Current Report Filing (8-k)

June 06 2023 - 5:20PM

Edgar (US Regulatory)

0001509223

false

00-0000000

0001509223

2023-06-01

2023-06-01

0001509223

RENN:AmericanDepositarySharesEachRepresenting45ClassOrdinarySharesMember

2023-06-01

2023-06-01

0001509223

RENN:ClassOrdinarySharesParValue0.001PerShareMember

2023-06-01

2023-06-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

June 1, 2023

Renren Inc.

(Exact Name of Registrant as specified in its

charter)

Commission file number: 001-35147

| Cayman Islands |

45 West Buchanan Street,

Phoenix, Arizona, 85003 |

Not Applicable |

(State or other jurisdiction of

incorporation or organization) |

(Address of principal executive offices,

including zip code) |

(I.R.S. Employer

Identification No.) |

| |

|

|

| |

(833) 258-7482 |

|

| |

(Registrant’s telephone number,

including area code) |

|

N/A

(Former name or former

address, if changed

since last report.)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading

Symbol(s) |

Name of each exchange on which

registered |

| American depositary shares, each representing 45 Class A ordinary shares |

RENN |

The New York Stock Exchange |

| Class A ordinary shares, par value $0.001 per share* |

RENN |

The New York Stock Exchange |

* Not for trading, but only in connection with the listing on The New

York Stock Exchange of American depositary shares.

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

As previously disclosed,

Renren Inc. (“Renren” or the “Company”) issued standby letters of credit (“Letters of Credit”) to

the benefit of East West Bank (the “Bank”) that guaranteed the payment of certain loans by Kaixin Auto Holdings (“Kaixin”)

and its subsidiary, Anhui Xin Jieying Auto Retail Co., Ltd. ( “Jieying”), each of whom were previously a subsidiary of the

Company. If Kaixin and/or Jieying defaulted on the guaranteed loans, the Bank may seize the Company’s cash deposits pledged as security

under the Letters of Credit and/or demand reimbursement from the Company. The cash deposits pledged amounted to US$9.1 million as of June

1, 2023. Because the Company believed the guarantee would not be released in the foreseeable future, it had recorded a provision for the

full value of the guarantee in its audited financial statements included in the Company’s Annual Report on Form 10-K for the year

ended December 31, 2022.

As of June 1, 2023, the

Bank had claimed approximately US$5.8 million under the Letters of Credit in connection with Jieying’s default of certain guaranteed

loan denominated in Chinese Renminbi. No payment has been made to the Bank in connection with such claim, but the Company expects to reimburse

the Bank for the full amount of the claim. Additionally, on June 1, 2023, East West Bank assigned to the Company all of the Bank’s

rights, title, and interest in and to that certain US$2,000,000 loan made by the Bank to Kaixin (the “Kaixin USD Loan”) for

a total consideration of approximately US$2.0 million. The Kaixin USD Loan was also guaranteed by the Letters of Credit. The Company is

evaluating its options to pursue recovery from Kaixin after the assignment, but there can be no assurance that the Company will be able

to achieve any recovery.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

RENREN INC. |

| |

|

|

| |

|

|

| |

By: |

/s/ Chris Palmer |

| Date: |

June 6, 2023 |

|

Chris Palmer |

| |

|

Chief Financial Officer |

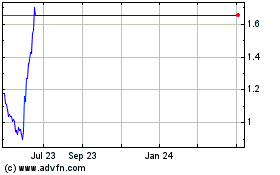

Renren (NYSE:RENN)

Historical Stock Chart

From Dec 2024 to Jan 2025

Renren (NYSE:RENN)

Historical Stock Chart

From Jan 2024 to Jan 2025