Exceeds third quarter key guidance metrics and reaffirms

full-year 2024 key guidance metrics

Reports record third quarter political revenue

Returns more than $90 million of capital to shareholders, on

track to meet commitment to return approximately $350 million of

capital in 2024

TEGNA Inc. (NYSE: TGNA) today announced financial results for

the third quarter ended September 30, 2024.

THIRD QUARTER FINANCIAL HIGHLIGHTS: All Year-Over-Year

Comparisons Unless Otherwise Noted:

- Total company revenue increased 13% to $807 million, above our

guidance range, primarily driven by strength in political

advertising and positive growth in advertising and marketing

services (AMS) revenue.

- Political advertising revenue totaled $126 million, a new third

quarter record.

- Full-year political advertising revenue through Election Day

was approximately $375 million.

- Subscription revenue decreased 6% to $356 million, primarily

due to subscriber declines partially offset by contractual rate

increases.

- AMS revenue increased slightly to $313 million driven by

increased advertising related to the Summer Olympic Games partially

offset by political crowd out. The underlying advertising trend

improved due to demand from local accounts that outweighed

continued softness from national accounts.

- GAAP operating expenses decreased slightly to $577 million and

non-GAAP operating expenses1 were $566 million, both benefiting

from a reduction of programming fees and our core cost

initiatives.

- GAAP and non-GAAP operating income1 totaled $230 million and

$240 million, respectively.

- GAAP net income attributable to TEGNA Inc. was $147 million and

non-GAAP net income attributable to TEGNA Inc.1 was $157

million.

- GAAP and non-GAAP earnings per diluted share1 were $0.89 and

$0.94, respectively.

- Total company Adjusted EBITDA2 increased 62% to $270 million

primarily due to strength in political advertising and continued

cost benefits from our core cost initiatives.

1 See Table 3 for details

2 See Table 4 for details

“I am thrilled to join TEGNA at this pivotal moment for the

Company and for local journalism,” said Mike Steib, CEO. “The good

work we do serving our communities, our strong brands, and sizable

TV and online audience position us well to adapt to the headwinds

in our industry. Our wins this quarter with political advertising,

the Summer Olympic games, and sports rights are a reminder of the

strong foundation on which we can build our future.”

KEY BUSINESS UPDATES:

- TEGNA reported record political advertising revenue during the

third quarter.

- TEGNA continued to expand its sports rights through agreements

with the Dallas Mavericks and Kroenke Sports & Entertainment’s

Denver Nuggets and Colorado Avalanche.

- Key personnel updates

- TEGNA appointed Alex Tolston chief legal officer, effective

October 21, 2024. Tolston serves as a member of the Company’s

leadership team, reporting to CEO Mike Steib.

- Lynn Beall, executive vice president and chief operating

officer of media operations, will depart TEGNA in mid-2025 after a

significant transition period, enabling the Company to benefit from

her invaluable experience as it transitions to a new organizational

structure.

- Ellen Crooke, senior vice president of news, will retire in

January 2025.

- TEGNA stations received ten 2024 National Edward R. Murrow

Awards for excellence in broadcast journalism, more than any other

station group.

CAPITAL ALLOCATION, LEVERAGE, AND LIQUIDITY:

- During the first nine months of 2024, we returned approximately

65% of Adjusted free cash flow to shareholders through share

repurchases and dividends. We continue to expect to return 40-60%

of our Adjusted free cash flow3 over 2024-2025 to shareholders,

including approximately $350 million in 2024.

- Adjusted free cash flow was $211 million for the quarter and

$441 million for the first nine months of 2024.

- During the third quarter, the Company returned $91 million of

capital to shareholders, with $70 million in share repurchases,

representing 4.9 million shares, and $21 million in dividends.

- Interest expense in the third quarter fell slightly to $42

million due to decreased undrawn fees on the company’s revolving

credit facility.

- Cash and cash equivalents totaled $536 million at the end of

the third quarter. Net leverage finished the third quarter at

2.8x4.

3 See Table 5 for details

4 See Table 6 for details

FULL-YEAR AND FOURTH QUARTER 2024

OUTLOOK:

Full-Year 2024 Key Guidance

Metrics

TEGNA is reaffirming its guidance metrics

for the full-year of 2024 and improving the effective tax rate

2024/2025 Two-Year Adjusted FCF

$900 million – 1.1 billion

Net Leverage Ratio

Below 3x at year end

Corporate Expenses

$40 – 45 million

Depreciation

$56 – 60 million

Amortization

$51 – 55 million

Interest Expense

$170 – 173 million

Capital Expenditures

$62 – 67 million

Effective Tax Rate

22.0 – 23.0%

Fourth Quarter 2024 Key Guidance

Metrics

Reflects expectations relative to fourth

quarter 2023 results

Total Company GAAP Revenue

Up 19% to 21%

Total Non-GAAP Operating Expenses

Up 1% to 3%

CONFERENCE CALL TEGNA will host a conference call and

webcast on Thursday, November 7, 2024, to discuss the Company’s

financial results and other business matters. The teleconference

will begin at 9:00 a.m. Eastern Time and will be hosted by Mike

Steib, CEO, and Julie Heskett, chief financial officer.

The conference call will be webcast through the company’s

website, and is open to investors, the financial community, the

media and other members of the public. To access the meeting by

phone, please visit investors.TEGNA.com at least 10 minutes prior

to the scheduled start time to access the links and register before

the conference call begins. Once registered, phone participants

will receive dial-in numbers and a unique PIN to seamlessly access

the call.

FORWARD-LOOKING STATEMENTS This communication includes

forward-looking statements within the meaning of the “safe harbor”

provisions of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. When used in this communication, the words “believes,”

“estimates,” “plans,” “expects,” “should,” “could,” “outlook,” and

“anticipates” and similar expressions as they relate to the Company

or its financial results are intended to identify forward-looking

statements. Forward-looking statements in this communication may

include, without limitation, statements regarding anticipated

growth rates and the Company’s plans, objectives and expectations.

Forward-looking statements are based on a number of assumptions

about future events and are subject to various risks, uncertainties

and other factors that may cause actual results to differ

materially from the views, beliefs, projections and estimates

expressed in such statements, many of which are outside the

Company’s control. These risks, uncertainties and other factors

include, but are not limited to, risks and uncertainties related

to: changes in the market price of the Company's shares, general

market conditions, constraints, volatility, or disruptions in the

capital markets; the possibility that the Company's capital

allocation plan, including dividends, share repurchases, and/or

strategic acquisitions, investments, and partnerships may not

enhance long-term stockholder value; legal proceedings, judgments

or settlements; the Company's ability to re-price or renew

subscribers; potential regulatory actions; changes in consumer

behaviors and impacts on and modifications to TEGNA's operations

and business relating thereto; and economic, competitive,

governmental, technological and other factors and risks that may

affect the Company's operations or financial results, which are

discussed in our Annual Report on Form 10-K and Quarterly Reports

on Form 10-Q. Any forward-looking statements in this communication

should be evaluated in light of these important risk factors. The

Company is not responsible for updating the information contained

in this communication beyond the published date, or for changes

made to this press release by wire services, Internet service

providers or other media.

Readers are cautioned not to place undue reliance on

forward-looking statements made by or on behalf of the Company.

Each such statement speaks only as of the day it was made. The

Company undertakes no obligation to update or to revise any

forward-looking statements.

ADDITIONAL INFORMATION TEGNA Inc. (NYSE: TGNA) serves

local communities across the U.S. through trustworthy journalism,

engaging content, and tools that help people navigate their daily

lives. Through customized marketing solutions, we help businesses

grow and thrive. With 64 television stations in 51 U.S. markets,

TEGNA reaches approximately 100 million people every month across

the web, mobile apps, streaming, and linear television. For more

information, visit TEGNA.com.

CONSOLIDATED STATEMENTS OF INCOME

TEGNA Inc. Unaudited, in thousands of dollars (except per share

amounts)

Table No. 1

Quarter ended Sept.

30,

2024

2023

Change

Revenues

$

806,827

$

713,243

13

%

Operating expenses:

Cost of revenues

437,855

438,260

0

%

Business units - Selling, general and

administrative expenses

96,882

98,394

(2

%)

Corporate - General and administrative

expenses

13,188

13,552

(3

%)

Depreciation

15,543

15,083

3

%

Amortization of intangible assets

13,467

13,297

1

%

Total

576,935

578,586

0

%

Operating income

229,892

134,657

71

%

Non-operating (expense) income:

Interest expense

(42,288

)

(43,418

)

(3

%)

Interest income

7,023

7,389

(5

%)

Other non-operating items, net

(2,696

)

25,427

***

Total

(37,961

)

(10,602

)

***

Income before income taxes

191,931

124,055

55

%

Provision for income taxes

44,743

27,801

61

%

Net income

147,188

96,254

53

%

Net loss (income) attributable to

redeemable noncontrolling interest

260

(71

)

***

Net income attributable to TEGNA

Inc.

$

147,448

$

96,183

53

%

Earnings per share:

Basic

$

0.89

$

0.48

85

%

Diluted

$

0.89

$

0.48

85

%

Weighted average number of common

shares outstanding:

Basic shares

165,188

200,779

(18

%)

Diluted shares

165,748

201,218

(18

%)

*** Not meaningful

CONSOLIDATED STATEMENTS OF INCOME

TEGNA Inc. Unaudited, in thousands of dollars (except per share

amounts)

Table No. 1 (continued)

Nine months ended Sept.

30,

2024

2023

Change

Revenues

$

2,231,442

$

2,185,076

2

%

Operating expenses:

Cost of revenues

1,300,466

1,295,720

0

%

Business units - Selling, general and

administrative expenses

294,080

294,734

0

%

Corporate - General and administrative

expenses

40,671

52,158

(22

%)

Depreciation

45,026

45,119

0

%

Amortization of intangible assets

40,790

40,175

2

%

Asset impairment and other

1,097

3,359

(67

%)

Merger termination fee

—

(136,000

)

***

Total

1,722,130

1,595,265

8

%

Operating income

509,312

589,811

(14

%)

Non-operating (expense) income:

Interest expense

(126,404

)

(129,121

)

(2

%)

Interest income

18,469

23,498

(21

%)

Other non-operating items, net

144,313

19,990

***

Total

36,378

(85,633

)

***

Income before income taxes

545,690

504,178

8

%

Provision for income taxes

127,211

103,827

23

%

Net income

418,479

400,351

5

%

Net loss attributable to redeemable

noncontrolling interest

673

240

***

Net income attributable to TEGNA

Inc.

$

419,152

$

400,591

5

%

Earnings per share:

Basic

$

2.44

$

1.86

31

%

Diluted

$

2.44

$

1.86

31

%

Weighted average number of common

shares outstanding:

Basic shares

170,820

214,297

(20

%)

Diluted shares

171,334

214,591

(20

%)

*** Not meaningful

REVENUE CATEGORIES TEGNA Inc.

Unaudited, in thousands of dollars

Table No. 2

Below is a detail of our primary sources

of revenue:

Quarter ended Sept.

30,

2024

2023

Change

Subscription

$

356,205

$

377,891

(6%)

Advertising & Marketing Services

312,963

312,413

0%

Political

126,318

11,643

***

Other

11,341

11,296

0%

Total revenues

$

806,827

$

713,243

13%

Nine months ended Sept.

30,

2024

2023

Change

Subscription

$

1,098,554

$

1,188,297

(8%)

Advertising & Marketing Services

912,632

937,984

(3%)

Political

185,789

22,925

***

Other

34,467

35,870

(4%)

Total revenues

$

2,231,442

$

2,185,076

2%

*** Not meaningful

USE OF NON-GAAP

INFORMATION

The company uses non-GAAP financial performance and liquidity

measures to supplement the financial information presented on a

GAAP basis. These non-GAAP financial measures should not be

considered in isolation from, or as a substitute for, the related

GAAP measures, nor should they be considered superior to the

related GAAP measures and should be read together with financial

information presented on a GAAP basis. Also, our non-GAAP measures

may not be comparable to similarly titled measures of other

companies.

Management and the company’s Board of Directors (the "Board")

regularly use Corporate–General and administrative expenses,

Operating expenses, Operating income, Income before income taxes,

Provision for income taxes, Net income attributable to TEGNA Inc.,

and Diluted earnings per share, each presented on a non-GAAP basis,

for purposes of evaluating company performance. Management and the

Board also use Adjusted EBITDA and Adjusted free cash flow to

evaluate company performance and liquidity, respectively. The

Leadership Development and Compensation Committee of our Board uses

non-GAAP measures such as Adjusted EBITDA, non-GAAP net income,

non-GAAP EPS, and Adjusted free cash flow to evaluate and

compensate senior management. The Board uses Adjusted free cash

flow in its periodic assessments of, among other things,

repurchases of the company’s common stock, the company’s dividends,

strategic opportunities and long-term debt retirement. The company,

therefore, believes that each of the non-GAAP measures presented

provides useful information to investors and other stakeholders by

allowing them to view our business through the eyes of management

and our Board, facilitating comparisons of results across

historical periods and focus on the underlying ongoing operating

performance of our business. The company also believes these

non-GAAP measures are frequently used by investors, securities

analysts and other interested parties in their evaluation of our

business and other companies in the broadcast industry.

The company discusses in this release non-GAAP financial

performance and liquidity measures that exclude from its reported

GAAP results the impact of “special items” consisting of asset

impairment and other, merger and acquisition (M&A)-related

costs, Merger termination fee, retention costs, workforce

restructuring, gain recognized on the partial sale of one of our

equity investments, and a gain related to the sale of the company’s

investment in Broadcast Music Inc. (“BMI”). In addition, we have

excluded an income tax special items associated with a valuation

allowance on a deferred tax asset related to an equity method

investment and a tax benefit associated with previously disallowed

transaction costs. The company believes that such expenses and

gains are not indicative of normal, ongoing operations. While these

items should not be disregarded in evaluation of our earnings or

liquidity performance, it is useful to exclude such items when

analyzing current results and trends compared to other periods as

these items can vary significantly from period to period depending

on specific underlying transactions or events that may occur.

Therefore, while we may incur or recognize these types of expenses,

charges and gains, in the future, the company believes that

removing these items for purposes of calculating the non-GAAP

financial measures provides investors with a more focused

presentation of our ongoing operating performance.

The company also discusses Adjusted EBITDA (with and without

stock-based compensation expense), a non-GAAP financial performance

measure that it believes offers a useful view of the overall

operation of its businesses. The company defines Adjusted EBITDA as

net income attributable to TEGNA before (1) net loss attributable

to redeemable noncontrolling interest, (2) income taxes, (3)

interest expense, (4) interest income, (5) other non-operating

items, net, (6) M&A-related costs, (7) asset impairment and

other, (8) workforce restructuring costs, (9) employee retention

costs, (10) the Merger termination fee, (11) depreciation and (12)

amortization of intangible assets. The company believes these

adjustments facilitate company-to-company operating performance

comparisons by removing potential differences caused by variations

unrelated to operating performance, such as capital structures

(interest expense), income taxes, and the age and book appreciation

of property and equipment (and related depreciation expense). The

most directly comparable GAAP financial measure to Adjusted EBITDA

is Net income attributable to TEGNA. Users should consider the

limitations of using Adjusted EBITDA, including the fact that this

measure does not provide a complete measure of our operating

performance. Adjusted EBITDA is not intended to purport to be an

alternate to net income as a measure of operating performance or to

cash flows from operating activities as a measure of liquidity. In

particular, Adjusted EBITDA is not intended to be a measure of cash

flow available for management’s discretionary expenditures, as this

measure does not consider certain cash requirements, such as

working capital needs, capital expenditures, contractual

commitments, interest payments, tax payments and other debt service

requirements.

This earnings release also discusses Adjusted free cash flow, a

non-GAAP liquidity measure. The most directly comparable GAAP

financial measure to Adjusted free cash flow is Net cash flow from

operating activities. Starting in the second quarter of 2024, the

company updated its definition of Adjusted free cash flow. Adjusted

free cash flow is now calculated as net cash flow from operating

activities less payments for purchases of property and equipment

plus or minus special items. The company removes special items

affecting cash flow from operating activities because we do not

consider these items to be indicative of its underlying cash flow

generation for the reporting period. Adjusted free cash flow is not

intended to be a measure of residual cash available for

management’s discretionary use since it omits significant sources

and uses of cash flow including mandatory debt repayments. The

principal difference between the new definition and the former

definition is the inclusion of cash flows driven by changes in

certain working capital accounts (primarily accounts receivable,

accounts payable and accrued expenses) which are now included. The

company’s 2024/2025 Two-Year Adjusted free cash flow guidance of

$900 million to $1.1 billion remains the same.

This earnings release also presents our net leverage ratio which

includes Adjusted EBITDA (without stock-based compensation) as a

component of the computation. Our net leverage ratio is a financial

measure that is used by management to assess the borrowing capacity

of the company and management believes it is useful to investors

for the same reason. The company defines its Net Leverage Ratio as

(a) net debt (total debt less cash and cash equivalents) as of the

balance sheet date divided by (b) Average Annual Adjusted EBITDA

for the trailing two-year period.

The company is furnishing forward-looking guidance with respect

to Adjusted free cash flow for the combined 2024-25 years, net

leverage and corporate expenses for fiscal year 2024 and non-GAAP

operating expenses for the fourth quarter of 2024. Our future GAAP

financial results will include the impact of special items such as

retention costs including stock-based compensation and cash

payments, M&A-related costs, workforce restructuring, and asset

impairment. The company believes that such expenses are not

indicative of normal, ongoing operations. While these items should

not be disregarded in evaluation of our earnings performance, it is

useful to exclude such items when analyzing current results and

trends compared to other periods. Therefore, while we may incur or

recognize these types of expenses in the future, the company

believes that removing these items for purposes of calculating the

non-GAAP basis financial measures provides investors with a more

focused presentation of our ongoing operating performance.

The company is not able to reconcile these amounts to their

comparable GAAP financial measures without unreasonable efforts

because certain information necessary to calculate such measures on

a GAAP basis is unavailable, dependent on future events outside of

our control and cannot be predicted. An example of such information

is share-based compensation, which is impacted by future share

price movement in the company’s stock price and also dependent on

future hiring and attrition. In addition, the company believes such

reconciliations could imply a degree of precision that might be

confusing or misleading to investors. The actual effect of the

reconciling items that the company may exclude from these non-GAAP

expense numbers, when determined, may be significant to the

calculation of the comparable GAAP measures.

NON-GAAP FINANCIAL INFORMATION

TEGNA Inc. Unaudited, in thousands of dollars (except per share

amounts)

Table No. 3

Reconciliations of certain line items

impacted by special items to the most directly comparable financial

measure calculated and presented in accordance with GAAP on the

company’s Consolidated Statements of Income follow:

Special Items

Quarter ended Sept. 30, 2024

GAAP

measure

Retention

costs - SBC

Retention

costs - Cash

Workforce

restructuring

Non-GAAP

measure

Corporate - General and administrative

expenses

$

13,188

$

(1,771

)

$

(1,181

)

$

(1,231

)

$

9,005

Operating expenses

576,935

(4,044

)

(2,390

)

(4,167

)

566,334

Operating income

229,892

4,044

2,390

4,167

240,493

Income before income taxes

191,931

4,044

2,390

4,167

202,532

Provision for income taxes

44,743

242

430

518

45,933

Net income attributable to TEGNA Inc.

147,448

3,802

1,960

3,649

156,859

Earnings per share - diluted

$

0.89

$

0.02

$

0.01

$

0.02

$

0.94

Special Items

Quarter ended Sept. 30, 2023

GAAP

measure

Retention

costs - SBC

Retention

costs - Cash

Other

non-operating

item

Special

tax item

Non-GAAP

measure

Corporate - General and administrative

expenses

$

13,552

$

(440

)

$

(553

)

$

—

$

—

$

12,559

Operating expenses

578,586

(1,692

)

(1,192

)

—

—

575,702

Operating income

134,657

1,692

1,192

—

—

137,541

Income before income taxes

124,055

1,692

1,192

(25,809

)

—

101,130

Provision for income taxes

27,801

237

152

(6,604

)

1,516

23,102

Net income attributable to TEGNA Inc.

96,183

1,455

1,040

(19,205

)

(1,516

)

77,957

Earnings per share - diluted

$

0.48

$

0.01

$

0.01

$

(0.10

)

$

(0.01

)

$

0.39

NON-GAAP FINANCIAL INFORMATION

TEGNA Inc. Unaudited, in thousands of dollars (except per share

amounts)

Table No. 3 (continued)

Special Items

Nine months ended Sept. 30,

2024

GAAP

measure

Retention

costs - SBC

Retention

costs - Cash

M&A-related

costs

Workforce

restructuring

Asset

impairment

and other

Other

non-operating

item

Non-GAAP

measure

Corporate - General and administrative

expenses

$

40,671

$

(3,094

)

$

(2,056

)

$

(2,290

)

$

(1,834

)

$

—

$

—

$

31,397

Operating expenses

1,722,130

(9,135

)

(3,963

)

(2,290

)

(7,804

)

(1,097

)

—

1,697,841

Operating income

509,312

9,135

3,963

2,290

7,804

1,097

—

533,601

Income before income taxes

545,690

9,135

3,963

2,290

7,804

1,097

(152,867

)

417,112

Provision for income taxes

127,211

1,035

678

593

1,408

284

(36,621

)

94,588

Net income attributable to TEGNA Inc.

419,152

8,100

3,285

1,697

6,396

813

(116,246

)

323,197

Earnings per share - diluted (a)

$

2.44

$

0.05

$

0.02

$

0.01

$

0.04

$

0.01

$

(0.68

)

$

1.88

(a) Per share amounts do not sum due to

rounding.

Special Items

Nine months ended Sept. 30,

2023

GAAP

measure

M&A-related

costs

Retention

costs - SBC

Retention

costs - Cash

Merger

termination

fee

Asset

impairment

and other

Other

non-operating

item

Special

tax item

Non-GAAP

measure

Corporate - General and administrative

expenses

$

52,158

$

(19,848

)

$

(440

)

$

(553

)

$

—

$

—

$

—

$

—

$

31,317

Operating expenses

1,595,265

(19,848

)

(1,692

)

(1,192

)

136,000

(3,359

)

—

—

1,705,174

Operating income

589,811

19,848

1,692

1,192

(136,000

)

3,359

—

—

479,902

Income before income taxes

504,178

19,848

1,692

1,192

(136,000

)

3,359

(25,809

)

—

368,460

Provision for income taxes

103,827

4,552

237

152

(24,504

)

860

(6,604

)

7,959

86,479

Net income attributable to TEGNA Inc.

400,591

15,296

1,455

1,040

(111,496

)

2,499

(19,205

)

(7,959

)

282,221

Earnings per share - diluted (a)

$

1.86

$

0.07

$

0.01

$

—

$

(0.52

)

$

0.01

$

(0.09

)

$

(0.04

)

$

1.31

(a) Per share amounts do not sum due to

rounding.

NON-GAAP FINANCIAL INFORMATION

TEGNA Inc. Unaudited, in thousands of dollars

Table No. 4

Reconciliations of Adjusted EBITDA to net

income presented in accordance with GAAP on the company’s

Consolidated Statements of Income are presented below:

Quarter ended Sept.

30,

2024

2023

Net income attributable to TEGNA Inc.

(GAAP basis)

$

147,448

$

96,183

(Less) Plus: Net (loss) income

attributable to redeemable noncontrolling interest

(260

)

71

Plus: Provision for income taxes

44,743

27,801

Plus: Interest expense

42,288

43,418

Less: Interest income

(7,023

)

(7,389

)

Plus (Less): Other non-operating items,

net

2,696

(25,427

)

Operating income (GAAP basis)

229,892

134,657

Plus: Workforce restructuring

4,167

—

Plus: Retention costs - Employee

stock-based compensation expenses

4,044

1,692

Plus: Retention costs - Cash

2,390

1,192

Adjusted operating income (non-GAAP

basis)

240,493

137,541

Plus: Depreciation

15,543

15,083

Plus: Amortization of intangible

assets

13,467

13,297

Adjusted EBITDA

$

269,503

$

165,921

Stock-based compensation expenses:

Employee awards

6,546

4,866

Company stock 401(k) match

contributions

4,035

3,924

Adjusted EBITDA before stock-based

compensation costs

$

280,084

$

174,711

Nine months ended Sept.

30,

2024

2023

Net income attributable to TEGNA Inc.

(GAAP basis)

$

419,152

$

400,591

Less: Net loss attributable to redeemable

noncontrolling interest

(673

)

(240

)

Plus: Provision for income taxes

127,211

103,827

Plus: Interest expense

126,404

129,121

Less: Interest income

(18,469

)

(23,498

)

Less: Other non-operating items, net

(144,313

)

(19,990

)

Operating income (GAAP basis)

509,312

589,811

Plus: M&A-related costs

2,290

19,848

Plus: Asset impairment and other

1,097

3,359

Plus: Workforce restructuring

7,804

—

Plus: Retention costs - Employee

stock-based compensation expenses

9,135

1,692

Plus: Retention costs - Cash

3,963

1,192

Less: Merger termination fee

—

(136,000

)

Adjusted operating income (non-GAAP

basis)

533,601

479,902

Plus: Depreciation

45,026

45,119

Plus: Amortization of intangible

assets

40,790

40,175

Adjusted EBITDA

$

619,417

$

565,196

Stock-based compensation expenses:

Employee awards

21,526

13,711

Company stock 401(k) match

contributions

14,251

14,150

Adjusted EBITDA before stock-based

compensation costs

$

655,194

$

593,057

NON-GAAP FINANCIAL INFORMATION

TEGNA Inc. Unaudited, in thousands of dollars

Table No. 5

Reconciliations of Adjusted free cash flow

to net cash flow from operating activities presented in accordance

with GAAP on the company’s Consolidated Statements of Cash Flows

are presented below:

Period ending September 30,

2024

Quarter

Year-to-date

Net cash flow from operating activities

(GAAP basis)

$

210,057

$

435,216

Less: Purchases of property and

equipment

(15,414

)

(36,297

)

Special

items:

M&A related costs

494

2,198

Workforce restructuring

3,084

5,146

Retention costs - cash

2,369

4,019

Asset impairment and other

-

1,097

Taxes on BMI gain

10,840

29,640

Total Adjustments

16,787

42,100

Adjusted free cash flow (non-GAAP

basis)

$

211,430

$

441,019

NON-GAAP FINANCIAL INFORMATION

TEGNA Inc. Unaudited, in thousands of dollars

Table No. 6

The following table reconciles long-term

debt, net of current portion to Net debt.

Sept. 30, 2024

Long-term debt, net of current portion

$

3,090,000

Plus: Current portion of long-term

debt

—

Less: Cash and cash equivalents

(536,253

)

Net debt (numerator)

$

2,553,747

The following table shows the calculation

of the average annual Adjusted EBITDA before stock-based

compensation over the trailing two-year period ("T2Y").

Adjusted EBITDA before stock-based

compensation:

Nine months ended Sept. 30, 20241

$

655,194

Plus: Year ended December 31, 20232

781,562

Plus: Year ended December 31, 20222

1,181,045

Less: Nine months ended Sept. 30,

20223

(809,219

)

Combined T2Y

$

1,808,582

Divided by

2

T2Y Adjusted EBITDA (denominator)

$

904,291

The following table shows the calculation

of the Net Leverage Ratio.

Sept. 30, 2024

Net debt (numerator)

$

2,553,747

T2Y Adjusted EBITDA (denominator)

$

904,291

Net Leverage Ratio

2.8

x

1 A non-GAAP measure detailed in Table

4.

2 Refer to page 39 of the 2023 Form 10-K

for reconciliations of 2023 and 2022 Adjusted EBITDA before

stock-based compensation costs to net income attributable to TEGNA

Inc.

3 Refer to page 27 in our Q3 2022 Form

10-Q for a reconciliation of the first nine months ended 2022

Adjusted EBITDA. Note that we did not present Adjusted EBITDA

before stock-based compensation in our Q3 2022 10-Q. Our Adjusted

EBITDA was $771,251 thousand while our stock-based compensation and

company stock 401(k) contribution expenses were $23,625 thousand

and $14,343 thousand, respectively, which sums to the amount shown

above.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106832994/en/

For media inquiries: Anne Bentley Vice President, Chief

Communications Officer 703-873-6366 abentley@TEGNA.com

For investor inquiries: Julie Heskett Senior Vice President,

Chief Financial Officer 703-873-6747

investorrelations@TEGNA.com

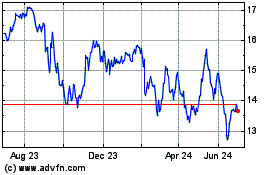

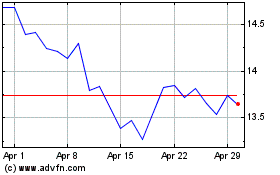

TEGNA (NYSE:TGNA)

Historical Stock Chart

From Nov 2024 to Dec 2024

TEGNA (NYSE:TGNA)

Historical Stock Chart

From Dec 2023 to Dec 2024