Townsquare Announces Repurchase of Just Under 10% of Outstanding Shares Reaffirms Q1’24 and FY’24 Guidance

April 01 2024 - 6:00AM

Townsquare Media, Inc. (NYSE: TSQ) (the “Company” or “Townsquare”)

announced that today we are repurchasing and retiring 1.5 million

shares of Class A common stock held by MSG National Properties, LLC

(“MSG”), for $9.76 per share. The purchase price reflects an 11%

discount from the closing price of the Class A common stock on

March 28, 2024. This transaction follows Townsquare’s June 2023

repurchase of 1.5 million shares from MSG at $9.70 per share, and

March 2021 repurchase of 12.6 million shares and warrants from

Oaktree Capital Management, L.P. at $6.40 per share. The purchase

price of $14.6 million was funded entirely with cash on hand. In

2023, Townsquare’s Cash Flow from Operations increased 35%

year-over-year to $68 million, or approximately $4.07 per basic

share based on shares outstanding as of March 28, 2024. Pro forma

for this transaction, Cash Flow from Operations per basic share

increased to approximately $4.47, representing accretion of

approximately 10%. Following the transaction, the Company has 15.2

million shares outstanding.

“We are very pleased to share that we have

repurchased just under 10% of our total shares outstanding in an

immediately accretive transaction for our shareholders. Since 2021,

we have repurchased 16.2 million shares at an average price of

$7.19, while simultaneously reducing leverage. The strong cash

generation characteristics of our business model, which produced

$68 million of cash flow from operations in 2023, has afforded us

the opportunity to accretively repurchase equity and debt, while

also investing internally in our digital growth engine. In

addition, we introduced a high-yielding dividend in 2023, and

recently increased it by 5%. Our dividend has a yield of 7% as of

March 28, 2024,” commented Bill Wilson, Townsquare’s Chief

Executive Officer. “With a strong cash balance of $40 million

following this transaction, we will retain financial flexibility

moving forward and we are confident in our ability to build

shareholder value for our investors through long-term net revenue,

Adjusted EBITDA and cash flow growth, net leverage reduction,

future dividend payments, and potential future share

repurchases.”

Q1’24 and Full Year 2024 Guidance

ReaffirmedFor the first quarter of 2024, net revenue

guidance is reaffirmed to be between $98.5 million and $100

million, and Adjusted EBITDA guidance is reaffirmed to be between

$17.5 million and $18.5 million.

For the full year 2024, net revenue guidance is

reaffirmed to be between approximately $440 million and $460

million, and Adjusted EBITDA guidance is reaffirmed to be between

$100 million and $110 million.

“We thank our Board of Directors for their vote

of confidence in our medium and long-term business plan to grow

revenue and profits, and MSG for their long-term support of our

Company,” concluded Mr. Wilson.About Townsquare Media,

Inc.Townsquare is a community-focused

digital media and digital marketing solutions company with market

leading local radio stations, principally focused outside the top

50 markets in the U.S. Our assets include a subscription digital

marketing services business, Townsquare

Interactive, providing website design, creation and

hosting, search engine optimization, social media and online

reputation management as well as other digital monthly services for

approximately 24,000 SMBs; a robust digital advertising division,

Townsquare Ignite, a powerful combination of a) an

owned and operated portfolio of more than 400 local news and

entertainment websites and mobile apps along with a network of

leading national music and entertainment brands, collecting

valuable first party data and b) a proprietary digital programmatic

advertising technology stack with an in-house demand and data

management platform; and a portfolio of 350 local terrestrial radio

stations in 74 U.S. markets strategically situated outside the Top

50 markets in the United States. Our portfolio includes local media

brands such as WYRK.com, WJON.com and NJ101.5.com, and premier

national music brands such as XXLmag.com, TasteofCountry.com,

UltimateClassicRock.com, and Loudwire.com. For more information,

please visit www.townsquaremedia.com, www.townsquareinteractive.com

and www.townsquareignite.com.Forward Looking

Statements

Except for the historical information contained

in this Press Release, the matters addressed are forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements often discuss the

Company’s current expectations. You can identify forward-looking

statements by the fact that they do not relate strictly to

historical or current facts. These statements may include words

such as “could,” “would,” “will,” “plan,” the negatives thereof and

other words and terms. The forward-looking statements contained in

this Press Release include, but are not limited to, statements

related to the Company’s long-term business plan. By nature,

forward-looking statements involve risks and uncertainties that

could cause actual results to differ materially from those

projected or implied by the forward-looking statements.

Forward-looking statements are based on current expectations and

assumptions and currently available data and are neither

predictions nor guarantees of future events or performance. You

should not place undue reliance on forward-looking statements,

which speak only as of the date hereof or as of the date specified

herein. See “Risk Factors” and “Forward-Looking Statements”

included in the Company’s Annual Report on Form 10-K for the year

ended December 31, 2023, filed with the Securities and Exchange

Commission (the “SEC”) on March 15, 2024, and subsequent filings

with the SEC, for a discussion of factors that could cause the

Company’s actual results to differ from those expressed or implied

by forward-looking statements. The Company assumes no

responsibility to update any forward-looking statement as a result

of new information, future events or otherwise.

Investor RelationsClaire

Yenicay(203) 900-5555investors@townsquaremedia.com

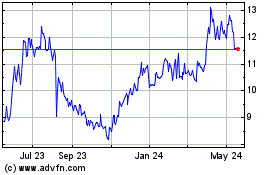

Townsquare Media (NYSE:TSQ)

Historical Stock Chart

From Nov 2024 to Dec 2024

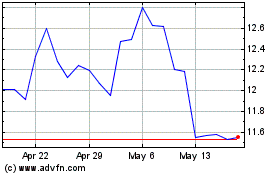

Townsquare Media (NYSE:TSQ)

Historical Stock Chart

From Dec 2023 to Dec 2024