Terreno Inks Lease Renewal Deal - Analyst Blog

March 08 2013 - 6:30AM

Zacks

San Francisco-based Terreno

Realty Corporation (TRNO) recently

announced the inking of a lease renewal deal with an existing

tenant, which is one of the leading independent foodservice

distributors in the U.S. This industrial real estate investment

trust (REIT) entered into a 10-years deal for an entire space

(98,745 square feet) at an industrial property in Savage, Md.

The lease renewal transaction is expected to augment Terreno

Realty’s strong tenant base and boost its relationship with

existing tenants. Moreover, it will likely prove accretive to the

earnings going forward and improve the company’s top line.

Terreno Realty owns and operates industrial real estate properties

primarily in 6 major coastal markets of the U.S. These include the

high barriers-to-entry markets of Los Angeles, Northern New Jersey,

San Francisco Bay Area, Seattle, Miami and Washington D.C. Lately,

Terreno Realty has been active on capitalizing on opportunities to

strengthen its foothold in these areas.

Recently, Terreno Realty purchased an industrial property in

Medley, Fla. for roughly $5.1 million. The acquired property

comprises 1 industrial building that spans 49,000 square feet

across 5.4 acres. It also represents the company’s 10th building in

Miami-Dade County and is fully leased to a single tenant.

Also, earlier this week, Terreno Realty signed a lease extension

and expansion deal with an existing tenant for an industrial

property in Commerce, Calif. As per the deal, the tenant company

will extend the lease period for its currently occupied space of

65,000 square feet for 26 months. In addition, it also plans to

occupy an additional adjacent space of 51,000 square feet at the

industrial property. The expiration date for the combined leased

space of 116,000 square feet is Mar 31, 2018.

Terreno Realty currently holds a Zacks Rank #3 (Hold). However, a

number of other REITs that are performing better and worth a look

are Omega Healthcare Investors Inc.

(OHI), Ryman Hospitality

Properties Inc. (RHP), Sabra

Health Care REIT Inc. (SBRA), all

carrying a Zacks Rank #1 (Strong Buy).

OMEGA HLTHCARE (OHI): Free Stock Analysis Report

RYMAN HOSPITLTY (RHP): Free Stock Analysis Report

SABRA HEALTHCR (SBRA): Free Stock Analysis Report

TERRENO REALTY (TRNO): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

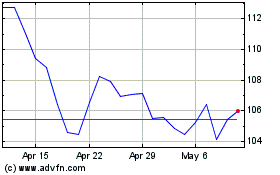

Ryman Hospitality Proper... (NYSE:RHP)

Historical Stock Chart

From Jun 2024 to Jul 2024

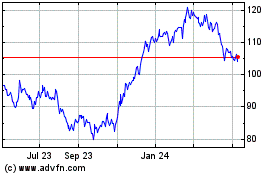

Ryman Hospitality Proper... (NYSE:RHP)

Historical Stock Chart

From Jul 2023 to Jul 2024