Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

August 19 2022 - 6:01AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

Report of Foreign Private

Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange

Act of 1934

For the month of

August, 2022

Commission File Number

1-15106

PETRÓLEO BRASILEIRO

S.A. – PETROBRAS

(Exact name of registrant

as specified in its charter)

Brazilian Petroleum

Corporation – PETROBRAS

(Translation of Registrant's

name into English)

Avenida Henrique Valadares, 28 – 19th floor

20231-030 – Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal

executive office)

Indicate by check mark

whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form

40-F _______

Indicate by check mark

whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Petrobras on the conclusion of the purchase of Ibiritermo S.A.

—

Rio de Janeiro, August 18, 2022 - Petróleo

Brasileiro S.A. - Petrobras, following up on the release disclosed on June 1, 2022, informs that, after compliance with all the precedent

conditions set forth in the share purchase and sale agreement, the purchase of Edison S.p.A.'s stake (50%) in Ibiritermo S.A. has been

completed and the transfer of the Usina Termelétrica Ibirité (UTE Ibirité) to Petrobras has been carried out.

With the conclusion of the transaction, Petrobras

now holds 100% of the shares of Ibiritermo S.A. and the exclusive ownership of UTE Ibirité, starting its operation as an asset

integrated to the company's portfolio of power plants, without an associated corporate structure. Also with the conclusion, Petrobras

begins the necessary measures for the closure of Ibiritermo S.A. by liquidation.

This operation is in compliance with the Energy

Conversion Contract (ECC), signed on 06/21/2002 with Ibiritermo S.A., and is aligned to the company's strategy of portfolio optimization

and capital allocation improvement, aiming at value maximization and greater return to society.

www.petrobras.com.br/ir

For more information:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

| Investors Relations

email: petroinvest@petrobras.com.br/acionistas@petrobras.com.br

Av. Henrique Valadares, 28 – 19th Floor

– 20231-030 – Rio de Janeiro, RJ.

Tel.: 55 (21) 3224-1510/9947 | 0800-282-1540

This document may contain forecasts

within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Trading

Act of 1934, as amended (Trading Act) that reflect the expectations of the Company's officers. The terms: "anticipates", "believes",

"expects", "predicts", "intends", "plans", "projects", "aims", "should,"

and similar terms, aim to identify such forecasts, which evidently involve risks or uncertainties, predicted or not by the Company. Therefore,

future results of the Company's operations may differ from current expectations, and the reader should not rely solely on the information

included herein.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: August 18, 2022

PETRÓLEO BRASILEIRO S.A–PETROBRAS

By: /s/ Rodrigo Araujo Alves

______________________________

Rodrigo Araujo Alves

Chief Financial Officer and Investor Relations

Officer

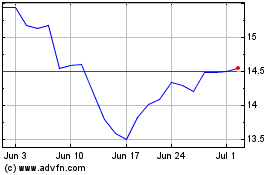

Petroleo Brasileiro ADR (NYSE:PBR)

Historical Stock Chart

From Aug 2024 to Sep 2024

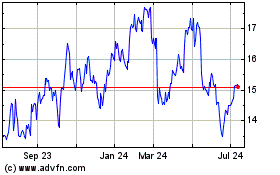

Petroleo Brasileiro ADR (NYSE:PBR)

Historical Stock Chart

From Sep 2023 to Sep 2024