- Q4 Consolidated Net Sales Increased 1.5% and Consolidated

Comparable Sales Increased 2.0%

- Q4 GAAP Operating Margin Expanded 50 Basis Points to 8.8%, and

Adjusted Operating Margin Expanded 80 Basis Points to 9.4%

- Strong Q4 Cash Flow from Operations of $111 Million Utilized to

Repay Outstanding Balance of $45 Million on ABL Credit Facility and

Fund $10 Million in Share Repurchases

- Beauty Systems Group Acquires Professional Beauty Distributor

in Florida

- Company Provides Fiscal 2025 Guidance

Sally Beauty Holdings, Inc. (NYSE: SBH) (“the Company”), the

leader in professional hair color, today announced financial

results for its fourth quarter and full year ended September 30,

2024. The Company will hold a conference call today at 7:30 a.m.

Central Time to discuss these results and its business.

Fiscal 2024 Fourth Quarter Summary

- Consolidated net sales of $935 million, an increase of 1.5%

compared to the prior year;

- Consolidated comparable sales increase of 2.0%;

- Global e-commerce sales of $91 million, representing 9.8% of

net sales;

- GAAP gross margin expanded 60 basis points to 51.2%;

- GAAP operating earnings of $82 million and GAAP operating

margin of 8.8%; Adjusted Operating Earnings of $88 million and

Adjusted Operating Margin of 9.4%;

- GAAP diluted net earnings per share of $0.46 and Adjusted

Diluted Net Earnings Per Share of $0.50; and

- Cash flow from operations of $111 million and Operating Free

Cash Flow of $73 million.

Fiscal 2024 Full Year Summary

- Consolidated net sales of $3.72 billion, a decrease of 0.3%

compared to the prior year;

- Consolidated comparable sales increase of 0.3%;

- Global e-commerce sales of $364 million, representing 9.8% of

net sales;

- GAAP gross margin of 50.9%, flat to the prior year, and

Adjusted Gross Margin increased to 50.9% compared to 50.8% in the

prior year;

- GAAP operating earnings of $283 million and GAAP operating

margin of 7.6%, Adjusted Operating Earnings of $315 million and

Adjusted Operating Margin of 8.5%;

- GAAP diluted net earnings per share of $1.43 and Adjusted

Diluted Net Earnings Per Share of $1.69; and

- Cash flow from operations of $247 million and Operating Free

Cash Flow of $145 million.

“We are pleased to conclude our fiscal year with strong fourth

quarter results, reflecting continued momentum across both our

Sally Beauty and Beauty Systems Group segments,” said Denise

Paulonis, president and chief executive officer. “We delivered a

second consecutive quarter of positive comparable sales across both

business units in combination with healthy gross margins, which

resulted in adjusted operating margin expansion of 80 basis points

to 9.4%. Additionally, we generated strong cash flow from

operations, which was deployed to complete another strategic

acquisition for Beauty Systems Group, invest in our strategic

initiatives, further reduce our debt levels, and return value to

shareholders through our share repurchase program.”

“We are carrying this operating and financial strength into

fiscal 2025, remaining focused on driving consistent profitable

growth and delivering value to shareholders. Our teams are

continuing to advance our strategic initiatives related to

enhancing our customer centricity, growing our high margin own

brands and amplifying innovation, and increasing the efficiency of

our operations.”

Beauty Systems Group Announces Strategic Acquisition of

Exclusive Beauty Supplies

In the fourth quarter of fiscal 2024, Beauty Systems Group

acquired certain assets of Exclusive Beauty Supplies of Florida, a

leading professional beauty distributor. The acquisition adds three

stores and seven direct sales consultants, as well as distribution

rights for major brands, including Moroccanoil®,

Olaplex®, Rusk® and Verb®, which also apply to

our 75 Cosmo Prof stores in the state of Florida.

Fiscal 2024 Fourth Quarter Operating Results

Fourth quarter consolidated net sales were $935.0 million, an

increase of 1.5% compared to the prior year. Foreign currency

translation had an unfavorable impact of 30 basis points on

consolidated net sales for the quarter. The Company was operating

26 fewer stores at the end of the quarter compared to the prior

year. At constant currency, global e-commerce sales were $91

million, or 9.8% of consolidated net sales, for the quarter.

Consolidated comparable sales increased 2.0%, driven primarily

by an improvement in new and reactivated customer trends at Sally

Beauty as key strategic initiatives continue to mature and the

continued momentum at Beauty Systems Group driven by expanded brand

and territory distribution.

Consolidated gross profit for the fourth quarter was $479.2

million compared to $466.6 million in the prior year, an increase

of 2.7%. Consolidated GAAP gross margin was 51.2%, an increase of

60 basis points compared to 50.6% in the prior year, driven

primarily by lower distribution and freight costs from supply chain

efficiencies.

GAAP selling, general and administrative (SG&A) expenses

totaled $397.4 million, an increase of $6.8 million compared to the

prior year. As a percentage of sales, SG&A expenses were 42.5%

compared to 42.4% in the prior year. Adjusted Selling, General and

Administrative Expenses, excluding the costs related to the

Company’s fuel for growth initiative, COVID-19-related net expenses

from the prior year, restructuring efforts and other expenses,

totaled $391.2 million, an increase of $3.9 million compared to the

prior year. The increase was driven primarily by higher labor and

other compensation-related expenses, and increased advertising

expenses, partially offset by $5.5 million in savings from our fuel

for growth initiative. As a percentage of sales, Adjusted SG&A

expenses were 41.8% compared to 42.0% in the prior year.

GAAP operating earnings and operating margin in the fourth

quarter were $82.3 million and 8.8%, compared to $76.9 million and

8.3%, in the prior year. Adjusted Operating Earnings and Operating

Margin, excluding the costs related to the Company’s fuel for

growth initiative, COVID-19-related net expenses from the prior

year, restructuring efforts and other expenses, were $88.0 million

and 9.4%, compared to $79.3 million and 8.6%, in the prior

year.

GAAP net earnings in the fourth quarter were $48.1 million, or

$0.46 per diluted share, compared to GAAP net earnings of $42.6

million, or $0.39 per diluted share, in the prior year. Adjusted

Net Earnings, excluding the costs related to the Company’s fuel for

growth initiative, COVID-19-related net expenses and the loss on

debt extinguishment from the prior year, restructuring efforts and

other expenses, were $52.3 million, or $0.50 per diluted share,

compared to Adjusted Net Earnings of $45.7 million, or $0.42 per

diluted share, in the prior year. Adjusted EBITDA in the fourth

quarter was $118.1 million, an increase of 8.1% compared to the

prior year, and Adjusted EBITDA Margin was 12.6%, an increase of 70

basis points compared to the prior year.

Balance Sheet and Cash Flow

As of September 30, 2024, the Company had cash and cash

equivalents of $108 million and no outstanding borrowings under its

asset-based revolving line of credit. At the end of the quarter,

inventory was $1.04 billion, up 6.3% versus a year ago. The Company

ended the quarter with a net debt leverage ratio of 2.0x.

Fourth quarter cash flow from operations was $110.7 million.

Capital expenditures in the quarter totaled $37.4 million. During

the quarter, the Company utilized its strong cash flow to acquire

assets from Exclusive Beauty Supplies in Florida for $7.5 million,

repay the remaining $45 million outstanding balance under its

asset-based revolving line of credit, and repurchase 0.8 million

shares under its share repurchase program at an aggregate cost of

$10 million.

Fiscal 2024 Fourth Quarter Segment Results

Sally Beauty Supply

- Segment net sales were $534.1 million in the quarter, an

increase of 1.8% compared to the prior year. The segment had an

unfavorable impact of 50 basis points from foreign currency

translation on reported sales and operated 19 fewer stores at the

end of the quarter compared to the prior year. At constant

currency, segment e-commerce sales were $38 million, or 7.1% of

segment net sales, for the quarter.

- Segment comparable sales increased 2.6% in the fourth quarter,

primarily reflecting an improvement in new and reactivated customer

trends as key strategic initiatives continue to mature.

- At the end of the quarter, segment store count was 3,129.

- GAAP gross margin increased by 120 basis points to 60.4%

compared to the prior year. The increase was driven primarily by

higher product margin resulting from enhanced promotional

strategies and lower distribution and freight costs from supply

chain efficiencies.

- GAAP operating earnings were $92.9 million compared to $78.5

million in the prior year, representing an increase of 18.4%. GAAP

operating margin increased to 17.4% compared to 15.0% in the prior

year.

Beauty Systems Group

- Segment net sales were $401.0 million in the quarter, an

increase of 1.0% compared to the prior year. The segment had an

unfavorable impact of 10 basis points on reported sales from

foreign currency translation and operated 7 fewer stores at the end

of the quarter compared to the prior year. At constant currency,

segment e-commerce sales were $53 million, or 13.3% of segment net

sales, for the quarter.

- Segment comparable sales increased 1.3% in the fourth quarter,

primarily reflecting the continued momentum at Beauty Systems Group

from expanded brand and territory distribution.

- At the end of the quarter, segment store count was 1,331.

- GAAP gross margin decreased 30 basis points to 39.0% in the

quarter compared to the prior year, driven primarily by lower

product margin related to brand mix, partially offset by lower

distribution and freight costs from supply chain efficiencies.

- GAAP operating earnings were $44.0 million in the quarter, a

decrease of 3.6% compared to $45.7 million in the prior year. GAAP

operating margin in the quarter was 11.0% compared to 11.5% in the

prior year.

- At the end of the quarter, there were 652 distributor sales

consultants compared to 670 in the prior year.

Fiscal Year 2025 Guidance*

The Company is providing the following guidance for fiscal year

2025:

First Quarter

- Consolidated net sales and comparable sales are expected to be

flat to up 2% compared to the prior year

- Adjusted Operating Margin is expected to be in the range of

8.0% to 8.4%

Full Year

- Consolidated net sales and comparable sales are expected to be

flat to up 2% compared to the prior year

- Adjusted Operating Margin is expected to be in the range of

8.5% to 9.0% * The Company does not provide a reconciliation for

forward-looking non-GAAP financial measures where it is unable to

provide a meaningful or accurate calculation or estimation of

reconciling items and the information is not available without

unreasonable effort. This is due to the inherent difficulty of

forecasting the occurrence and the financial impact of various

items that have not yet occurred, are out of the Company’s control

or cannot be reasonably predicted. For the same reasons, the

Company is unable to address the probable significance of the

unavailable information. Forward-looking non-GAAP financial

measures provided without the most directly comparable GAAP

financial measures may vary materially from the corresponding GAAP

financial measures.

Conference Call and Where You Can Find Additional

Information

The Company will hold a conference call and audio webcast at

approximately 7:30 a.m. Central Time today, November 14, 2024, to

discuss its financial results and its business. During the

conference call, the Company may discuss and answer one or more

questions concerning business and financial matters and trends

affecting the Company. The Company’s responses to these questions,

as well as other matters discussed during the conference call, may

contain or constitute material information that has not been

previously disclosed. Simultaneous to the conference call, an audio

webcast of the call will be available via a link on the Company’s

website, sallybeautyholdings.com/investor-relations. The

conference call can be accessed by dialing (844) 867-6169

(International: (409) 207-6975) and referencing the access code

3549572#. The teleconference will be held in a “listen-only” mode

for all participants other than the Company’s current sell-side and

buy-side investment professionals. A replay of the earnings

conference call will be available starting at 10:30 a.m. Central

Time, November 14, 2024, through November 28, 2024, by dialing

(866) 207-1041 (International: (402) 970-0847) and referencing

access code 1471652#. A website replay will also be available on

sallybeautyholdings.com/investor-relations.

About Sally Beauty Holdings, Inc.

Sally Beauty Holdings, Inc. (NYSE: SBH), as the leader in

professional hair color, sells and distributes professional beauty

supplies globally through its Sally Beauty Supply and Beauty

Systems Group businesses. Sally Beauty Supply stores offer up to

7,000 products for hair color, hair care, nails, and skin care

through proprietary brands such as Ion®, Bondbar®, Strawberry

Leopard®, Generic Value Products®, Inspired by Nature® and Silk

Elements® as well as professional lines such as Wella®, Clairol®,

OPI®, L’Oreal®, Wahl® and Babyliss Pro®. Beauty Systems Group

stores, branded as Cosmo Prof® or Armstrong McCall® stores, along

with its outside sales consultants, sell up to 8,000 professionally

branded products including Paul Mitchell®, Wella®, Matrix®,

Schwarzkopf®, Kenra®, Goldwell®, Joico®, Amika® and Moroccanoil®,

intended for use in salons and for resale by salons to retail

consumers. For more information about Sally Beauty Holdings, Inc.,

please visit https://www.sallybeautyholdings.com/.

Cautionary Notice Regarding Forward-Looking

Statements

Statements in this news release and the schedules hereto which

are not purely historical facts or which depend upon future events

may be forward-looking statements within the meaning of Section 27A

of the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Forward-looking

statements, as that term is defined in the Private Securities

Litigation Reform Act of 1995, can be identified by the use of

forward-looking terminology such as “believes,” “projects,”

“expects,” “can,” “may,” “estimates,” “should,” “plans,” “targets,”

“intends,” “could,” “will,” “would,” “anticipates,” “potential,”

“confident,” “optimistic,” or the negative thereof, or other

variations thereon, or comparable terminology, or by discussions of

strategy, objectives, estimates, guidance, expectations and future

plans. Forward-looking statements can also be identified by the

fact that these statements do not relate strictly to historical or

current matters.

Readers are cautioned not to place undue reliance on

forward-looking statements as such statements speak only as of the

date they were made. Any forward-looking statements involve risks

and uncertainties that could cause actual events or results to

differ materially from the events or results described in the

forward-looking statements, including, those described in our

filings with the Securities and Exchange Commission, including our

Annual Report on Form 10-K for the year ended September 30, 2024.

Consequently, all forward-looking statements in this release are

qualified by the factors, risks and uncertainties contained

therein. We assume no obligation to publicly update or revise any

forward-looking statements.

Use of Non-GAAP Financial Measures

This news release and the schedules hereto include the following

financial measures that have not been calculated in accordance with

accounting principles generally accepted in the United States,

(“GAAP”), and are therefore referred to as non-GAAP financial

measures: (1) Adjusted Gross Margin; (2) Adjusted Selling, General

and Administrative Expenses; (3) Adjusted EBITDA and EBITDA Margin;

(4) Adjusted Operating Earnings and Operating Margin; (5) Adjusted

Net Earnings; (6) Adjusted Diluted Net Earnings Per Share; and (7)

Operating Free Cash Flow. We have provided definitions below for

these non-GAAP financial measures and have provided tables in the

schedules hereto to reconcile these non-GAAP financial measures to

the comparable GAAP financial measures.

Adjusted Gross Margin – We define the measure Adjusted Gross

Margin as GAAP gross margin excluding the write-down of inventory

related to the Company’s distribution center consolidation and

store optimization plan for the relevant time periods as indicated

in the accompanying non-GAAP reconciliations to the comparable GAAP

financial measures.

Adjusted Selling, General and Administrative Expenses – We

define the measure Adjusted Selling, General and Administrative

Expenses as GAAP selling, general and administrative expenses

excluding costs related to the Company’s fuel for growth

initiative, costs related to the Company’s restructuring plans,

COVID-19-related net expenses and other expenses for the relevant

time periods as indicated in the accompanying non-GAAP

reconciliations to the comparable GAAP financial measures.

Adjusted EBITDA and EBITDA Margin – We define the measure

Adjusted EBITDA as GAAP net earnings before depreciation and

amortization, interest expense, income taxes, share-based

compensation, costs related to the Company’s fuel for growth

initiative, costs related to the Company’s restructuring plans,

COVID-19-related net expenses and other adjustments for the

relevant time periods as indicated in the accompanying non-GAAP

reconciliations to the comparable GAAP financial measures. Adjusted

EBITDA Margin is Adjusted EBITDA as a percentage of net sales.

Adjusted Operating Earnings and Operating Margin – Adjusted

operating earnings are GAAP operating earnings that exclude costs

related to the Company’s fuel for growth initiative, costs related

to the Company’s restructuring plans, net expenses related to

COVID-19 and other expenses for the relevant time periods as

indicated in the accompanying non-GAAP reconciliations to the

comparable GAAP financial measures. Adjusted Operating Margin is

Adjusted Operating Earnings as a percentage of net sales.

Adjusted Net Earnings – Adjusted net earnings is GAAP net

earnings that exclude tax-effected costs related to the Company’s

fuel for growth initiative, tax-effected costs related to the

Company’s restructuring plans, tax-effected net expenses related to

COVID-19, tax-effected expenses related to the loss on debt

extinguishment and other tax-effected expenses for the relevant

time periods as indicated in the accompanying non-GAAP

reconciliations to the comparable GAAP financial measures.

Adjusted Diluted Net Earnings Per Share – Adjusted diluted net

earnings per share is GAAP diluted earnings per share that exclude

tax-effected costs related to the Company’s fuel for growth

initiative, tax-effected related to the Company’s restructuring

plans, tax-effected net expenses related to COVID-19, tax-effected

expenses related to the loss on debt extinguishment and other

tax-effected expenses for the relevant time periods as indicated in

the accompanying non-GAAP reconciliations to the comparable GAAP

financial measures.

Operating Free Cash Flow – We define the measure Operating Free

Cash Flow as GAAP net cash provided by operating activities less

payments for capital expenditures (net). We believe Operating Free

Cash Flow is an important liquidity measure that provides useful

information to investors about the amount of cash generated from

operations after taking into account payments for capital

expenditures (net).

We believe that these non-GAAP financial measures provide

valuable information regarding our earnings and business trends by

excluding specific items that we believe are not indicative of the

ongoing operating results of our businesses, providing a useful way

for investors to make a comparison of our performance over time and

against other companies in our industry.

We have provided these non-GAAP financial measures as

supplemental information to our GAAP financial measures and believe

these non-GAAP measures provide investors with additional

meaningful financial information regarding our operating

performance and cash flows. Our management and Board of Directors

also use these non-GAAP measures as supplemental measures to

evaluate our businesses and the performance of management,

including the determination of performance-based compensation, to

make operating and strategic decisions, and to allocate financial

resources. We believe that these non-GAAP measures also provide

meaningful information for investors and securities analysts to

evaluate our historical and prospective financial performance.

These non-GAAP measures should not be considered a substitute for

or superior to GAAP results. Furthermore, the non-GAAP measures

presented by us may not be comparable to similarly titled measures

of other companies.

Supplemental Schedules

Segment Information

1

Non-GAAP Financial Measures

Reconciliations

2-3

Non-GAAP Financial Measures

Reconciliations; Adjusted EBITDA and

Operating Free Cash Flow

4

Store Count and Comparable Sales

5

SALLY BEAUTY HOLDINGS, INC. AND

SUBSIDIARIES Condensed Consolidated Statements of Earnings (In

thousands, except per share data) (Unaudited)

Three Months Ended September 30,

Twelve Months Ended September 30,

2024

2023

Percentage Change

2024

2023

Percentage Change Net

sales

$

935,028

$

921,356

1.5

%

$

3,717,031

$

3,728,131

(0.3

)%

Cost of products sold

455,827

454,794

0.2

%

1,826,699

1,829,951

(0.2

)%

Gross profit

479,201

466,562

2.7

%

1,890,332

1,898,180

(0.4

)%

Selling, general and administrative expenses

397,371

390,526

1.8

%

1,607,674

1,555,946

3.3

%

Restructuring

(436

)

(872

)

50.0

%

(75

)

17,205

(100.4

)%

Operating earnings

82,266

76,908

7.0

%

282,733

325,029

(13.0

)%

Interest expense

17,864

19,717

(9.4

)%

76,408

72,979

4.7

%

Earnings before provision for income taxes

64,402

57,191

12.6

%

206,325

252,050

(18.1

)%

Provision for income taxes

16,346

14,610

11.9

%

52,911

67,450

(21.6

)%

Net earnings

$

48,056

$

42,581

12.9

%

$

153,414

$

184,600

(16.9

)%

Earnings per share:

Basic

$

0.47

$

0.40

17.5

%

$

1.48

$

1.72

(14.0

)%

Diluted

$

0.46

$

0.39

17.9

%

$

1.43

$

1.69

(15.4

)%

Weighted average shares:

Basic

102,336

107,181

103,939

107,332

Diluted

105,346

109,098

106,933

109,336

Basis Point Change Basis

Point Change Comparison as a percentage

of net sales Consolidated gross margin

51.2

%

50.6

%

60

50.9

%

50.9

%

0

Selling, general and administrative expenses

42.5

%

42.4

%

10

43.3

%

41.7

%

160

Consolidated operating margin

8.8

%

8.3

%

50

7.6

%

8.7

%

(110

)

Effective tax

rate

25.4

%

25.5

%

(10

)

25.6

%

26.8

%

(120

)

SALLY

BEAUTY HOLDINGS, INC. AND SUBSIDIARIES Condensed Consolidated

Balance Sheets (In thousands) (Unaudited)

September 30,

2024

2023

Cash and cash equivalents

$

107,961

$

123,001

Trade and other accounts receivable

92,188

75,875

Inventory

1,036,624

975,218

Other current assets

68,541

53,903

Total current assets

1,305,314

1,227,997

Property and equipment, net

269,872

297,779

Operating lease assets

582,573

570,657

Goodwill and other intangible assets

598,226

588,252

Other assets

36,914

40,565

Total assets

$

2,792,899

$

2,725,250

Current maturities of long-term debt

$

4,127

$

4,173

Accounts payable

269,424

258,884

Accrued liabilities

162,950

163,366

Current operating lease liabilities

136,068

150,479

Income taxes payable

20,100

2,355

Total current liabilities

592,669

579,257

Long-term debt, including capital leases

978,255

1,065,811

Long-term operating lease liabilities

479,616

455,071

Other liabilities

22,066

23,139

Deferred income tax liabilities, net

91,758

93,224

Total liabilities

2,164,364

2,216,502

Total stockholders’ equity

628,535

508,748

Total liabilities and stockholders’ equity

$

2,792,899

$

2,725,250

Supplemental Schedule 1

SALLY BEAUTY HOLDINGS, INC. AND

SUBSIDIARIES Segment Information (In thousands) (Unaudited)

Three Months Ended September

30, Twelve Months Ended September 30,

2024

2023

Percentage Change

2024

2023

Percentage Change Net sales:

Sally Beauty Supply ("SBS")

$

534,074

$

524,556

1.8

%

$

2,107,089

$

2,139,206

(1.5

)%

Beauty Systems Group ("BSG")

400,954

396,800

1.0

%

1,609,942

1,588,925

1.3

%

Total net sales

$

935,028

$

921,356

1.5

%

$

3,717,031

$

3,728,131

(0.3

)%

Operating earnings: SBS

$

92,932

$

78,483

18.4

%

$

334,319

$

358,474

(6.7

)%

BSG

44,025

45,672

(3.6

)%

178,420

181,275

(1.6

)%

Segment operating earnings

136,957

124,155

10.3

%

512,739

539,749

(5.0

)%

Unallocated expenses (1)

55,127

48,119

14.6

%

230,081

197,515

16.5

%

Restructuring

(436

)

(872

)

50.0

%

(75

)

17,205

(100.4

)%

Interest expense

17,864

19,717

(9.4

)%

76,408

72,979

4.7

%

Earnings before provision for income taxes

$

64,402

$

57,191

12.6

%

$

206,325

$

252,050

(18.1

)%

Segment gross margin:

2024

2023

Basis Point Change

2024

2023

Basis Point Change

SBS

60.4

%

59.2

%

120

59.7

%

59.2

%

50

BSG

39.0

%

39.3

%

(30

)

39.3

%

39.8

%

(50

)

Segment operating margin:

SBS

17.4

%

15.0

%

240

15.9

%

16.8

%

(90

)

BSG

11.0

%

11.5

%

(50

)

11.1

%

11.4

%

(30

)

Consolidated operating margin

8.8

%

8.3

%

50

7.6

%

8.7

%

(110

)

(1) Unallocated expenses,

including share-based compensation expense, consist of corporate

and shared costs and are included in selling, general and

administrative expenses. Additionally, unallocated expenses include

costs associated with our Fuel for Growth initiative.

Supplemental Schedule 2

SALLY BEAUTY HOLDINGS,

INC. AND SUBSIDIARIES Non-GAAP Financial Measures

Reconciliations (In thousands, except per share data) (Unaudited)

Three Months Ended September

30, 2024 As Reported(GAAP) Restructuring (1) Fuel for

Growth and Other (2) As Adjusted (Non-GAAP) Cost of

products sold

$

455,827

$

—

$

—

$

455,827

Consolidated gross margin

51.2

%

51.2

%

Selling, general and administrative expenses

397,371

—

(6,191

)

391,180

SG&A expenses, as a percentage of sales

42.5

%

41.8

%

Restructuring

(436

)

436

—

—

Operating earnings

82,266

(436

)

6,191

88,021

Operating margin

8.8

%

9.4

%

Interest expense

17,864

—

—

17,864

Earnings before provision for income taxes

64,402

(436

)

6,191

70,157

Provision for income taxes (4)

16,346

(113

)

1,592

17,825

Net earnings

$

48,056

$

(323

)

$

4,599

$

52,332

Earnings per share: (5) Basic

$

0.47

$

(0.00

)

$

0.05

$

0.51

Diluted

$

0.46

$

(0.00

)

$

0.04

$

0.50

Three Months Ended September 30, 2023

As Reported(GAAP) Restructuring (1) COVID andOther (2) Loss

on Debt Extinguishment (3) As Adjusted (Non-GAAP)

Cost of products sold

$

454,794

$

—

$

—

$

—

$

454,794

Consolidated gross margin

50.6

%

50.6

%

Selling, general and administrative expenses

390,526

(606

)

(2,649

)

—

387,271

SG&A expenses, as a percentage of sales

42.4

%

42.0

%

Restructuring

(872

)

872

—

—

—

Operating earnings

76,908

(266

)

2,649

—

79,291

Operating margin

8.3

%

8.6

%

Interest expense

19,717

—

—

(1,793

)

17,924

Earnings before provision for income taxes

57,191

(266

)

2,649

1,793

61,367

Provision for income taxes (4)

14,610

(181

)

779

461

15,669

Net earnings

$

42,581

$

(85

)

$

1,870

$

1,332

$

45,698

Earnings per share: (5) Basic

$

0.40

$

(0.00

)

$

0.02

$

0.01

$

0.43

Diluted

$

0.39

$

(0.00

)

$

0.02

$

0.01

$

0.42

(1) For the three months ended

September 30, 2024 and 2023, restructuring represents expenses and

adjustments incurred primarily in connection with our Distribution

Center Consolidation and Store Optimization Plan. (2)

For the three months ended September 30, 2024, Fuel for Growth and

other represents expenses related to consulting services and

severance expenses. For the three months ended September 30, 2023,

COVID and other relates primarily to obsolete personal-protective

equipment ("PPE") related to store supplies in selling, general and

administrative expense. (3) Loss on debt

extinguishment relates to the repricing of our Term Loan B due

2030, which included a the write-off of unamortized deferred

financing costs of $1.8 million. (4) The provision

for income taxes was calculated using the applicable tax rates for

each country, while excluding the tax benefits for countries where

the tax benefit is not currently deemed probable of being realized.

(5) The sum of the earnings per share may not equal the full

amount due to rounding of the calculated amounts

Supplemental Schedule 3

SALLY BEAUTY HOLDINGS, INC. AND

SUBSIDIARIES Non-GAAP Financial Measures Reconciliations,

Continued (In thousands, except per share data) (Unaudited)

Twelve Months Ended September 30,

2024 As Reported(GAAP) Restructuring (1) Fuel for Growth

and Other (2) Loss on Debt Extinguishment (3) As Adjusted

(Non-GAAP) Cost of products sold

$

1,826,699

$

—

$

—

$

—

$

1,826,699

Consolidated gross margin

50.9

%

50.9

%

Selling, general and administrative expenses

1,607,674

—

(31,951

)

—

1,575,723

SG&A expenses, as a percentage of sales

43.3

%

42.4

%

Restructuring

(75

)

75

—

—

—

Operating earnings

282,733

(75

)

31,951

—

314,609

Operating margin

7.6

%

8.5

%

Interest expense

76,408

—

—

(4,261

)

72,147

Earnings before provision for income taxes

206,325

(75

)

31,951

4,261

242,462

Provision for income taxes (4)

52,911

(20

)

8,210

1,095

62,196

Net earnings

$

153,414

$

(55

)

$

23,741

$

3,166

$

180,266

Earnings per share: (5) Basic

$

1.48

$

(0.00

)

$

0.23

$

0.03

$

1.73

Diluted

$

1.43

$

(0.00

)

$

0.22

$

0.03

$

1.69

Twelve Months Ended September 30, 2023

As Reported(GAAP) Restructuring (1) COVID-19 andOther (2)

Loss on Debt Extinguishment (3) As Adjusted (Non-GAAP)

Cost of products sold

$

1,829,951

$

5,789

$

—

$

—

$

1,835,740

Consolidated gross margin

50.9

%

50.8

%

Selling, general and administrative expenses

1,555,946

(606

)

(3,701

)

—

1,551,639

SG&A expenses, as a percentage of sales

41.7

%

41.6

%

Restructuring

17,205

(17,205

)

—

—

—

Operating earnings

325,029

12,022

3,701

—

340,752

Operating margin

8.7

%

9.1

%

Interest expense

72,979

—

—

(1,793

)

71,186

Earnings before provision for income taxes

252,050

12,022

3,701

1,793

269,566

Provision for income taxes (4)

67,450

2,928

(1,651

)

461

69,188

Net earnings

$

184,600

$

9,094

$

5,352

$

1,332

$

200,378

Earnings per share: (5) Basic

$

1.72

$

0.08

$

0.05

$

0.01

$

1.87

Diluted

$

1.69

$

0.08

$

0.05

$

0.01

$

1.83

(1) For fiscal years 2024 and 2023,

restructuring represents expenses and adjustments incurred

primarily in connection with our Distribution Center Consolidation

and Store Optimization Plan, including $5.8 million in cost of

products sold related to adjustments to our expected obsolescence

reserve during fiscal year 2023. (2) For fiscal year

2024, Fuel for Growth and other represents expenses related to

consulting services and severance expenses. For fiscal year 2023,

COVID-19 and other primarily relates obsolete PPE related to store

supplies in selling, general and administrative expenses and to use

taxes around the donation of personal protection merchandise.

(3) For fiscal year 2024, loss on debt extinguishment

relates to the repayment of our 5.625% Senior Notes due 2025 and

the repricing of our Term Loan B due 2030. In connection with the

repayment of our senior notes, we recognized a write-off of $2.0

million in unamortized deferred financing costs and $0.5 million in

overlapping interest, net of interest earned on short-term cash

equivalents, on such senior notes after February 27, 2024 and until

their redemption. These pro-forma adjustments assume the redeemed

senior notes were repaid on February 27, 2024 at the time of

closing on our 6.75% Senior Notes due 2032. In connection with the

repricing of our Term Loan B, we recognized a write-off of

unamortized deferred financing costs of $1.7 million. For fiscal

year 2023, loss on debt extinguishment relates to the repricing of

our Term Loan B, which resulted in the write-off of unamortized

deferred financing costs of $1.8 million. (4) The

provision for income taxes was calculated using the applicable tax

rates for each country, while excluding the tax benefits for

countries where the tax benefit is not currently deemed probable of

being realized. Additionally, for fiscal year 2023, provision for

income taxes, within COVID-19 and other, includes additional $2.7

million in taxes and interest for the one-time transition tax on

unrepatriated foreign earnings (“Repatriation Tax”). The

Repatriation Tax in the prior year has been reclassified, from loss

on extinguishment to COVID-19 and other, to reflect current year

presentation. (5) The sum of the earnings per share

may not equal the full amount due to rounding of the calculated

amounts Supplemental Schedule 4

SALLY

BEAUTY HOLDINGS, INC. AND SUBSIDIARIES Non-GAAP Financial

Measures Reconciliations, Continued (In thousands) (Unaudited)

Three Months Ended September

30,

Twelve Months Ended September

30,

Adjusted EBITDA:

2024

2023

Percentage Change

2024

2023

Percentage Change

Net earnings

$

48,056

$

42,581

12.9

%

$

153,414

$

184,600

(16.9

)%

Add: Depreciation and amortization

26,205

26,639

(1.6

)%

109,738

102,412

7.2

%

Interest expense

17,864

19,717

(9.4

)%

76,408

72,979

4.7

%

Provision for income taxes

16,346

14,610

11.9

%

52,911

67,450

(21.6

)%

EBITDA (non-GAAP)

108,471

103,547

4.8

%

392,471

427,441

(8.2

)%

Share-based compensation

3,912

3,339

17.2

%

17,172

15,862

8.3

%

Restructuring

(436

)

(266

)

(63.9

)%

(75

)

12,022

(100.6

)%

Fuel for Growth and Other

6,191

—

100.0

%

31,951

—

100.0

%

COVID-19

—

2,649

(100.0

)%

—

3,701

(100.0

)%

Adjusted EBITDA (non-GAAP)

$

118,138

$

109,269

8.1

%

$

441,519

$

459,026

(3.8

)%

Basis Point Change

Basis Point Change

Adjusted EBITDA as a percentage of net

sales Adjusted EBITDA margin

12.6

%

11.9

%

70

11.9

%

12.3

%

(40

)

Operating Free Cash Flow:

2024

2023

Percentage Change

2024

2023

Percentage Change

Net cash provided by operating activities

$

110,673

$

116,540

(5.0

)%

$

246,528

$

249,311

(1.1

)%

Less: Payments for property and equipment, net

37,357

26,946

38.6

%

101,165

90,742

11.5

%

Operating free cash flow (non-GAAP)

$

73,316

$

89,594

(18.2

)%

$

145,363

$

158,569

(8.3

)%

Supplemental Schedule 5

SALLY BEAUTY HOLDINGS, INC. AND SUBSIDIARIES

Store Count and Comparable Sales (Unaudited)

As of September 30,

2024

2023

Change

Number of stores: SBS stores

3,129

3,148

(19

)

BSG: Company-operated stores

1,200

1,206

(6

)

Franchise stores

131

132

(1

)

Total BSG

1,331

1,338

(7

)

Total consolidated

4,460

4,486

(26

)

Number of BSG distributor sales consultants (1)

652

670

(18

)

(1) BSG distributor sales consultants (DSC) include

190 and 193 sales consultants employed by our franchisees at

September 30, 2024 and 2023, respectively.

Three

Months Ended September 30, Twelve Months Ended September

30,

2024

2023

Basis Point Change

2024

2023

Basis Point Change Comparable sales growth (decline):

SBS

2.6

%

(1.2

)%

380

(0.7

)%

3.4

%

(410

)

BSG

1.3

%

(2.3

)%

360

1.6

%

(1.3

)%

290

Consolidated

2.0

%

(1.6

)%

360

0.3

%

1.4

%

(110

)

Our comparable sales include sales from

stores that have been operating for 14 months or longer as of the

last day of a month and e-commerce revenue. Additionally, our

comparable sales include sales to franchisees and full-service

sales. Our comparable sales amounts exclude the effect of changes

in foreign exchange rates and sales from stores relocated until 14

months after the relocation. Revenue from acquired stores is

excluded from our comparable sales calculation until 14 months

after the acquisition.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241114390606/en/

Jeff Harkins Investor Relations 940-297-3877

jharkins@sallybeauty.com

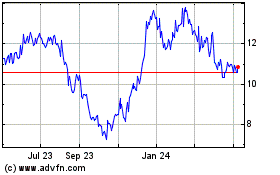

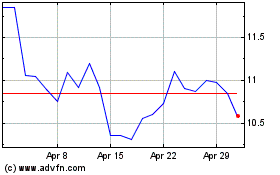

Sally Beauty (NYSE:SBH)

Historical Stock Chart

From Oct 2024 to Nov 2024

Sally Beauty (NYSE:SBH)

Historical Stock Chart

From Nov 2023 to Nov 2024