Northeast Utilities Misses Overall - Analyst Blog

May 03 2012 - 10:29AM

Zacks

Diversified utility company Northeast

Utilities’ (NU) first quarter 2012 pro forma earnings

of 56 cents per share missed the Zacks Consensus Estimate of 68

cents and also fell short of the year-ago quarter earnings of 64

cents per share.

The decrease in earnings resulted from mild weather experienced

in the winter season and higher pension costs.

The GAAP earnings per share during the quarter were 56 cents

versus 64 cents per share reported in the year-ago quarter.

Total Revenue

Northeast Utilities reported quarterly operating revenue of

$1,099.6 million, down 10.9% from the year-ago quarter figure of

$1,235.2 million. The quarterly revenue fell short of the Zacks

Estimate of $1,252.0 million.

The decline in revenue can be attributed to lower retail sales

from the company’s distribution and generation businesses.

Electric Sales Volumes

Northeast Utilities' retail electric sales in the first quarter

were down 5% from the comparable 2011 quarter to 8,271.0 Gigawatt

hours (GWh) due to warmer winter weather.

On a weather-adjusted basis, however, retail electric sales

increased 0.1% from the year-ago quarter. Yankee Gas' natural gas

sales decreased 13.2% to 16.8 billion cubic feet (Bcf). On a

weather-adjusted basis, Yankee Gas sales volume showed an increase

of 5.0% from the year-ago quarter.

Segmental Earnings

Distribution & Generation:

Electric and Gas Distribution earnings totaled $56.7 million in the

quarter, compared with $ 78.2 million in the prior-year

quarter.

The quarterly earnings fell mainly due to lower earnings from

the Connecticut Light & Power (CL&P) and

Public Service Company of New Hampshire (PSNH)

companies. This was traced to warmer winter temperature, and higher

pension and health care expenses. These were partially mitigated by

favorable earnings generated from the Western Massachusetts

Electric Company (WMECO) with its second solar facility

commencing operations.

Yankee Gas Services Company reported earnings of $14.7 million,

down 34.6% from $22.5 million in the previous year quarter. It was

the result of decline in natural gas sales.

Transmission: The

Transmission segment’s quarterly earnings of $46.3 million

increased 3.5% from $44.7 million earned in the prior-year quarter.

This improvement in earnings reflected higher investments made in

the Greater Springfield Reliability Project in Massachusetts and

Connecticut.

NU Parent & Other

Companies: Net expenses from

these companies registered a loss of $3.7 million in the quarter

compared with loss of $8.7 million in the first quarter of 2011.

This reduction in loss was primarily driven by lower after-tax,

merger-related expenses.

Operational Highlights

On the cost side, Northeast Utilities’ results were positive,

given its continuous drive towards cost control measures. Total

operating expense slipped 12.1% to $885.2 million from the year-ago

quarter. Lower fuel and power cost of 16% coupled with lower

operating expenses of 10.3% were the major contributors.

Northeast Utilities’ operating income in the current quarter

totaled $214.4 million compared with $227.3 million in first

quarter 2011.

Interest expense surged 13.5% to $66.4 million from $58.5

million in the year-ago quarter, indicating higher long-term

debt.

Financial Update

As of March 31, 2012, Northeast Utilities had cash and cash

equivalents of $283.3 million versus $6.5 million as of December

31, 2011.

Cash Flow from operating activities was $8.8 million versus

$373.0 million in the year-ago comparable quarter.

Long-term debt as of March 31, 2012 was $4,977.1 million, up

7.8% from $4,615.0 million as of December 31, 2012.

Peer Comparison

Northeast Utilities’ closest peer NiSource Inc.

(NI) posted first quarter 2012 net operating earnings of 76 cents

per share, surpassing the Zacks Consensus Estimate by 4 cents and

the year-ago figure by 2 cents.

Total revenue in the quarter under review declined 20.5%

year-over-year to $1.7 billion from $2.14 billion in the first

quarter of 2011. The year-over-year decline was attributed to

significantly lower performance from the Gas

Distribution segment which plummeted 33.6% year over

year.

Revenue was below the Zacks Consensus Estimate of $ 2.2

billion.

Our View

The company missed our sales as well as earnings per share

expectation in the reported quarter due to the impact of mild

weather. However, the continued cost management efforts and the

completion of merger with NSTAR can be beneficial for the company

in the long run.

However, any unexpected delay in infrastructural expansion

projects, coupled with the possibility of demand destruction due to

weather variations might act as a negative catalyst on part of the

company’s growth potential.

Northeast Utilities hold a Zacks #4 Rank which translates into a

short-term Sell rating. We have neutral recommendation in the long

run.

Based in Hartford, Connecticut, Northeast Utilities engages in

the energy delivery business for residential, commercial, and

industrial customers.

NISOURCE INC (NI): Free Stock Analysis Report

NORTHEAST UTIL (NU): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

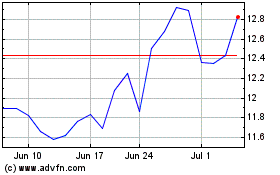

Nu (NYSE:NU)

Historical Stock Chart

From Oct 2024 to Nov 2024

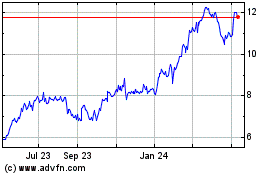

Nu (NYSE:NU)

Historical Stock Chart

From Nov 2023 to Nov 2024