Pitney Bowes Beats Estimates - Analyst Blog

May 08 2012 - 4:45AM

Zacks

Pitney Bowes Inc.

(PBI) reported first-quarter 2012 earnings per share from

continuing operations of 63 cents, above the Zacks Consensus

Estimateof 50 cents and prior-year earnings of 43 cents. Excluding

net tax benefit of 11 cents as a result of resolution of additional

tax matters with the IRS, adjusted earnings per share from

continuing operations came in at 52 cents.

Total Revenue

Total revenue came in at $1.26

billion, down 5% y/y, as a result of a fall in SMB sales and

weakness in Production Mail and Management Services segments.

Moreover, foreign currency led to a drop in total revenue by 1%.

The top line benefited from an improvement in Software and Mail

Services segments.

The company reported a revenue

increase in all its segments.

Segment

Performance

Small and Medium Business

(SMB) Solutions segment sales declined 7% year over year

on a constant currency basis to $629 million, as a result of a 9%

fall in North America Mailing revenue, partially offset by a 1%

increase in International Mailing

revenue.

Enterprise Business

Solutions segment sales inched down 2% year over year to

$626 million, due to a 12% decline in revenue from Worldwide

Production Mail, and 4% decline in Management Services. The

negative effect was partially offset by a 5% increase in Software,

4% in Mail Services and 1% in Marketing Services revenue.

Income

Pitney Bowes incurred total

SG&A expense of approximately $411.2 million in the quarter

versus approximately $426.6 million in the first quarter of 2011.

R&D expense was $34.1 million versus $34.8 million in the

year-ago quarter. The company’s income from continuing operations

was $143.9 million compared with $92.8 million in the prior-year

period.

Balance Sheet

Cash and cash equivalents were

$915.6 million with long-term debt of $3.7 billion and

shareholder’s deficit of $91 million at the end of the quarter.

Free cash flow in the quarter was

$211 million and generated $96 million from cash flow from

operations.

Outlook

The company updated its 2012

guidance to account for the benefits from sale of leveraged lease

assets in Canada. GAAP earnings from continuing operation is

expected to be in the range of $2.22 to $2.42, including net tax

benefits of 11 cents per share and benefit from the sale of

leveraged lease assets in Canada of 6 cents per share. Excluding

these, adjusted earnings per share from continuing operations is

expected to be in the to be in the range of $2.05 to $2.25. Revenue

growth, excluding the impact of currency, is expected to be in the

range of 2% growth to a decline of 2% compared to 2011. Free cash

flow for 2012 is expected to be in the range of $700 million to

$800 million.

Pitney Bowes Inc. is the largest

provider of mail processing equipment and integrated mail solutions

in the world. It offers a full suite of equipment, supplies,

software and services for end-to-end mailstream solutions, which

enable its customers to optimize the flow of physical and

electronic mail, documents and packages across their operations. A

major competitor of Pitney Bowes is Siemens Inc.

(SI).

We currently maintain our Neutral

rating on Pitney Bowes Inc. with a Zacks #3 Rank (short-term Hold

recommendation) over the next one-to-three months.

PITNEY BOWES IN (PBI): Free Stock Analysis Report

SIEMENS AG-ADR (SI): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

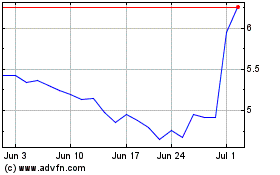

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

From Jun 2024 to Jul 2024

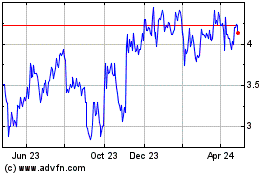

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

From Jul 2023 to Jul 2024