Form 8-K - Current report

July 07 2023 - 8:43AM

Edgar (US Regulatory)

0001605607false00016056072023-06-302023-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): June 30, 2023

Paramount Group, Inc.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maryland |

|

001-36746 |

|

32-0439307 |

(State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

|

|

|

|

|

1633 Broadway, Suite 1801 New York, New York |

|

10019 |

(Address of Principal Executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (212) 237-3100

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2.):

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

Title of each Class |

|

Trading Symbol |

|

Name of each exchange on which registered |

Common stock of Paramount Group, Inc., $0.01 par value per share |

|

PGRE |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

As disclosed in our Quarterly Report on Form 10-Q for the quarter ended March 31, 2023, filed with the Securities and Exchange Commission on May 3, 2023, Paramount Group, Inc. (“we,” or the “Company”), through a wholly-owned subsidiary, is the landlord under certain lease agreements with First Republic Bank (“First Republic”) aggregating 460,726 square feet, at our One Front Street property in San Francisco, CA. On May 1, 2023, First Republic was closed by the California Department of Financial Protection and Innovation, and the Federal Deposit Insurance Corporation (“FDIC”) was appointed as receiver. Subsequent thereto, JPMorgan Chase Bank, N.A. (“J.P. Morgan”) acquired all deposit accounts and substantially all the assets and assumed certain liabilities of First Republic from the FDIC. In connection therewith, J.P. Morgan had 60 days to assess whether or not to assume or reject our lease agreements with First Republic.

On June 30, 2023, we entered into a surrender and assumption agreement with J.P. Morgan whereby J.P. Morgan will (i) assume, under the same lease terms that we had with First Republic, 344,010 square feet of existing space, and (ii) surrender the remaining 116,716 square feet of space, which largely represented space that was not being utilized by First Republic, and a majority of which (88,236 square feet) was subleased to various other tenants under lease agreements expiring between 2023 and 2024.

The table below summarizes the impact of the above agreement:

|

|

|

|

|

|

|

|

|

Square Feet Occupied |

|

|

Annualized Rent

(in thousands) |

|

Existing space, as reported |

|

460,726 |

|

|

$ |

42,989 |

|

Surrendered space |

|

(116,716 |

) |

|

|

(12,068 |

) |

Space assumed by J.P. Morgan |

|

344,010 |

|

|

|

30,921 |

|

Portion of surrendered space that is subleased to various other tenants |

|

88,236 |

|

|

|

7,014 |

|

Pro Forma, as adjusted |

|

432,246 |

|

|

$ |

37,935 |

|

As of June 30, 2023, we had a $7.3 million straight-line rent receivable balance related to the space surrendered by J.P. Morgan which, in accordance with generally accepted accounting principles (“GAAP”), will be written-off in the quarter ended June 30, 2023.

Additionally, we, through a different wholly-owned subsidiary are also the landlord under a long-term lease agreement with SVB Securities (“SVB Securities”), at our 1301 Avenue of the Americas property in Manhattan, NY. SVB Securities leased an aggregate of 108,994 square feet from us and is a subsidiary of SVB Financial Group, which filed for Chapter 11 bankruptcy relief on March 17, 2023. On June 28, 2023, we executed a termination of our lease with SVB Securities and entered into a new lease with the entity acquiring substantially all of the assets of SVB Securities, including 68,183 square feet on a long-term basis, and 40,811 square feet on a short-term basis. The effectiveness of our new lease is subject to certain approvals. As of June 30, 2023, we had a $6.6 million straight-line rent receivable balance related to the prior lease with SVB Securities, which, in accordance with GAAP, will be written-off in the quarter ended June 30, 2023.

As a result of the transactions described above, the Company anticipates a negative impact to its full year 2023 Net Income and Funds from Operations of approximately $19.6 million, or $0.08 per diluted share, resulting from (i) the non-cash straight-line write-offs aggregating $13.9 million, and (ii) $5.7 million of lower GAAP rental revenue, related to the terminated SVB Securities lease and the J.P. Morgan surrendered space, net of rental revenue from the subleased space.

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of the federal securities laws. You can identify these statements by our use of the words “assumes,” anticipates,” “believes,” “estimates,” “expects,” “guidance,” “intends,” “plans,” “projects” and similar expressions that do not relate to historical matters. You should exercise caution in interpreting and relying on forward-looking statements because they involve known and unknown risks, uncertainties and other factors which are, in some cases, beyond the Company’s control and could materially affect actual results, performance or achievements. These factors include, without limitation, failure to obtain the noted approvals, and other risks and uncertainties detailed from time to time in the Company’s filings with the Securities and Exchange Commission. The Company does not undertake a duty to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

PARAMOUNT GROUP, INC. |

|

|

|

Date: July 7, 2023 |

By: |

/s/ Wilbur Paes |

|

Name: |

Wilbur Paes |

|

Title |

Chief Operating Officer, Chief Financial Officer and Treasurer |

|

|

|

v3.23.2

Document and Entity Information

|

Jun. 30, 2023 |

| Cover [Abstract] |

|

| Entity Address, State or Province |

NY

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001605607

|

| Document Type |

8-K

|

| Document Period End Date |

Jun. 30, 2023

|

| Entity Registrant Name |

Paramount Group, Inc.

|

| Entity Incorporation State Country Code |

MD

|

| Entity File Number |

001-36746

|

| Entity Tax Identification Number |

32-0439307

|

| Entity Address, Address Line One |

1633 Broadway

|

| Entity Address, Address Line Two |

Suite 1801

|

| Entity Address, City or Town |

New York

|

| Entity Address, Postal Zip Code |

10019

|

| City Area Code |

212

|

| Local Phone Number |

237-3100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre Commencement Tender Offer |

false

|

| Pre Commencement Issuer Tender Offer |

false

|

| Security 12b Title |

Common stock of Paramount Group, Inc., $0.01 par value per share

|

| Trading Symbol |

PGRE

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

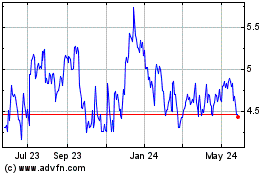

Paramount (NYSE:PGRE)

Historical Stock Chart

From Apr 2024 to May 2024

Paramount (NYSE:PGRE)

Historical Stock Chart

From May 2023 to May 2024