0001040829

false

0001040829

2023-06-30

2023-06-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 30, 2023

RYMAN HOSPITALITY PROPERTIES, INC.

(Exact name of registrant as specified

in its charter)

| Delaware |

|

1-13079 |

|

73-0664379 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

One

Gaylord Drive

Nashville, Tennessee |

37214 |

|

| |

(Address of principal executive offices) |

(Zip Code) |

|

Registrant’s telephone number,

including area code: (615) 316-6000

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| |

Securities registered pursuant to Section 12(b) of the Act: |

| Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange on

Which Registered |

| Common Stock, par value $.01 |

|

RHP |

|

New York Stock Exchange |

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended

transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a)

of the Exchange Act. ¨

| ITEM 2.01. | COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS. |

On June 30, 2023, a subsidiary of Ryman

Hospitality Properties, Inc. (the “Company”), RHP Property SA, LLC, a Delaware limited liability company (“Buyer”),

completed the previously announced purchase of the JW Marriott San Antonio Hill Country Resort

& Spa located in San Antonio, Texas and certain related assets (collectively, the “Hill Country Acquisition”), pursuant

to an Agreement of Purchase and Sale (the “Purchase Agreement”) with BREIT JWM San Antonio LP, a Delaware limited partnership,

and BREIT JWM San Antonio TRS LLC, a Delaware limited liability company. The aggregate purchase price paid by Buyer was approximately

$800 million, funded with the net proceeds of an underwritten registered public offering of 4,427,500

shares of common stock of the Company at the public offering price of $93.25 per share, which closed on June 9, 2023, a private placement

of $400 million aggregate principal amount of 7.250% senior notes due 2028, which closed on June 22, 2023, and cash on hand.

The foregoing description of the Purchase Agreement

and the transactions pursuant thereto does not purport to be and is not complete and is subject to and qualified in its entirety by reference

to the full text of the Purchase Agreement, which was filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K,

filed with the Securities and Exchange Commission on June 5, 2023, and is incorporated herein by reference.

| ITEM 7.01 | REGULATION FD DISCLOSURE. |

On June 30, 2023, the Company issued a press release

announcing the closing of the Hill Country Acquisition. A copy of the press release is furnished herewith as Exhibit 99.1

and is incorporated herein by reference.

The information furnished under Item 7.01 in this

Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section and shall not be deemed incorporated

by reference in any filing made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as set forth

by specific reference herein or in such filing.

| ITEM 9.01 | FINANCIAL STATEMENTS AND EXHIBITS. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

RYMAN HOSPITALITY PROPERTIES, INC. |

| |

|

| Date: June 30,

2023 |

By: |

/s/ Scott J. Lynn |

| |

Name: |

Scott J. Lynn |

| |

Title: |

Executive Vice President, General Counsel and Secretary |

Exhibit 99.1

Ryman Hospitality Properties, Inc. Closes Acquisition

of JW Marriott San Antonio Hill Country Resort & Spa from Blackstone Real Estate Income Trust, Inc.

NASHVILLE, Tenn. (June 30, 2023) – Ryman

Hospitality Properties, Inc. (NYSE: RHP) (“Ryman”) announced today it has closed the previously announced acquisition of the

JW Marriott San Antonio Hill Country Resort & Spa (“JW Hill Country”) in San Antonio, Texas from Blackstone Real Estate

Income Trust, Inc.

Mark Fioravanti, President and Chief Executive

Officer of Ryman Hospitality Properties, said, “I want to thank our Ryman team and the Blackstone team for facilitating a smooth

closing process. We are excited to begin integrating this beautiful resort into our one-of-a-kind portfolio of group hotels and look forward

to pursuing additional value creation opportunities at this property and throughout our portfolio.”

Located amid approximately 640 acres in the Texas

Hill Country, the JW Marriott Hill Country, which opened in 2010, is a premier group-oriented resort with 1,002 rooms and 268,000 total

square feet of indoor and outdoor meeting and event space. The resort’s amenities include the 26,000-square-foot Lantana Spa; eight

food and beverage outlets; the 9-acre River Bluff water experience; and TPC San Antonio featuring two 18-hole golf courses, the Greg Norman-designed

Oaks Course and the Pete Dye-designed Canyons course. The purchase price for the acquisition, subject to certain purchase price adjustments,

totaled approximately $800 million.

About Ryman Hospitality

Properties, Inc.

Ryman Hospitality Properties, Inc. (NYSE:

RHP) is a leading lodging and hospitality real estate investment trust that specializes in upscale convention center resorts and

entertainment experiences. RHP’s holdings include Gaylord Opryland Resort & Convention Center; Gaylord Palms Resort &

Convention Center; Gaylord Texan Resort & Convention Center; Gaylord National Resort & Convention Center; and Gaylord

Rockies Resort & Convention Center, five of the top ten largest non-gaming convention center hotels in the United States based

on total indoor meeting space. The Company also owns the JW Marriott San Antonio Hill Country Resort & Spa and two ancillary

hotels adjacent to our Gaylord Hotels properties. The Company’s hotel portfolio is managed by Marriott International and

includes a combined total of 11,414 rooms as well as more than 3 million square feet of total indoor and outdoor meeting space in

top convention and leisure destinations across the country. RHP also owns a 70% controlling ownership interest in Opry Entertainment

Group (OEG), which is composed of entities owning a growing collection of iconic and emerging country music brands, including the

Grand Ole Opry, Ryman Auditorium, WSM 650 AM, Ole Red and Circle, a country lifestyle media network OEG owns in a joint venture with

Gray Television, Nashville-area attractions, and Block 21, a mixed-use entertainment, lodging, office and retail complex, including

the W Austin Hotel and the ACL Live at Moody Theater, located in downtown Austin, Texas. RHP operates OEG as its Entertainment

segment in a taxable REIT subsidiary, and its results are consolidated in the Company’s financial results. Visit RymanHP.com

for more information.

Cautionary Note Regarding

Forward-Looking Statements

This press release contains

statements as to Ryman’s beliefs and expectations of the outcome of future events that are forward-looking statements as defined

in the Private Securities Litigation Reform Act of 1995. You can identify these statements by the fact that they do not relate strictly

to historical or current facts. Examples of these statements include, but are not limited to, statements regarding Ryman’s integration

of the JW Marriott Hill Country and Ryman’s pursuit of additional value creation opportunities at the JW Marriott Hill Country.

These forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from the

statements made. These include risks and uncertainties associated with Ryman’s integration of the JW Marriott Hill Country, Ryman’s

ability to identify and capitalize on additional value creation opportunities at the JW Marriott Hill Country and the occurrence of any

event, change or other circumstance that could limit Ryman’s ability to capitalize on any additional value creation opportunities

it identifies at the JW Marriott Hill Country. Other factors that could cause results to differ materially are described in the filings

made from time to time by Ryman with the U.S. Securities and Exchange Commission and include the risk factors and other risks and uncertainties

described in Ryman’s Annual Reports on Form 10-K for the fiscal year ended December 31, 2022, and its Quarterly Reports on Form

10-Q and subsequent filings. Except as required by law, Ryman does not undertake any obligation to release publicly any revisions to forward-looking

statements made to reflect events or circumstances occurring after the date hereof or the occurrence of unanticipated events.

| Investor Relations Contacts: |

Media Contacts: |

| Mark Fioravanti, President and Chief Executive Officer |

Shannon Sullivan, Vice President Corporate and Brand Communications |

| Ryman Hospitality Properties, Inc. |

Ryman Hospitality Properties, Inc. |

| (615) 316-6588 |

(615) 316-6725 |

| mfioravanti@rymanhp.com |

ssullivan@rymanhp.com |

| ~or~ |

~or~ |

| Jennifer Hutcheson, Chief Financial Officer |

Robert Winters |

| Ryman Hospitality Properties, Inc. |

Alpha IR Group |

| (615) 316-6320 |

(929) 266-6315 |

| jhutcheson@rymanhp.com |

robert.winters@alpha-ir.com |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

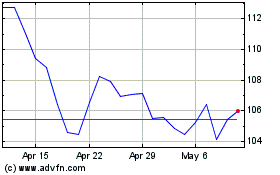

Ryman Hospitality Proper... (NYSE:RHP)

Historical Stock Chart

From Jun 2024 to Jul 2024

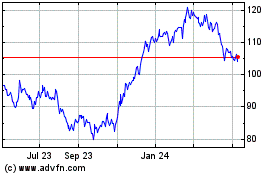

Ryman Hospitality Proper... (NYSE:RHP)

Historical Stock Chart

From Jul 2023 to Jul 2024