0001163739

false

0001163739

2023-10-25

2023-10-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form 8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

October 25, 2023

NABORS INDUSTRIES LTD.

(Exact name of registrant as specified in

its charter)

| Bermuda |

|

001-32657 |

|

98-0363970 |

| |

|

|

|

|

(State or Other Jurisdiction of

Incorporation or Organization) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

Crown House

4 Par-la-Ville Road

Second Floor

Hamilton, HM08 Bermuda |

|

N/A |

| (Address of principal executive offices) |

|

(Zip Code) |

(441) 292-1510

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Title of each class |

|

Trading Symbol(s) |

|

Name of exchange on which

registered |

| Common shares |

|

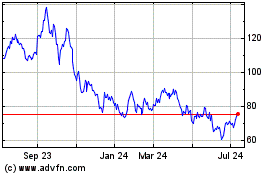

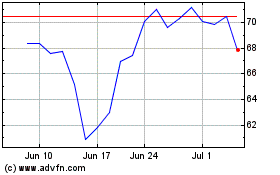

NBR |

|

NYSE |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results of Operations and Financial

Condition.

On October 25, 2023,

Nabors Industries Ltd. (“Nabors”) issued a press release announcing its results of operations for the three months ended September 30,

2023. A copy of that release is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

On October 26th, 2023,

Nabors will hold a conference call at 1:00 p.m. Central Time, regarding the Company’s financial results for the quarter ended

September 30, 2023. Information about the call—including dial-in information, recording and replay of the call, and supplemental

information—is available on the Investor Relations page of www.nabors.com.

The information in this Item

2.02, including Exhibits 99.1 and 99.2, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange

Act, of 1934 or otherwise subject to liabilities of that Section or Sections 11 and 12(a)(2) of the Securities Act of 1933.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

NABORS INDUSTRIES LTD. |

| |

|

| Date: October 25, 2023 |

By: |

/s/ Mark D. Andrews |

| |

|

Name: Mark D. Andrews |

| |

|

Title: Corporate Secretary |

Exhibit 99.1

|

NEWS RELEASE |

Nabors Announces

Third Quarter 2023 Results

HAMILTON,

Bermuda, October 25, 2023 /PRNewswire/ - Nabors Industries Ltd. (“Nabors”

or the “Company”) (NYSE: NBR) today reported third quarter 2023 operating revenues of $734 million, compared to operating

revenues of $767 million in the second quarter. The net loss attributable to Nabors shareholders for the quarter was $49 million, compared

to net income of $5 million in the second quarter. This equates to a loss of $6.26 per diluted share, compared to a loss per diluted share

of $0.31 in the second quarter. The third quarter results included a charge, related to mark-to-market treatment of Nabors warrants, of

$8 million, or $0.86 per diluted share, compared to a gain of $18 million, or $1.95 per diluted share, in the second quarter. Third quarter

adjusted EBITDA was $210 million, compared to $235 million in the previous quarter.

Anthony G. Petrello, Nabors Chairman,

CEO and President, commented, “Drilling activity across our markets generally met our expectations. As we had anticipated in the

Lower 48, rig count decreased in the third quarter but it appears to have bottomed, while leading-edge pricing also seems to have stabilized.

The reduced drilling activity in the U.S. did impact our Nabors Drilling Solutions and Rig Technologies results somewhat more than we

expected. In line with our forecasts, international markets have continued to expand with higher pricing.

“During the quarter we experienced

challenges with our newbuild rigs and some of their critical components in Saudi Arabia, which resulted in deployment delays and significant

downtime. We are currently addressing the quality assurance issues on these assets delivered by our third-party supplier. We expect our

supplier’s performance to improve rapidly as its local manufacturing experience increases.

“On

the positive side, margins in our Lower 48 operation remained at higher levels than in any prior upcycle. During the third quarter we

saw the early signs of the expected market upturn. In preparation, we have 14 warm stacked rigs ready to return to work immediately at

minimum cost, as soon as drilling activity turns around.

“In

our International segment, multiple rigs commenced operations, contributing to an increase in sequential revenue. We are encouraged by

the prospects for a significant number of additional rigs in our international markets through 2024 and beyond.

“Broad

demand for our technology portfolio in Nabors Drilling Solutions drove meaningful increases in U.S. third-party and international revenue.

“In

Rig Technologies, our Energy Transition initiatives continued to gain momentum as we expanded our PowerTAP deployments, and our customers

increased their demand for our innovative solutions.”

Segment Results

The U.S.

Drilling segment reported $117.4 million in adjusted EBITDA for the third quarter of 2023. Nabors’ average Lower 48 rig count totaled

74. Daily adjusted gross margin in the Lower 48 market averaged $15,855.

|

NEWS RELEASE |

International

Drilling adjusted EBITDA totaled $96.2 million. Improved results across multiple markets were offset by start-up expenses in Saudi Arabia

and lower rig count in Colombia and Kuwait. International rig count averaged 77, in line with the previous quarter. Daily adjusted gross

margin for the third quarter averaged $15,778, down approximately 3% from the prior quarter.

Drilling

Solutions adjusted EBITDA declined sequentially by approximately $2.3 million, to $30.4 million. Growth of 8% in both U.S. third-party

revenue and international operations was more than offset by decreased Lower 48 activity on the reductions in Nabors rig count.

In Rig

Technologies, adjusted EBITDA totaled $7.2 million, compared to $6.4 million in the second quarter. Increases in aftermarket margins and

growth from the Energy Transition products accounted for the sequential improvement in adjusted EBITDA.

Adjusted Free Cash

Flow

Adjusted free cash flow was negative

$5 million in the third quarter. Capital expenditures totaled $157 million, which included $52 million for the newbuilds in Saudi Arabia.

This compares to $152 million in the second quarter, including $66 million supporting the newbuilds in Saudi Arabia.

At the end of the third quarter,

net debt was $2.1 billion.

William Restrepo, Nabors CFO,

stated, “The results delivered by our operating rigs were encouraging. Our rig count in the Lower 48 held up well in the third quarter

despite total market rig count landing a bit below expectations. In addition, our revenue per day and daily gross margin remained near

the record high levels set the prior quarter. We remain well positioned to take advantage of any recovery in U.S. drilling activity. Internationally

we continued to deploy rigs at attractive pricing, offsetting the contract expirations in Colombia and Kuwait. In the fourth quarter we

expect rig count increases in the U.S. as well as in international markets, as compared to the current levels. And we expect Nabors Drilling

Solutions to resume its growth trajectory.

“During the quarter, on

top of the $5 million EBITDA shortfall on our new builds in Saudi Arabia, we faced several unexpected items that negatively affected our

adjusted free cash flow. Most of these were one-offs or timing shifts across quarters. Capital expenditures were the largest of these

items as they exceeded our forecast by $33 million. This increase was driven by higher capital spending in Saudi Arabia and by the $9.5

million purchase of our operating base in Vaca Muerta, Argentina. We had been attempting without success to lock in this critical facility

over the last couple of years and had the opportunity to do so during the third quarter. We expect capital spending to fall materially

in the fourth quarter as these items should not repeat. In addition, our accounts receivable and other working capital items were approximately

$40 million higher than we had forecast at the end of last quarter. We expect this impact to reverse in the fourth quarter.

“Mainly as a result of higher

capital expenditures, an EBITDA shortfall in Saudi Arabia of $11 million in the second half, and lower NDS and Rig Technologies EBITDA

of about $13 million combined in the second half, our full year free cash flow is now expected to total $225 to $250 million, as compared

to our prior forecast at the end of the second quarter of $300 to $350 million. The impact from higher capital expenditures during the

second half, an increment of approximately $40 million, comes from the acceleration of deployments in Algeria, which will shift $20 million

in capital expenditures from early 2024 into the fourth quarter of 2023, from capital spending in Saudi Arabia which is expected to be

some $10 million higher than forecast earlier, and from the acquisition of the Vaca Muerta base, which was not part of our prior forecast.

|

NEWS RELEASE |

“We are now beginning the

forecasting process for 2024. Although we are not yet ready to discuss these projections, we do expect meaningful year over year increases

in both EBITDA and free cash flow.”

Outlook

Nabors

expects the following metrics for the fourth quarter 2023:

U.S.

Drilling

| o | Lower 48 average rig count of 72 - 74 rigs |

| o | Lower 48 adjusted gross margin per day of $15,000 - $15,200 |

| o | Alaska and Gulf of Mexico adjusted EBITDA up by $1.5 million |

International

| o | Rig count up by one to two rigs versus the third quarter average |

| o | Adjusted gross margin per day of approximately $16,200 - $16,300 |

Drilling

Solutions

| o | Adjusted EBITDA up by approximately 10% vs the third quarter |

Rig Technologies

| o | Adjusted EBITDA up by approximately 20% vs the third quarter |

Capital

Expenditures

| o | Capital expenditures of $95 million, with approximately $35 million for the newbuilds in Saudi Arabia |

Adjusted

Free Cash Flow

| o | Adjusted free cash flow for the fourth quarter of $165 to $190 million and for the full year 2023 of $225

to $250 million |

Mr. Petrello

concluded, “As we look to the fourth quarter, we expect improvements in our financial results, especially in free cash flow. With

the international expansion already in hand, and the indications we have seen for growth in the U.S., we are positioned for meaningful

improvement in 2024. The momentum we are now generating with our Energy Transition initiatives gives us additional confidence in this

positive outlook.”

|

NEWS RELEASE |

About Nabors Industries

Nabors Industries

(NYSE: NBR) is a leading provider of advanced technology for the energy industry. With presence in more than 20 countries, Nabors has

established a global network of people, technology and equipment to deploy solutions that deliver safe, efficient and responsible energy

production. By leveraging its core competencies, particularly in drilling, engineering, automation, data science and manufacturing, Nabors

aims to innovate the future of energy and enable the transition to a lower-carbon world. Learn more about Nabors and its energy technology

leadership: www.nabors.com.

Forward-looking Statements

The information included

in this press release includes forward-looking statements within the meaning of the Securities Act of 1933 and the Securities Exchange

Act of 1934. Such forward-looking statements are subject to a number of risks and uncertainties, as disclosed by Nabors from time to time

in its filings with the Securities and Exchange Commission. As a result of these factors, Nabors' actual results may differ materially

from those indicated or implied by such forward-looking statements. The forward-looking statements contained in this press release

reflect management's estimates and beliefs as of the date of this press release. Nabors does not undertake to update these forward-looking

statements.

Non-GAAP Disclaimer

This press release presents certain “non-GAAP” financial

measures. The components of these non-GAAP measures are computed by using amounts that are determined in accordance with accounting

principles generally accepted in the United States of America (“GAAP”). Adjusted operating income (loss) represents income

(loss) from continuing operations before income taxes, interest expense, investment income (loss), and other, net. Adjusted EBITDA is

computed similarly, but also excludes depreciation and amortization expenses. In addition, adjusted EBITDA and adjusted operating income

(loss) exclude certain cash expenses that the Company is obligated to make. Net debt is calculated as total debt minus the sum of cash,

cash equivalents and short-term investments.

Adjusted free cash flow represents net cash provided by operating activities

less cash used for capital expenditures, net of proceeds from sales of assets. Management believes that adjusted free cash flow is

an important liquidity measure for the company and that it is useful to investors and management as a measure of the company’s ability

to generate cash flow, after reinvesting in the company for future growth, that could be available for paying down debt or other financing

cash flows, such as dividends to shareholders. Management believes that this non-GAAP measure is useful information to investors

when comparing our cash flows with the cash flows of other companies.

|

NEWS RELEASE |

Each of these non-GAAP measures has limitations and therefore should

not be used in isolation or as a substitute for the amounts reported in accordance with GAAP. However, management evaluates the performance

of its operating segments and the consolidated Company based on several criteria, including Adjusted EBITDA, adjusted operating income

(loss), net debt, and adjusted free cash flow, because it believes that these financial measures accurately reflect the Company’s

ongoing profitability and performance. Securities analysts and investors also use these measures as some of the metrics on which

they analyze the Company’s performance. Other companies in this industry may compute these measures differently. Reconciliations

of consolidated adjusted EBITDA and adjusted operating income (loss) to income (loss) from continuing operations before income taxes,

net debt to total debt, and adjusted free cash flow to net cash provided by operations, which are their nearest comparable GAAP financial

measures, are included in the tables at the end of this press release. We do not provide a forward-looking reconciliation of our

outlook for Segment Adjusted EBITDA, Segment Gross Margin or Adjusted Free Cash Flow, as the amount and significance of items required

to develop meaningful comparable GAAP financial measures cannot be estimated at this time without unreasonable efforts. These special

items could be meaningful.

Investor Contacts: William C. Conroy, CFA,

Vice President of Corporate Development & Investor Relations, +1 281-775-2423 or via e-mail william.conroy@nabors.com,

or Kara Peak, Director of Corporate Development & Investor Relations, +1 281-775-4954 or via email kara.peak@nabors.com.

To request investor materials, contact Nabors' corporate headquarters in Hamilton, Bermuda at +441-292-1510 or via e-mail mark.andrews@nabors.com

NABORS

INDUSTRIES LTD. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF INCOME (LOSS)

(Unaudited)

| | |

| | |

| | |

| | |

| | |

| |

| | |

Three

Months Ended | | |

Nine

Months Ended | |

| | |

September

30, | | |

June

30, | | |

September

30, | |

| (In

thousands, except per share amounts) | |

2023 | | |

2022 | | |

2023 | | |

2023 | | |

2022 | |

| Revenues and other income: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Operating revenues | |

$ | 733,974 | | |

$ | 694,136 | | |

$ | 767,067 | | |

$ | 2,280,180 | | |

$ | 1,893,618 | |

| Investment income

(loss) | |

| 10,169 | | |

| 4,813 | | |

| 11,743 | | |

| 31,778 | | |

| 5,798 | |

| Total revenues

and other income | |

| 744,143 | | |

| 698,949 | | |

| 778,810 | | |

| 2,311,958 | | |

| 1,899,416 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Costs and other deductions: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Direct costs | |

| 447,751 | | |

| 432,311 | | |

| 455,531 | | |

| 1,365,611 | | |

| 1,208,820 | |

| General and administrative expenses | |

| 62,182 | | |

| 57,594 | | |

| 63,232 | | |

| 187,144 | | |

| 169,400 | |

| Research and engineering | |

| 14,016 | | |

| 13,409 | | |

| 13,281 | | |

| 42,371 | | |

| 36,028 | |

| Depreciation and amortization | |

| 161,337 | | |

| 169,857 | | |

| 159,698 | | |

| 484,066 | | |

| 496,231 | |

| Interest expense | |

| 44,042 | | |

| 43,841 | | |

| 46,164 | | |

| 135,347 | | |

| 133,650 | |

| Other, net | |

| 35,546 | | |

| (25,954 | ) | |

| (1,775 | ) | |

| (8,604 | ) | |

| 68,975 | |

| Total costs

and other deductions | |

| 764,874 | | |

| 691,058 | | |

| 736,131 | | |

| 2,205,935 | | |

| 2,113,104 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Income (loss) before income taxes | |

| (20,731 | ) | |

| 7,891 | | |

| 42,679 | | |

| 106,023 | | |

| (213,688 | ) |

| Income tax expense

(benefit) | |

| 10,513 | | |

| 12,352 | | |

| 26,448 | | |

| 59,976 | | |

| 35,376 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) | |

| (31,244 | ) | |

| (4,461 | ) | |

| 16,231 | | |

| 46,047 | | |

| (249,064 | ) |

| Less: Net (income)

loss attributable to noncontrolling interest | |

| (17,672 | ) | |

| (9,322 | ) | |

| (11,620 | ) | |

| (41,128 | ) | |

| (32,132 | ) |

| Net income (loss) attributable to

Nabors | |

$ | (48,916 | ) | |

$ | (13,783 | ) | |

$ | 4,611 | | |

$ | 4,919 | | |

$ | (281,196 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Earnings (losses) per share: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | (6.26 | ) | |

$ | (1.80 | ) | |

$ | (0.31 | ) | |

$ | (2.79 | ) | |

$ | (32.72 | ) |

| Diluted | |

$ | (6.26 | ) | |

$ | (1.80 | ) | |

$ | (0.31 | ) | |

$ | (2.79 | ) | |

$ | (32.72 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Weighted-average number of common shares outstanding: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 9,148 | | |

| 9,099 | | |

| 9,195 | | |

| 9,168 | | |

| 8,830 | |

| Diluted | |

| 9,148 | | |

| 9,099 | | |

| 9,195 | | |

| 9,168 | | |

| 8,830 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted EBITDA | |

$ | 210,025 | | |

$ | 190,822 | | |

$ | 235,023 | | |

$ | 685,054 | | |

$ | 479,370 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted operating income (loss) | |

$ | 48,688 | | |

$ | 20,965 | | |

$ | 75,325 | | |

$ | 200,988 | | |

$ | (16,861 | ) |

NABORS

INDUSTRIES LTD. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED BALANCE SHEETS

(Unaudited)

| | |

| | |

| | |

| |

| | |

September

30, | | |

June

30, | | |

December

31, | |

| (In

thousands) | |

2023 | | |

2023 | | |

2022 | |

| ASSETS | |

| | | |

| | | |

| | |

| Current assets: | |

| | | |

| | | |

| | |

| Cash and short-term investments | |

$ | 406,643 | | |

$ | 429,059 | | |

$ | 452,315 | |

| Accounts receivable, net | |

| 324,970 | | |

| 297,388 | | |

| 327,397 | |

| Other current assets | |

| 228,941 | | |

| 251,687 | | |

| 220,911 | |

| Total current assets | |

| 960,554 | | |

| 978,134 | | |

| 1,000,623 | |

| Property, plant and equipment, net | |

| 2,945,964 | | |

| 2,963,898 | | |

| 3,026,100 | |

| Other long-term assets | |

| 820,332 | | |

| 521,235 | | |

| 703,131 | |

| Total

assets | |

$ | 4,726,850 | | |

$ | 4,463,267 | | |

$ | 4,729,854 | |

| | |

| | | |

| | | |

| | |

| LIABILITIES AND EQUITY | |

| | | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | | |

| | |

| Trade accounts payable | |

$ | 287,228 | | |

$ | 301,751 | | |

$ | 314,041 | |

| Other current liabilities | |

| 241,475 | | |

| 242,514 | | |

| 282,349 | |

| Total current liabilities | |

| 528,703 | | |

| 544,265 | | |

| 596,390 | |

| Long-term debt | |

| 2,501,339 | | |

| 2,503,250 | | |

| 2,537,540 | |

| Other long-term liabilities | |

| 314,441 | | |

| 310,263 | | |

| 380,529 | |

| Total liabilities | |

| 3,344,483 | | |

| 3,357,778 | | |

| 3,514,459 | |

| | |

| | | |

| | | |

| | |

| Redeemable noncontrolling interest in subsidiary | |

| 834,195 | | |

| 513,817 | | |

| 678,604 | |

| | |

| | | |

| | | |

| | |

| Equity: | |

| | | |

| | | |

| | |

| Shareholders' equity | |

| 348,234 | | |

| 402,650 | | |

| 368,956 | |

| Noncontrolling interest | |

| 199,938 | | |

| 189,022 | | |

| 167,835 | |

| Total

equity | |

| 548,172 | | |

| 591,672 | | |

| 536,791 | |

| Total

liabilities and equity | |

$ | 4,726,850 | | |

$ | 4,463,267 | | |

$ | 4,729,854 | |

NABORS

INDUSTRIES LTD. AND SUBSIDIARIES

SEGMENT

REPORTING

(Unaudited)

The

following tables set forth certain information with respect to our reportable segments and rig activity:

| | |

Three Months Ended | | |

Nine Months Ended | |

| | |

September 30, | | |

June 30, | | |

September 30, | |

| (In thousands, except rig activity) | |

2023 | | |

2022 | | |

2023 | | |

2023 | | |

2022 | |

| Operating revenues: | |

| | | |

| | | |

| | | |

| | | |

| | |

| U.S. Drilling | |

$ | 276,385 | | |

$ | 297,178 | | |

$ | 314,830 | | |

$ | 941,867 | | |

$ | 767,769 | |

| International Drilling | |

| 344,780 | | |

| 306,355 | | |

| 337,650 | | |

| 1,002,478 | | |

| 881,705 | |

| Drilling Solutions | |

| 72,831 | | |

| 61,981 | | |

| 76,855 | | |

| 224,729 | | |

| 172,042 | |

| Rig Technologies (1) | |

| 61,437 | | |

| 50,496 | | |

| 63,565 | | |

| 183,481 | | |

| 132,326 | |

| Other reconciling items (2) | |

| (21,459 | ) | |

| (21,874 | ) | |

| (25,833 | ) | |

| (72,375 | ) | |

| (60,224 | ) |

| Total operating revenues | |

$ | 733,974 | | |

$ | 694,136 | | |

$ | 767,067 | | |

$ | 2,280,180 | | |

$ | 1,893,618 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted EBITDA: (3) | |

| | | |

| | | |

| | | |

| | | |

| | |

| U.S. Drilling | |

$ | 117,357 | | |

$ | 114,486 | | |

$ | 141,446 | | |

$ | 415,292 | | |

$ | 276,122 | |

| International Drilling | |

| 96,175 | | |

| 85,922 | | |

| 98,331 | | |

| 283,114 | | |

| 239,616 | |

| Drilling Solutions | |

| 30,419 | | |

| 25,612 | | |

| 32,756 | | |

| 95,089 | | |

| 68,363 | |

| Rig Technologies (1) | |

| 7,221 | | |

| 4,818 | | |

| 6,408 | | |

| 18,583 | | |

| 7,138 | |

| Other reconciling items (4) | |

| (41,147 | ) | |

| (40,016 | ) | |

| (43,918 | ) | |

| (127,024 | ) | |

| (111,869 | ) |

| Total adjusted EBITDA | |

$ | 210,025 | | |

$ | 190,822 | | |

$ | 235,023 | | |

$ | 685,054 | | |

$ | 479,370 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted operating income (loss): (5) | |

| | | |

| | | |

| | | |

| | | |

| | |

| U.S. Drilling | |

$ | 49,582 | | |

$ | 37,776 | | |

$ | 75,408 | | |

$ | 210,859 | | |

$ | 40,213 | |

| International Drilling | |

| 9,862 | | |

| (907 | ) | |

| 10,407 | | |

| 22,226 | | |

| (2,629 | ) |

| Drilling Solutions | |

| 25,341 | | |

| 20,099 | | |

| 28,351 | | |

| 80,830 | | |

| 53,068 | |

| Rig Technologies (1) | |

| 4,995 | | |

| 3,412 | | |

| 5,052 | | |

| 13,741 | | |

| 2,788 | |

| Other reconciling items (4) | |

| (41,092 | ) | |

| (39,415 | ) | |

| (43,893 | ) | |

| (126,668 | ) | |

| (110,301 | ) |

| Total adjusted operating income (loss) | |

$ | 48,688 | | |

$ | 20,965 | | |

$ | 75,325 | | |

$ | 200,988 | | |

$ | (16,861 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Rig activity: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Average Rigs Working: (7) | |

| | | |

| | | |

| | | |

| | | |

| | |

| Lower 48 | |

| 73.7 | | |

| 92.1 | | |

| 81.6 | | |

| 82.8 | | |

| 88.3 | |

| Other US | |

| 6.7 | | |

| 7.7 | | |

| 7.0 | | |

| 6.9 | | |

| 7.2 | |

| U.S. Drilling | |

| 80.4 | | |

| 99.8 | | |

| 88.6 | | |

| 89.7 | | |

| 95.5 | |

| International Drilling | |

| 77.2 | | |

| 74.6 | | |

| 77.1 | | |

| 76.9 | | |

| 73.6 | |

| Total average rigs working | |

| 157.6 | | |

| 174.4 | | |

| 165.7 | | |

| 166.6 | | |

| 169.1 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Daily Rig Revenue: (6),(8) | |

| | | |

| | | |

| | | |

| | | |

| | |

| Lower 48 | |

$ | 35,697 | | |

$ | 29,190 | | |

$ | 36,751 | | |

$ | 36,324 | | |

$ | 26,050 | |

| Other US | |

| 56,163 | | |

| 70,661 | | |

| 65,860 | | |

| 64,312 | | |

| 70,953 | |

| U.S. Drilling (10) | |

| 37,397 | | |

| 32,380 | | |

| 39,049 | | |

| 38,474 | | |

| 29,449 | |

| International Drilling | |

| 48,528 | | |

| 44,658 | | |

| 48,106 | | |

| 47,728 | | |

| 43,859 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Daily Adjusted Gross Margin: (6),(9) | |

| | | |

| | | |

| | | |

| | | |

| | |

| Lower 48 | |

$ | 15,855 | | |

$ | 11,165 | | |

$ | 16,890 | | |

$ | 16,505 | | |

$ | 9,225 | |

| Other US | |

| 27,631 | | |

| 38,034 | | |

| 35,932 | | |

| 33,618 | | |

| 37,215 | |

| U.S. Drilling (10) | |

| 16,833 | | |

| 13,232 | | |

| 18,394 | | |

| 17,820 | | |

| 11,371 | |

| International Drilling | |

| 15,778 | | |

| 14,589 | | |

| 16,276 | | |

| 15,762 | | |

| 14,033 | |

| (1) |

Includes our oilfield equipment

manufacturing activities. |

| |

|

| (2) |

Represents the elimination of inter-segment transactions

related to our Rig Technologies operating segment. |

| |

|

| (3) |

Adjusted EBITDA represents net income (loss) before

income tax expense (benefit), investment income (loss), interest expense, other, net and depreciation and amortization. Adjusted

EBITDA is a non-GAAP financial measure and should not be used in isolation or as a substitute for the amounts reported in accordance

with GAAP. In addition, adjusted EBITDA excludes certain cash expenses that the Company is obligated to make. However, management

evaluates the performance of its operating segments and the consolidated Company based on several criteria, including adjusted EBITDA

and adjusted operating income (loss), because it believes that these financial measures accurately reflect the Company’s ongoing

profitability and performance. Securities analysts and investors use this measure as one of the metrics on which they

analyze the Company’s performance. Other companies in this industry may compute these measures differently. A

reconciliation of this non-GAAP measure to net income (loss), which is the most closely comparable GAAP measure, is provided in the

table set forth immediately following the heading "Reconciliation of Non-GAAP Financial Measures to Net Income (Loss)". |

| |

|

| (4) |

Represents the elimination of inter-segment transactions

and unallocated corporate expenses. |

| |

|

| (5) |

Adjusted operating income (loss) represents net income

(loss) before income tax expense (benefit), investment income (loss), interest expense and other, net. Adjusted operating

income (loss) is a non-GAAP financial measure and should not be used in isolation or as a substitute for the amounts reported in

accordance with GAAP. In addition, adjusted operating income (loss) excludes certain cash expenses that the Company is obligated

to make. However, management evaluates the performance of its operating segments and the consolidated Company based on several criteria,

including adjusted EBITDA and adjusted operating income (loss), because it believes that these financial measures accurately reflect

the Company’s ongoing profitability and performance. Securities analysts and investors use this measure as one of

the metrics on which they analyze the Company’s performance. Other companies in this industry may compute these

measures differently. A reconciliation of this non-GAAP measure to net income (loss), which is the most closely comparable

GAAP measure, is provided in the table set forth immediately following the heading "Reconciliation of Non-GAAP Financial Measures

to Net Income (Loss)". |

| |

|

| (6) |

Rig revenue days represents the number of days the

Company's rigs are contracted and performing under a contract during the period. These would typically include days in

which operating, standby and move revenue is earned. |

| |

|

| (7) |

Average rigs working represents a measure of the average

number of rigs operating during a given period. For example, one rig operating 45 days during a quarter represents approximately

0.5 average rigs working for the quarter. On an annual period, one rig operating 182.5 days represents approximately 0.5

average rigs working for the year. Average rigs working can also be calculated as rig revenue days during the period divided

by the number of calendar days in the period. |

| |

|

| (8) |

Daily rig revenue represents operating revenue, divided

by the total number of revenue days during the quarter. |

| |

|

| (9) |

Daily adjusted gross margin represents operating revenue

less direct costs, divided by the total number of rig revenue days during the quarter. |

| |

|

| (10) |

The U.S. Drilling segment includes the Lower 48, Alaska,

and Gulf of Mexico operating areas. |

NABORS

INDUSTRIES LTD. AND SUBSIDIARIES

Reconciliation

of Earnings per Share

(Unaudited)

| | |

| | |

| | |

| | |

| | |

| |

| | |

Three

Months Ended | | |

Nine

Months Ended | |

| | |

September 30, | | |

June

30, | | |

September 30, | |

| (in

thousands, except per share amounts) | |

2023 | | |

2022 | | |

2023 | | |

2023 | | |

2022 | |

| BASIC EPS: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) (numerator): | |

| | | |

| | | |

| | | |

| | | |

| | |

| Income (loss), net of

tax | |

$ | (31,244 | ) | |

$ | (4,461 | ) | |

$ | 16,231 | | |

$ | 46,047 | | |

$ | (249,064 | ) |

| Less: net (income) loss attributable

to noncontrolling interest | |

| (17,672 | ) | |

| (9,322 | ) | |

| (11,620 | ) | |

| (41,128 | ) | |

| (32,132 | ) |

| Less: deemed dividends to SPAC public

shareholders | |

| (823 | ) | |

| — | | |

| — | | |

| (8,180 | ) | |

| — | |

| Less: accrued

distribution on redeemable noncontrolling interest in subsidiary | |

| (7,517 | ) | |

| (2,601 | ) | |

| (7,436 | ) | |

| (22,307 | ) | |

| (7,720 | ) |

| Numerator for basic earnings per share: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted income

(loss), net of tax - basic | |

$ | (57,256 | ) | |

$ | (16,384 | ) | |

$ | (2,825 | ) | |

$ | (25,568 | ) | |

$ | (288,916 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Weighted-average number of shares outstanding - basic | |

| 9,148 | | |

| 9,099 | | |

| 9,195 | | |

| 9,168 | | |

| 8,830 | |

| Earnings (losses) per share: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total Basic | |

$ | (6.26 | ) | |

$ | (1.80 | ) | |

$ | (0.31 | ) | |

$ | (2.79 | ) | |

$ | (32.72 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| DILUTED EPS: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted income (loss), net of tax

- diluted | |

$ | (57,256 | ) | |

$ | (16,384 | ) | |

$ | (2,825 | ) | |

$ | (25,568 | ) | |

$ | (288,916 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Weighted-average number of shares outstanding - diluted | |

| 9,148 | | |

| 9,099 | | |

| 9,195 | | |

| 9,168 | | |

| 8,830 | |

| Earnings (losses) per share: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total Diluted | |

$ | (6.26 | ) | |

$ | (1.80 | ) | |

$ | (0.31 | ) | |

$ | (2.79 | ) | |

$ | (32.72 | ) |

NABORS

INDUSTRIES LTD. AND SUBSIDIARIES

NON-GAAP

FINANCIAL MEASURES

RECONCILIATION

OF ADJUSTED EBITDA BY SEGMENT TO ADJUSTED OPERATING INCOME (LOSS) BY SEGMENT

(Unaudited)

(In

thousands)

| | |

Three

Months Ended September 30, 2023 | |

| | |

U.S.

Drilling | | |

International

Drilling | | |

Drilling

Solutions | | |

Rig

Technologies | | |

Other

reconciling

items | | |

Total | |

| Adjusted operating income

(loss) | |

$ | 49,582 | | |

$ | 9,862 | | |

$ | 25,341 | | |

$ | 4,995 | | |

$ | (41,092 | ) | |

$ | 48,688 | |

| Depreciation

and amortization | |

| 67,775 | | |

| 86,313 | | |

| 5,078 | | |

| 2,226 | | |

| (55 | ) | |

| 161,337 | |

| Adjusted EBITDA | |

$ | 117,357 | | |

$ | 96,175 | | |

$ | 30,419 | | |

$ | 7,221 | | |

$ | (41,147 | ) | |

$ | 210,025 | |

| | |

Three

Months Ended September 30, 2022 | |

| | |

U.S.

Drilling | | |

International

Drilling | | |

Drilling

Solutions | | |

Rig

Technologies | | |

Other

reconciling

items | | |

Total | |

| Adjusted operating income

(loss) | |

$ | 37,776 | | |

$ | (907 | ) | |

$ | 20,099 | | |

$ | 3,412 | | |

$ | (39,415 | ) | |

$ | 20,965 | |

| Depreciation

and amortization | |

| 76,710 | | |

| 86,829 | | |

| 5,513 | | |

| 1,406 | | |

| (601 | ) | |

| 169,857 | |

| Adjusted EBITDA | |

$ | 114,486 | | |

$ | 85,922 | | |

$ | 25,612 | | |

$ | 4,818 | | |

$ | (40,016 | ) | |

$ | 190,822 | |

| | |

Three

Months Ended June 30, 2023 | |

| | |

U.S.

Drilling | | |

International

Drilling | | |

Drilling

Solutions | | |

Rig

Technologies | | |

Other

reconciling

items | | |

Total | |

| Adjusted operating income

(loss) | |

$ | 75,408 | | |

$ | 10,407 | | |

$ | 28,351 | | |

$ | 5,052 | | |

$ | (43,893 | ) | |

$ | 75,325 | |

| Depreciation

and amortization | |

| 66,038 | | |

| 87,924 | | |

| 4,405 | | |

| 1,356 | | |

| (25 | ) | |

| 159,698 | |

| Adjusted EBITDA | |

$ | 141,446 | | |

$ | 98,331 | | |

$ | 32,756 | | |

$ | 6,408 | | |

$ | (43,918 | ) | |

$ | 235,023 | |

| | |

Nine

Months Ended September 30, 2023 | |

| | |

U.S.

Drilling | | |

International

Drilling | | |

Drilling

Solutions | | |

Rig

Technologies | | |

Other

reconciling

items | | |

Total | |

| Adjusted operating income

(loss) | |

$ | 210,859 | | |

$ | 22,226 | | |

$ | 80,830 | | |

$ | 13,741 | | |

$ | (126,668 | ) | |

$ | 200,988 | |

| Depreciation

and amortization | |

| 204,433 | | |

| 260,888 | | |

| 14,259 | | |

| 4,842 | | |

| (356 | ) | |

| 484,066 | |

| Adjusted EBITDA | |

$ | 415,292 | | |

$ | 283,114 | | |

$ | 95,089 | | |

$ | 18,583 | | |

$ | (127,024 | ) | |

$ | 685,054 | |

| | |

Nine

Months Ended September 30, 2022 | |

| | |

U.S.

Drilling | | |

International

Drilling | | |

Drilling

Solutions | | |

Rig

Technologies | | |

Other

reconciling

items | | |

Total | |

| Adjusted operating income

(loss) | |

$ | 40,213 | | |

$ | (2,629 | ) | |

$ | 53,068 | | |

$ | 2,788 | | |

$ | (110,301 | ) | |

$ | (16,861 | ) |

| Depreciation

and amortization | |

| 235,909 | | |

| 242,245 | | |

| 15,295 | | |

| 4,350 | | |

| (1,568 | ) | |

| 496,231 | |

| Adjusted EBITDA | |

$ | 276,122 | | |

$ | 239,616 | | |

$ | 68,363 | | |

$ | 7,138 | | |

$ | (111,869 | ) | |

$ | 479,370 | |

NABORS

INDUSTRIES LTD. AND SUBSIDIARIES

NON-GAAP

FINANCIAL MEASURES

RECONCILIATION

OF ADJUSTED GROSS MARGIN BY SEGMENT TO ADJUSTED OPERATING INCOME (LOSS) BY SEGMENT

(Unaudited)

| | |

| | |

| | |

| | |

| | |

| |

| | |

Three

Months Ended | | |

Nine

Months Ended | |

| | |

September 30, | | |

June

30, | | |

September 30, | |

| (in

thousands) | |

2023 | | |

2022 | | |

2023 | | |

2023 | | |

2022 | |

| Lower 48 - U.S. Drilling | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted operating income (loss) | |

$ | 40,366 | | |

$ | 25,551 | | |

$ | 60,496 | | |

$ | 174,933 | | |

$ | 10,018 | |

| Plus: General and administrative costs | |

| 5,239 | | |

| 4,798 | | |

| 5,209 | | |

| 15,503 | | |

| 13,983 | |

| Plus: Research and engineering | |

| 1,389 | | |

| 1,652 | | |

| 1,189 | | |

| 4,098 | | |

| 4,902 | |

| GAAP Gross Margin | |

| 46,994 | | |

| 32,001 | | |

| 66,894 | | |

| 194,534 | | |

| 28,903 | |

| Plus: Depreciation and amortization | |

| 60,447 | | |

| 62,583 | | |

| 58,533 | | |

| 178,487 | | |

| 194,139 | |

| Adjusted gross margin | |

$ | 107,441 | | |

$ | 94,584 | | |

$ | 125,427 | | |

$ | 373,021 | | |

$ | 223,042 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Other - U.S. Drilling | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted operating income (loss) | |

$ | 9,216 | | |

$ | 12,225 | | |

$ | 14,912 | | |

$ | 35,926 | | |

$ | 30,195 | |

| Plus: General and administrative costs | |

| 331 | | |

| 343 | | |

| 323 | | |

| 999 | | |

| 1,034 | |

| Plus: Research and engineering | |

| 90 | | |

| 157 | | |

| 132 | | |

| 349 | | |

| 428 | |

| GAAP Gross Margin | |

| 9,637 | | |

| 12,725 | | |

| 15,367 | | |

| 37,274 | | |

| 31,657 | |

| Plus: Depreciation and amortization | |

| 7,329 | | |

| 14,127 | | |

| 7,504 | | |

| 25,945 | | |

| 41,770 | |

| Adjusted gross margin | |

$ | 16,966 | | |

$ | 26,852 | | |

$ | 22,871 | | |

$ | 63,219 | | |

$ | 73,427 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| U.S. Drilling | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted operating income (loss) | |

$ | 49,582 | | |

$ | 37,776 | | |

$ | 75,408 | | |

$ | 210,859 | | |

$ | 40,213 | |

| Plus: General and administrative costs | |

| 5,570 | | |

| 5,141 | | |

| 5,532 | | |

| 16,502 | | |

| 15,017 | |

| Plus: Research and engineering | |

| 1,479 | | |

| 1,809 | | |

| 1,321 | | |

| 4,447 | | |

| 5,330 | |

| GAAP Gross Margin | |

| 56,631 | | |

| 44,726 | | |

| 82,261 | | |

| 231,808 | | |

| 60,560 | |

| Plus: Depreciation and amortization | |

| 67,776 | | |

| 76,710 | | |

| 66,037 | | |

| 204,432 | | |

| 235,909 | |

| Adjusted gross margin | |

$ | 124,407 | | |

$ | 121,436 | | |

$ | 148,298 | | |

$ | 436,240 | | |

$ | 296,469 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| International Drilling | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted operating income (loss) | |

$ | 9,862 | | |

$ | (907 | ) | |

$ | 10,407 | | |

$ | 22,226 | | |

$ | (2,629 | ) |

| Plus: General and administrative costs | |

| 14,300 | | |

| 12,599 | | |

| 14,089 | | |

| 42,725 | | |

| 38,137 | |

| Plus: Research and engineering | |

| 1,622 | | |

| 1,558 | | |

| 1,821 | | |

| 5,229 | | |

| 4,360 | |

| GAAP Gross Margin | |

| 25,784 | | |

| 13,250 | | |

| 26,317 | | |

| 70,180 | | |

| 39,868 | |

| Plus: Depreciation and amortization | |

| 86,313 | | |

| 86,830 | | |

| 87,924 | | |

| 260,887 | | |

| 242,247 | |

| Adjusted gross margin | |

$ | 112,097 | | |

$ | 100,080 | | |

$ | 114,241 | | |

$ | 331,067 | | |

$ | 282,115 | |

Adjusted gross

margin by segment represents adjusted operating income (loss) plus general and administrative costs, research and engineering costs and

depreciation and amortization.

NABORS

INDUSTRIES LTD. AND SUBSIDIARIES

RECONCILIATION

OF NON-GAAP FINANCIAL MEASURES TO NET INCOME (LOSS)

(Unaudited)

| | |

| | |

| | |

| | |

| | |

| |

| | |

Three

Months Ended | | |

Nine

Months Ended | |

| | |

September

30, | | |

June

30, | | |

September

30, | |

| (In

thousands) | |

2023 | | |

2022 | | |

2023 | | |

2023 | | |

2022 | |

| Net income (loss) | |

| (31,244 | ) | |

| (4,461 | ) | |

| 16,231 | | |

| 46,047 | | |

| (249,064 | ) |

| Income

tax expense (benefit) | |

| 10,513 | | |

| 12,352 | | |

| 26,448 | | |

| 59,976 | | |

| 35,376 | |

| Income (loss) from continuing operations

before income taxes | |

| (20,731 | ) | |

| 7,891 | | |

| 42,679 | | |

| 106,023 | | |

| (213,688 | ) |

| Investment (income)

loss | |

| (10,169 | ) | |

| (4,813 | ) | |

| (11,743 | ) | |

| (31,778 | ) | |

| (5,798 | ) |

| Interest expense | |

| 44,042 | | |

| 43,841 | | |

| 46,164 | | |

| 135,347 | | |

| 133,650 | |

| Other,

net | |

| 35,546 | | |

| (25,954 | ) | |

| (1,775 | ) | |

| (8,604 | ) | |

| 68,975 | |

| Adjusted operating

income (loss) (1) | |

| 48,688 | | |

| 20,965 | | |

| 75,325 | | |

| 200,988 | | |

| (16,861 | ) |

| Depreciation

and amortization | |

| 161,337 | | |

| 169,857 | | |

| 159,698 | | |

| 484,066 | | |

| 496,231 | |

| Adjusted EBITDA

(2) | |

$ | 210,025 | | |

$ | 190,822 | | |

$ | 235,023 | | |

$ | 685,054 | | |

$ | 479,370 | |

| (1) Adjusted operating income (loss) represents net income (loss) before

income tax expense (benefit), investment income (loss), interest expense, and other, net. Adjusted operating income (loss) is a non-GAAP

financial measure and should not be used in isolation or as a substitute for the amounts reported in accordance with GAAP. In addition,

adjusted operating income (loss) excludes certain cash expenses that the Company is obligated to make. However, management evaluates

the performance of its operating segments and the consolidated Company based on several criteria, including adjusted EBITDA and adjusted

operating income (loss), because it believes that these financial measures accurately reflect the Company’s ongoing profitability

and performance. Securities analysts and investors use this measure as one of the metrics on which they analyze the Company’s

performance. Other companies in this industry may compute these measures differently. |

| |

| (2) Adjusted EBITDA represents net income (loss)

before income tax expense (benefit), investment income (loss), interest expense, other, net and depreciation and amortization. Adjusted

EBITDA is a non-GAAP financial measure and should not be used in isolation or as a substitute for the amounts reported in accordance

with GAAP. In addition, adjusted EBITDA excludes certain cash expenses that the Company is obligated to make. However, management

evaluates the performance of its operating segments and the consolidated Company based on several criteria, including adjusted EBITDA

and adjusted operating income (loss), because it believes that these financial measures accurately reflect the Company’s ongoing

profitability and performance. Securities analysts and investors use this measure as one of the metrics on which they

analyze the Company’s performance. Other companies in this industry may compute these measures differently. |

NABORS

INDUSTRIES LTD. AND SUBSIDIARIES

RECONCILIATION

OF NET DEBT TO TOTAL DEBT

(Unaudited)

| | |

| | |

| | |

| |

| | |

September

30, | | |

June

30, | | |

December

31, | |

| (In

thousands) | |

2023 | | |

2023 | | |

2022 | |

| Long-term debt | |

$ | 2,501,339 | | |

$ | 2,503,250 | | |

$ | 2,537,540 | |

| Less: Cash and short-term investments | |

| 406,643 | | |

| 429,059 | | |

| 452,315 | |

| Net

Debt | |

$ | 2,094,696 | | |

$ | 2,074,191 | | |

$ | 2,085,225 | |

NABORS

INDUSTRIES LTD. AND SUBSIDIARIES

RECONCILIATION

OF ADJUSTED FREE CASH FLOW TO

NET

CASH PROVIDED BY OPERATING ACTIVITIES

(Unaudited)

| | |

| | |

| | |

| |

| | |

Three

Months Ended | | |

Nine

Months Ended | |

| | |

September

30, | | |

June

30, | | |

September

30, | |

| (In

thousands) | |

2023 | | |

2023 | | |

2023 | |

| Net cash provided by

operating activities | |

$ | 133,425 | | |

$ | 168,466 | | |

$ | 455,941 | |

| Add: Capital expenditures, net of

proceeds from sales of assets | |

| (138,583 | ) | |

| (141,683 | ) | |

| (397,018 | ) |

| Adjusted

free cash flow | |

$ | (5,158 | ) | |

$ | 26,783 | | |

$ | 58,923 | |

Adjusted

free cash flow represents net cash provided by operating activities less cash used for capital expenditures, net of proceeds from sales

of assets. Management believes that adjusted free cash flow is an important liquidity measure for the company and that it

is useful to investors and management as a measure of the company’s ability to generate cash flow, after reinvesting in the company

for future growth, that could be available for paying down debt or other financing cash flows, such as dividends to shareholders. Adjusted

free cash flow does not represent the residual cash flow available for discretionary expenditures. Adjusted free cash flow

is a non-GAAP financial measure that should be considered in addition to, not as a substitute for or superior to, cash flow from operations

reported in accordance with GAAP.

Exhibit 99.2

| NABORS INDUSTRIES LTD. October 26, 2023

3Q 2023 Earnings

Presentation |

| N A B O R S . C O M

We often discuss expectations regarding our future markets, demand for our products and

services, and our performance in our annual, quarterly, and current reports, press releases, and

other written and oral statements. Such statements, including statements in this document that

relate to matters that are not historical facts, are “forward-looking statements” within the meaning

of the safe harbor provisions of Section 27A of the U.S. Securities Act of 1933 and Section 21E

of the U.S. Securities Exchange Act of 1934. These “forward-looking statements” are based on

our analysis of currently available competitive, financial and economic data and our operating

plans. They are inherently uncertain, and investors should recognize that events and actual

results could turn out to be significantly different from our expectations.

Factors to consider when evaluating these forward-looking statements include, but are not

limited to: • geopolitical events, pandemics (including COVID-19) and other macro-events and their

respective and collective impact on our operations as well as oil and gas markets and

prices; • fluctuations and volatility in worldwide prices of and demand for oil and natural gas; • fluctuations in levels of oil and natural gas exploration and development activities; • fluctuations in the demand for our services; • competitive and technological changes and other developments in the oil and gas and

oilfield services industries; • our ability to renew customer contracts in order to maintain competitiveness; • the existence of operating risks inherent in the oil and gas and oilfield services industries; • the possibility of the loss of one or a number of our large customers; • the impact of long-term indebtedness and other financial commitments on our financial

and operating flexibility; • our access to and the cost of capital, including the impact of a further downgrade in our

credit rating, covenant restrictions, availability under our revolving credit facility, and future

issuances of debt or equity securities and the global interest rate environment; • our dependence on our operating subsidiaries and investments to meet our

financial obligations;

2

Forward Looking Statements

• our ability to retain skilled employees; • our ability to complete, and realize the expected benefits of, strategic transactions; • changes in tax laws and the possibility of changes in other laws and regulation; • the possibility of changes to U.S. trade policies and regulations including the imposition

of trade embargoes or sanctions; and • global views on and the regulatory environment related to energy transition and our

ability to implement our energy transition initiatives; • the possibility of changes to U.S. trade policies and regulations including the imposition

of trade embargoes, sanctions or tariffs; and • general economic conditions, including the capital and credit markets.

Our businesses depend, to a large degree, on the level of spending by oil and gas companies for

exploration, development and production activities. Therefore, sustained lower oil or natural gas

prices that have a material impact on exploration, development or production activities could also

materially affect our financial position, results of operations and cash flows.

The above description of risks and uncertainties is by no means all-inclusive but is designed to

highlight what we believe are important factors to consider. For a discussion of these factors and

other risks and uncertainties, please refer to our filings with the Securities and Exchange

Commission ("SEC"), including those contained in our Annual Reports on Form 10-K and

Quarterly Reports on Form 10-Q, which are available at the SEC's website at www.sec.gov. We

undertake no obligation to publicly update or revise any forward-looking statement as a result of

new information, future events or otherwise, except as otherwise required by law.

Non-GAAP Financial Measures

This presentation refers to certain “non-GAAP” financial measures, such as adjusted EBITDA,

net debt, adjusted gross margin and adjusted free cash flow. The components of these non-GAAP measures are computed by using amounts that are determined in accordance with

accounting principles generally accepted in the United States of America (“GAAP”).

Reconciliations of non-GAAP measures to the most comparable GAAP measures are provided

in the Appendix at the end of this presentation. |

| N A B O R S . C O M 3

September 30 Rig Utilization and Availability

RIG FLEET(1)(2) 326

RIGS ON

REVENUE(1) 155

UTILIZATION AT

9/30/2023 49%

TOTAL U.S. OFFSHORE

12

3

25%

16

4

25%

ALASKA INTERNATIONAL

133

77

58%

111

71

64%

U.S. LOWER-48

HIGH SPEC(2)

(1) As of September 30, 2023

(2) Excludes non-high spec rigs in the Lower 48 |

| N A B O R S . C O M

Focus on leverage

Expecting $225-$250M

FCF in 2023

Net debt reduction of

$66M, or 3%, from 3Q a

year ago

RCF undrawn on Sept 30th

3Q 2023 adjusted

EBITDA of $210M

Adjusted EBITDA up 10%

year-on-year

Drilling Solutions

progress

3Q adjusted EBITDA of

$30M

Adjusted gross margin(1) of

51% in 3Q

Grew 3Q U.S. third party

and international revenue

each by 8% vs 2Q

Adjusted EBITDA up 19%

year-on-year

12 International awards

Saudi Arabia update:

• 4th newbuild was

deployed in mid-3Q

• 4 rigs anticipated to

start in 2024

• Awarded third tranche

of 5 newbuild rigs

Awarded 2 rigs in Colombia

in 3Q

Awarded 4 rigs in Algeria

Opportunities for additional

rigs in Latin America and

Middle East

ESG momentum

Growing revenue and

EBITDA from our Energy

Transition portfolio

SMARTPower™ 5

commercial installs

On target to meet

emissions reduction goal

for 2023

Recent

Highlights

Note: For reconciliations of adjusted EBITDA,

adjusted gross margin, net debt and adjusted free

cash flow to the most comparable GAAP measure,

see non-GAAP measures in the Appendix

Stabilization in L48 rig

count and leading edge

pricing

Daily adjusted gross margin

higher than that of any

quarter prior to 2023

(1) Adjusted gross margin percent represents

adjusted gross margin divided by total revenue |

| N A B O R S . C O M

Performance

excellence in

the Lower-48

Expanding &

enhancing our

International

segment

Advancing

technology &

innovation with

demonstrated

results

Progress on our

commitment to

de-lever

Leading in

Sustainability

and the Energy

Transition

Five Keys to Excellence

1 2 3 4 5 |

| N A B O R S . C O M $0

$2,000

$4,000

$6,000

$8,000

$10,000

$12,000

$14,000

$16,000

$18,000

1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q

2021 2022 2023

L48 Drilling Adjusted

Daily Gross Margin(1)

$0

$5,000

$10,000

$15,000

$20,000

$25,000

$30,000

$35,000

$40,000

1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q

2021 2022 2023

L48 Drilling

Daily Rig Revenue(1)

6

Powerful

daily revenue

and margins

1 Performance Excellence In The Lower-48

Daily Revenue and Margin Holding above

Prior Cycle Highs

(1) Daily rig revenue and adjusted daily gross margin for drilling rigs only, does not include Nabors Drilling Solutions |

| N A B O R S . C O M $0

$2,000

$4,000

$6,000

$8,000

$10,000

$12,000

$14,000

$16,000

$18,000

1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q

2021 2022 2023

L48 Drilling Adjusted

Daily Gross Margin(1)

0

10

20

30

40

50

60

70

80

90

100

1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q

2021 2022 2023

L48 Drilling Average

Rig Count

7

Disciplined

pricing maintains

attractive daily margins

1 Performance Excellence In The Lower-48

Margins Remain Robust as Rig Count Challenged

by Commodity Prices

(1) Adjusted daily gross margin for drilling rigs only, does not include Nabors Drilling Solutions |

| N A B O R S . C O M

Performance

excellence in

the Lower-48

Expanding &

enhancing our

International

segment

Advancing

technology &

innovation with

demonstrated

results

Progress on our

commitment to

de-lever

Leading in

Sustainability

and the Energy

Transition

1 2 3 4 5

Five Keys to Excellence |

| N A B O R S . C O M $0

$2,000

$4,000

$6,000

$8,000

$10,000

$12,000

$14,000

$16,000

$18,000

1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q

2021 2022 2023

International Drilling

Adjusted Daily Gross Margin(1)

$0

$5,000

$10,000

$15,000

$20,000

$25,000

$30,000

$35,000

$40,000

$45,000

$50,000

1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q

2021 2022 2023

International Drilling

Daily Rig Revenue(1)

Working to

enhance both the top

and bottom line

9

International Focus Growing Dayrates and Margin

2 Resilience Leading to Growth in Our International Segment

(1) Daily rig revenue and adjusted daily gross margin for drilling rigs only, does not include Nabors Drilling Solutions |

| N A B O R S . C O M

50

55

60

65

70

75

80

1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q

2021 2022 2023

International Drilling

Average Rig Count

$0

$2,000

$4,000

$6,000

$8,000

$10,000

$12,000

$14,000

$16,000

$18,000

1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q

2021 2022 2023

International Drilling

Adjusted Daily Gross Margin(1)

Increases in rig

activity while generating

solid margins

10

Growing International Rig Count with

Attractive Margins

2 Resilience Leading to Growth in Our International Segment

(1) Adjusted daily gross margin for drilling rigs only, does not include Nabors Drilling Solutions |

| N A B O R S . C O M 40

45

50

55

1Q 2Q 3Q 4Q 1QA 2QA 3QA 4QF 1Q 2Q 3Q 4Q

2022 A 2023 2024 F

SANAD Estimated Average Rig Count Potential*

11

Significant Growth Trajectory in Saudi Arabia

Resilience Leading to Growth in Our International Segment

• Awarded 15 total rigs to-date

• 50 rigs to be deployed over 10 years

• First startup in 3Q’22, second in 4Q’22, third in

2Q’23, fourth in 3Q’23 and four more expected

in 2024

• Capital expense funded organically by SANAD

• 6-year initial contracts, payout within 5 years,

plus 4-year renewal at market rate

Newbuild Program Generating Revenue

• These estimates are based on current market conditions and expectations are

based on information received from third parties, which are subject to change.

The estimates do not represent guidance or projections.

2 |

| N A B O R S . C O M

Performance

excellence in

the Lower-48

Expanding &

enhancing our

International

segment

Advancing

technology &

innovation

with

demonstrated

results

Progress on our

commitment to

de-lever

Leading in

Sustainability

and the Energy

Transition

1 2 3 4 5

Five Keys to Excellence |

| N A B O R S . C O M 30%

35%

40%

45%

50%

55%

60%

65%

$-

$10

$20

$30

$40

$50

$60

$70

$80

$90

1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q

2021 2022 2023

NDS Revenue & Adjusted Gross Margin

Revenue Adjusted gross margin Adjusted GM %

13

NDS Capitalizing on Higher Penetration

Improving Outlook For Our Technology & Innovation

Revenue(1)

Up 104%

Adjusted GM(1)

Up 124%

Expanding our high-value / high-margin

low-capital technology services

3

Adjusted gross margin of 51% in 3Q 2023

(1) Compared to 1Q 2021

“The results [of the collaboration] are delivering faster ROP,

lower vibration and reducing thousands of distractions per

well for drillers.”

Curtis Cheatham, VP of Research and Development at Corva on

Predictive Drilling collaboration |

| N A B O R S . C O M 14

3 Improving Outlook For Our Technology & Innovation

Successful Predictive-Drilling Closed Loop Test

in Delaware Basin

• ROP (Rate of Penetration) and WOB (Weight on Bit) maintained in an

optimal band while also reducing variance between crews

• Vibration filters actively adjust to reduce bit and tool wear, with an

observed 9.7% reduction in average vibration

• On-bottom ROP in the lateral improved 36% with Predictive Drilling turned on versus

off, within wells and against offsets

• Enables real-time remote control of the rig Auto Driller through seamless cloud-to-cloud connection, with no additional rig devices |

| N A B O R S . C O M 0

500

1000

1500

2000

2500

3000

3500

4000

Q2'18 Q4'18 Q2'19 Q4'19 Q2'20 Q4'20 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2 '23 Q3 '23 Cumulative Number of Wells Drilled

15

Smart Suite Growth Maintains Upward Trajectory

Improving Outlook For Our Technology & Innovation

3,500+ Wells Drilled

65+ Million Feet Drilled

SmartDRILL®

Automation

Commercialization

SmartNAV® &

SmartSLIDE®

Solutions

Commercialization

Third-Party

SmartDRILL®

Deployment

3

Third-Party

SmartSLIDE®

Deployment |

| N A B O R S . C O M

Performance

excellence in

the Lower-48

Expanding &

enhancing our

International

segment

Advancing

technology &

innovation with

demonstrated

results

Progress on

our

commitment

to de-lever

Leading in

Sustainability

and the Energy

Transition

1 2 3 4 5

Five Keys to Excellence |

| N A B O R S . C O M

$-

$0.5

$1.0

$1.5

$2.0

$2.5

$3.0

$3.5

$4.0

1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q

2018 2019 2020 2021 2022 2023 Billions

Net Debt

17

Significant Headway toward Financial Goals

4 Progress on Our Commitment to De-lever

~ $1.8B Net Debt(1) reduction from previous high in 1Q 2018

$1.8B

(1) Net Debt is a non-GAAP metric; see reconciliations in the Appendix |

| N A B O R S . C O M

Performance

excellence in

the Lower-48

Expanding &

enhancing our

International

segment

Advancing

technology &

innovation with

demonstrated

results

Progress on

our

commitment

to de-lever

Leading in

Sustainability

and the Energy

Transition

1 2 3 4 5

Five Keys to Excellence |

| N A B O R S . C O M

5 Leading in Sustainability and the Energy Transition

Energy Innovation vs.

Energy Exclusion

Remove tradeoffs between

energy sources

19

A Shared Path Forward

Capitalize on

Strengths and

Adjacencies

Can we add value to other

industries?

Collaboration is Key

to Success

Leverage collective strengths to

accelerate progress |

| N A B O R S . C O M

5 Leading in Sustainability and the Energy Transition

20

Nabors Initiatives to Lower Emissions

Pursuing

Multiple

Decarbonization

Pathways

Cleaner Fuels

Energy Storage

Engine Optimization

Emissions Monitoring

Alternative Energy |

| 5 Leading in Sustainability and the Energy Transition

Emissions

Monitoring

Energy

Storage

Alternative

Energy

Our Venture

Portfolio

Future energy system needs

clean, dispatchable and

scalable energy solutions N A B O R S . C O M 21 |

| N A B O R S . C O M 22

Ubiquitous

Ability to

create heat

reservoirs by

drilling into

deep rock

formations

Innovative Drilling Technologies

Reducing cost per energy-unit produced by using and

combining new technologies

Baseload

Reliable and

available 24/7

Renewable

Subsurface

heat

replenished

naturally

Nabors and its predecessor entities have

been continuously innovating in the

energy sector for over 100 years

Geothermal

Market

Technology

Advancements

Technological advancements are

enabling wide-scale commercial

geothermal development

Leading in Sustainability and the Energy

Transition

5 |

| N A B O R S . C O M Appendix

23 |

| N A B O R S . C O M

September 30, June 30, September 30,

2022 2023 2023

Net income (loss) ($4,461) $16,231 ($31,244)

Income tax expense (benefit) 12,352 26,448 10,513

Income (loss) from continuing operations before income taxes $7,891 $42,679 ($20,731)

Investment (income) loss (4,813) (11,743) (10,169)

Interest Expense 43,841 46,164 44,042

Other, net (25,954) (1,775) 35,546

Adjusted Operating Income (loss) 20,965 75,325 48,688

Depreciation and Amortization 169,857 159,698 161,337

Adjusted EBITDA $190,822 $235,023 $210,025

(In Thousands)

Three Months Ended

24

Reconciliation of Non-GAAP Financial Measures to Net

Income (Loss)

Adjusted EBITDA represents net income (loss) before income (loss) from discontinued operations, net of tax, income taxes, investment income (loss), interest

expense, other, net and depreciation and amortization. Adjusted EBITDA is a non-GAAP financial measure and should not be used in isolation or as a substitute for

the amounts reported in accordance with GAAP. In addition, adjusted EBITDA excludes certain cash expenses that the Company is obligated to make. However,

management evaluates the performance of its operating segments and the consolidated Company based on several criteria, including adjusted EBITDA and

adjusted operating income (loss), because it believes that these financial measures accurately reflect the Company’s ongoing profitability and performance.

Securities analysts and investors use this measure as one of the metrics on which they analyze the Company’s performance. Other companies in this industry may

compute these measures differently. A reconciliation of this non-GAAP measure to net income (loss), which is the most closely comparable GAAP measure, is

provided in the table below. |

| N A B O R S . C O M

September 30, June 30, September 30,

2022 2023 2023

Lower 48 - U.S. - Drilling

Adjusted operating income 25,551 $ 60,496 $ 40,366 $

Plus: General and administrative costs 4,798 5,209 5,239 Plus: Research and engineering 1,652 1,189 1,389 GAAP Gross Margin 32,001 66,894 46,994 Plus: Depreciation and amortization 62,583 58,533 60,447 Adjusted gross margin 94,584 $ 125,427 $ 107,441 $

Other - U.S. - Drilling

Adjusted operating income 12,225 $ 14,912 $ 9,216 $

Plus: General and administrative costs 343 323 331 Plus: Research and engineering 157 132 90 GAAP Gross Margin 12,725 15,367 9,637 Plus: Depreciation and amortization 14,127 7,504 7,329

Adjusted gross margin 26,852 $ 22,871 $ 16,966 $

U.S. - Drilling

Adjusted operating income 37,776 $ 75,408 $ 49,582 $

Plus: General and administrative costs 5,141 5,532 5,570 Plus: Research and engineering 1,809 1,321 1,479 GAAP Gross Margin 44,726 82,261 56,631 Plus: Depreciation and amortization 76,710 66,037 67,776 Adjusted gross margin 121,436 $ 148,298 $ 124,407 $

(In Thousands)

Three Months Ended

25

Reconciliation of U.S. Drilling Segment Adjusted Gross Margin

to U.S. Drilling Segment Adjusted Operating Income

Adjusted gross margin by segment represents adjusted operating income (loss) plus general and administrative costs, research and engineering costs and

depreciation and amortization. |

| N A B O R S . C O M

September 30, June 30, September 30,

2022 2023 2023

Long-Term Debt $2,585,517 $2,503,250 $2,501,339

Cash & Short-term Investments $425,070 $429,059 $406,643

Net Debt $2,160,447 $2,074,191 $2,094,696

(In Thousands)

26

Reconciliation of Net Debt to Total Debt

Net debt is computed by subtracting the sum of cash, cash equivalents and short-term investments from total debt. This non-GAAP measure has limitations and

therefore should not be used in isolation or as a substitute for the amounts reported in accordance with GAAP. However, management evaluates the performance

of its operating segments and the consolidated Company based on several criteria, including net debt, because it believes that this financial measure accurately

measures the Company’s liquidity. In addition, securities analysts and investors use this measure as one of the metrics on which they analyze the company’s

performance. Other companies in this industry may compute this measure differently. A reconciliation of net debt to total debt, which is the nearest comparable

GAAP financial measure, is provided in the table below. |

| N A B O R S . C O M

(In Thousands) Three Months Ended September 30, 2023

U.S.

Drilling

International

Drilling

Drilling

Solutions

Rig

Technologies

Other

reconciling

items

Total

Adjusted operating income (loss) 49,582 $ 9,862 $ 25,341 $ 4,995 $ (41,092) $ 48,688 $

Depreciation and amortization 67,775 86,313 5,078 2,226 (55) 161,337 Adjusted EBITDA 117,357 $ 96,175 $ 30,419 $ 7,221 $ (41,147) $ 210,025 $

(In Thousands) Three Months Ended June 30, 2023

U.S.

Drilling

International

Drilling

Drilling

Solutions

Rig

Technologies

Other

reconciling

items

Total

Adjusted operating income (loss) 75,408 $ 10,407 $ 28,351 $ 5,052 $ (43,893) $ 75,325 $

Depreciation and amortization 66,038 87,924 4,405 1,356 (25) 159,698 Adjusted EBITDA 141,446 $ 98,331 $ 32,756 $ 6,408 $ (43,918) $ 235,023 $

Three Months Ended September 30, 2022

U.S.

Drilling

International

Drilling

Drilling

Solutions

Rig

Technologies

Other

reconciling

items

Total

Adjusted operating income (loss) 37,776 $ (907) $ 20,099 $ 3,412 $ (39,415) $ 20,965 $