UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K/A

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

Date of Report: February 9, 2024

Commission File Number: 001-39570

TIM S.A.

(Exact name of Registrant as specified in its Charter)

João

Cabral de Melo Neto Avenue, 850 – North Tower – 12th floor

22775-057 Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form

40-F ☐

Indicate by check mark if the registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1).

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7).

Yes ☐ No ☒

TIM S.A. and SUBSIDIARY

INDIVIDUAL AND CONSOLIDATED FINANCIAL STATEMENTS on

December 31, 2023

TIM S.A.

FINANCIAL STATEMENTS

December 31, 2023

Contents

| Independent auditors’ report on the financial statements |

1 |

| Individual and consolidated financial statements |

|

| Balance sheets |

6 |

| Statements of income |

8 |

| Statements of comprehensive income |

9 |

| Statements of changes in shareholders' equity |

10 |

| Statements of cash flows |

12 |

| Statements of value added |

14 |

| Management Report |

15 |

| Notes to the individual and consolidated financial statements |

30 |

| Tax Council Opinion |

139 |

| Annual Report from Statutory Committee |

140 |

| Statement of the executive officers on the financial statements |

149 |

| Statement of the Executive Officers on the Independent auditors' report |

150 |

Independent auditor's report on the Financial statements

To the shareholders, board members and directors of

TIM S/A

Rio de Janeiro – RJ

Opinion

We have audited the individual and consolidated financial statements of

Tim S/A (the “Company”), identified as Individual and Consolidated, respectively, which comprise the balance sheets as at

December 31, 2023, and the statements of income, of comprehensive income, of changes in shareholder’s equity and cash flows for

the year then ended, and notes to the financial statements, including a summary of material accounting policy information.

In our opinion, the accompanying financial statements present fairly, in

all material respects, the individual and consolidated financial position of TIM S/A as at December 31, 2023, and its individual and consolidated

financial performance and cash flows for the year then ended in accordance with the accounting practices adopted in Brazil and with the

International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board (IASB).

Basis for opinion

We conducted our audit in accordance with Brazilian and International Standards

on Auditing. Our responsibilities under those standards are further described in the Auditor’s responsibilities for the audit of

the individual and consolidated financial statements section of our report. We are independent of the Company and its subsidiaries in

accordance with the relevant ethical principles set forth in the Code of Professional Ethics for Accountants, the professional standards

issued by the Brazil’s National Association of State Boards of Accountancy (CFC) and we have fulfilled our other ethical responsibilities

in accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a

basis for our opinion.

Emphasis of matter on

the restatement of corresponding figures

As mentioned in the note

2(h) to the financial statements, as a result of the changes in specifics cash flows, the corresponding figures referring to the prior

year of the individual and consolidated statements of cash flows, presented for comparison purposes, have been adjusted and are being

restated as provided for by CPC 23 (IAS 8) – Accounting Policies, Changes in Accounting Estimates and Errors. Our opinion has not

been modified with respect to this matter.

Independent auditor's report on the Financial statements

Key audit matters

Key audit matters are those matters that, in our professional judgment,

were of most significance in our audit of the financial statements of the current period. These matters were addressed in the context

of our audit of the individual and consolidated financial statements as a whole, and in forming our opinion thereon, and we do not provide

a separate opinion on these matters. For each matter below, our description of how our audit addressed the matter, including any commentary

on the findings or outcome of our procedures, is provided in that context.

We have fulfilled the responsibilities described in the Auditor’s

responsibilities for the audit of the individual and consolidated financial statements section of our report, including in relation to

these matters. Accordingly, our audit included the performance of procedures designed to respond to our assessment of the risks of material

misstatement of the financial statements. The results of our audit procedures, including the procedures performed to address the matters

below, provide the basis for our audit opinion on the accompanying financial statements.

Provision for tax related contingencies

As disclosed in the note 24 to the financial statements, the Company is

a party to numerous tax claims and proceedings at different jurisdictional levels, which amounted to R$19,903 million, as of December

31, 2023, for which a provision amounting to R$666 million was recorded in the financial statements, while the remaining R$19,236 million

was disclosed as possible losses, in accordance with CPC 25 (IAS 37) Provisions, Contingent Liabilities and Contingent Assets. The determination

of the provision and disclosures related to the tax contingencies involves significant judgment from management, including their analysis

of the matters in dispute, the opinion of internal and external legal counsel and the estimation surrounding their ultimate resolution.

In addition, in view of the magnitude of the amounts involved, any changes

in estimates or assumptions that impact the determination of the loss prognosis may have significant impacts on the Company’s financial

statements. Accordingly, this was considered a key audit matter.

How our audit conducted this matter

Our audit procedures included, among others: (a) obtaining an understanding

and evaluation of the design of controls over the identification and evaluation of tax claims, including management’s process to

determine whether the technical merits are more-likely-than-not to be sustained in court; (b) involving our tax professionals to assess

the Company’s technical merits regarding certain matters in dispute, obtaining and analyzing external legal opinions, obtaining

internal and external legal counsel confirmation letters, meeting with internal legal counsel to discuss certain tax disputes, and obtaining

a representation letter from the Company’s internal legal counsel; and (c) assessing the adequacy of the disclosures made by the

Company in note the 24 in respect of provision for tax related contingencies.

Independent auditor's report on the Financial statements

Based on the result of audit procedures performed in the provision

for tax contingencies and related disclosures, which is consistent with management’s assessment, we understand that the measurement

of tax claims assessed as probable and possible loss, as well as the respective disclosures in the note 24 are acceptable in the context

of the financial statements taken as a whole.

Other matters

Statements of value added

The individual and consolidated statements of value added (SVA) for year

ended December 31, 2023, prepared under the responsibility of Company management, and presented as supplementary information for purposes

of IFRS, were submitted to audit procedures conducted together with the audit of the Company’s financial statements. To form our

opinion, we evaluated if these statements are reconciled to the financial statements and accounting records, as applicable, and if their

form and content comply with the criteria defined by NBC TG 09 – Statement of Value Added. In our opinion, these statements of value

added were prepared fairly, in all material respects, in accordance with the criteria defined in abovementioned accounting pronouncement

and are consistent in relation to the overall individual and consolidated financial statements.

Other information accompanying the financial statements and the auditor’s

report

Management is responsible for such other information, which comprise the

Management Report.

Our opinion on the individual and consolidated financial statements does

not cover the Management Report and we do not express any form of assurance conclusion thereon.

In connection with our audit of the individual and consolidated financial

statements, our responsibility is to read the Management Report and, in doing so, consider whether this report is materially inconsistent

with the financial statements, or our knowledge obtained in the audit or otherwise appears to be materially misstated. If, based on the

work we have performed, we conclude that there is a material misstatement of the Management Report, we are required to report that fact.

We have nothing to report in this regard.

Responsibilities of management and those charged with governance for

the financial statements

Management is responsible for the preparation and fair presentation of the

individual and consolidated financial statements in accordance with the accounting practices adopted in Brazil and with the International

Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board (IASB), and for such internal control as management

determines is necessary to enable the preparation of financial statements that are free of material misstatement, whether due to fraud

or error.

In preparing the individual and consolidated financial statements, management

is responsible for assessing the Company’s ability to continue as a going concern, disclosing, as applicable, matters related to

going concern and using the going concern basis of accounting unless management either intends to liquidate the Company or to cease operations,

or has no realistic alternative but to do so.

Those charged with governance are responsible for overseeing the Company’s

and its subsidiaries’ financial reporting process.

Independent auditor's report on the Financial statements

Auditor’s responsibilities for the audit of the financial

statements

Our objectives are to obtain reasonable assurance about whether the individual

and consolidated financial statements as a whole are free of material misstatement, whether due to fraud or error, and to issue an auditor’s

report that includes our opinion. Reasonable assurance is a high level of assurance but is not a guarantee that an audit conducted in

accordance with Brazilian and International standards on Auditing will always detect a material misstatement when it exists. Misstatements

can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence

the economic decisions of users taken on the basis of these financial statements.

As part of an audit in accordance with Brazilian and International Standards

on Auditing, we exercise professional judgment and maintain professional skepticism throughout the audit. We also:

| · | Identified and assessed the

risks of material misstatement of the individual and consolidated financial statements, whether due to fraud or error, designed and performed

audit procedures responsive to those risks, and obtained audit evidence that is sufficient and appropriate to provide a basis for our

opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud

may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. |

| · | Obtained an understanding of

internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the

purpose of expressing an opinion on the effectiveness of the Company’s and its subsidiaries’ internal control. |

| · | Evaluated the appropriateness

of accounting policies used and the reasonableness of accounting estimates and related disclosures made by management. |

| · | Concluded on the appropriateness

of management’s use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty

exists related to events or conditions that may cast significant doubt on the Company’s ability to continue as a going concern.

If we conclude that a material uncertainty exists, we are required to draw attention in our auditor’s report to the related disclosures

in the individual and consolidated financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions

are based on the audit evidence obtained up to the date of our auditor’s report. However, future events or conditions may cause

the Company to cease to continue as a going concern. |

| · | Evaluated the overall presentation,

structure and content of the individual and consolidated financial statements, including the disclosures, and whether the financial statements

represent the underlying transactions and events in a manner that achieves fair presentation. |

Independent auditor's report on the Financial statements

We communicate with those charged with governance regarding, among other

matters, the scope and timing of the planned audit procedures and significant audit findings, including potential significant deficiencies

in internal control that we may have identified during our audit.

We also provided those charged with governance with a statement that we

have complied with relevant ethical requirements, including applicable independence requirements, and to communicate with them all relationships

and other matters that may reasonably be thought to bear on our independence, and where applicable, related safeguards.

From the matters communicated with those charged with governance, we determined

those matters that were of most significance in the audit of the financial statements of the current period and are therefore the key

audit matters. We describe these matters in our auditor’s report unless law or regulation precludes public disclosure about the

matter or when, in extremely rare circumstances, we determine that a matter should not be communicated in our report because the adverse

consequences of doing so would reasonably be expected to outweigh the public interest benefits of such communication.

Rio de Janeiro, February 6, 2024.

ERNST & YOUNG

Auditores Independentes S/S Ltda.

CRC SP-015199/F

Fernando Alberto S. Magalhães

Contador CRC SP-133169/O

| TIM S.A. |

| BALANCE SHEETS |

| December 31, 2023 and December 31, 2022 |

| (In thousands of reais) |

| |

|

|

|

|

|

|

|

| |

|

Parent Company |

|

|

Consolidated |

| |

Note |

2023 |

|

2022 |

|

|

2022 |

| |

|

|

|

|

|

|

|

| Assets |

|

55,260,156 |

|

52,925,205 |

|

|

56,408,367 |

| |

|

|

|

|

|

|

|

| Current assets |

|

11,404,293 |

|

9,828,112 |

|

|

10,364,415 |

| Cash and cash equivalents |

4 |

3,077,931 |

|

1,785,100 |

|

|

2,548,713 |

| Marketable securities |

5 |

1,958,490 |

|

2,190,635 |

|

|

2,190,635 |

| Trade accounts receivable |

6 |

3,709,766 |

|

3,739,452 |

|

|

3,421,094 |

| Inventories |

7 |

331,783 |

|

236,117 |

|

|

236,117 |

| Recoverable income tax and social contribution |

8.a |

494,382 |

|

361,349 |

|

|

361,349 |

| Recoverable taxes, fees and contributions |

9 |

943,767 |

|

820,338 |

|

|

831,661 |

| Prepaid expenses |

10 |

238,468 |

|

198,506 |

|

|

278,851 |

| Derivative financial instruments |

37 |

299,539 |

|

239,189 |

|

|

239,189 |

| Leases |

17 |

29,886 |

|

30,643 |

|

|

30,643 |

| Other amounts recoverable |

18 |

80,963 |

|

26,519 |

|

|

26,519 |

| Other assets |

13 |

239,318 |

|

200,264 |

|

|

199,644 |

| |

|

|

|

|

|

|

|

| Non-current assets |

|

43,855,863 |

|

43,097,093 |

|

|

46,043,952 |

| Long-term receivables |

|

4,368,195 |

|

4,579,313 |

|

|

5,426,136 |

| Marketable securities |

5 |

12,949 |

|

12,929 |

|

|

12,929 |

| Trade accounts receivable |

6 |

199,007 |

|

238,683 |

|

|

238,683 |

| Recoverable income tax and social contribution |

8.a |

218,897 |

|

517,878 |

|

|

517,878 |

| Recoverable taxes, fees and contributions |

9 |

874,539 |

|

889,472 |

|

|

895,408 |

| Deferred income tax and social contribution |

8.c |

1,257,494 |

|

526,700 |

|

|

1,367,586 |

| Judicial deposits |

11 |

689,739 |

|

1,377,560 |

|

|

1,377,560 |

| Prepaid expenses |

10 |

138,937 |

|

80,258 |

|

|

80,258 |

| Derivative financial instruments |

37 |

507,873 |

|

662,433 |

|

|

662,433 |

| Leases |

17 |

206,455 |

|

208,003 |

|

|

208,003 |

| Other financial assets |

12 |

216,721 |

|

- |

|

|

- |

| Other assets |

13 |

45,584 |

|

65,397 |

|

|

65,398 |

| |

|

|

|

|

|

|

|

| Investment |

14 |

1,450,812 |

|

5,739,739 |

|

|

1,540,116 |

| Property, plant and equipment |

15 |

22,411,815 |

|

19,775,260 |

|

|

22,661,152 |

| Intangible assets |

16 |

15,625,041 |

|

13,002,781 |

|

|

16,416,548 |

| |

|

|

|

|

|

|

|

See the accompanying notes to the individual and consolidated financial

statements.

| TIM S.A. |

| BALANCE SHEETS |

| December 31, 2023 and December 31, 2022 |

| (In thousands of reais) |

| |

|

|

|

|

|

|

| |

|

Parent Company |

|

Consolidated |

| |

Note |

2023 |

|

2022 |

|

2022 |

| |

|

|

|

|

|

|

| Total liabilities and shareholders' equity |

|

55,260,156 |

|

52,925,205 |

|

56,408,367 |

| |

|

|

|

|

|

|

| Total liabilities |

|

29,244,216 |

|

27,527,840 |

|

31,011,002 |

| |

|

|

|

|

|

|

| Current liabilities |

|

12,882,966 |

|

12,057,530 |

|

13,118,009 |

| Suppliers |

19 |

4,612,112 |

|

4,385,356 |

|

4,237,229 |

| Loans and financing |

21 |

1,267,237 |

|

1,264,967 |

|

1,264,967 |

| Lease liabilities |

17 |

1,808,740 |

|

1,353,869 |

|

2,257,211 |

| Derivative financial instruments |

37 |

239,714 |

|

343,142 |

|

343,142 |

| Labor obligations |

|

386,348 |

|

343,541 |

|

343,541 |

| Income tax and social contribution payable |

8.b |

64,407 |

|

78,351 |

|

78,351 |

| Taxes, fees and contributions payable |

22 |

3,048,115 |

|

2,126,678 |

|

2,277,727 |

| Dividends and interest on shareholders' equity payable |

26 |

647,872 |

|

661,494 |

|

661,494 |

| Authorizations payable |

20 |

407,747 |

|

507,685 |

|

507,685 |

| Deferred revenues |

23 |

279,401 |

|

222,829 |

|

265,417 |

| Other contractual obligations |

1.2.1 |

- |

|

748,291 |

|

748,291 |

| Other liabilities and provision |

25 |

121,273 |

|

21,327 |

|

132,954 |

| |

|

|

|

|

|

|

| Non-current liabilities |

|

16,361,250 |

|

15,470,310 |

|

17,892,993 |

| Loans and financing |

21 |

2,503,709 |

|

3,704,858 |

|

3,704,858 |

| Derivative financial instruments |

37 |

- |

|

50,230 |

|

50,230 |

| Lease liabilities |

17 |

10,448,035 |

|

8,595,004 |

|

10,574,654 |

| Taxes, fees and contributions payable |

22 |

10,603 |

|

13,540 |

|

13,540 |

| Provision for legal and administrative proceedings |

24 |

1,410,299 |

|

1,112,153 |

|

1,112,156 |

| Pension plan and other post-employment benefits |

38 |

5,019 |

|

5,825 |

|

5,825 |

| Authorizations payable |

20 |

1,117,416 |

|

1,150,531 |

|

1,165,705 |

| Deferred revenues |

23 |

621,601 |

|

666,612 |

|

666,612 |

| Other liabilities and provision |

25 |

244,568 |

|

171,557 |

|

599,413 |

| |

|

|

|

|

|

|

| Shareholders' equity |

26 |

26,015,940 |

|

25,397,365 |

|

25,397,365 |

| Share capital |

|

13,477,891 |

|

13,477,891 |

|

13,477,891 |

| Capital reserves |

|

384,311 |

|

408,602 |

|

408,602 |

| Profit reserves |

|

12,160,035 |

|

11,514,879 |

|

11,514,879 |

| Equity valuation adjustments |

|

(3,313) |

|

(3,844) |

|

(3,844) |

| Treasury shares |

|

(2,984) |

|

(163) |

|

(163) |

| |

|

|

|

|

|

|

See the accompanying notes to the individual and consolidated financial

statements.

| |

|

|

|

|

|

|

|

|

|

| TIM S.A. |

| STATEMENTS OF INCOME |

| Years ended December 31, 2023 and 2022 |

| (In thousands of reais, unless otherwise indicated) |

| |

|

|

|

|

|

|

|

|

|

| |

|

|

Parent Company |

|

Consolidated |

| |

Notes |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| |

|

|

|

|

|

|

|

|

|

| Net revenue |

28 |

|

23,843,006 |

|

20,759,080 |

|

23,833,893 |

|

21,530,801 |

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Costs of services provided and goods sold |

29 |

|

(11,739,481) |

|

(9,934,765) |

|

(11,496,437) |

|

(10,655,981) |

| Gross income |

|

|

12,103,525 |

|

10,824,315 |

|

12,337,456 |

|

10,874,820 |

| |

|

|

|

|

|

|

|

|

|

| Operating revenues (expenses): |

|

|

|

|

|

|

|

|

|

| Selling expenses |

29 |

|

(5,631,263) |

|

(5,175,582) |

|

(5,742,642) |

|

(5,596,211) |

| General and administrative expenses |

29 |

|

(1,757,848) |

|

(1,801,836) |

|

(1,759,433) |

|

(1,808,735) |

| Equity in earnings |

14 |

|

64,083 |

|

(553,752) |

|

(89,304) |

|

(61,587) |

| Other revenues (expenses), net |

30 |

|

(27,150) |

|

(243,178) |

|

(28,779) |

|

(248,371) |

| |

|

|

(7,352,178) |

|

(7,774,348) |

|

(7,620,158) |

|

(7,714,904) |

| |

|

|

|

|

|

|

|

|

|

| Income before financial revenues and expenses |

|

|

4,751,347 |

|

3,049,967 |

|

4,717,298 |

|

3,159,916 |

| |

|

|

|

|

|

|

|

|

|

| Financial revenues (expenses): |

|

|

|

|

|

|

|

|

|

| Financial revenues |

31 |

|

1,219,004 |

|

1,267,501 |

|

1,239,753 |

|

1,318,948 |

| Financial expenses |

32 |

|

(2,858,036) |

|

(2,466,068) |

|

(2,765,961) |

|

(2,762,963) |

| Net foreign exchange variations |

33 |

|

(7,057) |

|

5,007 |

|

(7,057) |

|

5,007 |

| |

|

|

(1,646,089) |

|

(1,193,560) |

|

(1,533,265) |

|

(1,439,008) |

| |

|

|

|

|

|

|

|

|

|

| Profit before income tax and social contribution |

|

|

3,105,258 |

|

1,856,407 |

|

3,184,033 |

|

1,720,908 |

| |

|

|

|

|

|

|

|

|

|

| Income tax and social contribution |

8.d |

|

(267,836) |

|

(185,652) |

|

(346,611) |

|

(50,153) |

| |

|

|

|

|

|

|

|

|

|

| Net profit for the year |

|

|

2,837,422 |

|

1,670,755 |

|

2,837,422 |

|

1,670,755 |

| |

|

|

|

|

|

|

|

|

|

| Earnings per share attributable to the Company’s shareholders (expressed in R$ per share) |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Basic earnings per share |

34 |

|

1.17 |

|

0.69 |

|

1.17 |

|

0.69 |

| |

|

|

|

|

|

|

|

|

|

| Diluted earnings per share |

34 |

|

1.17 |

|

0.69 |

|

1.17 |

|

0.69 |

| |

|

|

|

|

|

|

|

|

|

See the accompanying notes to the individual and consolidated financial

statements.

| |

|

|

|

|

|

|

|

|

| TIM S.A. |

| STATEMENTS OF COMPREHENSIVE INCOME |

| Years ended December 31, 2023 and 2022 |

| (In thousands of reais) |

| |

|

|

|

|

|

|

|

|

| |

|

Parent Company |

|

Consolidated |

| |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| |

|

|

|

|

|

|

|

|

| Net profit for the year |

|

2,837,422 |

|

1,670,755 |

|

2,837,422 |

|

1,670,755 |

| |

|

|

|

|

|

|

|

|

| Other components of the comprehensive income |

|

|

|

|

|

|

|

|

| Item that will not be reclassified to income (loss): |

|

|

|

|

|

|

|

|

| Pension plans and other post-employment benefits |

|

806 |

|

668 |

|

806 |

|

668 |

| Deferred taxes |

|

(275) |

|

(227) |

|

(275) |

|

(227) |

| Total comprehensive income for the year |

|

2,837,953 |

|

1,671,196 |

|

2,837,953 |

|

1,671,196 |

See the accompanying notes to the individual and consolidated financial

statements.

| TIM S.A. |

| STATEMENT OF CHANGES IN SHAREHOLDERS' EQUITY |

| Year ended December 31, 2023 |

| (In thousands of reais) |

| |

|

|

|

|

|

Profit reserves |

|

|

|

|

|

|

|

|

| |

|

Share capital |

|

Capital reserve |

|

Legal reserve |

|

Expansion reserve |

|

Additional dividends/interest on shareholders’ equity proposed |

|

Tax incentive reserve |

|

Treasury shares |

|

Equity valuation adjustments |

|

Retained earnings |

|

Total |

| Balances on January 01, 2023 |

13,477,891 |

|

408,602 |

|

1,250,448 |

|

7,540,020 |

|

600,000 |

|

2,124,411 |

|

(163) |

|

(3,844) |

|

- |

|

25,397,365 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total comprehensive income for the year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net profit for the year |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

2,837,422 |

|

2,837,422 |

| Post-employment benefit amount recorded directly in shareholders' equity |

|

- |

|

- |

|

- |

|

- |

|

- |

|

|

|

|

|

531 |

|

- |

|

531 |

| Total comprehensive income for the year |

|

- |

|

- |

|

- |

|

- |

- |

- |

|

- |

|

- |

|

531 |

|

2,837,422 |

|

2,837,953 |

| Total contribution from shareholders and distribution to shareholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Long-term incentive plan |

|

- |

|

(24,291) |

|

- |

|

- |

|

- |

|

|

|

|

|

- |

|

- |

|

(24,291) |

| Purchase of treasury shares, net of disposals |

|

- |

|

- |

|

- |

|

- |

|

- |

|

|

|

(2,821) |

|

- |

|

- |

|

(2,821) |

| Allocation of net profit for the year: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Legal reserve (Note 26) |

|

- |

|

- |

|

129,979 |

|

- |

|

- |

|

|

|

|

|

- |

|

(129,979) |

|

- |

| Interest on Shareholders’ Equity (note 26) |

|

- |

|

- |

|

- |

|

- |

|

- |

|

|

|

|

|

|

|

(1,600,000) |

|

(1,600,000) |

| Allocation to tax benefit reserve (Note 26) |

|

- |

|

- |

|

|

|

- |

|

- |

|

237,828 |

|

- |

|

- |

|

(237,828) |

|

- |

| Dividends/additional interest on shareholders’ equity distributed (Note 26) |

|

- |

|

- |

|

- |

|

(1,910,000) |

|

1,310,000 |

|

- |

|

- |

|

- |

|

- |

|

(600,000) |

| Distribution of reserve for expansion (Note 26) |

|

- |

|

- |

|

- |

|

1,469,615 |

|

(600,000) |

|

|

|

|

|

- |

|

(869,615) |

|

- |

| Unclaimed dividends (Note 26) |

|

- |

|

- |

|

- |

|

7,734 |

|

- |

|

- |

|

- |

|

- |

|

- |

|

7,734 |

| Total contribution from shareholders and distribution to shareholders |

|

- |

|

(24,291) |

|

129,979 |

|

(432,651) |

|

710,000 |

|

237,828 |

|

(2,821) |

|

- |

|

(2,837,422) |

|

(2,219,378) |

| Balances at December 31, 2023 |

13,477,891 |

|

384,311 |

|

1,380,427 |

|

7,107,369 |

|

1,310,000 |

|

2,362,239 |

|

(2,984) |

|

(3,313) |

|

- |

|

26,015,940 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See the accompanying notes to the individual and consolidated financial

statements.

|

TIM S.A. and TIM S.A. and SUBSIDIARY

|

| STATEMENT OF CHANGES IN SHAREHOLDERS’ EQUITY |

| Year ended December 31, 2022 |

|

|

|

|

|

|

|

|

| (In thousands of reais) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Profit reserves |

|

|

|

|

|

|

|

|

| |

|

Share capital |

|

Capital reserve |

|

Legal reserve |

|

Expansion reserve |

|

Additional dividends/interest on shareholders’ equity proposed |

|

Tax incentive reserve |

|

Treasury shares |

|

Equity valuation adjustments |

|

Retained earnings |

|

Total |

| Balances at January 01, 2022 |

13,477,891 |

|

401,806 |

|

1,175,215 |

|

8,103,035 |

|

- |

|

1,958,301 |

|

(4,857) |

|

(4,285) |

|

- |

|

25,107,106 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total comprehensive income for the year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net profit for the year |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

1,670,755 |

|

1,670,755 |

| Post-employment benefit amount recorded directly in shareholders' equity |

|

- |

|

- |

|

- |

|

- |

|

- |

|

|

|

|

|

441 |

|

- |

|

441 |

| Total comprehensive income for the year |

|

- |

|

- |

|

- |

|

- |

- |

- |

- |

- |

|

- |

|

441 |

|

1,670,755 |

|

1,671,196 |

| Total contribution from shareholders and distribution to shareholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Long-term incentive plan |

|

- |

|

6,796 |

|

- |

|

- |

|

- |

|

|

|

|

|

- |

|

- |

|

6,796 |

| Purchase of treasury shares, net of disposals |

|

- |

|

- |

|

- |

|

- |

|

- |

|

|

|

4,694 |

|

- |

|

- |

|

4,694 |

| Allocation of net profit for the year: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Legal reserve (Note 26) |

|

- |

|

- |

|

75,233 |

|

- |

|

- |

|

|

|

|

|

- |

|

(75,233) |

|

- |

| Interest on Shareholders’ Equity (note 26) |

|

- |

|

- |

|

- |

|

- |

|

- |

|

|

|

|

|

|

|

(1,400,000) |

|

(1,400,000) |

| Allocation to tax benefit reserve (Note 26) |

|

- |

|

- |

|

- |

|

- |

|

- |

|

166,110 |

|

- |

|

- |

|

(166,110) |

|

- |

| Additional dividends/interest on shareholders’ equity proposed |

|

- |

|

- |

|

- |

|

(570,588) |

|

600,000 |

|

- |

|

- |

|

- |

|

(29,412) |

|

- |

| Unclaimed dividends (Note 26) |

|

- |

|

- |

|

- |

|

7,573 |

|

|

|

|

|

|

|

- |

|

- |

|

7,573 |

| Total contribution from shareholders and distribution to shareholders |

|

- |

|

6,796 |

|

75,233 |

|

(563,015) |

|

600,000 |

|

166,110 |

|

4,694 |

|

- |

|

(1,670,755) |

|

(1,380,937) |

| Balances at December 31, 2022 |

13,477,891 |

|

408,602 |

|

1,250,448 |

|

7,540,020 |

|

600,000 |

|

2,124,411 |

|

(163) |

|

(3,844) |

|

- |

|

25,397,365 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See the accompanying notes to the individual and consolidated financial

statements.

| TIM S.A. and TIM S.A. and SUBSIDIARY |

| STATEMENT OF CASH FLOWS |

| Years ended December 31, 2023 and 2022 |

| (In thousands of reais) |

| |

|

|

|

|

|

|

|

|

|

| |

|

|

Parent Company |

|

Consolidated |

| |

Note |

|

2023 |

|

2022

(Restated) |

|

2023 |

|

2022

(Restated) |

| Operating activities |

|

|

|

|

|

|

|

|

|

| Profit before income tax and social contribution |

|

|

3,105,258 |

|

1,856,407 |

|

3,184,033 |

|

1,720,909 |

| Adjustments to reconcile income to net cash generated by operating activities: |

|

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

|

6,897,402 |

|

5,865,706 |

|

7,117,028 |

|

6,827,175 |

| Equity in earnings |

14 |

|

(64,083) |

|

553,752 |

|

89,304 |

|

61,587 |

| Residual value of written-off property, plant and equipment and intangible assets |

|

|

16,230 |

|

(128,103) |

|

93,304 |

|

(136,713) |

| Interest on asset retirement obligation |

|

|

33,180 |

|

718 |

|

38,355 |

|

23,212 |

| Provision for legal and administrative proceedings |

25 |

|

323,018 |

|

247,227 |

|

323,015 |

|

247,227 |

| Inflation adjustment on judicial deposits and legal and administrative proceedings |

|

|

257,058 |

|

91,681 |

|

257,057 |

|

91,681 |

| Interest, monetary and exchange rate variations on loans and other financial adjustments |

|

|

741,382 |

|

745,836 |

|

668,360 |

|

759,989 |

| Yield from marketable securities |

|

|

(83,204) |

|

(266,816) |

|

(83,204) |

|

(266,816) |

| Interest on lease liabilities |

32 |

|

1,163,824 |

|

1,075,603 |

|

1,062,251 |

|

1,333,007 |

| Lease interest |

31 |

|

(28,041) |

|

(28,101) |

|

(28,041) |

|

(28,101) |

| Gain from acquisition of Cozani (via price adjustment) |

|

|

(303,435) |

|

- |

|

(303,435) |

|

- |

| Provision for expected credit losses |

29 |

|

620,667 |

|

585,699 |

|

639,692 |

|

626,218 |

| Long-term incentive plans |

|

|

(24,291) |

|

6,796 |

|

(24,291) |

|

6,796 |

| |

|

|

12,654,965 |

|

10,606,405 |

|

13,033,428 |

|

11,266,171 |

| Decrease (increase) in operating assets |

|

|

|

|

|

|

|

|

|

| Trade accounts receivable |

|

|

(826,773) |

|

(1,269,979) |

|

(867,369) |

|

(628,272) |

| Recoverable taxes, fees and contributions |

|

|

91,412 |

|

916,029 |

|

85,982 |

|

912,306 |

| Inventories |

|

|

(95,666) |

|

(33,565) |

|

(95,666) |

|

(33,565) |

| Prepaid expenses |

|

|

(2,467) |

|

79,523 |

|

(18,295) |

|

164,288 |

| Judicial deposits |

|

|

749,336 |

|

(603,825) |

|

749,336 |

|

(603,825) |

| Other assets |

|

|

(76,756) |

|

(32,696) |

|

(70,677) |

|

(30,709) |

| Increase (decrease) in operating liabilities |

|

|

|

|

|

|

|

|

|

| Labor obligations |

|

|

42,807 |

|

40,302 |

|

42,807 |

|

40,302 |

| Suppliers |

|

|

736,417 |

|

1,088,993 |

|

353,319 |

|

757,628 |

| Taxes, fees and contributions payable |

|

|

647,239 |

|

122,922 |

|

617,975 |

|

102,948 |

| Authorizations payable |

|

|

(246,836) |

|

(2,378,796) |

|

(246,836) |

|

(2,378,796) |

| Payments for legal and administrative proceedings |

24 |

|

(343,440) |

|

(242,597) |

|

(343,444) |

|

(242,598) |

| Deferred revenues |

|

|

(2,235) |

|

3,100 |

|

(31,028) |

|

(49,446) |

| Other liabilities |

|

|

(526,266) |

|

(25,262) |

|

(560,692) |

|

(114,173) |

| Cash generated by operations |

|

|

12,801,737 |

|

8,270,554 |

|

12,648,840 |

|

9,162,259 |

| Income tax and social contribution paid |

|

|

(228,184) |

|

- |

|

(228,184) |

|

- |

| Net cash generated by operating activities |

|

|

12,573,553 |

|

8,270,554 |

|

12,420,656 |

|

9,162,259 |

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| TIM S.A. and TIM S.A. and SUBSIDIARY |

|

| STATEMENT OF CASH FLOWS |

|

| Years ended December 31, 2023 and 2022 |

|

| (In thousands of reais) |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

Parent Company |

|

Consolidated |

| |

Note |

|

2023 |

|

2022

(Restated) |

|

2023 |

|

2022

(Restated) |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Investment activities |

|

|

|

|

|

|

|

|

|

| Redemptions of marketable securities |

|

|

3,313,983 |

|

8,891,947 |

|

3,313,983 |

|

8,891,947 |

| Investments on marketable securities |

|

|

(2,998,654) |

|

(6,249,167) |

|

(2,998,654) |

|

(6,249,167) |

| Other financial assets |

12 |

|

(53,763) |

|

- |

|

(53,763) |

|

- |

| Capital increase in subsidiary Cozani |

|

|

- |

|

(250,722) |

|

- |

|

- |

| Cash from the acquisition of Cozani (Note 1) |

|

|

421,835 |

|

- |

|

- |

|

- |

| Consideration for the acquisition of Cozani, net from cash |

|

|

(443,096) |

|

(6,463,333) |

|

(443,096) |

|

(6,269,951) |

| Additions to property, plant and equipment and intangible assets |

|

|

(4,504,314) |

|

(4,730,433) |

|

(4,504,314) |

|

(4,730,433) |

| Other |

|

|

2,306 |

|

4,475 |

|

2,306 |

|

4,475 |

| Net cash used in investment activities |

|

|

(4,261,703) |

|

(8,797,233) |

|

(4,683,538) |

|

(8,353,129) |

| |

|

|

|

|

|

|

|

|

|

| Financing activities |

|

|

|

|

|

|

|

|

|

| New loans |

|

|

- |

|

1,568,343 |

|

- |

|

1,568,343 |

| Amortization of loans |

|

|

(1,197,950) |

|

(565,303) |

|

(1,197,950) |

|

(565,303) |

| Interest paid- Loans |

|

|

(205,507) |

|

(157,831) |

|

(205,507) |

|

(157,831) |

| Payment of lease liability |

|

|

(1,696,314) |

|

(1,251,552) |

|

(1,812,508) |

|

(1,566,344) |

| Interest paid on lease liabilities |

|

|

(1,347,870) |

|

(1,046,549) |

|

(1,420,557) |

|

(1,303,953) |

| Derivative financial instruments |

|

|

(393,628) |

|

(269,437) |

|

(393,628) |

|

(269,437) |

| Purchase of treasury shares, net of disposals |

|

|

(2,821) |

|

4,694 |

|

(2,821) |

|

4,694 |

| Dividends and interest on shareholders’ equity |

|

|

(2,174,929) |

|

(1,199,201) |

|

(2,174,929) |

|

(1,199,201) |

| Net cash used in financing activities |

|

|

(7,019,019) |

|

(2,916,836) |

|

(7,207,900) |

|

(3,489,032) |

| |

|

|

|

|

|

|

|

|

|

| Increase (decrease) in cash and cash equivalents |

|

|

1,292,831 |

|

(3,443,515) |

|

529,218 |

|

(2,679,902) |

| Cash and cash equivalents at the beginning of the year |

|

|

1,785,100 |

|

5,228,615 |

|

2,548,713 |

|

5,228,615 |

| Cash and cash equivalents at the end of the year |

|

|

3,077,931 |

|

1,785,100 |

|

3,077,931 |

|

2,548,713 |

See the accompanying notes to the individual and consolidated financial

statements.

| TIM S.A. |

| STATEMENT OF VALUE ADDED |

| Years ended December 31, 2023 and 2022 |

| (In thousands of reais) |

| |

Parent Company |

|

Consolidated |

| |

2023 |

|

2022 |

|

2023 |

|

2022 |

| Revenues |

|

|

|

|

|

|

|

| Gross operating revenue |

33,491,945 |

|

28,650,398 |

|

33,530,346 |

|

29,713,383 |

| Losses on doubtful accounts |

(620,667) |

|

(585,699) |

|

(639,692) |

|

(626,218) |

| Discounts granted, returns and others |

(6,038,568) |

|

(3,701,149) |

|

(6,039,172) |

|

(3,711,240) |

| |

26,832,710 |

|

24,363,550 |

|

26,851,482 |

|

25,375,925 |

| Inputs acquired from third parties |

|

|

|

|

|

|

|

| Cost of services rendered and goods sold |

(4,431,498) |

|

(3,726,974) |

|

(3,968,083) |

|

(3,482,166) |

| Materials, energy, outsourced services and other |

(3,525,465) |

|

(3,572,677) |

|

(3,596,819) |

|

(3,810,770) |

| |

(7,956,963) |

|

(7,299,651) |

|

(7,564,902) |

|

(7,292,936) |

| Retentions |

|

|

|

|

|

|

|

| Depreciation and amortization |

(6,897,402) |

|

(5,865,706) |

|

(7,117,029) |

|

(6,827,175) |

| Net added value produced |

11,978,345 |

|

11,198,193 |

|

12,169,551 |

|

11,255,814 |

| Value added received in transfer |

|

|

|

|

|

|

|

| Equity in earnings |

64,083 |

|

(553,752) |

|

(89,304) |

|

(61,587) |

| Financial revenues |

1,413,039 |

|

1,408,569 |

|

1,433,788 |

|

1,460,016 |

| |

1,477,122 |

|

854,817 |

|

1,344,484 |

|

1,398,429 |

| Total added value payable |

13,455,467 |

|

12,053,010 |

|

13,514,035 |

|

12,654,243 |

| |

|

|

|

|

|

|

|

| Distribution of added value |

|

|

|

|

|

|

|

| Personnel and charges |

|

|

|

|

|

|

|

| Direct remuneration |

788,411 |

|

741,769 |

|

788,411 |

|

741,769 |

| Benefits |

241,951 |

|

208,513 |

|

241,951 |

|

208,513 |

| F.G.T.S |

76,718 |

|

69,252 |

|

76,718 |

|

69,252 |

| Other |

38,653 |

|

40,268 |

|

38,653 |

|

40,268 |

| |

1,145,733 |

|

1,059,802 |

|

1,145,733 |

|

1,059,802 |

| Taxes, fees and contributions |

|

|

|

|

|

|

|

| Federal |

2,529,923 |

|

2,258,722 |

|

2,675,491 |

|

2,358,409 |

| State |

2,660,723 |

|

3,217,298 |

|

2,665,423 |

|

3,416,745 |

| Municipal |

5,665 |

|

96,950 |

|

5,345 |

|

97,683 |

| |

5,196,311 |

|

5,572,970 |

|

5,346,259 |

|

5,872,837 |

| Third-party capital remuneration |

|

|

|

|

|

|

|

| Interest |

3,054,465 |

|

2,598,942 |

|

2,962,390 |

|

2,895,837 |

| Rents |

1,213,380 |

|

1,144,754 |

|

1,214,075 |

|

1,149,225 |

| |

4,267,845 |

|

3,743,696 |

|

4,176,465 |

|

4,045,062 |

| Other |

|

|

|

|

|

|

|

| Social investment |

8,156 |

|

5,787 |

|

8,156 |

|

5,787 |

| |

8,156 |

|

5,787 |

|

8,156 |

|

5,787 |

| Shareholders’ Equity Remuneration |

|

|

|

|

|

|

|

| Dividends and interest on shareholders’ equity |

1,600,000 |

|

1,400,000 |

|

1,600,000 |

|

1,400,000 |

| Retained earnings |

1,237,422 |

|

270,755 |

|

1,237,422 |

|

270,755 |

| |

2,837,422 |

|

1,670,755 |

|

2,837,422 |

|

1,670,755 |

See the accompanying notes to the individual and consolidated financial

statements.

2023 MANAGEMENT REPORT AND EARNINGS ANALYSIS |

COMMENTS TO FINANCIAL STATEMENTS

FOR THE YEAR ENDED DECEMBER 31, 2023

Dear Shareholders,

The Management of TIM S.A. (“TIM S.A.”,

“Company” or “TIM”) hereby presents its Management Report and 2023 Earnings Analysis, along with the Individual

and Consolidated Financial Statements accompanied by the Independent Auditors’ Report for the fiscal year ended December 31, 2023.

The financial statements were prepared in accordance

with accounting practices adopted in Brazil, which include the Brazilian Corporate Law, the rules of the Brazilian Securities and Exchange

Commission (CVM) and the pronouncements of the Accounting Pronouncement Committee (CPC) and International Financial Reporting Standards

(IFRS) issued by the International Accounting Standards Board (IASB).

The operating and financial information for the

year ended in December 31, 2023, unless otherwise stated, is presented in Brazilian reais (R$), based on consolidated amounts and pursuant

to the Brazilian Corporation Law.

Company’s

Profile

TIM S.A. is a publicly held company, with shares

listed on the São Paulo Stock Exchange (B3), and American Depositary Receipts (ADRs) listed on the New York Stock Exchange (NYSE).

In 2023, TIM confirmed that, for the 16th year in a row, has maintained its status as one of a select group of companies that

comprise the ISE portfolio (B3’s Corporate Sustainability Index), reinforcing its commitment with the continuous management of social,

environmental and governance aspects, creating value for its shareholders and other stakeholders. Additionally, since 2011 TIM has been

listed on B3’s Novo Mercado, a segment recognized for maintaining the highest level of corporate governance. Starting in

2021, it became part of the following indexes: S&P-B3 Brasil ESG, Refinitiv Diversity & Inclusion, and Bloomberg Gender Equality.

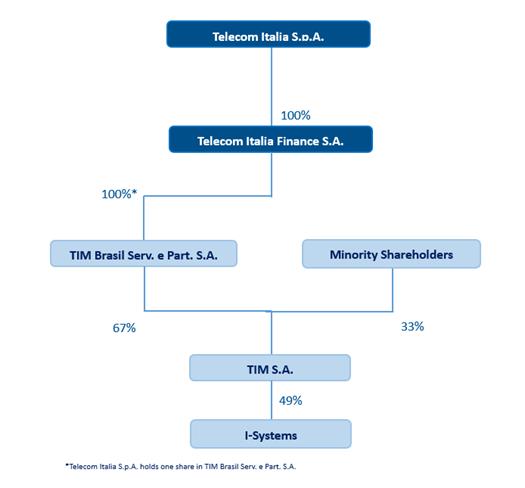

TIM S.A. is controlled by TIM Brasil Serviços

e Participações S.A., a subsidiary of the Telecom Italia group. TIM operates in the mobile, landline, long-distance, and

data transmission markets throughout Brazil, as well as in the ultra-broadband market covering several Brazilian states.

2023 MANAGEMENT REPORT AND EARNINGS ANALYSIS |

| 1. | Message from Management |

We are very pleased that 2023 was an outstanding

year with great achievements and record-high results. Such outcome was a consequence of navigating well in the new environment of the

Brazilian mobile market, our core business segment, and exploring opportunities that are emerging.

Our Core - The Mobile Market

During our Investor Day in November, we explained

that the Brazilian mobile market is healthier than ever before, supporting a more-for-more strategy. New market dynamics following the

consolidation and favorable demand are driving a better environment to operate.

This new environment is characterized by: (i)

a new, more rational, market dynamic with customers focused on value and quality, (ii) essentiality of the service mobile, (iii) opportunity

to increase usage with increased demand for data, and (iv) price accessibility.

Our Strategy – Next Generation

TIM

We have a clear strategy to craft the Next Generation

TIM. Under this framework, we defined four pillars, Mobile, B2B, Broadband and Efficiency, which are developed integrating our people,

society, and the environment into our business strategy.

This integration propels our ESG practices to

be recognized as one of the most developed in the country. TIM ranked 12th among the best companies to work for in Brazil in the Great

Place to Work selection. Sustainalytics also awarded us as ESG industry top-rated. S&P listed TIM among the most sustainable telecom

companies in the world. And we are the most diverse and inclusive company in LatAm and the number one telco in the world ranked by Refinitiv.

Our strategic pillars are summarized as follows.

| · | Mobile: where TIM generates most of its results

and where we aim to be the preferred operator for customers by developing the Best Service, Best Network and Best Offer; |

| · | B2B: the Company is shaping a new IoT[1]

-based market with services and connectivity to address an exponential growth opportunity. |

| · | Broadband: where TIM wants to grow profitably

using a selective approach while keeping future options open; |

| · | Efficiency: the Company has this pillar as inherent

to its operation and carries out all its actions with strict discipline in the allocation of capital resources. |

[1]

Internet of Things

2023 MANAGEMENT REPORT AND EARNINGS ANALYSIS |

Our Achievements[2]

– A Historical Year

Our service revenues grew, in 2023, 10.7% year-on-year,

totaling more than 23 billion Reais, a record high number in our history. With costs under control, our EBITDA grew more than 14% to reach

another record in our history, 11.7 billion Reais.

In this context, our 2023 EBITDA margin expanded

to almost 49%—the highest among the large telcos in Brazil and LatAm. Another metric that measures our efficiency in allocating

resources is the Capex-to-Sales ratio. We closed 2023 with the best result ever, just below 19%, contributing to our operating free cash

flow[3] growing more than 58% year-on-year, summing to 4.2 billion Reais. Additionally, our Net Income rose to 2.7 billion

Reais after expanding more than 50% year-over-year. These results explain why we were confident in raising our shareholder remuneration

target to 2.91 billion reais, from 2.3 billion.

During 2023, we worked extensively to deliver

improvements in customer experience. We seek the Best Service by digitalizing the interactions to accelerate and improve demand

resolution. And we were best in class in all resolution rankings of Brazil. At the same time, if a human attendant services a client,

the satisfaction with this interaction must be very high. And we delivered that – call center NPS improved more than 40% in the

fourth quarter.

Meanwhile, we consolidated our leadership in network

coverage and quality in Brazil, confirming that we have the Best Network. We developed the largest 4G and 5G coverage, being the

only operator to cover all the cities of Brazil. Our network was also the most awarded among the Brazilian operators, and we ranked number

one in Consistency Quality, the most relevant KPI to measure a customer's actual experience.

To complete, we are innovating to create the Best

Offer, leveraging new concepts and partnerships to generate novelty and distinctiveness. We’ve launched the first trial offer

in LatAm to encourage customers to test our services. We expect this tool to be relevant in changing clients' perceptions of our quality.

We just launched commercially our partnership with Ambev. We are expanding the benefits, using the cashback in the Zé Delivery

app as a loyalty tool.

These mobile developments are driving us to post

the highest blended (prepaid + postpaid) ARPU in the industry, close to 30 reais and growing nearly 13% year-over-year. At the same time,

we are improving churn in postpaid, increasing upsell results with upward migrations, and seeing a rise in prepaid spending.

Those notable achievements have been made possible

by the contribution of every TIM employee. And we are proud to lead a team of committed and hard-working people with an engagement level

of above 90%.

Conclusion and Perspectives

When we started the year, we set challenging but

achievable targets. As we executed our plan, results began to come faster, which led to the best performance of TIM’s history in

many KPIs.

[2]

All financial figures are normalized to non-recurring items to better represent business dynamics.

[3]

Represented as EBITDA After Leases minus Capex.

2023 MANAGEMENT REPORT AND EARNINGS ANALYSIS |

We completed a quarter of a century of existence

over-delivering on every front.

| Projections x Results 2023 |

| Indicator |

Short Term Projection |

Result |

|

Service Revenue

Growth |

High single-digit[4] Y/Y |

+10.7% Y/Y |

| EBITDA growth |

Low double-digit2 Y/Y |

+14.2% Y/Y |

| Investments |

CAPEX on net revenues Ratio: <20% |

18.9% |

| EBITDA-AL growth minus CAPEX |

Double-digit2 A/A |

+58.2% Y/Y |

| Dividends announced to shareholders |

> R$ 2.9 Bln |

R$ 2.91 Bln (R$ 1.6 bln in IOC and R$ 1.31 bln in dividends[5]) |

In this scenario we project for the coming years

a sustainable growth in Service Revenue above inflation and an expansion of EBITDA with positive evolution in the margin. This dynamic

combined with maintaining the level of investments that benefit from the efficiency of new technologies, such as 5G, should promote an

improvement in our operating free cash flow. All of this will enable us to continue evolving our shareholder remuneration strategy and

reinvest in growth avenues such as B2B and Broadband.

We are on a long journey to become the most preferred

telco, so we must keep focused on executing our strategy, adjusting to the environment, when necessary, but never losing sight of our

end goals.

2. Economic and Industrial

Overview

2.1. Macroeconomic Environment

The year 2023 overall was positive for Brazil.

After a 2022 with the most polarized presidential election in history, the country needed to advance important reforms and also carry

out a fiscal adjustment of a specific magnitude. At the end of the year, the approval of a tax reform was achieved, even if only a part

of it, which had been discussed for 30 years, in addition to projecting the zeroing of the primary deficit by 2024. The movement of the

The Central Bank, which from August began a process of gradual reduction of the SELIC, closing the year at 11.75% per year.

Another favorable fact was the decrease in the

unemployment rate 7.8%[6] in 2023, lowest number since 2014 and 7.4% in the fourth quarter continuing a series of declines

over the last quarters, impacted by the process of immunization against COVID-19 started in 2022. With

this quarter's results, the absolute number of unemployed people decreased marginally compared to the previous quarter, to 8.1 million

people.

[4]

Reference scales: High single-digit= >6.66% and <10%; Low double-digit = ≥10% and ≤13.33%;

Double-digit = ≥10% and <100%

[5] Subject

to approval on shareholders General Meeting

[6] Source

Brazilian Institute of Geography and Statistics (IBGE).

2023 MANAGEMENT REPORT AND EARNINGS ANALYSIS |

Inflation, measured by the Extended Consumer Price

Index (IPCA), ended 2023 at 4.62%[7], above of the target the estimated target for the year (3.25%), but inside of the margin

of the target of 1.5%. Despite having the second largest nominal increase (7.14%), the Transport group had the greatest weight in the

general inflation index, with 1.46 percentage points. Gasoline, which is part of the group, was the sub-item with the greatest weight

among the 377 that make up the IPCA. In the year, the increase was 12.09%, with an impact of 0.56 p.p. Also in the group are two other

sub-items that make up the podium of the most relevant price increases for the IPCA. Registration and licenses increased by 21.22% in

the year and weighed 0.53 p.p. in the IPCA. Air tickets come in third place in the ranking, as they rose 47.24% in the year and contributed

0.32 p.p. to the index. In the Health and personal care group, the biggest contribution came from the health plan (11.52% increase and

0.43 p.p. in the index). In Housing, the main positive contribution came from residential electricity (9.52% and 0.37 p.p.).

In 2023, the exchange rate recorded a considerable

volatility, with the Real appreciating against the US dollar in relation to the end of the previous year. At the last closing period,

the American currency ended quoted at R$ 4.85, accounting for a decrease of 8.06%. Uncertainties regarding American inflation and

external factors such as the War between Russia and Ukraine in addition to the confrontation that began in October 2023 between Israel

and Hamas, contributed to the oscillation scenario presented by the currency. In relation to the Brazilian Real, the American currency

recorded a high of R$ 5.45 against a low of R$ 4.72 during the year, accounting for a change of 15.5% in a scenario of domestic

uncertainties, fiscal risks and many discussions about, for example, the Tax Reform Proposal, in addition to the new expenditure framework.

Both measures would be approved months later and helped reduce market uncertainty, The trade balance ended the year with a surplus of

US$ 98 billion, accounting for an increase of 60.6% compared to the end of 2022. Exports closed the year at US$ 339.7 billion and

recorded a positive change of 1.7% compared to 2022. Imports recorded US$ 240.9 billion, accounting for a decrease of 11.7% in the

annual comparison. The superávit value represent the highest record of the entire historical series.

The international scenario was, for one more year,

marked by many uncertainties and volatility with high inflation rates with resistance to be reduced, led by commodity, food, and logistical

and production bottleneck, as well as a reduction in GDP growth rates in most countries. The United States showed a slowdown in the inflation

rate to 3.4%, and GDP growth of 2.5% compared to an expansion of 2.1% in 2022. The economy in Europe shows a low pace of growth, greatly

impacted by the effects of the war between Russia and Ukraine and more recently the conflict between Israel and Hamas, affected the pace

of the resumption of the post-pandemic economy. The GDP of the Organization for Economic Co-operation and Development (OECD) member countries

increased 0.7% in the third quarter. The International Monetary Fund (IMF) points to a forecast of 3.0% [8]growth for the global

economy in 203.

[7] Source:

Brazilian Institute of Geography and Statistics (IBGE).

[8] Source: International

Monetary Fund

2023 MANAGEMENT REPORT AND EARNINGS ANALYSIS |

2.2. Particularities of the

Telecommunications Sector

The telecommunications sector in Brazil is marked

by the high degree of competition and by the effective regulation of the National Telecommunications Agency (ANATEL), which has the mission

of “promoting the development of telecommunications in Brazil, in order to provide it with a modern and efficient telecommunications

infrastructure, capable of offering society appropriate and diversified services at fair prices nationwide”.

Throughout its trajectory, the sector has always

been impacted by fierce competition on the Brazilian market, which can be seen by the presence of very aggressive offers from the viewpoint

of the content available to customers and the reduced level of prices charged by operators in general. However, in recent years, this

competition has moved more towards issues related to quality and service, becoming more rational from the point of view of prices. In

the last year, it is possible to say that we had a process of continuity of this transition to a new model of competition.

In 2023, the acquisition process of the mobile

operation assets of Oi Móvel S.A. was fully completed by TIM, Telefônica Brasil S.A. and Claro S.A., after all the precedent

conditions provided for by the National Telecommunications Agency (ANATEL) and by the Administrative Council for Economic Defense (CADE)

were fulfilled, with the approval by the Arbitration Chamber Court of the agreement regarding the closing price, concluded between the

buyers, TIM, Telefônica Brasil S.A. and Claro S.A and the seller, Oi S.A..

Finally, the year 2023 was marked by the continuity

of the implementation and expansion of 5G technology in Brazil, which seeks to meet the demand for higher connection speeds. In this context,

TIM ended 2023 having implemented 5G technology in 137 cities, includingall 27 capital cities of the country, with a much higher number

of antennas than required by ANATEL, thus providing a better experience for the user.

3. TIM Services

3.1. Business

TIM is recognized for its strong brand and its

reputation as an innovative and disruptive company, capable of meeting new consumption patterns on the market. With a proactive approach

the Company is always in a leading position in the transformation of the telecommunications business model. The profiles of customer usage

are based on the consumption of data, content, and digital services.

TIM’s pioneering spirit and innovative offerings

are hallmarks registered of the Company, which has a complete portfolio both for individual customers and corporate solutions for small,

medium, and large enterprises. In addition to the traditional mobile voice and data services, TIM offers the fixed ultra-broadband service,

and continues to pursue new sources of revenue, with pioneering initiatives in new business fronts, such as financial services and monetization

of the client base, mobile advertising and IoT.

Also in its portfolio, the Company offers several

services and digital content in its packages, increasing the functionality of mobile devices in its customers’ daily lives. Positioning

itself in a unique way with the objective of becoming the most preferred operator for Brazilians, having the best value proposition in

a market that is leveraged by value. Whether with a better service, offering a better customer experience, or with a better network,

what was once a structural obstacle is now a competitive advantage, in other words, a better offer, counting on partnerships and innovative

offers.

2023 MANAGEMENT REPORT AND EARNINGS ANALYSIS |

Demonstrating this differential, in 2023, TIM

started several partnerships on the most varied fronts, with emphasis on the Content and Security segments (partnership with Deezer and

HBOMAX, for example), Education (Descomplica), Retail (Zé Delivery) and Health (Cartão de Todos). This simultaneously generates

social impact and solid revenue growth, which allows the Company to accumulate Free Operating Cash Flow.

3.2. Strategy

With the update of the Company’s strategic

plan, TIM reinforces the search for sustainable business growth considering all stakeholders and aiming to create value for each of them.

In this context, the plan designed by the Company is centered on strategies for the evolution of the existing business with incremental

innovations and initiatives that improve TIM's relative position. At the same time, new fronts are opened seeking business transformation

with more disruptive changes, entry into new markets and capture opportunities that go beyond TIM's core business. Among the levers to

achieve our aspiration, we can mention the following:

| § | Consolidate the best value proposition in a market

focused on value, with better service, better network and better offer. With better service we continue our best journey towards excellence

in customer experience, with the best network we consolidate our position as leader in network quality in Brazil and with the best offer,

we leverage our DNA of innovation and partnerships to offer the best offer. |

| § | Expansion of our presence in the B2B/IoT technology

area, leveraging TIM’s pioneering spirit with strategic moves aimed at capturing the expected market growth and seeking opportunities,

especially in 5G; |

| § | Search for high-growth opportunities, leveraging