Schlumberger Reports Lower 2Q Revenue Amid Drop in Oil-Services Demand

July 24 2020 - 7:52AM

Dow Jones News

By Matt Grossman

Schlumberger Ltd. on Friday reported a sharp fall in

second-quarter revenue as supply-and-demand imbalances during the

Covid-19 pandemic disrupted the global oil industry.

The Houston-based provider of oil-field services recorded a

first-quarter loss of $3.43 billion, or $2.47 a share, compared

with a profit of $492 million, or 35 cents a share, in the same

period a year earlier.

Excluding charges and credits, the company reported earning a

profit of 5 cents a share. Analysts polled by FactSet had expected

an adjusted loss of 1 cent a share.

Schlumberger's revenue in the quarter was $5.36 billion, a

decline of 35% compared with the $8.27 billion of revenue it

achieved in last year's second quarter. Analysts had forecast

revenue of $5.37 billion.

Revenue from the company's production segment declined 48%

year-over-year to $1.62 billion. Drilling revenue was down 28% to

$1.73 billion, and reservoir-characterization revenue was 32% lower

at $1.05 billion.

Schlumberger's second-quarter adjusted results stripped out more

than $3 billion of after-tax expenses such as workforce-reduction

charges and a variety of impairments. Schlumberger incurred $950

million of after-tax expenses related to workforce reductions in

the quarter, the company said. Fixed-asset impairments were $614

million, inventory write-downs were $554 million and right-of-use

asset impairments were $244 million, all on an after-tax basis.

Write to Matt Grossman at matt.grossman@wsj.com

(END) Dow Jones Newswires

July 24, 2020 07:37 ET (11:37 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

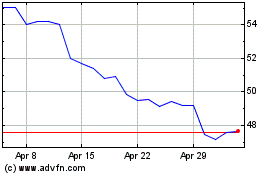

Schlumberger (NYSE:SLB)

Historical Stock Chart

From Apr 2024 to May 2024

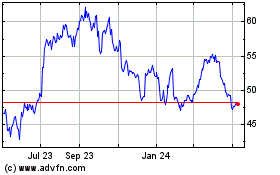

Schlumberger (NYSE:SLB)

Historical Stock Chart

From May 2023 to May 2024