SITE Centers Announces Tax Estimate for Curbline Properties Distribution

November 25 2024 - 4:05PM

Business Wire

SITE Centers Corp. (NYSE: SITC) (the “Company”

or “SITE Centers”) today provided additional information related to

the spin-off and distribution of Curbline Properties Corp. (NYSE:

CURB) (“Curbline Properties” or “CURB”). On October 1, 2024, each

shareholder of SITE Centers received two common shares of Curbline

Properties in a taxable spin. The fair market value of the CURB

shares received by SITE Centers shareholders for federal income tax

purposes has been determined by SITE Centers to be $22.29 per CURB

share.

Based upon preliminary taxable net income analysis to date, the

Company estimates that approximately 21% of the CURB distribution

constitutes a taxable capital gain and approximately 79%

constitutes a return of capital. Full year 2024 operating results

for SITE Centers could result in a change to the character of the

CURB distribution. The final determination of the tax treatment of

total 2024 distributions will be reported to SITE Centers

shareholders on Form 1099-DIV, which will be issued in January

2025.

About SITE Centers

SITE Centers is an owner and manager of open-air shopping

centers primarily located in suburban, high household income

communities. The Company is a self-administered and self-managed

REIT operating as a fully integrated real estate company, and is

publicly traded on the NYSE under the ticker symbol SITC.

Additional information about the Company is available at

www.sitecenters.com. To be included in the Company’s e-mail

distributions for press releases and other investor news, please

click here.

Safe Harbor

SITE Centers considers portions of the information in this press

release to be forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934, both as amended, with respect to

the Company's expectation for future periods. Although the Company

believes that the expectations reflected in such forward-looking

statements are based upon reasonable assumptions, it can give no

assurance that its expectations will be achieved. For this purpose,

any statements contained herein that are not historical fact may be

deemed to be forward-looking statements. There are a number of

important factors that could cause our results to differ materially

from those indicated by such forward-looking statements, including,

among other factors, the finalization of the tax basis for the

assets included in the CURB distribution and the calculation of the

Company’s earnings and profits and the character of the Company’s

dividends for 2024. For additional factors that could cause the

results of the Company to differ materially from those indicated in

the forward-looking statements, please refer to the Company's most

recent reports on Forms 10-K and 10-Q. The Company undertakes no

obligation to publicly revise these forward-looking statements to

reflect events or circumstances that arise after the date

hereof.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241125517292/en/

Gerald Morgan, EVP and Chief Financial Officer 216-755-5500

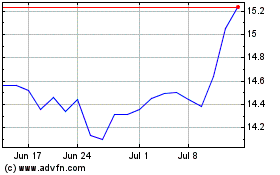

SITE Centers (NYSE:SITC)

Historical Stock Chart

From Jan 2025 to Feb 2025

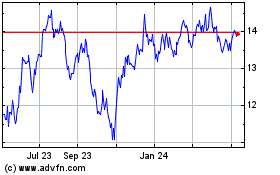

SITE Centers (NYSE:SITC)

Historical Stock Chart

From Feb 2024 to Feb 2025