Slack Deal Shows Big Tech's Handcuffs -- Heard on the Street

December 29 2020 - 6:59AM

Dow Jones News

By Dan Gallagher

One of the largest tech deals this year also shows why there

might be a lot fewer of them in the future.

Salesforce.com's $27.7 billion acquisition of Slack

Technologies, announced this month, was the largest to date for the

hyperacquisitive cloud-software provider, as well as the

second-largest deal so far in the software space -- behind IBM's

acquisition of Red Hat in 2018, according to Dealogic. The high

price Salesforce paid -- representing 26 times Slack's projected

revenue for the next 12 months -- led many to speculate that the

company faced competition on the deal.

But that wasn't the case. According to a regulatory filing last

week detailing the background of the merger, Slack Chief Executive

Stewart Butterfield said he received "informal messages" from

representatives of two large, publicly traded U.S. technology

companies on Nov. 25 -- the day The Wall Street Journal first

reported the talks between the two companies. But those reps only

"expressed a desire to discuss the market rumors," according to Mr.

Butterfield. No actual competing bids emerged.

That isn't a surprise. Besides the rather generous valuation

Salesforce was already offering, the most likely competition would

have come from tech giants that are already under intense

government scrutiny. Amazon.com and Alphabet's Google in particular

operate large cloud businesses that could have benefited from the

addition of Slack's popular messaging platform. But Google is now

the subject of several antitrust lawsuits from the federal

government and most states, while Amazon is dealing with its own

government probes into how it competes in the retail and

cloud-services sectors.

Microsoft, while not under the same level of scrutiny, was also

an unlikely bidder. The software giant has become Slack's primary

competitor with the popularity of its Teams platform, which has

been reporting superior growth numbers to Slack of late. Having its

own history with government crackdowns would also likely make

Microsoft think twice before spending top dollar to take out a

competitor. Other tech giants will be making similar calculations

for the foreseeable future.

Write to Dan Gallagher at dan.gallagher@wsj.com

(END) Dow Jones Newswires

December 29, 2020 06:44 ET (11:44 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

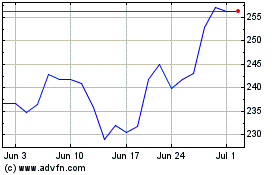

Salesforce (NYSE:CRM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Salesforce (NYSE:CRM)

Historical Stock Chart

From Apr 2023 to Apr 2024