Quarterly Schedule of Portfolio Holdings of Registered Management Investment Company (n-q)

May 14 2013 - 3:37PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-Q

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number

811-01932

Valley Forge Fund, Inc.

(Exact name of registrant as specified in charter)

3741 Worthington Road, Collegeville PA 19426-3431

(Address of principal executive offices) (Zip code)

Donald A. Peterson

3741 Worthington Road

Collegeville, PA 19426-3431

(Name and address of agent for service)

Registrant's telephone number, including area code:

1-855-833-6359

Date of fiscal year end:

December 31

Date of reporting period:

March 31, 2013

Form N-Q is to be used by management investment companies, other than small business investment companies registered on Form N-5 (ss.ss. 239.24 and 274.5 of this chapter), to file reports with the Commission, not later than 60 days after the close of the first and third fiscal quarters, pursuant to rule 30b1-5 under the Investment Company Act of 1940 (17 CFR 270.30b1-5). The Commission may use the information provided on Form N-Q in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-Q, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-Q unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, and 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

Item 1. Schedule of Investments.

|

|

|

|

|

|

Valley Forge Fund

|

|

Schedule of Investments

|

|

March 31, 2013 (Unaudited)

|

|

|

|

|

|

|

|

|

Shares

|

|

|

Value

|

|

|

|

|

|

|

|

COMMON STOCKS - 62.28%

|

|

|

|

|

|

|

|

|

|

Beverages - .13%

|

|

|

|

|

|

2,000

|

|

Crimson Wine Group, Inc. *

|

$ 18,600

|

|

|

|

|

|

|

|

|

Crude Petroleum & Natural Gas - 7.42%

|

|

|

|

15,000

|

|

Chesapeake Energy Corp.

|

306,150

|

|

|

150,000

|

|

Sandridge Energy, Inc. *

|

790,500

|

|

|

|

|

|

1,096,650

|

|

|

Fire, Marine & Casualty Insurance - 21.08%

|

|

|

|

50,000

|

|

American International Group, Inc. *

|

1,941,000

|

|

|

4,500

|

|

Berkshire Hathaway, Inc. Class-B *

|

468,900

|

|

|

1,800

|

|

Fairfax Financial Holdings, Ltd. *

|

704,052

|

|

|

|

|

|

3,113,952

|

|

|

Lumbar & Wood Products - 3.71%

|

|

|

|

20,000

|

|

Leucadia National Corp.

|

548,600

|

|

|

|

|

|

|

|

|

Retail-Department Stores - 13.65%

|

|

|

|

21,000

|

|

J.C. Penny Co., Inc.

|

317,310

|

|

|

34,000

|

|

Sears Holding Corp. *

|

1,698,980

|

|

|

|

|

|

2,016,290

|

|

|

Services-Prepackaged Software - 2.03%

|

|

|

|

10,500

|

|

Microsoft Corp.

|

300,353

|

|

|

|

|

|

|

|

|

Surety Insurance - 14.26%

|

|

|

|

205,200

|

|

MBIA, Inc. *

|

2,107,404

|

|

|

|

|

|

|

|

|

TOTAL FOR COMMON STOCKS (Cost $8,271,401) - 62.28%

|

$ 9,201,849

|

|

|

|

|

|

|

|

WARRANTS - 9.09%

|

|

|

|

|

|

235,722

|

|

Bank of America Warrants Class-A *

|

$ 1,343,615

|

|

|

|

|

|

|

|

|

TOTAL FOR WARRANTS (Cost $902,979) - 9.09%

|

$ 1,343,615

|

|

|

|

|

|

|

|

SHORT TERM INVESTMENTS - 28.63%

|

|

|

|

4,229,968

|

|

U.S. Bank Money Market Fund #6, 0.05% ** (Cost $4,229,968)

|

4,229,968

|

|

|

|

|

|

|

|

TOTAL INVESTMENTS (Cost $13,404,348) - 100.00%

|

$ 14,775,432

|

|

|

|

|

|

|

LIABILITIES IN EXCESS OF OTHER ASSETS - .00%

|

(709)

|

|

|

|

|

|

|

|

NET ASSETS - 100.00%

|

$ 14,774,723

|

|

|

|

|

|

|

|

|

*Non-income Producing.

|

|

|

|

**Variable rate security: the coupon rate shown represents the yield at March 31, 2013.

|

|

|

|

|

|

|

|

|

NOTES TO FINANCIAL STATEMENTS

|

|

|

Valley Forge Fund

|

|

|

|

|

1. SECURITY TRANSACTIONS

|

|

|

|

At March 31, 2013, the net unrealized appreciation on investments, based on cost for federal income tax purposes of $13,404,348 amounted to $1,371,084, which consisted of aggregate gross unrealized appreciation of $1,524,936 and aggregate gross unrealized depreciation of $153,852.

|

|

|

|

|

|

|

|

|

|

|

2. SECURITY VALUATION

|

|

|

|

|

|

Securities are valued at the last reported sales price, or in the case of securities where there is no reported last sale, the closing bid price. Securities for which market quotations are not readily available are valued at their fair values as determined in good faith by, or under, the supervision of the Company's Board of Directors in accordance with methods that have been authorized by the Board. Short-term investments (maturities of 60 days or less) are valued at amortized cost that approximates market value.

|

|

|

The Fund adopted Financial Accounting Standards Board Statement of Financial Accounting Standards No. 157, Fair Value Measurements (“ASC 820”), effective January 1, 2008. In accordance with ASC 820, fair value is defined as the price that the Fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. ASC 820 also established a framework for measuring fair value, and a three – level hierarchy for fair value measurements based upon the transparency of inputs to the valuation of an asset or liability. Inputs may be observable or unobservable and refer broadly to the assumptions that market participants would use in pricing the asset or liability. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability on market data obtained from sources independent of the Fund. Unobservable inputs reflect the Fund’s own assumptions about the assumptions that market participants would use in pricing the asset or liability developed based on the best information available in the circumstances. Each investment is assigned a level based upon the observability of the inputs that are significant to the overall valuation. The three-tier hierarchy of inputs is summarized below.

|

|

|

|

|

|

|

|

|

|

Valuation Inputs of Assets

|

|

Level 1

|

Level 2

|

Level 3

|

Total

|

|

Common Stock

|

|

$9,201,849

|

$0

|

$0

|

$9,201,849

|

|

Warrants

|

|

$1,343,615

|

$0

|

$0

|

$1,343,615

|

|

Cash Equivalents

|

|

$4,229,968

|

$0

|

$0

|

$4,229,968

|

|

Total

|

|

$14,775,432

|

$0

|

$0

|

$14,775,432

|

Item 2. Controls and Procedures.

(a)

EVALUATION OF DISCLOSURE CONTROLS AND PROCEDURES. The Registrant maintains disclosure controls and procedures that are designed to ensure that information required to be disclosed in the Registrant's filings under the Securities Exchange Act of 1934 and the Investment Company Act of 1940 is recorded, processed, summarized and reported within the periods specified in the rules and forms of the Securities and Exchange Commission. Such information is accumulated and communicated to the Registrant's management, including its principal executive officer and principal financial officer, as appropriate, to allow timely decisions regarding required disclosure. The Registrant's management, including the principal executive officer and the principal financial officer, recognizes that any set of controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving the desired control objectives.

Within 90 days prior to the filing date of this Quarterly Schedule of Portfolio Holdings on Form N-Q, the Registrant had carried out an evaluation, under the supervision and with the participation of the Registrant's management, including the Registrant's principal executive officer and the Registrant's principal financial officer, of the effectiveness of the design and operation of the Registrant's disclosure controls and procedures. Based on such evaluation, the Registrant's principal executive officer and principal financial officer concluded that the Registrant's disclosure controls and procedures are effective.

(b)

CHANGES IN INTERNAL CONTROLS. There have been no significant changes in the Registrant's internal controls or in other factors that could significantly affect the internal controls subsequent to the date of their evaluation in connection with the preparation of this Quarterly Schedule of Portfolio Holdings on Form N-Q.

Item 3. Exhibits.

Certifications pursuant to Rule 30a-2(a) under the 1940 Act and Section 302 of the Sarbanes-Oxley Act of 2002 are attached hereto.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Valley Forge Fund, Inc.

By /s/ Donald A. Peterson

*

Donald A. Peterson, President

Date May 14, 2013

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By /s/ Donald A. Peterson

*

Donald A. Peterson, President

Date May 14, 2013

By /s/ Lauren P. Tornetta

*

Lauren P. Tornetta, Secretary-Treasurer

Date May 14, 2013

* Print the name and title of each signing officer under his or her signature.

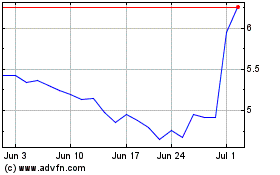

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

From Jun 2024 to Jul 2024

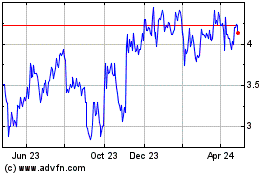

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

From Jul 2023 to Jul 2024