Jim Ossowski, PulteGroup Senior Vice

President, Finance, to Succeed O’Shaughnessy as CFO

PulteGroup, Inc. (NYSE: PHM) announced today that Bob

O’Shaughnessy, Executive Vice President and Chief Financial

Officer, has notified the Company that he intends to retire at the

end of 2025. As part of its long-term succession planning process,

PulteGroup has named Jim Ossowski, currently PulteGroup’s Senior

Vice President, Finance, as successor.

O’Shaughnessy, who joined the Company in 2011, will continue to

serve as PulteGroup CFO through year end and final certification of

the Company’s 2024 financial statements in early February 2025.

O’Shaughnessy will then remain with PulteGroup through the end of

2025 as Executive Vice President. In addition to supporting a

smooth transition of CFO responsibilities, in 2025 he will continue

to oversee the Company’s Financial Services business, strategic

partnerships, and its asset management committee.

Ossowski has been promoted to Executive Vice President and Chief

Financial Officer effective February 2025. At that time, he will

report directly to PulteGroup President and Chief Executive Officer

Ryan Marshall and have responsibility for PulteGroup’s accounting,

tax, audit, risk management and treasury functions.

“During his 13 years with PulteGroup, Bob has been an

outstanding leader and business partner who established many of the

critical financial processes upon which our success has been

built,” said Ryan Marshall, PulteGroup President and CEO. “Bob has

been a key strategic advisor and architect of our Company’s

transformation over the past decade. PulteGroup is a performance

leader in the homebuilding industry because of the impact of Bob’s

insights and strong financial stewardship.

“I’m also pleased to have Jim Ossowski join my senior leadership

team, and his promotion into the CFO role highlights PulteGroup’s

deep talent bench and long-term succession planning. Given his

extensive experience with our field operations and the Company’s

critical asset management committee, Jim has an unmatched

understanding of our homebuilding operations, and I am confident

that he is the right leader to advance our growth and track record

of financial success,” said Marshall.

In his current role, Ossowski has responsibility for all finance

and accounting activities for PulteGroup’s $16 billion homebuilding

operations, including managing the Company’s asset management

committee, which reviews and approves all land transactions, and

its risk management and financial planning and analysis functions.

Over his 22-year career with PulteGroup, Ossowski has served as VP

- Finance and Corporate Controller, VP - Finance, Homebuilding

Operations, Area VP – Finance and Director of Corporate Audit.

Ossowski has a Bachelor of Science degree in Accounting from

Oakland University in Michigan.

Forward-Looking Statements

This release includes “forward-looking statements.” These

statements are subject to a number of risks, uncertainties and

other factors that could cause our actual results, performance,

prospects or opportunities, as well as those of the markets we

serve or intend to serve, to differ materially from those expressed

in, or implied by, these statements. You can identify these

statements by the fact that they do not relate to matters of a

strictly factual or historical nature and generally discuss or

relate to forecasts, estimates or other expectations regarding

future events. Generally, the words “believe,” “expect,” “intend,”

“estimate,” “anticipate,” “plan,” “project,” “may,” “can,” “could,”

“might,” “should,” “will” and similar expressions identify

forward-looking statements, including statements related to any

potential impairment charges and the impacts or effects thereof,

expected operating and performing results, planned transactions,

planned objectives of management, future developments or conditions

in the industries in which we participate and other trends,

developments and uncertainties that may affect our business in the

future.

Such risks, uncertainties and other factors include, among other

things: interest rate changes and the availability of mortgage

financing; the impact of any changes to our strategy in responding

to the cyclical nature of the industry or deteriorations in

industry changes or downward changes in general economic or other

business conditions, including any changes regarding our land

positions and the levels of our land spend; economic changes

nationally or in our local markets, including inflation, deflation,

changes in consumer confidence and preferences and the state of the

market for homes in general; labor supply shortages and the cost of

labor; the availability and cost of land and other raw materials

used by us in our homebuilding operations; a decline in the value

of the land and home inventories we maintain and resulting possible

future writedowns of the carrying value of our real estate assets;

competition within the industries in which we operate; governmental

regulation directed at or affecting the housing market, the

homebuilding industry or construction activities, slow growth

initiatives and/or local building moratoria; the availability and

cost of insurance covering risks associated with our businesses,

including warranty and other legal or regulatory proceedings or

claims; damage from improper acts of persons over whom we do not

have control or attempts to impose liabilities or obligations of

third parties on us; weather related slowdowns; the impact of

climate change and related governmental regulation; adverse capital

and credit market conditions, which may affect our access to and

cost of capital; the insufficiency of our income tax provisions and

tax reserves, including as a result of changing laws or

interpretations; the potential that we do not realize our deferred

tax assets; our inability to sell mortgages into the secondary

market; uncertainty in the mortgage lending industry, including

revisions to underwriting standards and repurchase requirements

associated with the sale of mortgage loans, and related claims

against us; risks related to information technology failures, data

security issues, and the effect of cybersecurity incidents and

threats; the impact of negative publicity on sales; failure to

retain key personnel; the impairment of our intangible assets; the

disruptions associated with the COVID-19 pandemic (or another

epidemic or pandemic or similar public threat or fear of such an

event), and the measures taken to address it; and other factors of

national, regional and global scale, including those of a

political, economic, business and competitive nature. See Item 1A –

Risk Factors in our Annual Report on Form 10-K for the fiscal year

ended December 31, 2023 for a further discussion of these and other

risks and uncertainties applicable to our businesses. We undertake

no duty to update any forward-looking statement, whether as a

result of new information, future events or changes in our

expectations.

About PulteGroup

PulteGroup, Inc. (NYSE: PHM), based in Atlanta, Georgia, is one

of America’s largest homebuilding companies with operations in more

than 45 markets throughout the country. Through its brand portfolio

that includes Centex, Pulte Homes, Del Webb, DiVosta Homes,

American West and John Wieland Homes and Neighborhoods, the company

is one of the industry’s most versatile homebuilders able to meet

the needs of multiple buyer groups and respond to changing consumer

demand. PulteGroup’s purpose is building incredible places where

people can live their dreams.

For more information about PulteGroup, Inc. and PulteGroup

brands, go to pultegroup.com; pulte.com; centex.com; delwebb.com;

divosta.com; jwhomes.com; and americanwesthomes.com. Follow

PulteGroup, Inc. on X: @PulteGroupNews.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240722882306/en/

Investors: Jim Zeumer (404) 978-6434

jim.zeumer@pultegroup.com

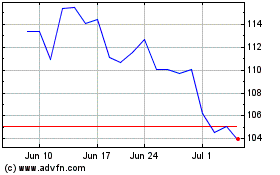

PulteGroup (NYSE:PHM)

Historical Stock Chart

From Nov 2024 to Dec 2024

PulteGroup (NYSE:PHM)

Historical Stock Chart

From Dec 2023 to Dec 2024