3rd UPDATE: Shah Deniz Excludes ITGI As European Gas Link - BP

February 20 2012 - 2:00PM

Dow Jones News

Shah Deniz, the consortium developing a natural-gas field

offshore Azerbaijan, has narrowed down its options to carry that

gas to Europe, the first major decision in a years-long process

that is key for Europe's strategy of diversifying energy

supplies.

The consortium has excluded the Interconnector

Turkey-Greece-Italy, or ITGI, pipeline project from those being

considered to transport the gas to Europe, energy giant BP PLC (BP,

BP.LN), which has a key role in Shah Deniz, said Monday. This means

that another, similar project called Trans-Adriatic Pipeline, or

TAP, will be negotiating exclusively to transport the gas from the

Caspian to Italy.

"The Socar-led [Azerbaijan's state-controlled energy company]

negotiating team has made the decision to undertake exclusive

negotiations with TAP on a southern pipeline route through Italy,"

a spokesman for BP told Dow Jones Newswires. The decision means

that ITGI's proposal "will not be considered further," he

explained.

The issue of natural-gas transportation from the Caspian to

Europe is key for the European Union's aim of opening a "corridor"

from Central Asia, across Turkey, and getting new suppliers in an

energy-rich region to ease its dependence on Russia's natural gas.

This latest news means the consortium is making real progress

toward a final decision in the process, after years of fierce

battle among different pipeline projects.

Two other projects, Nabucco and the South East Europe Pipeline,

or SEEP--both designed to carry the gas to Central Europe--are

still in the competition, the BP spokesman said.

The next decision will be between Nabucco and SEEP, which is

partially supported by BP. "Once that [decision] is done, it will

be possible to make a decision between a northern [to Central

Europe] or southern [to Italy] pipeline route," said the

spokesman.

The news is a blow for Italian energy company Edison SpA

(EDN.MI) and Greek natural-gas company DEPA, the two sponsors

behind ITGI, that have spent huge resources in promoting it.

The financial situation in Greece and Italy, together with

technical considerations about the pipelines, were some of the

reasons behind the decision, a person familiar with the talks told

Dow Jones.

However, Edison reaffirmed its commitment to the ITGI pipeline

project.

"Edison confirms its commitment to continue the development of

the ITGI pipeline as the most advanced option for the timely and

most efficient opening" of the natural-gas corridor from the

Caspian to Europe, the company said in a statement. A company

official also confirmed that Edison received a formal communication

from the Shah Deniz consortium.

The Italian and Greek governments also reiterated their support

for ITGI.

The Italian industry ministry said, speaking also on behalf of

the Greek government, that ITGI is "the most advanced and mature"

among the pipeline proposals. The two governments said that talks

should continue to "explore every alternative" to the opening up of

the gas corridor from the Caspian to Europe.

ITGI would carry gas from Greece to southern Italy, bypassing

Albania. TAP would do the same, but without bypassing Albania. Its

sponsors are Swiss energy-trading company

Elektrizitats-Gesellschaft Laufenburg AG (EGL.EB), Germany's E.ON

AG (EOAN.XE, EONGY) and Norway's energy giant Statoil ASA (STL.OS,

STO), which is also one of the two main shareholders of the Shah

Deniz consortium.

"We firmly believe that TAP remains a strong contender to win

the bid to transport Shah Deniz II gas to Europe," Kjetil Tungland,

TAP's managing director, said in a statement. "We are also

confident that the TAP route to Italy offers the Shah Deniz

consortium the most attractive market and the most advanced

evacuation route," he explained.

Shah Deniz II is expected to add roughly 16 billion cubic meters

of annual production as early as 2018, 10 billion cubic meters of

which would be ready for export to the EU. BP and Statoil both own

25.5% stakes of Shah Deniz. The State Oil Co. of Azerbaijan, or

Socar, Russia's OAO Lukoil Holdings (LKOH.RS, LUKOY), France's

Total SA (FP.FR, TOT) and National Iranian Oil Co. all own 10%

each, while Turkish Petroleum Corp., or TPAO, owns 9%.

-By Alessandro Torello and Alexis Flynn, Dow Jones Newswires;

32-2-741-14-88; alessandro.torello@dowjones.com

--Liam Moloney contributed to this article.

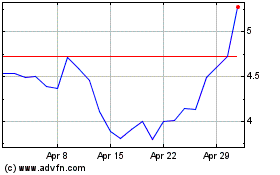

NIO (NYSE:NIO)

Historical Stock Chart

From Jun 2024 to Jul 2024

NIO (NYSE:NIO)

Historical Stock Chart

From Jul 2023 to Jul 2024