0000822416falsetrue00008224162024-07-232024-07-230000822416us-gaap:CommonStockMember2024-07-232024-07-230000822416phm:SeriesAJuniorParticipatingPreferredSharePurchaseRightsMember2024-07-232024-07-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 23, 2024

PULTEGROUP, INC.

(Exact name of registrant as specified in its Charter)

| | | | | | | | |

| Michigan | 1-9804 | 38-2766606 |

| (State or other jurisdiction | (Commission | (IRS Employer |

| of incorporation) | File Number) | Identification No.) |

| | | | | | | | |

| 3350 Peachtree Road NE, Suite 1500 |

| Atlanta, | Georgia | 30326 |

(Address of principal executive offices) (Zip Code)

|

Registrant's telephone number, including area code 404 978-6400

____________________________________________________

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Shares, par value $0.01 | | PHM | | New York Stock Exchange |

Series A Junior Participating Preferred Share Purchase Rights

| | | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company. ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION

On July 23, 2024, PulteGroup, Inc. (the "Company") issued a press release announcing its financial results for its second quarter ended June 30, 2024. A copy of this earnings press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated in Item 2.02 by reference.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

The information in Item 2.02 of this Current Report on Form 8-K, including the earnings press release incorporated in such Item 2.02, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be incorporated by reference in any filing under the Securities Act of 1933, except as expressly set forth by specific reference in such filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | PULTEGROUP, INC. |

| | | | | |

| | | | | |

| Date: | July 23, 2024 | | By: | /s/ Todd N. Sheldon |

| | | | Name: | Todd N. Sheldon |

| | | | Title: | Executive Vice President, General Counsel and Corporate Secretary |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| FOR IMMEDIATE RELEASE | Company Contact |

| Investors: Jim Zeumer |

| (404) 978-6434 |

| Email: jim.zeumer@pultegroup.com |

| |

PULTEGROUP REPORTS SECOND QUARTER 2024 FINANCIAL RESULTS

•Earnings Increased 19% to $3.83 Per Share

•Home Sale Revenues Increased 10% to $4.4 Billion

•Closings Increased 8% to 8,097 Homes; Average Sales Price Increased 2% to $549,000

•Home Sale Gross Margin Increased 30 Basis Points to 29.9%

•Net New Orders Totaled 7,649 Homes with a Value of $4.4 Billion

•Unit Backlog of 12,982 Homes with a Value of $8.1 Billion

•Repurchased $314 Million of Common Shares and $300 Million of Senior Notes in the Quarter

ATLANTA - July 23, 2024 – PulteGroup, Inc. (NYSE: PHM) announced today financial results for its second quarter ended June 30, 2024. For the quarter, the Company reported net income of $809 million, or $3.83

per share. Reported net income for the quarter includes a $52 million pre-tax, or $0.19 per share, insurance benefit recorded in the period, and a $13 million, or $0.06 per share, benefit related to the favorable resolution of certain state tax matters. Prior year reported net income of $720 million, or $3.21 per share, included a $65 million pre-tax, or $0.21 per share, insurance benefit recorded in the period.

“PulteGroup’s balanced operating model continues to deliver outstanding financial results as increases in closings, average sales price and gross margin were key drivers of the 19% increase in our earnings to $3.83 per share,” said Ryan Marshall, President and Chief Executive Officer of PulteGroup. “The resulting strong cash flows are providing us with tremendous flexibility as we continued to intelligently allocate capital in the quarter to invest in our business growth, while returning funds to shareholders and further strengthening our overall capital structure.

“While interest rate movements can impact short-term homebuying demand, long-term market dynamics continue to benefit from a structural shortage of homes caused by years of underbuilding,” added Mr. Marshall. “As demonstrated by our 27.1% return on equity* for the past 12 months, we continue to successfully navigate these conditions by actively managing sales price, pace and starts on a community-by-community basis with the goal of realizing high returns on invested capital and equity over time.”

Home sale revenues for the second quarter increased 10% over the prior year to $4.4 billion. Higher revenues in the quarter were driven by an 8% increase in closings to 8,097 homes, combined with a 2% increase in average sales price to $549,000.

The Company reported second quarter homebuilding gross margins of 29.9%, which is an increase of 30 basis points over both last year and the first quarter of 2024. The Company’s reported second quarter SG&A expense of $361 million, or 8.1% of home sale revenues, includes the $52 million pre-tax insurance benefit recorded in the quarter. Prior year reported SG&A expense of $315 million, or 7.8% of home sale revenues, includes a $65 million pre-tax insurance benefit recorded in the second quarter of 2023.

In the second quarter, the Company reported net new orders of 7,649, compared with 7,947 homes in the comparable prior year period. The dollar value of net new orders in the second quarter increased 2% over the prior year to $4.4 billion. The Company operated out of an average of 934 communities in the period, which is an increase of 3% over the second quarter of 2023.

At the end of the second quarter, the Company’s backlog was 12,982 homes with a value of $8.1 billion.

The Company's financial services operations reported second quarter pre-tax income of $63 million, compared with prior year pre-tax income of $46 million. The 36% increase in pre-tax income was driven by gains across all business lines within financial services: mortgage, title and insurance. Mortgage capture rate for the second quarter was 86%, up from 80% last year.

The Company’s reported income tax expense for the second quarter was $239 million, representing an effective tax rate of 22.8%. The Company’s effective tax rate is inclusive of the $13 million benefit related to the favorable resolution of certain state tax matters realized in the quarter.

In the second quarter, the Company repurchased 2.8 million of its outstanding common shares for $314 million, or an average price of $113.79 per share. The Company also completed a tender offer in the period for $300 million of its outstanding senior notes, lowering its quarter-end outstanding notes payable to $1.7 billion. Inclusive of these transactions, the Company ended the second quarter with $1.4 billion of cash and a debt-to-capital ratio of 12.8%.

A conference call discussing PulteGroup's second quarter 2024 results is scheduled for Tuesday, July 23, 2024, at 8:30 a.m. Eastern Time. Interested investors can access the live webcast via PulteGroup's corporate website at www.pultegroup.com.

* The Company's return on equity is calculated as net income for the trailing twelve months divided by average shareholders' equity, where average shareholders' equity is the sum of ending shareholders' equity balances of the trailing five quarters divided by five.

Forward-Looking Statements

This release includes “forward-looking statements.” These statements are subject to a number of risks, uncertainties and other factors that could cause our actual results, performance, prospects or opportunities, as well as those of the markets we serve or intend to serve, to differ materially from those expressed in, or implied by, these statements.

You can identify these statements by the fact that they do not relate to matters of a strictly factual or historical nature and generally discuss or relate to forecasts, estimates or other expectations regarding future events. Generally, the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “plan,” “project,” “may,” “can,” “could,” “might,” “should,” “will” and similar expressions identify forward-looking statements, including statements related to any potential impairment charges and the impacts or effects thereof, expected operating and performing results, planned transactions, planned objectives of management, future developments or conditions in the industries in which we participate and other trends, developments and uncertainties that may affect our business in the future.

Such risks, uncertainties and other factors include, among other things: interest rate changes and the availability of mortgage financing; the impact of any changes to our strategy in responding to the cyclical nature of the industry or deteriorations in industry changes or downward changes in general economic or other business conditions, including any changes regarding our land positions and the levels of our land spend; economic changes nationally or in our

local markets, including inflation, deflation, changes in consumer confidence and preferences and the state of the market for homes in general; labor supply shortages and the cost of labor; the availability and cost of land and other raw materials used by us in our homebuilding operations; a decline in the value of the land and home inventories we maintain and resulting possible future writedowns of the carrying value of our real estate assets; competition within the industries in which we operate; governmental regulation directed at or affecting the housing market, the homebuilding industry or construction activities, slow growth initiatives and/or local building moratoria; the availability and cost of insurance covering risks associated with our businesses, including warranty and other legal or regulatory proceedings or claims; damage from improper acts of persons over whom we do not have control or attempts to impose liabilities or obligations of third parties on us; weather related slowdowns; the impact of climate change and related governmental regulation; adverse capital and credit market conditions, which may affect our access to and cost of capital; the insufficiency of our income tax provisions and tax reserves, including as a result of changing laws or interpretations; the potential that we do not realize our deferred tax assets; our inability to sell mortgages into the secondary market; uncertainty in the mortgage lending industry, including revisions to underwriting standards and repurchase requirements associated with the sale of mortgage loans, and related claims against us; risks related to information technology failures, data security issues, and the effect of cybersecurity incidents and threats; the impact of negative publicity on sales; failure to retain key personnel; the impairment of our intangible assets; the disruptions associated with the COVID-19 pandemic (or another epidemic or pandemic or similar public threat or fear of such an event), and the measures taken to address it; and other factors of national, regional and global scale, including those of a political, economic, business and competitive nature. See Item 1A – Risk Factors in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 for a further discussion of these and other risks and uncertainties applicable to our businesses. We undertake no duty to update any forward-looking statement, whether as a result of new information, future events or changes in our expectations.

About PulteGroup

PulteGroup, Inc. (NYSE: PHM), based in Atlanta, Georgia, is one of America’s largest homebuilding companies with operations in more than 45 markets throughout the country. Through its brand portfolio that includes Centex, Pulte Homes, Del Webb, DiVosta Homes, American West and John Wieland Homes and Neighborhoods, the company is one of the industry’s most versatile homebuilders able to meet the needs of multiple buyer groups and respond to changing consumer demand. PulteGroup’s purpose is building incredible places where people can live their dreams.

For more information about PulteGroup, Inc. and PulteGroup brands, go to pultegroup.com; pulte.com; centex.com; delwebb.com; divosta.com; jwhomes.com; and americanwesthomes.com. Follow PulteGroup, Inc. on X: @PulteGroupNews.

# # #

PulteGroup, Inc.

Consolidated Statements of Operations

($000's omitted, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, | | June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenues: | | | | | | | |

| Homebuilding | | | | | | | |

| Home sale revenues | $ | 4,448,168 | | | $ | 4,058,930 | | | $ | 8,267,754 | | | $ | 7,546,567 | |

| Land sale and other revenues | 39,825 | | | 37,604 | | | 77,042 | | | 67,671 | |

| 4,487,993 | | | 4,096,534 | | | 8,344,796 | | | 7,614,238 | |

| Financial Services | 111,662 | | | 92,219 | | | 204,019 | | | 150,156 | |

| Total revenues | 4,599,655 | | | 4,188,753 | | | 8,548,815 | | | 7,764,394 | |

| | | | | | | |

| Homebuilding Cost of Revenues: | | | | | | | |

| Home sale cost of revenues | (3,117,482) | | | (2,856,361) | | | (5,806,569) | | | (5,328,690) | |

| Land sale and other cost of revenues | (38,873) | | | (32,494) | | | (75,917) | | | (57,461) | |

| (3,156,355) | | | (2,888,855) | | | (5,882,486) | | | (5,386,151) | |

| | | | | | | |

| Financial Services expenses | (49,334) | | | (46,778) | | | (100,712) | | | (90,813) | |

| Selling, general, and administrative expenses | (361,145) | | | (314,637) | | | (718,739) | | | (651,156) | |

| Equity income from unconsolidated entities, net | 2,167 | | | 944 | | | 40,069 | | | 3,456 | |

| | | | | | | |

| Other income, net | 13,324 | | | 13,586 | | | 30,008 | | | 15,405 | |

| Income before income taxes | 1,048,312 | | | 953,013 | | | 1,916,955 | | | 1,655,135 | |

| Income tax expense | (239,179) | | | (232,668) | | | (444,846) | | | (402,531) | |

| Net income | $ | 809,133 | | | $ | 720,345 | | | $ | 1,472,109 | | | $ | 1,252,604 | |

| | | | | | | |

| Per share: | | | | | | | |

| Basic earnings | $ | 3.86 | | | $ | 3.23 | | | $ | 6.99 | | | $ | 5.58 | |

| Diluted earnings | $ | 3.83 | | | $ | 3.21 | | | $ | 6.93 | | | $ | 5.55 | |

| Cash dividends declared | $ | 0.20 | | | $ | 0.16 | | | $ | 0.40 | | | $ | 0.32 | |

| | | | | | | |

| Number of shares used in calculation: | | | | | | | |

| Basic | 209,547 | | | 222,160 | | | 210,692 | | | 223,635 | |

| Effect of dilutive securities | 1,654 | | | 1,232 | | | 1,682 | | | 1,031 | |

| Diluted | 211,201 | | | 223,392 | | | 212,374 | | | 224,666 | |

PulteGroup, Inc.

Condensed Consolidated Balance Sheets

($000's omitted)

(Unaudited)

| | | | | | | | | | | |

| June 30,

2024 | | December 31,

2023 |

| | | |

| ASSETS | | | |

| | | |

| Cash and equivalents | $ | 1,392,902 | | | $ | 1,806,583 | |

| Restricted cash | 53,064 | | | 42,594 | |

| Total cash, cash equivalents, and restricted cash | 1,445,966 | | | 1,849,177 | |

| House and land inventory | 12,302,301 | | | 11,795,370 | |

| Land held for sale | 21,559 | | | 23,831 | |

| Residential mortgage loans available-for-sale | 569,387 | | | 516,064 | |

| Investments in unconsolidated entities | 210,246 | | | 166,913 | |

| Other assets | 1,820,092 | | | 1,545,667 | |

| Goodwill | 68,930 | | | 68,930 | |

| Other intangible assets | 51,300 | | | 56,338 | |

| Deferred tax assets | 54,288 | | | 64,760 | |

| $ | 16,544,069 | | | $ | 16,087,050 | |

| | | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | |

| | | |

| Liabilities: | | | |

| Accounts payable | $ | 651,580 | | | $ | 619,012 | |

| Customer deposits | 654,427 | | | 675,091 | |

| Deferred tax liabilities | 381,021 | | | 302,155 | |

| Accrued and other liabilities | 1,459,998 | | | 1,645,690 | |

| Financial Services debt | 524,042 | | | 499,627 | |

| | | |

| Notes payable | 1,650,178 | | | 1,962,218 | |

| 5,321,246 | | | 5,703,793 | |

| Shareholders' equity | 11,222,823 | | | 10,383,257 | |

| $ | 16,544,069 | | | $ | 16,087,050 | |

PulteGroup, Inc.

Consolidated Statements of Cash Flows

($000's omitted)

(Unaudited)

| | | | | | | | | | | |

| Six Months Ended |

| June 30, |

| 2024 | | 2023 |

| Cash flows from operating activities: | | | |

| Net income | $ | 1,472,109 | | | $ | 1,252,604 | |

| Adjustments to reconcile net income to net cash from operating activities: | | | |

| Deferred income tax expense | 89,321 | | | 93,389 | |

| Land-related charges | 7,798 | | | 10,110 | |

| | | |

| Depreciation and amortization | 42,891 | | | 39,204 | |

| Equity income from unconsolidated entities | (40,069) | | | (3,456) | |

| Distributions of income from unconsolidated entities | 2,358 | | | 4,564 | |

| Share-based compensation expense | 29,084 | | | 27,960 | |

| Other, net | 120 | | | (161) | |

| Increase (decrease) in cash due to: | | | |

| Inventories | (473,665) | | | 52,001 | |

| Residential mortgage loans available-for-sale | (55,346) | | | 244,516 | |

| Other assets | (294,335) | | | (6,602) | |

| Accounts payable, accrued and other liabilities | (123,002) | | | (263,546) | |

| Net cash provided by operating activities | 657,264 | | | 1,450,583 | |

| Cash flows from investing activities: | | | |

| Capital expenditures | (55,317) | | | (45,076) | |

| Investments in unconsolidated entities | (9,096) | | | (7,858) | |

| Distributions of capital from unconsolidated entities | 3,474 | | | 2,216 | |

| | | |

| Other investing activities, net | (5,262) | | | (3,278) | |

| Net cash used in investing activities | (66,201) | | | (53,996) | |

| Cash flows from financing activities: | | | |

| | | |

| Repayments of notes payable | (318,288) | | | (17,305) | |

| | | |

| | | |

| Financial Services borrowings (repayments), net | 24,416 | | | (271,128) | |

| | | |

| Proceeds from liabilities related to consolidated inventory not owned | 32,721 | | | 91,354 | |

| Payments related to consolidated inventory not owned | (70,608) | | | (33,577) | |

| | | |

| Share repurchases | (559,999) | | | (400,000) | |

| Cash paid for shares withheld for taxes | (17,623) | | | (10,389) | |

| Dividends paid | (84,893) | | | (72,315) | |

| Net cash used in financing activities | (994,274) | | | (713,360) | |

| Net increase (decrease) in cash, cash equivalents, and restricted cash | (403,211) | | | 683,227 | |

| Cash, cash equivalents, and restricted cash at beginning of period | 1,849,177 | | | 1,094,553 | |

| Cash, cash equivalents, and restricted cash at end of period | $ | 1,445,966 | | | $ | 1,777,780 | |

| | | |

| Supplemental Cash Flow Information: | | | |

| Interest paid (capitalized), net | $ | 13,215 | | | $ | 2,757 | |

| Income taxes paid (refunded), net | $ | 365,061 | | | $ | 380,527 | |

PulteGroup, Inc.

Segment Data

($000's omitted)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, | | June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| HOMEBUILDING: | | | | | | | |

| Home sale revenues | $ | 4,448,168 | | | $ | 4,058,930 | | | $ | 8,267,754 | | | $ | 7,546,567 | |

| Land sale and other revenues | 39,825 | | | 37,604 | | | 77,042 | | | 67,671 | |

| Total Homebuilding revenues | 4,487,993 | | | 4,096,534 | | | 8,344,796 | | | 7,614,238 | |

| | | | | | | |

| Home sale cost of revenues | (3,117,482) | | | (2,856,361) | | | (5,806,569) | | | (5,328,690) | |

| Land sale and other cost of revenues | (38,873) | | | (32,494) | | | (75,917) | | | (57,461) | |

| Selling, general, and administrative expenses | (361,145) | | | (314,637) | | | (718,739) | | | (651,156) | |

| Equity income (loss) from unconsolidated entities, net | 1,117 | | | (110) | | | 39,019 | | | 2,402 | |

| | | | | | | |

| Other income, net | 13,324 | | | 13,586 | | | 30,008 | | | 15,405 | |

| Income before income taxes | $ | 984,934 | | | $ | 906,518 | | | $ | 1,812,598 | | | $ | 1,594,738 | |

| | | | | | | |

| FINANCIAL SERVICES: | | | | | | | |

| Income before income taxes | $ | 63,378 | | | $ | 46,495 | | | $ | 104,357 | | | $ | 60,397 | |

| | | | | | | |

| CONSOLIDATED: | | | | | | | |

| Income before income taxes | $ | 1,048,312 | | | $ | 953,013 | | | $ | 1,916,955 | | | $ | 1,655,135 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

PulteGroup, Inc.

Segment Data, continued

($000's omitted)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| | | Three Months Ended | | Six Months Ended |

| | | June 30, | | June 30, |

| | | | | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | | | | | |

| Home sale revenues | | | | | $ | 4,448,168 | | | $ | 4,058,930 | | | $ | 8,267,754 | | | $ | 7,546,567 | |

| | | | | | | | | | | |

| Closings - units | | | | | | | | | | | |

| Northeast | | | | | 378 | | | 315 | | | 663 | | | 652 | |

| Southeast | | | | | 1,499 | | | 1,405 | | | 2,944 | | | 2,573 | |

| Florida | | | | | 2,150 | | | 2,067 | | | 4,067 | | | 3,819 | |

| Midwest | | | | | 1,196 | | | 918 | | | 2,186 | | | 1,675 | |

| Texas | | | | | 1,472 | | | 1,511 | | | 2,800 | | | 2,819 | |

| West | | | | | 1,402 | | | 1,302 | | | 2,532 | | | 2,374 | |

| | | | | 8,097 | | | 7,518 | | | 15,192 | | | 13,912 | |

| Average selling price | | | | | $ | 549 | | | $ | 540 | | | $ | 544 | | | $ | 542 | |

| | | | | | | | | | | |

| Net new orders - units | | | | | | | | | | | |

| Northeast | | | | | 400 | | | 400 | | | 841 | | | 785 | |

| Southeast | | | | | 1,396 | | | 1,556 | | | 2,790 | | | 2,903 | |

| Florida | | | | | 1,746 | | | 1,910 | | | 3,718 | | | 3,788 | |

| Midwest | | | | | 1,265 | | | 1,253 | | | 2,539 | | | 2,336 | |

| Texas | | | | | 1,275 | | | 1,388 | | | 2,729 | | | 2,812 | |

| West | | | | | 1,567 | | | 1,440 | | | 3,411 | | | 2,677 | |

| | | | | 7,649 | | | 7,947 | | | 16,028 | | | 15,301 | |

| Net new orders - dollars | | | | | $ | 4,358,508 | | | $ | 4,271,008 | | | $ | 9,057,167 | | | $ | 8,061,001 | |

| | | | | | | | | | | |

| Unit backlog | | | | | | | | | | | |

| Northeast | | | | | | | | | 745 | | | 607 | |

| Southeast | | | | | | | | | 2,092 | | | 2,236 | |

| Florida | | | | | | | | | 3,443 | | | 4,610 | |

| Midwest | | | | | | | | | 2,045 | | | 2,011 | |

| Texas | | | | | | | | | 1,566 | | | 1,782 | |

| West | | | | | | | | | 3,091 | | | 2,312 | |

| | | | | | | | | 12,982 | | | 13,558 | |

| Dollars in backlog | | | | | | | | | $ | 8,109,128 | | | $ | 8,188,502 | |

| | | | | | | | | | | |

PulteGroup, Inc.

Segment Data, continued

($000's omitted)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, | | June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| MORTGAGE ORIGINATIONS: | | | | | | | |

| Origination volume | 5,105 | | | 4,539 | | | 9,437 | | | 8,408 | |

| Origination principal | $ | 2,140,103 | | | $ | 1,790,977 | | | $ | 3,895,150 | | | $ | 3,307,427 | |

| Capture rate | 86.5 | % | | 79.7 | % | | 85.4 | % | | 79.1 | % |

Supplemental Data

($000's omitted)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, | | June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| Interest in inventory, beginning of period | $ | 148,101 | | | $ | 141,271 | | | $ | 139,078 | | | $ | 137,262 | |

| Interest capitalized | 29,284 | | | 31,927 | | | 59,903 | | | 63,729 | |

| Interest expensed | (28,023) | | | (31,204) | | | (49,619) | | | (58,997) | |

| Interest in inventory, end of period | $ | 149,362 | | | $ | 141,994 | | | $ | 149,362 | | | $ | 141,994 | |

PulteGroup, Inc.

Reconciliation of Non-GAAP Financial Measures

This report contains information about our debt-to-capital ratios. These measures could be considered non-GAAP financial measures under the SEC's rules and should be considered in addition to, rather than as a substitute for, comparable GAAP financial measures. We calculate total net debt by subtracting total cash, cash equivalents, and restricted cash from notes payable to present the amount of assets needed to satisfy the debt. We use the debt-to-capital and net debt-to-capital ratios as indicators of our overall leverage and believe they are useful financial measures in understanding the leverage employed in our operations. We believe that these measures provide investors relevant and useful information for evaluating the comparability of financial information presented and comparing our profitability and liquidity to other companies in the homebuilding industry. Although other companies in the homebuilding industry report similar information, the methods used may differ. We urge investors to understand the methods used by other companies in the homebuilding industry to calculate these measures and any adjustments thereto before comparing our measures to those of such other companies.

The following table sets forth a reconciliation of the debt-to-capital ratios ($000's omitted):

| | | | | | | | | | | | | | |

| Debt-to-Capital Ratios |

| | | | |

| | June 30,

2024 | | December 31,

2023 |

| Notes payable | | $ | 1,650,178 | | | $ | 1,962,218 | |

| | | | |

| | | | |

| | | | |

| Shareholders' equity | | 11,222,823 | | | 10,383,257 | |

| Total capital | | $ | 12,873,001 | | | $ | 12,345,475 | |

| Debt-to-capital ratio | | 12.8 | % | | 15.9 | % |

| | | | |

| Notes payable | | $ | 1,650,178 | | | $ | 1,962,218 | |

Less: Total cash, cash equivalents, and

restricted cash | | (1,445,966) | | | (1,849,177) | |

| Total net debt | | $ | 204,212 | | | $ | 113,041 | |

| Shareholders' equity | | 11,222,823 | | | 10,383,257 | |

| Total net capital | | $ | 11,427,035 | | | $ | 10,496,298 | |

| Net debt-to-capital ratio | | 1.8 | % | | 1.1 | % |

v3.24.2

Document and Entity Information Document

|

Jul. 23, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jul. 23, 2024

|

| Entity Registrant Name |

PULTEGROUP, INC.

|

| Entity Central Index Key |

0000822416

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

MI

|

| Entity File Number |

1-9804

|

| Entity Tax Identification Number |

38-2766606

|

| Entity Address, Address Line One |

3350 Peachtree Road NE, Suite 1500

|

| Entity Address, City or Town |

Atlanta,

|

| Entity Address, State or Province |

GA

|

| Entity Address, Postal Zip Code |

30326

|

| City Area Code |

404

|

| Local Phone Number |

978-6400

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock [Member] |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Shares, par value $0.01

|

| Security Exchange Name |

NYSE

|

| Trading Symbol |

PHM

|

| Series A Junior Participating Preferred Share Purchase Rights [Member] |

|

| Entity Information [Line Items] |

|

| No Trading Symbol Flag |

true

|

| Title of 12(b) Security |

Series A Junior Participating Preferred Share Purchase Rights

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=phm_SeriesAJuniorParticipatingPreferredSharePurchaseRightsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

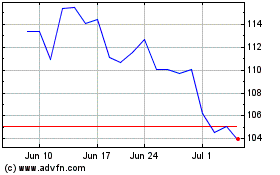

PulteGroup (NYSE:PHM)

Historical Stock Chart

From Nov 2024 to Dec 2024

PulteGroup (NYSE:PHM)

Historical Stock Chart

From Dec 2023 to Dec 2024