UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

Date of Report: February 26, 2024

Commission File Number: 001-39570

TIM S.A.

(Exact name of Registrant as specified in its Charter)

João

Cabral de Melo Neto Avenue, 850 – North Tower – 12th floor

22775-057 Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form

40-F ☐

Indicate by check mark if the registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1).

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7).

Yes ☐ No ☒

INDEX

| 1. | Message from the Management |

1 |

| 2. | Shareholders’ Meeting date, time, agenda and local |

2 |

| 3. | Information about the matters to be resolved |

3 |

| 5. | Participation Guidelines |

8 |

1. Message from the Management

Dear Shareholder,

TIM S.A. (“Company” or “TIM”) reinforces its commitment

to the best practices of corporate governance, with the professionalism of its management and works to offer direct and objective communication

with its shareholders and with the market in general. In conducting its business guided by good faith, in addition to ethics and loyalty,

the Company seeks to: (i) act with transparency in its business; (ii) promote loyalty with peers; (iii) world-class market competitiveness;

(iv) serve the well-being and growth of the community in which it operates; (v) enhance its human resources; and (vi) promote sustainable

development.

We highlight that TIM is the company in the telecommunications sector for

the longest time, being part of the special listing segment of the Novo Mercado B3, recognized as the highest level of corporate governance.

Among the practices adopted, we reinforce the exclusive negotiation of ordinary shares (with voting rights), permanent Fiscal Council

and Statutory Audit Committee, among other Committees, and 100% “Tag Along rights”.

The effective attendance of shareholders in this Shareholders’ Meeting

is an opportunity to discuss and vote the matters to be resolved considering the disclosed information to a conscious decision taking.

For that matter, with the purpose to facilitate and incentive the participation

of its shareholders and reinforce the commitment to develop the best corporate governance practices, the Company will adopt the remote

voting system established by CVM Resolution No. 81/2022, as amended. The guidelines to vote through remote voting form are detailed in

this document.

The purpose of these Instructions is to present precisely all the information

regarding the Companies’ Annual and Extraordinary Shareholders’ Meeting, with the detailed matters to be analyzed and instructions

for the shareholders to take part in the Shareholders’ Meeting.

Thus, we have the pleasure to invite you to attend the Annual and Extraordinary

Shareholders’ Meetings to be held on March 28th, 2024, at 02:30pm, at Avenida João Cabral de Mello Neto, nº 850, South

Tower, 13th floor, Barra da Tijuca, in the City and State of Rio de Janeiro.

Cordially,

The Management

2. Shareholders’ Meeting date, time, agenda and place

Date and Time

Annual and Extraordinary Shareholders’ Meeting: March

28th, 2024, at 02:30pm. It is recommended that the interested arrive at the local 30 (thirty) minutes earlier than the time indicated.

Agenda

| 01:30pm: |

Shareholders access will be granted and attendants accredited |

| 02:30pm |

Beginning of the Shareholders’ Meeting |

| 04:00pm |

Forecast for the Shareholders’ Meeting closure * |

* Estimated closure time based upon the historical times of previous

Meetings, subject to changes.

Local

TIM S.A. - Avenida João Cabral de Mello Neto, nº

850 South Tower, 13th floor, Barra da Tijuca, Rio de Janeiro (RJ). The access to the meeting will be through the Company’s social

entrance.

3. Information about the matters to be resolved

On Annual Shareholders’ Meeting:

(1) To resolve on the management’s report and the financial

statements of the Company, dated as of December 31st, 2023;

In compliance with the Annual Circular Letter-2023- CVM/SEP,

and as set forth in the CVM Resolution No. 81/2022, TIM S.A. informs that the Opinion of the Fiscal Council is available on the site of

Comissão de Valores Mobiliários (Brazilian Securities and Exchange Commission) filed under the category “Reunião

da Administração”, type “Conselho Fiscal”, species “Ata”, subject “Parecer

acerca das Demonstrações Financeiras”.

The Financial Statements, Opinions of the Independent Auditors

and the DFP Form, for the year of 2023, are available on the site of Comissão de Valores Mobiliários (Brazilian Securities

and Exchange Commission), and on the Company’s site of Investors Relations, on the sites below:

www.cvm.gov.br

www.sec.gov

https://ri.tim.com.br/

(2) To resolve on the management’s proposal for the allocation

of the results related to the fiscal year of 2023, and on the dividends distribution by the Company;

The Companies’ net income, that represents the fiscal

year deducted of legal reserve and tax incentives not to be distributed, related to the fiscal year 2023 amounted to R$2,837,422,255.02.

The Management proposes to allocate the results as follows:

| Total dividends and JCP (gross): |

R$2,910,000,000.00 |

| % Distributed net income for the year: |

102.56% |

(3) To ratify the appointment of the Company’s Board of Directors’

Member, previously appointed at the Board of Directors’ Meeting held on July 31st, 2023.;

The Company's Management proposes the ratification of the appointment

of the member of the Board of Directors below:

| Candidate |

Independency |

Appointment |

| Gigliola Bonino |

No |

07/31/2023 |

(4) To resolve on the composition of the Fiscal Council of the Company;

The management propose the composition of the Fiscal Council

with 3 (three) regular members and 3 (three) alternate members.

(5) To elect the regular and alternate members of the Fiscal Council

of the Company; and

The Management indicates the single group of candidates bellow

to compose the Fiscal Council with mandate until the Annual Shareholders’ Meeting which approve the Financial Statements of the

fiscal year ended in December 31st, 2024.

| Candidate |

Regular/Alternate |

Independency |

Elected by Controlling Shareholder |

| Walmir Urbano Kesseli |

Regular |

Independent |

Yes |

| Carlos Eduardo do Nascimento |

Alternate |

Independent |

Yes |

| Heloisa Belotti Bedicks |

Regular |

Independent |

Yes |

| Ana Maria Gati |

Alternate |

Independent |

Yes |

| Heinz Egon Lowen |

Regular |

Independent |

Yes |

| Arthur Piotto Filho |

Alternate |

Independent |

Yes |

| |

|

|

|

|

|

|

(8)

To resolve on the compensation proposal for the Company’s Administrators,

members of the Committees and the members of the Company's Fiscal Council, for the fiscal year 2024.

The management propose the Companies’ administrator a

fixed compensation to be paid during the fiscal year 2024 with the following amounts:

| Board |

Amount: |

| Board of Directors |

R$ 4,860,000.00 |

| Fiscal Council |

R$

678,000.00 |

| Board of Officers |

R$ 42,814,000.00 |

| Committee |

R$ 3,024,000.00 |

* Values exclude charges arising from social security contributions (INSS).

On Extraordinary Shareholders’ Meeting:

(1) To resolve on the proposal for the extension of the Cooperation

and Support Agreement, through the execution of the 17th amendment to this agreement, to be entered into between Telecom Italia

S.p.A., on the one hand, and the Company, on the other hand:

The Company’s Management proposes the approval of the

17th Amendment of the Cooperation and Support Agreement with Telecom Italia S.p.A. that has as main benefits the following

aspects:

| § | Capturing strategic and economic synergies in projects

planned for the Security structure of the entire TIM group, taking advantage of TIM Italia's general experience and methodologies; |

| § | Support for TIM in Brazil on topics related to FTTx

Ultra Banda Larga networks, with regard to implemented technologies and creation of services; |

| § | Support from TIM Brasil in the development of the wholesale

roaming business; |

| § | Sharing TIM Italia's expertise regarding Business Planning

Consolidation (BPC) and simplification/automation of the process of communicating essential information between TIM S.A. and TIM Italia; |

| § | Support systems for provisioning mobile services, for

the TIM UltraFibra service, working on the provisioning and troubleshooting of CPEs, for managing Marketing campaigns for 20% of the TIM

customer base in Brazil and for provisioning broadband services fixed; |

| § | Development and evolution of the Sentinel tool, used

to monitor the SDN environment and system integration; |

| § | Development and maintenance of test automation for the

postpaid environment; |

| § | Use of SCTR, a system developed by TIM Italia for interconnection,

considering new developments in accordance with the migration requirements of Oi customers. |

(2) To resolve on the Company’s Long-Term Incentive Plan proposal.

Presentation of the Proposal for a new Company Long-Term Incentive

Plan (LTI) for the new three-year cycle (2024-2026), replacing the Plan terminated in the previous year, considering the award to participants

with shares issued by the Company , subject to certain time and/or performance conditions, with the objective of promoting the alignment

of interests between the management and shareholders, ensuring the engagement and retention of strategic resources and encouraging the

achievement of the Company's strategic objectives.

(3) To resolve on the amendment and restatement of the Company’s

By-laws.

Resolve on (i) the amendment of item VII of Article 22 to clarify

the powers of the Board of Directors in deliberating on the participation of the Company or companies under its control in vehicles that

provide for the incorporation of a company; (ii) the amendment in Paragraph 3 of Article 25 to include the possibility of holding meetings

of the Board of Directors in the virtual deliberative circuit format; (iii) the amendment of item VII of Article 29 to adapt the powers

and duties of the members of the Statutory Audit Committee in the complaints received by the company at the request of Internal Audit;

(iv) the amendment in Paragraph 3 of Article 33 to include the possibility of holding Estatutory Board of Officers meetings in the virtual

deliberative circuit format; (v) the amendment to Article 34 to establish joint signature as a general rule for the Company's representation;

(vi) the changes to Article 35 to establish joint signature as a general rule for representing the Company, establish exceptions that

allow isolated representation and to make the issuance of power of attorney instruments more flexible in this scenario and to make clear

the nature of the ad judicia et extra power of attorney; (vii) the amendment in Paragraph 2 of Article 40 to include the possibility

of holding Fiscal Council meetings in the virtual deliberative circuit format; (viii) the change in Paragraph 4 of Article 46 to expressly

provide for the possibility of distributing intermediate dividends (based on balance sheets approved at the general meeting) and interim

dividends (based on balance sheets drawn up during the course of the financial year itself); and (ix) the consequent consolidation of

its Bylaws.

4. General Information

Annual Shareholders’ Meetting

Pursuant to Section 132 of Law No. 6,404/1976 (“Corporate Law”),

stock companies must hold a General Shareholders' Meeting annually within a period of four months after the end of the fiscal year. The

fiscal year of TIM S.A. starts on January 1 and ends on December 31 of each year. Thus, annually, the Company must hold the Annual Shareholders'

Meeting by April 30.

Installation Quorum

Pursuant to Section 125 of the Corporate Law, for the installation

of the Annual Shareholders’ Meeting and the Extraordinary Shareholders’ Meeting, the presence of shareholders representing

at least 1/4 (one quarter) of the Company's capital stock, on first call, will be required.

Should this quorum not be reached, the Company shall publish a new

Call Notice announcing the new date for the General Meeting on second call, which may be installed with the presence of any number of

shareholders. The participation shareholders may be personal, by a duly constituted attorney or by means of sending a distance voting

ballot, under the terms of CVM Resolution No. 81/2022.

Support Documents

All documents and information pertinent to the matters to be examined

and resolved at the Shareholders' Meeting are available to shareholders at the Company's headquarters, as well as at the electronic addresses:

https://ri.tim.com.br/, www.cvm.gov, www.b3.com.br and www.sec.gov.

5. Participation Guidelines

The Shareholder's participation may be in person or by a duly constituted

attorney-in-fact, as provided for in Section 126 of Law No. 6,404/1976 and in the Paragraphs 1 and 2 of Section 12 of the Company's By-laws,

as well as via a distance ballot paper, according to the guidelines described below:

| I. | In Person: A Shareholder who chooses to participate

in person shall deposit a copy of its identity and the respective share statement issued at least five (5) business days prior to the

Shareholders' General Meeting, within two (2) business days prior to the General Meeting; |

| II. | Representation: The Shareholder who wishes

to be represented at the General Meeting shall deposit at the Company's headquarters the respective supporting documentation of its representation,

including the power of attorney and/or the incorporation and corporate acts related to the appointment, as the case may be, and the identification

of the representative, within two (2) business days prior to the General Meeting; |

| III. | Distance Voting Ballot: A Shareholder who,

pursuant to CVM Resolution No. 81/2022, chooses to participate through the distance voting ballot must transmit the instructions for completing

the ballot to its respective custodian or the depositary institution of the Company’s shares, or send the ballot directly to the

Company, in any case, the Company must receive the bulletin no later than 07 (seven) days before the General Meeting. |

| i. | A shareholder who chooses to exercise his right to

vote through a third party service provider shall transmit his voting instructions to his respective custody agent, observing the rules

determined by them, which, in turn, shall forward such vote statements to the Depositary Central of B3. In order to do so, shareholders

should contact their custodian agents to verify the procedures established by them for the issuance of voting instructions via ballot,

as well as the required documents and information. |

| ii. | The shareholder who chooses to exercise his right

to vote through the Company's depositary institution shall attend any branch of Banco Bradesco bank in Brazil in possession of the identification

document or legal representation. |

The list of available agencies can be verified through the website

www.bradesco.com.br

Bradesco's Stock and Custody Department is available to shareholders

for further clarification and service on the following channels:

Department of Shares and Custody

E-mail: dac.escrituracao@bradesco.com.br

Phone: 0800 701 1616

| iii. | The shareholder who chooses to send the ballot paper

directly to the Company may also send a digitized copy of the properly completed, initialed and signed ballot paper together with the

authenticated identification and/or representation documents to the electronic address ri@timbrasil.com.br, in which case, it will also

be necessary to send the original ballot paper and certified copy of the other required documents, up to seven (07) days prior to the

General Meeting to the following address: Avenida João Cabral de Melo Neto, nº 850, South Tower, 13th floor, Barra

da Tijuca, Rio de Janeiro – RJ (CEP: 22775-057). |

Once the documents are received, the Company will notify its receipt

to the shareholder and acceptance or not, pursuant to CVM Resolution No. 81/2022, as amended.

If the ballot paper is eventually sent directly to the Company

but is not fully completed or is not accompanied by the supporting documents described, it will be disregarded and the shareholder will

be notified through the electronic address indicated on the ballot paper.

The required documents mentioned above must be filed in the Company

no later than 2 days before the date of the Shareholders’ Meeting. Any ballot papers received by the Company after this date will

be disregarded.

In case there is any divergence between a distance voting ballot

received directly by the Company and voting instructions contained in the consolidated voting map sent by the depositary under the same

CPF or CNPJ registration number, the voting instruction contained in the voting map shall prevail and the ballot received directly by

the Company shall be disregarded, in accordance with the exception rule provided for in CVM Resolution No. 81/2022.

The documents mentioned herein must be addressed as follows: TIM SA, Investor

Relations Area, Mr. Alberto Mario Griselli; Av. João Cabral de Melo Neto, 850, South Tower, 13th floor, Barra da Tijuca, Rio de

Janeiro (RJ).

6. Links of interest

INVESTOR RELATIONS WEBSITE:

www.tim.com.br/ir

ANNUAL FINANCIAL STATEMENTS AND INDEPENDENT AUDITORS REPORT

ON FINANCIAL STATEMENTS:

www.cvm.gov.br

www.sec.gov

https://ri.tim.com.br/

CALL NOTICE:

www.cvm.gov.br

www.sec.gov

https://ri.tim.com.br/

MANAGEMENT’S PROPOSAL:

www.cvm.gov.br

www.sec.gov

https://ri.tim.com.br/

SIGNATURES

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

|

TIM S.A. |

| Date:

February 26, 2024 |

|

By: |

/s/ Alberto

Mario Griselli |

| |

|

|

Alberto

Mario Griselli |

| |

|

|

Chief

Executive Officer, Chief Financial Officer and Investor Relations Officer |

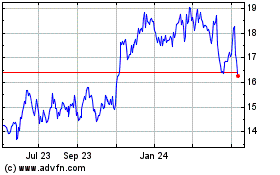

TIM (NYSE:TIMB)

Historical Stock Chart

From Dec 2024 to Jan 2025

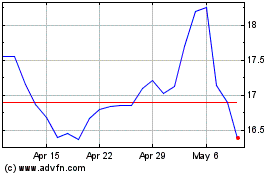

TIM (NYSE:TIMB)

Historical Stock Chart

From Jan 2024 to Jan 2025