

Contact:

Tutor Perini Corporation

Jorge Casado, 818-362-8391

Vice President, Investor Relations & Corporate Communications

www.tutorperini.com

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Tutor Perini Corporation |

| Condensed Consolidated Statements of Operations |

| Unaudited |

| | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (in thousands, except per common share amounts) | | 2024 | | 2023 | | 2024 | | 2023 |

| REVENUE | | $ | 1,082,816 | | | $ | 1,060,705 | | | $ | 3,259,273 | | | $ | 2,858,756 | |

| COST OF OPERATIONS | | (1,108,644) | | | (1,009,792) | | | (3,052,773) | | | (2,767,051) | |

| GROSS PROFIT (LOSS) | | (25,828) | | | 50,913 | | | 206,500 | | | 91,705 | |

General and administrative expenses(a) | | (80,979) | | | (63,479) | | | (224,008) | | | (183,828) | |

| LOSS FROM CONSTRUCTION OPERATIONS | | (106,807) | | | (12,566) | | | (17,508) | | | (92,123) | |

| Other income, net | | 4,487 | | | 2,967 | | | 15,636 | | | 12,442 | |

| Interest expense | | (21,223) | | | (20,313) | | | (63,614) | | | (63,842) | |

| LOSS BEFORE INCOME TAXES | | (123,543) | | | (29,912) | | | (65,486) | | | (143,523) | |

| Income tax benefit | | 33,941 | | | 4,086 | | | 19,355 | | | 52,004 | |

| NET LOSS | | (89,602) | | | (25,826) | | | (46,131) | | | (91,519) | |

| LESS: NET INCOME ATTRIBUTABLE TO NONCONTROLLING INTERESTS | | 11,260 | | | 11,070 | | | 38,159 | | | 32,107 | |

| NET LOSS ATTRIBUTABLE TO TUTOR PERINI CORPORATION | | $ | (100,862) | | | $ | (36,896) | | | $ | (84,290) | | | $ | (123,626) | |

| BASIC LOSS PER COMMON SHARE | | $ | (1.92) | | | $ | (0.71) | | | $ | (1.61) | | | $ | (2.39) | |

| DILUTED LOSS PER COMMON SHARE | | $ | (1.92) | | | $ | (0.71) | | | $ | (1.61) | | | $ | (2.39) | |

| WEIGHTED-AVERAGE COMMON SHARES OUTSTANDING: | | | | | | | | |

| BASIC | | 52,408 | | | 51,994 | | | 52,276 | | | 51,784 | |

| DILUTED | | 52,408 | | | 51,994 | | | 52,276 | | | 51,784 | |

___________________________________________________________________________________________________

(a)General and administrative expenses for the three and nine months ended September 30, 2024 include share-based compensation expense of $16.5 million ($12.1 million after tax, or $0.23 per diluted share) and $39.0 million ($28.6 million after tax, or $0.55 per diluted share), respectively. General and administrative expenses for the three and nine months ended September 30, 2023 include share-based compensation expense of $3.5 million ($2.5 million after tax, or $0.05 per diluted share) and $9.1 million ($6.6 million after tax, or $0.13 per diluted share), respectively. The higher expense in the 2024 periods was primarily due to a substantial increase in the Company’s stock price during 2024, which increased the expense recognized for certain long-term incentive compensation awards with payouts that are indexed to the Company's stock price.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Tutor Perini Corporation |

| Segment Information |

| Unaudited |

| | | | | | | | |

| Reportable Segments | | | | |

| (in thousands) | Civil | Building | Specialty

Contractors | Total | | Corporate | | Consolidated

Total |

| Three Months Ended September 30, 2024 | | | | | | | | |

| Total revenue | $ | 569,080 | | $ | 457,141 | | $ | 101,206 | | $ | 1,127,427 | | | $ | — | | | $ | 1,127,427 | |

| Elimination of intersegment revenue | (23,185) | | (21,426) | | — | | (44,611) | | | — | | | (44,611) | |

| Revenue from external customers | $ | 545,895 | | $ | 435,715 | | $ | 101,206 | | $ | 1,082,816 | | | $ | — | | | $ | 1,082,816 | |

| Loss from construction operations | $ | (12,545) | | $ | (3,895) | | $ | (56,911) | | $ | (73,351) | | (a) | $ | (33,456) | | (b) | $ | (106,807) | |

| Capital expenditures | $ | 4,237 | | $ | 238 | | $ | 53 | | $ | 4,528 | | | $ | 2,386 | | | $ | 6,914 | |

Depreciation and amortization(c) | $ | 10,718 | | $ | 579 | | $ | 569 | | $ | 11,866 | | | $ | 1,644 | | | $ | 13,510 | |

| | | | | | | | |

| Three Months Ended September 30, 2023 | | | | | | | | |

| Total revenue | $ | 543,776 | | $ | 368,244 | | $ | 174,933 | | $ | 1,086,953 | | | $ | — | | | $ | 1,086,953 | |

| Elimination of intersegment revenue | (23,282) | | (2,795) | | (171) | | (26,248) | | | — | | | (26,248) | |

| Revenue from external customers | $ | 520,494 | | $ | 365,449 | | $ | 174,762 | | $ | 1,060,705 | | | $ | — | | | $ | 1,060,705 | |

| Income (loss) from construction operations | $ | 46,889 | | $ | 123 | | $ | (38,429) | | $ | 8,583 | | (d) | $ | (21,149) | | (b) | $ | (12,566) | |

| Capital expenditures | $ | 11,941 | | $ | 241 | | $ | 391 | | $ | 12,573 | | | $ | 2,394 | | | $ | 14,967 | |

Depreciation and amortization(c) | $ | 7,698 | | $ | 743 | | $ | 615 | | $ | 9,056 | | | $ | 2,175 | | | $ | 11,231 | |

___________________________________________________________________________________________________

(a)During the three months ended September 30, 2024, the Company’s loss from construction operations was impacted by unfavorable adjustments of $101.6 million ($74.5 million after tax, or $1.42 per diluted share) related to an unexpected adverse arbitration decision on a legacy dispute related to a completed Civil segment bridge project in California, which the Company will appeal; $20.0 million ($14.7 million after tax, or $0.28 per diluted share) related to a settlement on a legacy dispute related to a completed Building segment government facility project in Florida; $17.7 million ($13.0 million after tax, or $0.25 per diluted share) due to an unfavorable judgment on a completed Specialty Contractors segment mass-transit project in California; and $11.5 million ($8.4 million after tax, or $0.16 per diluted share) due to an unfavorable arbitration ruling on a completed Specialty Contractors segment mass-transit project in New York. The period was also impacted by a favorable adjustment of $18.4 million ($13.5 million after tax, or $0.26 per diluted share) due to a settlement of a claim associated with a completed Civil segment highway tunneling project in the Western United States.

(b)Consists primarily of corporate general and administrative expenses. Corporate general and administrative expenses for the three months ended September 30, 2024 and 2023 included share-based compensation expense of $16.5 million ($12.1 million after tax, or $0.23 per diluted share) and $3.5 million ($2.5 million after tax, or $0.05 per diluted share), respectively. The increase in share-based compensation expense in the third quarter of 2024 was primarily due to a substantial increase in the Company’s stock price during the period, which impacted the fair value of liability-classified awards. These awards are remeasured at fair value at the end of each reporting period with the change recognized in earnings.

(c)Depreciation and amortization is included in income (loss) from construction operations.

(d)During the three months ended September 30, 2023, the Company’s income (loss) from construction operations was adversely impacted by $16.9 million ($12.3 million after tax, or $0.24 per diluted share) of unfavorable non-cash adjustments due to changes in estimates on the Specialty Contractors segment’s electrical and mechanical scope of a transportation project in the Northeast associated with changes in the expected recovery on certain unapproved change orders resulting from ongoing negotiations, $14.0 million ($10.9 million after tax, or $0.21 per diluted share) of unfavorable adjustments on the same transportation project in the Northeast, split evenly between the Civil and Building segments, primarily due to the settlement of certain change orders, changes in estimates due to recent negotiations and incremental cost incurred during project closeout, and a $9.4 million ($6.8 million after tax, or $0.13 per diluted share) unfavorable adjustment due to ongoing negotiations and an anticipated settlement on a completed Specialty Contractors segment mass-transit project in California. During the third quarter of 2023, the Company reached a settlement that impacted multiple components of a Civil segment mass-transit project in California, which included the resolution of certain ongoing disputes and increased the expected profit from work to be performed in the future. The settlement resulted in an unfavorable non-cash adjustment of $23.2 million ($16.8 million after tax, or $0.32 per diluted share) to one component of the project that is nearing completion, partially offset by a favorable adjustment of $8.8 million ($7.0 million after tax, or $0.13 per diluted share) on the other component of the project that has substantial scope of work remaining. As a result of the settlement, the net unfavorable impact to the period from these two adjustments is expected to be mitigated by the increased profit generated from future work on the project.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Tutor Perini Corporation |

Segment Information (continued) |

| Unaudited |

| | | | | | | | |

| Reportable Segments | | | | |

| (in thousands) | Civil | Building | Specialty

Contractors | Total | | Corporate | | Consolidated

Total |

| Nine Months Ended September 30, 2024 | | | | | | | | |

| Total revenue | $ | 1,649,421 | | $ | 1,313,114 | | $ | 429,152 | | $ | 3,391,687 | | | $ | — | | | $ | 3,391,687 | |

| Elimination of intersegment revenue | (84,873) | | (47,591) | | 50 | | (132,414) | | | — | | | (132,414) | |

| Revenue from external customers | $ | 1,564,548 | | $ | 1,265,523 | | $ | 429,202 | | $ | 3,259,273 | | | $ | — | | | $ | 3,259,273 | |

| Income (loss) from construction operations | $ | 133,785 | | $ | 17,272 | | $ | (83,069) | | $ | 67,988 | | (a) | $ | (85,496) | | (b) | $ | (17,508) | |

| Capital expenditures | $ | 21,847 | | $ | 523 | | $ | 326 | | $ | 22,696 | | | $ | 5,570 | | | $ | 28,266 | |

Depreciation and amortization(c) | $ | 31,699 | | $ | 1,749 | | $ | 1,741 | | $ | 35,189 | | | $ | 5,909 | | | $ | 41,098 | |

| | | | | | | | |

| Nine Months Ended September 30, 2023 | | | | | | | | |

| Total revenue | $ | 1,477,553 | | $ | 919,468 | | $ | 508,004 | | $ | 2,905,025 | | | $ | — | | | $ | 2,905,025 | |

| Elimination of intersegment revenue | (53,066) | | 6,976 | | (179) | | (46,269) | | | — | | | (46,269) | |

| Revenue from external customers | $ | 1,424,487 | | $ | 926,444 | | $ | 507,825 | | $ | 2,858,756 | | | $ | — | | | $ | 2,858,756 | |

| Income (loss) from construction operations | $ | 170,308 | | $ | (83,917) | | $ | (120,709) | | $ | (34,318) | | (d) | $ | (57,805) | | (b) | $ | (92,123) | |

| Capital expenditures | $ | 36,649 | | $ | 3,716 | | $ | 1,091 | | $ | 41,456 | | | $ | 4,134 | | | $ | 45,590 | |

Depreciation and amortization(c) | $ | 21,753 | | $ | 1,655 | | $ | 1,856 | | $ | 25,264 | | | $ | 6,721 | | | $ | 31,985 | |

___________________________________________________________________________________________________

(a)During the nine months ended September 30, 2024, the Company’s income (loss) from construction operations was impacted by unfavorable adjustments of $101.6 million ($74.5 million after tax, or $1.43 per diluted share) in the third quarter related to an unexpected adverse arbitration decision on a legacy dispute related to a completed Civil segment bridge project in California, which the Company will appeal; $20.0 million ($14.7 million after tax, or $0.28 per diluted share) in the third quarter related to a settlement on a legacy dispute related to a completed Building segment government facility project in Florida; $17.7 million ($13.0 million after tax, or $0.25 per diluted share) in the third quarter due to an unfavorable judgment on a completed Specialty Contractors segment mass-transit project in California; $12.4 million ($9.1 million after tax, or $0.17 per diluted share) in the second quarter due to the impact of a settlement on two completed Civil segment highway projects in the Northeast; and $12.0 million ($8.8 million after tax, or $0.17 per diluted share) in the first quarter due to an arbitration ruling that only provided a partial award to the Company pertaining to a completed Specialty Contractors segment electrical project in New York; and $11.5 million ($8.4 million after tax, or $0.16 per diluted share) in the third quarter due to an unfavorable arbitration ruling on a completed Specialty Contractors segment mass-transit project in New York. The period was also impacted by favorable adjustments of $18.4 million ($13.5 million after tax, or $0.26 per diluted share) in the third quarter due to a settlement of a claim associated with a completed Civil segment highway tunneling project in the Western United States and $10.2 million ($7.5 million after tax, or $0.14 per diluted share) in the first quarter on a Civil segment mass-transit project in California related to a dispute resolution and associated expected cost savings.

(b)Consists primarily of corporate general and administrative expenses. Corporate general and administrative expenses for the nine months ended September 30, 2024 and 2023 included share-based compensation expense of $39.0 million ($28.6 million after tax, or $0.55 per diluted share) and $9.1 million ($6.6 million after tax, or $0.13 per diluted share), respectively. The increase in share-based compensation expense in the current-year period was primarily due to a substantial increase in the Company’s stock price during the period, which impacted the fair value of liability-classified awards. These awards are remeasured at fair value at the end of each reporting period with the change recognized in earnings.

(c)Depreciation and amortization is included in income (loss) from construction operations.

(d)During the nine months ended September 30, 2023, the Company’s income (loss) from construction operations was impacted by an adverse legal ruling on a completed mixed-use project in New York, which resulted in a non-cash, pre-tax charge of $83.6 million ($60.1 million after tax, or $1.16 per diluted share) in the first quarter, of which $72.2 million impacted the Building segment and $11.4 million impacted the Specialty Contractors segment; $57.0 million ($41.4 million after tax, or $0.80 per diluted share) of unfavorable non-cash adjustments due to changes in estimates on the Specialty Contractors segment’s electrical and mechanical scope of a transportation project in the Northeast associated with changes in the expected recovery on certain unapproved change orders resulting from ongoing negotiations; $27.5 million ($21.4 million after tax, or $0.41 per diluted share) of unfavorable adjustments on the same transportation project in the Northeast, split evenly between the Civil and Building segments, primarily due to the settlement of certain change orders, changes in estimates due to recent negotiations and incremental cost incurred during project closeout; net favorable adjustments of $25.6 million ($20.3 million after tax, or $0.39 per diluted share) for a Civil segment mass-transit project in California that resulted from changes in estimates due to improved performance; a non-cash charge of $25.1 million ($18.2 million after tax, or $0.35 per diluted share) in the second quarter of 2023 that resulted from an adverse legal ruling on a Specialty Contractors segment educational facilities project in New York; and a $9.4 million ($6.8 million after tax, or $0.13 per diluted share) unfavorable adjustment in the third quarter due to ongoing negotiations and an anticipated settlement on a completed Specialty Contractors segment mass-transit project in California. During the third quarter of 2023, the Company reached a settlement that impacted multiple components of a Civil segment mass-transit project in California, which included the resolution of certain ongoing disputes and increased the expected profit from work to be performed in the future. The settlement resulted in an unfavorable non-cash adjustment of $23.2 million ($16.8 million after tax, or $0.32 per diluted share) to one component of the project that is nearing completion, partially offset by a favorable adjustment of $8.8 million ($7.0 million after tax, or $0.14 per diluted share) on the other component of the project that has substantial scope of work remaining. As a result of the settlement, the net unfavorable impact to the period from these two adjustments is expected to be mitigated by the increased profit generated from future work on the project.

| | | | | | | | | | | | | | |

| Tutor Perini Corporation |

| Condensed Consolidated Balance Sheets |

| Unaudited |

| (in thousands, except share and per share amounts) | | As of September 30,

2024 | | As of December 31,

2023 |

| | | | |

| ASSETS |

| CURRENT ASSETS: | | | | |

| Cash and cash equivalents ($135,688 and $173,118 related to variable interest entities (“VIEs”)) | | $ | 287,403 | | | $ | 380,564 | |

| Restricted cash | | 13,994 | | | 14,116 | |

| Restricted investments | | 135,493 | | | 130,287 | |

| Accounts receivable ($107,158 and $84,014 related to VIEs) | | 1,310,683 | | | 1,054,014 | |

| Retention receivable ($166,568 and $161,187 related to VIEs) | | 549,736 | | | 580,926 | |

| Costs and estimated earnings in excess of billings ($76,698 and $58,089 related to VIEs) | | 966,251 | | | 1,143,846 | |

| Other current assets ($20,421 and $26,725 related to VIEs) | | 188,220 | | | 217,601 | |

| Total current assets | | 3,451,780 | | | 3,521,354 | |

PROPERTY AND EQUIPMENT ("P&E"), net of accumulated depreciation of $559,333 and $534,171 (net P&E of $25,476 and $35,135 related to VIEs) | | 427,053 | | | 441,291 | |

| GOODWILL | | 205,143 | | | 205,143 | |

| INTANGIBLE ASSETS, NET | | 66,628 | | | 68,305 | |

| DEFERRED INCOME TAXES | | 111,367 | | | 74,083 | |

| OTHER ASSETS | | 124,530 | | | 119,680 | |

| TOTAL ASSETS | | $ | 4,386,501 | | | $ | 4,429,856 | |

| | | | |

| LIABILITIES AND EQUITY |

| CURRENT LIABILITIES: | | | | |

| Current maturities of long-term debt | | $ | 25,724 | | | $ | 117,431 | |

| Accounts payable ($35,486 and $24,160 related to VIEs) | | 651,676 | | | 466,545 | |

| Retention payable ($18,276 and $22,841 related to VIEs) | | 226,033 | | | 223,138 | |

| Billings in excess of costs and estimated earnings ($361,866 and $439,759 related to VIEs) | | 1,052,007 | | | 1,103,530 | |

| Accrued expenses and other current liabilities ($16,813 and $18,206 related to VIEs) | | 276,690 | | | 214,309 | |

| Total current liabilities | | 2,232,130 | | | 2,124,953 | |

LONG-TERM DEBT, less current maturities, net of unamortized discount and debt issuance costs totaling $30,020 and $11,000 | | 655,706 | | | 782,314 | |

| | | | |

| OTHER LONG-TERM LIABILITIES | | 266,976 | | | 238,678 | |

| TOTAL LIABILITIES | | 3,154,812 | | | 3,145,945 | |

| COMMITMENTS AND CONTINGENCIES | | | | |

| EQUITY | | | | |

| Stockholders' equity: | | | | |

| Preferred stock - authorized 1,000,000 shares ($1 par value), none issued | | — | | | — | |

| Common stock - authorized 112,500,000 shares ($1 par value), issued and outstanding 52,434,803 and 52,025,497 shares | | 52,435 | | | 52,025 | |

| Additional paid-in capital | | 1,148,196 | | | 1,146,204 | |

| Retained earnings | | 48,856 | | | 133,146 | |

| Accumulated other comprehensive loss | | (35,984) | | | (39,787) | |

| Total stockholders' equity | | 1,213,503 | | | 1,291,588 | |

| Noncontrolling interests | | 18,186 | | | (7,677) | |

| TOTAL EQUITY | | 1,231,689 | | | 1,283,911 | |

| TOTAL LIABILITIES AND EQUITY | | $ | 4,386,501 | | | $ | 4,429,856 | |

| | | | | | | | | | | |

| Tutor Perini Corporation |

| Condensed Consolidated Statements of Cash Flows |

| Unaudited |

| Nine Months Ended September 30, |

| (in thousands) | 2024 | | 2023 |

| Cash Flows from Operating Activities: | | | |

| Net loss | $ | (46,131) | | | $ | (91,519) | |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | | |

| Depreciation | 39,421 | | | 30,308 | |

| Amortization of intangible assets | 1,677 | | | 1,677 | |

| Share-based compensation expense | 38,961 | | | 9,103 | |

| Change in debt discounts and deferred debt issuance costs | 5,887 | | | 2,992 | |

| Deferred income taxes | (39,396) | | | (61,146) | |

| (Gain) loss on sale of property and equipment | 555 | | | (5,077) | |

| Changes in other components of working capital | 172,298 | | | 296,839 | |

| Other long-term liabilities | 4,376 | | | (2,976) | |

| Other, net | (3,678) | | | 610 | |

| NET CASH PROVIDED BY OPERATING ACTIVITIES | 173,970 | | | 180,811 | |

| | | |

| Cash Flows from Investing Activities: | | | |

| Acquisition of property and equipment | (28,266) | | | (45,590) | |

| Proceeds from sale of property and equipment | 2,941 | | | 9,006 | |

| Investments in securities | (25,783) | | | (17,986) | |

| Proceeds from maturities and sales of investments in securities | 23,812 | | | 11,134 | |

| NET CASH USED IN INVESTING ACTIVITIES | (27,296) | | | (43,436) | |

| | | |

| Cash Flows from Financing Activities: | | | |

| Proceeds from debt | 642,833 | | | 702,427 | |

| Repayment of debt | (842,127) | | | (758,473) | |

| Cash payments related to share-based compensation | (3,257) | | | (737) | |

| Distributions paid to noncontrolling interests | (12,400) | | | (26,500) | |

| Contributions from noncontrolling interests | 87 | | | 4,500 | |

| Debt issuance, extinguishment and modification costs | (25,093) | | | (500) | |

| NET CASH USED IN FINANCING ACTIVITIES | (239,957) | | | (79,283) | |

| | | |

| Net increase (decrease) in cash, cash equivalents and restricted cash | (93,283) | | | 58,092 | |

| Cash, cash equivalents and restricted cash at beginning of period | 394,680 | | | 273,831 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 301,397 | | | $ | 331,923 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Tutor Perini Corporation |

| Backlog Information |

| Unaudited |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| (in millions) | | Backlog at

June 30, 2024 | | New Awards in the Three Months Ended

September 30, 2024(a) | | Revenue Recognized in the Three Months Ended

September 30, 2024 | | Backlog at September 30, 2024 |

| Civil | | $ | 4,364.6 | | | $ | 3,076.2 | | | $ | (545.8) | | | $ | 6,895.0 | |

| Building | | 4,188.7 | | | 1,385.1 | | | (435.8) | | | 5,138.0 | |

| Specialty Contractors | | 1,865.6 | | | 227.8 | | | (101.2) | | | 1,992.2 | |

| Total | | $ | 10,418.9 | | | $ | 4,689.1 | | | $ | (1,082.8) | | | $ | 14,025.2 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| (in millions) | | Backlog at December 31, 2023 | | New Awards in the Nine Months Ended

September 30, 2024(a) | | Revenue Recognized in the Nine Months Ended

September 30, 2024 | | Backlog at September 30, 2024 |

| Civil | | $ | 4,240.6 | | | $ | 4,218.9 | | | $ | (1,564.5) | | | $ | 6,895.0 | |

| Building | | 4,177.5 | | | 2,226.1 | | | (1,265.6) | | | 5,138.0 | |

| Specialty Contractors | | 1,740.3 | | | 681.1 | | | (429.2) | | | 1,992.2 | |

| Total | | $ | 10,158.4 | | | $ | 7,126.1 | | | $ | (3,259.3) | | | $ | 14,025.2 | |

____________________________________________________________________________________________________

(a)New awards consist of the original contract price of projects added to backlog plus or minus subsequent changes to the estimated total contract price of existing contracts.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

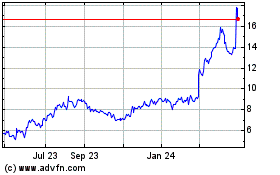

Tutor Perini (NYSE:TPC)

Historical Stock Chart

From Nov 2024 to Dec 2024

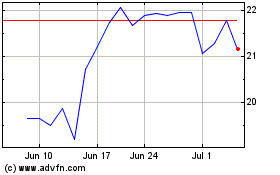

Tutor Perini (NYSE:TPC)

Historical Stock Chart

From Dec 2023 to Dec 2024