Osisko Gold Royalties Ltd (the “

Corporation” or

“

Osisko”) (OR: TSX & NYSE) is pleased to

provide an update on its fourth quarter 2022 deliveries, revenues,

cash margin and recent asset advancements. All monetary amounts

included in this report are expressed in Canadian dollars, unless

otherwise noted.

PRELIMINARY Q4 2022 RESULTS

Osisko earned approximately 25,023 attributable

gold equivalent ounces1 (“GEOs”) in the fourth quarter of 2022, for

a total of approximately 89,367 GEOs in 2022, representing record

quarterly and annual deliveries for the Corporation.

Osisko recorded preliminary revenues from

royalties and streams of $61.9 million during the fourth quarter

and preliminary cost of sales (excluding depletion) of

$4.7 million, resulting in a record quarterly cash margin2 of

approximately $57.2 million (or 92%).

For the year 2022, preliminary revenues from

royalties and streams reached a record $217.8 million and

preliminary cost of sales (excluding depletion) are estimated at

$16.1 million, resulting in a record annual cash margin2 of

approximately $201.7 million (or 93%).

As at December 31st, 2022, Osisko’s cash

position amounted to approximately $90.5 million, after repaying,

in full, the $300 million convertible debentures on December 31,

2022 and advancing US$50 million to SolGold plc (“SolGold”)

pursuant to the previously announced royalty financing on the

world-class Cascabel copper-gold property. The Corporation’s

revolving credit facility was drawn by approximately $150 million

at the end of 2022, with an additional amount of $400 million

available to be drawn, plus the uncommitted accordion of up to $200

million.

Sandeep Singh, President and CEO of Osisko,

commented: “2022 was an exceptionally positive year for Osisko. We

had successive quarters of record GEOs earned, revenues and cash

margins, we added world-class assets to an already high-quality

portfolio, took advantage of volatile markets to buy-back 1.7

million common shares for $22.1 million, reactivated stream

payments from the Renard mine, simplified the business with the

deconsolidation of Osisko Development Corp. realigning Osisko as a

pure-play royalty and streaming business and continued to

strengthen and diversify our Board of Directors.

“Our GEOs earned, year-over-year, increased by

12% in 2022 but fell slightly short of the low end of our guidance

of 90,000 ounces. This was partly due to the Eagle mine still

working towards steady-state production and the Mantos mine facing

delays in the ramp up of their mill expansion. That extra growth

will flow into upcoming quarters and we expect significant upward

momentum in deliveries from both mines going forward. The higher

gold-silver price ratio, experienced mostly in the second and third

quarters, also reduced GEOs earned by approximately 1,550 ounces in

2022 versus expectations.

“Our asset base continues to outperform through

numerous expansions, mine life extensions and reserve and resource

replacement, and we look forward to continuing to showcase the

depth and quality of our asset base throughout 2023.”

Osisko will provide full production and

financial details with the release of its fourth quarter and full

year 2022 results after market close on Thursday, February 23rd,

2023 followed by a conference call on Friday, February 24th at 10am

ET. More details are provided at the end of this release.

RECENT ASSET ADVANCEMENTS AND UPCOMING

CATALYSTS

CSA (100% Silver Stream - Pending

Transaction Closing)

On December 28th, Osisko announced that Osisko

Bermuda Limited (“OBL”) entered into a revised binding agreement

with Metals Acquisition Corp (“MAC”) with respect to the previously

announced silver stream on the producing CSA mine (“CSA”) in New

South Wales, Australia. The key amendment in the revised agreement

is a potential reduction in the upfront deposit amount payable by

OBL on closing from US$90 million to US$75 million for 100% of

payable silver for the life of mine. Between 2019-2021, annual

payable silver production from CSA averaged ~431,000 ounces, or

~5,700 gold equivalent ounces3 annually (based on commodity prices

on December 22, 2022).

Additionally, OBL entered into a backstop

financing agreement with MAC as an update to the previously

announced copper stream option. OBL may provide an upfront deposit

of up to US$75 million in respect of a copper stream on CSA, which

MAC may draw in whole or in part to fund any shortfall in the

equity financing required to complete the acquisition of the mine.

If the full deposit is drawn, OBL will be entitled to receive 3.0%

of payable copper until the 5th anniversary of the closing date

(the “First Threshold Stream”), then 4.875% of payable copper until

33,000 metric tonnes have been delivered in aggregate (the “Second

Threshold Stream”), and thereafter 2.25% for the remaining life of

mine. Between 2019-2021, annual copper production from CSA averaged

~43,000 metric tonnes. Based on historical production levels,

average gold equivalent ounces4 deliverable under the First

Threshold Stream and the Second Threshold Stream would equate to

between ~5,700 to 9,300 ounces annually (based on commodity prices

on December 22, 2022).

Closing of the acquisition is expected in 2023,

subject to MAC securing sufficient acquisition financing.

Canadian Malartic Update (5% NSR royalty

on open pit and 3-5% NSR royalty on underground)

On November 4th, Agnico Eagle Mines Ltd.

(“Agnico Eagle”) announced a binding offer to acquire Yamana Gold

Inc.’s (“Yamana”) interest in its Canadian assets, including the

other half of the Canadian Malartic mine (“Canadian Malartic”). The

consolidation of Canadian Malartic would give Agnico Eagle

operational control during the remaining development period of the

Odyssey underground project and would provide the opportunity to

monetize future additional mill capacity at the mine, given Agnico

Eagle’s extensive operations and strategic land position in the

region. In addition to the 3-5% Odyssey net smelter return (“NSR”)

royalty, a $0.40 per tonne milling fee is payable to Osisko on ore

processed from any property that was not part of the Canadian

Malartic Property at the time of the sale of the mine in 2014.

On October 26th, Agnico Eagle reported that

construction and development activities at the Odyssey underground

project remain on schedule. Shaft sinking activities are expected

to commence in January 2023, with pre-commercial production from

the Odyssey South ramp expected in March 2023. In the third quarter

of 2022, ten diamond drill rigs were active at surface and four

rigs were active underground. An expanded drill program is focused

on infill drilling at Odyssey South, on drill testing the Odyssey

Internal zones and on infill and step-out drilling at East Gouldie.

A recent intercept at Odyssey South yielded 5.7 grams per tonne

(“g/t”) gold over 21.8 meters at 367 meters depth. At East Gouldie,

the drilling in the core of the deposit continues to return wide,

high-grade intersections, with recent results including 4.6 g/t

gold over 50.7 meters at 1,537 meters depth. Step-out drilling to

the west of East Gouldie continues to test the western extension

and filling the gap between East Gouldie and the Norrie Zone, with

a recent intercept of 4.2 g/t gold over 12.8 meters at 1,331 meters

depth in an area approximately 100 meters above the Norrie Zone and

670 meters west of the current East Gouldie mineral resources

(Figure 1).

At a conference in Toronto in November, Agnico

Eagle highlighted that recent drilling at Odyssey has extended East

Gouldie to the west by ~670 meters and to the east at depth by

~500 meters, to more than 1,700 meters from the current

mineral resources, demonstrating significant resource growth

potential. Recent drilling suggests the potential connection of the

East Gouldie deposit and the Norrie Zone along strike (Figure 1).

The presentation highlighted that, while still in the concept

phase, there is the potential for an additional 150,000-250,000

ounces of annual gold production from Odyssey Extension (West or

East) based on the assumption of a second shaft producing 10,000 to

15,000 tonnes per day at 2.5 g/t to 2.75 g/t gold (link).

Figure 1: Canadian Malartic Mine – Composite

Longitudinal Section is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/693a19f5-8515-4a5c-8985-0e8cd5bf276b

Mantos Blancos Expansion (100% Silver

Stream)

On October 31st, Capstone Copper Corp.

(“Capstone”) announced that ramp up activities at the Mantos

Blancos Concentrator Debottlenecking Project (“MB-CDP”) continued

during the third quarter with increased focus on achieving

operational stability of the auxiliary systems such as the

electrical and tailing systems. Ramp-up in production has been

slower than initially expected, however, mill throughput continues

to improve and the plant averaged above design throughput level for

20 of 27 planned operating days in October.

Delivery of refined silver to OBL under the

silver stream occurs approximately two months post production at

the Mantos Blancos mine. As a result, Osisko anticipates starting

to fully benefit from the expansion in early 2023.

As part of MD-CDP Phase II, Capstone is

analyzing the potential to increase throughput of the plant to 10.0

million tonnes per year (from 7.3 million tonnes per year) using

existing underutilized ball mills and process equipment. Capstone

is also evaluating the potential to extend the life of copper

cathode production. The Advanced Basic Engineering Study is

expected to be released in the first half of 2023, and the

Environmental DIA application was submitted in August 2022.

Victoria Gold Update (5% NSR

Royalty)

Production throughout 2022 at Eagle was affected

by slower than expected ramp up to steady state primarily due to

mechanical availability of the crushing and conveying circuit being

lower than expected. The primary reason for the lower mechanical

availability was the conveyor belt failure late in the third

quarter resulting in almost three weeks of downtime. Based on

improved operational and maintenance staffing and protocols, it is

expected that gold production will be higher in 2023.

Drilling over the past two years has focused on

testing areas below and adjacent to the current pit at Eagle.

Results have extended mineralization to 850 meters depth

(previously 350 meters depth) and 500 meters to the west

along strike. A new technical report, including an updated mineral

resource estimate, is expected early in 2023 on both Eagle and the

Raven deposit.

Seabee (3% NSR Royalty)

On December 12th, SSR Mining Inc. (“SSR”)

reported exploration results from Seabee including both near-mine

resource development drilling adjacent to current underground

infrastructure at the Santoy Mine Complex, as well as more regional

activity across the Seabee property. Notably, the regional

exploration activity included drilling at the Porky Main and Porky

West targets, with results to-date returning broad intercepts of

near-surface mineralization potentially amenable to open pit mining

in the future.

Additional regional exploration included the

initial delineation of the Shane target, which remains open along

strike and is located adjacent to the Santoy Road that connects the

mine to the Seabee processing facility. Results at Shane included

54.3 g/t gold over 4.6 meters. Given the number of prospective

targets at Seabee, SSR expects to expand their exploration program

at the mine again in 2023, to aggressively advance these

opportunities towards potential development.

Island Gold (1.38-3% NSR

Royalty)

On November 29th, Alamos Gold Inc. (“Alamos”)

reported results from surface and underground exploration drilling

at the Island Gold mine, further extending high-grade gold

mineralization in Island West, Island East and at depth (Figure 2)

and highlighting the significant upside potential; not only

laterally and at depth, but within newly defined sub-parallel

structures. The majority of highlighted drill intersections are

within Osisko’s claims of 2% or 3% NSR royalty, which is a higher

NSR royalty than current production. As of November 25th, a total

of 28,174 meters of surface directional drilling, 17,984 meters of

underground exploration drilling, and 9,707 meters of regional

surface exploration drilling has been completed at the Island Gold

Mine.

At Island West, high-grade mineralization has

been extended 225 meters west of existing Mineral Reserves and

Resources. At the Island West Hanging Wall Zones, high-grade gold

mineralization was intersected within newly defined sub-parallel

zones in the hanging wall (B, G, and G1 zones). These sub-parallel

zones are within proximity of existing underground infrastructure

and represent a significant opportunity to add near mine Mineral

Reserves and Resources. At Island East Lower, high-grade gold

mineralization further extended down-plunge from the large

high-grade Inferred Mineral Resource block in the lower part of

Island East which contained 2.0 million ounces (3.96 million tonnes

grading 15.48 g/t gold) as of December 31, 2021. At Island Main,

high-grade gold mineralization extended 160 meters below Inferred

Mineral Resources (MH30-02), representing one of the deepest

intersections to date at a vertical depth of 1,666 meters. This

highlights the significant opportunity for further high-grade

Mineral Reserve and Resource additions with the deposit open

laterally and at depth across the currently defined 2 kilometers

strike.

Figure 2: Island Gold – Long Section

Highlighting Exploration Drilling Results is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/1765ab40-642f-46c6-811e-c95fe46aeb4f

Lamaque (1% NSR Royalty)

On December 5th, Eldorado published its updated

mineral resource and reserve estimates having an effective date of

September 30, 2022. Lamaque’s Proven and Probable reserves include

4.3 million tonnes of 6.62 g/t gold for 985,000 ounces, which

represented a 10% year-over-year decline (or a 7% increase net of

annual depletion).Eldorado plans to spend ~55% of their 2022

exploration budget ($44 million to $48 million) in Canada.

Approximately 112,000 meters of drilling is planned with a focus on

brownfields opportunities within the Lamaque/Bourlamaque

properties, including exploration drift and resource conversion at

Ormaque and resource conversion of C6 and C7 at Lower Triangle.

Eldorado has 28,000 drill meters dedicated to the Bourlamaque

property, where Osisko has a 2.5% NSR royalty.

Windfall Gold Project (2-3% NSR

Royalty)

On December 8th, Osisko Mining Inc. (“Osisko

Mining”) announced that it had signed a binding term sheet with

Miyuukaa Corp. (“Miyuukaa”), a wholly-owned corporation of the Cree

First Nation of Waswanipi, with respect to the construction of

proposed transmission facilities and the transport of hydroelectric

power to the Windfall project. Miyuukaa will finance, build, own

and operate a 69 kV dedicated transmission line that will transport

hydroelectricity to the Windfall project minimizing the

environmental footprint.

On November 28th, Osisko Mining delivered a

positive step forward for the Windfall gold project in Québec with

the release of feasibility study results highlighting full year

average production of 306,000 ounces of gold at an average fully

diluted grade of 8.1 g/t gold, an after-tax NPV of $1.2 billion at

a 5% discount rate and IRR of 34%. Osisko Mining anticipates

completion of the EIA study and commencement of the permitting

process in Q1 2023. Project financing plans are expected to be

announced in the first half of 2023 with a production decision in

early 2024.

On October 18th, Osisko Mining announced a new

regional exploration program on its Urban-Barry gold project

located in the Abitibi region in Québec. The program, to begin in

early 2023, will focus largely on areas outside the Windfall gold

deposit and will start with 10,000 meters of drilling, and induced

polarization geophysical surveys. Near deposit exploration targets

include a high-potential exploration area identified 1.5 kilometers

east-northeast of the Windfall deposit and on previously identified

showings, including Golden Bear and Fox, which are parallel to the

main Windfall deposit.

Cariboo Gold Project (5% NSR

Royalty)

On January 3rd, 2023, Osisko Development Corp.

(“Osisko Development” or “ODV”) announced results from a

feasibility study on the Cariboo Gold Project (“Cariboo”). Results

highlighted a scalable project with a base case scenario producing

an average of approximately 163,695 ounces of gold annually over a

12-year mine life (1.87 million ounces of cumulative gold

production) at an average diluted head grade of 3.78 g/t gold.

Initial production (“Phase 1”) for the first three years

contemplates a 1,500 tonnes per day operation yielding

approximately 72,501 ounces of gold per year. Concurrently,

underground development will advance to ramp up operations to 4,900

tonnes per day in year four, increasing annual production to

approximately 193,798 ounces of gold per year in Phase 2. The

project delivers a 20.7% IRR and an after-tax NPV of $502 million

at a 5% discount rate and US$1,700 per ounce gold price. The

feasibility study utilized initial Proven and Probable reserves of

16.7 million tonnes at an average grade of 3.78 g/t gold for a

total of 2.03 million ounces of gold.

ODV remains on track for completing the

Environmental Assessment process early in in the second quarter of

2023, anticipates receiving final permits by the end of 2023, with

initial production expected in 2024.

Tintic Project (2.5% Metals

Stream)

On November 30th, Osisko Development announced

sampling results from its ongoing underground exploration program

at its Trixie test mine (“Trixie”). Assay highlights on 702 chip

samples, from 177 mine faces, included the high grade result of

4,757 g/t gold and 528 g/t silver over 1.22 meters. Approximately

7,315 meters of surface reverse circulation drilling and 1,274

meters of underground diamond drilling has been completed to

November 15, 2022, which, together with the continuous face and

back sampling results, will support the completion of an initial

mineral resource estimate expected in the first quarter of

2023.

AK Deposit (2% NSR Royalty)

On October 26th, Agnico Eagle reported that an

assessment is underway to evaluate the Amalgamated Kirkland Deposit

(“AK Deposit” or “AK”) as a potential ore source for its Macassa

mine. At a recent conference in Toronto, Agnico Eagle highlighted

the potential for the AK Deposit to produce

30,000-50,000 ounces of gold starting in 2024. The exploration

ramp into the AK Deposit was completed in the third quarter of

2022. An infill drilling program from underground is underway, with

9,983 meters completed in 75 holes by the end of the third quarter

of 2022. Recent results from infill drilling at AK include a

highlight intercept of 30.7 g/t gold over 3.6 meters at 64 meters

depth. Further expansion potential of the AK Deposit is now being

assessed, as elimination of the property boundaries from the merger

with Kirkland Lake simplifies targeting and exploration in the

eastern extension of the deposit.

Upper Beaver (2% NSR

Royalty)

On October 26th, Agnico Eagle reported that work

continues on the engineering for an exploration shaft and the

potential to use existing Kirkland Lake Camp equipment and

infrastructure to reduce capital expenditures and operating costs

at the Upper Beaver project. Several development scenarios for

Upper Beaver are currently being evaluated.

At a recent conference in Toronto, Agnico Eagle

highlighted the potential for Upper Beaver to produce

150,000-250,000 ounces of gold as early as 2027. Upper Beaver

currently hosts Proven and Probable reserves of 7.9 million

tonnes at 5.43 g/t gold for 1.4 million ounces, Measured and

Indicated resources of 3.6 million tonnes at 3.45 g/t gold for

403,000 ounces and Inferred resources of 8.7 million tonnes at

5.07 g/t gold for 1.4 million ounces.

Cascabel (0.6% NSR Royalty)

On November 23rd, SolGold announced that

investors, including Jiangxi Copper (Hong Kong) Investment Company

Limited (“Jiangxi”), invested US$36 million into the company. Post

the financing, Jiangxi owns approximately 6.3% of SolGold’s

outstanding shares. Jiangxi Copper Company Limited, the parent

company of Jiangxi, is one of the largest global producers of

refined copper. The investment strengthens SolGold’s balance sheet

and signifies another strong endorsement for SolGold and the

Cascabel project.

SolGold is currently undertaking a strategic

review process to maximize shareholder value, including a review of

financing alternatives, the spin out of non-core assets and/or a

direct or indirect sale of an interest in Cascabel as well as

opportunities to de-risk the project, reduce costs and improve

overall economics.

Marimaca Copper (1% NSR

Royalty)

On December 15th, Marimaca Copper Corp.

(“Marimaca”) announced a high-grade primary sulphide intercept from

hole MAD-22. The full drill hole intersected 240 meters at 1.01%

Total Copper (“CuT”) from surface in two separate zones of oxide

and primary sulphide. Sulphide highlights include 92 meters at

2.11% CuT from 140 meters, including 22 meters at 5.27% CuT from

204 meters (Figure 3). While previous drilling into the down-dip

geophysical targets, identified in 2020 and 2021, intersected

additional mixed and secondary sulphides at depth, MAD-22

represents the first significant primary sulphide intersection to

date and could represent a primary high grade feeder structure as

interpreted in Marimaca’s geological model for the deposit.

On November 7th, Marimaca announced it had

entered into a water option agreement to secure future water supply

required for the Marimaca Copper Project. The option will allow

Marimaca to advance final project permitting and technical studies,

including water pipeline studies that are already underway.

On October 13th, Marimaca announced an updated

resource update for the Marimaca Oxide Deposit (“MOD”), which

demonstrated significant resource growth over the 2019 estimate and

could support a potential production rate higher than outlined in

the 2020 PEA. The update highlighted a 98% growth in Measured and

Indicated resources to 139.6 million tonnes at 0.48% CuT

(0.30% Soluble Copper (“CuS”)) for 665,000 tonnes of contained

copper and a 92% growth in Inferred resources to 82.7 million

tonnes at 0.39% CuT (0.16% CuS) for 323,000 tonnes of contained

copper. Given the increase in resources, Marimaca will be examining

50,000 tonne and 60,000 tonne per year copper cathode

production cases versus the 36,000 tonne per year average in

the 2020 PEA. A definitive feasibility study on the MOD is planned

for the second half of 2023 or early 2024.

Figure 3: Marimaca – East West

Cross Section Looking North, Highlighting hole MAD-22 within a

modelled magnetic anomaly is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/e67f9a14-d960-461c-b9ba-ea818d34828e

Hermosa (1% NSR Royalty)

On October 24th, South32 Limited (“South32”)

announced that the feasibility study for the Taylor Deposit remains

on-track to support a final investment decision in mid-2023. Growth

capital expenditure at the Hermosa project was US$46M during the

September 2022 quarter, with US$290M expected to be spent in 2023.

Dewatering is a critical path item which will enable access to both

the Taylor and Clark orebodies. South32 progressed drilling of the

first two dewatering wells and construction of the second water

treatment plant, which remains on-track for commissioning in the

June 2023 quarter.

The selection phase of the Clark pre-feasibility

study was expected to be complete by the end of 2022. Subsequent to

the third quarter, South32 commenced phase two metallurgical test

work and bulk sample collection to support pilot plant production

at the Clark deposit from mid 2023. South32 continues to evaluate

options to accelerate the development pathway for Clark, supported

by the decision of the United States Government to invoke the

Defense Production Act for the production of critical minerals

including manganese, and ongoing discussions with potential

customers and end-users of battery-grade manganese.

Patriot Battery Metals (2% NSR Royalty

on Lithium)

On December 19th, Patriot Battery Metals Inc.

(“Patriot”) released metallurgical test results which showed 79%

recovery to a 5.8% Li2O concentrate using dense media separation

alone.

On December 13th, Patriot reported results from

twelve holes from the CV5 Pegmatite. Osisko’s NSR royalty covers

the majority of known pegmatite bodies on the property. Results

returned some of the highest individual lithium grades to date and

included 113.4 meters at 1.61% Li2O including 38 meters at 2.17%

Li2O. Drilling continues to extend mineralization to the

east-northeast, flanked by several secondary lenses, traced over a

strike length of at least 2,200 meters. Mineralization remains open

in all directions with wide widths and strong grades encountered

along the currently defined length. A winter/spring drill program

is planned to commence in early-January with three rigs already at

site, and an additional two rigs scheduled to mobilize in early

February. The primary objectives of the drill program are to

further delineate the extent of the CV5 Pegmatite, as well as

infill drilling to improve the geological model to achieve

Indicated resource confidence to support a subsequent

Prefeasibility Study. A maiden resource estimate is anticipated in

the first half of 2023.

WKP (2% NSR Royalty)

On December 13th, OceanaGold Corporation

(“Oceana”) announced results from their 2022 resource conversion

program at Wharekirauponga (“WKP”). Since the March 2022 mineral

resource estimate, 5,829 meters were drilled at WKP, predominantly

targeting resource conversion at the EG Vein Zone, in addition to a

further 679 meters supporting geohydrological and geotechnical

studies. Results are anticipated to increase confidence in the

geological and grade continuity of the deposit.

Resource conversion and extensional drilling

continues with approximately 2,500 meters scheduled for the first

half of 2023 in support of a pre-feasibility study expected to be

completed towards the end of 2023. An Indicated Resource of 1.1

million gold ounces has been determined as the optimal resource

size target for defining the initial development plans for the

project study work.

Tocantinzinho (0.75% NSR

Royalty)

On November 22nd, G Mining Ventures (“GMIN”)

provided an update on the Tocantinzinho Project (“TZ”) in Brazil

highlighting that the project remains on track and on budget for

commercial production in the second half of 2024. Detailed

engineering is 43% complete and overall project procurement has

progressed to 73% completion.

On October 18th, GMIN announced results from

delineation drilling at TZ. The program confirmed the continuity of

higher-grade gold in the main pit area (continuous width of close

to 200 meters and to a depth of 400 meters), confirmed that

mineralization extends below the existing pit shell and increased

definition areas to be mined during pre-production. Highlights

confirming a high-grade core include 193.6 meters of 1.48 g/t gold

including 12.8 meters of 4.59 g/t gold and 144.7 meters of 1.70 g/t

gold including 13.7 meters of 2.41 g/t gold. Highlight intercepts

outside the feasibility pit shell include 72.1 meters of 1.05 g/t

gold including 14.8 meters of 3.45 g/t gold.

Regulus Resources (up to 1.5% NSR

Royalty on AntaKori)

On December 22nd, Regulus Resources Inc.

(“Regulus”) announced a US$15 million strategic investment by

Nuton, a Rio Tinto Venture. The investment bolsters Regulus’

balance sheet and represents another strong endorsement of the

AntaKori project. Upon closing, Nuton will own an ~16.5% interest

in Regulus. Regulus and Nuton will jointly undertake copper

sulphide leach testing at AntaKori utilizing Nuton’s technologies.

The Nuton technologies have the potential to process

arsenic-bearing copper sulphides with less impact on the

environment and water resources than traditional concentrator

processing.

ADDITIONAL HIGHLIGHTS

1) Agnico Eagle

reported that work commenced at Akasaba West open pit project in

September 2022 with mobilization of main contractor and initiation

of clearing activities (2.5% NSR royalty)

2) Western Copper and

Gold announced Rio Tinto exercised its right to extend certain

rights under the investor rights agreement (2.75% NSR royalty)

3) First Majestic

announced strong Q3 production from the Ermitaño mine, continued

mill improvements to enhance recoveries (2% NSR royalty)

4) Taseko Mines

announced highest quarterly mill throughput at Gibraltar since

expansion and see potential for continued increases (75% silver

stream)

5) Osisko Development

announced the sale of 7,358 ounces of gold from the San Antonio

stockpile processing in 2022 and 1.1 million tonnes at an average

grade of 0.58 g/t gold have been placed on the pad. ODV is awaiting

receipt of change of use land and EA permits from the Mexican

government while it continues its efforts on stockpile

processing.

6) Highland Copper

announced selection of G Mining Services to prepare a PEA on

combined scenario for Copperwood and White Pine Projects (1.5% NSR

royalty & 100% silver NSR royalty)

7) Osisko Metals

announced definition drilling at Pine Point including 9 meters of

10.51% Zinc and 3.52% Lead, 11.5 meters of 9.37% Zinc and

4.99% Lead and 12 meters of 25.80% Zinc and 6.84% Lead (3% NSR

royalty)

8) Group6 announced

updated project economics for the Dolphin Tungsten Mine including

an increase in the NPV8% to A$300 million from A$231 million and

first tungsten concentrate production on track for Q1 2023 (1.5%

GRR)

9) Shanta Gold

continues to hit high-grade gold at the West Kenya Project

including 721 g/t gold over 0.6 meters, 155 g/t gold over 2.8

meters and 153 g/t gold over 2.2 meters (2% NSR royalty)

10) O3 Mining filed

the Initial Project Description at the Federal and Provincial

Levels for permitting of the Marban Project (0.435-2% NSR

royalty)

11) Calibre Mining

intersected 5.5 g/t gold over 3 meters and suggested that new

results indicate there could be a large, untested Carlin-style

mineral system at depth (4% NSR royalty over most of Gold Rock)

12) Westhaven Gold

intersected 1.95 g/t gold and 5.61 g/t silver over 25 meters at

Shovelnose (2% NSR royalty)

13) Pacific Ridge

Exploration intersected 278 meters of 0.72 g/t Au, 0.14% Cu and

0.95 g/t Ag at the Kliyul copper-gold porphyry project (1.5% NSR

royalty)

14) Eagle Mountain

Mining intersected 1.3% Cu, 13.63 g/t Ag, and 0.18 g/t Au over 29.7

meters at Talon (3% NSR royalty)

15) Poseidon Nickel

released a feasibility study on the Black Swan Project which

includes 300,000 tonnes of 4.7% nickel for 13,000 tonnes of nickel

metal from Silver and Golden Swan. A final investment decision is

expected in 2023 with a concentrate production possible in 2024

(1.75% NSR royalty on base metals on Golden Swan and Silver

Swan).

Q4 AND YEAR-END 2022 RESULTS AND CONFERENCE CALL

DETAILS

Osisko provides notice of the fourth quarter and

annual 2022 results and conference call details.

|

Results Release: |

Thursday, February 23rd, 2023 after market close |

|

Conference Call: |

Friday, February 24th, 2023 at 10:00 am ET |

|

Dial-in Numbers: |

North American Toll-Free: 1 (888) 886 7786Local and International:

1 (416) 764 8658Conference ID: 04967722 |

| Replay (available until Friday,

March 24th at 11:59 pm ET): |

North American Toll-Free: 1 (877) 674 7070Local and International:

1 (416) 764 8692Playback Passcode: 967722# |

|

|

Replay also available on our website at www.osiskogr.com |

Notes:

The figures presented in this press release,

including revenues and costs of sales, have not been audited and

are subject to change. As the Corporation has not yet finished its

quarter-end and year-end procedures, the anticipated financial

information presented in this press release is preliminary, subject

to quarter-end and year-end adjustments, and may change

materially.

(1) Gold Equivalent OuncesGEOs

are calculated on a quarterly basis and include royalties, streams

and offtakes. Silver earned from royalty and stream agreements are

converted to gold equivalent ounces by multiplying the silver

ounces earned by the average silver price for the period and

dividing by the average gold price for the period. Diamonds, other

metals and cash royalties are converted into gold equivalent ounces

by dividing the associated revenue earned by the average gold price

for the period. Offtake agreements are converted using the

financial settlement equivalent divided by the average gold price

for the period.

Average Metal Prices and Exchange Rate

|

|

Three months ended December 31 |

|

Years ended December 31 |

|

|

|

2022 |

|

2021 |

|

|

2022 |

|

2021 |

| |

|

|

|

|

|

| Gold(i) |

$1,727 |

$1,796 |

|

$1,800 |

$1,799 |

| Silver(ii) |

$21.17 |

$23.33 |

|

$21.73 |

$25.14 |

| |

|

|

|

|

|

| Exchange rate

(US$/Can$)(iii) |

|

1.3578 |

|

1.2603 |

|

|

1.3013 |

|

1.2535 |

(i) The

London Bullion Market Association’s pm price in U.S.

dollars. (ii) The

London Bullion Market Association’s price in U.S.

dollars. (iii) Bank

of Canada daily rate.

(2) Non-IFRS MeasuresThe

Corporation has included certain performance measures in this press

release that do not have any standardized meaning prescribed by

International Financial Reporting Standards (IFRS) including cash

margin in dollars and in percentage. The presentation of these

non-IFRS measures is intended to provide additional information and

should not be considered in isolation or as a substitute for

measures of performance prepared in accordance with IFRS. These

measures are not necessarily indicative of operating profit or cash

flow from operations as determined under IFRS. As Osisko’s

operations are primarily focused on precious metals, the

Corporation presents cash margins as it believes that certain

investors use this information, together with measures determined

in accordance with IFRS, to evaluate the Corporation’s performance

in comparison to other companies in the precious metals mining

industry who present results on a similar basis. However, other

companies may calculate these non-IFRS measures differently.

Cash margin (in dollars) represents revenues less cost of sales

(excluding depletion). Cash margin (in percentage) represents the

cash margin (in dollars) divided by revenues.

| |

|

Three months endedDecember 31, 2022 |

|

Year endedDecember 31, 2022 |

| |

|

|

|

|

|

|

Revenues |

$61,914 |

|

|

$217,809 |

|

|

|

Less: Cost of sales (excluding depletion) |

|

($4,732 |

) |

|

|

($16,076 |

) |

| |

Cash margin (in dollars) |

$57,182 |

|

|

$201,733 |

|

| |

Cash margin (in percentage of revenues) |

|

92 |

% |

|

|

93 |

% |

| |

|

(3) In the case of the CSA

silver stream, silver ounces were converted to gold equivalent

ounces by multiplying the average payable silver ounces produced

annually at CSA by the LBMA Silver Price on December 22, 2022 and

dividing by the LBMA Gold Price PM as of December 22,

2022.(4) In the case of the CSA copper stream,

copper tonnes were converted to gold equivalent ounces by

multiplying the average payable copper tonnes produced annually at

CSA by the LME Official Copper Settlement Price on December 22,

2022 and dividing by the LBMA Gold Price PM as of December 22,

2022. Assumed Buy-Down Option is not exercised.Qualified

Person

The scientific and technical content of this

news release has been reviewed and approved by Guy Desharnais,

Ph.D., P.Geo., Vice President, Project Evaluation at Osisko Gold

Royalties Ltd, who is a “qualified person” as defined by National

Instrument 43-101 – Standards of Disclosure for Mineral Projects

(“NI 43-101”).

In this press release, Osisko relies on

information publicly disclosed by other issuers and third parties

pertaining to its assets and, therefore, assumes no liability for

such third-party public disclosure.

About Osisko Gold Royalties

Ltd

Osisko is an intermediate precious metal royalty

company focused on the Americas that commenced activities in June

2014. Osisko holds a North American focused portfolio of over 175

royalties, streams and precious metal offtakes. Osisko’s portfolio

is anchored by its cornerstone asset, a 5% net smelter return

royalty on the Canadian Malartic mine, which is the largest gold

mine in Canada.

Osisko’s head office is located at 1100 Avenue

des Canadiens-de-Montréal, Suite 300, Montréal, Québec,

H3B 2S2.

| For further

information, please contact Osisko Gold Royalties

Ltd: |

| Heather TaylorVice President,

Investor RelationsTel: (514) 940-0670 #105Email:

htaylor@osiskogr.com |

|

Forward-looking Statements

Certain statements contained in this press

release may be deemed “forward‐looking statements” within the

meaning of the United States Private Securities Litigation Reform

Act of 1995 and “forward-looking information” within the meaning of

applicable Canadian securities legislation. These forward‐looking

statements, by their nature, may require Osisko to make or rely on

certain assumptions and necessarily involve known and unknown risks

and uncertainties that could cause actual results to differ

materially from those expressed or implied in these forward‐looking

statements. Forward‐looking statements are not guarantees of

performance. These forward‐looking statements, may involve,

but are not limited to, statements with respect to future events or

future performance, the realization of the anticipated benefits

deriving from Osisko’s investments, the general performance of the

assets of Osisko, and the results of exploration, development and

production activities as well as expansions projects relating to

the properties in which Osisko holds a royalty, stream or other

interest. Words such as “may”, “will”, “would”, “could”, “expect”,

“suggest”, “appear”, “believe”, “plan”, “anticipate”, “intend”,

“target”, “estimate”, “continue”, or the negative or comparable

terminology, as well as terms usually used in the future and the

conditional, are intended to identify forward‐looking statements.

Information contained in forward‐looking statements is based upon

certain material assumptions that were applied in drawing a

conclusion or making a forecast or projection, including, without

limitation, management’s perceptions of historical trends; current

conditions; expected future developments; the ongoing operation of

the properties in which Osisko holds a royalty, stream or other

interest by the operators of such properties in a manner consistent

with past practice; the accuracy of public statements and

disclosures made by the operators of such underlying properties; no

material adverse change in the market price of the commodities that

underlie the asset portfolio; no adverse development in respect of

any significant property in which Osisko holds a royalty, stream or

other interest; the accuracy of publicly disclosed expectations for

the development of underlying properties that are not yet in

production; and the absence of any other factors that could cause

actions, events or results to differ from those anticipated,

estimated or intended. Osisko considers its assumptions to be

reasonable based on information currently available, but cautions

the reader that their assumptions regarding future events, many of

which are beyond the control of Osisko, may ultimately prove to be

incorrect since they are subject to risks and uncertainties that

affect Osisko and its business. Such risks and uncertainties

include, among others, that the financial information presented in

this press release is preliminary and could be subject to

adjustments, the successful continuation of operations underlying

the Corporation’s assets, the performance of the assets of Osisko,

the growth and the benefits deriving from its portfolio of

investments, risks related to the operators of the properties in

which Osisko holds a royalty, stream or other interest, including

changes in the ownership and control of such operators; risks

related to exploration, development, permitting, infrastructure,

operating or technical difficulties on any of the properties in

which Osisko holds a royalty, stream or other interest, the

influence of macroeconomic developments as well as the impact of

and the responses of relevant governments to the COVID-19 outbreak

and the effectiveness of such responses. In this press release,

Osisko relies on information publicly disclosed by other issuers

and third parties pertaining to its assets and, therefore, assumes

no liability for such third party public disclosure.

For additional information with respect to these

and other factors and assumptions underlying the forward‐looking

statements made in this press release, see the section entitled

“Risk Factors” in the most recent Annual Information Form of Osisko

which is filed with the Canadian securities commissions and

available electronically under Osisko’s issuer profile on SEDAR at

www.sedar.com and with the U.S. Securities and Exchange Commission

and available electronically under Osisko’s issuer profile on EDGAR

at www.sec.gov. The forward‐ looking statements set forth

herein reflect Osisko’s expectations as at the date of this press

release and are subject to change after such date. Osisko disclaims

any intention or obligation to update or revise any forward‐looking

statements, whether as a result of new information, future events

or otherwise, other than as required by law.

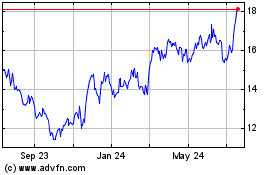

Osisko Gold Royalties (NYSE:OR)

Historical Stock Chart

From Aug 2024 to Sep 2024

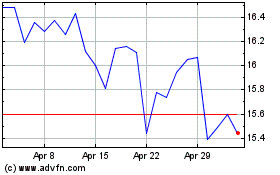

Osisko Gold Royalties (NYSE:OR)

Historical Stock Chart

From Sep 2023 to Sep 2024