Sprott Inc. (NYSE/TSX: SII) (“Sprott” or the “Company”) today

announced its financial results for the three and six months ended

June 30, 2023.

Management commentary "Sprott's

Assets Under Management ("AUM") declined slightly during the second

quarter, as precious metal prices pulled back following strong

performance in April," said Whitney George, CEO of Sprott. "Despite

the challenging market conditions, we continued to record strong

sales in our Exchange Listed Products and Private Strategies

segments, with $199 million in net sales and new fee earning

committed capital during the second quarter and $1.1 billion in net

sales and new fee earning committed capital during the first half

of 2023. Our Private Lending team closed the third vintage of

Sprott's Private Resource Lending Strategy during the second

quarter and our Streaming and Royalty team closed a new partnership

in July, subsequent to quarter end."

"The outlook for precious metals and energy

transition investments continues to improve and we expect our

positioning in these core areas to be rewarded in the second half

of 2023," added Mr. George. "Our product pipeline is robust and we

intend to launch new public and private strategies before the end

of the year."

Key Assets Under Management ("AUM")

highlights

- AUM was $25.1

billion as at June 30, 2023, down $0.2 billion (1%) from March 31,

2023 and up $1.7 billion (7%) from December 31, 2022. On a

three months ended basis, we were impacted by market value

depreciation across the majority of our fund products, partially

offset by inflows to our exchange listed products and new fee

earning capital commitments into our private strategies funds. On a

six months ended basis, we benefited from new capital raises and

net capital calls to our private strategies funds and strong

inflows to our exchange listed products, as well as market value

appreciation across the majority of our fund products.

Key revenue highlights

- Management fees

were $33.2 million in the quarter, up $2.6 million (8%) from the

quarter ended June 30, 2022 and $64.7 million on a year-to-date

basis, up $6.9 million (12%) from the six months ended June 30,

2022. Carried interest and performance fees were $0.4 million in

the quarter and on a year-to-date basis, up $0.4 million from the

quarter ended June 30, 2022 and down $1.7 million (81%) from the

six months ended June 30, 2022. Net fees were $30.4 million in the

quarter, up $2.3 million (8%) from the quarter ended June 30, 2022

and $59.1 million on a year-to-date basis, up $5.5 million (10%)

from the six months ended June 30, 2022. Our revenue performance

was due to higher average AUM in our exchange listed products

(primarily our uranium, gold and silver trusts) and private

strategies segments. These increases were partially offset by lower

average AUM in our managed equities segment and lower carried

interest crystallization in our private strategies segment on a

year-to-date basis.

- Commission

revenues were $1.6 million in the quarter, down $4.8 million (74%)

from the quarter ended June 30, 2022 and $6.4 million on a

year-to-date basis, down $13.1 million (67%) from the six months

ended June 30, 2022. Net commissions were $1.1 million in the

quarter, down $2.3 million (67%) from the quarter ended June 30,

2022 and $3.5 million on a year-to-date basis, down $6.5 million

(65%) from the six months ended June 30, 2022. Lower commissions

were due to the sale of our former Canadian broker-dealer and

slower at-the-market ("ATM") activity in our physical uranium

trust.

- Finance income

was $1.3 million in the quarter, up $0.1 million (8%) from the

quarter ended June 30, 2022 and $2.5 million on a year-to-date

basis, down $0.2 million (6%) from the six months ended June 30,

2022. Our quarterly and year-to-date results were driven by income

generation in co-investment positions we hold in LPs managed in our

private strategies segment.

Key expense highlights

- Net compensation

expense was $15.5 million in the quarter, up $1.5 million (11%)

from the quarter ended June 30, 2022 and $30.4 million on a

year-to-date basis, up $0.7 million (2%) from the six months ended

June 30, 2022. The increase in the quarter and on a year-to-date

basis was due to the reversal of salary, AIP and LTIP entitlements

of the former CEO out of net compensation in the second quarter of

2022 on the successful completion of the former CEO’s transition

agreement. The transition agreement exchanged the former CEO's

salary, AIP and LTIP entitlements for a 3-year LTIP transition

payment. The 3-year LTIP transition payment is reported on the

severance line and was accelerated upon successful completion of

the SCP sale during the second quarter of the year. We also saw a

general increase in base salaries in the current quarter relating

to new hires.

- SG&A was $5

million in the quarter, up $0.8 million (18%) from the quarter

ended June 30, 2022 and $9.3 million on a year-to-date basis, up

$1.6 million (21%) from the six months ended June 30, 2022. The

increase was due to higher technology and marketing costs.

Earnings summary

-

Net income was $17.7 million ($0.70 per share) in the quarter, up

$17 million ($0.67 per share) from the quarter ended June 30, 2022

and $25.4 million on a year-to-date basis ($1.00 per share), up

$18.1 million ($0.71 per share) from the six months ended June 30,

2022. Net income on both a three and six months ended basis

benefited from the receipt of shares on the realization of a

previously unrecorded contingent asset from a historical

acquisition. We also benefited from higher net fees on improved

average AUM in our exchange listed and private strategies

segments.

-

Adjusted base EBITDA was $18 million ($0.71 per share) in the

quarter, up slightly from the same three month period ended last

year. The increase in the quarter was due to higher average AUM in

our exchange listed products and private strategies segments more

than offsetting lower commission income in the quarter due to the

sale of our former Canadian broker-dealer.

- Adjusted base EBITDA was $35.3 million ($1.40 per share) on a

year-to-date basis, down 2% or $0.8 million ($0.04 per share) from

the six months ended June 30, 2022. The decrease on a year-to-date

basis was due to lower commission income on the sale of our former

Canadian broker-dealer and slower ATM activity in our uranium

trust. The lower commission income on a year-to-date basis was

nearly offset by growth in net fees on improved AUM. We expect net

fee levels to increase even further in the second half of the year,

leading to the eventual replacement of low margin commission income

from our former Canadian broker-dealer with higher margin fees from

our exchange listed products and private strategies segments.

Subsequent events

-

During the quarter, the Company paid down $20 million, or 37% of

its outstanding debt facility. Subsequent to quarter end, the

Company completed a review of our current and near-term funding and

borrowing needs and determined that we no longer require a $120

million credit facility. Consequently, management decided to lower

the maximum borrowing capacity under the credit facility by $45

million to $75 million. Offsetting the reduction in borrowing

capacity is the release of capital restrictions on the sale of our

former Canadian broker-dealer that closed earlier this quarter and

the eventual monetization of shares received on the realization of

a previously unrecorded contingent asset from a historical

acquisition.

-

On August 8, 2023, the Sprott Board of Directors announced a

quarterly dividend of $0.25 per share.

1 See “non-IFRS financial measures” section in

this press release and schedule 2 and 3 of "Supplemental financial

information"

Supplemental financial

information

Please refer to the June 30, 2023 interim

financial statements of the Company and the related management

discussion and analysis filed earlier this morning for further

details into the Company's financial position as at June 30,

2023 and the company's financial performance for the three and six

months ended June 30, 2023.

Schedule 1 - AUM continuity

|

3 months results |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(In millions $) |

AUMMar. 31, 2023 |

Net inflows (1) |

Market value changes |

Othernet inflows (1) |

AUM Jun. 30, 2023 |

|

Blended netmanagement fee rate (2) |

|

|

|

|

|

|

|

|

|

| Exchange listed

products |

|

|

|

|

|

|

|

| - Physical trusts |

|

|

|

|

|

|

|

|

- Physical Gold Trust |

6,191 |

101 |

(168) |

— |

6,124 |

|

0.35% |

|

- Physical Gold and Silver Trust |

4,209 |

— |

(153) |

— |

4,056 |

|

0.40% |

|

- Physical Silver Trust |

4,181 |

45 |

(240) |

— |

3,986 |

|

0.45% |

|

- Physical Uranium Trust |

3,151 |

— |

322 |

— |

3,473 |

|

0.30% |

|

- Physical Platinum & Palladium Trust |

123 |

3 |

(16) |

— |

110 |

|

0.50% |

| - Exchange Traded Funds |

|

|

|

|

|

|

|

|

- Energy Transition Material ETFs |

935 |

26 |

74 |

— |

1,035 |

|

0.63% |

|

- Precious Metals ETFs |

401 |

(3) |

(43) |

— |

355 |

|

0.28% |

|

|

19,191 |

172 |

(224) |

— |

19,139 |

|

0.39% |

| |

|

|

|

|

|

|

|

| Managed

equities |

|

|

|

|

|

|

|

|

- Precious metals strategies |

1,864 |

(68) |

(163) |

— |

1,633 |

|

0.89% |

|

- Other (3) |

1,132 |

4 |

(47) |

— |

1,089 |

|

1.13% |

|

|

2,996 |

(64) |

(210) |

— |

2,722 |

|

0.99% |

| |

|

|

|

|

|

|

|

| Private

strategies |

2,482 |

38 |

4 |

53 |

2,577 |

|

0.88% |

|

|

|

|

|

|

|

|

|

|

Core AUM |

24,669 |

146 |

(430) |

53 |

24,438 |

|

0.50% |

|

|

|

|

|

|

|

|

|

| Non-core AUM (4) |

708 |

— |

(4) |

— |

704 |

|

0.51% |

|

|

|

|

|

|

|

|

|

|

Total AUM (5) |

25,377 |

146 |

(434) |

53 |

25,142 |

|

0.50% |

| |

|

|

|

|

|

|

|

| 6 months

results |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(In millions $) |

AUMDec. 31, 2022 |

Net inflows (1) |

Market value changes |

Othernet inflows (1) |

AUM Jun. 30, 2023 |

|

Blended netmanagement fee rate (2) |

|

|

|

|

|

|

|

|

|

| Exchange listed

products |

|

|

|

|

|

|

|

|

- Physical trusts |

|

|

|

|

|

|

|

|

- Physical Gold Trust |

5,746 |

99 |

279 |

— |

6,124 |

|

0.35% |

|

- Physical Gold and Silver Trust |

3,998 |

— |

58 |

— |

4,056 |

|

0.40% |

|

- Physical Silver Trust |

4,091 |

112 |

(217) |

— |

3,986 |

|

0.45% |

|

- Physical Uranium Trust |

2,876 |

141 |

456 |

— |

3,473 |

|

0.30% |

|

- Physical Platinum & Palladium Trust |

138 |

6 |

(34) |

— |

110 |

|

0.50% |

| - Exchange Traded Funds |

|

|

|

|

|

|

|

|

- Energy Transition Material ETFs |

857 |

119 |

49 |

10 |

1,035 |

|

0.63% |

|

- Precious Metals ETFs |

349 |

(2) |

8 |

— |

355 |

|

0.28% |

|

|

18,055 |

475 |

599 |

10 |

19,139 |

|

0.39% |

| |

|

|

|

|

|

|

|

| Managed

equities |

|

|

|

|

|

|

|

|

- Precious metals strategies |

1,721 |

(61) |

(27) |

— |

1,633 |

|

0.89% |

|

- Other (3) |

1,032 |

(5) |

62 |

— |

1,089 |

|

1.13% |

|

|

2,753 |

(66) |

35 |

— |

2,722 |

|

0.99% |

| |

|

|

|

|

|

|

|

| Private

strategies |

1,880 |

74 |

(51) |

674 |

2,577 |

|

0.88% |

|

|

|

|

|

|

|

|

|

|

Core AUM |

22,688 |

483 |

583 |

684 |

24,438 |

|

0.50% |

|

|

|

|

|

|

|

|

|

| Non-core AUM (4) |

745 |

(26) |

(15) |

— |

704 |

|

0.51% |

|

|

|

|

|

|

|

|

|

|

Total AUM (5) |

23,433 |

457 |

568 |

684 |

25,142 |

|

0.50% |

|

|

|

(1) See "Net inflows" and "Other net inflows" in the key

performance indicators and non-IFRS and other financial measures

section of the MD&A. Year-to-date figures were reclassified to

conform with current presentation |

|

(2) Management fee rate represents the weighted average fees for

all funds in the category. |

|

(3) Includes institutional managed accounts and high net worth

discretionary managed accounts in the U.S. |

|

(4) This AUM is related to our legacy asset management business in

Korea, which accounts for 2.8% of total AUM and less than 1% of

consolidated net income and EBITDA. |

|

(5) No performance fees are earned on exchange listed

products. Performance fees are earned on certain precious metals

strategies and are based on returns above relevant benchmarks.

Other managed equities strategies primarily earn performance fees

on flow-through products. Private strategies LPs earn carried

interest calculated as a predetermined net profit over a preferred

return. |

Schedule 2 - Summary financial information

|

(In thousands $) |

Q2 2023 |

Q1 2023 |

Q4 2022 |

Q3 2022 |

Q2 2022 |

Q1 2022 |

Q4 2021 |

Q3 2021 |

|

Summary income statement |

|

|

|

|

|

|

|

|

|

Management fees |

33,222 |

|

31,434 |

|

28,405 |

|

29,158 |

|

30,620 |

|

27,172 |

|

27,783 |

|

28,612 |

|

|

Trailer, sub-advisor and fund expense |

(1,635 |

) |

(1,554 |

) |

(1,204 |

) |

(1,278 |

) |

(1,258 |

) |

(853 |

) |

(872 |

) |

(637 |

) |

|

Direct payouts |

(1,342 |

) |

(1,187 |

) |

(1,114 |

) |

(1,121 |

) |

(1,272 |

) |

(1,384 |

) |

(1,367 |

) |

(1,892 |

) |

|

Carried interest and performance fees |

388 |

|

- |

|

1,219 |

|

- |

|

- |

|

2,046 |

|

4,298 |

|

- |

|

|

Carried interest and performance fee payouts - internal |

(236 |

) |

- |

|

(567 |

) |

- |

|

- |

|

(1,029 |

) |

(2,516 |

) |

- |

|

|

Carried interest and performance fee payouts - external (1) |

- |

|

- |

|

(121 |

) |

- |

|

- |

|

(476 |

) |

(790 |

) |

- |

|

|

Net fees |

30,397 |

|

28,693 |

|

26,618 |

|

26,759 |

|

28,090 |

|

25,476 |

|

26,536 |

|

26,083 |

|

|

Commissions |

1,647 |

|

4,784 |

|

5,027 |

|

6,101 |

|

6,458 |

|

13,077 |

|

14,153 |

|

11,273 |

|

|

Commission expense - internal |

(494 |

) |

(1,727 |

) |

(1,579 |

) |

(2,385 |

) |

(2,034 |

) |

(3,134 |

) |

(4,128 |

) |

(3,089 |

) |

|

Commission expense - external (1) |

(27 |

) |

(642 |

) |

(585 |

) |

(476 |

) |

(978 |

) |

(3,310 |

) |

(3,016 |

) |

(2,382 |

) |

|

Net Commissions |

1,126 |

|

2,415 |

|

2,863 |

|

3,240 |

|

3,446 |

|

6,633 |

|

7,009 |

|

5,802 |

|

|

Finance income |

1,277 |

|

1,180 |

|

1,439 |

|

933 |

|

1,186 |

|

1,433 |

|

788 |

|

567 |

|

|

Gain (loss) on investments |

(1,950 |

) |

1,958 |

|

(930 |

) |

45 |

|

(7,884 |

) |

(1,473 |

) |

(43 |

) |

310 |

|

|

Other income (2) |

19,763 |

|

1,250 |

|

999 |

|

(227 |

) |

170 |

|

208 |

|

313 |

|

529 |

|

|

Total net revenues |

50,613 |

|

35,496 |

|

30,989 |

|

30,750 |

|

25,008 |

|

32,277 |

|

34,603 |

|

33,291 |

|

|

|

|

|

|

|

|

|

|

|

|

Compensation |

21,610 |

|

19,103 |

|

17,030 |

|

18,934 |

|

19,364 |

|

21,789 |

|

20,632 |

|

18,001 |

|

|

Direct payouts |

(1,342 |

) |

(1,187 |

) |

(1,114 |

) |

(1,121 |

) |

(1,272 |

) |

(1,384 |

) |

(1,367 |

) |

(1,892 |

) |

|

Carried interest and performance fee payouts - internal |

(236 |

) |

- |

|

(567 |

) |

- |

|

- |

|

(1,029 |

) |

(2,516 |

) |

- |

|

|

Commission expense - internal |

(494 |

) |

(1,727 |

) |

(1,579 |

) |

(2,385 |

) |

(2,034 |

) |

(3,134 |

) |

(4,128 |

) |

(3,089 |

) |

|

Severance, new hire accruals and other |

(4,067 |

) |

(1,257 |

) |

(1,240 |

) |

(1,349 |

) |

(2,113 |

) |

(514 |

) |

(187 |

) |

(207 |

) |

|

Net compensation |

15,471 |

|

14,932 |

|

12,530 |

|

14,079 |

|

13,945 |

|

15,728 |

|

12,434 |

|

12,813 |

|

|

Severance, new hire accruals and other (3) |

4,067 |

|

1,257 |

|

1,240 |

|

1,349 |

|

2,113 |

|

514 |

|

187 |

|

207 |

|

|

Selling, general and administrative |

4,988 |

|

4,267 |

|

4,080 |

|

4,239 |

|

4,221 |

|

3,438 |

|

4,172 |

|

3,682 |

|

|

Interest expense |

1,087 |

|

1,247 |

|

1,076 |

|

884 |

|

483 |

|

480 |

|

239 |

|

312 |

|

|

Depreciation and amortization |

748 |

|

706 |

|

710 |

|

710 |

|

959 |

|

976 |

|

1,136 |

|

1,134 |

|

|

Other expenses |

471 |

|

2,824 |

|

1,650 |

|

5,697 |

|

868 |

|

1,976 |

|

2,910 |

|

3,875 |

|

|

Total expenses |

26,832 |

|

25,233 |

|

21,286 |

|

26,958 |

|

22,589 |

|

23,112 |

|

21,078 |

|

22,023 |

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

17,724 |

|

7,638 |

|

7,331 |

|

3,071 |

|

757 |

|

6,473 |

|

10,171 |

|

8,718 |

|

|

Net income per share |

0.70 |

|

0.30 |

|

0.29 |

|

0.12 |

|

0.03 |

|

0.26 |

|

0.41 |

|

0.35 |

|

|

Adjusted base EBITDA |

17,953 |

|

17,321 |

|

18,083 |

|

16,837 |

|

17,909 |

|

18,173 |

|

17,705 |

|

16,713 |

|

|

Adjusted base EBITDA per share |

0.71 |

|

0.68 |

|

0.72 |

|

0.67 |

|

0.71 |

|

0.73 |

|

0.71 |

|

0.67 |

|

|

Operating margin |

57 |

% |

57 |

% |

59 |

% |

55 |

% |

55 |

% |

57 |

% |

55 |

% |

52 |

% |

|

|

|

|

|

|

|

|

|

|

|

Summary balance sheet |

|

|

|

|

|

|

|

|

|

Total assets |

381,519 |

|

386,765 |

|

383,748 |

|

375,386 |

|

376,128 |

|

380,843 |

|

365,873 |

|

375,819 |

|

|

Total liabilities |

83,711 |

|

108,106 |

|

106,477 |

|

103,972 |

|

89,264 |

|

83,584 |

|

74,654 |

|

84,231 |

|

|

|

|

|

|

|

|

|

|

|

|

Total AUM |

25,141,561 |

|

25,377,189 |

|

23,432,661 |

|

21,044,252 |

|

21,944,675 |

|

23,679,354 |

|

20,443,088 |

|

19,016,313 |

|

|

Average AUM |

25,679,214 |

|

23,892,335 |

|

22,323,075 |

|

21,420,015 |

|

23,388,568 |

|

21,646,082 |

|

20,229,119 |

|

19,090,702 |

|

| |

|

|

|

|

|

|

|

|

|

(1) These amounts are included in the "Trailer, sub-advisor and

fund expenses" line on the consolidated statements of

operations. |

|

(2) The majority of the amount in Q2, 2023 relates to the receipt

of shares on the the realization of a previously unrecorded

contingent asset from a historical acquisition. |

|

(3) The majority of the Q2, 2023 amount is accelerated compensation

and other transition payments to the former CEO on the successful

completion of the sale of Sprott Capital Partners ("SCP") during

the quarter. |

Schedule 3 - EBITDA reconciliation

|

|

3 months ended |

6 months ended |

|

(in thousands $) |

Jun. 30, 2023 |

Jun. 30, 2022 |

Jun. 30, 2023 |

Jun. 30, 2022 |

| |

|

|

|

|

|

Net income for the period |

17,724 |

|

757 |

|

25,362 |

|

7,230 |

|

|

Adjustments: |

|

|

|

|

|

Interest expense |

1,087 |

|

483 |

|

2,334 |

|

963 |

|

|

Provision for income taxes |

6,057 |

|

1,662 |

|

8,682 |

|

4,354 |

|

|

Depreciation and amortization |

748 |

|

959 |

|

1,454 |

|

1,935 |

|

|

EBITDA |

25,616 |

|

3,861 |

|

37,832 |

|

14,482 |

|

| |

|

|

|

|

| Other

adjustments: |

|

|

|

|

|

(Gain) loss on investments (1) |

1,950 |

|

7,884 |

|

(8 |

) |

9,357 |

|

|

Amortization of stock based compensation |

4,064 |

|

3,101 |

|

7,728 |

|

7,278 |

|

|

Other (income) expenses (2) |

(13,525 |

) |

3,063 |

|

(10,126 |

) |

5,506 |

|

|

Adjusted EBITDA |

18,105 |

|

17,909 |

|

35,426 |

|

36,623 |

|

| |

|

|

|

|

| Other

adjustments: |

|

|

|

|

|

Carried interest and performance fees |

(388 |

) |

- |

|

(388 |

) |

(2,046 |

) |

|

Carried interest and performance fee payouts - internal |

236 |

|

- |

|

236 |

|

1,029 |

|

|

Carried interest and performance fee payouts - external |

- |

|

- |

|

- |

|

476 |

|

|

Adjusted base EBITDA |

17,953 |

|

17,909 |

|

35,274 |

|

36,082 |

|

|

Operating margin (3) |

57 |

% |

55 |

% |

57 |

% |

56 |

% |

| |

|

|

|

|

|

|

|

|

| (1) This adjustment

removes the income effects of certain gains or losses on short-term

investments, co-investments, and digital gold strategies to ensure

the reporting objectives of our EBITDA metric as described above

are met. |

| (2) In addition to

the items outlined in Note 5 of the interim financial statements,

this reconciliation line also includes $4.1 million severance, new

hire accruals and other for the three months ended June 30, 2023

(three months ended June 30, 2022 - $2.1 million) and $5.3 million

for the six months ended June 30, 2023 (six months ended June 30,

2022 - $2.6 million). This reconciliation line excludes income

(loss) attributable to non-controlling interest of ($0.5) million

for the three months ended June 30, 2023 (three months ended June

30, 2022 - ($0.1) million) and $0.2 million for the six months

ended June 30, 2023 (six months ended June 30, 2022 - nominal

loss). |

| (3) Calculated as

adjusted base EBITDA inclusive of depreciation and amortization.

This figure is then divided by revenues before gains (losses) on

investments, net of direct costs as applicable. |

Conference Call and Webcast

A webcast will be held today, August 9, 2023 at

10:00 am ET to discuss the Company's financial results. To listen

to the webcast, please register at

https://edge.media-server.com/mmc/p/njthpd42

Please note, analysts who cover the Company should

register at

https://register.vevent.com/register/BI39d3c67cd7c74a17b837964393516404

Non-IFRS Financial Measures

This press release includes financial terms

(including AUM, net revenues, net commissions, net fees, expenses,

adjusted base EBITDA, operating margins and net compensation) that

the Company utilizes to assess the financial performance of its

business that are not measures recognized under International

Financial Reporting Standards (“IFRS”). These non-IFRS measures

should not be considered alternatives to performance measures

determined in accordance with IFRS and may not be comparable to

similar measures presented by other issuers. Non-IFRS financial

measures do not have a standardized meaning prescribed by IFRS and

are therefore unlikely to be comparable to similar measures

presented by other issuers. Our key performance indicators and

non-IFRS and other financial measures are discussed below. For

quantitative reconciliations of non-IFRS financial measures to

their most directly comparable IFRS financial measures please see

schedule 2 and schedule 3 of the "Supplemental financial

information" section of this press release.

Net fees

Management fees, net of trailer, sub-advisor,

fund expenses and direct payouts, and carried interest and

performance fees, net of carried interest and performance fee

payouts (internal and external), are key revenue indicators as they

represent the net revenue contribution after directly associated

costs that we generate from our AUM.

Net commissions

Commissions, net of commission expenses

(internal and external), arise primarily from purchases and sales

of uranium in our exchange listed products segment and

transaction-based service offerings by our broker dealers.

Net compensation

Net compensation excludes commission expenses

paid to employees, other direct payouts to employees, carried

interest and performance fee payouts to employees, which are all

presented net of their related revenues in the MD&A, and

severance, new hire accruals and other which are non-recurring.

EBITDA, adjusted EBITDA, adjusted base EBITDA

and operating margins

EBITDA in its most basic form is defined as

earnings before interest expense, income taxes, depreciation and

amortization. EBITDA (or adjustments thereto) is a measure commonly

used in the investment industry by management, investors and

investment analysts in understanding and comparing results by

factoring out the impact of different financing methods, capital

structures, amortization techniques and income tax rates between

companies in the same industry. While other companies, investors or

investment analysts may not utilize the same method of calculating

EBITDA (or adjustments thereto), the Company believes its adjusted

base EBITDA metric, in particular, results in a better comparison

of the Company's underlying operations against its peers and a

better indicator of recurring results from operations as compared

to other non-IFRS financial measures. Operating margins are a key

indicator of a company’s profitability on a per dollar of revenue

basis, and as such, is commonly used in the financial services

sector by analysts, investors and management.

Forward Looking Statements

Certain statements in this press release contain

forward-looking information and forward-looking statements

(collectively referred to herein as the "Forward-Looking

Statements") within the meaning of applicable Canadian and U.S.

securities laws. The use of any of the words "expect",

"anticipate", "continue", "estimate", "may", "will", "project",

"should", "believe", "plans", "intends" and similar expressions are

intended to identify Forward-Looking Statements. In particular, but

without limiting the forgoing, this press release contains

Forward-Looking Statements pertaining to: (i) the fact that the

outlook for precious metals and energy transition investments

continues to improve and we expect our positioning in these core

areas to be rewarded in the second half of 2023; (ii) that our

product pipeline is robust and our intention to launch new public

and private strategies before the end of the year; (iii) our

expectation that net fee levels will increase even further in the

second half of the year, leading to the eventual replacement of low

margin commission income from our former Canadian broker-dealer

with higher margin fees from our exchange listed products and

private strategies segments; (iv) the eventual monetization of

shares received on the realization of a previously unrecorded

contingent asset from a historical acquisition; and (v) the

declaration, payment and designation of dividends and confidence

that our business will support the dividend level without impacting

our ability to fund future growth initiatives.

Although the Company believes that the

Forward-Looking Statements are reasonable, they are not guarantees

of future results, performance or achievements. A number of factors

or assumptions have been used to develop the Forward-Looking

Statements, including: (i) the impact of increasing competition in

each business in which the Company operates will not be material;

(ii) quality management will be available; (iii) the effects of

regulation and tax laws of governmental agencies will be consistent

with the current environment; (iv) the impact of COVID-19; and (v)

those assumptions disclosed under the heading "Critical Accounting

Estimates, Judgments and Changes in Accounting Policies" in the

Company’s MD&A for the period ended June 30, 2023. Actual

results, performance or achievements could vary materially from

those expressed or implied by the Forward-Looking Statements should

assumptions underlying the Forward-Looking Statements prove

incorrect or should one or more risks or other factors materialize,

including: (i) difficult market conditions; (ii) poor investment

performance; (iii) failure to continue to retain and attract

quality staff; (iv) employee errors or misconduct resulting in

regulatory sanctions or reputational harm; (v) performance fee

fluctuations; (vi) a business segment or another counterparty

failing to pay its financial obligation; (vii) failure of the

Company to meet its demand for cash or fund obligations as they

come due; (viii) changes in the investment management industry;

(ix) failure to implement effective information security policies,

procedures and capabilities; (x) lack of investment opportunities;

(xi) risks related to regulatory compliance; (xii) failure to

manage risks appropriately; (xiii) failure to deal appropriately

with conflicts of interest; (xiv) competitive pressures; (xv)

corporate growth which may be difficult to sustain and may place

significant demands on existing administrative, operational and

financial resources; (xvi) failure to comply with privacy laws;

(xvii) failure to successfully implement succession planning;

(xviii) foreign exchange risk relating to the relative value of the

U.S. dollar; (xix) litigation risk; (xx) failure to develop

effective business resiliency plans; (xxi) failure to obtain or

maintain sufficient insurance coverage on favorable economic terms;

(xxii) historical financial information being not necessarily

indicative of future performance; (xxiii) the market price of

common shares of the Company may fluctuate widely and rapidly;

(xxiv) risks relating to the Company’s investment products; (xxv)

risks relating to the Company's proprietary investments; (xxvi)

risks relating to the Company's lending business; (xxvii) those

risks described under the heading "Risk Factors" in the Company’s

annual information form dated February 23, 2023; and (xxviii) those

risks described under the headings "Managing Financial Risks" and

"Managing Non-Financial Risks" in the Company’s MD&A for the

period ended June 30, 2023. In addition, the payment of dividends

is not guaranteed and the amount and timing of any dividends

payable by the Company will be at the discretion of the Board of

Directors of the Company and will be established on the basis of

the Company’s earnings, the satisfaction of solvency tests imposed

by applicable corporate law for the declaration and payment of

dividends, and other relevant factors. The Forward-Looking

Statements speak only as of the date hereof, unless otherwise

specifically noted, and the Company does not assume any obligation

to publicly update any Forward-Looking Statements, whether as a

result of new information, future events or otherwise, except as

may be expressly required by applicable securities laws.

About Sprott

Sprott is a global leader in precious metal and

energy transition investments. We are specialists. Our in-depth

knowledge, experience and relationships separate us from the

generalists. Our investment strategies include Exchange Listed

Products, Managed Equities and Private Strategies. Sprott has

offices in Toronto, New York and Connecticut and the company’s

common shares are listed on the New York Stock Exchange and the

Toronto Stock Exchange under the symbol (SII). For more

information, please visit www.sprott.com.

Investor contact

information:

Glen WilliamsManaging PartnerInvestor and

Institutional Client Relations;Head of Corporate

Communications(416) 943-4394gwilliams@sprott.com

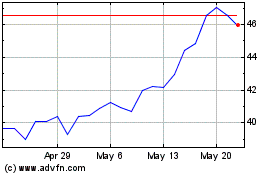

Sprott (NYSE:SII)

Historical Stock Chart

From Oct 2024 to Nov 2024

Sprott (NYSE:SII)

Historical Stock Chart

From Nov 2023 to Nov 2024