New York Mortgage Trust Announces Resignation of Michael I. Wirth as Chief Financial Officer and Appointment of Steven R. Mumma

November 01 2006 - 2:14PM

PR Newswire (US)

NEW YORK, Nov. 1 /PRNewswire-FirstCall/ -- New York Mortgage Trust,

Inc. (NYSE:NTR), announced today that Michael I. Wirth, Chief

Financial Officer, age 48, will resign his position to pursue

another opportunity. Mr. Wirth's last day with the Company will be

November 3, 2006, by which time he will have fully assisted the

Company in transitioning the Chief Financial Officer position to

Steven R. Mumma, the Company's Chief Investment Officer and Chief

Operating Officer, who has been appointed to serve as the Company's

Chief Financial Officer on an interim basis. Mr. Mumma, age 47, has

a public accounting background and is a certified public

accountant. Given Mr. Mumma's financial and accounting expertise,

and his intimate knowledge of the Company's financial reporting

processes, the Company anticipates that this interim role could

become a permanent part of Mr. Mumma's responsibilities. Steven

Schnall, Chairman, Co-CEO and President, commented, "Mike has made

many significant strategic and operating contributions to New York

Mortgage Trust including our transition from a private entity to a

public entity, successful completion of compliance with Sarbanes

Oxley and the improvement of many of our financial and operating

practices. I would like to thank him for all his contributions and

we wish him best in his new position." Mr. Schnall added, "Looking

ahead, we are very fortunate to have another very capable member of

our executive management team, Steve Mumma, to step in as our

interim CFO. Steve has a strong working knowledge of our operations

and systems as well as all aspects of the Company's financial

reporting and corporate governance. Given Steve's experience and

expertise, we believe that this interim role for Steve Mumma could

become a permanent role in the coming months." Mr. Wirth commented,

"I have greatly enjoyed working with the employees and management

of NYMT, and helping take the organization through its IPO and

tackling the opportunities and challenges we have shared over the

years. I am confident that Steve Mumma, with his similar past

experience and the quality team supporting him, will easily

transition into the CFO role." Mr. Mumma, the Company's interim CFO

designee, has been the Company's Chief Operating Officer since

November 2003 and the Company's Chief Investment Officer since July

2005. Prior to joining NYMT, from September 2000 to September 2003,

Mr. Mumma was a Vice President of Natexis ABM Corp, a wholly-owned

subsidiary of Natexis Banques Populaires. From 1997 to 2000, Mr.

Mumma served as a Vice President of Mortgage-Backed Securities

trading for Credit Agricole. Prior to joining Credit Agricole, from

1988 to 1997, Mr. Mumma was a Vice President of Natexis ABM Corp.

Prior to joining Natexis ABM Corp., from 1986 to 1988, Mr. Mumma

was a Controller for PaineWebber Real Estate Securities Inc., the

mortgage-backed trading subsidiary of PaineWebber Inc. Prior to

joining PaineWebber, from 1984 to 1985, Mr. Mumma worked for

Citibank in its Capital Markets Group, as well as for Ernst &

Young. Mr. Mumma is a certified public accountant, and received a

B.B.A. cum laude from Texas A&M University. About New York

Mortgage Trust New York Mortgage Trust, Inc., a real estate

investment trust (REIT), is engaged in the origination of and

investment in residential mortgage loans throughout the United

States. The Company, through its wholly owned taxable REIT

subsidiary, The New York Mortgage Company, LLC (NYMC), originates a

broad spectrum of residential loan products with a focus on high

credit quality, or prime, loans. In addition to prime loans, NYMC

also originates jumbo loans, alternative-A loans, sub-prime loans

and home equity or second mortgage loans through its retail and

wholesale origination branch network. The Company's REIT portfolio

is comprised of securitized, high credit quality, adjustable and

hybrid ARM loans, the majority of which, over time, will be

originated by NYMC. As a REIT, the Company is not subject to

federal income tax provided that it distributes at least 90% of its

REIT income to shareholders. This news release contains

forward-looking statements that predict or describe future events

or trends. The matters described in these forward- looking

statements are subject to known and unknown risks, uncertainties

and other unpredictable factors, many of which are beyond the

Company's control. The Company faces many risks that could cause

its actual performance to differ materially from the results

predicted by its forward- looking statements, including, without

limitation, the possibilities that a rise in interest rates may

cause a decline in the market value of the Company's assets, a

decrease in the demand for mortgage loans may have a negative

effect on the Company's volume of closed loan originations,

prepayment rates may change, borrowings to finance the purchase of

assets may not be available on favorable terms, the Company may not

be able to maintain its qualification as a REIT for federal tax

purposes, the Company may experience the risks associated with

investing in real estate, including changes in business conditions

and the general economy, and the Company's hedging strategies may

not be effective. The reports that the Company files with the

Securities and Exchange Commission contain a fuller description of

these and many other risks to which the Company is subject. Because

of those risks, the Company's actual results, performance or

achievements may differ materially from the results, performance or

achievements contemplated by its forward-looking statements. The

information set forth in this news release represents management's

current expectations and intentions. The Company assumes no

responsibility to issue updates to the forward-looking matters

discussed in this news release. DATASOURCE: New York Mortgage

Trust, Inc. CONTACT: A. Bradley Howe, Senior Vice President and

General Counsel, New York Mortgage Trust, Inc., +1-212-634-9401, ;

Joe Calabrese - General, +1-212-827-3772, or Julie Tu - Analysts,

+1-212-827-3776, both of both of Financial Relations Board

Copyright

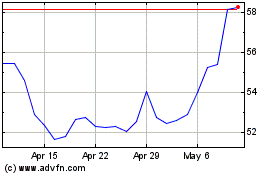

Nutrien (NYSE:NTR)

Historical Stock Chart

From May 2024 to Jun 2024

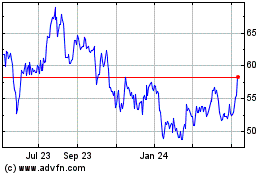

Nutrien (NYSE:NTR)

Historical Stock Chart

From Jun 2023 to Jun 2024