Canada’s total credit debt grew by 3.2% year-over-year (YoY) to a

record $2.41 trillion during the first quarter of the year,

according to TransUnion Canada’s Q2 2024 Credit Industry Insights

Report, which is produced quarterly to map consumer credit market

trends and health. Mortgage debt, comprising 74% of total debt,

remains relatively healthy, underpinned by strong credit quality

among mortgage holders and rising home values. Non-mortgage debt,

including credit cards, loans, and lines of credit, continues to

rise, reflective of higher consumption needs for Canadian

consumers.

The TransUnion Credit Industry Indicator (CII)

dropped slightly by one point from prior year to 104.5, due to a

slowdown in credit supply coupled with a rise in delinquency rates,

somewhat offset by higher balances and strong demand for

credit.

Credit access – the overall number of

credit-active consumers – is a key driver of this growth, up by

3.7% from prior year. As of Q2 2024, there are 32 million Canadians

with at least one active credit product in their wallets, which

represents approximately 92% of adult credit eligible Canadians.

Younger Canadians are driving the bulk of increased participation,

with Millennials (born 1980 to 1994) and Gen Z (born 1995 to 2010)

driving $98 billion in growth of outstanding balances

year-over-year. Gen Z consumers continue to be the fastest growing

segment as more consumers from this group are becoming of

credit-eligible age (18+) each year and entering the credit market

for the very first time.

New credit openings grew YoY 10.4% (representing

$77.9 billion in balances), driven by credit cards, with new credit

card balances1 growing 7.5%. This is partly because of the

continued influx of Gen Z consumers into the credit market, who

typically open a credit card as their first credit product. New

mortgage originations stalled, driving an increase in real estate

supply, as elevated interest rates continue to leave some buyers on

the sidelines.

More Consumers Face Payment

StressAverage balances for major products held by Canadian

consumers continued to grow during Q2 2024, with auto loan balances

showing the highest growth (6.2% YoY) driven by higher ticket

prices. In Q2 2024, average balances for credit cards grew 4.7%

YoY, and installment loan and mortgage average balances grew 4.4%

and 3.1%, respectively.

The growth in average credit card balances was

primarily driven by consumers spending more on their credit cards,

while paying down less on their monthly due payments. This

indicates that specific segments of Canadians may be experiencing

cash flow challenges while being increasingly reliant on credit

cards. The number of Canadians only making minimum payments on

their credit cards increased six basis points (bps) YoY to 1.2% of

all credit card holders.

Higher outstanding balances combined with the

higher cost of debt may have reduced financial flexibility for some

consumers, making them more vulnerable to reduced disposable

income, or the capacity to meet unexpected expenses. Increases in

minimum payment due amounts were observed to have the largest

impact to mortgages (13.5% YoY), followed by credit cards (10.6%

YoY) and personal loans (10.5% YoY), with the growth in payment due

amounts seen across all risk tiers2.

|

|

Average Monthly Minimum Payment Due |

|

|

Q2 2023 |

Q2 2024 |

YoY Growth Rate |

|

Mortgage |

$2,071 |

$2,350 |

13.5% |

| Credit

Cards |

$104 |

$115 |

10.6% |

| Personal

Loans |

$76 |

$84 |

10.5% |

| Line of

Credit |

$445 |

$489 |

9.9% |

| Auto

Finance |

$640 |

$682 |

6.6% |

| |

|

|

|

“If the Bank of Canada continues to reduce

interest rates, payment pressures may ease; however, lenders need

to carefully monitor consumer behaviours, and predict and identify

resilient versus vulnerable borrowers. Our analysis shows that a 50

bps decrease in mortgage interest rates from current levels could

reduce mortgage payments by 12% or more for new or renewable

mortgages openings in the coming months and help reduce the number

of Canadians that are unable to make their monthly payment,” said

Matthew Fabian, director of financial services research and

consulting at TransUnion Canada.

Delinquencies Continue to Rise as the

Cost of Living Pressure MountsOverall serious

consumer-level delinquency rates (90 or more days past due on

payments on any account) continued to rise, up 22 bps YoY to 1.74%,

as the pressures of higher cost of living combined with high

interest rates have impacted vulnerable consumer segments.

This phenomenon is especially evident among

subprime borrowers, with serious delinquency among this group

rising 131 bps to 15.7%. Some consumers with lower credit scores

are struggling to keep up with their payments in the current

economic climate.

Albertans had the highest serious delinquency

observed in Canada at 2.18%. This is followed by consumers in

Manitoba (2.03%) and New Brunswick (2.03%). Alberta also saw the

highest YoY rise in delinquency, at 30 bps YoY, followed by

Ontario.

|

Serious Consumer Delinquency Levels by

Province |

|

|

Q22023 |

Q22024 |

BpsIncreaseYoY |

| Canada |

1.52% |

1.74% |

22 |

| AB |

1.88% |

2.18% |

30 |

| MB |

1.78% |

2.03% |

25 |

| NB |

1.97% |

2.03% |

5 |

| NS |

1.88% |

1.96% |

8 |

| SK |

1.84% |

1.96% |

12 |

| NL |

1.82% |

1.87% |

5 |

| ON |

1.56% |

1.83% |

27 |

| PEI |

1.70% |

1.74% |

4 |

| BC |

1.53% |

1.66% |

12 |

| QC |

1.05% |

1.24% |

19 |

| |

|

|

|

In addition to rising delinquencies, consumers

are progressing from early stages (30 days past due payments) into

later stages (90 days past due payments) of delinquency at a higher

rate. A higher percentage of delinquent consumers moved or rolled

forward from early stage to later stage of delinquencies – 12% in

Q2 2024, compared to a 7% roll forward rate a year ago. Across

products, when borrowers fail to make payments on balances and move

into later stages of delinquency, the impacts can include increased

interest charges, fees and penalties, along with reduction to

credit scores.

“During these times of uncertainties, lenders

need to monitor and predict portfolio health indicators by

leveraging holistic consumer attributes. Our recent research

studies have shown that by incorporating consumer-level trended

data, we can help predict resilient consumers to drive smart

growth, identify early warning signs of vulnerability to mitigate

risk, and prioritize collection resources effectively to predict

repayments. The Canadian credit economy would benefit from enabling

consumers to continue leveraging credit for responsible

behaviours,” said Fabian.

About TransUnion®

(NYSE: TRU)

TransUnion is a global information and insights

company with over 13,000 associates operating in more than 30

countries, including Canada, where we’re the credit bureau of

choice for the financial services ecosystem and most of Canada’s

largest banks. We make trust possible by ensuring each person is

reliably represented in the marketplace. We do this by providing an

actionable view of consumers, stewarded with care.

Through our acquisitions and technology

investments we have developed innovative solutions that extend

beyond our strong foundation in core credit into areas such as

marketing, fraud, risk and advanced analytics. As a result,

consumers and businesses can transact with confidence and achieve

great things. We call this Information for Good® — and it leads to

economic opportunity, great experiences and personal empowerment

for millions of people around the world.

For more information visit: www.transunion.ca

For more information or to request an interview,

contact:

Contact: Katie DuffyE-mail:

katie.duffy@ketchum.comTelephone: +1

647-772-0969

1 New balances are defined as the sum of outstanding balances

from credit cards that have opened within the quarter (Q1 2024)

2 According to TransUnion CreditVision® risk score: Subprime =

300-639; Near prime = 640-719; Prime = 720-759; Prime plus =

760-799; Super prime = 800+

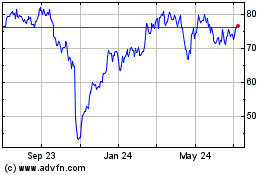

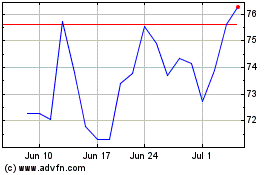

TransUnion (NYSE:TRU)

Historical Stock Chart

From Oct 2024 to Nov 2024

TransUnion (NYSE:TRU)

Historical Stock Chart

From Nov 2023 to Nov 2024