Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

December 08 2021 - 12:32PM

Edgar (US Regulatory)

|

Royal Bank of Canada

|

Free Writing Prospectus Relating to

MSELN-488-RTX, Registration Statement

No. 333-259205; Dated December 8,

2021; Filed Pursuant to Rule 433

|

Contingent Income Auto-Callable Securities due December 22, 2022

With the Coupon and Payment at Maturity Subject to the Performance of the Common Stock of Raytheon Technologies Corporation

Principal at Risk Securities

This document provides a summary of the terms of the securities. Investors must carefully review the accompanying preliminary pricing

supplement referenced below, the prospectus supplement and the prospectus, and the “Risk Considerations” on the following page, prior to making an investment decision.

|

Summary Terms

|

|

|

Issuer:

|

Royal Bank of Canada

|

|

|

Underlying stock:

|

Raytheon Technologies Corporation common stock (“RTX”)

|

|

|

Stated principal amount:

|

$10 per security

|

|

|

Issue price:

|

$10 per security

|

|

|

Pricing date:

|

December 17, 2021

|

|

|

Original issue date:

|

December 22, 2021 (3 business days after the pricing date)

|

|

|

Valuation date:

|

December 19, 2022

|

|

|

Maturity date:

|

December 22, 2022

|

|

|

Early redemption:

|

If, on any of the first three determination dates, beginning in March 2022, the determination closing price of the underlying stock is greater than or equal to the redemption threshold

price, the securities will be automatically redeemed for an early redemption payment on the third business day following the related determination date. No further payments will be made on the securities once they have been redeemed.

|

|

|

Early redemption payment:

|

The early redemption payment will be an amount equal to (i) the stated principal amount plus (ii) the contingent quarterly coupon with respect to the related determination date.

|

|

|

Determination

closing price:

|

The closing price of the underlying stock on any determination date other than the final determination date times the adjustment factor on that determination date.

|

|

|

Contingent quarterly coupon:

|

• If, on

any determination date, the determination closing price or the final share price, as applicable, is greater than or equal to the downside threshold price, we will pay a contingent quarterly coupon of $0.1925 (1.925% of the stated

principal amount, or 7.70% per annum) per security on the related contingent payment date.

• If, on

any determination date, the determination closing price or the final share price, as applicable, is less than the downside threshold price, no contingent quarterly coupon will be made with respect to that determination date.

|

|

|

Determination

dates:

|

March 17, 2022, June 17, 2022, September 19, 2022 and December 19, 2022, subject to postponement for non-trading days and certain market disruption events. We also refer to December 19, 2022

as the final determination date.

|

|

|

Contingent payment dates:

|

With respect to each determination date other than the final determination date, the third business day after the related determination date. The payment of the contingent quarterly coupon,

if any, with respect to the final determination date will be made on the maturity date.

|

|

|

Payment at maturity

|

• If the

final share price is greater than or equal to the downside threshold price:

• If the

final share price is less than the downside threshold price:

|

(i) the stated principal amount plus (ii) the final contingent quarterly coupon

(i) the stated principal amount multiplied by (ii) the share performance factor

|

|

|

Share performance factor:

|

Final share price divided by the initial share price

|

|

|

Adjustment factor:

|

1.0, subject to adjustment in the event of certain corporate events affecting the underlying stock

|

|

|

Redemption threshold price

|

100% of the initial share price

|

|

|

Downside threshold price:

|

80% of the initial share price

|

|

|

Initial share price:

|

The closing price of the underlying stock on the pricing date

|

|

|

Final share price:

|

The closing price of the underlying stock on the final determination date times the adjustment factor on that date

|

|

|

CUSIP / ISIN:

|

78016C127 / US78016C1273

|

|

|

|

Preliminary pricing supplement:

|

|

|

|

Hypothetical Payout at Maturity1

(if the securities have not previously been redeemed)

|

|

Change in Underlying Stock

|

Payment at Maturity (excluding any

coupon payable at maturity)

|

|

+30%

|

$10.00

|

|

+20%

|

$10.00

|

|

+10%

|

$10.00

|

|

0%

|

$10.00

|

|

-10%

|

$10.00

|

|

-20%

|

$10.00

|

|

-21%

|

$7.90

|

|

-25%

|

$7.50

|

|

-30%

|

$7.00

|

|

-40%

|

$6.00

|

|

-50%

|

$5.00

|

|

-60%

|

$4.00

|

|

-70%

|

$3.00

|

|

-80%

|

$2.00

|

|

-90%

|

$1.00

|

|

-100%

|

$0

|

1All payments are subject to our credit risk

Royal Bank of Canada has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you

should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC

website at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-877-688-2301.

Underlying Stock

For more information about the underlying stock, including historical performance information, please see the accompanying preliminary pricing supplement.

Risk Considerations

The risks set forth below are discussed in more detail in the “Risk Factors” section in the accompanying preliminary pricing supplement. Please review those risk factors carefully prior to

making an investment decision.

Risks Relating to the Terms and Structure of the Securities

|

•

|

The securities do not guarantee the return of any principal.

|

|

•

|

The potential contingent repayment of principal represented by the downside threshold price applies only at maturity.

|

|

•

|

The contingent quarterly coupon, if any, is based solely on the determination closing price or the final share price, as applicable.

|

|

•

|

You will not receive any contingent quarterly coupon for any quarterly period where the determination closing price, or the final share price, as applicable, is less than the downside threshold price.

|

|

•

|

Your return on the securities may be lower than the return on a conventional debt security of comparable maturity.

|

|

•

|

Investors will not participate in any appreciation in the price of the underlying stock.

|

|

•

|

The automatic early redemption feature may limit the term of your investment to approximately three months. If the securities are redeemed early, you may not be able to reinvest at comparable terms or

returns.

|

|

•

|

The securities are subject to our credit risk, and any actual or anticipated changes to our credit ratings or credit spreads may adversely affect the market value of the securities.

|

|

•

|

Investing in the securities is not equivalent to investing in the underlying stock.

|

|

•

|

We will not hold any shares of the underlying stock for your benefit.

|

Risks Relating to the Estimated Value of the Securities

|

•

|

The initial estimated value of the securities, which is expected to be between $9.22 and $9.72 per security, will be less than the price to the public.

|

|

•

|

Our initial estimated value of the securities is an estimate only, calculated as of the time that the terms of the securities are set.

|

Risks Relating to the Secondary Market for the Securities

|

•

|

The market price will be influenced by many unpredictable factors.

|

|

•

|

If the price of the shares of the underlying stock changes, the market value of the securities may not change in the same manner.

|

|

•

|

The securities will not be listed on any securities exchange and secondary trading may be limited.

|

|

•

|

The securities are not designed to be short-term trading instruments.

|

Risks Relating to the Underlying Stock

|

•

|

We have no affiliation with the underlying company.

|

|

•

|

The historical performance of the underlying stock should not be taken as an indication of its future performance.

|

|

•

|

The antidilution adjustments the calculation agent is required to make do not cover every corporate event that could affect the underlying stock.

|

Risks Relating to Conflicts of Interest

|

•

|

We or our affiliates may have adverse economic interests to the holders of the securities.

|

|

•

|

Hedging and trading activity by our subsidiaries could potentially adversely affect the value of the securities.

|

|

•

|

We may engage in business with or involving the underlying company without regard to your interests.

|

|

•

|

You must rely on your own evaluation of the merits of an investment linked to the underlying stock.

|

|

•

|

The calculation agent, which is a subsidiary of Royal Bank of Canada, will make determinations with respect to the securities.

|

Risks Relating to Taxation

|

•

|

Significant aspects of the income tax treatment of an investment in the securities are uncertain.

|

|

•

|

A 30% U.S. federal withholding tax will be withheld on contingent quarterly coupons paid to non-U.S. holders.

|

Tax Considerations

You should review carefully the discussion in the accompanying preliminary pricing supplement under the caption “Additional Information About the Securities–U.S. tax considerations” concerning

the U.S. federal income tax consequences of an investment in the securities, and you should consult your tax adviser.

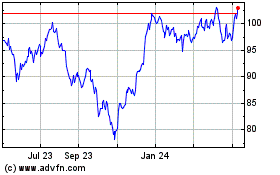

Royal Bank of Canada (NYSE:RY)

Historical Stock Chart

From Dec 2024 to Jan 2025

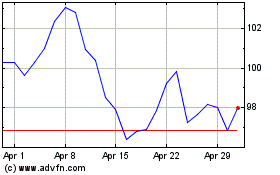

Royal Bank of Canada (NYSE:RY)

Historical Stock Chart

From Jan 2024 to Jan 2025