Prologis Inks Build-to-Suit Deal in China - Analyst Blog

April 04 2013 - 6:20AM

Zacks

San Francisco-based industrial real estate investment trust

(REIT), Prologis Inc. (PLD), inked a build-to-suit

agreement with Chinese logistics provider, Deppon. The agreement is

for 2 facilities aggregating 452,000 square feet in southern

China.

The proximity of this distribution center, which will be built at

the Prologis Dongguan Shipai Logistics Center, to the Congguan

Expressway that is scheduled for completion by year-end, would

offer direct access to key cities like Guangzhou and Shenzhen.

Notably, there is an increased demand for such facilities in

Dongguan, aided by economic growth, considerable manufacturing base

as well as domestic consumption. Prologis stands to benefit as it

has the capacity to offer modern distribution facilities in

strategic infill locations.

The new facilities would function as regional distribution centers

for the East Pearl River Delta area. It would include an extended

truck court, which would assist express inbound and outbound

operations of Deppon.

As a matter of fact, Deppon has been Prologis’ client in the past

and this particular deal will extend Prologis' relationship with

Deppon to over 1 million square feet across 5 markets in China.

Prologis is significantly capitalizing on the growing opportunities

in build-to-suit development projects across the globe.

Additionally, leasing decisions that were earlier postponed due to

volatility in the markets are gradually coming off the shelf. Also,

the company has been actively spreading itself worldwide through

joint ventures.

As of Dec 31, 2012, the company had about 36.6 million square feet

of distribution space in Asia alone. Moreover, as of that date, the

company owned or had investments in, on a consolidated basis or

through unconsolidated joint ventures, properties and development

projects projected to total around 554 million square feet in 21

countries. We believe such strategic moves will help augment the

company’s top line going forward and provide upside potential to

its stock price.

Prologis currently holds a Zacks Rank #3 (Hold). Other REITs that

are performing well and are worth a look include Ryman

Hospitality Properties Inc. (RHP), Omega

Healthcare Investors (OHI), both of which carry a Zacks

Rank #1 (Strong Buy) and Cousins Properties Inc.

(CUZ) that holds a Zacks Rank #2 (Buy).

COUSIN PROP INC (CUZ): Free Stock Analysis Report

OMEGA HLTHCARE (OHI): Free Stock Analysis Report

PROLOGIS INC (PLD): Free Stock Analysis Report

RYMAN HOSPITLTY (RHP): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

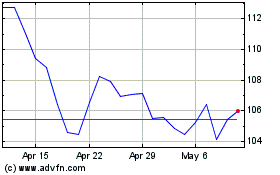

Ryman Hospitality Proper... (NYSE:RHP)

Historical Stock Chart

From Jun 2024 to Jul 2024

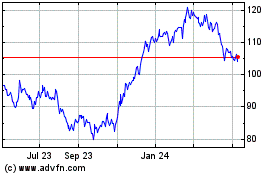

Ryman Hospitality Proper... (NYSE:RHP)

Historical Stock Chart

From Jul 2023 to Jul 2024