Life-licensed sales force grew 3% driven by

strong new life licenses

Term Life net premiums increased 6%;

adjusted direct premiums increased 7%

Investment and Savings Products sales of

$2.2 billion declined 23% reflecting market conditions; net client

inflows remained positive at $0.7 billion

Net earnings per diluted share (EPS) of

$1.37 (including a non-cash goodwill impairment of $1.59 per

diluted share) decreased 51%; return on stockholders’ equity (ROE)

of 12.2%

Diluted adjusted operating EPS of $3.02

increased 1%; adjusted net operating income return on adjusted

stockholders’ equity (ROAE) of 23.8%

Declared dividend of $0.55 per share,

payable on December 14, 2022, and repurchased $97 million of common

stock during the quarter

Primerica, Inc. (NYSE: PRI) today announced financial results

for the quarter ended September 30, 2022. Total revenues were

$673.3 million, decreasing 3% compared to the third quarter of

2021. Net income of $51.8 million decreased 54%, while net earnings

per diluted share of $1.37 decreased 51% compared to the same

period in the prior year. Results reflect a non-cash goodwill

impairment charge of $60.0 million, or $1.59 per diluted share, in

connection with the annual goodwill impairment test for the Senior

Health reporting unit. The calculated decline in fair value was

primarily attributable to an increase in the market-based weighted

average cost of capital (“WACC”) used to discount forecasted cash

flows. The increase in the WACC was driven by higher equity market

risk premiums and interest rates.

The Company excludes the goodwill impairment charge from

adjusted operating results as it represents a non-recurring item

that causes incomparability of the Company’s core results between

periods. Adjusted operating revenues were $676.1 million,

decreasing 2% compared to the third quarter of 2021. Adjusted net

operating income of $113.9 million decreased 4% year-over-year,

while adjusted operating net earnings per diluted share of $3.02

increased 1%.

Operating results during the quarter were pressured by market

volatility, which led to a substantial decline in client asset

values and lower sales volume in the Investment and Savings Product

segment. Continued growth in Term Life earnings partly offset the

negative impact of equity markets on the current period’s financial

results. The Company continues to make progress in addressing

challenges in the senior health distribution marketplace. Insurance

and other operating expense growth has normalized as expected from

the higher growth levels reported earlier in the year. The Company

continues to make significant progress in growing the size of the

independent life-licensed sales force by leveraging improvements in

the licensing process and the excitement generated at the biennial

convention.

“Our focus remains on serving the protection and savings needs

of our clients during these times of market volatility and economic

uncertainty as we expand the size of our sales force,” said Glenn

Williams, Chief Executive Officer. “Our biennial convention had the

desired impact of adding energy and excitement to our

organization.”

Third Quarter Distribution & Segment Results

Distribution Results

Q3 2022

Q3 2021

%

Change

Life-Licensed Sales Force (1)

134,313

130,023

3

%

Recruits

127,788

91,884

39

%

New Life-Licensed Representatives

12,518

9,381

33

%

Life Insurance Policies Issued

71,104

75,914

(6

)%

Life Productivity (2)

0.18

0.19

*

ISP Product Sales ($ billions)

$

2.16

$

2.79

(23

)%

Average Client Asset Values ($

billions)

$

83.32

$

92.65

(10

)%

Senior Health Submitted Policies (3)

16,095

20,867

(23

)%

Senior Health Approved Policies (4)

14,862

18,276

(19

)%

Closed U.S. Mortgage Volume ($ million

brokered)

$

99.8

$

337.6

(70

)%

___________________

(1)

End of period. The 2021 period includes an

estimated 800 individuals who we expected would not pursue the

steps necessary to convert a COVID-related temporary license to a

permanent license or renew a license with a COVID-related extended

renewal date.

(2)

Life productivity equals policies issued

divided by the average number of life insurance licensed

representatives per month.

(3)

Represents the number of completed

applications that, with respect to each such application, the

applicant has authorized us to submit to the health insurance

carrier.

(4)

Represents an estimate of submitted

policies approved by health insurance carriers during the indicated

period. Not all approved policies will go in force.

* Not calculated

Segment Results

Q3 2022

Q3 2021

%

Change

($ in thousands)

Adjusted Operating Revenues:

Term Life Insurance

$

427,830

$

401,451

7

%

Investment and Savings Products

201,697

233,337

(14

)%

Senior Health (1)

17,184

22,936

(25

)%

Corporate and Other Distributed Products

(1)

29,345

34,745

(16

)%

Total adjusted operating revenues

(1)

$

676,056

$

692,469

(2

)%

Adjusted Operating Income (Loss) before

income taxes:

Term Life Insurance

$

111,764

$

107,589

4

%

Investment and Savings Products

58,377

69,368

(16

)%

Senior Health (1)

(3,723

)

(6,608

)

(44

)%

Corporate and Other Distributed Products

(1)

(17,752

)

(13,529

)

31

%

Total adjusted operating income before

income taxes (1)

$

148,666

$

156,820

(5

)%

___________________

(1)

See the Non-GAAP Financial Measures

section and the Adjusted Operating Results reconciliation tables at

the end of this release for additional information.

Life Insurance Licensed Sales Force

Licensing momentum continued with 12,518 new life-licensed

representatives being added during the third quarter of 2022, a 33%

increase compared to the prior year period. Part of this growth was

driven by significant recruiting incentives launched at the

convention for the month of July that offered various levels of

licensing fee discounts. The Company recruited approximately 83,000

individuals in July and 127,788 in total for the quarter,

demonstrating the attractiveness of our business model to

middle-income households today. The size of the sales force has

increased nearly 4% since the end of last year with a total of

134,313 independent life-licensed representatives as of September

30, 2022.

Term Life Insurance

During the third quarter of 2022, the Company issued 71,104 new

life insurance policies, a decrease of 6% compared to the third

quarter of 2021. The Company believes the year-over-year decline in

sales was attributable in part to the impact of economic

uncertainty and a higher cost of living on middle-income families.

Productivity at 0.18 policies per life-licensed representative per

month remained in line with the Company’s historical range, but

down slightly from 0.19 in the prior year period.

Third quarter revenues of $427.8 million increased 7%

year-over-year, driven by 7% growth in adjusted direct premiums.

Overall persistency continues to normalize and policies that were

sold during the current year are generally performing in line with

pre-pandemic levels. Lapse rates for policies issued during the

first year of the pandemic continued to trend around 15% higher

than historical norms. The DAC amortization ratio of 16.0% was

generally in line with typical third quarter levels. The benefits

and claims ratio during the quarter was 59.5%, reflecting $2

million in excess claims split between COVID-related deaths and

normal volatility.

Investment and Savings Products

Total product sales during the quarter were $2.2 billion, or 23%

lower compared to the third quarter of 2021 as equity markets

continued to decline, pressuring sales and client asset values.

Despite heightened market volatility, clients remain committed to

long-term retirement savings and net client flows were robust at

$714 million during the quarter. Client asset values on September

30, 2022 were $78.7 billion, declining 14% year-over-year.

Revenues of $201.7 million during the quarter declined 14%

compared to the third quarter of 2021 as a result of a 28% drop in

revenue-generating sales and a 10% decline in average client asset

values. Asset-based net revenues declined slightly less than

average client asset values due to the continued growth in managed

account assets, while sales-based net revenues declined in line

with commission-generating sales.

Senior Health

The third quarter results reflected seasonally lower activity

levels ahead of the Annual Enrollment Period, which started on

October 15. A total of 14,862 policies were approved during the

quarter with lifetime value of commissions ("LTV") per approved

policy of $868 and contract acquisition costs ("CAC") per approved

policy of $905, resulting in an LTV/CAC ratio slightly below

1.0x.

The pre-tax operating loss during the third quarter was $3.7

million compared to a pre-tax operating loss attributable to

Primerica of $6.6 million in the prior year period. The current

period results include an increase in insurance carriers’

commission rates, which led to a $1.7 million positive tail

adjustment. During the first nine months of 2022, the Company did

not need to provide funding to the Senior Health segment as cash

tax benefits from net operating losses were sufficient to cover

operating needs.

Corporate and Other Distributed Products

During the third quarter, the segment recorded an adjusted

operating loss before taxes of $17.8 million, increasing $4.2

million year-over-year. The increase was due to a $2.7 million

lower contribution from the mortgage business as interest rate

headwinds accelerated during the quarter, as well as higher

insurance and other operating expenses.

Invested Asset Portfolio

Consolidated net investment income increased $4.3 million

compared to the prior year period, reflecting higher yields on

investments and growth in the size of the invested asset portfolio.

Most of the increase was allocated to the Term Life segment,

reflecting the growth in the business.

The invested asset portfolio ended the quarter with an

unrealized loss of $321 million, compared to an unrealized loss of

$223 million at June 30, reflecting the substantial rise in

interest rates, and to a lesser extent, changes in credit spreads,

during the period.

Taxes

The effective tax rate was 39.7% in the third quarter of 2022

compared to 24.2% in the prior year period. The increase in the

effective tax rate during the third quarter of 2022 was driven by

the non-cash goodwill impairment charge that is not deductible for

income tax purposes. Excluding the goodwill impairment, the

effective tax rate in the third quarter of 2022 would have been

23.4%. This rate is lower compared to the third quarter of 2021

because of e-TeleQuote state income tax benefits recorded in the

current year.

Capital

During the third quarter, the Company repurchased $97.4 million

of common stock, for a total of $324.3 million year-to-date. The

Company expects to complete an additional $32 million by the end of

2022. The Board of Directors has approved a dividend of $0.55 per

share, payable on December 14, 2022 to stockholders of record on

November 22, 2022.

Primerica has a strong balance sheet, including invested assets

and cash at the holding company of $240 million at quarter-end.

Primerica Life Insurance Company’s statutory risk-based capital

(RBC) ratio was estimated to be about 460% as of September 30,

2022.

Non-GAAP Financial Measures

In addition to reporting financial results in accordance with

U.S. generally accepted accounting principles (“GAAP”), the Company

presents certain non-GAAP financial measures. Specifically, the

Company presents adjusted direct premiums, other ceded premiums,

adjusted operating revenues, adjusted operating income before

income taxes, adjusted net operating income, adjusted stockholders’

equity and diluted adjusted operating earnings per share. Adjusted

direct premiums and other ceded premiums are net of amounts ceded

under coinsurance transactions that were executed concurrent with

our initial public offering (the “IPO coinsurance transactions”)

for all periods presented. We exclude amounts ceded under the IPO

coinsurance transactions in measuring adjusted direct premiums and

other ceded premiums to present meaningful comparisons of the

actual premiums economically maintained by the Company. Amounts

ceded under the IPO coinsurance transactions will continue to

decline over time as policies terminate within this block of

business. Adjusted operating revenues, adjusted operating income

before income taxes, adjusted net operating income and diluted

adjusted operating earnings per share exclude the impact of

investment gains (losses) and fair value mark-to-market (“MTM”)

investment adjustments, including credit impairments, for all

periods presented. We exclude investment gains (losses), including

credit impairments, and MTM investment adjustments in measuring

these non-GAAP financial measures to eliminate period-over-period

fluctuations that may obscure comparisons of operating results due

to items such as the timing of recognizing gains (losses) and

market pricing variations prior to an invested asset’s maturity or

sale that are not directly associated with the Company’s insurance

operations. Adjusted operating income before taxes, adjusted net

operating income, and diluted adjusted operating earnings per share

also exclude transaction-related expenses/recoveries associated

with the purchase of e-TeleQuote Insurance, Inc. and subsidiaries

(collectively, “e-TeleQuote”), adjustments to share-based

compensation expense for shares exchanged in the business

combination and non-cash goodwill impairment charges. We exclude

e-TeleQuote transaction-related expenses/recoveries and non-cash

goodwill impairment charges as these are non-recurring items that

will cause incomparability between period-over-period results. We

exclude adjustments to share-based compensation expense for shares

exchanged in the business combination to eliminate

period-over-period fluctuations that may obscure comparisons of

operating results primarily due to the volatility of changes in the

fair value of shares, which were ultimately redeemed at zero value.

Adjusted operating income before income taxes and adjusted net

operating income exclude income attributable to the noncontrolling

interest to present only the income that is attributable to

stockholders of the Company. Adjusted stockholders’ equity excludes

the impact of net unrealized investment gains (losses) recorded in

accumulated other comprehensive income (loss) for all periods

presented. We exclude unrealized investment gains (losses) in

measuring adjusted stockholders’ equity as unrealized gains

(losses) from the Company’s available-for-sale securities are

largely caused by market movements in interest rates and credit

spreads that do not necessarily correlate with the cash flows we

will ultimately realize when an available-for-sale security matures

or is sold.

Our definitions of these non-GAAP financial measures may differ

from the definitions of similar measures used by other companies.

Management uses these non-GAAP financial measures in making

financial, operating and planning decisions and in evaluating the

Company’s performance. Furthermore, management believes that these

non-GAAP financial measures may provide users with additional

meaningful comparisons between current results and results of prior

periods as they are expected to be reflective of the core ongoing

business. These measures have limitations and investors should not

consider them in isolation or as a substitute for analysis of the

Company’s results as reported under GAAP. Reconciliations of GAAP

to non-GAAP financial measures are attached to this release.

Earnings Webcast Information

Primerica will hold a webcast on Wednesday, November 9, 2022, at

10:00 a.m. Eastern, to discuss the quarter’s results. To access the

webcast, go to https://investors.primerica.com at least 15 minutes

prior to the event to register, download and install any necessary

software. A replay of the call will be available for approximately

30 days. This release and a detailed financial supplement will be

posted on Primerica’s website.

Forward-Looking Statements

Except for historical information contained in this press

release, the statements in this release are forward-looking and

made pursuant to the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements contain known and unknown risks and uncertainties that

may cause our actual results in future periods to differ materially

from anticipated or projected results. Those risks and

uncertainties include, among others, our failure to continue to

attract and license new recruits, retain sales representatives or

license or maintain the licensing of sales representatives; new

laws or regulations that could apply to our distribution model,

which could require us to modify our distribution structure;

changes to the independent contractor status of sales

representatives; our or sales representatives’ violation of or

non-compliance with laws and regulations; any failure to protect

the confidentiality of client information; differences between our

actual experience and our expectations regarding mortality or

persistency as reflected in the pricing for our insurance policies;

changes in federal, state and provincial legislation or regulation

that affects our insurance, investment product and mortgage

businesses; our failure to meet regulatory capital ratios or other

minimum capital and surplus requirements; a significant downgrade

by a ratings organization; the failure of our reinsurers or reserve

financing counterparties to perform their obligations; the failure

of our investment products to remain competitive with other

investment options or the loss of our relationship with one or more

of the companies whose investment products we provide; litigation

and regulatory investigations and actions concerning us or sales

representatives; heightened standards of conduct or more stringent

licensing requirements for sales representatives; inadequate

policies and procedures regarding suitability review of client

transactions; revocation of our subsidiary’s status as a non-bank

custodian; economic down cycles that impact our business, financial

condition and results of operations; major public health pandemics,

epidemics or outbreaks or other catastrophic events; the failure of

our information technology systems, breach of our information

security, failure of our business continuity plan or the loss of

the Internet; the effects of credit deterioration and interest rate

fluctuations on our invested asset portfolio and other assets;

incorrectly valuing our investments; changes in accounting

standards may impact how we record and report our financial

condition and results of operations; the inability of our

subsidiaries to pay dividends or make distributions; litigation and

regulatory investigations and actions; a significant change in the

competitive environment in which we operate; the loss of key

personnel or sales force leaders; any acquisition or investment in

businesses that do not perform as we expect or are difficult to

integrate; due to our very limited history with e-TeleQuote, we

cannot be certain that its business will be successful or that we

will successfully address any risks not known to us that may become

material; a failure by e-TeleQuote to comply with the requirements

of the United States government’s Centers for Medicare and Medicaid

Services and those of its carrier partners; legislative or

regulatory changes to Medicare Advantage or changes to the

implementing guidance by the Centers for Medicare and Medicaid

Services; e-TeleQuote’s inability to acquire or generate leads on

commercially viable terms, convert leads to sales or if customer

policy retention is lower than assumed; e-TeleQuote’s inability to

enroll individuals during the Medicare annual election period; the

loss of a key carrier, or the modification of commission rates or

underwriting practices with a key carrier partner could adversely

affect e-TeleQuote’s business; cyber-attack(s), security breaches

or if e-TeleQuote is otherwise unable to safeguard the security and

privacy of confidential data, including personal health

information; and fluctuations in the market price of our common

stock or Canadian currency exchange rates. These and other risks

and uncertainties affecting us are more fully described in our

filings with the Securities and Exchange Commission, which are

available in the "Investor Relations" section of our website at

https://investors.primerica.com. Primerica assumes no duty to

update its forward-looking statements as of any future date.

About Primerica, Inc.

Primerica, Inc., headquartered in Duluth, GA, is a leading

provider of financial services to middle-income households in North

America. Independent licensed representatives educate Primerica

clients about how to better prepare for a more secure financial

future by assessing their needs and providing appropriate solutions

through term life insurance, which we underwrite, and mutual funds,

annuities and other financial products, which we distribute

primarily on behalf of third parties. We insured over 5.7 million

lives and had over 2.7 million client investment accounts on

December 31, 2021. Primerica, through its insurance company

subsidiaries, was the #2 issuer of Term Life insurance coverage in

the United States and Canada in 2021. Primerica stock is included

in the S&P MidCap 400 and the Russell 1000 stock indices and is

traded on The New York Stock Exchange under the symbol “PRI”.

PRIMERICA, INC. AND

SUBSIDIARIES

Condensed Consolidated Balance

Sheets

(Unaudited)

September 30, 2022

December 31, 2021

(In thousands)

Assets

Investments:

Fixed-maturity securities

available-for-sale, at fair value

$

2,457,989

$

2,702,567

Fixed-maturity security held-to-maturity,

at amortized cost

1,433,760

1,379,100

Short-term investments available-for-sale,

at fair value

-

85,243

Equity securities, at fair value

33,079

42,551

Trading securities, at fair value

3,718

24,355

Policy loans and other invested assets

48,787

30,612

Total investments

3,977,333

4,264,428

Cash and cash equivalents

438,025

392,501

Accrued investment income

19,949

18,702

Reinsurance recoverables

4,033,897

4,268,419

Deferred policy acquisition costs, net

3,049,102

2,943,782

Renewal commissions receivable

198,027

231,751

Agent balances, due premiums and other

receivables

266,831

257,675

Goodwill

127,707

179,154

Intangible assets

188,150

195,825

Income taxes

90,719

81,799

Operating lease right-of-use assets

42,343

47,942

Other assets

403,452

441,253

Separate account assets

2,206,608

2,799,992

Total assets

$

15,042,143

$

16,123,223

Liabilities and Stockholders'

Equity

Liabilities:

Future policy benefits

$

7,314,688

$

7,138,649

Unearned and advance premiums

16,153

16,437

Policy claims and other benefits

payable

496,563

585,382

Other policyholders' funds

492,479

501,823

Notes payable - short term

-

15,000

Notes payable - long term

592,705

592,102

Surplus note

1,433,293

1,378,585

Income taxes

129,347

241,311

Operating lease liabilities

47,935

53,920

Other liabilities

611,646

615,710

Payable under securities lending

80,754

94,529

Separate account liabilities

2,206,608

2,799,992

Total liabilities

13,422,171

14,033,440

Temporary Stockholders' Equity

Redeemable noncontrolling interests in

consolidated entities

-

7,271

Permanent Stockholders' equity

Equity attributable to Primerica,

Inc.:

Common stock

370

394

Paid-in capital

-

5,224

Retained earnings

1,887,952

2,004,506

Accumulated other comprehensive income

(loss), net of income tax

(268,350

)

72,388

Total permanent stockholders' equity

1,619,972

2,082,512

Total liabilities and temporary and

permanent stockholders' equity

$

15,042,143

$

16,123,223

PRIMERICA, INC. AND

SUBSIDIARIES

Condensed Consolidated

Statements of Income

(Unaudited)

Three months ended September

30,

2022

2021

(In thousands, except

per-share amounts)

Revenues:

Direct premiums

$

810,079

$

785,277

Ceded premiums

(404,870

)

(401,295

)

Net premiums

405,209

383,982

Commissions and fees

225,468

269,796

Net investment income

24,346

20,000

Investment gains (losses)

(2,699

)

1,410

Other, net

20,965

18,051

Total revenues

673,289

693,239

Benefits and expenses:

Benefits and claims

171,293

183,425

Amortization of deferred policy

acquisition costs

90,925

62,214

Sales commissions

105,915

129,268

Insurance expenses

57,552

51,901

Insurance commissions

7,666

8,412

Contract acquisition costs

13,446

23,524

Interest expense

6,802

7,529

Goodwill impairment loss

60,000

-

Other operating expenses

73,791

79,864

Total benefits and expenses

587,390

546,137

Income before income taxes

85,899

147,102

Income taxes

34,092

35,663

Net income

$

51,807

$

111,439

Net income attributable to noncontrolling

interests

-

(1,017

)

Net income attributable to Primerica,

Inc.

$

51,807

$

112,456

Earnings per share attributable to

common stockholders:

Basic earnings per share

$

1.38

$

2.83

Diluted earnings per share

$

1.37

$

2.82

Weighted-average shares used in

computing earnings per share:

Basic

37,438

39,561

Diluted

37,541

39,679

PRIMERICA, INC. AND

SUBSIDIARIES

Consolidated Adjusted

Operating Results Reconciliation

(Unaudited – in thousands,

except per share amounts)

Three months ended September

30,

2022

2021

% Change

Total revenues

$

673,289

$

693,239

(3

)%

Less: Investment gains (losses)

(2,699

)

1,410

Less: 10% deposit asset MTM included in

NII

(68

)

(640

)

Adjusted operating revenues

$

676,056

$

692,469

(2

)%

Income before income taxes

$

85,899

$

147,102

(42

)%

Less: Investment gains (losses)

(2,699

)

1,410

Less: 10% deposit asset MTM included in

NII

(68

)

(640

)

Less: e-TeleQuote transaction-related

expenses

-

(10,027

)

Less: Equity comp for awards exchanged

during acquisition

-

1,004

Less: Noncontrolling interest

-

(1,465

)

Less: Goodwill impairment

(60,000

)

-

Adjusted operating income before income

taxes

$

148,666

$

156,820

(5

)%

Net income

$

51,807

$

111,439

(54

)%

Less: Investment gains (losses)

(2,699

)

1,410

Less: 10% deposit asset MTM included in

NII

(68

)

(640

)

Less: e-TeleQuote transaction-related

expenses

-

(10,027

)

Less: Equity comp for awards exchanged

during acquisition

-

1,004

Less: Noncontrolling interest

-

(1,465

)

Less: Goodwill impairment

(60,000

)

-

Less: Tax impact of preceding items

647

2,449

Adjusted net operating income

$

113,927

$

118,708

(4

)%

Diluted earnings per share (1)

$

1.37

$

2.82

(51

)%

Less: Net after-tax impact of operating

adjustments

(1.65

)

(0.16

)

Diluted adjusted operating earnings per

share (1)

$

3.02

$

2.98

1

%

___________________

(1)

Percentage change in earnings per share is

calculated prior to rounding per share amounts.

TERM LIFE INSURANCE

SEGMENT

Adjusted Premiums

Reconciliation

(Unaudited – in

thousands)

Three months ended September

30,

2022

2021

% Change

Direct premiums

$

804,586

$

779,490

3

%

Less: Premiums ceded to IPO coinsurers

226,869

241,439

Adjusted direct premiums

577,717

538,051

7

%

Ceded premiums

(403,416

)

(399,835

)

Less: Premiums ceded to IPO coinsurers

(226,869

)

(241,439

)

Other ceded premiums

(176,548

)

(158,396

)

Net premiums

$

401,169

$

379,655

6

%

SENIOR HEALTH SEGMENT

Adjusted Operating Results

Reconciliation

(Unaudited – in

thousands)

Three months ended September

30,

2022

2021

% Change

Loss before income taxes

$

(63,723

)

$

(8,490

)

651

%

Less: e-TeleQuote transaction-related

costs

-

(417

)

Less: Noncontrolling interest

-

(1,465

)

Less: Goodwill impairment

(60,000

)

-

Adjusted operating loss before taxes

$

(3,723

)

$

(6,608

)

(44

)%

CORPORATE AND OTHER

DISTRIBUTED PRODUCTS SEGMENT

Adjusted Operating Results

Reconciliation

(Unaudited – in

thousands)

Three months ended September

30,

2022

2021

% Change

Total revenues

$

26,578

$

35,515

(25

)%

Less: Investment gains (losses)

(2,699

)

1,410

Less: 10% deposit asset MTM included in

NII

(68

)

(640

)

Adjusted operating revenues

$

29,345

$

34,745

(16

)%

Loss before income taxes

$

(20,519

)

$

(21,365

)

(4

)%

Less: Investment gains (losses)

(2,699

)

1,410

Less: 10% deposit asset MTM included in

NII

(68

)

(640

)

Less: e-TeleQuote transaction-related

expenses

-

(9,610

)

Less: Equity comp for awards exchanged

during acquisition

-

1,004

Adjusted operating loss before income

taxes

$

(17,752

)

$

(13,529

)

31

%

PRIMERICA, INC. AND

SUBSIDIARIES

Adjusted Stockholders' Equity

Reconciliation

(Unaudited – in

thousands)

September 30,

2022

December 31,

2021

% Change

Stockholders' equity (1)

$

1,619,972

$

2,082,512

(22

)%

Less: Unrealized net investment gains

(losses) recorded in stockholders' equity, net of income tax

(252,913

)

63,777

Adjusted stockholders' equity (1)

$

1,872,885

$

2,018,735

(7

)%

___________________

(1)

Reflects the Company’s permanent

stockholders’ equity and does not include temporary stockholders’

equity.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221108005908/en/

Investor Contact: Nicole Russell 470-564-6663 Email:

Nicole.Russell@primerica.com

Media Contact: Susan Chana 404-229-8302 Email:

Susan.Chana@Primerica.com

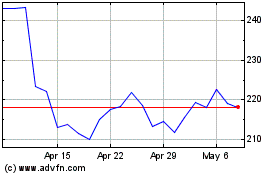

Primerica (NYSE:PRI)

Historical Stock Chart

From Aug 2024 to Sep 2024

Primerica (NYSE:PRI)

Historical Stock Chart

From Sep 2023 to Sep 2024