Company Substantially Completes Transition to Passive REIT NEW

YORK, Aug. 6 /PRNewswire-FirstCall/ -- New York Mortgage Trust,

Inc. (NYSE:NTR), a self-advised real estate investment trust (REIT)

engaged in the investment in and management of high credit quality

residential adjustable rate mortgage (ARM) loans and

mortgage-backed securities (MBS), today reported results for its

second quarter ended June 30, 2007. Highlights: -- 98% of the

mortgage backed securities portfolio is either Agency or "AAA"

rated. -- As of June 30, 2007, the loans held in securitization

trusts that were 60-days or more delinquent totaled 1.38%; total

delinquencies were 1.60%. -- Consolidated net loss of $14.2

million, or $0.79 per share, for the quarter ended June 30, 2007,

as compared to net income of $0.2 million, or $0.01 per share for

the quarter ending June 30, 2006. -- Of the $14.2 million net loss

incurred for the quarter ended June 30, 2007, $9.0 million relates

to losses from the discontinued mortgage lending operations, and

$3.8 million relates to a portfolio impairment charge. -- Portfolio

margin increased to 12 basis points as of June 30, 2007 compared

with 2 basis points for the quarter ending March 31, 2007. --

Portfolio restructured subsequent to June 30, 2007; $231.8 million

of lower yielding private label MBS sold and replaced with $182.4

million of MBS floating rate securities increasing net coupon by 30

basis points. -- 52% of all repurchase demands settled, 42% being

negotiated; all remaining demands reserved. -- Book value per share

of $3.07 which includes $1.01 per share relating to the net

deferred tax-asset. Comments from Management David Akre, Vice

Chairman and Co-Chief Executive Officer of the Company, commented,

"Our financial results for the quarter ended June 30, 2007 are

reflective of the important, but difficult, steps we have taken in

our transition to a passive REIT model as well as the challenging

market conditions facing the mortgage industry. The Company no

longer originates mortgage loans, maintains lending warehouse

lines, or is subject to mortgage banking regulatory oversight. Of

the steps we have taken, one of the most important has been

addressing the repurchase requests related to our discontinued

mortgage lending business. Through proactive negotiations, we have

reduced the outstanding repurchase requests for mortgage loans from

approximately $25.2 million to approximately $12.1 million. Of the

remaining repurchase requests, we are in active negotiations with

respect to $10.5 million. The resolution of these repurchase

requests relieves the Company of substantially all future

repurchase obligations. These steps, along with others taken in the

second quarter, have been difficult, but should increase stability

and foster long term growth in the coming quarters." Mr. Akre

added, "Our focus going forward is to prudently grow the portfolio

and implement our portfolio strategy." Steve Mumma, Co-Chief

Executive Officer, President and Chief Financial Officer of the

Company, stated "The second quarter results were driven by costs

associated with the discontinued mortgage lending business. The

second quarter loss from discontinued operations was larger than

anticipated due to deteriorating market conditions. Specifically,

the Company incurred $5.1 million in loan losses, $1.8 million in

additional expense reserves for residual liabilities and $2.1 in

operating losses. As of June 30, 2007, the Company has sold a

significant portion of the mortgage loans held for sale and

established reserves for loan losses and expenses to cover the

remaining anticipated costs." "In the quarter ended June 30, 2007,

we determined that certain lower yielding private label MBS would

be sold and replaced with floating rate Agency securities. As a

result of this determination, the Company incurred an impairment

charge of $3.8 million. In July, the Company sold $231.8 million of

lower yielding private label MBS and purchased $182.4 million of

floating rate securities, of which $157.4 million are Agency

securities, resulting in an increase in overall portfolio spread of

30 basis points and improved liquidity for financing purposes."

"The reduction of staffing to 12 employees as of June 30, 2007, as

well as transitioning to a passive REIT, has reduced our expense

base going forward. With improved portfolio spreads and reduced

operating overhead, we believe the Company is positioned for

improved results going forward." Results from Operations For the

second quarter of 2007, the Company reported a consolidated net

loss of $14.2 million, or $0.79 per share. This compares to a net

loss of $4.7 million, or $0.26 per share, for the immediate

preceding quarter ended March 31, 2007 and net income of $0.2

million, or $0.01 per share, for the quarter ended June 30, 2006.

The $14.2 million loss for the quarter ended June 30, 2007 was

comprised of a $5.2 million loss from the continuing operations and

a $9.0 million loss from discontinued mortgage lending operations.

The $5.2 million loss from continuing operations for the quarter

ended June 30, 2007 included a permanent impairment charge of $3.8

million related the Company's determination to sell $231.8 million

of lower yielding non- Agency MBS. The impairment charge, while

lowering earnings by $3.8 million, did not reduce the book value of

the Company as the charge was previously reflected as an adjustment

in the Other Comprehensive Income section of the Balance Sheet.

Also, the Company reserved $0.9 million for potential loan losses

for the loans held in securitization trust. Included in the $9.0

million loss for the discontinued mortgage lending operations was a

$5.1 million charge for loan losses, $1.8 million in additional

expense reserves for residual liabilities and $2.1 in operating

losses. Book value per share for the quarter ended June 30, 2007

was $3.07 per share, including $1.01 per share in net deferred

tax-asset. The net deferred tax asset remains unchanged from the

quarter ended March 31, 2007. As of June 30, 2007, mortgage loans

held for sale totaled $10.0 million as compared to $60.9 million as

of March 31, 2007. Of the remaining $10.0 million of loans held for

sale, the Company intends to keep $6.2 million of high quality

hybrid prime ARMs in its investment portfolio. The Company has

reserved $1.6 million on the remaining $3.8 million of mortgage

loans held for sale. The Company's employee headcount as of June

30, 2007 was 12, down from 35 as of March 31, 2007 and 616 as of

December 31, 2006. The vast majority of the Company's employee

headcount at December 31, 2006 were employees of the Company's now

discontinued mortgage lending operations. As previously announced

the Company completed the sale of substantially all of the assets

of its retail mortgage lending operations on March 31, 2007 and

exited the mortgage lending business. Portfolio Results The

following table summarizes the Company's investment portfolio of

residential mortgage-backed securities and loans owned at June 30,

2007, classified by relevant categories: (dollars in thousands)

Carrying Par Value Coupon Value Yield Agency REMIC floaters

$187,147 6.53% $187,472 6.51% Private label floaters 5,595 6.18%

5,583 6.22% Private label ARMs 244,911 4.79% 242,622 6.00% NYMT

retained securities 20,449 5.74% 19,258 7.44% Total mortgage backed

securities 458,102 5.56% 454,935 6.27% Loans held in securitization

trusts 502,222 5.63% 504,522 5.81% Total/Weighted Average $960,324

5.60% $959,457 6.03% -- 98% of the mortgage backed securities

portfolio is either Agency or "AAA" rated. -- As of June 30, 2007,

the loans held in securitization trusts that were 60-days or more

delinquent totaled 1.38%; total delinquencies were 1.60%. The

Company reserved $0.9 million for loan losses on these delinquent

loans. -- Subsequent to June 30, 2007, the Company sold

approximately $231.8 in lower yielding private label ARMs. The

Company purchased approximately $157.4 million in Agency REMIC

floaters resulting in a weighted average coupon increase for the

total portfolio of 30 basis points. Repurchase Demands Repurchase

demands increased during the quarter ended June 30, 2007 to a total

of $25.2 million from $14.3 million for the quarter ended March 31,

2007. As of August 6, 2007 approximately 52% of all repurchase

demands outstanding have been settled with the investors and will

not require the Company to repurchase the loans. These cash settled

negotiated amounts relieve the Company of substantially all future

claims against the Company. Dividend Declaration On July 3, 2007,

the Company's Board of Directors announced its decision to omit a

dividend for the quarter ending June 30, 2007. The Board's decision

reflected the Company's focus on elimination of operating losses

through the sale of its mortgage lending business and conserving

capital to build future earnings from its mortgage portfolio

operations. The Company reevaluates its dividend policy each

quarter and makes adjustments as necessary based on a variety of

factors, including future earnings projections. Investors are

advised that the Company's earnings projections are based on a

number of operational, financial and market assumptions, and if

such assumptions do not materialize, the Company may not be able to

maintain its dividend policy. In addition to such assumptions, the

Company's dividend policy is subject to its Board of Directors

approval and ongoing review, which includes, but is not limited to,

considerations such as the Company's financial condition,

liquidity, earnings projections and business prospects. The

dividend policy does not constitute an obligation to pay dividends,

which only occurs when the Board of Directors declares a dividend.

Conference Call On Tuesday August 7, 2007 at 9:00 a.m. Eastern

Time, New York Mortgage Trust's executive management is scheduled

to host a conference call and audio webcast highlighting the

Company's second quarter 2007 financial results. The conference

call dial-in number is 303-262-2004. A live audio webcast of the

conference call can be accessed via the Internet, on a listen-only

basis, at http://www.earnings.com/ or at the Investor Relations

section of the Company's website at http://www.nymtrust.com/.

Please allow extra time, prior to the call, to visit the site and

download the necessary software to listen to the Internet

broadcast. The online archive of the webcast will be available for

approximately 90 days. Second quarter 2007 financial and operating

data can be viewed in the Company's Quarterly Report on Form 10-Q,

which is expected to be filed Thursday August 9, 2007. About New

York Mortgage Trust New York Mortgage Trust, Inc., a self-advised

real estate investment trust (REIT), is engaged in the investment

in and management of high credit quality residential adjustable

rate mortgage (ARM) loans and mortgage-backed securities (MBS). As

of March 31, 2007, the Company has exited the mortgage lending

business. The Company's portfolio is comprised of securitized, high

credit quality, adjustable and hybrid ARM loans, and purchased MBS.

Historically at least 98% of the portfolio has been rated "AA" or

"AAA". As a REIT, the Company is not subject to federal income tax

provided that it distributes at least 90% of its REIT income to

stockholders. Certain statements contained in this press release

may be deemed to be forward-looking statements that predict or

describe future events or trends. The matters described in these

forward-looking statements are subject to known and unknown risks,

uncertainties and other unpredictable factors, many of which are

beyond the Company's control. The Company faces many risks that

could cause its actual performance to differ materially from the

results predicted by its forward-looking statements, including,

without limitation, that a rise in interest rates may cause a

decline in the market value of the Company's assets, prepayment

rates that may change, borrowings to finance the purchase of assets

may not be available or may not be available on favorable terms,

the Company may not be able to maintain its qualification as a REIT

for federal tax purposes, the Company may experience the risks

associated with investing in mortgage loans, including changes in

loan delinquencies, and the Company's hedging strategies may not be

effective. The reports that the Company files with the Securities

and Exchange Commission contain a fuller description of these and

many other risks to which the Company is subject. Because of those

risks, the Company's actual results, performance or achievements

may differ materially from the results, performance or achievements

contemplated by its forward- looking statements. The information

set forth in this news release represents management's current

expectations and intentions. The Company assumes no responsibility

to issue updates to the forward-looking matters discussed in this

press release. NEW YORK MORTGAGE TRUST, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS (dollar amounts in thousands,

except per share data) (unaudited) For the Six For the Three Months

Ended Months Ended June 30, June 30, 2007 2006 2007 2006 REVENUE:

Interest income investment securities and loans held in

securitization trusts $26,611 $33,052 $12,898 $15,468 Interest

expense investment securities and loans held in securitization

trusts 24,976 26,438 11,892 12,359 Net interest income from

investment securities and loans held in securitization trusts 1,635

6,614 1,006 3,109 Subordinated debentures 1,776 1,779 894 894 Net

interest (loss) income (141) 4,835 112 2,215 OTHER EXPENSE:

Realized loss on sale of investment securities -- (969) -- -- Loss

on other-than-temporary impaired securities (3,821) -- (3,821) --

Loan loss reserve on loans held in securitization trusts (940) --

(940) -- Total other expenses (4,761) (969) (4,761) -- EXPENSES:

Salaries and benefits 496 452 151 202 Marketing and promotion 62 34

39 26 Data processing and communications 93 119 56 63 Professional

fees 205 365 105 271 Depreciation and amortization 149 127 81 60

Other 171 223 97 136 Total expenses 1,176 1,320 529 758 (LOSS)

INCOME FROM CONTINUING OPERATIONS (6,078) 2,546 (5,178) 1,457 Loss

from discontinued operation - net of tax (12,859) (4,164) (9,018)

(1,279) NET (LOSS) INCOME $(18,937) $(1,618) $(14,196) $178 Basic

(loss) income per share $(1.05) $(0.09) $(0.79) $0.01 Diluted

(loss) income per share $(1.05) $(0.09) $(0.79) $0.01 Weighted

average shares outstanding-basic 18,096 17,950 18,113 17,933

Weighted average shares outstanding- diluted 18,096 17,950 18,113

18,296 NEW YORK MORTGAGE TRUST, INC. AND SUBSIDIARIES CONSOLIDATED

BALANCE SHEETS (dollar amounts in thousands) June 30, December 31,

2007 2006 (unaudited) ASSETS Cash and cash equivalents $1,883 $969

Restricted cash 4,198 3,151 Investment securities - available for

sale 454,935 488,962 Accounts and accrued interest receivable 4,528

5,189 Mortgage loans held in securitization trusts 504,522 588,160

Prepaid and other assets 20,343 20,951 Derivative assets 2,486

2,632 Property and equipment (net) 89 -- Assets related to

discontinued operation 11,700 212,894 Total Assets $1,004,684

$1,322,908 LIABILITIES AND STOCKHOLDERS' EQUITY Liabilities:

Financing arrangements, portfolio investments $423,741 $815,313

Collateralized debt obligations 465,761 197,447 Accounts payable

and accrued expenses 5,139 5,871 Subordinated debentures 45,000

45,000 Liabilities related to discontinued operation 9,317 187,705

Total liabilities $948,958 $1,251,336 Commitments and Contingencies

Stockholders' Equity: Common stock, $0.01 par value, 400,000,000

shares authorized, 18,179,271 shares issued and outstanding at June

30, 2007 and 18,325,187 shares issued and 18,077,880 outstanding at

December 31, 2006 182 183 Additional paid-in capital 99,068 99,509

Accumulated other comprehensive loss (848) (4,381) Accumulated

deficit (42,676) (23,739) Total stockholders' equity 55,726 71,572

Total Liabilities and Stockholders' Equity $1,004,684 $1,322,908

DATASOURCE: New York Mortgage Trust, Inc. CONTACT: Steven R. Mumma,

Co-CEO, President, Chief Financial Officer of New York Mortgage

Trust, Inc., +1-212-634-2411, ; or Joe Calabrese, General,

+1-212-827-3772, or Julie Tu, Analysts, +1-212-827-3776, both of

Financial Relations Board for New York Mortgage Trust, Inc. Web

site: http://www.nymtrust.com/

Copyright

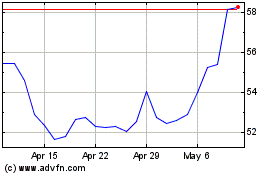

Nutrien (NYSE:NTR)

Historical Stock Chart

From May 2024 to Jun 2024

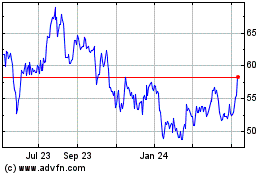

Nutrien (NYSE:NTR)

Historical Stock Chart

From Jun 2023 to Jun 2024