00016187560001618755false00016187562024-01-082024-01-080001618756qsr:RestaurantBrandsInternationalLimitedPartnershipMember2024-01-082024-01-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 8, 2024

RESTAURANT BRANDS INTERNATIONAL INC.

RESTAURANT BRANDS INTERNATIONAL LIMITED PARTNERSHIP

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Canada | | 001-36786 | | 98-1202754 |

| Ontario | | 001-36787 | | 98-1206431 |

| (State or other jurisdiction of | | (Commission | | (I.R.S. Employer |

| incorporation) | | File Number) | | Identification No.) |

| | | | | | | | | | | |

| 130 King Street West, Suite 300 | | M5X 1E1 |

| Toronto, | Ontario | | |

| (Address of Principal Executive Offices) | | (Zip Code) |

(905) 339-6011

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbols | | Name of each exchange on which registered |

| Common Shares, without par value | | QSR | | New York Stock Exchange |

| | | | Toronto Stock Exchange |

| Securities registered pursuant to Section 12(g) of the Act: |

| Title of each class | | Trading Symbols | | Name of each exchange on which registered |

| Class B exchangeable limited partnership units | | QSP | | Toronto Stock Exchange |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On January 8, 2024, Restaurant Brands International Inc. (“RBI”) announced further details on its previously announced change to its reportable segments and announced an updated measure of segment income. Beginning with the fourth quarter and year ended December 31, 2023, RBI revised its reportable segments to align with how the Chief Operating Decision Maker manages RBI’s business, including resource allocation and performance assessment. RBI’s revised reportable segments consist of the following: (1) Tim Hortons (“TH”); (2) Burger King (“BK”); (3) Popeyes Louisiana Kitchen (“PLK”); (4) Firehouse Subs (“FHS”); and (5) International (“INTL”). The TH, BK, PLK and FHS segments include results from each brands’ operations in the United States and Canada. INTL includes consolidated results from each brands’ operations outside of the United States and Canada.

In addition, RBI has transitioned its measure of segment income from Adjusted EBITDA to Adjusted Operating Income (“AOI”). AOI represents income from operations, adjusted to exclude (i) franchise agreement amortization (“FAA”) as a result of acquisition accounting, (ii) (income) loss from equity method investments, net of cash distributions received from equity method investments, (iii) other operating expenses (income), net and, (iv) income/expenses from non-recurring projects and non-operating activities. Unlike Adjusted EBITDA, AOI includes depreciation and amortization (excluding FAA) as well as share-based compensation and non-cash incentive compensation expense. RBI will continue to report Adjusted EBITDA on a consolidated and segment level basis for supplemental purposes.

In order to assist investors, RBI has included in Exhibits 99.1 and 99.2 to this report certain unaudited historical information to provide investors with supplemental financial and operational information that is on a basis consistent with RBI’s revised segment structure and new measure of segment income. These changes only affect segment allocation of results and do not revise or restate RBI’s previously reported consolidated financial statements or RBI’s previously reported non-GAAP adjustments on a consolidated basis.

The information furnished under Item 7.01 of this Current Report on Form 8-K is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits | | | | | | | | |

| | |

| Exhibit No. | | Description |

| | |

| | |

| 104 | | Cover Page Interactive Data File – the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | |

| | RESTAURANT BRANDS INTERNATIONAL INC.

RESTAURANT BRANDS INTERNATIONAL LIMITED PARTNERSHIP, by its general partner RESTAURANT BRANDS INTERNATIONAL INC. |

| | |

| Date: January 8, 2024 | | /s/ Matthew Dunnigan |

| | Name: | Matthew Dunnigan |

| | Title: | Chief Financial Officer |

EXHIBIT 99.1

Restaurant Brands International Inc. Announces Revised Segment Reporting

New Segments Provide Enhanced Disclosure on International and Home Market Businesses

RBI to Report Under New Segments Beginning with Year-End 2023 Results on February 13, 2024

Toronto, January 8, 2024 - Restaurant Brands International Inc. (“RBI”, “Company”) (TSX: QSR) (NYSE: QSR) (TSX: QSP) today announced details of its shift in reportable segments and definition of segment income.

Beginning with the fourth quarter and year ended December 31, 2023, RBI will report results under five reportable segments: (1) Tim Hortons (“TH”); (2) Burger King (“BK”); (3) Popeyes Louisiana Kitchen (“PLK”); (4) Firehouse Subs (“FHS”); and (5) International (“INTL”). The TH, BK, PLK and FHS segments include results from each brands’ operations in the United States and Canada. INTL includes consolidated results from each brands’ operations outside of the United States and Canada. This shift in reportable segments reflects how RBI's leadership intends to oversee and manage the business going forward.

In addition, RBI has transitioned its definition of segment income from Adjusted EBITDA to Adjusted Operating Income (“AOI”). Unlike Adjusted EBITDA, AOI includes depreciation and amortization (excluding franchise agreement amortization) as well as share-based compensation and non-cash incentive compensation expense. RBI will continue to report Adjusted EBITDA on a consolidated and segment level basis for supplemental purposes.

Josh Kobza, Chief Executive Officer of RBI commented, "Our announcement today reflects how I plan to oversee and manage our business moving forward. We have four amazing brands being led by five ambitious leaders across our home markets and international. I am excited to provide them with even greater autonomy over their strategic decisions so they can move quickly to accelerate growth.”

Matthew Dunnigan, Chief Financial Officer added, “Our business leaders are prioritizing investments that will drive long-term growth and attractive returns for our shareholders. Our transition to Adjusted Operating Income will provide increased focus on all the operating expenses associated with these investments and add greater accountability for delivering strong returns through profitability growth over time.”

The Company has included supplemental unaudited information containing 11 quarters of historical financial and operational metrics (from the first quarter of 2021 through the third quarter of 2023) for these five reportable segments in this press release, in a Form 8-K published today and in an excel file posted to rbi.com/investors. Additional details on each segment are included in the supplemental information below. The supplemental unaudited historical business segment information does not represent a restatement or reissuance of previously issued financial statements and relates entirely to segment presentation with no effect on previously reported consolidated results.

The Company will report under these segments and with its new segment income definition beginning with its results for the fourth quarter and year ended December 31, 2023 which will be announced before market open on February 13, 2024.

About Restaurant Brands International Inc.

Restaurant Brands International Inc. is one of the world's largest quick service restaurant companies with over $40 billion in annual system-wide sales and over 30,000 restaurants in more than 100 countries. RBI owns four of the world’s most prominent and iconic quick service restaurant brands – TIM HORTONS®, BURGER KING®, POPEYES®, and FIREHOUSE SUBS®. These independently operated brands have been serving their respective guests, franchisees and communities for decades. Through its Restaurant Brands for Good framework, RBI is improving sustainable outcomes related to its food, the planet, and people and communities. To learn more about RBI, please visit the company’s website at www.rbi.com.

Contacts

Investors: investor@rbi.com

Media: media@rbi.com

Forward-Looking Statements

This press release contains certain forward-looking statements and information, which reflect management's current beliefs and expectations regarding future events and operating performance and speak only as of the date hereof. These forward-looking statements are not guarantees of future performance and involve a number of risks and uncertainties. These forward-looking statements include statements about our expectations regarding our future structure, growth, positioning, plans and strategies for each of our brands and international markets, timing and content of future reporting, future investments in technology, development and operations, our aspiration to deliver strong returns through profitability growth over time, and our ability to enhance operations and drive long-term growth and shareholder returns. The factors that could cause actual results to differ materially from RBI’s expectations are detailed in filings of RBI with the Securities and Exchange Commission and applicable Canadian securities regulatory authorities, such as its annual and quarterly reports and current reports on Form 8-K, and include the following: future restructurings and strategic initiatives that RBI undertakes, risks related to unforeseen events such as pandemics, geopolitical conflicts and macroeconomic conditions; risks related to the supply chain; risks related to ownership and leasing of properties; risks related to our franchisees financial stability and their ability to access and maintain the liquidity necessary to operate their business; risks related to our fully franchised business model; risks related to RBI’s ability to successfully implement its domestic and international growth strategy and risks related to its international operations; risks related to RBI’s ability to compete domestically and internationally in an intensely competitive industry; risks related to technology; evolving legislation and regulations in the area of franchise and labor and employment law; our ability to address environmental and social sustainability issues and changes in applicable tax and other laws and regulations or interpretations thereof. Other than as required under U.S. federal securities laws or Canadian securities laws, we do not assume a duty to update these forward-looking statements, whether as a result of new information, subsequent events or circumstances, change in expectations or otherwise.

SUPPLEMENTAL INFORMATION

RBI’s Reportable Segments

We have five reportable segments: (1) Tim Hortons (“TH”); (2) Burger King (“BK”); (3) Popeyes Louisiana Kitchen (“PLK”); (4) Firehouse Subs (“FHS”); and (5) International (“INTL”). The TH, BK, PLK and FHS segments include results from each brands’ operations in the United States (U.S.) and Canada. INTL includes consolidated results from each brands’ operations outside of the U.S. and Canada, collectively representing over 120 countries and territories globally.

| | | | | | | | | | | | | | |

| Franchised Restaurants | Company Restaurants | LTM Revenue

($s mm) | LTM AOI ($s mm) |

| Tim Hortons | 4,495 | 7 | $3,940 | $953 |

| Burger King | 7,174 | 50 | $1,263 | $404 |

| Popeyes | 3,288 | 41 | $671 | $217 |

| Firehouse Subs | 1,212 | 39 | $172 | $38 |

| International | 14,069 | 0 | $844 | $585 |

| TOTAL RBI | 30,238 | 137 | $6,891 | $2,197 |

Restaurant count as of September 30, 2023. LTM represents last twelve months ended September 30, 2023 and can be calculated using the trending schedules attached to this release by summing results from the 3 months ended December 31, 2022, March 31, 2023, June 30, 2023, and September 30, 2023.

Segment Contribution: LTM September 30, 2023

Key Revenue Drivers by Segment

Our business generates revenues from the following sources: (i) sales, consisting primarily of supply chain sales, which represent sales of products, supplies and restaurant equipment to franchisees, as well as sales of consumer packaged goods (“CPG”) to retailers and sales at Company restaurants; (ii) franchise revenues, consisting primarily of royalties based on a percentage of sales reported by franchise restaurants and franchise fees paid by franchisees; (iii) property revenues from properties we lease or sublease to franchisees; and (iv) advertising revenues and other services, consisting primarily of advertising fund contributions based on a percentage of sales from franchised restaurants.

As of September 30, 2023, the primary revenue drivers for each segment were:

| | | | | | | | | | | | | | | | | |

| Revenue Drivers | Sales | Royalties1 | Property2 | Franchise Fees

& Other4 | Advertising & Other Services |

| Tim Hortons | Supply Chain

& CPG | Mid-4% Average Varies by US vs CA and Property Control | Rental Income on ~75% of System3 | Amortized Franchise Agreement Fees | Ad Fund: 4% SWS |

| Burger King | Company Restaurants | ~4.5% | Rental Income on ~20% of System3 | Ad Fund: 4% SWS5 Tech: Fee Per Digital Ticket |

| Popeyes | ~5.0% | Rental Income on <3% of System3 | Ad Fund: 4% SWS Tech: $2.4k Fee + 1% Digital Sales6 |

| Firehouse Subs | ~6.0% | None | Ad Fund: 5% SWS |

| International | None | Mid-4% Average Varies by Market & Master Franchisee | Not Meaningful | Ad Fund: up to 0.5% SWS7 &

Tech Revenue |

(1)Actual royalty rates may be impacted by development incentive programs for new builds and remodels. TH rates vary depending on property control. TH franchisees who lease land and/or buildings from us typically pay a royalty of 3.0% to 4.5% of gross sales while franchisees who do not lease from us typically pay a higher royalty up to 6% of gross sales. INTL royalty rates vary by market and master franchisee.

(2)Represents percent of restaurants (all formats) that pay rental income as of September 30, 2023. For TH, represents range of rental income percentages received for Standard format restaurants, excluding Petrol and Non-Standard restaurants. INTL receives rental income from 10 stores.

(3)Rental income typically comprised of the greater of fixed monthly payments or rental payments based on percentage (8.5% to 10%) of gross sales.

(4)Each segment recognizes convention related revenues in the period in which they occur within Franchise Fees and Other Revenues.

(5)Potential for advertising fund to increase to 4.5% from January 1, 2025 to December 31, 2028, should certain average profitability thresholds be met.

(6)Beginning January 1, 2024, digital technology fee equals 1% of all digital sales. During 2023, digital technology fee equaled 1% of first party digital sales only. For both periods, the digital technology fee includes a $2,400 annual fixed fee with total digital technology fees capped at $6,500 per year.

(7)INTL advertising funds are generally managed by franchisees in their respective markets. In addition, franchisees contribute to a global advertising fund managed by the franchisor. These contributions vary by brand and market and are typically up to 0.5% of system-wide sales.

International Segment Foreign Currency Information

For the nine months ended September 30, 2023, the International segment system-wide sales were primarily derived from the following currencies: Euro (~37% of system-wide sales), British pound (~6%), Australian dollar (~6%), Chinese yuan (~6%), Brazilian real (~5%) and Turkish Lira (~5%). We also derived approximately 1.5% of system-wide sales from the Argentine peso.

For the vast majority of International franchise agreements, system-wide sales are converted to either US dollar, European Euro, British pound or Australian dollar (“main currencies”) at month-end foreign exchange rates and royalties are paid to RBI in main currencies.

Key Expense Drivers by Segment

Our primary business expenses are related to the following: (i) cost of sales, consisting primarily of costs associated with the management of our TH supply chain, cost of products sold to retailers, and food, paper and labor costs of Company restaurants; (ii) franchise and property expenses, consisting primarily of depreciation of properties leased to franchisees, and rental expense associated with properties subleased to franchisees, and (iii) advertising expenses and other services consisting primarily of expenses relating to marketing, advertising and promotion, technology initiatives and depreciation and amortization. As a reminder, we generally manage advertising expenses to equal advertising revenues in the long term, however in some periods there may be a mismatch in the timing of revenues and expenses or higher expenses due to our support of certain marketing program initiatives – such as our C$80 million investment behind the Tim Hortons Canada advertising fund in 2021 and our current (Q4 2022 through Q4 2024) $120 million advertising investment in Burger King US as part of the brand’s multi-year Reclaim the Flame program.

As of September 30, 2023, the primary expense drivers for each segment were:

| | | | | | | | | | | |

Expense Drivers1 | Cost of Sales | Franchise & Property Expense2 | Advertising &

Other Services4 |

| Tim Hortons | Supply Chain, CPG, Depreciation & Amortization | Depreciation, Rent for Leased Properties & Amortization3 | Ad Fund, Tech Expenses, Digital Expenses & CPG Marketing |

| Burger King | Company

Restaurants | Ad Fund, Tech Expenses & Digital Expenses |

| Popeyes |

| Firehouse Subs | Minimal |

| International | None | Minimal |

(1)Each segment may recognize bad debt expenses (recoveries) within the line item in which the aged receivable occurs.

(2)Each segment recognizes convention related expenses in the period in which they occur within Franchise and Property Expenses.

(3)Related to franchise agreements and tenant inducements (primarily contributions towards remodels in which we have property control).

(4)Includes depreciation and amortization related to technology and digital assets.

In addition to the above, we report segment general and administrative expenses (“Segment G&A”) which consist primarily of salary and employee-related costs for non-restaurant employees, share-based compensation and non-cash incentive compensation expense (“SBC”), professional fees, information technology systems, general overhead for our corporate offices and depreciation and amortization of assets related to our corporate functions. Segment G&A excludes FHS Transaction costs and Corporate restructuring and advisory fees.

Key Operating Metrics

We evaluate our restaurants and assess our business based on the following operating metrics.

System-wide sales growth refers to the percentage change in sales at all franchised restaurants and Company restaurants (referred to as system-wide sales) in one period from the same period in the prior year. Comparable sales refers to the percentage change in restaurant sales in one period from the same prior year period for restaurants that have been open for 13 months or longer for Tim Hortons, Burger King and Firehouse Subs and 17 months or longer for Popeyes Louisiana Kitchen. Additionally, if a restaurant is closed for a significant portion of a month (such as during a renovation), the restaurant is excluded from the monthly comparable sales calculation. System-wide sales growth and comparable sales are measured on a constant currency basis, which means that results exclude the effect of foreign currency translation ("FX Impact") and are calculated by translating prior year results at current year monthly average exchange rates. We analyze key operating metrics on a constant currency basis as this helps identify underlying business trends, without distortion from the effects of currency movements.

System-wide sales represent sales at all franchise restaurants and company-owned restaurants. We do not record franchise sales as revenues; however, our royalty revenues and advertising fund contributions are calculated based on a percentage of franchise sales.

Net restaurant growth refers to the net increase in restaurant count (openings, net of permanent closures) over a trailing twelve-month period, divided by the restaurant count at the beginning of the trailing twelve-month period.

These metrics are important indicators of the overall direction of our business, including trends in sales and the effectiveness of each brand’s marketing, operations and growth initiatives.

In our 2022 financial reports, our key business metrics included results from our franchised Burger King restaurants in Russia, with supplemental disclosure provided excluding these restaurants. We did not generate any new profits from restaurants in Russia in 2022 and do not expect to generate any new profits in 2023. Consequently, beginning in the first quarter of 2023, our reported key business metrics exclude the results from Russia for all periods after December 31, 2021.

Non-GAAP Measures

Below, we define the non-GAAP financial measures included in the trending schedules and recast financial statements. In addition, we discuss the reasons why we believe this information is useful to management and may be useful to investors. These measures do not have standardized meanings under GAAP and may differ from similarly captioned measures of other companies in our industry.

To supplement our condensed consolidated financial statements presented on a GAAP basis, RBI reports the following non-GAAP financial measures: Adjusted Operating Income (“AOI”), EBITDA, Adjusted EBITDA, LTM Adjusted EBITDA, Adjusted Net Income, Adjusted Diluted Earnings per Share (“Adjusted Diluted EPS”), Organic revenue growth, Organic Adjusted EBITDA growth, Organic Adjusted Net Income growth, Organic Adjusted Diluted EPS growth, Free Cash Flow, LTM Free Cash Flow, Net Interest Paid, and Adjusted EBITDA Net Leverage. We believe that these non-GAAP measures are useful to investors in assessing our operating performance or liquidity, as they provide them with the same tools that management uses to evaluate our performance or liquidity and are responsive to questions we receive from both investors and analysts. By disclosing these non-GAAP measures, we intend to provide investors with a consistent comparison of our operating results and trends for the periods presented.

Adjusted Operating Income (“AOI”) represents income from operations adjusted to exclude (i) franchise agreement amortization (“FAA”) as a result of acquisition accounting, (ii) (income) loss from equity method investments, net of cash distributions received from equity method investments, (iii) other operating expenses (income), net and, (iv) income/expenses from non-recurring projects and non-operating activities. For the periods referenced in the following financial results, income/expenses from non-recurring projects and non-operating activities included (i) non-recurring fees and expense incurred in connection with the Firehouse Acquisition consisting of professional fees, compensation-related expenses and integration costs (“FHS Transaction costs”); and (ii) non-operating costs from professional advisory and consulting services associated with certain transformational corporate restructuring initiatives that rationalize our

structure and optimize cash movements as well as services related to significant tax reform legislation and regulations (“Corporate restructuring and advisory fees”). Management believes that these types of expenses are either not related to our underlying profitability drivers or not likely to re-occur in the foreseeable future and the varied timing, size and nature of these projects may cause volatility in our results unrelated to the performance of our core business that does not reflect trends of our core operations. AOI is used by management to measure operating performance of the business, excluding these other specifically identified items that management believes are not relevant to management’s assessment of our operating performance. AOI, as defined above, also represents our measure of segment income for each of our five operating segments.

EBITDA is defined as earnings (net income or loss) before interest expense, net, (gain) loss on early extinguishment of debt, income tax (benefit) expense, and depreciation and amortization and is used by management to measure operating performance of the business. Adjusted EBITDA is defined as EBITDA excluding (i) the non-cash impact of share-based compensation and non-cash incentive compensation expense, (ii) (income) loss from equity method investments, net of cash distributions received from equity method investments, (iii) other operating expenses (income), net, and (iv) income or expense from non-recurring projects and non-operating activities (as described above).

LTM Adjusted EBITDA is defined as Adjusted EBITDA for the last twelve-month period to the date reported.

Adjusted Net Income is defined as net income excluding (i) franchise agreement amortization as a result of acquisition accounting, (ii) amortization of deferred financing costs and debt issuance discount, (iii) loss on early extinguishment of debt and interest expense, which represents non-cash interest expense related to losses reclassified from accumulated comprehensive income (loss) into interest expense in connection with interest rate swaps de-designated in May 2015, November 2019 and September 2021, (iv) (income) loss from equity method investments, net of cash distributions received from equity method investments, (v) other operating expenses (income), net, and (vi) income or expense from non-recurring projects and non-operating activities (as described above).

Adjusted Diluted EPS is calculated by dividing Adjusted Net Income by the weighted average diluted shares outstanding of RBI during the reporting period. Adjusted Net Income and Adjusted Diluted EPS are used by management to evaluate the operating performance of the business, excluding certain non-cash and other specifically identified items that management believes are not relevant to management’s assessment of operating performance.

Free Cash Flow is the total of Net cash provided by operating activities minus Payments for property and equipment. Free Cash Flow is a liquidity measure used by management as one factor in determining the amount of cash that is available for working capital needs or other uses of cash, however, it does not represent residual cash flows available for discretionary expenditures. LTM Free Cash Flow is defined as Free Cash Flow for the last twelve-month period to the date reported.

Net Interest Paid is the total of cash interest paid in the period, cash proceeds (payments) related to derivatives, net from both investing activities and financing activities and cash interest income received. This liquidity measure is used by management to understand the net effect of interest paid, received and related hedging payments and receipts.

Included Within: Consolidated Operational Highlights; Consolidated Statement of Operations; Consolidated Segment Results; Tim Hortons Segment Results; Burger King Segment Results; Popeyes Segment Results; Firehouse Segment Results; International Segment Results; Home Market and International Operational Metrics; Reconciliation of Income from Operations to AOI, Segment G&A to G&A, Net Income to Adjusted EBITDA; Reconsolidation of Net Income to Adjusted Net Income and Adjusted Diluted EPS; Net Leverage, Reconciliation of Free Cash Flow and Net Interest Paid; Reconcilation of Organic Revenue and Adj. EBITDA Growth; Non-GAAP Definitions New Segment Disclosure Trending Schedules January 2024 EXHIBIT 99.2

Consolidated Operational Highlights Unaudited 3 Months Ending Year-End 3 Months Ending Year-End 3 Months Ending 3/31/21 6/30/21 9/30/21 12/31/21 12/31/21 3/31/22 6/30/22 9/30/22 12/31/22 12/31/22 3/31/23 6/30/23 9/30/23 System-wide Sales Growth TH (6.3%) 30.0% 9.2% 11.5% 10.4% 10.0% 14.8% 11.1% 10.5% 11.7% 16.1% 12.1% 8.1% BK 4.8% 13.4% (2.0%) 1.5% 4.2% 0.7% 0.2% 4.6% 5.5% 2.8% 8.5% 8.1% 6.4% PLK 6.7% 6.3% 1.5% 4.8% 4.8% 1.2% 6.4% 8.1% 6.5% 5.6% 9.6% 9.9% 11.2% FHS 8.7% 5.1% 6.7% INTL 0.1% 72.5% 27.4% 29.9% 28.9% 33.8% 28.2% 24.2% 18.5% 25.6% 21.6% 21.5% 15.6% Consolidated 1.4% 31.9% 10.8% 13.8% 13.8% 13.5% 13.3% 13.4% 11.4% 12.9% 14.7% 14.0% 10.9% System-Wide Sales (in US$ millions) TH $1,325 $1,576 $1,698 $1,644 $6,243 $1,457 $1,746 $1,828 $1,701 $6,732 $1,596 $1,872 $1,929 BK 2,463 2,733 2,648 2,631 10,475 2,481 2,734 2,764 2,768 10,747 2,684 2,949 2,938 PLK 1,249 1,286 1,276 1,275 5,086 1,259 1,359 1,369 1,351 5,338 1,374 1,488 1,520 FHS 272 292 289 301 1,154 289 303 304 INTL 2,859 3,311 3,756 3,765 13,691 3,389 3,636 3,862 3,813 14,700 3,889 4,334 4,532 Consolidated $7,896 $8,906 $9,378 $9,315 $35,495 $8,858 $9,767 $10,112 $9,934 $38,671 $9,832 $10,946 $11,223 Comparable Sales TH (2.4%) 27.5% 8.9% 10.4% 10.6% 8.6% 12.5% 10.2% 10.1% 10.4% 14.9% 11.8% 7.6% BK 6.6% 13.0% (1.4%) 1.9% 4.8% (0.3%) 0.5% 3.9% 5.0% 2.3% 8.7% 8.3% 6.6% PLK 1.5% (1.9%) (4.6%) (2.2%) (1.9%) (4.7%) (0.4%) 1.1% 1.7% (0.6%) 3.6% 4.4% 5.6% FHS 6.2% 2.2% 3.5% INTL (4.8%) 25.9% 17.1% 20.0% 14.2% 20.1% 17.3% 14.9% 10.5% 15.4% 12.6% 12.0% 7.7% Consolidated 0.3% 16.5% 6.5% 9.3% 7.9% 7.4% 8.2% 8.6% 7.5% 7.9% 10.3% 9.6% 7.0% Net Restaurant Growth TH (1.8%) (1.5%) (1.0%) 0.5% 0.5% (0.1%) (0.4%) (0.8%) (1.1%) (1.1%) (0.9%) (0.8%) (0.4%) BK (2.6%) (2.0%) (1.4%) 0.7% 0.7% 0.2% (0.2%) (0.1%) (0.6%) (0.6%) (1.3%) (1.8%) (2.4%) PLK 6.2% 6.7% 6.3% 6.4% 6.4% 6.6% 6.5% 6.9% 6.7% 6.7% 6.3% 5.6% 5.3% FHS 2.4% 2.4% 2.2% 2.0% 2.5% INTL 1.4% 3.1% 5.1% 7.8% 7.8% 8.1% 7.8% 7.3% 9.1% 9.1% 8.9% 9.2% 9.5% Consolidated 0.2% 1.3% 2.4% 4.5% 4.5% 4.3% 4.0% 3.9% 4.4% 4.4% 4.2% 4.1% 4.2% System Restaurant Count at Period End TH 4,551 4,556 4,556 4,571 4,571 4,547 4,537 4,521 4,519 4,519 4,507 4,501 4,502 BK 7,403 7,405 7,407 7,433 7,433 7,415 7,388 7,401 7,389 7,389 7,317 7,258 7,224 PLK 2,878 2,927 2,958 3,031 3,031 3,068 3,118 3,162 3,235 3,235 3,260 3,294 3,329 FHS 1,213 1,213 1,219 1,233 1,234 1,242 1,242 1,233 1,244 1,251 INTL 12,341 12,515 12,746 13,208 13,208 12,507 12,651 12,830 13,517 13,517 13,639 13,828 14,069 Consolidated 27,173 27,403 27,667 29,456 29,456 28,756 28,927 29,148 29,902 29,902 29,956 30,125 30,375 Note: Consolidated results include BK Russia from 1/1/21 to 12/31/21. Beginning 1/1/22, consolidated results exclude BK Russia, with the exception of 2 months of royalties in the first quarter of 2022. Consolidated SWS growth, NRG and comparable sales do not include the results of FHS (which was acquired 12/15/21) for Q1'21-Q3'22. Page 2

Consolidated Statement of Operations Audited, $ in millions (nominal) 3 Months Ending Year-End 3 Months Ending Year-End 3 Months Ending 3/31/21 6/30/21 9/30/21 12/31/21 12/31/21 3/31/22 6/30/22 9/30/22 12/31/22 12/31/22 3/31/23 6/30/23 9/30/23 Sales $507 $590 $621 $660 $2,378 $609 $708 $759 $743 $2,819 $668 $744 $771 Franchise and Property Revenues 548 612 635 648 2,443 615 676 698 672 2,661 668 742 753 Advertising Revenues and Other Services 205 236 239 238 918 227 255 269 274 1,025 254 289 313 Total Revenues $1,260 $1,438 $1,495 $1,546 $5,739 $1,451 $1,639 $1,726 $1,689 $6,505 $1,590 $1,775 $1,837 Cost of Sales $401 $467 $490 $532 $1,890 $494 $584 $615 $619 $2,312 $550 $612 $630 Franchise and Property Expenses 116 121 121 131 489 130 125 137 126 518 123 130 119 Advertising Expenses and Other Services 237 243 245 261 986 247 259 276 295 1,077 271 312 326 General and Adminstrative Expenses ("G&A") 104 108 115 157 484 133 146 156 196 631 175 163 169 (Income) Loss from Equity Method Investments ("EMIs") 2 3 7 (8) 4 13 9 8 14 44 7 11 1 Other Operating Expenses (Income), Net (42) 8 (16) 57 7 (16) (25) (27) 93 25 17 (7) 10 Total Operating Costs and Expenses $818 $950 $962 $1,130 $3,860 $1,001 $1,098 $1,165 $1,343 $4,607 $1,143 $1,221 $1,255 Income from Operations $442 $488 $533 $416 $1,879 $450 $541 $561 $346 $1,898 $447 $554 $582 Interest Expense, Net 124 126 128 127 505 127 129 133 144 533 142 145 143 Loss on Early Extinguishment of Debt 11 11 16 Income Before Income Taxes 318 362 394 289 1,363 323 412 428 202 1,365 305 409 423 Income Tax Expense (Benefit) 47 (29) 65 27 110 53 66 (102) (134) (117) 28 58 59 Net Income $271 $391 $329 $262 $1,253 $270 $346 $530 $336 $1,482 $277 $351 $364 Net Income Attributable to Noncontrolling Interests 92 132 108 83 415 87 110 170 107 474 88 110 112 Net Income Attributable to Common Shareholders $179 $259 $221 $179 $838 $183 $236 $360 $229 $1,008 $189 $241 $252 Earnings per Common Share: Basic $0.59 $0.84 $0.71 $0.57 $2.71 $0.59 $0.77 $1.18 $0.75 $3.28 $0.61 $0.77 $0.80 Diluted $0.58 $0.84 $0.70 $0.57 $2.69 $0.59 $0.76 $1.17 $0.74 $3.25 $0.61 $0.77 $0.79 Weighted Average Shares Outstanding (mms): Basic 306 307 311 313 310 309 308 306 306 307 309 312 314 Diluted 465 466 465 462 464 458 455 454 455 455 456 458 459 Note: No change to previously reported results. Consolidated results include BK Russia from 1/1/21 to 12/31/21. Beginning 1/1/22, consolidated results exclude BK Russia, with the exception of 2 months of royalties in the first quarter of 2022. Page 3

Selected Consolidated Results Unaudited, $ in millions (nominal) 3 Months Ending Year-End 3 Months Ending Year-End 3 Months Ending 3/31/21 6/30/21 9/30/21 12/31/21 12/31/21 3/31/22 6/30/22 9/30/22 12/31/22 12/31/22 3/31/23 6/30/23 9/30/23 System-wide Sales Growth 1.4% 31.9% 10.8% 13.8% 13.8% 13.5% 13.3% 13.4% 11.4% 12.9% 14.7% 14.0% 10.9% System-wide Sales $7,896 $8,906 $9,378 $9,315 $35,495 $8,858 $9,767 $10,112 $9,934 $38,671 $9,832 $10,946 $11,223 Comparable Sales 0.3% 16.5% 6.5% 9.3% 7.9% 7.4% 8.2% 8.6% 7.5% 7.9% 10.3% 9.6% 7.0% Net Restaurant Growth 0.2% 1.3% 2.4% 4.5% 4.5% 4.3% 4.0% 3.9% 4.4% 4.4% 4.2% 4.1% 4.2% System Restaurant Count at Period End 27,173 27,403 27,667 29,456 29,456 28,756 28,927 29,148 29,902 29,902 29,956 30,125 30,375 Segment P&L Sales $507 $590 $621 $660 $2,378 $609 $708 $759 $743 $2,819 $668 $744 $771 Franchise and Property Revenues 548 612 635 648 $2,443 615 676 698 672 $2,661 668 742 753 Advertising Revenues and Other Services 205 236 239 238 918 227 255 269 274 1,025 254 289 313 Total Revenues $1,260 $1,438 $1,495 $1,546 $5,739 $1,451 $1,639 $1,726 $1,689 $6,505 $1,590 $1,775 $1,837 Cost of Sales 401 467 490 532 1,890 494 584 615 619 2,312 550 612 630 Franchise and Property Expenses 116 121 121 131 489 130 125 137 126 518 123 130 119 Advertising Expenses and Other Services 237 243 245 261 986 247 259 276 295 1,077 271 312 326 Segment G&A 103 105 111 131 450 129 136 141 155 561 151 156 164 Add Backs: Franchise Agreement Amortization 8 8 8 8 32 8 8 8 8 32 8 8 7 Cash Distributions Received from EMIs 3 3 3 12 21 3 3 5 3 14 3 3 4 AOI $413 $514 $540 $510 $1,977 $462 $546 $570 $506 $2,084 $505 $577 $609 Share-based compensation and non-cash incentive 26 20 25 31 102 27 32 34 43 136 45 47 49 Segment Depreciation and Amortization 41 43 42 43 169 41 40 38 39 158 38 41 40 Adjusted EBITDA $480 $577 $607 $584 $2,248 $530 $618 $642 $588 $2,378 $588 $665 $698 Organic Growth YoY 5.2% 51.8% 5.1% 15.3% 17.1% 9.2% 8.7% 8.3% 4.0% 7.5% 15.6% 10.3% 9.3% Disaggregation of Total Revenues Sales $507 $590 $621 $660 $2,378 $609 $708 $759 $743 $2,819 $668 $744 $771 Royalties 346 391 412 412 1,561 403 438 451 445 1,737 442 491 503 Property Revenues 182 203 206 202 793 188 209 214 202 813 196 220 221 Franchise Fees and Other Revenue 20 18 17 34 89 24 29 33 25 111 30 31 29 Advertising Revenues and Other Services 205 236 239 238 918 227 255 269 274 1,025 254 289 313 Total Revenues $1,260 $1,438 $1,495 $1,546 $5,739 $1,451 $1,639 $1,726 $1,689 $6,505 $1,590 $1,775 $1,837 Organic Growth YoY (0.5%) 28.3% 8.5% 11.8% 11.5% 13.5% 15.1% 16.5% 12.8% 14.5% 13.9% 11.4% 7.6% Note: Consolidated results include BK Russia from 1/1/21 to 12/31/21. Beginning 1/1/22, consolidated results exclude BK Russia, with the exception of 2 months of royalties in the first quarter of 2022. Consolidated SWS growth, NRG and comparable sales do not include results of FHS (which was acquired 12/15/21) for Q1'21-Q3'22. Page 4

Tim Hortons ("TH") Segment Results Unaudited, $ in millions (nominal) 3 Months Ending Year-End 3 Months Ending Year-End 3 Months Ending 3/31/21 6/30/21 9/30/21 12/31/21 12/31/21 3/31/22 6/30/22 9/30/22 12/31/22 12/31/22 3/31/23 6/30/23 9/30/23 System-wide Sales Growth (6.3%) 30.0% 9.2% 11.5% 10.4% 10.0% 14.8% 11.1% 10.5% 11.7% 16.1% 12.1% 8.1% System-wide Sales $1,325 $1,576 $1,698 $1,644 $6,243 $1,457 $1,746 $1,828 $1,701 $6,732 $1,596 $1,872 $1,929 Comparable Sales (2.4%) 27.5% 8.9% 10.4% 10.6% 8.6% 12.5% 10.2% 10.1% 10.4% 14.9% 11.8% 7.6% Net Restaurant Growth (1.8%) (1.5%) (1.0%) 0.5% 0.5% (0.1%) (0.4%) (0.8%) (1.1%) (1.1%) (0.9%) (0.8%) (0.4%) System Restaurant Count at Period End 4,551 4,556 4,556 4,571 4,571 4,547 4,537 4,521 4,519 4,519 4,507 4,501 4,502 Segment P&L Sales $473 $556 $592 $628 $2,249 $566 $661 $710 $694 $2,631 $618 $688 $718 Franchise and Property Revenues 188 216 227 222 853 201 233 245 225 905 213 247 253 Advertising Revenues and Other Services 47 56 63 63 229 57 69 72 68 266 62 73 82 Total Revenues $708 $828 $882 $913 $3,331 $825 $963 $1,026 $987 $3,801 $893 $1,008 $1,052 Cost of Sales 370 434 462 499 1,765 453 537 568 573 2,131 505 562 582 Franchise and Property Expenses 81 85 84 86 336 81 84 87 80 332 79 85 80 Advertising Expenses and Other Services 62 68 68 80 277 68 71 74 69 282 65 78 84 Segment G&A 30 30 32 41 133 35 38 36 42 151 37 41 43 Add Backs: Franchise Agreement Amortization 2 2 2 2 8 2 2 2 2 7 2 2 2 Cash Distributions Received from EMIs 3 3 4 8 17 3 3 5 2 13 3 3 4 AOI $171 $216 $242 $216 $845 $193 $237 $269 $226 $925 $212 $246 $269 SBC 8 6 8 10 32 8 9 9 11 37 12 13 13 Segment Depreciation and Amortization 30 31 30 32 123 29 27 26 26 108 25 26 25 Adjusted EBITDA $209 $253 $279 $258 $999 $230 $273 $304 $263 $1,070 $248 $285 $307 Disaggregation of Total Revenues Sales $473 $556 $592 $628 $2,249 $566 $661 $710 $694 $2,631 $618 $688 $718 Royalties 59 70 75 74 278 65 79 82 76 302 71 84 87 Property Revenues 124 141 148 143 556 130 149 154 144 577 137 158 161 Franchise Fees and Other Revenue 5 5 5 5 19 6 5 9 5 26 6 5 5 Advertising Revenues and Other Services 47 56 63 63 229 57 69 72 68 266 62 73 82 Total Revenues $708 $828 $882 $913 $3,331 $825 $963 $1,026 $987 $3,801 $893 $1,008 $1,052 Average Exchange Rate (CAD) 0.7897 0.8144 0.7939 0.7938 0.7980 0.7895 0.7835 0.7658 0.7368 0.7689 0.7398 0.7447 0.7456 % Change YoY (0.0%) (3.8%) (3.5%) (7.2%) (3.6%) (6.3%) (4.9%) (2.6%) Note: Includes results from Tim Hortons in Canada and the U.S. Amounts may not recalculate due to rounding. 2021 Advertising Expenses and Other Services included our C$80 million support behind the TH Canada advertising fund. Page 5

Burger King ("BK") Segment Results Unaudited, $ in millions (nominal) 3 Months Ending Year-End 3 Months Ending Year-End 3 Months Ending 3/31/21 6/30/21 9/30/21 12/31/21 12/31/21 3/31/22 6/30/22 9/30/22 12/31/22 12/31/22 3/31/23 6/30/23 9/30/23 System-wide Sales Growth 4.8% 13.4% (2.0%) 1.5% 4.2% 0.7% 0.2% 4.6% 5.5% 2.8% 8.5% 8.1% 6.4% System-wide Sales $2,463 $2,733 $2,648 $2,631 $10,475 $2,481 $2,734 $2,764 $2,768 $10,747 $2,684 $2,949 $2,938 Comparable Sales 6.6% 13.0% (1.4%) 1.9% 4.8% (0.3%) 0.5% 3.9% 5.0% 2.3% 8.7% 8.3% 6.6% Net Restaurant Growth (2.6%) (2.0%) (1.4%) 0.7% 0.7% 0.2% (0.2%) (0.1%) (0.6%) (0.6%) (1.3%) (1.8%) (2.4%) System Restaurant Count at Period End 7,403 7,405 7,407 7,433 7,433 7,415 7,388 7,401 7,389 7,389 7,317 7,258 7,224 Segment P&L Sales $16 $17 $16 $15 $64 $16 $17 $19 $18 $70 $19 $24 $21 Franchise and Property Revenues 160 173 167 173 674 160 174 180 174 688 172 186 183 Advertising Revenues and Other Services 95 110 108 106 419 99 110 111 117 438 106 117 124 Total Revenues $271 $300 $291 $295 $1,156 $275 $301 $309 $310 $1,196 $297 $327 $329 Cost of Sales 16 17 16 17 66 17 19 19 19 74 17 22 20 Franchise and Property Expenses 32 34 33 38 137 34 34 40 37 144 36 32 32 Advertising Expenses and Other Services 110 104 108 111 433 107 111 117 134 467 117 131 131 Segment G&A 25 27 26 32 110 27 29 33 37 126 34 35 37 Add Backs: Franchise Agreement Amortization 3 3 3 3 11 3 3 3 3 11 3 3 3 Cash Distributions Received from EMIs AOI $90 $121 $110 $100 $421 $94 $112 $103 $87 $396 $96 $110 $111 SBC 7 5 7 7 25 5 7 8 10 30 10 10 11 Segment Depreciation and Amortization 8 8 8 9 33 8 8 8 9 34 9 9 9 Adjusted EBITDA $105 $134 $125 $116 $480 $107 $128 $119 $105 $459 $115 $129 $131 Disaggregation of Total Revenues Sales $16 $17 $16 $15 $64 $16 $17 $19 $18 $70 $19 $24 $21 Royalties 102 113 110 110 435 103 115 116 116 450 113 125 124 Property Revenues 54 57 55 56 221 54 56 57 54 222 55 57 57 Franchise Fees and Other Revenue 5 2 2 8 17 3 3 7 4 16 3 4 3 Advertising Revenues and Other Services 95 110 108 106 419 99 110 111 117 438 106 117 124 Total Revenues $271 $300 $291 $295 $1,156 $275 $301 $309 $310 $1,196 $297 $327 $329 Supplemental Information Fuel the Flame Investment (Included in Advertising Expenses and Other Services) $13 $13 $7 $12 $2 Note: Includes results from Burger King in the U.S. and Canada. Amounts may not recalculate due to rounding. Fuel the Flame investment includes both Marketing and Digital investments. Page 6

Popeyes Louisiana Kitchen ("PLK") Segment Results Unaudited, $ in millions (nominal) 3 Months Ending Year-End 3 Months Ending Year-End 3 Months Ending 3/31/21 6/30/21 9/30/21 12/31/21 12/31/21 3/31/22 6/30/22 9/30/22 12/31/22 12/31/22 3/31/23 6/30/23 9/30/23 System-wide Sales Growth 6.7% 6.3% 1.5% 4.8% 4.8% 1.2% 6.4% 8.1% 6.5% 5.6% 9.6% 9.9% 11.2% System-wide Sales $1,249 $1,286 $1,276 $1,275 $5,086 $1,259 $1,359 $1,369 $1,351 $5,338 $1,374 $1,488 $1,520 Comparable Sales 1.5% (1.9%) (4.6%) (2.2%) (1.9%) (4.7%) (0.4%) 1.1% 1.7% (0.6%) 3.6% 4.4% 5.6% Net Restaurant Growth 6.2% 6.7% 6.3% 6.4% 6.4% 6.6% 6.5% 6.9% 6.7% 6.7% 6.3% 5.6% 5.3% System Restaurant Count at Period End 2,878 2,927 2,958 3,031 3,031 3,068 3,118 3,162 3,235 3,235 3,260 3,294 3,329 Segment P&L Sales $18 $17 $13 $16 $64 $17 $20 $21 $20 $78 $21 $22 $22 Franchise and Property Revenues 65 67 67 66 265 66 75 72 72 284 73 82 80 Advertising Revenues and Other Services 56 59 58 57 230 59 63 64 70 256 66 69 75 Total Revenues $138 $143 $139 $139 $559 $142 $158 $157 $162 $619 $159 $173 $177 Cost of Sales 15 16 12 15 58 16 19 19 18 72 19 20 20 Franchise and Property Expenses 2 2 2 2 8 2 5 2 2 11 2 6 2 Advertising Expenses and Other Services 57 60 59 58 233 60 64 65 71 261 67 70 77 Segment G&A 15 15 16 18 64 17 17 18 20 72 21 22 21 Add Backs: Franchise Agreement Amortization 1 1 1 1 2 1 1 1 1 2 1 1 1 Cash Distributions Received from EMIs AOI $50 $52 $50 $46 $198 $47 $54 $52 $52 $205 $51 $56 $58 SBC 4 3 3 4 14 4 5 5 6 20 6 7 6 Segment Depreciation and Amortization 2 2 2 2 7 2 2 2 2 8 2 2 2 Adjusted EBITDA $55 $57 $55 $52 $219 $53 $60 $59 $60 $232 $59 $65 $67 Disaggregation of Total Revenues Sales $18 $17 $13 $16 $64 $17 $20 $21 $20 $78 $21 $22 $22 Royalties 61 63 62 61 247 62 67 67 67 263 68 73 75 Property Revenues 3 4 3 3 13 3 3 3 3 12 3 3 3 Franchise Fees and Other Revenue 1 1 1 2 5 1 5 1 2 8 1 5 2 Advertising Revenues and Other Services 56 59 58 57 230 59 63 64 70 256 66 69 75 Total Revenues $138 $143 $139 $139 $559 $142 $158 $157 $162 $619 $159 $173 $177 Note: Includes results from Popeyes in the U.S. and Canada. Amounts may not recalculate due to rounding. Page 7

Firehouse Subs ("FHS") Segment Results Unaudited, $ in millions (nominal) 3 Months Ending Year-End 3 Months Ending Year-End 3 Months Ending 3/31/21 6/30/21 9/30/21 12/31/21 12/31/21 3/31/22 6/30/22 9/30/22 12/31/22 12/31/22 3/31/23 6/30/23 9/30/23 System-wide Sales Growth 27.0% 37.9% 19.3% 18.1% 25.1% 7.4% 2.2% 3.8% 3.9% 4.2% 8.7% 5.1% 6.7% System-wide Sales $254 $286 $278 $273 $1,091 $272 $292 $289 $301 $1,154 $289 $303 $304 Comparable Sales 24.2% 31.2% 14.9% 14.7% 20.9% 4.2% (1.4%) 0.0% 0.4% 0.6% 6.2% 2.2% 3.5% Net Restaurant Growth 1.7% 2.5% 2.0% 1.6% 1.6% 1.8% 2.5% 2.5% 2.4% 2.4% 2.2% 2.0% 2.5% System Restaurant Count at Period End 1,198 1,203 1,204 1,213 1,213 1,219 1,233 1,234 1,242 1,242 1,233 1,244 1,251 Segment P&L Sales $1 $1 $10 $10 $9 $11 $40 $10 $10 $10 Franchise and Property Revenues 4 4 20 22 21 22 85 23 24 27 Advertising Revenues and Other Services 0 0 1 1 8 3 13 4 14 15 Total Revenues $5 $5 $31 $33 $38 $36 $138 $37 $48 $51 Cost of Sales 1 1 8 9 9 9 35 8 9 8 Franchise and Property Expenses 1 1 2 2 2 1 7 2 2 4 Advertising Expenses and Other Services 0 0 0 1 7 4 12 5 14 15 Segment G&A 1 1 12 13 14 13 52 13 13 14 Add Backs: Franchise Agreement Amortization 1 0 0 1 0 0 0 Cash Distributions Received from EMIs AOI $2 $2 $8 $8 $9 $8 $33 $9 $11 $10 SBC 0 0 1 2 2 3 8 3 4 4 Segment Depreciation and Amortization 0 0 1 1 1 1 3 1 1 1 Adjusted EBITDA $2 $2 $10 $11 $11 $12 $44 $13 $15 $15 Disaggregation of Total Revenues Sales $1 $1 $10 $10 $9 $11 $40 $10 $10 $10 Royalties 2 2 16 17 16 18 66 17 18 17 Property Revenues Franchise Fees and Other Revenue 2 2 5 5 5 5 19 6 6 9 Advertising Revenues and Other Services 0 0 1 1 8 3 13 4 14 15 Total Revenues $5 $5 $31 $33 $38 $36 $138 $37 $48 $51 Note: FHS figures from 1/1/21 through 12/14/21 are shown for informational purposes only. Includes results from the U.S. and Canada. Amounts may not recalculate due to rounding. Page 8

International ("INTL") Segment Results Unaudited, $ in millions (nominal) 3 Months Ending Year-End 3 Months Ending Year-End 3 Months Ending 3/31/21 6/30/21 9/30/21 12/31/21 12/31/21 3/31/22 6/30/22 9/30/22 12/31/22 12/31/22 3/31/23 6/30/23 9/30/23 System-wide Sales Growth 0.1% 72.5% 27.4% 29.9% 28.9% 33.8% 28.2% 24.2% 18.5% 25.6% 21.6% 21.5% 15.6% System-wide Sales $2,859 $3,311 $3,756 $3,765 $13,691 $3,389 $3,636 $3,862 $3,813 $14,700 $3,889 $4,334 $4,532 Comparable Sales (4.8%) 25.9% 17.1% 20.0% 14.2% 20.1% 17.3% 14.9% 10.5% 15.4% 12.6% 12.0% 7.7% Net Restaurant Growth 1.4% 3.1% 5.1% 7.8% 7.8% 8.1% 7.8% 7.3% 9.1% 9.1% 8.9% 9.2% 9.5% System Restaurant Count at Period End 12,341 12,515 12,746 13,208 13,208 12,507 12,651 12,830 13,517 13,517 13,639 13,828 14,069 Segment P&L Sales Franchise and Property Revenues 134 156 173 183 647 167 172 182 178 699 187 203 210 Advertising Revenues and Other Services 8 11 11 12 41 11 12 13 15 51 16 16 18 Total Revenues $142 $166 $184 $195 $688 $178 $183 $195 $194 $750 $203 $219 $228 Cost of Sales Franchise and Property Expenses 1 0 1 5 7 11 0 6 6 24 5 5 1 Advertising Expenses and Other Services 8 11 11 13 43 11 12 14 16 54 18 18 20 Segment G&A 33 33 37 39 142 38 39 40 43 160 46 45 49 Add Backs: Franchise Agreement Amortization 3 3 3 3 11 3 3 3 3 10 3 3 3 Cash Distributions Received from EMIs 4 4 1 1 AOI $102 $125 $138 $146 $511 $120 $135 $137 $133 $525 $137 $154 $161 SBC 8 6 8 9 31 8 10 11 13 41 14 13 14 Segment Depreciation and Amortization 1 1 2 1 6 1 2 1 2 7 2 3 3 Adjusted EBITDA $111 $133 $148 $156 $548 $130 $146 $149 $148 $573 $153 $171 $178 Disaggregation of Total Revenues Sales Royalties 124 145 164 166 599 156 161 170 168 655 173 192 199 Property Revenues 1 1 1 4 1 1 1 1 2 1 Franchise Fees and Other Revenue 9 10 9 17 45 10 10 12 10 42 14 10 11 Advertising Revenues and Other Services 8 11 11 12 41 11 12 13 15 51 16 16 18 Total Revenues $142 $166 $184 $195 $688 $178 $183 $195 $194 $750 $203 $219 $228 Average Exchange Rate (EUR) 1.2056 1.2053 1.1786 1.1438 1.1833 1.1226 1.0649 1.0068 1.0215 1.0539 1.0731 1.0891 1.0879 % Change YoY (6.9%) (11.7%) (14.6%) (10.7%) (10.9%) (4.4%) 2.3% 8.1% Note: INTL excludes results from the U.S. and Canada in all periods. Results include BK Russia from 1/1/21 to 12/31/21. Beginning 1/1/22, INTL results exclude BK Russia, with the exception of 2 months of royalties in the first quarter of 2022. INTL excludes FHS Puerto Rico from 1/1/22 to 12/31/22. FHS Puerto Rico was reclassified to INTL on 1/1/23. Amounts may not recalculate due to rounding. Page 9

Supplemental Operational Information Home Market and International Results by Brand 3 Months Ending Year-End 3 Months Ending Year-End 3 Months Ending 3/31/21 6/30/21 9/30/21 12/31/21 12/31/21 3/31/22 6/30/22 9/30/22 12/31/22 12/31/22 3/31/23 6/30/23 9/30/23 System-wide Sales Growth TH - Canada (7.3%) 29.8% 9.8% 12.4% 10.5% 11.7% 16.7% 12.1% 11.2% 12.9% 16.6% 12.8% 8.5% BK - US 4.7% 13.2% (2.4%) 1.1% 3.9% 0.2% (0.3%) 4.4% 5.3% 2.4% 8.1% 7.9% 6.0% PLK - US 5.7% 5.1% 1.3% 4.3% 4.1% 0.6% 6.0% 7.7% 6.1% 5.1% 9.1% 9.4% 11.0% FHS - US 25.6% 36.8% 18.5% 17.7% 24.3% 6.7% 1.6% 3.3% 4.0% 3.9% 7.4% 4.8% 6.6% International: TH 48.1% 225.5% 85.9% 91.8% 96.6% 83.0% 54.7% 66.5% 44.6% 60.2% 44.3% 67.5% 34.1% BK (0.9%) 69.6% 25.9% 28.5% 27.4% 32.2% 26.5% 21.7% 16.0% 23.6% 19.1% 18.5% 13.2% PLK 11.7% 129.5% 52.2% 41.0% 48.6% 46.9% 60.5% 67.1% 66.3% 60.8% 66.7% 66.4% 60.2% FHS 8.9% 3.1% 16.6% System-wide Sales (in US$ millions) TH - Canada $1,165 $1,399 $1,521 $1,471 $5,556 $1,301 $1,568 $1,645 $1,518 $6,032 $1,420 $1,683 $1,737 BK - US 2,369 2,618 2,530 2,516 10,033 2,375 2,611 2,641 2,651 10,278 2,568 2,816 2,800 PLK - US 1,182 1,209 1,194 1,190 4,775 1,184 1,275 1,280 1,262 5,001 1,292 1,395 1,421 FHS - US 244 274 266 260 1,044 260 278 276 288 1,102 276 289 290 International: TH $54 $62 $75 $92 $283 $99 $92 $117 $124 $431 $136 $152 $159 BK 2,710 3,149 3,564 3,551 12,975 3,166 3,400 3,582 3,507 13,656 3,557 3,952 4,125 PLK 95 100 116 122 433 124 144 163 182 613 193 226 244 FHS 3 4 4 Comparable Sales TH - Canada (3.3%) 27.4% 9.5% 11.3% 10.8% 10.1% 14.2% 11.1% 11.0% 11.6% 15.5% 12.5% 8.1% BK - US 6.6% 13.0% (1.6%) 1.8% 4.7% (0.5%) 0.4% 4.0% 5.0% 2.2% 8.7% 8.3% 6.6% PLK - US 0.9% (2.5%) (4.5%) (1.8%) (2.0%) (4.6%) (0.1%) 1.3% 1.5% (0.5%) 3.4% 4.2% 5.6% FHS - US 23.9% 31.3% 15.2% 15.2% 21.0% 4.5% (1.2%) 0.3% 1.0% 1.1% 6.7% 2.6% 3.9% International: TH 3.0% 33.3% 8.5% 9.9% 11.1% 4.4% 4.8% 1.9% (4.3%) 0.9% (3.0%) 3.3% (4.5%) BK (5.1%) 25.4% 16.7% 20.0% 13.9% 20.3% 17.2% 14.7% 10.2% 15.3% 12.5% 11.7% 7.6% PLK 2.0% 48.9% 39.7% 27.8% 27.3% 23.3% 28.7% 31.6% 29.2% 28.4% 29.8% 27.4% 21.0% FHS 1.1% (2.7%) (1.8%) Note: INTL results exclude U.S. for TH and Canada for BK, PLK and FHS. BK INTL includes Russia from 1/1/21 to 12/31/21. FHS INTL excludes Puerto Rico from 1/1/21 to 12/31/22. Restaurants in Puerto Rico were reclassified to International beginning January 1, 2023. FHS figures from 1/1/21 through 12/14/21 are shown for informational purposes only. Page 10

3 Months Ending Year-End 3 Months Ending Year-End 3 Months Ending 3/31/21 6/30/21 9/30/21 12/31/21 12/31/21 3/31/22 6/30/22 9/30/22 12/31/22 12/31/22 3/31/23 6/30/23 9/30/23 Net Restaurant Growth TH - Canada (1.7%) (1.5%) (1.0%) 0.3% 0.3% (0.2%) (0.5%) (1.0%) (1.3%) (1.3%) (1.2%) (1.0%) (0.6%) BK - US (2.8%) (2.2%) (1.7%) 0.3% 0.3% (0.1%) (0.5%) (0.4%) (0.9%) (0.9%) (1.7%) (2.2%) (2.8%) PLK - US 5.6% 5.8% 5.6% 5.6% 5.6% 5.7% 6.0% 6.1% 6.1% 6.1% 5.9% 5.1% 5.0% FHS - US 1.0% 1.6% 1.0% 1.0% 1.0% 1.0% 1.9% 2.2% 2.0% 2.0% 1.6% 1.2% 1.8% International: TH 49.3% 64.7% 74.0% 79.6% 79.6% 77.3% 60.1% 52.2% 50.1% 50.1% 44.0% 42.5% 35.6% BK 0.4% 1.5% 3.2% 5.1% 5.1% 4.8% 4.8% 4.3% 5.3% 5.3% 5.1% 5.2% 5.6% PLK (1.3%) 1.3% 2.2% 11.8% 11.8% 13.9% 15.4% 18.0% 27.0% 27.0% 30.6% 33.0% 36.3% FHS 7.7% 15.4% 15.4% System Restaurant Count at Period End TH - Canada 3,935 3,938 3,940 3,949 3,949 3,928 3,917 3,899 3,896 3,896 3,882 3,878 3,874 BK - US 7,097 7,095 7,093 7,105 7,105 7,088 7,058 7,062 7,042 7,042 6,964 6,900 6,864 PLK - US 2,633 2,667 2,693 2,754 2,754 2,784 2,827 2,858 2,921 2,921 2,947 2,972 3,000 FHS - US 1,157 1,159 1,155 1,164 1,164 1,169 1,181 1,180 1,187 1,187 1,174 1,182 1,188 International: TH 436 509 581 720 720 773 815 884 1,081 1,081 1,113 1,161 1,199 BK 11,288 11,371 11,516 11,814 11,814 11,031 11,103 11,180 11,580 11,580 11,594 11,677 11,811 PLK 617 635 649 674 674 703 733 766 856 856 918 975 1,044 FHS 14 15 15 Note: INTL results exclude U.S. for TH and Canada for BK, PLK and FHS. BK INTL includes Russia from 1/1/21 to 12/31/21. FHS INTL excludes Puerto Rico from 1/1/21 to 12/31/22. Restaurants in Puerto Rico were reclassified to International beginning January 1, 2023. FHS figures from 1/1/21 through 12/14/21 are shown for informational purposes only. Supplemental Operational Information Home Market and International Results by Brand (Continued) Page 11

3 Months Ending Year-End 3 Months Ending Year-End 3 Months Ending 3/31/21 6/30/21 9/30/21 12/31/21 12/31/21 3/31/22 6/30/22 9/30/22 12/31/22 12/31/22 3/31/23 6/30/23 9/30/23 Income from Operations $442 $488 $533 $416 $1,879 $450 $541 $561 $346 $1,898 $447 $554 $582 Franchise Agreement Amortization 8 8 8 8 32 8 8 8 8 32 8 8 7 FHS Transaction Costs 18 18 1 4 3 16 24 19 Corporate Restructuring and Advisory Fees 1 3 4 8 16 3 6 12 25 46 5 7 5 Impact of Equity Method Investments 4 7 11 3 25 16 12 13 18 59 9 15 5 Other Operating Expenses (Income), net (42) 8 (16) 57 7 (16) (25) (27) 93 25 17 (7) 10 AOI $413 $514 $540 $510 $1,977 $462 $546 $570 $506 $2,084 $505 $577 $609 AOI Tim Hortons $171 $216 $242 $216 $845 $193 $237 $269 $226 $925 $212 $246 $269 Burger King 90 121 110 100 421 94 112 103 87 396 96 110 111 Popeyes 50 52 50 46 198 47 54 52 52 205 51 56 58 Firehouse 2 2 8 8 9 8 33 9 11 10 International 102 125 138 146 511 120 135 137 133 525 137 154 161 Consolidated $413 $514 $540 $510 $1,977 $462 $546 $570 $506 $2,084 $505 $577 $609 Segment G&A $103 $105 $111 $131 $450 $129 $136 $141 $155 $561 $151 $156 $164 FHS Transaction Costs 18 18 1 4 3 16 24 19 Corporate Restructuring and Advisory Fees 1 3 4 8 16 3 6 12 25 46 5 7 5 General and Administrative Expenses $104 $108 $115 $157 $484 $133 $146 $156 $196 $631 $175 $163 $169 Net Income $271 $391 $329 $262 $1,253 $270 $346 $530 $336 $1,482 $277 $351 $364 Income Tax (Benefit) Expense 47 (29) 65 27 110 53 66 (102) (134) (117) 28 58 59 Loss on Early Extinguishment of Debt 11 11 16 Interest Expense, net 124 126 128 127 505 127 129 133 144 533 142 145 143 Income from Operations $442 $488 $533 $416 $1,879 $450 $541 $561 $346 $1,898 $447 $554 $582 Franchise Agreement Amortization ("FAA") 8 8 8 8 32 8 8 8 8 32 8 8 7 FHS Transaction Costs 18 18 1 4 3 16 24 19 Corporate Restructuring and Advisory Fees 1 3 4 8 16 3 6 12 25 46 5 7 5 Impact of Equity Method Investments 4 7 11 3 25 16 12 13 18 59 9 15 5 Other Operating Expenses (Income), net (42) 8 (16) 57 7 (16) (25) (27) 93 25 17 (7) 10 Depreciation and Amortization, Excluding FAA 41 43 42 43 169 41 40 38 39 158 38 41 40 SBC 26 20 25 31 102 27 32 34 43 136 45 47 49 Adjusted EBITDA $480 $577 $607 $584 $2,248 $530 $618 $642 $588 $2,378 $588 $665 $698 Note: No change to previously reported Adjusted EBITDA results. Amounts may not recalculate due to rounding. Reconciliation of Income from Operations to AOI, Net Income to Adjusted EBITDA and Segment G&A to G&A $ in millions (nominal) Page 12

3 Months Ending Year-End 3 Months Ending Year-End 3 Months Ending 3/31/21 6/30/21 9/30/21 12/31/21 12/31/21 3/31/22 6/30/22 9/30/22 12/31/22 12/31/22 3/31/23 6/30/23 9/30/23 Net Income $271 $391 $329 $262 $1,253 $270 $346 $530 $336 $1,482 $277 $351 $364 Income Tax (Benefit) Expense 47 (29) 65 27 110 53 66 (102) (134) (117) 28 58 59 Income Before Income Taxes $318 $362 $394 $289 $1,363 $323 $412 $428 $202 $1,365 $305 $409 $423 Adjustments: Franchise Agreement Amortization $8 $8 $8 $8 $32 $8 $8 $8 $8 $32 $8 $8 $7 Amortization of Deferred Financing Costs and Debt Issuance Discount 7 6 7 7 27 7 7 7 7 28 7 7 7 Interest Expense and Loss on Extinguished Debt 8 7 24 20 59 16 16 16 16 64 12 13 28 FHS Transaction Costs 18 18 1 4 3 16 24 19 Corporate Restructuring and Advisory Fees 1 3 4 8 16 3 6 12 25 46 5 7 5 Impact of Equity Method Investments 4 7 11 3 25 16 12 13 18 59 9 15 5 Other Operating Expenses (Income), net (42) 8 (16) 57 7 (16) (25) (27) 93 25 17 (7) 10 Total Adjustments ($14) $39 $38 $121 $184 $35 $28 $32 $183 $278 $77 $43 $62 Adjusted Income Before Income Taxes $304 $401 $432 $410 $1,547 $358 $440 $460 $385 $1,643 $382 $452 $485 Adjusted Income Tax Expense 47 43 79 70 239 63 67 24 59 213 42 65 72 Adjusted Net Income $257 $358 $353 $340 $1,308 $295 $373 $436 $326 $1,430 $340 $387 $413 Adjusted Diluted Earnings per Share $0.55 $0.77 $0.76 $0.74 $2.82 $0.64 $0.82 $0.96 $0.72 $3.14 $0.75 $0.85 $0.90 Weighted Average Diluted Shares Outstanding 465 466 465 462 464 458 455 454 455 455 456 458 459 Note: No change to previously reported results. Reconcilation of Net Income to Adjusted Net Income and Adjusted Diluted EPS $ in millions except per share data Page 13

As of Year-End As of Year-End As of Balance Sheet and Leverage 3/31/21 6/30/21 9/30/21 12/31/21 12/31/21 3/31/22 6/30/22 9/30/22 12/31/22 12/31/22 3/31/23 6/30/23 9/30/23 Net Leverage Long-Term Debt, net of Current Portion $12,386 $12,375 $12,379 $12,916 $12,916 $12,903 $12,881 $12,853 $12,839 $12,839 $12,821 $12,801 $12,862 Finance Leases, net of Current Portion 318 326 328 333 333 337 326 310 311 311 310 315 305 Current Portion of Long-Term Debt and Finance Leases 112 113 113 96 96 105 112 117 127 127 128 132 87 Unamortized Deferred Financing Costs and Deferred Issue Discount 148 142 138 138 138 131 125 118 111 111 105 98 128 Total Debt $12,964 $12,956 $12,958 $13,483 $13,483 $13,476 $13,444 $13,398 $13,388 $13,388 $13,364 $13,346 $13,382 Cash and Cash Equivalents 1,563 1,762 1,773 1,087 1,087 895 838 946 1,178 1,178 1,033 1,213 1,310 Net Debt $11,401 $11,194 $11,185 $12,396 $12,396 $12,581 $12,606 $12,452 $12,210 $12,210 $12,331 $12,133 $12,072 LTM Adjusted EBITDA 1,900 2,119 2,165 2,248 2,248 2,298 2,339 2,374 2,378 2,378 2,436 2,483 2,539 Adjusted EBITDA Net Leverage 6.0x 5.3x 5.2x 5.5x 5.5x 5.5x 5.4x 5.2x 5.1x 5.1x 5.1x 4.9x 4.8x 3 Months Ending Year-End 3 Months Ending Year-End 3 Months Ending Free Cash Flow and Net Interest Paid 3/31/21 6/30/21 9/30/21 12/31/21 12/31/21 3/31/22 6/30/22 9/30/22 12/31/22 12/31/22 3/31/23 6/30/23 9/30/23 Free Cash Flow Net Cash Provided by Operating Activities $266 $479 $510 $471 $1,726 $234 $435 $398 $423 $1,490 $95 $392 $433 Payments for Property and Equipment (15) (31) (24) (36) (106) (10) (18) (24) (48) (100) (18) (30) (25) Free Cash Flow $251 $448 $486 $435 $1,620 $224 $417 $374 $375 $1,390 $77 $362 $408 Net Interest Paid Interest Paid $72 126 $83 $123 $404 $75 134 $109 $169 $487 $163 $217 $164 Proceeds (Payments) from Derivatives, net within Investing Activities 4 2 3 3 12 3 5 10 45 63 11 12 12 Proceeds (Payments) from Derivatives, net within Financing Activities (16) (16) (13) (6) (51) (6) 14 26 34 29 34 37 Interest Income 1 1 1 3 1 2 4 7 7 9 13 Net Interest Paid $83 $140 $92 $125 $440 $78 $128 $83 $94 $383 $116 $162 $102 Note: No change to previously reported results. Net Leverage, Reconciliation of Free Cash Flow and Net Interest Paid $ in millions Page 14

3 Months Ending Year-End 3 Months Ending Year-End 3 Months Ending 3/31/21 6/30/21 9/30/21 12/31/21 12/31/21 3/31/22 6/30/22 9/30/22 12/31/22 12/31/22 3/31/23 6/30/23 9/30/23 Organic Revenue Growth Total Revenues Current Year Period $1,260 $1,438 $1,495 $1,546 $5,739 $1,451 $1,639 $1,726 $1,689 $6,505 $1,590 $1,775 $1,837 - Total Revenues Prior Year Period 1,225 1,048 1,337 1,358 4,968 1,260 1,438 1,495 1,546 5,739 1,451 1,639 1,726 = $ Variance (Nominal) $35 $390 $158 $188 $771 $191 $201 $231 $143 $766 $139 $136 $111 - FHS Impact 5 5 31 33 38 31 133 - Impact of FX Movements 42 72 41 21 176 (8) (42) (48) (76) (174) (56) (44) (19) = Organic Growth $ ($7) $318 $117 $162 $590 $168 $210 $241 $188 $807 $195 $180 $130 Organic Revenue Growth % (0.5%) 28.3% 8.5% 11.8% 11.5% 13.5% 15.1% 16.5% 12.8% 14.5% 13.9% 11.4% 7.6% Organic Adjusted EBITDA Growth Total Adjusted EBITDA Current Year Period $480 $577 $607 $584 $2,248 $530 $618 $642 $588 $2,378 $588 $665 $698 - Total Adjusted EBITDA Prior Year Period 444 358 561 501 1,864 480 577 607 584 2,248 530 618 642 = $ Variance (Nominal) $36 $219 $46 $83 $384 $50 $41 $35 $4 $130 $58 $47 $56 - FHS Impact 2 2 14 13 13 14 54 - Impact of FX Movements 13 22 15 5 55 (7) (21) (26) (31) (85) (21) (15) (4) = Organic Growth $ $23 $197 $31 $76 $327 $43 $49 $48 $21 $161 $79 $62 $60 Organic Adjusted EBITDA Growth % 5.2% 51.8% 5.1% 15.3% 17.1% 9.2% 8.7% 8.3% 4.0% 7.5% 15.6% 10.3% 9.3% Note: No change to previously reported results. Percentage changes may not recalculate due to rounding. Reconcilation of Organic Revenue and Adjusted EBITDA Growth $ in millions Page 15

Non-GAAP Financial Measure Definition Adjusted Operating Income ("AOI") EBITDA Adjusted EBITDA LTM Adjusted EBITDA Adjusted Net Income Adjusted Diluted EPS Free Cash Flow Net Interest Paid Net income excluding (i) franchise agreement amortization as a result of acquisition accounting, (ii) amortization of deferred financing costs and debt issuance discount, (iii) loss on early extinguishment of debt and interest expense, which represents non-cash interest expense related to losses reclassified from accumulated comprehensive income (loss) into interest expense in connection with interest rate swaps de-designated in May 2015, November 2019 and September 2021, (iv) (income) loss from equity method investments, net of cash distributions received from equity method investments, (v) other operating expenses (income), net, and (vi) income or expense from non-recurring projects and non-operating activities (as described above). Calculated by dividing Adjusted Net Income by the weighted average diluted shares outstanding of RBI during the reporting period. Adjusted Net Income and Adjusted Diluted EPS are used by management to evaluate the operating performance of the business, excluding certain non-cash and other specifically Total of Net cash provided by operating activities minus Payments for property and equipment. Free Cash Flow is a liquidity measure used by management as one factor in determining the amount of cash that is available for working capital needs or other uses of cash, however, it does not represent residual cash flows available for discretionary expenditures. LTM Free Cash Flow is defined as Free Cash Flow for the last twelve-month period to the date reported Total of cash interest paid in the period, cash proceeds (payments) related to derivatives, net from both investing activities and financing activities and cash interest income received. This liquidity measure is used by management to understand the net effect of interest paid, received and related hedging payments and receipts Non-GAAP Financial Measure Definitions method investments, net of cash distributions received from equity method investments, (iii) other operating expenses (income), net and, (iv) income/expenses from non-recurring projects and non-operating activities. For the periods referenced in the following financial results, income/expenses from non-recurring projects and non-operating activities included (i) non-recurring fees and expense incurred in connection with the Firehouse Acquisition consisting of consulting services associated with certain transformational corporate restructuring initiatives that rationalize our structure and optimize cash movements as types of expenses are either not related to our underlying profitability drivers or not likely to re-occur in the foreseeable future and the varied timing, size and nature of these projects may cause volatility in our results unrelated to the performance of our core business that does not reflect trends of our core operations. AOI is used by management to measure operating performance of the business, excluding these other specifically identified items that segment income for each of our five operating segments. Earnings (net income or loss) before interest expense, net, (gain) loss on early extinguishment of debt, income tax (benefit) expense, and depreciation and amortization and is used by management to measure operating performance of the business. EBITDA excluding (i) the non-cash impact of share-based compensation and non-cash incentive compensation expense, (ii) (income) loss from equity method investments, net of cash distributions received from equity method investments, (iii) other operating expenses (income), net, and (iv) income or expense from non-recurring projects and non-operating activities (as described above). Adjusted EBITDA for the last twelve-month period to the date reported. Page 16

v3.23.4

Cover

|

Jan. 08, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 08, 2024

|

| Entity Registrant Name |

RESTAURANT BRANDS INTERNATIONAL INC.

|

| Entity Central Index Key |

0001618756

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

Z4

|

| Entity File Number |

001-36786

|

| Entity Tax Identification Number |

98-1202754

|

| Entity Address, Address Line One |

130 King Street West, Suite 300

|

| Entity Address, City or Town |

Toronto,

|

| Entity Address, State or Province |

ON

|

| Entity Address, Postal Zip Code |

M5X 1E1

|

| City Area Code |

905

|

| Local Phone Number |

339-6011

|

| Title of 12(b) Security |

Common Shares, without par value

|

| Trading Symbol |

QSR

|

| Security Exchange Name |

NYSE

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Restaurant Brands International Limited Partnership |

|

| Entity Information [Line Items] |

|

| Entity Registrant Name |

RESTAURANT BRANDS INTERNATIONAL LIMITED PARTNERSHIP

|

| Entity Central Index Key |

0001618755

|

| Entity Incorporation, State or Country Code |

A6

|

| Entity File Number |

001-36787

|

| Entity Tax Identification Number |

98-1206431

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

dei_LegalEntityAxis=qsr_RestaurantBrandsInternationalLimitedPartnershipMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

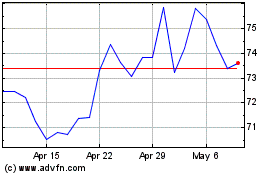

Restaurant Brands (NYSE:QSR)

Historical Stock Chart

From Apr 2024 to May 2024

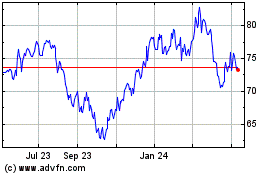

Restaurant Brands (NYSE:QSR)

Historical Stock Chart

From May 2023 to May 2024