NCL Corporation Ltd. (“NCLC”) (the “Company” or “Norwegian”), a

subsidiary of Norwegian Cruise Line Holdings Ltd. (NYSE: NCLH),

today announced that S&P Global Ratings (S&P) has recently

upgraded NCLC’s issuer credit rating and issue-level ratings.

NCLC’s issuer credit rating has been upgraded to B+, marking a

notable improvement in the Company’s creditworthiness. In addition,

S&P has raised the issue-level ratings on NCLC’s existing

secured and unsecured debt. The Company’s senior secured debt

ratings were raised to BB/BB- and its unsecured debt rating was

upgraded two notches to B.

S&P highlighted several factors for the

upgrade, including NCLC’s current forward-booked position,

increased capacity, occupancy recovery, and higher pricing

providing good revenue and cash flow visibility for 2024. In

addition, S&P noted that the Company’s leverage will benefit

from higher revenue, EBITDA, and cash as it generates a full year

of operations from its 2023 ship deliveries, without incurring

incremental ship delivery debt in 2024.

Further enhancing its financial position, on

March 7, 2024, the Company successfully completed the refinancing

of its $650 million backstop commitment. This commitment has been

refinanced from a secured to an unsecured commitment, and as part

of this refinancing, the Company has repaid its $250 million 9.75%

senior secured notes due 2028, eliminating its highest interest

rate debt.

“The upgraded ratings are an important

recognition of the strength of our business and our ability to

reduce leverage,” commented Mark A. Kempa, executive vice president

and chief financial officer of Norwegian Cruise Line Holdings Ltd.

He continued, “Our recent refinancing, which reduces interest costs

while releasing the related collateral, is a clear demonstration of

our commitment to de-levering and improving our balance sheet.”

About Norwegian Cruise Line Holdings Ltd.

Norwegian Cruise Line Holdings Ltd. (NYSE: NCLH)

is a leading global cruise company which operates Norwegian Cruise

Line, Oceania Cruises and Regent Seven Seas Cruises. With a

combined fleet of 32 ships and approximately 66,500 berths, NCLH

offers itineraries to approximately 700 destinations worldwide.

NCLH has five additional ships scheduled for delivery across its

three brands, which will add approximately 16,000 berths to its

fleet. To learn more, visit www.nclhltd.com.

Cautionary Statement Concerning

Forward-Looking Statements

Some of the statements, estimates or projections contained in

this release are “forward-looking statements” within the meaning of

the U.S. federal securities laws intended to qualify for the safe

harbor from liability established by the Private Securities

Litigation Reform Act of 1995. All statements other than statements

of historical facts contained, or incorporated by reference, in

this release, including, without limitation, those regarding our

business strategy, financial position, results of operations,

plans, prospects, actions taken or strategies being considered with

respect to our liquidity position, valuation and appraisals of our

assets and objectives of management for future operations

(including those regarding expected fleet additions, our

expectations regarding the impact of macroeconomic conditions and

recent global events, our expectations regarding cruise voyage

occupancy, operational position, demand for voyages, plans or goals

for our sustainability program and decarbonization efforts, our

expectations for future cash flows and profitability, financing

opportunities and extensions, and efforts to reduce operating

expenses and capital expenditures) are forward-looking statements.

Many, but not all, of these statements can be found by looking for

words like “expect,” “anticipate,” “goal,” “project,” “plan,”

“believe,” “seek,” “will,” “may,” “forecast,” “estimate,” “intend,”

“future” and similar words. Forward-looking statements do not

guarantee future performance and may involve risks, uncertainties

and other factors which could cause our actual results, performance

or achievements to differ materially from the future results,

performance or achievements expressed or implied in those

forward-looking statements. Examples of these risks, uncertainties

and other factors include, but are not limited to the impact of:

adverse general economic factors, such as fluctuating or increasing

levels of interest rates, inflation, unemployment, underemployment

and the volatility of fuel prices, declines in the securities and

real estate markets, and perceptions of these conditions that

decrease the level of disposable income of consumers or consumer

confidence; implementing precautions in coordination with

regulators and global public health authorities to protect the

health, safety and security of guests, crew and the communities we

visit and to comply with related regulatory restrictions; our

indebtedness and restrictions in the agreements governing our

indebtedness that require us to maintain minimum levels of

liquidity and be in compliance with maintenance covenants and

otherwise limit our flexibility in operating our business,

including the significant portion of assets that are collateral

under these agreements; our ability to work with lenders and others

or otherwise pursue options to defer, renegotiate, refinance or

restructure our existing debt profile, near-term debt amortization,

newbuild related payments and other obligations and to work with

credit card processors to satisfy current or potential future

demands for collateral on cash advanced from customers relating to

future cruises; our need for additional financing or financing to

optimize our balance sheet, which may not be available on favorable

terms, or at all, and our outstanding exchangeable notes and any

future financing which may be dilutive to existing shareholders;

the unavailability of ports of call; future increases in the price

of, or major changes, disruptions or reduction in, commercial

airline services; changes involving the tax and environmental

regulatory regimes in which we operate, including new regulations

aimed at reducing greenhouse gas emissions; the accuracy of any

appraisals of our assets; our success in controlling operating

expenses and capital expenditures; trends in, or changes to, future

bookings and our ability to take future reservations and receive

deposits related thereto; adverse events impacting the security of

travel, or customer perceptions of the security of travel, such as

terrorist acts, armed conflict, such as Russia’s invasion of

Ukraine or the Israel-Hamas war, or threats thereof, acts of

piracy, and other international events; public health crises,

including the COVID-19 pandemic, and their effect on the ability or

desire of people to travel (including on cruises); adverse

incidents involving cruise ships; our ability to maintain and

strengthen our brand; breaches in data security or other

disturbances to our information technology systems and other

networks or our actual or perceived failure to comply with

requirements regarding data privacy and protection; changes in fuel

prices and the type of fuel we are permitted to use and/or other

cruise operating costs; mechanical malfunctions and repairs, delays

in our shipbuilding program, maintenance and refurbishments and the

consolidation of qualified shipyard facilities; the risks and

increased costs associated with operating internationally; our

inability to recruit or retain qualified personnel or the loss of

key personnel or employee relations issues; impacts related to

climate change and our ability to achieve our climate-related or

other sustainability goals; our inability to obtain adequate

insurance coverage; pending or threatened litigation,

investigations and enforcement actions; volatility and disruptions

in the global credit and financial markets, which may adversely

affect our ability to borrow and could increase our counterparty

credit risks, including those under our credit facilities,

derivatives, contingent obligations, insurance contracts and new

ship progress payment guarantees; any further impairment of our

trademarks, trade names or goodwill; our reliance on third parties

to provide hotel management services for certain ships and certain

other services; fluctuations in foreign currency exchange rates;

our expansion into new markets and investments in new markets and

land-based destination projects; overcapacity in key markets or

globally; and other factors set forth under “Risk Factors” in our

most recently filed Annual Report on Form 10-K, Quarterly Report on

Form 10-Q and subsequent filings with the Securities and Exchange

Commission. The above examples are not exhaustive and new risks

emerge from time to time. There may be additional risks that we

consider immaterial or which are unknown. Such forward-looking

statements are based on our current beliefs, assumptions,

expectations, estimates and projections regarding our present and

future business strategies and the environment in which we expect

to operate in the future. These forward-looking statements speak

only as of the date made. We expressly disclaim any obligation or

undertaking to release publicly any updates or revisions to any

forward-looking statement to reflect any change in our expectations

with regard thereto or any change of events, conditions or

circumstances on which any such statement was based, except as

required by law.

Investor Relations & Media Contact

Sarah Inmon(786) 812-

3233InvestorRelations@nclcorp.comNCLHmedia@nclcorp.com

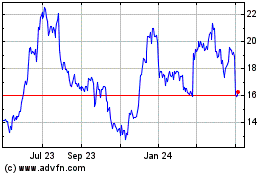

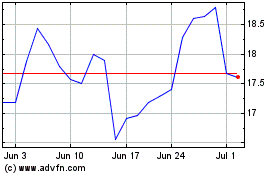

Norwegian Cruise Line (NYSE:NCLH)

Historical Stock Chart

From Oct 2024 to Nov 2024

Norwegian Cruise Line (NYSE:NCLH)

Historical Stock Chart

From Nov 2023 to Nov 2024