Filed Pursuant to Rule 424(b)(3)

Registration No. 333-254987

PROSPECTUS FOR

95,795,231 SHARES OF COMMON STOCK AND

6,000,000 WARRANTS TO PURCHASE SHARES OF COMMON STOCK

AND

15,999,990 SHARES OF

COMMON STOCK UNDERLYING WARRANTS

OF

OUSTER, INC.

This prospectus relates to

(i) the resale of 90,474,330 shares of common stock, par value $0.0001 per share (the “common stock”) issued in connection with the Merger (as defined below) by certain of the securityholders named in this prospectus (each a

“Registered Holder” and, collectively, the “Registered Holders”), (ii) the resale of 5,168,333 shares of common stock issued in the PIPE Investment (as defined below) by certain of the Registered Holders, (iii) the resale of

up to 152,568 shares of common stock upon the settlement of restricted stock units and (iv) the issuance by us of up to 15,999,990 shares of common stock upon the exercise of outstanding warrants. This prospectus also relates to the resale of

up to 6,000,000 of our outstanding warrants originally purchased in a private placement by certain of the Registered Holders.

On March 11,

2021, we consummated the transactions contemplated by that certain Agreement and Plan of Merger, dated as of December 21, 2020 (the “Merger Agreement”), by and among Colonnade Acquisition Corp., a Cayman Islands exempted company

(“CLA”), Beam Merger Sub Inc., a Delaware corporation and a direct wholly owned subsidiary of CLA (“Merger Sub”), and Ouster, Inc., a Delaware corporation (“Old Ouster”). As contemplated by the Merger Agreement, CLA was

domesticated as a Delaware corporation and changed its name to “Ouster, Inc.” (the “Domestication”). Following the Domestication, Merger Sub merged with and into Old Ouster, the separate corporate existence of Merger Sub ceased

and Old Ouster survived as a wholly owned subsidiary of Ouster (the “Merger” and, together with the Domestication, the “Business Combination”).

We will receive the proceeds from any exercise of the warrants for cash, but not from the resale of the shares of common stock or warrants by the Registered

Holders.

We will bear all costs, expenses and fees in connection with the registration of the shares of common stock and warrants. The Registered Holders

will bear all commissions and discounts, if any, attributable to their respective sales of the shares of common stock and warrants.

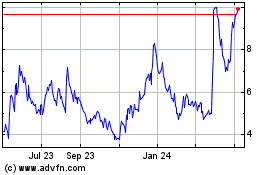

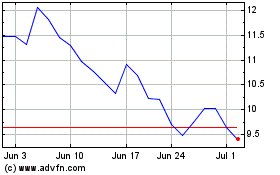

Our common stock

trades on the New York Stock Exchange (the “NYSE”) under the ticker symbol “OUST” and our warrants trade on the NYSE under the ticker symbol “OUST WS”. On July 21, 2022, the closing sale price of our common stock as

reported by the NYSE was $1.96 per share and the closing price of our warrants was $0.29 per warrant.

Investing in shares of our

common stock or warrants involves risks that are described in the “Risk Factors” section beginning on page 6 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued under this

prospectus or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date

of this prospectus is July 22, 2022.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the U.S. Securities and Exchange Commission (the “SEC”) using a

“shelf” registration process. By using a shelf registration statement, the Registered Holders named in this prospectus may, from time to time, sell the securities described in this prospectus from time to time in one or more offerings as

described in this prospectus. To the extent necessary, each time that the Registered Holders offer and sell securities, we or the Registered Holders may provide a prospectus supplement to this prospectus that contains specific information about the

securities being offered and sold and the specific terms of that offering. To the extent permitted by law, we may also authorize one or more free writing prospectuses that may contain material information relating to these offerings. Such prospectus

supplement or free writing prospectus may also add, update or change information contained in this prospectus with respect to that offering. If there is any inconsistency between the information in this prospectus and the applicable prospectus

supplement or free writing prospectus, you should rely on the prospectus supplement or free writing prospectus, as applicable. Before purchasing any securities, you should carefully read both this prospectus and the applicable prospectus supplement

(and any applicable free writing prospectuses), together with the additional information described under the heading “Where You Can Find More Information; Incorporation by Reference.”

Neither we nor the Registered Holders have authorized anyone to provide you with any information or to make any representations other than those contained in

this prospectus, any applicable prospectus supplement or any free writing prospectuses prepared by or on behalf of us or to which we have referred you. Neither we nor the Registered Holders take any responsibility for, nor provide any assurance as

to the reliability of, any other information that others may give you. Neither we nor the Registered Holders will make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the

information appearing in this prospectus and the applicable prospectus supplement to this prospectus is accurate only as of the date on its respective cover, that the information appearing in any applicable free writing prospectus is accurate only

as of the date of that free writing prospectus, and that any information incorporated by reference is accurate only as of the date of the document incorporated by reference, unless we indicate otherwise. Our business, financial condition, results of

operations and prospects may have changed since those dates.

This prospectus incorporates by reference, and any prospectus supplement or free writing

prospectus may contain and incorporate by reference, market data and industry statistics and forecasts that are based on independent industry publications and other publicly available information. Although we believe these sources are reliable,

neither we nor the Registered Holders guarantee the accuracy or completeness of this information and neither we nor the Registered Holders have independently verified this information. In addition, the market and industry data and forecasts that may

be included or incorporated by reference in this prospectus, any prospectus supplement or any applicable free writing prospectus may involve estimates, assumptions and other risks and uncertainties and are subject to change based on various factors,

including those discussed under the heading “Risk Factors” contained in this prospectus, any applicable prospectus supplement and any applicable free writing prospectus, and under similar headings in other documents that are incorporated

by reference into this prospectus. Accordingly, investors should not place undue reliance on this information.

As used in this prospectus, unless

otherwise indicated or the context otherwise requires, the terms “we,” “our,” “us” and the “Company” mean Ouster, Inc. and its subsidiaries, which was a special purpose acquisition company called

“Colonnade Acquisition Corp.” prior to the closing of the Business Combination. When we refer to “you,” we mean the potential holders of the shares of our common stock or warrants to purchase shares of our common stock.

In this prospectus, we refer to our common stock and warrants to purchase shares of common stock, collectively, as “securities.”

1

WHERE YOU CAN FIND MORE INFORMATION;

INCORPORATION BY REFERENCE

Available

Information

We file reports, proxy statements and other information with the SEC. The SEC maintains a web site that contains reports, proxy and

information statements and other information about issuers, such as us, who file electronically with the SEC. The address of that website is http://www.sec.gov. You may access these materials free of charge as soon as reasonably practicable

after they are electronically filed with or furnished to the SEC.

Our web site address is www.ouster.com. The information on our web site, however, is

not, and should not be deemed to be, a part of, or incorporated by reference into, this prospectus.

This prospectus and any prospectus supplement are

part of a registration statement that we filed with the SEC and do not contain all of the information in the registration statement. The full registration statement may be obtained from the SEC or us, as provided above. Statements in this prospectus

or any prospectus supplement about these documents are summaries and each statement is qualified in all respects by reference to the document to which it refers. You should refer to the actual documents for a more complete description of the

relevant matters. You may inspect a copy of the registration statement through the SEC’s website, as provided above.

Incorporation by Reference

The SEC’s rules allow us to “incorporate by reference” information into this prospectus, which means that we can disclose important

information to you by referring you to another document filed separately with the SEC. The information incorporated by reference is deemed to be part of this prospectus, and subsequent information that we file with the SEC will automatically update

and supersede that information. Any statement contained in this prospectus or a previously filed document incorporated by reference will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained

in this prospectus or a subsequently filed document incorporated by reference modifies or replaces that statement.

This prospectus and any accompanying

prospectus supplement incorporate by reference the documents set forth below that have previously been filed with the SEC:

| |

• |

|

Our Annual Report on Form

10-K for the year ended December 31, 2021, filed with the SEC on February 28, 2022. |

| |

• |

|

Our Quarterly Report on Form

10-Q for the quarter ended March 31, 2022, filed with the SEC on May 6, 2022. |

| |

• |

|

The description of our shares of Common Stock contained in the our Registration Statement on

Form 8-A, filed with the SEC on August 19, 2020, as updated in Exhibit 4.3 to our Annual

Report for the year ended December 31, 2021, filed with the SEC on February 28, 2022, as well as any additional amendments or reports filed for the purpose of updating such description. |

All reports and other documents we subsequently file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended,

which we refer to as the “Exchange Act” in this prospectus, prior to the termination of this offering, including all such documents we may file with the SEC after the date of the initial registration statement and prior to the

effectiveness of the registration statement, but excluding any information furnished to, rather than filed with, the SEC, will also be incorporated by reference into this prospectus and deemed to be part of this prospectus from the date of the

filing of such reports and documents.

2

You may request a free copy of any of the documents incorporated by reference in this prospectus by writing

or telephoning us at the following address:

Ouster, Inc.

350 Treat Avenue

San Francisco,

California 94110

(415) 949-0108

Exhibits to the filings will not be sent, however, unless those exhibits have specifically been incorporated by reference in this prospectus or any

accompanying prospectus supplement.

3

THE COMPANY

Ouster is building the eyes of autonomy. We are a leading provider of high-resolution digital lidar sensors and enabling software that gives robots,

machinery, vehicles and fixed infrastructure advanced 3D vision allowing them to safely interact with the physical world.

We design and manufacture

digital lidar sensors that we believe to be the highest performing, lowest cost lidar solutions available today across each of our four target markets: automotive, industrial automation; smart infrastructure and robotics. We believe that our digital

lidar technology positions us at the center of a global revolution in autonomy. We believe that 3D vision technologies, coupled with artificial intelligence, will power new autonomous technologies that in turn will fundamentally disrupt business

models across many existing industries and also enable entirely new industries and capabilities.

Beyond the automotive market, we believe that there is

an even larger market for lidar sensors. We believe our highly flexible digital lidar architecture strongly positions us to address what we believe is a rapidly growing demand. Our industrial customers today are using lidar to increase safety and

automating operations across the global supply chain, in material handling vehicles at ports and warehouses, in off-highway vehicles at mines and farms, and in manufacturing equipment in factories. In our

smart infrastructure vertical, cities are increasing safety and efficiency through using lidar control traffic lights and warning systems, and security companies are improving intrusion detection and tracking by augmenting existing CCTV systems with

the spatial tracking capabilities of lidar. We believe these markets present a significant opportunity for growth, as they touch nearly every aspect of our daily lives.

We envision a future where lidar-powered solutions are widespread, with useful and affordable 3D perception capabilities built into every moving robot, car,

truck and drone, as well as every factory, building, stoplight, dock, and airport terminal.

The registrant was initially incorporated under the name

“Colonnade Acquisition Corp.” on June 4, 2020 as a Cayman Islands exempted company for purposes of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more

businesses. On March 10, 2021, the registrant domesticated into a Delaware corporation and changed our name to “Ouster, Inc.” in connection with the consummation of the business combination with Ouster Technologies, Inc. Following the

business combination, the operations of Ouster Technologies, Inc. were the only ongoing operations of the registrant.

Our principal executive office is

located at 350 Treat Avenue, San Francisco, CA 94110. Our telephone number is (415) 949-0108. Our website address is www.ouster.com. Information contained on our website is not a part of this prospectus, and

the inclusion of our website address in this prospectus is an inactive textual reference only.

4

THE OFFERING

| Shares of Common Stock to be Issued by Us upon Exercise of All Warrants |

15,999,990 shares |

| Securities Offered by the Registered Holders |

Up to (i) 95,795,231 shares of common stock, (ii) 6,000,000 warrants to purchase shares of common stock and (iii) 15,999,990 shares of common stock underlying warrants. |

| Use of Proceeds |

All of the shares of common stock and warrants offered by the Registered Holders will be sold by them for their respective accounts. We will not receive any of the proceeds from these sales. |

We will receive any proceeds from the exercise of the warrants for cash, but not from the sale of the shares of common stock issuable upon

such exercise.

Unless otherwise disclosed in a prospectus supplement, we intend to use any net proceeds from the exercise of warrants

for cash for general corporate purposes.

| Market for Securities |

Our common stock and warrants are listed on the NYSE under the symbols “OUST” and “OUST WS”, respectively. |

| Risk Factors |

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 6 of this prospectus for a discussion of factors you should carefully consider before investing in our securities. |

5

RISK FACTORS

Investment in any securities offered pursuant to this prospectus and the applicable prospectus supplement involves risks. You should carefully consider the

risk factors incorporated by reference to our most recent Annual Report on Form 10-K, and any subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K, and all other information contained or incorporated by reference into this prospectus, as updated by our subsequent filings under the Exchange Act, and the risk factors and other information contained

in the applicable prospectus supplement and any applicable free writing prospectus before acquiring any of such securities. The risks and uncertainties we have described are not the only ones facing our company. Additional risks and uncertainties

not presently known to us or that we currently deem immaterial may also affect our business operations. The occurrence of any of these risks might cause you to lose all or part of your investment in the offered securities. The discussion of risks

includes or refers to forward-looking statements. You should read the explanation of the qualifications and limitations on such forward-looking statements contained or incorporated by reference into this prospectus and in any applicable prospectus

supplement.

6

USE OF PROCEEDS

All of the shares of common stock and warrants offered by the Registered Holders will be sold by them for their respective accounts. We will not receive any

of the proceeds from these sales.

The Registered Holders will pay any underwriting fees, discounts, selling commissions, stock transfer taxes and certain

legal expenses incurred by such Registered Holders in disposing of their shares of common stock and warrants, and we will bear all other costs, fees and expenses incurred in effecting the registration of such securities covered by this prospectus,

including, without limitation, all registration and filing fees, NYSE listing fees and fees and expenses of our counsel and our independent registered public accountants.

We will receive any proceeds from the exercise of the warrants for cash, but not from the sale of the shares of common stock issuable upon such exercise.

Unless otherwise disclosed in a prospectus supplement, we intend to use any net proceeds from the exercise of warrants for cash for general corporate purposes.

7

DESCRIPTION OF SECURITIES

The following description of the terms of our capital stock and warrants is not complete and is qualified in its entirety by reference to our Restated

Certificate of Incorporation, as amended (the “Certificate of Incorporation”), our Amended and Restated Bylaws (the “Bylaws”) and the warrant agreement, all of which are attached as exhibits to our Annual Report on Form 10-K.

Capital Stock

Authorized Capitalization

General

The total amount of our authorized capital stock consists of 1,000,000,000 shares of common stock, par value $0.0001 per share, and 100,000,000 shares of

preferred stock, par value $0.0001 per share.

Preferred Stock

Our board of directors (the “Board”) has authority to issue shares of preferred stock in one or more series, to fix for each such series such voting

powers, designations, preferences, qualifications, limitations or restrictions thereof, including dividend rights, conversion rights, redemption privileges and liquidation preferences for the issue of such series all to the fullest extent permitted

by the Delaware General Corporation Law (“DGCL”). The issuance of preferred stock could have the effect of decreasing the trading price of our common stock, restricting dividends on our capital stock, diluting the voting power of our

common stock, impairing the liquidation rights of our capital stock, or delaying or preventing a change in control of our company.

Common Stock

Our common stock does not entitle its holders to preemptive or other similar subscription rights to purchase any of our securities. Our common stock

is neither convertible nor redeemable. Unless our Board determines otherwise, we will issue all of our capital stock in uncertificated form.

Voting

Rights

Each holder of our common stock is entitled to one vote per share on each matter submitted to a vote of stockholders, as provided by the

Certificate of Incorporation. The Bylaws provide that the holders of a majority of the capital stock issued and outstanding and entitled to vote thereat, present in person, or by remote communication, if applicable, or represented by proxy, will

constitute a quorum at all meetings of the stockholders for the transaction of business. When a quorum is present, the affirmative vote of a majority of the votes cast is required to take action, unless otherwise specified by law, the Bylaws or the

Certificate of Incorporation, and except for the election of directors, which is determined by a plurality vote. There are no cumulative voting rights.

Dividend Rights

Each holder of shares of our capital

stock is entitled to the payment of dividends and other distributions as may be declared by Board from time to time out of our assets or funds legally available for dividends or other distributions. These rights are subject to the preferential

rights of the holders of our preferred stock, if any, and any contractual limitations on our ability to declare and pay dividends.

Other Rights

The rights of each holder of our common stock are subject to, and may be adversely affected by, the rights of the holders of any series of our

preferred stock that we may designate and issue in the future.

8

Liquidation Rights

If we are involved in voluntary or involuntary liquidation, dissolution or winding up of our affairs, or a similar event, each holder of our common stock will

participate pro rata in all assets remaining after payment of liabilities, subject to prior distribution rights of our preferred stock, if any, then outstanding.

Anti-takeover Effects of the Certificate of Incorporation and the Bylaws

The Certificate of Incorporation and the Bylaws contain provisions that may delay, defer or discourage another party from acquiring control of our company. We

expect that these provisions, which are summarized below, will discourage coercive takeover practices or inadequate takeover bids. These provisions are also designed to encourage persons seeking to acquire control of our company to first negotiate

with the Board, which we believe may result in an improvement of the terms of any such acquisition in favor of our stockholders. However, they also give the Board the power to discourage mergers that some stockholders may favor.

Special Meetings of Stockholders

The Certificate

of Incorporation provides that a special meeting of stockholders may be called by (a) the Chairperson of the Board, (b) the Board, (c) our Chief Executive Officer or (d) our President, provided that such special meeting may be

postponed, rescheduled or cancelled by the Board or other person calling the special meeting.

Action by Written Consent

The Certificate of Incorporation provides that any action required or permitted to be taken by our stockholders must be effected at an annual or special

meeting of the stockholders, and may not be taken by written consent in lieu of a meeting.

Classified Board of Directors

Our Certificate of Incorporation provides that our Board is divided into three classes, with the classes as nearly equal in number as possible and each class

serving three-year staggered terms. The Board or any individual director may be removed from office at any time, but only for cause and only by the affirmative vote of the holders of at least a majority of the voting power of all of the then

outstanding shares of our voting stock entitled to vote at an election of directors.

Election of Directors and Vacancies

Subject to the rights of the holders of any series of preferred stock to elect additional directors under specified circumstances, the number of directors of

our Board is fixed exclusively by the Board. Our Board is divided into three classes, designated Class I, II and III, with each class to be elected by our stockholders every three years.

Amendment of the Certificate of Incorporation and Bylaws

Our Board is expressly authorized to adopt, amend or repeal the Bylaws, subject to the power of our stockholders entitled to vote with respect thereto to

adopt, amend or repeal the Bylaws. Our stockholders have the power to adopt, amend or repeal the Bylaws; provided, that in addition to any vote of the holders of any class or series of our stock required by applicable law or by our Certificate of

Incorporation or Bylaws, the adoption, amendment or repeal of our Bylaws by our stockholders shall require the affirmative vote of the holders of at least two-thirds of the voting power of all of the then

outstanding shares of our voting stock entitled to vote generally in an election of directors.

9

Additionally, the vote of at least 66 2/3% of the total voting power of our outstanding shares entitled to

vote thereon, voting together as a single class, is required to amend certain provisions of our Certificate of Incorporation, including those relating to the terms of our authorized preferred stock (Article V(B)), the authority and composition of

our Board (Article VII), special meetings of our stockholders and the ability of our stockholders to act by written consent (Article VIII), limitation of liability of our directors (Article IX), restrictions similar to Section 203 of the DGCL

(Article X), our obligation to indemnify our directors and officers to the fullest extent permitted by law (Article XI), exclusive jurisdiction of certain legal proceedings involving our stockholders (Article XII).

Delaware Anti-Takeover Statute

Section 203

of the DGCL provides that if a person acquires 15% or more of the voting stock of a Delaware corporation, such person becomes an “interested stockholder” and may not engage in certain “business combinations” with such corporation

for a period of three years from the time such person acquired 15% or more of such corporation’s voting stock, unless: (a) the board of directors of such corporation approves the acquisition of stock or the merger transaction before the

time that the person becomes an interested stockholder, (b) the interested stockholder owns at least 85% of the outstanding voting stock of such corporation at the time the merger transaction commences (excluding voting stock owned by directors

who are also officers and certain employee stock plans), or (c) the merger transaction is approved by the board of directors and at a meeting of stockholders, not by written consent, by the affirmative vote of at least two-thirds of the outstanding voting stock which is not owned by the interested stockholder. A Delaware corporation may elect in its certificate of incorporation or bylaws not to be governed by this particular

Delaware law. Under the Certificate of Incorporation, we have opted out of Section 203 of the DGCL, but the Certificate of Incorporation provides other similar restrictions regarding takeovers by interested stockholders.

Limitations on Liability and Indemnification of Officers and Directors

The Certificate of Incorporation provides that we are to indemnify our directors to the fullest extent authorized or permitted by applicable law. We have

entered and expect to continue to enter into agreements to indemnify our directors, executive officers and other employees as determined by the Board. Under the Bylaws, we are required to indemnify each of our directors and officers if the basis of

the indemnitee’s involvement was by reason of the fact that the indemnitee is or was our director or officer or was serving at our request as a director, officer, employee or agent for another entity. We must indemnify our officers and

directors against all expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by the indemnitee in connection with such action, suit or proceeding if the indemnitee acted in good

faith and in a manner the indemnitee reasonably believed to be in or not opposed to our best interests, and, with respect to any criminal action or proceeding, had no reasonable cause to believe the indemnitee’s conduct was unlawful. The Bylaws

also require us to advance expenses (including attorneys’ fees) incurred by a director or officer in defending any civil, criminal, administrative or investigative action, suit or proceeding, provided that such person will repay any such

advance if it is ultimately determined that such person is not entitled to indemnification by us. Any claims for indemnification by our directors and officers may reduce our available funds to satisfy successful third-party claims against us and may

reduce the amount of money available to us.

Exclusive Jurisdiction of Certain Actions

Our Certificate of Incorporation provides that, to the fullest extent permitted by law, and unless we consent in writing to the selection of an alternative

forum, the Court of Chancery of the State of Delaware (or, in the event that the Chancery Court does not have jurisdiction, the federal district court for the District of Delaware or other state courts of the State of Delaware) will be the sole and

exclusive forum for (i) any derivative action, suit or proceeding brought on our behalf, (ii) any action, suit or proceeding asserting a claim of breach of a fiduciary duty owed by any of our directors, officers or stockholders to us or

our stockholders, (iii) any action, suit or proceeding arising pursuant to any provision of the DGCL or the Bylaws or the Certificate of Incorporation (as

10

each may be amended from time to time), (iv) any action, suit or proceeding as to which the DGCL confers jurisdiction on the Court of Chancery of the State of Delaware, or (v) any action,

suit or proceeding asserting a claim against us or any current or former director, officer or stockholder governed by the internal affairs doctrine, and, if brought outside of Delaware, the stockholder bringing the suit will be deemed to have

consented to (a) the personal jurisdiction of the state and federal courts in the State of Delaware in connection with any action brought in any such court to enforce the exclusive jurisdiction provisions of the Certificate of Incorporation and

(b) service of process on such stockholder’s counsel.

Section 22 of the Securities Act creates concurrent jurisdiction for federal and

state courts over all suits brought to enforce any duty or liability created by the Securities Act or the rules and regulations thereunder. Accordingly, both state and federal courts have jurisdiction to entertain such Securities Act claims. To

prevent having to litigate claims in multiple jurisdictions and the threat of inconsistent or contrary rulings by different courts, among other considerations, the Certificate of Incorporation also provides that, unless we consent in writing to the

selection of an alternative forum, to the fullest extent permitted by law, the federal district courts of the United States of America shall be the exclusive forum for the resolution of any complaint asserting a cause of action arising under the

Securities Act; however, there is uncertainty as to whether a court would enforce such provision, and investors cannot waive compliance with federal securities laws and the rules and regulations thereunder. Notwithstanding the foregoing, the

Certificate of Incorporation provides that the exclusive forum provision will not apply to suits brought to enforce any cause of action arising by the Exchange Act or any other claim for which the federal courts have exclusive jurisdiction.

Section 27 of the Exchange Act creates exclusive federal jurisdiction over all suits brought to enforce any duty or liability created by the Exchange Act or the rules and regulations thereunder. Although we believe these provisions would

benefit us by providing increased consistency in the application of applicable law in the types of lawsuits to which they apply, these provisions may have the effect of discouraging lawsuits against our directors and officers.

Transfer Agent

The transfer agent for our common

stock is Continental Stock Transfer & Trust Company.

Warrants

Public Warrants

Public warrants refers to the

Company’s warrants that were offered and sold in the Company’s initial public offering pursuant to a registration statement. As of December 31, 2021, there were 15,999,990, public warrants outstanding. Each whole public warrant

entitles the registered holder to purchase one share of our common stock at a price of $11.50 per share, subject to adjustment as discussed below, provided that there is an effective registration statement under the Securities Act covering the

shares of our common stock issuable upon exercise of the warrants and a current prospectus relating to them available (or we permit holders to exercise their warrants on a cashless basis under the circumstances specified in the warrant agreement)

and such shares are registered, qualified or exempt from registration under the securities, or blue sky, laws of the state of residence of the holder. Pursuant to the warrant agreement, a warrant holder may exercise its warrants only for a whole

number of shares of our common stock. This means only a whole warrant may be exercised at a given time by a warrant holder. The warrants will expire on March 11, 2026 at 5:00 p.m., New York City time, or earlier upon redemption or liquidation.

We are not obligated to deliver any shares of common stock pursuant to the exercise of a warrant and have no obligation to settle such warrant exercise

unless a registration statement under the Securities Act with respect to the shares of our common stock underlying the warrants is then effective and a prospectus relating thereto is current, subject to us satisfying our obligations described below

with respect to registration. No warrant will be exercisable and we will not be obligated to issue a share of common stock upon exercise of a warrant unless the shares of common stock issuable upon such warrant exercise has been registered,

qualified or deemed to be

11

exempt under the securities laws of the state of residence of the registered holder of the warrants. In the event that the conditions in the two immediately preceding sentences are not satisfied

with respect to a warrant, the holder of such warrant will not be entitled to exercise such warrant and such warrant may have no value and expire worthless. In no event will we be required to net cash settle any warrant.

We have agreed to maintain the effectiveness of a registration statement covering the issuance, under the Securities Act, of the shares of common stock

issuable upon exercise of the warrants, and a current prospectus relating thereto, until the expiration of the warrants in accordance with the provisions of the warrant agreement. Notwithstanding the above, if the shares of common stock are at the

time of any exercise of a warrant not listed on a national securities exchange such that they satisfy the definition of a “covered security” under Section 18(b)(1) of the Securities Act, we may, at our option, require holders of

public warrants who exercise their warrants to do so on a “cashless basis” in accordance with Section 3(a)(9) of the Securities Act and, in the event we so elect, we will not be required to maintain in effect a registration statement,

and in the event we do not so elect, we will be obligated to use our best efforts to register or qualify the shares under applicable blue sky laws to the extent an exemption is not available.

We may call the warrants for redemption:

| |

• |

|

in whole and not in part; |

| |

• |

|

at a price of $0.01 per warrant; |

| |

• |

|

upon not less than 30 days’ prior written notice of redemption (the

“30-day redemption period”) to each warrantholder; and |

| |

• |

|

if, and only if, the reported closing price of our common stock equals or exceeds $18.00 per share (as adjusted

for stock splits, stock dividends, reorganizations, recapitalizations and the like) for any 20 trading days within a 30 trading-day period ending three business days before we send the notice of redemption to

the warrantholders. |

If and when the warrants become redeemable by us, we may exercise our redemption right even if we are unable to

register or qualify the underlying securities for sale under all applicable state securities laws.

If the foregoing conditions are satisfied and we issue

a notice of redemption of the warrants, each warrant holder will be entitled to exercise his, her or its warrant prior to the scheduled redemption date. However, the price of our common stock may fall below the $18.00 redemption trigger price (as

adjusted for stock splits, stock dividends, reorganizations, recapitalizations and the like) as well as the $11.50 warrant exercise price after the redemption notice is issued.

If we call the warrants for redemption as described above, our Board will have the option to require any holder that wishes to exercise his, her or its

warrant to do so on a “cashless basis.” In determining whether to require all holders to exercise their warrants on a “cashless basis,” our management may consider, among other factors, our cash position, the number of warrants

that are outstanding and the dilutive effect on our stockholders of issuing the maximum number of shares of common stock issuable upon the exercise of the warrants. If we takes advantage of this option, all holders of warrants would pay the exercise

price by surrendering their warrants for that number of shares of common stock equal to the quotient obtained by dividing (a) the product of the number of shares of common stock underlying the warrants, multiplied by the excess of the

“fair market value” (defined below) over the exercise price of the warrants by (b) the fair market value. The “fair market value” will mean the average reported closing price of the shares of common stock for the 10 trading

days ending on the third trading day prior to the date on which the notice of redemption is sent to the holders of warrants. If we take advantage of this option, the notice of redemption will contain the information necessary to calculate the number

of shares of common stock to be received upon exercise of the warrants, including the “fair market value” in such case. Requiring a cashless exercise in this manner will reduce the number of shares to be issued and thereby lessen the

dilutive effect of a warrant redemption. We believe this feature is an attractive option to us if we do not need the

12

cash from the exercise of the warrants. If we call the warrants for redemption and do not take advantage of this option, the holders of the private placement warrants and their permitted

transferees would still be entitled to exercise their private placement warrants for cash or on a cashless basis using the same formula described above that other warrant holders would have been required to use had all warrant holders been required

to exercise their warrants on a cashless basis, as described in more detail below. A holder of a warrant may notify us in writing in the event it elects to be subject to a requirement that such holder will not have the right to exercise such

warrant, to the extent that after giving effect to such exercise, such person (together with such person’s affiliates), to the warrant agent’s actual knowledge, would beneficially own in excess of 4.9% or 9.8% (or such other amount as

specified by the holder) of the shares of our common stock outstanding immediately after giving effect to such exercise.

If the number of outstanding

shares of our common stock is increased by a stock dividend payable in shares of our common stock, or by a split-up or other similar event, then, on the effective date of stock dividend, split-up or similar event, the number of shares of common stock issuable on exercise of each warrant will be increased in proportion to such increase in the outstanding shares of our common stock. A rights offering

to holders of our common stock entitling holders to purchase shares of our common stock at a price less than the fair market value will be deemed a stock dividend of a number of shares of our common stock equal to the product of (a) the number

of shares of common stock actually sold in such rights offering (or issuable under any other equity securities sold in such rights offering that are convertible into or exercisable for shares of our common stock) and (b) the quotient of

(i) the price per share of our common stock paid in such rights offering and (ii) the fair market value. For these purposes (a) if the rights offering is for securities convertible into or exercisable for shares of our common stock,

in determining the price payable for shares of our common stock, there will be taken into account any consideration received for such rights, as well as any additional amount payable upon exercise or conversion and (b) fair market value means

the volume weighted average price of shares of our common stock as reported during the 10 trading day period ending on the trading day prior to the first date on which the shares of our common stock trade on the applicable exchange or in the

applicable market, regular way, without the right to receive such rights.

In addition, if we, at any time while the warrants are outstanding and

unexpired, pay a dividend or make a distribution in cash, securities or other assets to the holders of shares of our common stock on account of such shares of common stock (or other securities into which the warrants are convertible), other than as

described above or certain ordinary cash dividends, then the warrant exercise price will be decreased, effective immediately after the effective date of such event, by the amount of cash and/or the fair market value of any securities or other assets

paid on each share of our common stock in respect of such event.

If the number of outstanding shares of our common stock is decreased by a consolidation,

combination, reverse stock split or reclassification of shares of our common stock or other similar event, then, on the effective date of such consolidation, combination, reverse stock split, reclassification or similar event, the number of shares

of common stock issuable on exercise of each warrant will be decreased in proportion to such decrease in outstanding shares of our common stock.

Whenever

the number of shares of our common stock purchasable upon the exercise of the warrants is adjusted, as described above, the warrant exercise price will be adjusted by multiplying the warrant exercise price immediately prior to such adjustment by a

fraction (a) the numerator of which will be the number of shares of common stock purchasable upon the exercise of the warrants immediately prior to such adjustment, and (b) the denominator of which will be the number of shares of common

stock so purchasable immediately thereafter.

In case of any reclassification or reorganization of the outstanding shares of our common stock (other than

those described above or that solely affects the par value of such shares of our common stock), or in the case of any merger or consolidation of our company with or into another corporation (other than a consolidation or merger in which we are the

continuing corporation and that does not result in any reclassification or reorganization of the issued and outstanding shares of our common stock), or in the case of any sale or conveyance to another corporation or entity of the assets or other

property of our as an entirety or substantially as an entirety in

13

connection with which we are dissolved, the holders of the warrants will thereafter have the right to purchase and receive, upon the basis and upon the terms and conditions specified in the

warrants and in lieu of the shares of our common stock immediately theretofore purchasable and receivable upon the exercise of the rights represented thereby, the kind and amount of shares of our common stock or other securities or property

(including cash) receivable upon such reclassification, reorganization, merger or consolidation, or upon a dissolution following any such sale or transfer, that the holder of the warrants would have received if such holder had exercised their

warrants immediately prior to such event. If less than 70% of the consideration receivable by the holders of shares of our common stock in such a transaction is payable in the form of shares of common stock in the successor entity that is listed for

trading on a national securities exchange or is quoted in an established over-the-counter market, or is to be so listed for trading or quoted immediately following such

event, and if the registered holder of the warrant properly exercises the warrant within 30 days following public disclosure of such transaction, the warrant exercise price will be reduced as specified in the warrant agreement based on the

Black-Scholes Warrant Value (as defined in the warrant agreement) of the warrant. The purpose of such exercise price reduction is to provide additional value to holders of the warrants when an extraordinary transaction occurs during the exercise

period of the warrants pursuant to which the holders of the warrants otherwise do not receive the full potential value of the warrants.

The warrants are

issued in registered form under a warrant agreement between Continental Stock Transfer & Trust Company, as warrant agent, and us. The warrant agreement provides that the terms of the warrants may be amended without the consent of any holder

for the purpose of (a) curing any ambiguity or to correct any defective provision, (b) adjusting the provisions relating to cash dividends on shares of our common stock as contemplated by and in accordance with the warrant agreement or

(c) adding or changing any other provisions with respect to matters or questions arising under the warrant agreement as the parties to the warrant agreement may deem necessary or desirable and that the parties deem to not adversely affect the

interests of the registered holders of the warrants. All other modifications or amendments will require the approval by the holders of at least 50% of the then-outstanding public warrants and, solely with respect to any amendment to the terms of the

private placement warrants, 50% of the then outstanding private placement warrants. You should review a copy of the warrant agreement, which is filed as an exhibit to our Annual Report on Form 10-K, for a

complete description of the terms and conditions applicable to the warrants.

The warrants may be exercised upon surrender of the warrant certificate on

or prior to the expiration date at the offices of the warrant agent, with the exercise form on the reverse side of the warrant certificate completed and executed as indicated, accompanied by full payment of the exercise price (or on a cashless

basis, if applicable), by certified or official bank check payable to us, for the number of warrants being exercised. The warrant holders do not have the rights or privileges of holders of shares of our common stock and any voting rights until they

exercise their warrants and receive shares of our common stock. After the issuance of shares of our common stock upon exercise of the warrants, each holder will be entitled to one vote for each share held of record on all matters to be voted on by

stockholders.

No fractional shares will be issued upon exercise of the warrants. If, upon exercise of the warrants, a holder would be entitled to receive

a fractional interest in a share, we will, upon exercise, round down to the nearest whole number of shares of our common stock to be issued to the warrantholder.

Private Placement Warrants

Private placement

warrants refers to the warrants issued in a private placement to Colonnade Sponsor LLC (the “Sponsor”). As of December 31, 2021, there were 6,000,000 private placement warrants outstanding. The private placement warrants (including

the shares of our common stock issuable upon exercise of such warrants) will not be redeemable by us so long as they are held by the Sponsor, members of the Sponsor or their permitted transferees. The Sponsor or its permitted transferees have the

option to exercise the private placement warrants on a cashless basis. Except as described below, the private placement warrants have terms and provisions that are identical to those of the public warrants, including as to exercise price,

exercisability and exercise period. If the

14

private placement warrants are held by holders other than the Sponsor or its permitted transferees, the private placement warrants will be redeemable by us and exercisable by the holders on the

same basis as the public warrants.

If holders of the private placement warrants elect to exercise them on a cashless basis, they would pay the exercise

price by surrendering his, her or its warrants for that number of shares of our common stock equal to the quotient obtained by dividing (a) the product of the number of shares of our common stock underlying the warrants, multiplied by the

excess of the “fair market value” (defined below) over the exercise price of the warrants by (b) the fair market value. The “fair market value” will mean the average reported closing price of the shares of our common stock

for the 10 trading days ending on the third trading day prior to the date on which the notice of warrant exercise is sent to the warrant agent.

15

REGISTERED HOLDERS

This prospectus relates to (i) the resale of 90,474,330 shares of common stock issued in connection with the Merger by certain of the Registered Holders,

(ii) the resale of 5,168,333 shares of common stock issued in the PIPE Investment by certain of the Registered Holders, (iii) the resale of up to 152,568 shares of common stock upon the settlement of restricted stock units and

(iv) the issuance by us of up to 15,999,990 shares of common stock upon the exercise of outstanding warrants. This prospectus also relates to the resale of up to 6,000,000 of our outstanding warrants originally purchased in a private placement

by certain of the Registered Holders. The Registered Holders may from time to time offer and sell any or all of the shares of common stock and warrants set forth below pursuant to this prospectus and any accompanying prospectus supplement. When we

refer to the “Registered Holders” in this prospectus, we mean the persons listed in the table below, and the pledgees, donees, transferees, assignees, successors, designees and others who later come to hold any of the Registered

Holders’ interest in the common stock or warrants other than through a public sale.

The following table sets forth, as of July 1, 2022, the names of

the Registered Holders, and the aggregate number of shares of common stock and warrants that the Registered Holders may offer pursuant to this prospectus. The table does not include the issuance by us of up to 9,999,996 shares of common stock upon

the exercise of outstanding warrants, each of which is also covered by this prospectus.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Name of Registered Holders |

|

Before the Offering |

|

|

After the Offering |

|

| |

Number of

Shares of

Common

Stock |

|

|

Number of

Warrants |

|

|

Number of

Shares of

Common

Stock

Being

Offered (1) |

|

|

Number of

Warrants

Being

Offered (2) |

|

|

Number of

Shares of

Common

Stock |

|

|

Percentage of

Outstanding

Shares of

Common

Stock |

|

|

Number of

Warrants |

|

|

Percentage

of

Outstanding

Warrants |

|

| Angus Pacala (3) |

|

|

4,385,807 |

|

|

|

— |

|

|

|

4,385,807 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Arcadia Investment Partners LLC |

|

|

20,000 |

|

|

|

— |

|

|

|

20,000 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Banyan Venture Holdings LLC (4) |

|

|

25,572,646 |

|

|

|

— |

|

|

|

25,572,646 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| BBR Absolute Return (QP), LP |

|

|

13,831 |

|

|

|

— |

|

|

|

13,831 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| BBR Absolute Return 03OS |

|

|

1,431 |

|

|

|

— |

|

|

|

1,431 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| BBR Absolute Return, LP |

|

|

1,908 |

|

|

|

— |

|

|

|

1,908 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Beacon Hill Private Limited |

|

|

25,000 |

|

|

|

— |

|

|

|

25,000 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Blackwell Partners LLC – Series A |

|

|

165,000 |

|

|

|

— |

|

|

|

165,000 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Carthona Capital FS PTY LTD ACN 600 937 933 as Trustee For The Carthona Ouster No.2 Trust

(ABN 17 818 905 922) (5) |

|

|

2,641,227 |

|

|

|

— |

|

|

|

2,641,227 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Carthona Capital FS PTY LTD ATF Carthona Ouster Trust

(ABN 12 364 567 438) (5) |

|

|

890,529 |

|

|

|

— |

|

|

|

890,529 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| CCVF1 (HP) Services PTY LTD

(ACN 620 088 459) in its Capacity as the Trustee for the Carthona

Capital Venture Fund (HP) No. 1 (ABN 93 305 716 604) Part A (6) |

|

|

196,612 |

|

|

|

— |

|

|

|

196,612 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| CCVF1 (HP) Services PTY LTD (ACN 620 088 459) in its Capacity as the Trustee for the

Carthona Capital Venture Fund (HP) No. 1 (ABN 93 305 716 604) Part B (5) |

|

|

298,550 |

|

|

|

— |

|

|

|

298,550 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

16

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Name of Registered Holders |

|

Before the Offering |

|

|

After the Offering |

|

| |

Number of

Shares of

Common

Stock |

|

|

Number of

Warrants |

|

|

Number of

Shares of

Common

Stock

Being

Offered (1) |

|

|

Number of

Warrants

Being

Offered (2) |

|

|

Number of

Shares of

Common

Stock |

|

|

Percentage of

Outstanding

Shares of

Common

Stock |

|

|

Number of

Warrants |

|

|

Percentage

of

Outstanding

Warrants |

|

| CCVF1 (HP) Services PTY LTD

(ACN 620 088 459) in its Capacity as the Trustee for the Carthona

Capital Venture Fund (HP) No. 1 (ABN 93 305 716 604) Part C |

|

|

4,258,980 |

|

|

|

— |

|

|

|

4,258,980 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| CCVF2 (HP) Services PTY LTD ACN 637 907 414 As Trustee For The Carthona Capital Venture

Fund (HP) No. 2 ABN 11 878 913 827 |

|

|

2,348,957 |

|

|

|

— |

|

|

|

2,348,957 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Christopher Glinski |

|

|

315,000 |

|

|

|

— |

|

|

|

315,000 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Citadel Multi-Strategy Equities Master Fund Ltd. (6) |

|

|

900,000 |

|

|

|

— |

|

|

|

900,000 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Emil W. Henry (7) |

|

|

25,000 |

|

|

|

— |

|

|

|

25,000 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| GAC Acquisition LLC |

|

|

975,890 |

|

|

|

— |

|

|

|

975,890 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Hartree Partners LP |

|

|

400,000 |

|

|

|

— |

|

|

|

400,000 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| HF Fund LP |

|

|

1,000,000 |

|

|

|

— |

|

|

|

1,000,000 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Hiddenite Capital Master Fund LTD |

|

|

160,000 |

|

|

|

75,000 |

|

|

|

60,000 |

|

|

|

— |

|

|

|

100,000 |

|

|

|

* |

|

|

|

75,000 |

|

|

|

* |

|

| James C. Flores (8) |

|

|

138,636 |

|

|

|

— |

|

|

|

138,636 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Joseph S. Sambuco (9) |

|

|

1,730,152 |

|

|

|

2,100,000 |

|

|

|

1,730,152 |

|

|

|

2,100,000 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Joseph S. Sambuco 2012 Family Trust |

|

|

154,091 |

|

|

|

— |

|

|

|

154,091 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Manny de Zarraga (10) |

|

|

138,636 |

|

|

|

— |

|

|

|

138,636 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Mark Frichtl (11) |

|

|

3,343,636 |

|

|

|

— |

|

|

|

3,343,636 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Maso Capital Investments Limited |

|

|

60,000 |

|

|

|

— |

|

|

|

60,000 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| OIG Ouster IV, LLC (12) |

|

|

8,058,362 |

|

|

|

— |

|

|

|

8,058,362 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Ouster Investments LLC (13) |

|

|

4,991,190 |

|

|

|

— |

|

|

|

4,991,190 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Remy W. Trafelet (14) |

|

|

1,557,576 |

|

|

|

2,100,000 |

|

|

|

1,557,576 |

|

|

|

2,100,000 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Remy W. Trafelet Revocable Trust |

|

|

391,667 |

|

|

|

— |

|

|

|

391,667 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Roger T. Mullarkey |

|

|

20,000 |

|

|

|

— |

|

|

|

20,000 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| RTCM Holdings PTE. LTD. |

|

|

391,666 |

|

|

|

— |

|

|

|

391,666 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Schonfeld Strategic 460 Fund LLC |

|

|

500,000 |

|

|

|

— |

|

|

|

500,000 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Sharing LLC Ouster 2 PS (15) |

|

|

6,726,512 |

|

|

|

— |

|

|

|

6,726,512 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Sharing LLC Ouster 3 PS (15) |

|

|

3,703,221 |

|

|

|

— |

|

|

|

3,703,221 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Sharing LLC Ouster PS (15) |

|

|

456,889 |

|

|

|

— |

|

|

|

456,889 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Spring Creek Capital, LLC |

|

|

— |

|

|

|

274,200 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

274,200 |

|

|

|

1.7 |

% |

| Star V Partners LLC |

|

|

75,000 |

|

|

|

— |

|

|

|

75,000 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Tanpoint (US) Private Limited |

|

|

1,257,576 |

|

|

|

1,800,000 |

|

|

|

1,257,576 |

|

|

|

1,800,000 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Tao Invest II LLC (16) |

|

|

11,253,152 |

|

|

|

— |

|

|

|

11,253,152 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Tech Opportunities LLC (17) |

|

|

1,000,000 |

|

|

|

— |

|

|

|

1,000,000 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Xiaoping Hu |

|

|

30,000 |

|

|

|

— |

|

|

|

30,000 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Total |

|

|

90,574,330 |

|

|

|

6,349,200 |

|

|

|

90,474,330 |

|

|

|

6,000,000 |

|

|

|

100,000 |

|

|

|

* |

|

|

|

349,200 |

|

|

|

2.2 |

% |

| (1) |

The amounts set forth in this column are the number of shares of common stock that may be offered by such

Registered Holder using this prospectus. These amounts do not represent any other shares of our common stock that the Registered Holder may own beneficially or otherwise. |

| (2) |

The amounts set forth in this column are the number of warrants that may be offered by such Registered Holder

using this prospectus. These amounts do not represent any other warrants that the Registered Holder may own beneficially or otherwise. |

17

| (3) |

Angus Pacala has served as the Company’s Chief Executive Officer and as a member of the board of directors

since the closing of the business combination on March 11, 2021 and held the same or similar positions with Old Ouster prior to the business combination. |

| (4) |

Krishna Kantheti is the manager of Banyan Venture Holdings LLC. As a result, Mr. Kantheti may be deemed to

beneficially own the shares held by Banyan Venture Holdings LLC. Mr. Kantheti also served as a member of the board of directors of Old Ouster prior to the business combination. The address for Banyan Venture Holdings LLC is 215 NW 24th St,

Suite 501, Miami FL 33127. |

| (5) |

Consists of (i) 4,754,142 shares of Ouster common stock held by Carthona Capital Venture Fund (HP)

No. 1 (“Carthona Fund 1”), (ii) 2,348,957 shares of Ouster common stock held by Carthona Capital Venture Fund (HP) No. 2 (“Carthona Fund 2”), (iii) 890,529 shares of Ouster common stock held by Carthona

Ouster Trust (“Carthona Fund 3”) and (iv) 2,641,227 shares of Ouster common stock held by Carthona Ouster No. 2 Trust (“Carthona Fund 4” and collectively with Carthona Fund 1, Carthona Fund 2 and Carthona Fund 3, the

“Carthona Funds”). Carthona Fund 1 and Carthona Fund 2 are managed by Carthona Capital FS Pty Ltd (“Carthona Manager 1”). Carthona Fund 3 and Carthona Fund 4 are managed by Carthona Capital Pty Ltd a/t/f the Carthona Capital

Ventures Trust (“Carthona Manager 2”). Dean Dorrell and James Synge are the directors of Carthona Manager 1 and Carthona Manager 2. Messrs. Dorrell and Synge, as the directors of Carthona Manager 1 and Carthona Manager 2, share voting

and investment power of the securities held by the Carthona Funds. |

| (6) |

Pursuant to a portfolio management agreement, Citadel Advisors LLC, an investment advisor registered under the

U.S. Investment Advisers Act of 1940 (“CAL”), holds the voting and dispositive power with respect to the shares held by Citadel Multi-Strategy Equities Master Fund Ltd. Citadel Advisors Holdings LP (“CAH”) is the sole member of

CAL. Citadel GP LLC is the general partner of CAH. Kenneth Griffin (“Griffin”) is the President and Chief Executive Officer of and sole member of Citadel GP LLC. Citadel GP LLC and Griffin may be deemed to be the beneficial owners of the

shares of common stock through their control of CAL and/or certain other affiliated entities. |

| (7) |

Emil W. Henry served as a director of the Company from August 25, 2020 (inception) until the closing of

the business combination on March 11, 2021. |

| (8) |

James C. Flores served as a director of the Company from August 25, 2020 (inception) until the closing of

the business combination on March 11, 2021. |

| (9) |

Joseph S. Sambuco served as Chairman of the Company’s board of directors from June 4, 2020

(inception) until the closing of the business combination on March 11, 2021. |

| (10) |

Manny de Zarraga served as a director of the Company from August 25, 2020 (inception) until the closing of

the business combination on March 11, 2021. |

| (11) |

Mark Frichtl has served as the Company’s Chief Technology Officer since the closing of the business

combination on March 11, 2021 and held the same or similar positions with Old Ouster prior to the business combination. |

| (12) |

Kyle Veenstra is the sole manager of OIG Ouster IV, LLC. As a result, Mr. Veenstra may be deemed to

beneficially own the shares held by OIG Ouster IV, LLC. |

| (13) |

Consists of 7,406,443 shares of Ouster common stock held of record by Ouster Investments LLC. Zach Frankel

exercises voting and dispositive power with respect to these securities. As a result, Mr. Frankel may be deemed to beneficially own the shares held by Ouster Investments LLC. |

| (14) |

Remy W. Trafelet has served as a director of the company since June 4, 2020 (inception), and served as the

Company’s Chief Executive Officer from June 4, 2020 (inception) until the closing of the business combination on March 11, 2021. |

| (15) |

Consists of (i) 6,726,512 shares of Ouster common stock held of record by Sharing LLC Ouster 2 PS,

(ii) 3,703,221 shares of Ouster common stock held of record by Sharing LLC Ouster 3 PS dated June 15, 2016 and (iii) 456,889 shares of Ouster common stock held of record by Sharing LLC Ouster PS. By virtue of his authority to vote or sell

such shares, Jacob Goldfield may be deemed to beneficially own the shares held by such entities. The address for each of the foregoing entities is 33 Union Square West New York, NY 10003. |

| (16) |

The managing member of Tao Invest II LLC (“Tao Invest”) is Tao Capital Management LP (“LP”)

whose general partner is Tao Capital Management Inc. (“GP”). Joseph I. Perkovich, James Schwaba, and Lori |

18

| |

Mills, as officers of GP, have voting and dispositive power over the shares of Ouster common stock that held by Tao Invest. Tao Invest, LP, GP, and the foregoing individuals disclaim any

beneficial ownership of such shares of Ouster common stock except to the extent of their direct or indirect pecuniary interest therein. The business address of Tao Invest, LP and GP is One Letterman Drive, Suite

C4-420, San Francisco, California 94129. |

| (17) |

Hudson Bay Capital Management LP, the investment manager of Tech Opportunities LLC, has voting and investment

power over these securities. Sander Gerber is the managing member of Hudson Bay Capital GP LLC, which is the general partner of Hudson Bay Capital Management LP. Each of Tech Opportunities LLC and Sander Gerber disclaims beneficial ownership over

these securities. |

Registered Holder information for each additional Registered Holder, if any, will be set forth by prospectus

supplement to the extent required prior to the time of any offer or sale of such Registered Holder’s shares pursuant to this prospectus. To the extent permitted by law, a prospectus supplement may add, update, substitute or change the

information contained in this prospectus, including the identity of each Registered Holder and the number of shares of common stock or warrants registered on its behalf. A Registered Holder may sell or otherwise transfer all, some or none of such

shares of common stock or warrants in this offering. See “Plan of Distribution.”

For information regarding transactions between us and the

Registered Holders, see the section entitled “Certain Relationships and Related Person Transactions.”

19

PLAN OF DISTRIBUTION

The Registered Holders, which as used herein includes donees, pledgees, transferees, distributees or other successors-in-interest selling shares of our common stock or warrants or interests in our common stock or warrants received after the date of this prospectus from the Registered Holders as a gift, pledge,

partnership distribution or other transfer, may, from time to time, sell, transfer, distribute or otherwise dispose of certain of their shares of common stock or warrants or interests in our common stock or warrants on any stock exchange, market or

trading facility on which shares of our common stock or warrants, as applicable, are traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing

market price, at varying prices determined at the time of sale, or at negotiated prices.

The Registered Holders may use any one or more of the following

methods when disposing of their shares of common stock or warrants or interests therein:

| |

• |

|