Current Report Filing (8-k)

December 12 2022 - 5:05PM

Edgar (US Regulatory)

false

0001786248

0001786248

2022-12-08

2022-12-08

0001786248

nref:CommonStockParValue001PerShareCustomMember

2022-12-08

2022-12-08

0001786248

nref:SeriesACumulativeRedeemablePreferredStockParValue001PerShare850CustomMember

2022-12-08

2022-12-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): December 8, 2022

NEXPOINT REAL ESTATE FINANCE, INC.

(Exact Name Of Registrant As Specified In Charter)

|

Maryland

|

|

001-39210

|

|

84-2178264

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

300 Crescent Court, Suite 700

Dallas, Texas 75201

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (214) 276-6300

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, par value $0.01 per share

8.50% Series A Cumulative Redeemable Preferred Stock, par value $0.01 per share

|

|

NREF

NREF-PRA

|

|

New York Stock Exchange

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

The information contained under “Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant” is incorporated herein by reference.

|

Item 2.03.

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

On December 8, 2022 and in connection with a restructuring of NexPoint Storage Partners, Inc. (“NSP”), NexPoint Real Estate Finance, Inc. through its indirect majority owned subsidiary NREF OP IV REIT Sub, LLC (“REIT Sub”), together with NexPoint Diversified Real Estate Trust, Highland Income Fund and NexPoint Real Estate Strategies Fund (collectively, the “Co-Guarantors”), as guarantors, entered into a Sponsor Guaranty Agreement in favor of Extra Space pursuant to which REIT Sub and the Co-Guarantors guaranteed obligations of NSP with respect to NSP’s newly created Series D Preferred Stock and two promissory notes in an aggregate principal amount of approximately $64.2 million issued to Extra Space. The guaranties by REIT Sub and the Co-Guarantors are capped at $97.6 million, which cap amount will be reduced as the guaranteed obligations of NSP are paid. Each of REIT Sub and the Co-Guarantors generally guaranteed the foregoing obligations of NSP up to the cap amount on a pro rata basis with respect to its percentage ownership of NSP’s common stock. The maximum liability of REIT Sub under the guaranties is approximately $83.8 million.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this Current Report on Form 8-K to be signed on its behalf by the undersigned hereunto duly authorized.

| |

NexPoint Real Estate Finance, Inc.

|

|

| |

|

|

|

| |

By:

|

/s/ Brian Mitts

|

|

| |

Name:

|

Brian Mitts

|

|

| |

Title:

|

Chief Financial Officer, Executive

VP-Finance, Secretary and Treasurer

|

|

| |

|

|

Date: December 12, 2022

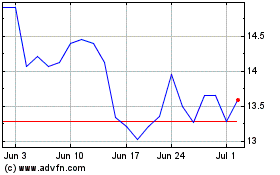

NexPoint Real Estate Fin... (NYSE:NREF)

Historical Stock Chart

From Sep 2024 to Oct 2024

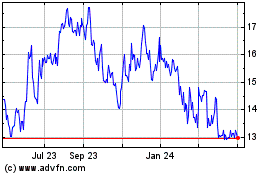

NexPoint Real Estate Fin... (NYSE:NREF)

Historical Stock Chart

From Oct 2023 to Oct 2024