- $2.68 of diluted earnings per share in 2023 surpassing $2.43

per diluted share in 2022, initial 2023 guidance of $2.40 to $2.50

and inline with the updated guidance of $2.65 to $2.70

- $272 million in infrastructure investments, exceeding 2023

guidance

- 10.01% Water Cost of Capital Mechanism (WCCM)-adjusted return

on equity in California as of January 1, 2024

- 2024 guidance issued of $2.68 to $2.78 diluted earnings per

share

SJW Group (NYSE: SJW) today reported financial results for

2023.

“With a strong fourth quarter, our 2023 financial results and

operating performance exceeded expectations and the initial

earnings per share guidance we set for SJW Group at this time last

year,” stated SJW Group Chair, CEO, and President, Eric W.

Thornburg. “The results we announce today are a testament to our

talented teams across the country delivering on our company’s

mission to be a force for good every day for our customers,

communities and shareholders.”

Continued Thornburg, “I’m also pleased to share that we met and

surpassed our annual capital expenditure goal in 2023 by $17

million, with $272 million invested in improving and maintaining

our water supply and infrastructure across our local operations. We

secured constructive regulatory outcomes that in 2024 are providing

a 10.01% WCCM-adjusted return on equity in California, and a $2.6

million revenue increase in Maine related to operating and

financing costs for our award-winning Saco River Drinking Water

Resource Center. Importantly, we grew our customer base in Texas by

12% in 2023 through organic growth and acquisitions, while also

significantly increasing our water supply portfolio in this rapidly

growing service area through strategic acquisitions. I’m confident

that our continued focus on executing our proven growth strategy

will position us for further success in 2024.”

2023 Operating Results

Net income in 2023 was $85.0 million, or $2.68 per diluted

share, up 15% compared to $73.8 million, or $2.43 per diluted

share, in 2022, surpassing initial guidance of $2.40 to $2.50 per

share and inline with updated guidance of $2.65 to $2.70 per

diluted share announced in October 2023. The increase was primarily

driven by rate filings in California and Maine, a decrease in

income taxes due to the partial release of an uncertain tax

position reserve (which had a $0.14 positive impact on net income

per diluted share), and lower maintenance costs; partially offset

by higher water production costs and increased interest expense

from higher cost of borrowings for our short-term debt and new

long-term debt.

Operating revenue for 2023 was $670.4 million, up 8% compared to

$620.7 million for 2022. The increase was primarily driven by $46.6

million in rate filings, $5.7 million due to regulatory mechanism

adjustments, and customer growth of $3.8 million; partially offset

by lower customer usage of $6.6 million driven primarily by weather

conditions in California, Maine, and Texas.

Operating expenses for 2023 were $520.9 million, up 6% compared

to $489.7 million for 2022. This change in operating expenses

reflects:

- An increase in water production expenses of $23.4 million, to

$256.2 million in 2023 compared to $232.8 million in 2022, due to

the higher cost of purchased water, partially offset by lower

usage;

- A decrease in the gain on sale of nonutility properties of $6.2

million due to the recording of a non-recurring sale of non utility

properties in 2022, and no recorded gain on the sale of nonutility

properties in 2023;

- An increase in general and administrative expenses of $3.3

million primarily due to allowances for customer credit

losses;

- An increase in depreciation and amortization of $1.5 million

primarily due to increases in depreciation related to new utility

plant additions; partially offset by a $2.4 million one-time impact

related to amortization on certain Cupertino concession assets in

2022; and

- A decrease in maintenance expenses of $5.0 million primarily

due to a one-time cost incurred in the prior year. In addition, our

proactive asset management and advanced leak detection programs,

which enable us to reduce emergency projects and replace them with

scheduled improvements, also contributed to lower maintenance

expenses for the year.

The effective consolidated income tax rates for 2023 and 2022

were approximately 7% and 10%, respectively. The lower effective

tax rate for 2023 was primarily due to the partial release of an

uncertain tax position reserve.

Note Regarding Fourth Quarter Operating Results

Comparisons between 2023 and 2022 fourth quarter operating

results are affected by and reflect the delay in San Jose Water

Company's (SJWC) 2022 to 2024 general rate case (GRC) proceeding.

As a reminder, while the California Public Utilities Commission

(CPUC) approved the settlement agreement and SJWC recorded the

authorized revenue increase from the GRC in the fourth quarter of

2022, the revenue increase was retroactive to January 1, 2022. This

delayed recognition of GRC-authorized revenues affects

quarter-over-quarter comparisons through 2023.

As noted last quarter, the CPUC approved SJWC's request for

reinstatement of the Water Conservation Memorandum Account (WCMA)

and Water Conservation Expense Memorandum Account (WCEMA) on

October 2, 2023. The WCMA and WCEMA are temporary revenue

protection mechanisms that allow water utilities to track for

potential future recovery revenue losses and incremental expenses

in response to water conservation efforts. The mechanisms were no

longer available after the end of the drought emergency on April

11, 2023. SJWC requested authorization to reinstate the mechanisms

based on our water wholesaler’s, Valley Water, request for a

voluntary 15% reduction in water usage. Valley Water has cited

restricted local storage over the next decade and precipitation

volatility as the basis for continuing voluntary conservation. The

reinstated WCMA and WCEMA protections were retroactive to April 20,

2023 and remain in effect.

Quarterly Operating Results

Net income for the quarter ended December 31, 2023 was $18.9

million, or $0.59 per diluted share, a 43% decrease compared to

$33.5 million, or $1.09 per diluted share, in the same quarter last

year. The decrease was primarily driven by the delayed decision in

SJWC's 2022 GRC proceeding and higher production costs in 2023.

Operating revenue for the quarter ended December 31, 2023 was

$171.3 million, a slight decrease compared to $171.4 million for

the same quarter last year. The decrease was primarily driven by

SJWC's delayed 2022 GRC, which resulted in approximately $20.7

million being reflected entirely in the fourth quarter of 2022;

partially offset by $12.5 million in rate filings, an increase of

$6.6 million due to regulatory mechanism adjustments, customer

growth of $0.8 million, and higher customer usage of $0.7 million

driven primarily by weather conditions and the end of California

mandatory water conservation requirements.

Operating expenses for the quarter ended December 31, 2023 were

$134.8 million, up 11% compared to $121.0 million for the same

quarter last year. This change in operating expenses reflects:

- An increase in water production expenses of $11.6 million due

to increased groundwater extraction charges, resulting in $64.7

million in water production expenses for the fourth quarter 2023

compared to $53.1 million in the same quarter last year;

- An increase in taxes other than income tax of $1.1

million;

- An increase in depreciation and amortization of $0.9 million

primarily due to increases in new utility plant additions;

- A decrease in the gain on the sale of nonutility properties of

$0.7 million due to the recording of a non-recurring sale of non

utility properties in the fourth quarter 2022, and no recorded gain

on the sale of nonutility properties in the fourth quarter 2023;

and

- A decrease in maintenance expenses of $3.2 million primarily

due to costs incurred in the prior year related to the Order of

Instituting Investigation settlement agreement.

The effective consolidated income tax rates for the fourth

quarter of December 31, 2023 and 2022 were approximately 9% and

13%, respectively. The lower effective tax rate was primarily due

to the partial release of an uncertain tax position reserve.

Capital Expenditures

In 2023 SJW Group invested $272 million in infrastructure and

water supply, which exceeded our 2023 capital expenditures guidance

of $255 million.

SJW Group plans to invest more than $1.6 billion in capital over

the next 5 years to build and maintain its water and wastewater

operations, including approximately $230 million to install

treatment for per- and polyfluoroalkyl substances (PFAS), subject

to regulatory approvals and availability of funding.

Rate Activity and Regulatory Updates

California

On December 28, 2023, the CPUC approved SJWC's Advice Letter 603

establishing a Group Insurance Balancing Account effective on

January 1, 2024. The purpose of the account is to capture the

difference between authorized and actual medical, dental, and

opt-out insurance costs.

On January 1, 2024, new rates went into effect that included a

WCCM-adjusted return on equity (ROE) of 10.01%, less 20 basis

points (bps) for use of the WCMA, a 5.28% cost of debt, a capital

structure of 54.55% equity, and a 7.75% overall rate of return

(ROR) including the 20 bps ROE reduction due to the WCMA. On

January 1, 2023, the ROE was 8.80%, the cost of debt was 6.20%, the

capital structure was 53.28% equity, and the overall ROR was

7.64%.

On January 2, 2024, SJWC filed its 2024 GRC application with the

CPUC for new rates spanning 2025 to 2027. The company proposed an

increase over current authorized revenues of approximately $55.2

million, or 11.1%, in 2025, approximately $22.0 million, or 4.0%,

in 2026, and approximately $25.8 million, or 4.5%, in 2027. SJWC is

also proposing a 3-year $540 million capital expenditure program

focusing on:

- Treating PFAS in drinking water;

- Reducing greenhouse gas emissions through solar generation,

energy storage systems, continued electrification of our vehicle

fleet, and expansion of our advanced leak detection program;

and

- Advancing the CPUC’s Environmental and Social Justice Action

Plan by improving access to high-quality water service, climate

resiliency, and economic and workforce development.

On February 2, 2024, SJWC, along with three other Class A

California water utilities, received approval from CPUC granting a

one-year deferment in their 2024 Cost of Capital (COC) filings to

May 1, 2025 in response to the water utilities' request for a

one-year postponement of their COC filings otherwise scheduled to

be filed on May 1, 2024. This deferment alleviates administrative

processing costs for both the water utilities and CPUC staff. The

approved deferral includes a provision that the WCCM remains in

place for 2025 and allows it to adjust up or down in accordance

with movements of 100 bps or more in the Moody’s Aa Utility Bond

Index between October 1, 2023 and September 30, 2024.

Connecticut

On October 3, 2023, The Connecticut Water Company (CWC) filed a

GRC application with the Connecticut Public Utilities Regulatory

Authority (PURA) to amend rates. CWC is requesting a $21.4 million,

or approximately 18.1%, increase over current authorized revenues

to recover approximately $135 million in drinking water and

wastewater infrastructure investment, as well increased operating

and borrowing costs. CWC expects any PURA authorized increase in

rates to be effective on or about July 1, 2024.

Maine

On January 5, 2024, the Maine Public Utilities Commission

approved a stipulation agreement between Maine Water Company (MWC)

and the Office of the Public Advocate to settle MWC’s March 2023

rate application in the Biddeford Saco Division. Under the approved

agreement, MWC annual revenues will increase by $2.6 million, or

17.6%, effective January 1, 2024. MWC had requested a $2.9 million

revenue increase in March 2023 to cover the operating expenses and

increased borrowing costs of the $60 million Saco River Drinking

Water Resource Center that went in-service in June 2022.

Texas

On January 5, 2024, The Texas Water Company (TWC) filed an

application with the Public Utilities Commission of Texas (PUCT) to

acquire 3009 Water Company, a water system serving approximately

270 water customers in Comal County, Texas.

On January 26, 2024, TWC closed on the acquisition of Elm Ridge,

a water system serving approximately 21 water customers in Comal

County, Texas.

TWC's completed application for a system improvement charge

(SIC) is pending before the PUCT. We expect the PUCT to issue a

final decision on the application in the first quarter of 2024. The

SIC would allow TWC to add certain utility plant additions made

since 2020 to its rate base, thereby increasing revenue and

avoiding the need for a general rate case in 2024. At the time of

filing in December 2022, the SIC was projected to increase TWC’s

annualized water revenue by $1.6 million, and sewer revenue by

$29,000 within one year of the SIC's approval.

Corporate Responsibility Recognition

SJW Group was recently recognized in the Newsweek Excellence

1000 Index 2024. SJW Group was the highest ranked water utility

company in the index, which ranks a select group of 1000 companies

globally that have been identified as exemplars of corporate

success and responsibility.

2024 Guidance

The following is the company’s 2024 full-year guidance:

- Net income per diluted common share of $2.68 to $2.78; and

- Regulated infrastructure investments of approximately $332

million in 2024

In addition, we reiterate our non-linear long-term diluted EPS

growth of 5% to 7%, anchored off 2022's diluted EPS of $2.43.

When considering the company's 2024 guidance relative to actual

results in 2023, it is important to note that the company's

adjustment to income tax reserves in 2023 resulted in an increase

of $0.14 per diluted share.

Our guidance is subject to risks and uncertainties, including,

without limitation, those factors outlined in the “Forward Looking

Statements” of this release and the “Risk Factors” section of the

company’s annual and quarterly reports filed with the Securities

and Exchange Commission.

Financial Results Call Information

Eric W. Thornburg, president, chief executive officer, and board

chair, and Andrew F. Walters, chief financial officer and

treasurer, will review results for 2023 in a live webcast

presentation at 11 a.m. PT, or 2 p.m. ET, on Thursday, February 22,

2024.

Interested parties may access the webcast and related

presentation materials at the website www.sjwgroup.com. An archive

of the webcast will be available until April 22, 2024.

About SJW Group

SJW Group is among the largest investor-owned pure-play water

and wastewater utilities in the United States, providing

life-sustaining and high-quality water service to nearly 1.5

million people. SJW Group’s locally led and operated water

utilities - San Jose Water Company in California, The Connecticut

Water Company in Connecticut, The Maine Water Company in Maine, and

SJWTX, Inc. (dba The Texas Water Company) in Texas - possess the

financial strength, operational expertise, and technological

innovation to safeguard the environment, deliver outstanding

service to customers, and provide opportunities to employees. SJW

Group remains focused on investing in its operations, remaining

actively engaged in its local communities, and delivering continued

sustainable value to its stockholders. For more information about

SJW Group, please visit www.sjwgroup.com.

Forward-Looking Statements

This release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995, as

amended. Some of these forward-looking statements can be identified

by the use of forward-looking words such as “believes,” “expects,”

“estimates,” “anticipates,” “intends,” “seeks,” “plans,”

“projects,” “may,” “should,” “will,” or the negative of those words

or other comparable terminology. These forward-looking statements

are only predictions and are subject to risks, uncertainties, and

assumptions that are difficult to predict.

These forward-looking statements involve a number of risks,

uncertainties and assumptions including, but not limited to, the

following factors: (1) the effect of water, utility, environmental

and other governmental policies and regulations, including

regulatory actions concerning rates, authorized return on equity,

authorized capital structures, capital expenditures and other

decisions; (2) changes in demand for water and other services; (3)

unanticipated weather conditions and changes in seasonality

including those affecting water supply and customer usage; (4) the

effect of the impact of climate change; (5) unexpected costs,

charges or expenses; (6) our ability to successfully evaluate

investments in new business and growth initiatives; (7)

contamination of our water supplies and damage or failure of our

water equipment and infrastructure; (8) the risk of work stoppages,

strikes and other labor-related actions; (9) catastrophic events

such as fires, earthquakes, explosions, floods, ice storms,

tornadoes, hurricanes, terrorist acts, physical attacks,

cyber-attacks, epidemic, or similar occurrences; (10) changes in

general economic, political, business and financial market

conditions; (11) the ability to obtain financing on favorable

terms, which can be affected by various factors, including credit

ratings, changes in interest rates, compliance with regulatory

requirements, compliance with the terms and conditions of our

outstanding indebtedness, and general market and economic

conditions; and (12) legislative, and general market and economic

developments. The risks, uncertainties and other factors may cause

the actual results, performance or achievements of SJW Group to be

materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements.

Results for a quarter are not indicative of results for a full

year due to seasonality and other factors. Other factors that may

cause actual results, performance or achievements to materially

differ are described in SJW Group’s most recent Annual Report on

Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on

Form 8-K filed with the SEC. Forward-looking statements are not

guarantees of performance, and speak only as of the date made. SJW

Group undertakes no obligation to publicly update or revise any

forward-looking statement, whether as a result of new information,

future events, or otherwise.

SJW Group

Condensed Consolidated Statements

of Comprehensive Income

(Unaudited)

(in thousands, except share and

per share data)

Three months ended December

31,

Twelve months ended December

31,

2023

2022

2023

2022

OPERATING REVENUE

$

171,338

171,374

$

670,363

620,698

OPERATING EXPENSE:

Production Expenses:

Purchased water

34,928

38,021

135,982

122,334

Power

2,239

(1,498

)

9,602

8,889

Groundwater extraction charges

16,229

4,811

62,980

56,158

Other production expenses

11,257

11,802

47,636

45,409

Total production expenses

64,653

53,136

256,200

232,790

Administrative and general

26,897

24,030

98,656

95,404

Maintenance

6,916

10,083

25,729

30,734

Property taxes and other non-income

taxes

9,383

8,330

34,475

32,572

Depreciation and amortization

26,996

26,075

105,868

104,417

Gain on sale of nonutility property

—

(665

)

—

(6,197

)

Total operating expense

134,845

120,989

520,928

489,720

OPERATING INCOME

36,493

50,385

149,435

130,978

OTHER (EXPENSE) INCOME:

Interest on long-term debt and other

interest expense

(17,231

)

(15,902

)

(66,144

)

(58,062

)

Pension non-service (cost) credit

(324

)

2,163

(1,230

)

5,023

Other, net

1,840

1,691

8,882

4,385

Income before income taxes

20,778

38,337

90,943

82,324

Provision for income taxes

1,829

4,838

5,956

8,496

NET INCOME

18,949

33,499

84,987

73,828

Other comprehensive (loss) income, net

(106

)

2,242

314

1,640

COMPREHENSIVE INCOME

$

18,843

35,741

$

85,301

75,468

EARNINGS PER SHARE

Basic

$

0.59

1.10

$

2.69

2.44

Diluted

$

0.59

1.09

$

2.68

2.43

DIVIDENDS PER SHARE

$

0.38

0.36

$

1.52

1.44

WEIGHTED AVERAGE SHARES OUTSTANDING

Basic

31,988

30,478

31,575

30,305

Diluted

32,068

30,618

31,663

30,424

Note: Certain prior period amounts on the

condensed consolidated statements of comprehensive income have been

reclassified to conform to the current period presentation.

SJW Group

Condensed Consolidated Balance

Sheets

(Unaudited)

(in thousands, except share and

per share data)

December 31,

2023

December 31,

2022

ASSETS

Utility plant:

Land

$

41,415

39,982

Depreciable plant and equipment

3,967,911

3,661,285

Construction in progress

106,980

116,851

Intangible assets

35,946

35,959

Total utility plant

4,152,252

3,854,077

Less accumulated depreciation and

amortization

981,598

1,223,760

Net utility plant

3,170,654

2,630,317

Nonutility properties and real estate

investments

13,350

58,033

Less accumulated depreciation and

amortization

194

17,158

Net nonutility properties and real estate

investments

13,156

40,875

CURRENT ASSETS:

Cash and cash equivalents

9,723

12,344

Accounts receivable:

Customers, net of allowances for

uncollectible accounts of $6,551 and $5,753 on December 31, 2023

and December 31, 2022, respectively

67,870

59,172

Income tax

5,187

—

Other

3,684

5,560

Accrued unbilled utility revenue

49,543

45,722

Assets held for sale

40,850

—

Prepaid expenses

11,110

9,753

Current regulatory assets, net

4,276

19,740

Other current assets

6,146

6,095

Total current assets

198,389

158,386

OTHER ASSETS:

Regulatory assets, less current

portion

235,910

246,035

Investments

16,411

14,819

Postretirement benefit plans

33,794

16,990

Other intangible asset

28,386

—

Goodwill

640,311

640,311

Other

8,056

7,323

Total other assets

962,868

925,478

TOTAL ASSETS

$

4,345,067

3,755,056

Note: Certain prior period amounts on the

condensed consolidated balance sheets have been reclassified to

conform to the current period presentation.

SJW Group

Condensed Consolidated Balance

Sheets

(Unaudited)

(in thousands, except share and

per share data)

December 31,

2023

December 31,

2022

CAPITALIZATION AND LIABILITIES

CAPITALIZATION:

Stockholders’ equity:

Common stock, $0.001 par value; authorized

70,000,000 shares; issued and outstanding shares 32,023,004 on

December 31, 2023 and 30,801,912 on December 31, 2022

$

32

31

Additional paid-in capital

736,191

651,004

Retained earnings

495,383

458,356

Accumulated other comprehensive income

1,791

1,477

Total stockholders’ equity

1,233,397

1,110,868

Long-term debt, less current portion

1,526,699

1,491,965

Total capitalization

2,760,096

2,602,833

CURRENT LIABILITIES:

Lines of credit

171,500

159,578

Current portion of long-term debt

48,975

4,360

Accrued groundwater extraction charges,

purchased water and power

24,479

19,707

Accounts payable

46,121

29,581

Accrued interest

15,816

13,907

Accrued payroll

12,229

11,908

Income tax payable

—

2,696

Current regulatory liabilities

3,059

3,672

Other current liabilities

20,795

22,913

Total current liabilities

342,974

268,322

DEFERRED INCOME TAXES

238,528

218,155

ADVANCES FOR CONSTRUCTION

146,582

137,696

CONTRIBUTIONS IN AID OF CONSTRUCTION

326,451

323,668

POSTRETIREMENT BENEFIT PLANS

46,836

59,738

REGULATORY LIABILITIES, LESS CURRENT

PORTION

461,108

118,760

OTHER NONCURRENT LIABILITIES

22,492

25,884

COMMITMENTS AND CONTINGENCIES

TOTAL CAPITALIZATION AND LIABILITIES

$

4,345,067

3,755,056

Note: Certain prior period amounts on the

condensed consolidated balance sheets have been reclassified to

conform to the current period presentation.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240221538675/en/

Andrew F. Walters Chief Financial Officer and Treasurer

408.279.7818 Andrew.Walters@sjwater.com

Daniel J. Meaney, APR Director of Investor Relations

860.664.6016 Daniel.Meaney@ctwater.com

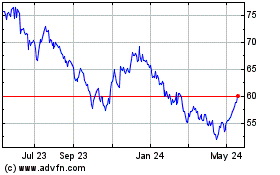

SJW (NYSE:SJW)

Historical Stock Chart

From Dec 2024 to Jan 2025

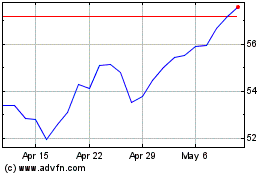

SJW (NYSE:SJW)

Historical Stock Chart

From Jan 2024 to Jan 2025