Osisko Gold Royalties Ltd (the “

Company” or

“

Osisko”) (OR: TSX & NYSE) is pleased to

provide some select asset updates. All monetary amounts included in

this update are expressed in Canadian dollars, unless otherwise

noted.

Jason Attew, President & CEO of Osisko

commented: “As we head into the final stretch of 2024, positive

progress continues to be made across Osisko’s high-quality asset

base thanks to the ongoing hard work and dedication of our

operating partners. These achievements continue to surface

incremental value for Osisko and its shareholders, largely by

underpinning the Company’s near-to-medium-term gold equivalent

ounce delivery growth profile. Osisko’s projected growth trajectory

remains peer-leading and comes from assets that require no

contingent capital along the way; in other words, our five-year

growth outlook is already entirely bought and paid for.”

SELECT ASSET UPDATES

Mantos Blancos (operated by Capstone Copper

Corp.)

On October 31st, 2024, Capstone Copper Corp.

(“Capstone”) provided an update on its Mantos

Blancos mine located in the Antofagasta Region of Chile. In July

2024, a successful two-week planned shutdown was completed which

included the installation of a new holding tank and additional

pumps in the tailings area. These investments addressed the

deficiencies identified that were preventing the sustained

achievement of the 20,000 tonnes per day (“tpd”)

throughput capacity from the plant’s sulphide concentrator.

Following the plant ramp-up period in August, Capstone reported

that ore throughput averaged 18,062 tpd through to the end of the

third quarter of 2024, with plant throughput meeting or exceeding

the nameplate capacity of 20,000 tpd over 23 separate operating

days (as at September 30th, 2024). Capstone subsequently reported

that the average daily throughput at Mantos Blancos for October

2024 was 18,481 tpd and that from November 1st to November 16th,

2024, plant throughput averaged over and above 20,000 tpd. The

overall variability of the milling process has been significantly

reduced and consistently higher throughput is expected throughout

the fourth quarter of 2024, and beyond.

Additionally, Capstone continues to highlight

the potential for a Phase II expansion at Mantos Blancos over the

next few years, with a Feasibility Study, looking at increasing

throughput to at least 27,000 tpd, expected towards the end of

2025.

Osisko, through its wholly-owned subsidiary

Osisko Bermuda Limited (“Osisko Bermuda”), owns a

silver stream on Mantos Blancos. Under the stream agreement, Osisko

Bermuda will purchase 100% of payable silver produced at Mantos

Blancos until 19.3 million ounces have been delivered and 40% of

payable silver thereafter for the remaining life-of-mine

(“LOM”).

Island Gold District (operated by Alamos Gold

Inc.)

On September 12th, 2024, Alamos Gold Inc.

(“Alamos”) provided updated three-year production

and operating guidance incorporating the recently completed

acquisition of the Magino mine and mill

(“Magino”), now part of Alamos’ Island Gold

District. Alamos is spending US$40 million to expand the newly

acquired Magino mill to 12,400 tpd by 2026. This will accommodate

ore from both Magino and the increased production from the Island

Gold Mine (“Island Gold”) following the completion

of the Island Gold Phase 3+ Expansion in the first half of 2026.

The Phase 3+ Expansion includes a new shaft which is expected to

increase underground production from Island Gold to at least 2,400

tpd. On November 4th, 2024, Alamos announced that it expects to

conclude an Island Gold District LOM plan by mid-2025, followed by

an Island Gold District Expansion Study by the fourth quarter of

2025.

Alamos is also now considering a further

expansion of the Island Gold District in the future that would

potentially increase production from the underground operation,

over and above the Phase 3+ Expansion already underway. According

to Alamos, a further expansion of the Magino mill to 15,000 to

20,000 tpd will be evaluated, including possibly increasing

underground throughput sourced from Island Gold beyond the

currently planned 2,400 tpd.

Finally, the union of Island Gold and Magino

will continue to facilitate previously impossible exploration

initiatives, whereby Alamos sees potential to expand the Magino

open pit to the east, which was previously constrained by the

boundary between the two separately owned properties; drilling is

already underway.

Osisko owns a 1.38-3.0% net smelter return

(“NSR”) royalty on the Island Gold Mine. With the

district now fully consolidated, Alamos’ expanded and accelerated

Phase 3+ Expansion mine plan at Island Gold is anticipated to

transition a greater proportion of production towards Osisko’s 2%

and 3% NSR royalty boundaries earlier in the mine plan, as opposed

to the mineral inventory covered by Osisko’s current 1.38% NSR

royalty. A small portion of the eastern limit of the Magino pit is

also covered by the 3.0% NSR royalty owned by Osisko.

Éléonore Mine (operated by Newmont Corp.)

On November 25th, 2024, Newmont Corp.

(“Newmont”) announced that it has agreed to sell

its Éléonore operation in Northern Quebec, Canada, to Dhilmar Ltd

(“Dhilmar”) for US$795 million in cash

consideration. The transaction is expected to close in the first

quarter of 2025, subject to certain conditions being satisfied.

Dhilmar is a newly incorporated, UK-based private mining company.

The company is led by its CEO and Managing Director, Alexander

Ramlie, and supported by board members with decades of mining

experience across a range of commodities and with both surface and

underground operations. Mr. Ramlie and his team worked closely with

Newmont in 2016 to acquire the Batu Hijau copper-gold mine in

Indonesia on behalf of PT Amman Mineral Internasional Tbk.

Osisko has a 2.2-3.5% NSR royalty on Éléonore,

with a sliding scale based on production. The royalty starts at

2.0% for the first 3.0 million ounces of gold and increases by

0.25% per million ounces produced thereafter. If the spot gold

price exceeds US$500 per ounce, the rate is multiplied by 1.1. The

maximum rate is capped at 3.5%. As at October 31st, 2024, Éléonore

has produced over 2.46 million ounces of gold, resulting in a

current NSR royalty rate of 2.2%.

Seabee Mine (operated by SSR Mining Inc.)

On November 6th, 2024, SSR Mining Inc.

(“SSR Mining”) announced that gold production from

Seabee was 10,252 ounces in the third quarter of 2024, reflecting

the temporary suspension of operations at Seabee due to forest

fires. Following the temporary suspension, employees were cleared

to return to the site on September 23rd, 2024 to begin repairs to

ancillary equipment damaged by the fires, including power poles,

piping, and exploration equipment. Operations at Seabee were fully

reinstated on October 11, 2024. As a result, full-year 2024

production guidance for Seabee is now 65,000 to 70,000 ounces of

gold (previously 75,000 to 85,000 ounces of gold).

Osisko owns a 3.0% NSR royalty on Seabee,

including the Santoy, Porky, and Shane exploration targets.

Namdini Gold Mine (operated by Cardinal Namdini Mining Ltd., a

majority-owned subsidiary of Shandong Gold Mining Co Ltd.)

On November 8th, 2024, Cardinal Namdini Mining

Ltd. (“Cardinal Namdini”) hosted a commissioning

ceremony for the Namdini Gold Mine in Ghana. Cardinal Namdini

reiterated that it is committed to becoming a leader in sustainable

mining. The event was honoured by the presence of the many esteemed

guests including: H.E. Nana Addo Dankwa Akufo-Addo, President of

the Republic of Ghana; H.E. Tong Defa, Ambassador Extraordinary

& Plenipotentiary of the People’s Republic of China to Ghana;

Mr. Han Yaodong, CEO of Shandong Gold Group; Kugbilsong

Nanlebeglang, Paramount Chief of the Talensi Traditional Area; and,

Hon. Samuel A. Jinapor, Ghana Minister for Lands & Natural

Resources. Subsequent to the commissioning update, news of first

gold being poured at Namdini was announced on November 11th,

2024.

Namdini has been developed as a single open-pit

mine feeding a conventional carbon-in-leach processing facility,

with mining expected to initially focus on a high-grade starter pit

area towards the north of the deposit.

Osisko owns a 1.0% NSR covering the Namdini Gold

Mine.

Dalgaranga Project (operated by Spartan

Resources Ltd.)

On November 25th, 2024, Spartan Resources Ltd.

(”Spartan”) announced that it has received

approvals from both the Department of Energy, Mines, Industry

Regulation and Safety and the Department of Water and Environment

Regulation for the mining and processing of underground ores at the

Dalgaranga Gold Project (“Dalgaranga”), along with

modifications to the mill. These approvals were an important step

towards the restart of Spartan’s 100%-owned Dalgaranga project

following the receipt of all key regulatory approvals required to

allow the mining and processing of underground ores to proceed.

On November 27th, 2024, Spartan also announced

that recent surface drilling has confirmed a significant new gold

discovery, named “Freak”, immediately south (110 meters) of the

Pepper Gold Deposit at Dalgaranga. Highlight intercepts included

5.37 grams per tonne (“g/t”) gold

(“Au”) over 10.26 meters (”m”),

and 5.30 g/t Au over 7.43 m, amongst others. Follow-up wedge holes

from the parent discovery hole have now returned multiple

high-grade intercepts in the new mineralized position, which

remains open down-plunge, sits in a similar orientation to the

Pepper and Never Never Gold Deposits and exhibits identical

alteration styles and mineralogy to the first two breakthrough

high-grade underground discoveries at Dalgaranga. This exciting new

discovery, which is currently the focus of an intensive

three-to-four diamond rig drilling program, represents the third

significant high-grade discovery made by Spartan at Dalgaranga

adjacent to the existing 2.5 million tonne per annum process plant

and supporting surface infrastructure. On September 30th, 2024,

Osisko announced that it had entered into an agreement to acquire a

1.8% gross revenue royalty (“GRR”) on Dalgaranga

operated by Spartan in Western Australia. The consideration to be

paid by Osisko to the seller, Tembo Capital Mining Fund III, for

the GRR will total US$44 million (“the

Transaction”). Spartan has the ability to buy back up to

20% of the 1.8% GRR for a total of A$3.15 million until February

2027. Closing of the Transaction is subject to approval from

Australia’s Foreign Investment Review Board which is expected in

the fourth quarter or 2024.

Hermosa Project (operated by South32 Ltd.)

In its September 2024 Quarterly Activities

Report published on October 20th, 2024, South32 Ltd.

(“South32”) announced that it had invested US$124

million at Hermosa during the September 2024 quarter. South32

progressed construction of the Taylor zinc-lead-silver project

(“Taylor”), as well as on an exploration decline

for the Clark battery-grade manganese deposit. All critical path

dewatering wells were also commissioned during the period.

Construction of Taylor continues to progress as

planned. The headframe for the main shaft has been completed and

commissioning of the hoisting system for the ventilation shaft is

underway. Shaft sinking is on track to commence in the December

2024 quarter. South32 is expecting to spend US$530 million at

Taylor in its fiscal year 2025. Taylor has an initial 28-year LOM

based on current Mineral Reserves, with the potential to realize

further exploration upside, and first production is still on

schedule for South32’s fiscal year 2027.

Osisko owns a 1.0% NSR royalty on zinc and lead

sulphide ores produced at Taylor / Hermosa.

Wharekirauponga Project (operated by OceanaGold

Ltd.)

On October 6th, 2024, OceanaGold Ltd.

(“OceanaGold”) announced that it welcomed the

inclusion of its Waihi North Project, which includes the

Wharekirauponga (“WKP”) proposed underground mine,

in the list of proposed projects under the New Zealand Government's

Fast-track Approvals Bill for regionally and nationally significant

infrastructure and development projects. The Fast-track Approvals

Bill is expected to be passed into law later this year, allowing

listed projects to apply directly to a government-appointed expert

panel for a final decision.

On November 14th, OceanaGold also reported

exploration results from drilling at WKP, located ~10 km from its

operating Waihi gold mine, where highlights included 34.7 g/t Au

over 4.2 m (true width), 16.8 g/t Au over 5.7 m, and 13.0 g/t Au

over 6.6 m. In addition, OceanaGold noted that it is planning to

release a Pre-Feasibility Study for the Waihi North Project (which

includes WKP), and its existing Waihi operation on December 11th,

2024.

Osisko owns a 2.0% NSR royalty on WKP.

Windfall Project (operated by Gold Fields

Limited)

On October 28th, 2024, Gold Fields Limited

(“Gold Fields”) announced the completion of the

acquisition of Osisko Mining Inc. following receipt of all

regulatory approvals and support from shareholders for the

transaction at the Osisko Mining Inc. shareholder meeting on

October 17th, 2024. At the time, Gold Fields CEO Mike Fraser

commented:

“Deposits of the scale and quality of Windfall

with highly prospective exploration camps are rare, particularly in

a world-class jurisdiction like Québec, Canada. This transaction

therefore marks an important step in our journey to continue

improving the quality of our portfolio. The key members of the

Windfall team are remaining with the project, and we look forward

to working with them and our Windfall business partners to develop

this truly exceptional asset. We are also looking forward to

partnering with our host communities, the Cree First Nation of

Waswanipi and the city of Lebel-sur-Quévillon, other local

communities, and the Québec Government to build the next major

mining complex in Québec.”

Osisko owns a 2.0-3.0% NSR royalty on the

Windfall Project and surrounding property.

Cariboo Project (operated by Osisko Development

Corp.)

On October 14th, 2024, Osisko Development Corp.

(“Osisko Development”) announced the successful

closing of a non-brokered private placement of units of the company

for aggregate gross proceeds of US$34.5 million. Following

this, and on November 12th, 2024, Osisko Development announced the

closing of an additional brokered private placement of units of the

company for aggregate gross proceeds of US$57.5 million.

Separately, and on November 20th, 2024, Osisko

Development announced the approval of the British Columbia

(“BC”) Mines Act permits for its 100%-owned

Cariboo Gold Project ("Cariboo") located in

central BC, Canada. The approval of these permits marks an

important milestone in enabling Osisko Development to move forward

with the construction and operation of the underground Cariboo Gold

Project, in parallel with Osisko Development’s ongoing discussions

and consultations with the Xatśūll First Nation. A decision for the

remaining Environmental Management Act permits referred to the

Statutory Decision Maker of the Ministry of Energy and Climate

Solutions is expected shortly.

Progress continues on the ongoing bulk sample

and underground development alongside the optimized Cariboo

feasibility study work, which are slated to be completed in the

first quarter of 2025 and second quarter of 2025, respectively. A

formal positive final investment decision and the engagement on a

project financing package in the coming months would allow for

full-scale construction to commence in the second half of 2025 with

a targeted completion date at the end of 2027.

Osisko owns a 5.0% NSR royalty on the Cariboo

property.

Altar (operated by Aldebaran Resources Inc.)

On November 25th, 2024, Aldebaran Resources Inc.

(“Aldebaran”) announced the results of an updated

Mineral Resource Estimate (“MRE”) for Altar. This

updated MRE includes three main porphyry discoveries (Altar

Central, Altar East, and Altar United) reported within a single

conceptual open pit. Highlights included a Measured & Indicated

Mineral Resource of 2.40 billion tonnes grading 0.42% copper

(“Cu”), 0.07 g/t Au, 1.22 g/t silver

(“Ag”) and 42 parts per million

(“ppm”) molybdenum (“Mo”), and an

Inferred Mineral Resource of 1.22 billion tonnes grading 0.37% Cu,

0.04 g/t Au, 1.25 g/t Ag and 45 ppm Mo.Previous to this, and on

November 7th, 2024, Aldebaran announced that it had entered into an

option to joint venture agreement with Nuton Holdings Ltd.

(“Nuton”), a Rio Tinto venture, whereby Nuton can

acquire a 20% indirect interest in the Altar copper-gold project

(“Altar”) in San Juan, Argentina, by making staged

payments totaling US$250 Million.

Osisko owns a 1.0% NSR royalty on the majority

of Altar.

ADDITIONAL PORTFOLIO

UPDATES

|

1) |

On

November 29th, 2024, Osisko received its first Tocantinzinho

(“TZ”) royalty payment from G Mining Ventures

Corp. (“G Mining”). This was after G Mining

achieved commercial production at TZ on September 1st, 2024, and

also announced the production of 22,071 ounces of gold, as well as

17,144 ounces sold, during the third quarter ending September 30th,

2024. (0.75% NSR royalty) |

|

2) |

Eldorado Gold Corp. announced

that at Lamaque, the inaugural reserve at Ormaque is expected to be

announced by the end of 2024, and material for the bulk sample is

now being stockpiled in preparation for processing through the mill

in December 2024. (1.0% NSR royalty, including Ormaque) |

|

3) |

Minera Alamos Inc.

(“Minera Alamos”) announced that at its operating

Santana Gold Mine, mining and stacking operations during the first

full quarter (third quarter of 2024) of production from the new

Nicho Main Zone pit reached 3,800 ounces of gold which is in line

with Minera Alamos’ forecasts for the period, and an amount that

surpasses the total ounces mined and stacked for the entirety of

2023. (3.0% NSR royalty) |

|

4) |

Marimaca Copper Corp.

(“Marimaca”) announced a $68 million strategic

investment by Assore International Holdings

(“AIH”), including private placements totaling

$30.3 million by AIH. Completion of the Definitive Feasibility

Study for the Marimaca MOD Project remains on track for near-term

delivery in the first half of 2025. (1.0% NSR royalty) |

|

5) |

Calibre Mining Corp. announced

revised 2024 production guidance from its Nevada Operations,

including Pan, to be 34,000 to 36,000 ounces of gold vs. 40,000 to

45,000 ounces of gold, previously. (4.0% NSR royalty) |

|

6) |

Falco Resources Ltd. provided a

corporate update on its flagship Horne 5 Project located in

Rouyn-Noranda, Québec. Following the completion of the public

hearing process with the Office of Public Hearings on the

Environment (“BAPE”), Falco continues to file

documentation and provide responses to the BAPE, in view of the

completion of its report, which is due for submission to the

Minister of the Environment, the Fight Against Climate Change,

Wildlife and Parks by December 26, 2024. (90-100% silver

stream) |

|

7) |

Talisker Resources Ltd. announced

an increased financing package for its 100%-owned Bralorne Gold

Project (“Bralorne”) in British Columbia;

aggregate proceeds of the entire financing package increased to

approximately $22.6 million, and will be used to continue

advancement of Bralorne, including the transition to underground

mining, and for general corporate purposes. (1.7% NSR royalty) |

|

8) |

U.S. GoldMining Inc. announced an

updated Mineral Resource Estimate for its 100%-owned Whistler

Gold-Copper Project in Alaska, U.S.A. Highlights included Indicated

Mineral Resources of 294.5 million tonnes grading 0.42 g/t Au,

0.16% Cu and 2.01 g/t Ag, and Inferred Mineral Resources of 198.2

million tonnes grading 0.52 g/t Au, 0.07% Cu and 1.81 g/t Ag.

(2.75% NSR royalty) |

Qualified Person

The scientific and technical content of this

news release has been reviewed and approved by Guy Desharnais,

Ph.D., P.Geo., Vice President, Project Evaluation at Osisko Gold

Royalties Ltd, who is a “qualified person” as defined by National

Instrument 43-101 – Standards of Disclosure for Mineral Projects

(“NI 43-101”).

About Osisko Gold Royalties Ltd

Osisko is an intermediate precious metal royalty

company focused on the Americas that commenced activities in June

2014. Osisko holds a North American focused portfolio of over 185

royalties, streams and precious metal offtakes. Osisko’s portfolio

is anchored by its cornerstone asset, a 3-5% net smelter return

royalty on the Canadian Malartic Complex, which is home to one of

Canada’s largest gold mines.

Osisko’s head office is located at 1100 Avenue

des Canadiens-de-Montréal, Suite 300, Montréal, Québec,

H3B 2S2.

| For further

information, please contact Osisko Gold Royalties

Ltd: |

|

Grant MoentingVice President, Capital MarketsTel: (514) 940-0670

x116Cell: (365) 275-1954Email: gmoenting@osiskogr.com |

Heather TaylorVice President, Sustainability and CommunicationsTel:

(514) 940-0670 x105Email: htaylor@osiskogr.com |

Forward-looking Statements

Certain statements contained in this press

release may be deemed “forward-looking statements” within the

meaning of the United States Private Securities Litigation Reform

Act of 1995 and “forward-looking information” within the meaning of

applicable Canadian securities legislation. Forward-looking

statements are statements other than statements of historical fact,

that address, without limitation, future events, management’s

expectations on the growth of its asset base and expected

development on time and on budget of the projects and properties

underlying Osisko’s interests. Forward-looking statements are

statements that are not historical facts and are generally, but not

always, identified by the words “expects”, “plans”, “anticipates”,

“believes”, “intends”, “estimates”, “projects”, “potential”,

“scheduled” and similar expressions or variations (including

negative variations), or that events or conditions “will”, “would”,

“may”, “could” or “should” occur. Forward-looking statements are

subject to known and unknown risks, uncertainties and other

factors, most of which are beyond the control of Osisko, and actual

results may accordingly differ materially from those in

forward-looking statements. Such risk factors include, without

limitation, (i) with respect to properties in which Osisko holds a

royalty, stream or other interest; risks related to: (a) the

operators of the properties, (b) timely development, permitting,

construction, commencement of production, ramp-up (including

operating and technical challenges), (c) differences in rate and

timing of production from resource estimates or production

forecasts by operators, (d) differences in conversion rate from

resources to reserves and ability to replace resources, (e) the

unfavorable outcome of any challenges or litigation relating title,

permit or license, (f) hazards and uncertainty associated with the

business of exploring, development and mining including, but not

limited to unusual or unexpected geological and metallurgical

conditions, slope failures or cave-ins, flooding and other natural

disasters or civil unrest or other uninsured risks, (ii) with

respect to other external factors: (a) fluctuations in the prices

of the commodities that drive royalties, streams, offtakes and

investments held by Osisko, (b) fluctuations in the value of the

Canadian dollar relative to the U.S. dollar, (c) regulatory changes

by national and local governments, including permitting and

licensing regimes and taxation policies, regulations and political

or economic developments in any of the countries where properties

in which Osisko holds a royalty, stream or other interest are

located or through which they are held, (d) continued availability

of capital and financing and general economic, market or business

conditions, and (e) responses of relevant governments to infectious

diseases outbreaks and the effectiveness of such response and the

potential impact of such outbreaks on Osisko’s business, operations

and financial condition; (iii) with respect to internal factors:

(a) business opportunities that may or not become available to, or

are pursued by Osisko, (b) the integration of acquired assets or

(c) the determination of Osisko’s PFIC status (d) that financial

information may be subject to year-end adjustments. The

forward-looking statements contained in this press release are

based upon assumptions management believes to be reasonable,

including, without limitation: the absence of significant change in

Osisko’s ongoing income and assets relating to determination of its

PFIC status, and the absence of any other factors that could cause

actions, events or results to differ from those anticipated,

estimated or intended and, with respect to properties in which

Osisko holds a royalty, stream or other interest, (i) the ongoing

operation of the properties by the owners or operators of such

properties in a manner consistent with past practice and with

public disclosure (including forecast of production), (ii) the

accuracy of public statements and disclosures made by the owners or

operators of such underlying properties (including expectations for

the development of underlying properties that are not yet in

production), (iii) no adverse development in respect of any

significant property, (iv) that statements and estimates relating

to mineral reserves and resources by owners and operators are

accurate and (v) the implementation of an adequate plan for

integration of acquired assets.

For additional information on risks,

uncertainties and assumptions, please refer to the most recent

Annual Information Form of Osisko filed on SEDAR+ at

www.sedarplus.ca and EDGAR at www.sec.gov which also provides

additional general assumptions in connection with these statements.

Osisko cautions that the foregoing list of risk and uncertainties

is not exhaustive. Investors and others should carefully consider

the above factors as well as the uncertainties they represent and

the risk they entail. Osisko believes that the assumptions

reflected in those forward-looking statements are reasonable, but

no assurance can be given that these expectations will prove to be

accurate as actual results and prospective events could materially

differ from those anticipated such the forward-looking statements

and such forward-looking statements included in this press release

are not guarantee of future performance and should not be unduly

relied upon. In this press release, Osisko relies on

information publicly disclosed by other issuers and third parties

pertaining to its assets and, therefore, assumes no liability for

such third-party public disclosure. These statements speak

only as of the date of this press release. Osisko undertakes no

obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, other than as required by applicable law.

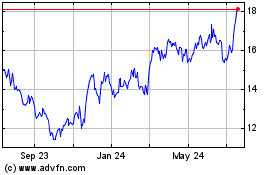

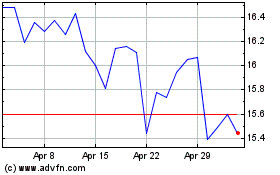

Osisko Gold Royalties (NYSE:OR)

Historical Stock Chart

From Nov 2024 to Dec 2024

Osisko Gold Royalties (NYSE:OR)

Historical Stock Chart

From Dec 2023 to Dec 2024