Current Report Filing (8-k)

December 02 2022 - 6:03AM

Edgar (US Regulatory)

0001549922FALSE00015499222022-09-192022-09-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): December 1, 2022

Summit Midstream Partners, LP

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-35666 | | 45-5200503 |

| (State or other jurisdiction | | (Commission | | (IRS Employer |

| of incorporation) | | File Number) | | Identification No.) |

910 Louisiana Street, Suite 4200

Houston, TX 77002

(Address of principal executive office) (Zip Code)

(Registrant’s telephone number, including area code): (832) 413-4770

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Securities Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Units | SMLP | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.01 Completion of Acquisition or Disposition of Assets.

On December 1, 2022, Summit Midstream Holdings, LLC (“SMP Holdings”), a wholly owned subsidiary of Summit Midstream Partners, LP (NYSE: SMLP) (“Summit,” “SMLP” or the “Partnership”), completed the acquisition of Outrigger DJ Midstream LLC (“Outrigger DJ”) from Outrigger Energy II LLC, and each of Sterling Energy Investments LLC, Grasslands Energy Marketing LLC and Centennial Water Pipelines LLC (collectively, “Sterling DJ”) from Sterling Investment Holdings LLC, respectively, pursuant to definitive agreements, each dated October 14, 2022 (collectively, the “Transactions”).

As previously reported, as a result of the Transactions, SMLP acquired natural gas gathering and processing systems, a crude oil gathering system, freshwater rights, and a subsurface freshwater delivery system in the DJ Basin for an aggregate cash consideration of $305 million, subject to customary post-closing adjustments. The Outrigger DJ and Sterling DJ consolidated asset portfolio is located in Weld, Morgan, and Logan Counties, Colorado and Cheyenne County, Nebraska.

In the Transactions, Summit acquired 100% of the membership interests in Outrigger DJ from Outrigger Energy II LLC for cash consideration of $165 million, subject to post-closing adjustments, and 100% of the membership interests in each of Sterling Energy Investments LLC, Grasslands Energy Marketing LLC and Centennial Water Pipelines LLC from Sterling Investment Holdings LLC for cash consideration of $140 million, subject to post-closing adjustments.

The Transactions were financed through a combination of borrowings under Summit’s ABL Credit Facility and $85 million aggregate principal amount of additional 8.500% Senior Secured Second Lien Notes due 2026 issued at a price of 99.26% of their face value on November 14, 2022. The Transactions represent a reinvestment of approximately $115 million of the net proceeds received from the previously announced divestitures of Summit’s Lane Gathering and Processing System, in the Delaware Basin, and Bison Gas Gathering System, in the Williston Basin.

Giving effect to the Transactions, SMLP has approximately $335 million drawn on its $400 million ABL Credit Facility.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

In connection with the completion of the Transactions, SMP Holdings and Summit Midstream Finance Corp., a Delaware corporation (together with SMP Holdings, the “Co-Issuers”), called for redemption all of the $85 million aggregate principal amount of the issued and outstanding 8.500% Senior Secured Second Lien Notes due 2026 (the “Mirror Notes”) issued to certain purchasers pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”), pursuant to the temporary notes indenture, dated November 14, 2022, at a redemption price equal to 100% of the aggregate principal amount thereof. The consideration paid to each such holder to redeem the Mirror Notes consisted only of an equal principal amount of additional 8.500% Senior Secured Second Lien Notes due 2026 (the “Additional 2026 Notes”) issued pursuant to the Indenture dated as of November 2, 2021, by and among the Co-Issuers, the subsidiaries of Summit Holdings party thereto, the Partnership and Regions Bank, as trustee and collateral agent (the “Additional 2026 Notes Indenture”).

The Additional 2026 Notes constitute an additional issuance of the Co-Issuers’ Additional 2026 Notes pursuant to the Additional 2026 Notes Indenture, under which the Co-Issuers previously issued $700 million in aggregate principal amount of Additional 2026 Notes.

Item 7.01 Regulation FD Disclosure.

On December 1, 2022, the Partnership issued a press release announcing the consummation of the Transactions, a copy of which is furnished as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

The information furnished in this Item 7.01 shall not be deemed “filed” for purposes of the Securities Exchange Act of 1934, as amended (the “1934 Act”), and shall not be deemed incorporated by reference in any filing with the Securities and Exchange Commission, whether or not filed under the Securities Act of 1933, as amended, or the 1934 Act, regardless of any general incorporation language in such document.

Item 9.01 Financial Statements and Exhibits.

(a) Financial Statements of Business Acquired.

The Partnership will file the financial statements required by Item 9.01(a) of Form 8-K by an amendment to this Current Report on Form 8-K no later than 71 calendar days from the date this Current Report on Form 8-K is required to be filed.

(b) Pro Forma Financial Information.

The Partnership will file the pro forma financial information required by Item 9.01(b) of Form 8-K by an amendment to this Current Report on Form 8-K no later than 71 calendar days from the date this Current Report on Form 8-K is required to be filed.

(d) Exhibits.

| | | | | | | | |

| Exhibit Number | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File – the cover page XBRL tags are embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | Summit Midstream Partners, LP |

| | (Registrant) |

| | |

| | By: | Summit Midstream GP, LLC (its general partner) |

| | |

| Dated: | December 1, 2022 | /s/ William J. Mault |

| | William J. Mault, Executive Vice President and Chief Financial Officer |

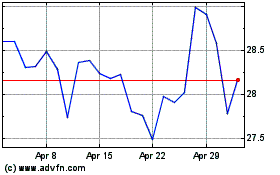

Summit Midstream Partners (NYSE:SMLP)

Historical Stock Chart

From Aug 2024 to Sep 2024

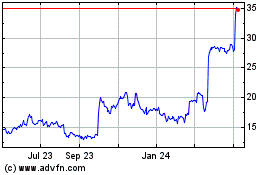

Summit Midstream Partners (NYSE:SMLP)

Historical Stock Chart

From Sep 2023 to Sep 2024