Highlights (second-quarter 2024 versus second-quarter 2023,

unless otherwise noted):

- Reported revenues of $5.3 billion, up 13 percent; organic

revenues* up 13 percent

- GAAP operating margin up 70 bps; adjusted operating margin*

up 140 bps

- Adjusted EBITDA margin* of 21.1 percent, up 140 bps

- GAAP continuing EPS of $3.33; adjusted continuing EPS* of

$3.30, up 23 percent

- Bookings* up 19 percent, led by Americas Commercial HVAC, up

21 percent

*This news release contains non-GAAP financial measures.

Definitions of the non-GAAP financial measures can be found in the

footnotes of this news release. See attached tables for additional

details and reconciliations.

Trane Technologies plc (NYSE:TT), a global climate innovator,

today reported diluted earnings per share (EPS) from continuing

operations of $3.33 for the second quarter of 2024. Adjusted

continuing EPS was $3.30, up 23 percent.

Second-Quarter 2024 Results

Financial Comparisons - Second-Quarter Continuing

Operations

$, millions except EPS

Q2 2024

Q2 2023

Y-O-Y Change

Organic Y-O-Y Change

Bookings

$5,340

$4,495

19%

19%

Net Revenues

$5,307

$4,705

13%

13%

GAAP Operating Income

$1,034

$885

17%

GAAP Operating Margin

19.5%

18.8%

70 bps

Adjusted Operating Income*

$1,027

$849

21%

Adjusted Operating Margin*

19.4%

18.0%

140 bps

Adjusted EBITDA*

$1,119

$927

21%

Adjusted EBITDA Margin*

21.1%

19.7%

140 bps

GAAP Continuing EPS

$3.33

$2.57

30%

Adjusted Continuing EPS

$3.30

$2.68

23%

Pre-Tax Non-GAAP Adjustments,

net**

$(7.1)

$15.3

$(22.4)

**For details see table 2 and 3 of the

news release.

"Our team around the world delivered strong performance in the

second quarter, continuing our consistent track record of

execution," said Dave Regnery, chair and CEO, Trane Technologies.

"Customers continue to choose our sustainable solutions,

demonstrated by our exceptional bookings growth and backlog -

giving us good visibility for 2024 and into 2025.

"Given our strong first half performance and positive outlook,

we are raising our full-year revenue and adjusted EPS guidance well

above the high end of our prior range. With our purpose-driven

strategy, proven business operating system and uplifting culture,

we are well positioned to continue delivering leading growth among

industrials and differentiated shareholder returns over the long

term."

Highlights from the Second Quarter of 2024 (all comparisons

against second-quarter 2023 unless otherwise noted)

- Delivered strong revenue, operating income, EBITDA and EPS

growth.

- Strong bookings of $5.3 billion, up 19 percent.

- Backlog of $7.5 billion, including approximately $2.8 billion

of Commercial HVAC backlog for 2025 and beyond, with $1 billion

added in the second quarter.

- Enterprise reported revenues and organic revenues were both up

13 percent. Approximately 1 percentage point related to

acquisitions was offset by 1 percentage point of negative foreign

exchange impact.

- GAAP operating margin was up 70 basis points, adjusted

operating margin was up 140 basis points and adjusted EBITDA margin

was up 140 basis points.

- Strong volume growth, positive price realization and

productivity more than offset inflation. The Company also continued

high levels of business reinvestment.

Second-Quarter Business Review (all comparisons against

second-quarter 2023 unless otherwise noted)

Americas Segment: innovates for customers in the North

America and Latin America regions. The Americas segment encompasses

commercial heating, cooling and ventilation systems, building

controls and solutions, energy services and solutions, residential

heating and cooling; and transport refrigeration systems and

solutions.

$, millions

Q2 2024

Q2 2023

Y-O-Y Change

Organic Y-O-Y Change

Bookings

$4,221.9

$3,422.9

23%

23%

Net Revenues

$4,290.9

$3,692.5

16%

16%

GAAP Operating Income

$912.1

$783.1

16%

GAAP Operating Margin

21.3%

21.2%

10 bps

Adjusted Operating Income

$903.9

$732.6

23%

Adjusted Operating Margin

21.1%

19.8%

130 bps

Adjusted EBITDA

$978.2

$791.3

24%

Adjusted EBITDA Margin

22.8%

21.4%

140 bps

- Strong bookings of $4.2 billion, up 23 percent, led by

Commercial HVAC, up more than 20 percent.

- Reported and organic revenues were both up 16 percent.

- GAAP operating margin was up 10 basis points, adjusted

operating margin was up 130 basis points and adjusted EBITDA margin

was up 140 basis points.

- Strong volume growth, positive price realization and

productivity more than offset inflation. The Company also continued

high levels of business reinvestment.

Europe, Middle East and Africa (EMEA) Segment: innovates

for customers in the Europe, Middle East and Africa region. The

EMEA segment encompasses heating, cooling and ventilation systems,

services and solutions for commercial buildings and transport

refrigeration systems and solutions.

$, millions

Q2 2024

Q2 2023

Y-O-Y Change

Organic Y-O-Y Change

Bookings

$669.4

$610.0

10%

10%

Net Revenues

$645.3

$617.6

4%

5%

GAAP Operating Income

$120.7

$101.1

19%

GAAP Operating Margin

18.7%

16.4%

230 bps

Adjusted Operating Income

$121.0

$108.0

12%

Adjusted Operating Margin

18.8%

17.5%

130 bps

Adjusted EBITDA

$131.0

$117.8

11%

Adjusted EBITDA Margin

20.3%

19.1%

120 bps

- Bookings were up 10 percent, led by Commercial HVAC, up 20

percent.

- Reported revenues were up 4 percent, including approximately 1

percentage point related to acquisitions offset by 2 percentage

points of negative foreign exchange impact. Organic revenues were

up 5 percent.

- GAAP operating margin was up 230 basis points; adjusted

operating margin was up 130 basis points and adjusted EBITDA margin

was up 120 basis points.

- Strong volume growth, positive price realization and

productivity more than offset inflation. The Company also continued

high levels of business reinvestment.

Asia Pacific Segment: innovates for customers throughout

the Asia Pacific region. The Asia Pacific segment encompasses

heating, cooling and ventilation systems, services and solutions

for commercial buildings and transport refrigeration systems and

solutions.

$, millions

Q2 2024

Q2 2023

Y-O-Y Change

Organic Y-O-Y Change

Bookings

$448.8

$461.9

(3)%

flat

Net Revenues

$371.2

$394.6

(6)%

(3)%

GAAP Operating Income

$89.3

$82.3

9%

GAAP Operating Margin

24.1%

20.9%

320 bps

Adjusted Operating Income

$89.3

$82.7

8%

Adjusted Operating Margin

24.1%

21.0%

310 bps

Adjusted EBITDA

$94.8

$86.6

9%

Adjusted EBITDA Margin

25.5%

21.9%

360 bps

- Organic bookings were flat.

- Reported revenues were down 6 percent, including approximately

3 percentage points of negative foreign exchange impact. Organic

revenues were down 3 percent.

- GAAP operating margin was up 320 basis points, adjusted

operating margin was up 310 basis points and adjusted EBITDA margin

was up 360 basis points.

- Positive price realization and productivity more than offset

inflation. The Company also continued high levels of business

reinvestment.

Balance Sheet and Cash Flow

$, millions

Q2 2024

Q2 2023

Y-O-Y Change

Cash From Continuing Operating

Activities Y-T-D

$959

$548

$411

Free Cash Flow Y-T-D*

$810

$427

$383

Working Capital/Revenue*

4.2%

6.3%

(210) bps

Cash Balance June 30**

$1,326

$664

$662

Debt Balance June 30

$5,268

$5,027

$241

**Includes short-term investments of $451

million.

- Through June 30, 2024, cash flow from continuing operating

activities was $959 million and free cash flow was $810

million.

- Year-to-date through July, the Company deployed or committed

approximately $1.2 billion of capital including $379 million for

dividends, approximately $100 million for M&A and $731 million

for share repurchases.

- The Company expects to continue to pay a competitive and

growing dividend and to deploy 100 percent of excess cash to

shareholders over time.

Raising Full-Year 2024 Revenue and EPS Guidance

- The Company expects full-year reported and organic revenue

growth of approximately 10 percent; reported revenue growth

includes approximately 1 percentage point of M&A offset by

approximately 1 percentage point of negative foreign exchange.

- The Company expects GAAP and adjusted continuing EPS for

full-year 2024 of approximately $10.80.

- Additional information regarding the Company's 2024 guidance is

included in the Company's second-quarter earnings presentation

found at www.tranetechnologies.com in the Investor Relations

section.

This news release includes “forward-looking" statements within

the meaning of securities laws, which are statements that are not

historical facts, including statements that relate to our future

financial performance and targets, including revenue, EPS, and

earnings; our business operations; demand for our products and

services, including bookings and backlog; capital deployment,

including the amount and timing of our dividends, our share

repurchase program, anticipated capital commitments for M&A

activity, and our capital allocation strategy; our available

liquidity; our anticipated revenue growth, and the performance of

the markets in which we operate.

These forward-looking statements are based on our current

expectations and are subject to risks and uncertainties, which may

cause actual results to differ materially from our current

expectations. Such factors include, but are not limited to, global

economic conditions, including recessions and economic downturns,

inflation, volatility in interest rates and foreign exchange;

changing energy prices; national and international conflict;

impacts of global health crises, epidemics, pandemics, or other

contagious outbreaks on our business operations, financial results

and financial position and on the world economy; financial

institution disruptions; climate change and our sustainability

strategies and goals; commodity shortages; supply chain constraints

and price increases; government regulation; restructurings activity

and cost savings associated with such activity; secular trends

toward decarbonization, energy efficiency and internal air quality,

the outcome of any litigation, including the risks and

uncertainties associated with the Chapter 11 proceedings for our

deconsolidated subsidiaries Aldrich Pump LLC and Murray Boiler LLC;

cybersecurity risks; and tax audits and tax law changes and

interpretations. Additional factors that could cause such

differences can be found in our Form 10-K for the year ended

December 31, 2023, as well as our subsequent reports on Form 10-Q

and other SEC filings. New risks and uncertainties arise from time

to time, and it is impossible for us to predict these events and

how they may affect the Company. We assume no obligation to update

these forward-looking statements.

This news release also includes non-GAAP financial information,

which should be considered supplemental to, not a substitute for,

or superior to, the financial measure calculated in accordance with

GAAP. The definitions of our non-GAAP financial information and

reconciliation to GAAP are attached to this news release.

All amounts reported within the earnings release above related

to net earnings (loss), earnings (loss) from continuing operations,

earnings (loss) from discontinued operations, adjusted EBITDA and

per share amounts are attributed to Trane Technologies' ordinary

shareholders.

Trane Technologies (NYSE:TT) is a global climate innovator.

Through our strategic brands Trane® and Thermo King®, and our

portfolio of environmentally responsible products and services, we

bring efficient and sustainable climate solutions to buildings,

homes and transportation. For more information, visit

tranetechnologies.com.

# # #

7/31/2024

(See Accompanying Tables)

- Table 1: Condensed Consolidated Income Statement

- Tables 2 - 5: Reconciliation of GAAP to Non-GAAP

- Table 6: Condensed Consolidated Balance Sheets

- Table 7: Condensed Consolidated Statement of Cash Flows

- Table 8: Balance Sheet Metrics and Free Cash Flow

*Q2 Non-GAAP measures definitions

Adjusted operating income in 2024 is defined as GAAP

operating income adjusted for restructuring costs, a non-cash

adjustment for contingent consideration, merger and acquisition

related costs, and legacy legal liability. Adjusted operating

income in 2023 is defined as GAAP operating income adjusted for

restructuring costs, transformation costs, a non-cash adjustment

for contingent consideration and merger and acquisition related

costs. Please refer to the reconciliation of GAAP to non-GAAP

measures on tables 2, 3 and 4 of the news release.

Adjusted operating margin is defined as the ratio of

adjusted operating income divided by net revenues.

Adjusted earnings from continuing operations attributable to

Trane Technologies plc (Adjusted net earnings) in 2024 is

defined as GAAP earnings from continuing operations attributable to

Trane Technologies plc adjusted for net of tax impacts of

restructuring costs, a non-cash adjustment for contingent

consideration, merger and acquisition related costs, and legacy

legal liability. Adjusted net earnings in 2023 is defined as GAAP

earnings from continuing operations attributable to Trane

Technologies plc adjusted for an impairment of equity investment

and the net of tax impacts of restructuring costs, transformation

costs, a non-cash adjustment for contingent consideration and

merger and acquisition related costs. Please refer to the

reconciliation of GAAP to non-GAAP measures on tables 2 and 3 of

the news release.

Adjusted continuing EPS in 2024 is defined as GAAP

continuing EPS adjusted for net of tax impacts of restructuring

costs, a non-cash adjustment for contingent consideration, merger

and acquisition related costs, and legacy legal liability. Adjusted

continuing EPS in 2023 is defined as GAAP continuing EPS adjusted

for an impairment of equity investment and the net of tax impacts

of restructuring costs, transformation costs, a non-cash adjustment

for contingent consideration and merger and acquisition related

costs. Please refer to the reconciliation of GAAP to non-GAAP

measures on tables 2 and 3 of the news release.

Adjusted EBITDA in 2024 is defined as adjusted operating

income adjusted for depreciation and amortization expense and other

income / (expense), net. Adjusted EBITDA in 2023 is defined as

adjusted operating income adjusted for depreciation and

amortization expense, other income / (expense), net, and excluding

an impairment of equity investment. Please refer to the

reconciliation of GAAP to non-GAAP measures on tables 4 and 5 of

the news release.

Adjusted EBITDA margin is defined as the ratio of

adjusted EBITDA divided by net revenues.

Adjusted effective tax rate for 2024 is defined as the

ratio of income tax expense adjusted for the net tax effect of

adjustments for restructuring costs, a non-cash adjustment for

contingent consideration, merger and acquisition related costs, and

legacy legal liability divided by adjusted net earnings. Adjusted

effective tax rate for 2023 is defined as the ratio of income tax

expense adjusted for the net tax effect of adjustments for

restructuring costs, transformation costs, a non-cash adjustment

for contingent consideration and merger and acquisition related

costs divided by adjusted net earnings. This measure allows for a

direct comparison of the effective tax rate between periods.

Free cash flow in 2024 is defined as net cash provided by

(used in) continuing operating activities adjusted for capital

expenditures, cash payments for restructuring costs, legacy legal

liability, and merger and acquisition related costs. Free cash flow

in 2023 is defined as net cash provided by (used in) continuing

operating activities adjusted for capital expenditures, cash

payments for restructuring costs, transformation costs and merger

and acquisition related costs. Please refer to the free cash flow

reconciliation on table 8 of the news release.

Operating leverage is defined as the ratio of the change

in adjusted operating income for the current period (e.g. Q2 2024)

less the prior period (e.g. Q2 2023), divided by the change in net

revenues for the current period less the prior period.

Organic revenue is defined as GAAP net revenues adjusted

to eliminate currency fluctuations and the impact of

acquisitions.

Organic bookings is defined as reported orders in the

current period adjusted to eliminate currency fluctuations and the

impact of acquisitions.

Working capital measures a firm’s operating liquidity

position and its overall effectiveness in managing the enterprise's

current accounts.

- Working capital is calculated by adding net accounts and

notes receivables and inventories and subtracting total current

liabilities that exclude short-term debt, dividend payable and

income tax payables.

- Working capital as a percent of revenue is calculated by

dividing the working capital balance (e.g. as of June 30) by the

annualized revenue for the period (e.g. reported revenues for the

three months ended June 30 multiplied by 4 to annualize for a full

year).

The Company reports its financial results in accordance with

generally accepted accounting principles in the United States

(GAAP). The following schedules provide non-GAAP financial

information and a quantitative reconciliation of the difference

between the non-GAAP financial measures and the financial measures

calculated and reported in accordance with GAAP.

The non-GAAP financial measures should be considered

supplemental to, not a substitute for or superior to, financial

measures calculated in accordance with GAAP. They have limitations

in that they do not reflect all of the costs associated with the

operations of our businesses as determined in accordance with GAAP.

In addition, these measures may not be comparable to non-GAAP

financial measures reported by other companies.

We believe the non-GAAP financial information provides important

supplemental information to both management and investors regarding

financial and business trends used in assessing our financial

condition and results of operations.

Non-GAAP financial measures assist investors with analyzing our

business results as well as with predicting future performance. In

addition, these non-GAAP financial measures are also reviewed by

management in order to evaluate the financial performance of each

segment. Presentation of these non-GAAP financial measures helps

investors and management to assess the operating performance of the

Company.

As a result, one should not consider these measures in isolation

or as a substitute for our results reported under GAAP. We

compensate for these limitations by analyzing results on a GAAP

basis as well as a non-GAAP basis, prominently disclosing GAAP

results and providing reconciliations from GAAP results to non-GAAP

results.

Table 1

TRANE TECHNOLOGIES PLC

Condensed Consolidated Income

Statement

(In millions, except per share

amounts)

UNAUDITED

For the quarter

For the six months

ended June 30,

ended June 30,

2024

2023

2024

2023

Net revenues

$

5,307.4

$

4,704.7

$

9,523.0

$

8,370.6

Cost of goods sold

(3,371.9

)

(3,120.3

)

(6,127.6

)

(5,642.7

)

Selling and administrative expenses

(901.3

)

(699.0

)

(1,727.4

)

(1,385.7

)

Operating income

1,034.2

885.4

1,668.0

1,342.2

Interest expense

(57.5

)

(61.6

)

(115.5

)

(119.2

)

Other income/(expense), net

(4.1

)

(57.4

)

(29.2

)

(66.8

)

Earnings before income taxes

972.6

766.4

1,523.3

1,156.2

Provision for income taxes

(205.8

)

(169.6

)

(311.3

)

(242.8

)

Earnings from continuing operations

766.8

596.8

1,212.0

913.4

Discontinued operations, net of tax

(6.9

)

(6.1

)

(12.3

)

(11.6

)

Net earnings

759.9

590.7

1,199.7

901.8

Less: Net earnings from continuing

operations attributable to noncontrolling interests

(4.6

)

(4.5

)

(8.1

)

(8.5

)

Net earnings attributable to Trane

Technologies plc

$

755.3

$

586.2

$

1,191.6

$

893.3

Amounts attributable

to Trane Technologies plc ordinary shareholders:

Continuing operations

$

762.2

$

592.3

$

1,203.9

$

904.9

Discontinued operations

(6.9

)

(6.1

)

(12.3

)

(11.6

)

Net earnings

$

755.3

$

586.2

$

1,191.6

$

893.3

Diluted earnings

(loss) per share attributable to Trane Technologies plc ordinary

shareholders:

Continuing operations

$

3.33

$

2.57

$

5.25

$

3.92

Discontinued operations

(0.03

)

(0.02

)

(0.05

)

(0.05

)

Net earnings

$

3.30

$

2.55

$

5.20

$

3.87

Weighted-average number of common shares

outstanding:

Diluted

228.7

230.3

229.1

230.9

Table 2

TRANE TECHNOLOGIES PLC

Reconciliation of GAAP to

non-GAAP

(In millions, except per share

amounts)

UNAUDITED

For the quarter ended June 30,

2024

For the six months ended June 30,

2024

As

As

As

As

Reported

Adjustments

Adjusted

Reported

Adjustments

Adjusted

Net revenues

$

5,307.4

$

—

$

5,307.4

$

9,523.0

$

—

$

9,523.0

Operating income

1,034.2

(7.1

)

(a,b,c,d)

1,027.1

1,668.0

(1.3

)

(a,b,c,d)

1,666.7

Operating margin

19.5

%

19.4

%

17.5

%

17.5

%

Earnings from continuing operations before

income taxes

972.6

(7.1

)

(a,b,c,d)

965.5

1,523.3

(1.3

)

(a,b,c,d)

1,522.0

Provision for income taxes

(205.8

)

(0.3

)

(e)

(206.1

)

(311.3

)

(1.7

)

(e)

(313.0

)

Tax rate

21.2

%

21.3

%

20.4

%

20.6

%

Earnings from continuing operations

attributable to Trane Technologies plc

$

762.2

$

(7.4

)

(f)

$

754.8

$

1,203.9

$

(3.0

)

(f)

$

1,200.9

Diluted earnings per

common share

Continuing operations

$

3.33

$

(0.03

)

$

3.30

$

5.25

$

(0.01

)

$

5.24

Weighted-average number of common shares

outstanding:

Diluted

228.7

—

228.7

229.1

—

229.1

Detail of

Adjustments:

(a)

Restructuring costs (COGS &

SG&A)

$

0.8

$

5.5

(b)

Legacy legal liability (SG&A)

0.6

1.7

(c)

M&A transaction costs (SG&A)

0.4

0.4

(d)

Non-cash adjustments for contingent

consideration (SG&A)

(8.9

)

(8.9

)

(e)

Tax impact of adjustments (a,b,c)

(0.3

)

(1.7

)

(f)

Impact of adjustments on earnings from

continuing operations attributable to Trane Technologies plc

$

(7.4

)

$

(3.0

)

Pre-tax impact of adjustments on cost of

goods sold

$

0.6

$

0.6

Pre-tax impact of adjustments on selling

& administrative expenses

(7.7

)

(1.9

)

Pre-tax impact of adjustments on operating

income

$

(7.1

)

$

(1.3

)

Table 3

TRANE TECHNOLOGIES PLC

Reconciliation of GAAP to

non-GAAP

(In millions, except per share

amounts)

UNAUDITED

For the quarter ended June 30,

2023

For the six months ended June 30,

2023

As

As

As

As

Reported

Adjustments

Adjusted

Reported

Adjustments

Adjusted

Net revenues

$

4,704.7

$

—

$

4,704.7

$

8,370.6

$

—

$

8,370.6

Operating income

885.4

(36.9

)

(a,b,c,d,e)

848.5

1,342.2

(21.3

)

(a,b,c,d,e)

1,320.9

Operating margin

18.8

%

18.0

%

16.0

%

15.8

%

Earnings from continuing operations before

income taxes

766.4

15.3

(a,b,c,d,e,f)

781.7

1,156.2

30.9

(a,b,c,d,e,f)

1,187.1

Benefit (Provision) for income taxes

(169.6

)

9.1

(g)

(160.5

)

(242.8

)

6.2

(g)

(236.6

)

Tax rate

22.1

%

20.5

%

21.0

%

19.9

%

Earnings from continuing operations

attributable to Trane Technologies plc

$

592.3

$

24.4

(h)

$

616.7

$

904.9

$

37.1

(h)

$

942.0

Diluted earnings per

common share

Continuing operations

$

2.57

$

0.11

$

2.68

$

3.92

$

0.16

$

4.08

Weighted-average number of common shares

outstanding:

Diluted

230.3

—

230.3

230.9

—

230.9

Detail of

Adjustments:

(a)

Non-cash adjustment for contingent

consideration (SG&A)

$

(52.0

)

$

(49.3

)

(b)

Acquisition inventory step-up and backlog

amortization (COGS & SG&A)

7.5

10.1

(c)

Restructuring costs (COGS &

SG&A)

1.5

7.8

(d)

Transformation costs (SG&A)

1.3

2.4

(e)

M&A transaction costs (SG&A)

4.8

7.7

(f)

Impairment of equity investment (OIOE)

52.2

52.2

(g)

Tax impact of adjustments (a,b,c,d,e)

9.1

6.2

(h)

Impact of adjustments on earnings from

continuing operations attributable to Trane Technologies plc

$

24.4

$

37.1

Pre-tax impact of adjustments on cost of

goods sold

$

4.0

$

12.2

Pre-tax impact of adjustments on selling

& administrative expenses

(40.9

)

(33.5

)

Pre-tax impact of adjustments on operating

income

(36.9

)

(21.3

)

Pre-tax impact of adjustments on other

income / (expense), net

52.2

52.2

Pre-tax impact of adjustments on earnings

from continuing operations

$

15.3

$

30.9

Table 4

TRANE TECHNOLOGIES PLC

Reconciliation of GAAP to

non-GAAP

(In millions)

UNAUDITED

For the quarter ended June 30,

2024

For the quarter ended June 30,

2023

As Reported

Margin

As Reported

Margin

Americas

Net revenues

$

4,290.9

$

3,692.5

Segment operating income

$

912.1

21.3

%

$

783.1

21.2

%

Restructuring/Other (a)

(8.2

)

(0.2

)%

(50.5

)

(1.4

)%

Adjusted operating income *

903.9

21.1

%

732.6

19.8

%

Depreciation and amortization (b)

76.5

1.8

%

64.7

1.8

%

Other income/(expense), net (c)

(2.2

)

(0.1

)%

(6.0

)

(0.2

)%

Adjusted EBITDA *

$

978.2

22.8

%

$

791.3

21.4

%

Europe, Middle

East & Africa

Net revenues

$

645.3

$

617.6

Segment operating income

$

120.7

18.7

%

$

101.1

16.4

%

Restructuring/Other (d)

0.3

0.1

%

6.9

1.1

%

Adjusted operating income *

121.0

18.8

%

108.0

17.5

%

Depreciation and amortization (e)

10.7

1.7

%

9.9

1.6

%

Other income/(expense), net

(0.7

)

(0.2

)%

(0.1

)

—

%

Adjusted EBITDA *

$

131.0

20.3

%

$

117.8

19.1

%

Asia

Pacific

Net revenues

$

371.2

$

394.6

Segment operating income

$

89.3

24.1

%

$

82.3

20.9

%

Restructuring/Other (f)

—

—

%

0.4

0.1

%

Adjusted operating income *

89.3

24.1

%

82.7

21.0

%

Depreciation and amortization (g)

4.4

1.1

%

4.6

1.2

%

Other income/(expense), net

1.1

0.3

%

(0.7

)

(0.3

)%

Adjusted EBITDA *

$

94.8

25.5

%

$

86.6

21.9

%

Corporate

Unallocated corporate expense

$

(87.9

)

$

(81.1

)

Restructuring/Other (h)

0.8

6.3

Adjusted corporate expense *

(87.1

)

(74.8

)

Depreciation and amortization

4.6

4.3

Other income/(expense), net

(2.3

)

1.6

Adjusted EBITDA *

$

(84.8

)

$

(68.9

)

Total

Company

Net revenues

$

5,307.4

$

4,704.7

Operating income

$

1,034.2

19.5

%

$

885.4

18.8

%

Restructuring/Other (a,d,f,h)

(7.1

)

(0.1

)%

(36.9

)

(0.8

)%

Adjusted operating income *

1,027.1

19.4

%

848.5

18.0

%

Depreciation and amortization (b,e,g)

96.2

1.8

%

83.5

1.8

%

Other income/(expense), net (c)

(4.1

)

(0.1

)%

(5.2

)

(0.1

)%

Adjusted EBITDA *

$

1,119.2

21.1

%

$

926.8

19.7

%

*Represents a non-GAAP measure, refer to

pages 5-6 in the Earnings Release for definitions.

(a) Restructuring/Other within Americas

includes ($8.9) million of a non-cash adjustment for contingent

consideration in 2024. Restructuring/Other includes ($52) million

non-cash adjustment for contingent consideration and acquisition

inventory step-up and backlog amortization of $1.0 million in

2023.

(b) Depreciation and amortization within

Americas excludes $0.1 million of acquisition backlog amortization,

which has been accounted for in the Restructuring/Other line in

2023.

(c) Other income/(expense), net within

Americas excludes $52.2 million of impairment of an equity

investment in 2023.

(d) Restructuring/Other within EMEA

includes acquisition inventory step-up and backlog amortization of

$6.1 million in 2023.

(e) Depreciation and amortization within

EMEA excludes acquisition backlog amortization of $4.4 million,

which has been accounted for in the Restructuring/Other line in

2023.

(f) Restructuring/Other within Asia

Pacific includes acquisition backlog amortization of $0.4 million

in 2023.

(g) Depreciation and amortization within

Asia Pacific excludes $0.4 million of acquisition backlog

amortization, which has been accounted for in the

Restructuring/Other line in 2023.

(h) Other within Corporate includes $0.6

million and $0.4 million of legacy legal liability and M&A

transaction costs, respectively, in 2024. Other within Corporate

includes $1.3 million and $4.8 million of transformation and

M&A transaction costs, respectively, in 2023.

Table 5

TRANE TECHNOLOGIES PLC

Reconciliation of GAAP to

non-GAAP

(In millions)

UNAUDITED

For the quarter

ended June 30,

2024

2023

Total Company

Adjusted EBITDA *

$

1,119.2

$

926.8

Less: items to reconcile adjusted EBITDA

to net earnings attributable to Trane Technologies plc

Depreciation and amortization (1)

(96.2

)

(83.5

)

Interest expense

(57.5

)

(61.6

)

Provision for income taxes

(205.8

)

(169.6

)

Restructuring costs

(0.8

)

(1.5

)

Transformation costs

—

(1.3

)

M&A transaction costs

(0.4

)

(4.8

)

Legacy legal liability

(0.6

)

—

Non-cash adjustment for contingent

consideration

8.9

52.0

Acquisition inventory step-up and backlog

amortization

—

(7.5

)

Impairment of equity investment

—

(52.2

)

Discontinued operations, net of tax

(6.9

)

(6.1

)

Net earnings from continuing operations

attributable to noncontrolling interests

(4.6

)

(4.5

)

Net earnings attributable to Trane

Technologies plc

$

755.3

$

586.2

(1) Depreciation and amortization excludes

acquisition backlog amortization of $4.9 million which has been

included in the acquisition inventory step-up and backlog

amortization line in 2023.

*Represents a non-GAAP measure, refer to

pages 5-6 in the Earnings Release for definitions.

Table 6

TRANE TECHNOLOGIES PLC

Condensed Consolidated Balance

Sheets

(In millions)

UNAUDITED

June 30,

December 31,

2024

2023

ASSETS

Cash and cash equivalents

$

874.6

$

1,095.3

Short-term investments

451.2

—

Accounts and notes receivable, net

3,433.3

2,956.8

Inventories

2,203.5

2,152.1

Other current assets

751.4

665.7

Total current assets

7,714.0

6,869.9

Property, plant and equipment, net

1,827.8

1,772.2

Goodwill

6,057.7

6,095.3

Intangible assets, net

3,351.6

3,439.8

Other noncurrent assets

1,248.1

1,214.7

Total assets

$

20,199.2

$

19,391.9

LIABILITIES AND EQUITY

Accounts payable

$

2,180.1

$

2,025.2

Accrued expenses and other current

liabilities

3,460.3

3,226.4

Short-term borrowings and current

maturities of long-term debt

952.0

801.9

Total current liabilities

6,592.4

6,053.5

Long-term debt

4,316.2

3,977.9

Other noncurrent liabilities

2,323.0

2,343.5

Shareholders' Equity

6,967.6

7,017.0

Total liabilities and equity

$

20,199.2

$

19,391.9

Table 7

TRANE TECHNOLOGIES PLC

Condensed Consolidated

Statement of Cash Flows

(In millions)

UNAUDITED

For the six months

ended June 30,

2024

2023

Operating Activities

Earnings from continuing operations

$

1,212.0

$

913.4

Depreciation and amortization

187.7

168.2

Changes in assets and liabilities and

other non-cash items

(441.1

)

(533.5

)

Net cash provided by (used in) continuing

operating activities

958.6

548.1

Net cash provided by (used in)

discontinued operating activities

(15.5

)

(15.6

)

Net cash provided by (used in) operating

activities

943.1

532.5

Investing Activities

Capital expenditures, net

(156.7

)

(134.0

)

Acquisition of businesses, net of cash

acquired

(5.2

)

(506.2

)

Sales (purchases) of short-term

investments, net

(450.0

)

—

Other investing activities, net

(14.7

)

(6.8

)

Net cash provided by (used in) investing

activities

(626.6

)

(647.0

)

Financing Activities

Net proceeds from (payments of) debt

491.0

189.5

Dividends paid to ordinary

shareholders

(379.4

)

(341.4

)

Repurchase of ordinary shares

(624.4

)

(300.0

)

Other financing activities, net

8.5

15.5

Net cash provided by (used in) financing

activities

(504.3

)

(436.4

)

Effect of exchange rate changes on cash

and cash equivalents

(32.9

)

(6.0

)

Net increase (decrease) in cash and cash

equivalents

(220.7

)

(556.9

)

Cash and cash equivalents - beginning of

period

1,095.3

1,220.5

Cash and cash equivalents - end of

period

$

874.6

$

663.6

Table 8

TRANE TECHNOLOGIES PLC

Balance Sheet Metrics and Free

Cash Flow

($ in millions)

UNAUDITED

June 30,

June 30,

December 31,

2024

2023

2023

Net Receivables

$

3,433.3

$

3,199.8

$

2,956.8

Days Sales Outstanding

59.0

62.1

61.0

Net Inventory

$

2,203.5

$

2,355.8

$

2,152.1

Inventory Turns

6.1

5.3

5.5

Accounts Payable

$

2,180.1

$

2,176.9

$

2,025.2

Days Payable Outstanding

59.0

63.7

62.6

-------------------------------------------------------------------------------------------------------------------------------------------------------

Six months ended

Six months ended

June 30, 2024

June 30, 2023

Net cash flow provided by continuing

operating activities

$

958.6

$

548.1

Capital expenditures

(156.7

)

(134.0

)

Cash payments for restructuring

5.9

4.8

Legacy legal liability

1.7

—

M&A transaction costs

0.6

6.8

Transformation costs paid

—

1.2

Free cash flow *

$

810.1

$

426.9

*Represents a non-GAAP measure, refer to

pages 5-6 in the Earnings Release for definitions.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240731213209/en/

Media: Travis Bullard 919-802-2593

Media@tranetechnologies.com

Investors: Zac Nagle 704-990-3913

InvestorRelations@tranetechnologies.com

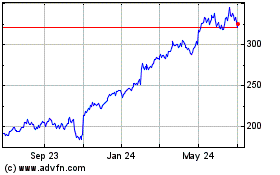

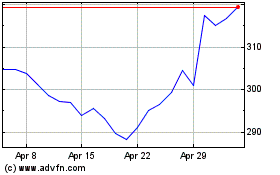

Trane Technologies (NYSE:TT)

Historical Stock Chart

From Nov 2024 to Dec 2024

Trane Technologies (NYSE:TT)

Historical Stock Chart

From Dec 2023 to Dec 2024