Northeast Utilities (NYSE:NU) today reported earnings for the

third quarter of 2010 and raised its earnings guidance for the full

year of 2010.

NU earned $100.5 million, or $0.57 per share, in the third

quarter of 2010, compared with $64.8 million, or $0.37 per share,

in the third quarter of 2009. NU earned $258.7 million, or $1.46

per share, in the first nine months of 2010, compared with $245.3

million, or $1.43 per share, in the first nine months of 2009.

Charles W. Shivery, NU chairman, president and chief executive

officer, said the improvement in third quarter results was due to

increased electric sales, driven by much warmer temperatures in the

summer of 2010, the company’s continued success managing its costs,

and the results of distribution rate cases that became effective

July 1, 2010. NU results also benefited from its investment in New

England’s high-voltage electric transmission grid, which continues

to lower congestion costs to the benefit of customers.

2010 earnings guidance

NU today raised its earnings guidance for 2010. Primarily as a

result of strong third quarter sales due to warmer than normal

summer weather, the continued control of operating expenses,

significant progress in reducing uncollectibles expense, and the

settlement of various routine tax issues in the fourth quarter of

2010, NU now projects consolidated earnings of between $2.10 per

share and $2.20 per share in 20101, excluding a non-recurring tax

benefit and certain merger-related expenses that will affect NU

Parent results in the fourth quarter of 2010. The revised guidance

is reflected in a table shown later in this release.

2010 Results - Transmission

NU’s transmission segment earned $45.2 million in the third

quarter of 2010 and $127.3 million in the first nine months of

2010, compared with $42.8 million in the third quarter of 2009 and

$120 million in the first nine months of 2009. The increases in

third quarter and nine months net income in 2010, compared with the

same periods in 2009, primarily reflect NU’s higher level of

investment in transmission facilities.

2010 Results - Distribution and

Generation

NU’s distribution and generation segment earned $55.7 million in

the third quarter of 2010 and $130.7 million in the first nine

months of 2010, compared with $22.5 million in the third quarter of

2009 and $120 million in the first nine months of 2009.

The Connecticut Light and Power Company’s (CL&P)

distribution segment earned $31.5 million in the third quarter of

2010 and $54.2 million in the first nine months of 2010, compared

with $11.4 million in the third quarter of 2009 and $55 million in

the first nine months of 2009. Higher third quarter results reflect

increased weather-related electric sales, lower uncollectibles

expense in the third quarter of 2010, and the impact of a

distribution rate case that was effective July 1, 2010.

Public Service Company of New Hampshire’s (PSNH) distribution

and generation segment earned $23.4 million in the third quarter of

2010 and $51.5 million in the first nine months of 2010, compared

with $10.7 million in the third quarter of 2009 and $36.2 million

in the first nine months of 2009. Improved third-quarter results

reflect the impact of PSNH’s distribution rate case, which was

decided in late June 2010. Third-quarter and year-to-date results

also reflect higher generation-related earnings on an increased

level of investment in generation assets.

Western Massachusetts Electric Company’s (WMECO) distribution

segment earned $3.7 million in the third quarter of 2010 and $8.9

million in the first nine months of 2010, compared with $4.9

million in the third quarter of 2009 and $13.5 million in the first

nine months of 2009. Lower results were due to higher storm

restoration and other operating costs, and higher municipal

property taxes, partially offset by a 2.5 percent increase in

year-to-date electric sales.

NU’s retail electric sales were up 6.5 percent in the third

quarter of 2010, compared with the same period of 2009, but were

down 4.4 percent on a weather-adjusted basis. Over the first nine

months of 2010, NU’s retail electric sales were up 2.3 percent

compared with the same period in 2009, but down 2.1 percent on a

weather-adjusted basis.

Yankee Gas Services Company lost $2.9 million in the third

quarter of 2010, compared with a loss of $4.5 million in the third

quarter of 2009. Yankee Gas earned $16.1 million in the first nine

months of 2010, compared with earnings of $15.3 million in the

first nine months of 2009. Improved third quarter results were due

primarily to lower uncollectibles expense. Yankee Gas firm natural

gas sales were up 9.9 percent in the third quarter of 2010,

compared with the same period of 2009. During the first nine months

of 2010, Yankee Gas firm natural gas sales were down 1.2 percent

compared with the same period in 2009 but up 6.1 percent on a

weather-adjusted basis.

2010 Results – Competitive

businesses

NU Enterprises, Inc. (NUEI), the holding company for NU’s

competitive businesses, earned $0.1 million in the third quarter of

2010 and $7.7 million in the first nine months of 2010, compared

with $0.3 million in the third quarter of 2009 and $11.6 million in

the first nine months of 2009. Lower 2010 results were primarily

due to marking to market NUEI’s remaining wholesale obligations,

which contributed $0.5 million to earnings in the first nine months

of 2010, compared with $3.7 million in the first nine months of

2009.

2010 Results - NU Parent and other

companies

NU Parent and other companies had net expenses of $0.5 million

in the third quarter of 2010 and $7 million in the first nine

months of 2010, compared with net expenses of $0.8 million in the

third quarter of 2009 and $6.3 million in the first nine months of

2009.

The following table reflects the change in 2010 earnings per

share guidance1.

August 2010

EarningsGuidance

October 2010

EarningsGuidance

2010 Consolidated (GAAP)

$1.95-$2.05 $2.10-$2.20 Distribution/Generation

$1.00-$1.10 $1.10-$1.20 Transmission $0.95

$1.00 Competitive business $0.05 $0.05 Parent/Other

($0.05) ($0.05)* 2010 Consolidated (Non-GAAP)

$1.95-$2.05 $2.10-$2.20*

* Excludes non-recurring tax-related gains that will be recorded

in the fourth quarter of 2010 ($0.09 per share) as well as expected

expenses related to NU’s proposed merger of equals with NSTAR

($0.07 per share) that was announced on October 18, 2010.

The following table reconciles 2010 and 2009 third-quarter and

first nine-month results:

Third Quarter1

First Nine Months1

2009

Reported EPS $0.37 $1.43

Change in transmission earnings in 2010 $0.02

$0.02 Change in distribution/generation results in

2010 $0.18 $0.04 Change in competitive

business results in 2010 $0.00 ($0.03)

2010

Reported EPS $0.57 $1.46

Financial results for the third quarter and first nine months of

2010 and 2009 are noted below.

Three months ended:

(in millions, except EPS)

September 30, 2010

September 30, 2009

Increase(Decrease)

2010 EPS1

CL&P Distribution $31.5 $11.4

$20.1 $0.18 PSNH

Distribution/Generation $23.4 $10.7

$12.7 $0.13 WMECO Distribution

$3.7 $4.9 ($1.2 ) $0.02

Yankee Gas ($2.9 ) ($4.5 ) $1.6

($0.02 )

Total—Distribution/Generation $55.7

$22.5 $33.2

$0.31 CL&P Transmission $36.1

$33.7 $2.4 $0.21 PSNH

Transmission $5.3 $5.5 ($0.2 )

$0.03 WMECO Transmission $3.7

$3.6 $0.1 $0.02 NU Transmission

Ventures $0.1 $0.0 $0.1

$0.00

Total—Transmission $45.2

$42.8 $2.4

$0.26 NU parent and other companies ($0.5 )

($0.8 ) $0.3 $0.00 Competitive

$0.1 $0.3 ($0.2 ) $0.00

Reported Earnings $100.5

$64.8 $35.7 $0.57

Nine months ended:

(in millions, except EPS)

September 30, 2010

September 30, 2009

Increase(Decrease)

2010 EPS1

CL&P Distribution $54.2 $55.0

($0.8 ) $0.31 PSNH Distribution/Generation

$51.5 $36.2 $15.3

$0.29 WMECO Distribution $8.9 $13.5

($4.6 ) $0.05 Yankee Gas $16.1

$15.3 $0.8 $0.09

Total—Distribution/Generation $130.7

$120.0 $10.7

$0.74 CL&P Transmission $103.1

$98.9 $4.2 $0.58 PSNH

Transmission $14.7 $14.1 $0.6

$0.09 WMECO Transmission $9.4

$7.0 $2.4 $0.05 NU

Transmission Ventures $0.1 $0.0

$0.1 $0.00

Total—Transmission

$127.3 $120.0 $7.3

$0.72 NU Parent and Other companies

($7.0 ) ($6.3 ) ($0.7 ) ($0.04 )

Competitive $7.7 $11.6 ($3.9 )

$0.04

Reported Earnings $258.7

$245.3 $13.4

$1.46

Retail sales data:

Gwh for three months ended

September 30,2010

September 30,2009

% ChangeActual

% ChangeWeather Norm.

CL&P 6,293 5,903 6.6 (4.6 )

PSNH 2,147 2,009 6.9 (3.9 )

WMECO 1,009

957

5.5 (3.9 )

Total NU 9,444

8,865 6.5 (4.4

)

Gwh for nine months ended

CL&P 17,221 16,814

2.4 (2.2 ) PSNH 5,934 5,822

1.9 (2.2 ) WMECO 2,818 2,749

2.5 (1.3 )

Total NU

25,961 25,374 2.3

(2.1 )

Yankee Gas firm volumes in

mmcffor three months ended

6,031

5,486

9.9

10.4

Yankee Gas firm volumes in

mmcffor nine months ended

29,406

29,762

(1.2

)

6.1

NU has approximately 176 million common shares outstanding. It

operates New England’s largest energy delivery system, serving more

than 2 million customers in Connecticut, New Hampshire and

Massachusetts.

This news release includes statements concerning NU’s

expectations, beliefs, plans, objectives, goals, strategies,

assumptions of future events, future financial performance or

growth and other statements that are not historical facts. These

statements are “forward-looking statements” within the meaning of

the Private Securities Litigation Reform Act of 1995. In some

cases, readers can identify these forward-looking statements

through the use of words or phrases such as “estimate”, “expect”,

“anticipate”, “intend”, “plan”, “project,” “believe”, “forecast”,

“should”, “could”, and other similar expressions. Forward-looking

statements involve risks and uncertainties that may cause actual

results or outcomes to differ materially from those included in the

forward-looking statements. Factors that may cause actual results

to differ materially from those included in the forward-looking

statements include, but are not limited to, actions or inaction of

local, state and federal regulatory and taxing bodies; changes in

business and economic conditions, including their impact on

interest rates, bad debt expense and demand for NU’s products and

services; changes in weather patterns; changes in laws, regulations

or regulatory policy; changes in levels or timing of capital

expenditures; disruptions in the capital markets or other events

that make NU’s access to necessary capital more difficult or

costly; developments in legal or public policy doctrines;

technological developments; changes in accounting standards and

financial reporting regulations; fluctuations in the value of our

remaining competitive contracts; actions of rating agencies; and

other presently unknown or unforeseen factors. Other risk factors

are detailed from time to time in NU’s reports filed with the

Securities and Exchange Commission. Any forward-looking statement

speaks only as of the date on which such statement is made, and NU

undertakes no obligation to update the information contained in any

forward-looking statements to reflect developments or circumstances

occurring after the statement is made or to reflect the occurrence

of unanticipated events.

1 All per share amounts in this news release are reported on a

fully diluted basis. The only common equity securities that are

publicly traded are common shares of NU parent. The earnings and

EPS of each business do not represent a direct legal interest in

the assets and liabilities allocated to such business, but rather

represent a direct interest in NU's assets and liabilities as a

whole. EPS by business is a non-GAAP (not determined using

generally accepted accounting principles) measure that is

calculated by dividing the net income or loss attributable to

controlling interests of each business by the weighted average

fully diluted NU parent common shares outstanding for the period.

Management uses this non-GAAP financial measure to evaluate

earnings results and to provide details of earnings results and

guidance by business. Our earnings guidance also excludes certain

non-recurring charges as a result of various tax settlements in the

fourth quarter of 2010 ($0.09 per share) and the expected amount of

merger costs we will expense during the fourth quarter of 2010

(approximately $0.07 per share). Management believes that this

measurement is useful to investors to evaluate the actual and

projected financial performance and contribution of NU’s

businesses. Non-GAAP financial measures should not be considered as

alternatives to NU consolidated net income attributable to

controlling interests or EPS determined in accordance with GAAP as

indicators of NU’s operating performance.

Note: NU will webcast an investor presentation on Monday,

November 1, 2010, at 10 a.m. Eastern Time. The webcast can be

accessed through NU’s website at www.nu.com.

NORTHEAST UTILITIES AND SUBSIDIARIES CONDENSED

CONSOLIDATED BALANCE SHEETS (Unaudited)

September 30, December 31, (Thousands of Dollars)

2010 2009

ASSETS

Current Assets: Cash and Cash Equivalents $ 41,179 $ 26,952

Receivables, Net 526,280 512,770 Unbilled Revenues 151,923 229,326

Fuel, Materials and Supplies 247,254 277,085 Marketable Securities

79,969 66,236 Derivative Assets 10,651 31,785 Prepayments and Other

Current Assets 178,739 123,700 Total Current Assets

1,235,995 1,267,854 Property, Plant and

Equipment, Net 9,318,017 8,839,965 Deferred

Debits and Other Assets: Regulatory Assets 3,085,019 3,244,931

Goodwill 287,591 287,591 Marketable Securities 45,727 54,905

Derivative Assets 134,704 189,751 Other Long-Term Assets

190,535 172,682 Total Deferred Debits and Other Assets

3,743,576 3,949,860 Total Assets

$ 14,297,588 $ 14,057,679

The data contained in this report is

preliminary and is unaudited. This report is being submitted for

the sole purpose of providing information to present shareholders

about Northeast Utilities and Subsidiaries and is not a

representation, prospectus, or intended for use in connection with

any purchase or sale of securities.

NORTHEAST UTILITIES AND SUBSIDIARIES CONDENSED

CONSOLIDATED BALANCE SHEETS (Unaudited)

September 30, December 31, (Thousands of Dollars)

2010 2009

LIABILITIES AND

CAPITALIZATION

Current Liabilities: Notes Payable to Banks $ 156,000 $

100,313 Long-Term Debt - Current Portion 66,286 66,286 Accounts

Payable 379,184 457,582 Obligations to Third Party Suppliers 71,995

44,978 Accrued Taxes 69,870 50,246 Accrued Interest 107,828 83,763

Derivative Liabilities 61,317 37,617 Other Current Liabilities

144,668 138,627 Total Current

Liabilities 1,057,148 979,412

Rate Reduction Bonds 246,711 442,436

Deferred Credits and Other Liabilities: Accumulated Deferred

Income Taxes 1,546,255 1,380,143 Regulatory Liabilities 434,498

485,706 Derivative Liabilities 996,209 955,646 Accrued Pension

759,263 781,431 Other Long-Term Liabilities 781,246

845,868 Total Deferred Credits and Other Liabilities

4,517,471 4,448,794

Capitalization: Long-Term Debt 4,635,960

4,492,935 Noncontrolling Interest in Consolidated

Subsidiary: Preferred Stock Not Subject to Mandatory Redemption

116,200 116,200 Equity: Common

Shareholders' Equity: Common Shares 978,677 977,276 Capital

Surplus, Paid In 1,772,959 1,762,097 Deferred Contribution Plan -

(2,944 ) Retained Earnings 1,368,956 1,246,543 Accumulated Other

Comprehensive Loss (40,979 ) (43,467 ) Treasury Stock

(356,950 ) (361,603 ) Common Shareholders' Equity 3,722,663

3,577,902 Noncontrolling Interest 1,435 -

Total Equity 3,724,098 3,577,902

Total Capitalization 8,476,258 8,187,037

Total Liabilities and Capitalization $

14,297,588 $ 14,057,679

The data contained in this report is

preliminary and is unaudited. This report is being submitted for

the sole purpose of providing information to present shareholders

about Northeast Utilities and Subsidiaries and is not a

representation, prospectus, or intended for use in connection with

any purchase or sale of securities.

NORTHEAST UTILITIES AND SUBSIDIARIES CONDENSED

CONSOLIDATED STATEMENTS OF INCOME (Unaudited)

Three Months Ended September 30, Nine

Months Ended September 30, (Thousands of Dollars, Except Share

Information) 2010 2009

2010 2009 Operating Revenues $ 1,243,337 $

1,306,173 $ 3,694,182 $ 4,124,087 Operating Expenses: Fuel,

Purchased and Net Interchange Power 494,125 611,632 1,539,703

2,034,151 Other Operating Expenses 233,472 250,296 688,409 732,562

Maintenance 49,951 61,609 162,405 166,812 Depreciation 70,954

77,074 228,685 231,825 Amortization of Regulatory Assets, Net

50,341 10,542 50,908 19,194 Amortization of Rate Reduction Bonds

60,434 56,669 175,000 163,871 Taxes Other Than Income Taxes

84,427 75,798 244,431 216,651 Total Operating

Expenses 1,043,704 1,143,620 3,089,541

3,565,066 Operating Income 199,633 162,553 604,641 559,021

Interest Expense: Interest on Long-Term Debt 57,802 55,733 173,594

168,191 Interest on Rate Reduction Bonds 4,661 8,657 16,985 28,889

Other Interest 3,435 5,245 9,778 8,490

Interest Expense 65,898 69,635 200,357 205,570 Other Income, Net

10,118 9,490 19,726 26,081 Income

Before Income Tax Expense 143,853 102,408 424,010 379,532 Income

Tax Expense 41,918 36,230 161,126

130,047 Net Income 101,935 66,178 262,884 249,485 Net Income

Attributable to Noncontrolling Interests 1,411 1,390

4,204 4,169 Net Income Attributable to Controlling

Interests $ 100,524 $ 64,788 $ 258,680 $ 245,316 Basic

Earnings Per Common Share $ 0.57 $ 0.37 $ 1.47 $ 1.43 Fully

Diluted Earnings Per Common Share $ 0.57 $ 0.37 $ 1.46 $ 1.43

Dividends Declared Per Common Share $ 0.26 $ 0.24 $ 0.77 $

0.71 Weighted Average Common Shares Outstanding: Basic

176,752,714 175,358,776 176,557,889

170,958,396 Fully Diluted 177,012,278 175,995,506

176,762,088 171,532,913

The data contained in this report is

preliminary and is unaudited. This report is being submitted for

the sole purpose of providing information to present shareholders

about Northeast Utilities and Subsidiaries and is not a

representation, prospectus, or intended for use in connection with

any purchase or sale of securities.

NORTHEAST UTILITIES AND SUBSIDIARIES CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

Nine Months Ended September 30, (Thousands of Dollars)

2010 2009 Operating

Activities: Net Income $ 262,884 $ 249,485 Adjustments to Reconcile

Net Income to Net Cash Flows Provided by Operating Activities: Bad

Debt Expense 24,632 31,519 Depreciation 228,685 231,825 Deferred

Income Taxes 105,070 77,617 Pension and PBOP Expense, Net of PBOP

Contributions 41,709 10,197 Pension Contribution (45,000 ) -

Regulatory Overrecoveries, Net 44,479 44,519 Amortization of

Regulatory Assets, Net 50,908 19,194 Amortization of Rate Reduction

Bonds 175,000 163,871 Allowance for Equity Funds Used During

Construction (11,552 ) (6,162 ) Derivative Assets and Liabilities

(9,228 ) (18,519 ) Other (34,638 ) (7,323 ) Changes in Current

Assets and Liabilities: Receivables and Unbilled Revenues, Net

20,905 122,700 Fuel, Materials and Supplies 33,337 18,900 Taxes

Receivable/(Accrued) (12,904 ) 59,641 Other Current Assets (6,379 )

(7,490 ) Accounts Payable (59,601 ) (242,179 ) Other Current

Liabilities 35,340 13,335 Net Cash

Flows Provided by Operating Activities 843,647

761,130 Investing Activities: Investments in Property

and Plant (677,579 ) (634,446 ) Proceeds from Sales of Marketable

Securities 146,305 182,131 Purchases of Marketable Securities

(148,075 ) (183,814 ) Other Investing Activities (10,412 )

4,298 Net Cash Flows Used in Investing Activities

(689,761 ) (631,831 ) Financing Activities:

Issuance of Common Shares - 388,529 Cash Dividends on Common Shares

(135,349 ) (120,647 ) Cash Dividends on Preferred Stock (4,169 )

(4,169 ) Increase/(Decrease) in Short-Term Debt 55,687 (293,663 )

Issuance of Long-Term Debt 145,000 312,000 Retirements of Long-Term

Debt (4,286 ) (54,286 ) Retirements of Rate Reduction Bonds

(195,724 ) (183,208 ) Other Financing Activities (818 )

(14,694 ) Net Cash Flows (Used in)/Provided by Financing

Activities (139,659 ) 29,862 Net Increase in

Cash and Cash Equivalents 14,227 159,161 Cash and Cash Equivalents

- Beginning of Period 26,952 89,816

Cash and Cash Equivalents - End of Period $ 41,179 $ 248,977

The data contained in this report is

preliminary and is unaudited. This report is being submitted for

the sole purpose of providing information to present shareholders

about Northeast Utilities and Subsidiaries and is not a

representation, prospectus, or intended for use in connection with

any purchase or sale of securities.

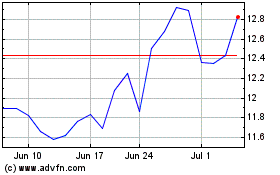

Nu (NYSE:NU)

Historical Stock Chart

From Aug 2024 to Sep 2024

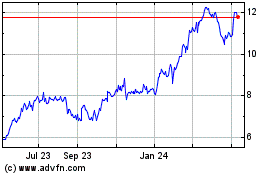

Nu (NYSE:NU)

Historical Stock Chart

From Sep 2023 to Sep 2024