Newmont Sees Relatively Stable Gold Production Through 2025

December 08 2020 - 8:20AM

Dow Jones News

By Micah Maidenberg

Newmont Corp. said it expects relatively stable levels of

production over the next five years even as costs move lower over

that timeframe.

The gold miner on Tuesday said it believes it will generate 6.5

million ounces of gold next year. In 2022 and 2023, the company

expects to produce between 6.2 million and 6.7 million ounces. The

floor for the range rises to 6.5 million ounces for 2024 and 2025,

while the ceiling rises to 7 million ounces for those years.

"Newmont's outlook reflects increasing gold production and

ongoing investment in its operating assets and most promising

growth prospects," the company said. Next year, the company is

including a property in Ghana and one in Peru in its outlook for

the first time.

All-in sustainable costs are forecast at $970 an ounce next

year; $850 to $950 an ounce in 2022 and $825 to $925 an ounce for

2023. In 2024 and 2025, Newmont forecast those costs to range from

$800 to $900 an ounce.

The company assumed a price for gold of $1,200 an ounce for the

forecast.

The front-month Comex gold contract ended at $1,861.80 a troy

ounce Monday and prices are up nearly 23% this year.

Write to Micah Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

December 08, 2020 08:05 ET (13:05 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

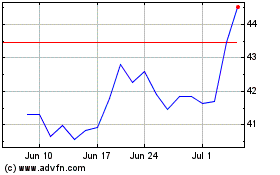

Newmont (NYSE:NEM)

Historical Stock Chart

From Mar 2024 to Apr 2024

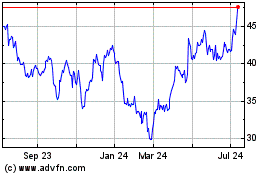

Newmont (NYSE:NEM)

Historical Stock Chart

From Apr 2023 to Apr 2024