Additional Proxy Soliciting Materials - Non-management (definitive) (dfan14a)

April 12 2023 - 5:08PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Under § 240.14a-12 |

PITNEY BOWES INC.

|

(Name of Registrant as Specified In Its Charter)

|

| |

HESTIA CAPITAL PARTNERS LP

HELIOS I, LP

HESTIA CAPITAL PARTNERS GP, LLC

HESTIA CAPITAL MANAGEMENT, LLC

KURTIS J. WOLF

MILENA ALBERTI-PEREZ

TODD A. EVERETT

KATIE A. MAY

LANCE E. ROSENZWEIG

|

(Name of Persons(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Hestia Capital Partners,

LP (“Hestia Capital”), together with the other participants named herein (collectively, “Hestia”), has filed a

definitive proxy statement and accompanying WHITE universal proxy card with the Securities and Exchange Commission (“SEC”)

to be used to solicit votes for the election of its slate of highly-qualified director nominees at the 2023 annual meeting of stockholders

(the “Annual Meeting”) of Pitney Bowes Inc., a Delaware corporation (the “Company”).

Item 1: On April 12, 2023,

Hestia issued the below press release. The press release also included a link to the Investor Presentation in the form attached as Exhibit

1 to Form DFAN14A filed by Hestia Capital with the SEC on April 11, 2023, which is incorporated herein by reference.

Hestia Capital Releases Presentation Detailing

the Urgent Need for Changes in Leadership and Strategy at Pitney Bowes

Visit www.TransformPBI.com

to Download a Copy of the Presentation and Obtain Information About How to Vote on the WHITE Universal Proxy Card

PITTSBURGH--(BUSINESS WIRE)--Hestia Capital Management,

LLC (collectively with its affiliates, “Hestia” or “we”), which is the third largest stockholder of Pitney Bowes,

Inc. (NYSE: PBI) (“Pitney Bowes” or the “Company”) and has a beneficial ownership position of 8.5% of the Company’s

outstanding common stock, today announced that it has issued a presentation that details the urgent need for boardroom change and opportunity

for a sustainable, value-enhancing turnaround. Notably, Hestia’s director candidates have prepared a comprehensive six-pillar plan

that targets a $15+ stock price in the coming years, which they believe will also help improve the Company’s credit profile. The

six-pillar plan can be viewed at the following link: bit.ly/TransformPitneyBowes.

As a reminder, Hestia is seeking to elect five

highly qualified and independent candidates to Pitney Bowes’ nine-member Board of Directors (the “Board”) at the Annual

Meeting of Stockholders (the “Annual Meeting”) on May 9, 2023. To maximize the likelihood of a turnaround at Pitney Bowes,

we urge you to vote for Hestia’s full slate on the WHITE universal proxy card or WHITE voting instruction

form. Visit www.TransformPBI.com to download a copy of the presentation and sign up for future

updates.

About Hestia Capital

Hestia Capital is a long-term focused, deep value

investment firm that typically makes investments in a narrow selection of companies facing company-specific, and/or industry, disruptions.

Hestia seeks to leverage its General Partner’s expertise in competitive strategy, operations and capital markets to identify attractive

situations within this universe of disrupted companies. These companies are often misunderstood by the general investing community or

suffer from mismanagement, which we reasonably expect to be corrected, and provide the ‘price dislocations’ which allows Hestia

to identify, and invest in, highly attractive risk/reward investment opportunities.

Contacts

Longacre Square Partners

Charlotte Kiaie / Miller Winston, 646-386-0091

hestia@longacresquare.com

Saratoga Proxy Consulting LLC

John Ferguson / Joe Mills, 212-257-1311

info@saratogaproxy.com

Item 2: On April 12, 2023,

Hestia sent the following email to subscribers of www.TransformPitneyBowes.com:

Item 3: On April 12, 2023, Hestia posted the

following material to LinkedIn:

Item 4: On April 12, 2023,

Hestia posted the following material to www.TransformPitneyBowes.com:

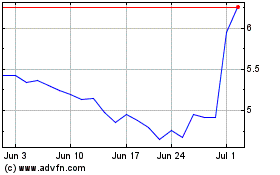

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

From Jun 2024 to Jul 2024

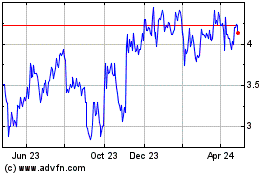

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

From Jul 2023 to Jul 2024