Northeast Utilities (NYSE:NU) and NSTAR (NYSE:NST) today

announced that both companies’ Boards of Trustees have unanimously

approved a definitive merger agreement that will create one of the

nation’s largest utilities, with a total enterprise value of $17.5

billion. The Company will continue to be called Northeast

Utilities.

“The combination of Northeast Utilities and NSTAR will create a

great New England based company, assuring the regional benefits of

a locally controlled energy company for years to come,” said

Charles W. Shivery, Chairman, President and CEO of Northeast

Utilities. “Our companies already have a strong track record of

working together for New England. We recently jointly executed an

agreement to invest $1.1 billion in new transmission lines to

Québec, which will provide low-carbon hydro energy to power one

million homes in New England beginning in 2015.”

“NSTAR’s strong cash flows are very complementary to Northeast

Utilities’ attractive regulated investment opportunities,

mitigating the need for future equity issuances which is a

significant benefit for our shareholders,” continued Mr. Shivery.

“This merger, upon completion, will provide a significant increase

in the dividend for Northeast Utilities shareholders and will

enable long term dividend growth opportunities that are so

important to all of our investors.”

Thomas J. May, Chairman, President and CEO of NSTAR said, “This

is simply the start. Together, with enhanced financial resources,

complementary distribution and transmission assets, reputations for

operating excellence and talented employees, we will be able to

accomplish great things. NSTAR’s very strong balance sheet coupled

with Northeast Utilities’ impressive array of transmission

investment opportunities and diversified suite of distribution

businesses translates into a compelling growth story. Merging with

Northeast Utilities provides more diverse, stable and higher

earnings and dividend growth than NSTAR would have achieved on its

own. It also assures that the long track record of success our

investors have enjoyed in the past will continue.”

Mr. May added, “With this transaction we will create a larger,

stronger and more diversified regulated utility with over 9,000

employees in Massachusetts, New Hampshire and Connecticut, thereby

benefiting our region as a whole. The combined company will have

the scale, employee talent and financial resources to meet the

complex and demanding energy needs of customers across New England

and provide sustainable energy solutions that will support regional

growth.”

The companies will come together in a stock for stock merger of

equals. The combined company will provide electric and gas energy

to over half of the customers in New England.

The combined company will operate six regulated electric and gas

utilities in three states and will have nearly 3.5 million electric

and gas customers. Northeast Utilities will have nearly 4,500 miles

of electric transmission lines, 72,000 miles of electric

distribution lines and 6,000 miles of gas distribution lines.

The transaction is expected to be accretive to Northeast

Utilities’ earnings in the first year following close.

CUSTOMER BENEFITS

The transaction will create many opportunities for the companies

to leverage their combined resources to strengthen service quality

in the various service territories. The two companies have plans to

invest $9 billion in New England’s energy infrastructure over the

next five years. The combined scope and scale of Northeast

Utilities will make investment more cost effective, spread over a

larger customer base, allowing investments on a scale that might

not be attractive to the companies on a stand-alone basis. In

addition, the combined company will share best practices and

implement them over the entire customer base. For example,

Northeast Utilities and NSTAR have been long recognized by many

national and international organizations for the success of their

energy-efficiency programs that, when combined, total more than

$200 million in annual spending.

Customers will not experience any merger-related rate changes.

The merger is expected to produce important long term net savings

as a result of efficiencies. These efficiencies are expected to be

realized over time primarily through process improvements,

voluntary attrition and retirements. Current terms of the

collective bargaining agreements will remain in place.

Both companies have longstanding reputations as excellent

corporate citizens and Northeast Utilities will maintain the

current level of funding for vital civic and philanthropic

organizations across its combined service areas.

TERMS

Under the terms of the agreement, NSTAR shareholders would

receive 1.312 Northeast Utilities common shares for each NSTAR

share that they own in a transaction with a total equity value of

$9.5 billion and an enterprise value of $17.5 billion. The exchange

ratio reflects a no premium merger based on the average closing

share price of each company for the preceding 20 trading days.

Following completion of the merger, it is anticipated that

Northeast Utilities shareholders would own approximately 56 percent

and NSTAR shareholders would own approximately 44 percent of the

combined company. The agreement provides that, upon closing of the

transaction, Northeast Utilities’ dividend per share would be

increased to a rate that is equivalent to NSTAR’s dividend per

share, at that time, on an exchange ratio adjusted basis.

ORGANIZATION AND LEADERSHIP

Northeast Utilities will have dual headquarters in Hartford, CT

and Boston, MA.

Upon the closing of the transaction, Charles W. Shivery will

become the Non-Executive Chairman of Northeast Utilities for a

period of 18 months. Thomas J. May will serve as President and CEO

of Northeast Utilities and assume the additional role of Chairman

after 18 months.

The Board of Trustees of Northeast Utilities will be made up of

a combination of Trustees from the two companies, including 7

members nominated by the Board of Northeast Utilities and 7 members

nominated by the Board of NSTAR, with the Lead Trustee nominated by

the Board of Northeast Utilities.

APPROVALS AND TIMING

The merger is conditioned upon, among other things, approval by

two-thirds of the outstanding shares of both companies, the

expiration or termination of any applicable waiting period under

the Hart-Scott-Rodino Antitrust Improvements Act of 1976 and

reviews by federal and state energy authorities. These include the

Massachusetts Department of Public Utilities, the Federal Energy

Regulatory Commission (FERC), the Nuclear Regulatory Commission

(NRC), the Securities and Exchange Commission (SEC) and the Federal

Communications Commission (FCC).

The companies anticipate that the regulatory approvals can be

obtained within 9 – 12 months. The companies intend to seek

shareholder approval of the transaction in early 2011.

ADVISORS

Barclays Capital is serving as lead financial advisor and Lazard

is serving as financial advisor to Northeast Utilities. Skadden,

Arps, Slate, Meagher & Flom LLP is serving as transaction

counsel to Northeast Utilities. Goldman, Sachs and Co., is serving

as lead financial advisor and Lexicon Partners (US) LLC is serving

as financial advisor to NSTAR. Ropes & Gray LLP is serving as

transaction counsel to NSTAR.

CONFERENCE CALL AND WEBCAST

Northeast Utilities and NSTAR will conduct a conference call at

8:30am EDT on October 18, 2010 to discuss the merger. To

participate, please dial (888) 802-8577 (or +1-973-935-8754 if

outside the United States), and enter the access code 19106148,

approximately 15 minutes before the scheduled start of the call.

The conference call will also be accessible live in the Investor

Relations section of both the Northeast Utilities website at

www.nu.com and the NSTAR website at www.nstar.com.

A replay of the conference call will be available online in the

Investor Relations section of both companies’ websites and via

telephone by dialing (800) 642-1687 (+1-706-645-9291 outside the

United States), and entering access code 19106148, beginning

11:30am EDT from October 18, 2010 through 11:59pm EDT on October

24, 2010.

About Northeast Utilities

NU, headquartered in Hartford, operates New England’s largest

utility system with annual revenues of approximately $5.4 billion

and assets of $14.2 billion. NU, and its companies in Connecticut,

New Hampshire and Massachusetts, serve more than 2.1 million

electric and natural gas customers in nearly 500 cities and towns.

For more information, go to www.nu.com.

About NSTAR

NSTAR, headquartered in Boston, is an energy delivery company

with annual revenues of approximately $3 billion and assets of $8

billion that serves 1.4 million customers in Massachusetts,

including approximately 1.1 million electric distribution customers

in 81 communities and 300,000 natural gas distribution customers in

51 communities. For more information, go to www.nstar.com.

Information Concerning Forward-Looking Statements

In addition to historical information, this press release may

contain a number of “forward-looking statements” as defined in the

Private Securities Litigation Reform Act of 1995. Words such as

anticipate, expect, project, intend, plan, believe, and words and

terms of similar substance used in connection with any discussion

of future plans, actions, or events identify forward-looking

statements. Forward-looking statements relating to the proposed

merger include, but are not limited to: statements about the

benefits of the proposed merger involving NSTAR and Northeast

Utilities, including future financial and operating results;

NSTAR’s and Northeast Utilities' plans, objectives, expectations

and intentions; the expected timing of completion of the

transaction; and other statements relating to the merger that are

not historical facts. Forward-looking statements involve estimates,

expectations and projections and, as a result, are subject to risks

and uncertainties. There can be no assurance that actual results

will not materially differ from expectations. Important factors

could cause actual results to differ materially from those

indicated by such forward-looking statements. With respect to the

proposed merger, these factors include, but are not limited to:

risks and uncertainties relating to the ability to obtain the

requisite NSTAR and Northeast Utilities shareholder approvals; the

risk that NSTAR or Northeast Utilities may be unable to obtain

governmental and regulatory approvals required for the merger, or

required governmental and regulatory approvals may delay the merger

or result in the imposition of conditions that could reduce the

anticipated benefits from the merger or cause the parties to

abandon the merger; the risk that a condition to closing of the

merger may not be satisfied; the length of time necessary to

consummate the proposed merger; the risk that the businesses will

not be integrated successfully; the risk that the cost savings and

any other synergies from the transaction may not be fully realized

or may take longer to realize than expected; disruption from the

transaction making it more difficult to maintain relationships with

customers, employees or suppliers; the diversion of management time

on merger-related issues; the effect of future regulatory or

legislative actions on the companies; and the risk that the credit

ratings of the combined company or its subsidiaries may be

different from what the companies expect. These risks, as well as

other risks associated with the merger, will be more fully

discussed in the joint proxy statement/prospectus that will be

included in the Registration Statement on Form S-4 that will be

filed with the SEC in connection with the merger. Additional risks

and uncertainties are identified and discussed in NSTAR’s and

Northeast Utilities’ reports filed with the SEC and available at

the SEC’s website at www.sec.gov. Forward-looking statements

included in this release speak only as of the date of this release.

Neither NSTAR nor Northeast Utilities undertakes any obligation to

update its forward-looking statements to reflect events or

circumstances after the date of this release.

Additional Information and Where To Find It

In connection with the proposed merger between Northeast

Utilities and NSTAR, Northeast Utilities will file with the SEC a

Registration Statement on Form S-4 that will include a joint proxy

statement of Northeast Utilities and NSTAR that also constitutes a

prospectus of Northeast Utilities. Northeast Utilities and NSTAR

will mail the joint proxy statement/prospectus to their respective

shareholders. Northeast Utilities and NSTAR urge investors and

shareholders to read the joint proxy statement/prospectus regarding

the proposed merger when it becomes available, as well as other

documents filed with the SEC, because they will contain important

information. You may obtain copies of all documents filed with

the SEC regarding this proposed transaction, free of charge, at the

SEC’s website (www.sec.gov). You may also obtain these documents,

free of charge, from Northeast Utilities’ website (www.nu.com)

under the tab “Investors” and then under the heading "Financial/SEC

Reports." You may also obtain these documents, free of charge, from

NSTAR’s website (www.nstar.com) under the tab “Investor

Relations.”

Participants in the Merger Solicitation

Northeast Utilities, NSTAR and their respective trustees,

executive officers and certain other members of management and

employees may be soliciting proxies from Northeast Utilities and

NSTAR shareholders in favor of the merger and related matters.

Information regarding the persons who may, under the rules of the

SEC, be deemed participants in the solicitation of Northeast

Utilities and NSTAR shareholders in connection with the proposed

merger will be set forth in the joint proxy statement/prospectus

when it is filed with the SEC. You can find information about

Northeast Utilities' executive officers and trustees in its

definitive proxy statement filed with the SEC on April 1, 2010. You

can find information about NSTAR’s executive officers and trustees

in its definitive proxy statement filed with the SEC on March 12,

2010. Additional information about Northeast Utilities' executive

officers and trustees and NSTAR’s executive officers and trustees

can be found in the above-referenced Registration Statement on Form

S-4 when it becomes available. You can obtain free copies of these

documents from Northeast Utilities and NSTAR using the website

information above.

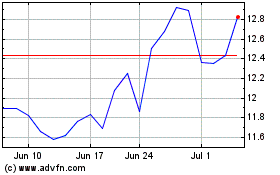

Nu (NYSE:NU)

Historical Stock Chart

From Oct 2024 to Nov 2024

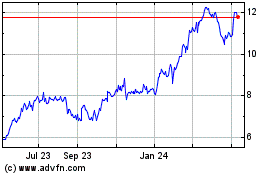

Nu (NYSE:NU)

Historical Stock Chart

From Nov 2023 to Nov 2024