false

0001534675

0001534675

2024-08-08

2024-08-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): August 8, 2024

TECNOGLASS

INC.

(Exact

Name of Registrant as Specified in Charter)

| Cayman

Islands |

|

001-35436 |

|

98-1271120 |

| (State

or Other Jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

Incorporation) |

|

File

Number) |

|

Identification

No.) |

3550

NW 49th Street, Miami, Florida 33142

Avenida

Circunvalar a 100 mts de la Via 40, Barrio Las Flores Barranquilla, Colombia

(Address

of Principal Executive Offices) (Zip Code)

(57)(5)

3734000

(Registrant’s

Telephone Number, Including Area Code)

Not

Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e 4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Ordinary

Shares |

|

TGLS |

|

The

New York Stock Exchange |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02. Results of Operations and Financial Condition.

On

August 8, 2024, Tecnoglass Inc. (the “Company”) issued a press release announcing its financial results for the second quarter

ended June 30, 2024. The press release is included as Exhibit 99.1 hereto.

The

information furnished under this Item 2.02, including the exhibit related thereto, shall not be deemed “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any disclosure document of

the Company, except as shall be expressly set forth by specific reference in such document.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Dated:

August 8, 2024

| |

TECNOGLASS

INC. |

| |

|

| |

By:

|

/s/

Jose M. Daes |

| |

Name:

|

Jose

M. Daes |

| |

Title: |

Chief

Executive Officer |

Exhibit

99.1

Tecnoglass

Reports Second Quarter 2024 Results

-

Revenue of $219.7 Million -

-

Strong Organic Growth in Single-Family Residential Revenue to a Record $95.7 Million -

-

Net Income of $35.0 Million, or $0.75 Per Diluted Share -

-

Adjusted Net Income1 of $40.5 Million, or $0.86 Per Diluted Share -

-

Adjusted EBITDA1 of $64.1 Million -

-

Strong Cash Flow from Operations of $34.5 Million, Representing 54% of Adjusted EBITDA1 -

-

All Time Record Low Net Leverage Ratio of 0.06x at Quarter End -

-

Backlog Growth Continued Record Trajectory, Expanding 29% Year-Over-Year to a Record $1.02 Billion -

-

Single Family Residential Orders Continued Record Trajectory for the Second Quarter, Up Over 60% Versus the Prior Year Quarter -

-

Provides Improved Full Year 2024 Outlook -

Miami,

FL – August 8, 2024 – Tecnoglass, Inc. (NYSE: TGLS) (“Tecnoglass” or the “Company”), a leading

producer of high-end aluminum and vinyl windows and architectural glass for the global residential and commercial end markets, today

reported financial results for the second quarter ended June 30, 2024.

José

Manuel Daes, Chief Executive Officer of Tecnoglass, commented, “Our team demonstrated exceptional performance in the second quarter

of 2024, successfully navigating a complex macroeconomic landscape. We maintained strong momentum, capitalizing on the robust demand

observed at the end of the first quarter to drive record single-family residential revenues in the second quarter. Our multi-family/commercial

business improved sequentially and is expected to continue a positive trend as we move into the second half of the year and into 2025.

This outlook is supported by substantial order levels in June, which contributed to another record quarter of backlog. Furthermore, our

continued focus on operational efficiencies and prudent working capital management continues to yield benefits, resulting in robust cash

flow generation despite the timing of seasonal tax payments made during the quarter. While we face year-over-year margin pressures from

a combination of factors, particularly unfavorable foreign exchange impacts, we’re encouraged by the sequential improvement in

our profitability and the reasonable stability in FX rates for the last 12 months. We remain confident in our ability to navigate the

evolving market landscape and drive additional shareholder value in 2024.”

Christian

Daes, Chief Operating Officer of Tecnoglass, added, “We’re proud to report another record multi-year backlog of $1.02 billion,

providing strong visibility into our multi-family and commercial project pipeline through 2025 and now building into 2026. The robust

demand for our best-in-class product offerings, coupled with our ability to continue taking market share in geographies that are outperforming

the broader US market, drove record single-family residential revenues this quarter. The expiration of the ‘Florida Impact-Resistant

Windows and Doors Sales Tax Exemption’ in June contributed to record orders for the quarter that positions us for strong single-family

residential revenues through year-end. We maintain a growth outlook for the full year reinforced by our established customer relationships,

record backlog, innovative product portfolio and the benefits of our vertically-integrated operations. We are well-situated to continue

on our journey of innovation and value creation.”

Second

Quarter 2024 Results

Total

revenues for the second quarter of 2024 decreased 2.5% to $219.7 million, the second-highest revenue quarter in the company´s history,

compared to a record $225.3 million in the prior year quarter. Single-family residential revenues increased 10.1% year-over-year to record

levels, reflecting improving market trends and what we estimate to be a partial pull-forward effect related to the Florida sales tax

waiver. Multi-family/commercial revenues grew sequentially in the second quarter of 2024, but decreased compared to the prior year quarter

given record activity during the second quarter 2023 and higher interest and mortgage rates during 2024. Changes in foreign currency

exchange rates had an adverse impact of $0.7 million on total revenues in the quarter.

Gross

profit for the second quarter of 2024 was $89.6 million, representing a 40.8% gross margin, compared to gross profit of $109.7 million,

representing a 48.7% gross margin, in the prior year quarter. The year-over-year change in gross margin reflected an unfavorable foreign

exchange impact of nearly 340 basis points, reduced operating leverage on lower revenues coupled with higher salary expenses, and to

a lesser extent a less favorable mix of revenues. In line with the last two quarters but at a lesser magnitude given the normalization

of FX rates that began in the second quarter of 2023, margins were impacted by a Colombian Peso revaluation of approximately 11% year-over-year.

The year-over-year impact of unfavorable foreign exchange is expected to dissipate beginning in the third quarter of 2024 given the relative

stabilization of the currency exchange rates during the last twelve months. On a sequential basis, gross margin improved by 200 basis

points when compared to 38.8% in the first quarter of 2024.

Selling,

general and administrative expense (“SG&A”) was $38.4 million for the second quarter of 2024 compared to $35.2 million

in the prior year quarter, with the increase primarily attributable to higher personnel expenses given overall salary adjustments that

took place at the beginning of the year. As a percent of total revenues, SG&A was 17.5% for the second quarter of 2024 compared to

15.6% in the prior year quarter, primarily due to lower revenues and the aforementioned salary adjustments.

Net

income was $35.0 million, or $0.75 per diluted share, in the second quarter of 2024 compared to net income of $52.6 million, or

$1.10 per diluted share, in the prior year quarter, including a non-cash foreign exchange transaction loss of $5.6 million in

the second quarter of 2024 and a $0.9 million gain in the second quarter of 2023. These non-cash gains and losses are related to the

accounting re-measurement of U.S. Dollar denominated assets and liabilities against the Colombian Peso as functional currency.

Adjusted

net income1 was

$40.5 million, or $0.86 per diluted share, in the second quarter of 2024 compared to adjusted net income of $53.5 million, or $1.12

per diluted share, in the prior year quarter. Adjusted net income1, as reconciled

in the table below, excludes the impact of non-cash foreign exchange transaction gains or losses and other non-core items, along with

the tax impact of adjustments at statutory rates, to better reflect core financial performance.

Adjusted

EBITDA1,

as reconciled in the table below, was $64.1 million, or 29.2% of total revenues, in the second quarter of 2024, compared to $85.0 million,

or 37.7% of total revenues, in the prior year quarter. The change was primarily attributable to the aforementioned factors impacting

gross margin as well as lower year-over-year revenues. Adjusted EBITDA1 included a

$1.4 million contribution from the Company’s joint venture with Saint-Gobain, compared to $0.3 million in the prior year quarter.

Cash

Generation, Capital Allocation and Liquidity

Cash

provided by operating activities for the second quarter of 2024 was $34.5 million, primarily driven by a reduction in working capital.

Capital expenditures of $20.3 million in the quarter included payments for previously purchased land for future potential capacity expansion,

a down payment for the Miami headquarters and the associated flagship showroom, and the amortization of a portion of previously disclosed

investments in facilities and operational infrastructure.

During

the quarter, the Company returned capital to shareholders through the payment of $5.2 million in cash dividends. Additionally, the Company

has approximately $26 million remaining under the current share repurchasing program. During the quarter, the Company also made a $15

million voluntary prepayment to its syndicate term loan facility.

The

Company ended the second quarter of 2024 with total liquidity of approximately $300 million, including $127 million of cash and cash

equivalents and $170.0 million of availability under its revolving credit facilities. Given the Company’s strong cash generation,

net debt leverage was a record low of 0.1x net debt to LTM Adjusted EBITDA1, compared to 0.2x in the prior year.

Full

Year 2024 Outlook

Santiago

Giraldo, Chief Financial Officer of Tecnoglass, stated, “We are providing full year outlook ranges for revenue and Adjusted EBITDA

that are in aggregate stronger than our previous outlook scenarios. This reflects our strong results through June and our visibility

through the remainder of the year. We expect full year 2024 revenues to grow to a range of $860 million to $910 million, representing

approximately 6% growth at the midpoint, and entirely organic. We expect Adjusted EBITDA1 to be in the range of $260 million

to $285 million. The implied Adjusted EBITDA1 margin of approximately 31% at the midpoint assumes a full year gross margin

in the low to mid 40% range, along with healthy free cash flow into year end. This outlook is predicated on a variety of factors including

the surge in our single-family residential orders, an expected increase in vinyl sales, an increased mix of revenues from installation

and stand-alone product sales, stable FX rates, and the timely execution of our multi-family/commercial backlog through year end. As

we look to the remainder of the year, we remain confident in our ability to drive value for our shareholders given the opportunities

we see to expand our market share.”

Webcast

and Conference Call

Management

will host a webcast and conference call on August 8, 2024, at 10:00 a.m. Eastern time to review the Company’s results. The conference

call will be broadcast live over the Internet. Additionally, a slide presentation will accompany the conference call. To listen to the

call and view the slides, please visit the Investor Relations section of Tecnoglass’ website at www.tecnoglass.com. Please go to

the website at least 15 minutes early to register, download and install any necessary audio software. For those unable to access the

webcast, the conference call will be accessible by dialing 1-844-826-3035 (domestic) or 1-412-317-5195 (international). Upon dialing

in, please request to join the Tecnoglass Second Quarter 2024 Earnings Conference Call.

If

you are unable to listen live, a replay of the webcast will be archived on the website. You may also access the conference call playback

by dialing 1-844-512-2921 (Domestic) or 1-412-317-6671 (International) and entering passcode: 10190661.

About

Tecnoglass

Tecnoglass

Inc. is a leading producer of high-end aluminum and vinyl windows and architectural glass serving the multi-family, single-family, and

commercial end markets. Tecnoglass is the second largest glass fabricator serving the U.S. and the #1 architectural glass transformation

company in Latin America. Located in Barranquilla, Colombia, the Company’s 5.6 million square foot, vertically integrated, and

state-of-the-art manufacturing complex provide efficient access to nearly 1,000 customers in North, Central and South America, with the

United States accounting for 95% of total revenues. Tecnoglass’ tailored, high-end products are found on some of the world’s

most distinctive properties, including One Thousand Museum (Miami), Paramount (Miami), Salesforce Tower (San Francisco), Via 57 West

(NY), Hub50House (Boston), Aeropuerto Internacional El Dorado (Bogotá), One Plaza (Medellín), Pabellon de Cristal (Barranquilla).

For more information, please visit www.tecnoglass.com or view our corporate video at https://vimeo.com/134429998.

Forward

Looking Statements

This

press release includes certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995,

including statements regarding future financial performance, future growth and future acquisitions. These statements are based on Tecnoglass’

current expectations or beliefs and are subject to uncertainty and changes in circumstances. Actual results may vary materially from

those expressed or implied by the statements herein due to changes in economic, business, competitive and/or regulatory factors, and

other risks and uncertainties affecting the operation of Tecnoglass’ business. These risks, uncertainties and contingencies are

indicated from time to time in Tecnoglass’ filings with the Securities and Exchange Commission. The information set forth herein

should be read in light of such risks. Further, investors should keep in mind that Tecnoglass’ financial results in any particular

period may not be indicative of future results. Tecnoglass is under no obligation to, and expressly disclaims any obligation to, update

or alter its forward-looking statements, whether as a result of new information, future events and changes in assumptions or otherwise,

except as required by law.

1

Adjusted net income (loss) and Adjusted EBITDA in both periods are reconciled in the table below.

Investor

Relations:

Santiago

Giraldo

CFO

305-503-9062

investorrelations@tecnoglass.com

Tecnoglass

Inc. and Subsidiaries

Consolidated

Balance Sheets

(In

thousands, except share and per share data)

| | |

June 30, 2024 | | |

December 31, 2023 | |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 126,805 | | |

$ | 129,508 | |

| Investments | |

| 2,699 | | |

| 2,907 | |

| Trade accounts receivable, net | |

| 178,790 | | |

| 166,498 | |

| Due from related parties | |

| 1,686 | | |

| 1,387 | |

| Inventories | |

| 132,497 | | |

| 159,070 | |

| Contract assets – current portion | |

| 22,961 | | |

| 17,800 | |

| Other current assets | |

| 51,223 | | |

| 58,590 | |

| Total current assets | |

$ | 516,661 | | |

$ | 535,760 | |

| Long-term assets: | |

| | | |

| | |

| Property, plant and equipment, net | |

$ | 323,981 | | |

$ | 324,591 | |

| Deferred income taxes | |

| 235 | | |

| 169 | |

| Contract assets – non-current | |

| 8,541 | | |

| 8,797 | |

| Intangible assets | |

| 3,592 | | |

| 3,475 | |

| Goodwill | |

| 23,561 | | |

| 23,561 | |

| Long-term investments | |

| 60,150 | | |

| 60,570 | |

| Other long-term assets | |

| 5,768 | | |

| 5,794 | |

| Total long-term assets | |

| 425,828 | | |

| 426,957 | |

| Total assets | |

$ | 942,489 | | |

$ | 962,717 | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Short-term debt and current portion of long-term debt | |

$ | 2,197 | | |

$ | 7,002 | |

| Trade accounts payable and accrued expenses | |

| 99,572 | | |

| 82,784 | |

| Due to related parties | |

| 6,377 | | |

| 7,498 | |

| Dividends payable | |

| 5,197 | | |

| 4,265 | |

| Contract liability – current portion | |

| 77,406 | | |

| 72,543 | |

| Other current liabilities | |

| 22,196 | | |

| 61,794 | |

| Total current liabilities | |

$ | 212,945 | | |

$ | 235,886 | |

| Long-term liabilities: | |

| | | |

| | |

| Deferred income taxes | |

$ | 14,647 | | |

$ | 15,793 | |

| Contract liability – non-current | |

| - | | |

| 14 | |

| Long-term debt | |

| 140,058 | | |

| 163,004 | |

| Total long-term liabilities | |

| 154,705 | | |

| 178,811 | |

| Total liabilities | |

$ | 367,650 | | |

$ | 414,697 | |

| SHAREHOLDERS’ EQUITY | |

| | | |

| | |

| Preferred shares, $0.0001 par value, 1,000,000 shares authorized, 0 shares issued and outstanding at June 30, 2024 and December 31, 2023, respectively | |

$ | | | |

$ | - | |

| Ordinary shares, $0.0001 par value, 100,000,000 shares authorized, 46,996,608 and 46,996,708 shares issued and outstanding at June 30, 2024 and December 31, 2023, respectively | |

| 5 | | |

| 5 | |

| Legal Reserves | |

| 1,458 | | |

| 1,458 | |

| Additional paid-in capital | |

| 192,380 | | |

| 192,385 | |

| Retained earnings | |

| 454,456 | | |

| 400,035 | |

| Accumulated other comprehensive loss | |

| (73,460 | ) | |

| (45,863 | ) |

| Total shareholders’ equity | |

| 574,839 | | |

| 548,020 | |

| Total liabilities and shareholders’ equity | |

$ | 942,489 | | |

$ | 962,717 | |

Tecnoglass

Inc. and Subsidiaries

Consolidated

Statements of Operations and Comprehensive Income

(In

thousands, except share and per share data)

(Unaudited)

| | |

Three months ended | | |

Six months ended | |

| | |

June 30, | | |

June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Operating revenues: | |

| | | |

| | | |

| | | |

| | |

| External customers | |

$ | 218,928 | | |

$ | 224,788 | | |

$ | 411,017 | | |

$ | 427,094 | |

| Related parties | |

| 726 | | |

| 492 | | |

| 1,264 | | |

| 825 | |

| Total operating revenues | |

| 219,654 | | |

| 225,280 | | |

| 412,281 | | |

| 427,919 | |

| Cost of sales | |

| (130,077 | ) | |

| (115,610 | ) | |

| (248,044 | ) | |

| (210,494 | ) |

| Gross profit | |

| 89,577 | | |

| 109,670 | | |

| 164,237 | | |

| 217,425 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Selling expense | |

| (20,000 | ) | |

| (20,487 | ) | |

| (37,583 | ) | |

| (36,807 | ) |

| General and administrative expense | |

| (18,443 | ) | |

| (14,682 | ) | |

| (34,498 | ) | |

| (32,437 | ) |

| Total operating expenses | |

| (38,443 | ) | |

| (35,169 | ) | |

| (72,081 | ) | |

| (69,244 | ) |

| Operating income | |

| 51,134 | | |

| 74,501 | | |

| 92,156 | | |

| 148,181 | |

| Non-operating income, net | |

| 2,731 | | |

| 1,625 | | |

| 3,811 | | |

| 2,912 | |

| Equity method income | |

| 1,237 | | |

| 1,119 | | |

| 2,283 | | |

| 2,568 | |

| Foreign currency transactions (loss) gains | |

| (5,575 | ) | |

| 889 | | |

| (5,728 | ) | |

| (211 | ) |

| Interest expense and deferred cost of financing | |

| (2,006 | ) | |

| (2,321 | ) | |

| (4,112 | ) | |

| (4,594 | ) |

| Income before taxes | |

| 47,521 | | |

| 75,813 | | |

| 88,410 | | |

| 148,856 | |

| Income tax provision | |

| (12,493 | ) | |

| (23,248 | ) | |

| (23,652 | ) | |

| (47,919 | ) |

| Net income | |

$ | 35,028 | | |

$ | 52,565 | | |

$ | 64,758 | | |

$ | 100,937 | |

| Income attributable to non-controlling interest | |

| - | | |

| (120 | ) | |

| - | | |

| (257 | ) |

| Income attributable to parent | |

$ | 35,028 | | |

$ | 52,445 | | |

$ | 64,758 | | |

$ | 100,680 | |

| Basic income per share | |

$ | 0.75 | | |

$ | 1.10 | | |

$ | 1.38 | | |

$ | 2.12 | |

| Diluted income per share | |

$ | 0.75 | | |

| 1.10 | | |

$ | 1.38 | | |

$ | 2.12 | |

| Basic weighted average common shares outstanding | |

| 46,996,705 | | |

| 47,647,041 | | |

| 46,996,706 | | |

| 47,674,403 | |

| Diluted weighted average common shares outstanding | |

| 46,996,705 | | |

| 47,647,041 | | |

| 46,996,706 | | |

| 47,674,403 | |

| Other comprehensive income: | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation adjustments | |

| (28,321 | ) | |

| 27,238 | | |

| (28,291 | ) | |

| 35,049 | |

| Change in fair value of derivative contracts | |

| (342 | ) | |

| 1,823 | | |

| 694 | | |

| (14 | ) |

| Total other comprehensive income | |

| (28,663 | ) | |

| 29,061 | | |

| (27,597 | ) | |

| 35,035 | |

| Total comprehensive income | |

$ | 6,365 | | |

$ | 81,626 | | |

$ | 37,161 | | |

$ | 135,972 | |

| Income attributable to non-controlling interest | |

| - | | |

| (120 | ) | |

| - | | |

| (257 | ) |

| Total comprehensive income attributable to parent | |

$ | 6,365 | | |

$ | 81,506 | | |

$ | 37,161 | | |

$ | 135,715 | |

Tecnoglass

Inc. and Subsidiaries

Consolidated

Statements of Cash Flows

(In

thousands)

(Unaudited)

| | |

Six months ended June 30, | |

| | |

2024 | | |

2023 | |

| CASH FLOWS FROM OPERATING ACTIVITIES | |

| | | |

| | |

| Net income | |

$ | 64,758 | | |

$ | 100,937 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | |

| | | |

| | |

| Allowance for credit losses | |

| 275 | | |

| 1,899 | |

| Depreciation and amortization | |

| 12,788 | | |

| 9,914 | |

| Deferred income taxes | |

| 1,456 | | |

| 4,130 | |

| Equity method income | |

| (2,283 | ) | |

| (2,568 | ) |

| Deferred cost of financing | |

| 640 | | |

| 610 | |

| Other non-cash adjustments | |

| 32 | | |

| 118 | |

| Unrealized currency translation (gains) loss | |

| 741 | | |

| (14,609 | ) |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Trade accounts receivable | |

| (5,913 | ) | |

| (24,778 | ) |

| Inventories | |

| 14,395 | | |

| (15,584 | ) |

| Prepaid expenses | |

| (1,743 | ) | |

| (1,660 | ) |

| Other assets | |

| 8,827 | | |

| (22,550 | ) |

| Trade accounts payable and accrued expenses | |

| 12,695 | | |

| 16,167 | |

| Taxes payable | |

| (36,961 | ) | |

| (20,153 | ) |

| Labor liabilities | |

| (121 | ) | |

| 345 | |

| Other liabilities | |

| 42 | | |

| (57 | ) |

| Contract assets and liabilities | |

| (3,192 | ) | |

| 10,843 | |

| Related parties | |

| 1,509 | | |

| 210 | |

| CASH PROVIDED BY OPERATING ACTIVITIES | |

$ | 67,945 | | |

$ | 43,214 | |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES | |

| | | |

| | |

| Dividends received | |

| 2,703 | | |

| | |

| Purchase of investments | |

| (317 | ) | |

| (193 | ) |

| Acquisition of property and equipment | |

| (30,188 | ) | |

| (37,886 | ) |

| CASH USED IN INVESTING ACTIVITIES | |

$ | (27,802 | ) | |

$ | (38,079 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES | |

| | | |

| | |

| Cash dividend | |

| (9,407 | ) | |

| (7,868 | ) |

| Minority stock purchase | |

| (2,500 | ) | |

| | |

| Stock buyback | |

| (5 | ) | |

| (56 | ) |

| Proceeds from debt | |

| 2,571 | | |

| 98 | |

| Repayments of debt | |

| (30,986 | ) | |

| (6 | ) |

| CASH USED IN FINANCING ACTIVITIES | |

$ | (40,327 | ) | |

$ | (7,832 | ) |

| | |

| | | |

| | |

| Effect of exchange rate changes on cash and cash equivalents | |

$ | (2,519 | ) | |

$ | 3,711 | |

| | |

| | | |

| | |

| NET (DCREASE) INCREASE IN CASH | |

| (2,703 | ) | |

| 1,014 | |

| CASH - Beginning of period | |

| 129,508 | | |

| 103,672 | |

| CASH - End of period | |

$ | 126,805 | | |

$ | 104,686 | |

| | |

| | | |

| | |

| SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION | |

| | | |

| | |

| Cash paid during the period for: | |

| | | |

| | |

| Interest | |

$ | 5,559 | | |

$ | 5,556 | |

| Income Tax | |

$ | 59,607 | | |

$ | 82,807 | |

| | |

| | | |

| | |

| NON-CASH INVESTING AND FINANCING ACTIVITIES: | |

| | | |

| | |

| Assets acquired under credit or debt | |

$ | 4,572 | | |

$ | 7,223 | |

Revenues

by Region

(Amounts

in thousands)

(Unaudited)

| | |

Three months ended | |

| | |

June 30, | |

| | |

2024 | | |

2023 | | |

% Change | |

| Revenues by Region | |

| | | |

| | | |

| | |

| United States | |

| 209,697 | | |

| 214,725 | | |

| -2.3 | % |

| Colombia | |

| 5,831 | | |

| 5,962 | | |

| -2.2 | % |

| Other Countries | |

| 4,126 | | |

| 4,593 | | |

| (10.2 | )% |

| Total Revenues by Region | |

| 219,654 | | |

| 225,280 | | |

| -2.5 | % |

Reconciliation

of Non-GAAP Performance Measures to GAAP Performance Measures

(In

thousands)

(Unaudited)

The

Company believes that total revenues with foreign currency held neutral, which are not performance measures under generally accepted

accounting principles (“GAAP”), may provide users of the Company’s financial information with additional meaningful

bases for comparing the Company’s current results and results in a prior period, as these measures reflect factors that are unique

to one period relative to the comparable period. Management uses such performance measures in managing and evaluating the Company’s

business. However, these non-GAAP performance measures should be viewed in addition to, and not as an alternative for, the Company’s

reported results under accounting principles generally accepted in the United States.

| | |

Three months ended | |

| | |

June 30, | |

| | |

2024 | | |

2023 | | |

% Change | |

| | |

| | |

| | |

| |

| Total Revenues with Foreign Currency Held Neutral | |

| 218,988 | | |

| 225,280 | | |

| -2.8 | % |

| Impact of changes in foreign currency | |

| 666 | | |

| - | | |

| | |

| Total Revenues, As Reported | |

| 219,654 | | |

| 225,280 | | |

| -2.5 | % |

Currency

impacts on total revenues for the current quarter have been derived by translating current quarter revenues at the prevailing average

foreign currency rates during the prior year quarter, as applicable.

Reconciliation

of Adjusted EBITDA and Adjusted net (loss) income to net (loss) income

(In

thousands, except share and per share data) / (Unaudited)

Adjusted

EBITDA and adjusted net (loss) income are non-GAAP performance measures. Management believes Adjusted EBITDA and adjusted net (loss)

income, in addition to operating profit, net (loss) income and other GAAP measures, are useful to investors to evaluate the Company’s

results because they exclude certain items that are not directly related to the Company’s core operating performance. Investors

should recognize that Adjusted EBITDA and adjusted net (loss) income might not be comparable to similarly-titled measures of other companies.

These measures should be considered in addition to, and not as a substitute for or superior to, any measure of performance prepared in

accordance with GAAP.

Reconciliations

of the non-GAAP measures used in this press release are included in the tables attached to this press release, to the extent available

without unreasonable effort. Because GAAP financial measures on a forward-looking basis are not accessible, and reconciling information

is not available without unreasonable effort, we have not provided reconciliations for forward-looking non-GAAP measures. Items excluded

to arrive at forward-looking non-GAAP measures may have a significant, and potentially unpredictable, impact on our future GAAP results.

A

reconciliation of Adjusted net (loss) income and Adjusted EBITDA to the most directly comparable GAAP measure in accordance with SEC

Regulation G follows, with amounts in thousands:

| | |

Three months ended | | |

Six months ended | |

| | |

June 30, | | |

June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| Net (loss) income | |

| 35,028 | | |

| 52,565 | | |

| 64,758 | | |

| 100,937 | |

| Less: Income (loss) attributable to non-controlling interest | |

| - | | |

| (120 | ) | |

| - | | |

| (257 | ) |

| (Loss) Income attributable to parent | |

| 35,028 | | |

| 52,445 | | |

| 64,758 | | |

| 100,680 | |

| Foreign currency transactions losses (gains) | |

| 5,575 | | |

| (889 | ) | |

| 5,728 | | |

| 211 | |

| Provision for bad debt | |

| 150 | | |

| 985 | | |

| 275 | | |

| 1,899 | |

| Non-Recurring expenses (non-recurring professional fees, capital market fees, other non-core items) | |

| 968 | | |

| 1,436 | | |

| 1,639 | | |

| 3,797 | |

| Joint Venture VA (Saint Gobain) adjustments | |

| 1,409 | | |

| (43 | ) | |

| 2,192 | | |

| 392 | |

| Tax impact of adjustments at statutory rate | |

| (2,593 | ) | |

| (476 | ) | |

| (3,147 | ) | |

| (2,016 | ) |

| Adjusted net (loss) income | |

| 40,537 | | |

| 53,458 | | |

| 71,445 | | |

| 104,963 | |

| | |

| | | |

| | | |

| | | |

| | |

| Basic income (loss) per share | |

| 0.75 | | |

| 1.10 | | |

| 1.38 | | |

| 2.12 | |

| Diluted income (loss) per share | |

| 0.75 | | |

| 1.10 | | |

| 1.38 | | |

| 2.12 | |

| Diluted Adjusted net income (loss) per share | |

| 0.86 | | |

| 1.12 | | |

| 1.52 | | |

| 2.20 | |

| | |

| | | |

| | | |

| | | |

| | |

| Diluted Weighted Average Common Shares Outstanding in thousands | |

| 46,997 | | |

| 47,675 | | |

| 46,997 | | |

| 47,675 | |

| Basic weighted average common shares outstanding in thousands | |

| 46,997 | | |

| 47,675 | | |

| 46,997 | | |

| 47,675 | |

| Diluted weighted average common shares outstanding in thousands | |

| 46,997 | | |

| 47,675 | | |

| 46,997 | | |

| 47,675 | |

| | |

Three months ended | | |

Six months ended | |

| | |

June 30, | | |

June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| Net (loss) income | |

| 35,028 | | |

| 52,565 | | |

| 64,758 | | |

| 100,937 | |

| Less: Income (loss) attributable to non-controlling interest | |

| - | | |

| (120 | ) | |

| - | | |

| (257 | ) |

| (Loss) Income attributable to parent | |

| 35,028 | | |

| 52,445 | | |

| 64,758 | | |

| 100,680 | |

| Interest expense and deferred cost of financing | |

| 2,006 | | |

| 2,321 | | |

| 4,112 | | |

| 4,594 | |

| Income tax (benefit) provision | |

| 12,493 | | |

| 23,248 | | |

| 23,652 | | |

| 47,919 | |

| Depreciation & amortization | |

| 6,463 | | |

| 5,147 | | |

| 12,779 | | |

| 9,914 | |

| Foreign currency transactions losses (gains) | |

| 5,575 | | |

| (889 | ) | |

| 5,728 | | |

| 211 | |

| Provision for bad debt | |

| 150 | | |

| 985 | | |

| 275 | | |

| 1,899 | |

| Non-Recurring expenses (non-recurring professional fees, capital market fees, other non-core items) | |

| 968 | | |

| 1,436 | | |

| 1,639 | | |

| 3,797 | |

| Joint Venture VA (Saint Gobain) EBITDA adjustments | |

| 1,409 | | |

| 313 | | |

| 2,192 | | |

| 1,828 | |

| Adjusted EBITDA | |

| 64,092 | | |

| 85,006 | | |

| 115,135 | | |

| 170,842 | |

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

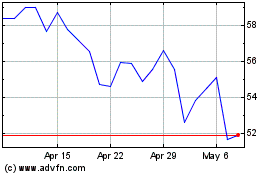

Tecnoglass (NYSE:TGLS)

Historical Stock Chart

From Nov 2024 to Dec 2024

Tecnoglass (NYSE:TGLS)

Historical Stock Chart

From Dec 2023 to Dec 2024