UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2024

Commission File Number: 001-38748

MOGU Inc.

Mingqi Center, 8/F

Building No. 1

No. 666 Zhenhua Road

Xihu District, Hangzhou, 310012

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

MOGU Inc. |

|

|

By: |

/s/ Qi Chen |

Name: |

Qi Chen |

Title: |

Chairman |

Date: November 22, 2024

Exhibit 99.1

MOGU Announces Unaudited Financial Results for the Six Months Ended September 30, 2024

HANGZHOU, China, November 22, 2024 /BUSINESS WIRE/ -- MOGU Inc. (NYSE: MOGU) (“MOGU” or the “Company”), a KOL-driven online fashion and lifestyle destination in China, today announced its unaudited financial results for the six months ended September 30, 2024.

Mr. Fan Yiming, Chief Executive Officer of MOGU, commented, "In the first half of fiscal year 2025, China’s online retail industry entered a phase of intense competition for existing markets, marked by a further decline in consumer purchasing appetite. All major platforms responded by implementing highly competitive product pricing and user benefits to attract customers, resulting in a sharper-than-expected decline in MOGU’s user traffic during this period. Meanwhile, the platform faced challenges with the lifecycle of key opinion leaders (KOLs), which led to a decline in live streaming hours and sales. Consequently, MOGU’s gross merchandise value (GMV1) declined year-on-year in the first half of fiscal year 2025.

To address these challenges, we have been launching targeted marketing initiatives focusing on high-value members during this fiscal year, with an aim to increase both retention rates and average revenue per user (ARPU) for these members. Meanwhile, we leveraged the supply chain resources and service capabilities that we have developed over the years to actively explore new business opportunities on other platforms. To date, MOGU has successfully signed dozens of fashion KOLs from other social e-commerce platforms. After four months of operation, MOGU has quickly become a live streaming service provider on these platforms. Additionally, we formed live-streaming management partnerships with some brands, helping them to establish a stable business model. We believe these two new segments present growth potential and will contribute to MOGU’s overall expansion beyond its core platform."

“During the first half of fiscal year of 2025, our total revenues decreased by 25.7% to RMB61.9 million for the same period of fiscal year 2024. The loss from operations was RMB41.4 million, compared to RMB52.1 million for the same period of fiscal year 2024. Despite the efforts to improve operational efficiency, the increasing cost of acquiring new customers and a decline in revenue prevented us from achieving our targeted operational results. Looking ahead, we will continue to focus on cost reduction and efficiency enhancements and continue looking for new revenue growth opportunities. We believe that these measures will contribute to our overall financial resilience and sustainable growth. ” added Ms. Qi Feng, Financial Controller.

Highlights for the Six Months Ended September 30, 2024

•Total revenues for the six months ended September 30, 2024 decreased by 25.7% to RMB61.9 million (US$8.8 million) from RMB83.3 million during the same period of fiscal year 2024.

•Live video broadcast (“LVB”) associated GMV for the six months ended September 30, 2024 decreased by 34.7% period-over-period to RMB1,395 million (US$198.8 million2).

•GMV for the six months ended September 30, 2024 was RMB1,442 million (US$205.5 million), a decrease of 34.3% period-over-period.

1 GMV are to gross merchandise volume, refers to the total value of orders placed on the MOGU platform regardless of whether the products are sold, delivered or returned, calculated based on the listed prices of the ordered products without taking into consideration any discounts on the listed prices. Buyers on the MOGU platform are not charged for separate shipping fees over the listed price of a product. If merchants include certain shipping fees in the listed price of a product, such shipping fees will be included in GMV. As a prudent matter aiming at eliminating any influence on MOGU’s GMV of irregular transactions, the Company excludes from its calculation of GMV transactions over a certain amount (RMB100,000) and transactions by users over a certain amount (RMB1,000,000) per day.

2 The U.S. dollar (US$) amounts disclosed in this press release, except for those transaction amounts that were actually settled in U.S. dollars, are presented solely for the convenience of the readers. The conversion of Renminbi (RMB) into US$ in this press release is based on the exchange rate set forth in the H.10 statistical release of the Board of Governors of the Federal Reserve System as of September 30, 2024, which was RMB7.0176 to US$1.00. The percentages stated in this press release are calculated based on the RMB amounts.

Financial Results For the Six Months Ended September 30, 2024

Total revenues for the six months ended September 30, 2024 decreased by 25.7% to RMB61.9 million (US$8.8 million) from RMB83.3 million during the same period of fiscal year 2024.

•Commission revenues for the six months ended September 30, 2024 decreased by 36.6% to RMB35.3 million (US$5.0 million) from RMB55.6 million in the same period of fiscal year 2024, primarily attributable to the lower GMV due to the heightened competitive environment.

•Financing solutions revenues for the six months ended September 30, 2024 decreased by 29.2% to RMB3.8 million (US$0.55 million) from RMB5.4 million in the same period of fiscal year 2024. The decrease was primarily due to the decrease in the service fee of loans to users in line with the lower GMV.

•Technology services revenues for the six months ended September 30,2024 increased by 12.8% to RMB20.7 million (US$3.0 million) from RMB18.4 million in the same period of fiscal year 2024, primarily attributable to the increase of revenue generated by one-stop customized services provided by Ruisha to corporate customers.

•Other revenues for the six months ended September 30, 2024 decreased by 37.9% to RMB2.0 million (US$0.3 million) from RMB3.1 million in the same period of fiscal year 2024.

Cost of revenues for the six months ended September 30, 2024 decreased by 20.2% to RMB39.6 million (US$5.6 million) from RMB49.6 million in the same period of fiscal year 2024, which was primarily due to a decrease in IT-related expenses of RMB5.1 million and a decrease in payroll costs of RMB1.6 million, in line with the overall trend of reduction in revenue.

Sales and marketing expenses for the six months ended September 30, 2024 decreased by 29.3% to RMB26.4 million (US$3.8 million) from RMB37.3 million in the same period of fiscal year 2024, primarily due to a decrease in performance-related bonus of RMB4.5 million and user acquisition costs of RMB4.6 million.

Research and development expenses for the six months ended September 30, 2024 decreased by 11.1% to RMB12.3 million (US$1.8 million) from RMB13.9 million in the same period of fiscal year 2024 due to a decrease in performance-related bonus.

General and administrative expenses for the six months ended September 30, 2024 decreased by 2.8% to RMB27.1 million (US$3.9 million) from RMB27.9 million in the same period of fiscal year 2024, primarily due to a decrease in performance-related bonus.

Amortization of intangible assets for the six months ended September 30, 2024 decreased by 95.9% to RMB0.1 million (US$0.01 million) from RMB1.8 million in the same period of the fiscal year 2024, primarily because the intangible assets recorded as a result of the acquisition of Hangzhou Ruisha Technology Co., Ltd. (“Ruisha Technology”) had been fully amortized and impaired as of September 30, 2023.

Impairment of intangible assets for the six months ended September 30, 2024 decreased by 100.0% to nil from RMB9.9 million in the same period of fiscal year 2024, primarily due to the Company’s recognition of a full impairment charge of RMB9.9 million against its intangible assets arising from the acquisition of Ruisha Technology in the same period of fiscal year 2024.

Loss from operations for the six months ended September 30, 2024 was RMB41.4 million (US$5.9 million), compared to the loss from operations of RMB52.1 million in the same period of fiscal year 2024.

Net loss attributable to MOGU Inc. for the six months ended September 30, 2024 was RMB24.1 million (US$3.4 million), compared to the net loss attributable to MOGU Inc. of RMB35.4 million in the same period of fiscal year 2024.

Adjusted EBITDA3 for the six months ended September 30, 2024 was negative RMB35.0 million (US$5.0 million), compared to negative RMB34.0 million in the same period of fiscal year 2024.

Adjusted net loss4 for the six months ended September 30, 2024 was RMB38.3 million (US$5.5 million), compared to the adjusted net loss of RMB32.8 million in the same period of fiscal year 2024.

Basic and diluted loss per ADS for the six months ended September 30, 2024 were RMB2.76 (US$0.39) and RMB2.76 (US$0.39), respectively, compared with RMB4.11 and RMB4.11, respectively, in the same period of fiscal year 2024. One ADS represents 300 Class A ordinary shares.

Cash and cash equivalents, Restricted cash and Short-term investments were RMB356.4 million (US$50.8 million) as of September 30, 2024, compared with RMB420.6 million as of March 31, 2024.

3 Adjusted EBITDA represents net loss before (i) interest income, gain from investments, net, income tax (benefits)/expenses and share of results of equity method investees, impairment of intangible assets and (ii) certain non-cash expenses, consisting of share-based compensation expenses, amortization of intangible assets, and depreciation of property and equipment. See “Unaudited Reconciliations of GAAP and Non-GAAP Results” at the end of this press release.

4 Adjusted net loss represents net loss excluding (i) gain from investments, net, (ii) share-based compensation expenses, (iii) impairment of intangible assets, (iv) adjustments for tax effects. See “Unaudited Reconciliations of GAAP and Non-GAAP Results” at the end of this press release.

Use of Non-GAAP Financial Measures

In evaluating the business, the Company considers and uses non-GAAP measures, such as Adjusted EBITDA and Adjusted net income/loss as supplemental measures to review and assess operating performance. The presentation of these non-GAAP financial measures is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The Company defines Adjusted EBITDA as net loss before interest income, gain from investments, net, income tax (benefits)/expenses, share of results of equity investees, impairment of intangible assets, share-based compensation expenses, amortization of intangible assets, and depreciation of property and equipment. The Company defines Adjusted net loss as net loss excluding gain from investments, net, impairment of intangible assets, share-based compensation expenses, and adjustments for tax effects. See “Unaudited Reconciliations of GAAP and Non-GAAP Results” at the end of this press release.

The Company presents these non-GAAP financial measures because they are used by management to evaluate operating performance and formulate business plans. The Company believes that the non-GAAP financial measures help identify underlying trends in its business by excluding certain expenses, gain/loss and other items that are not expected to result in future cash payments or that are nonrecurring in nature or may not be indicative of the Company’s core operating results and business outlook. The Company also believes that the non-GAAP financial measures could provide further information about the Company’s results of operations, enhance the overall understanding of the Company’s past performance and future prospects.

The non-GAAP financial measures are not defined under U.S. GAAP and are not presented in accordance with U.S. GAAP. The non-GAAP financial measures have limitations as analytical tools. The Company’s non-GAAP financial measures do not reflect all items of income and expense that affect the Company’s operations and do not represent the residual cash flow available for discretionary expenditures. Further, these non-GAAP measures may differ from the non-GAAP information used by other companies, including peer companies, and therefore their comparability may be limited. The Company compensates for these limitations by reconciling the non-GAAP financial measures to the nearest U.S. GAAP performance measure, all of which should be considered when evaluating performance. The Company encourages you to review the Company’s financial information in its entirety and not rely on a single financial measure.

For more information on the non-GAAP financial measures, please see the table captioned “Unaudited Reconciliations of GAAP and Non-GAAP Results” set forth at the end of this press release.

Safe Harbor Statement

This announcement contains forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,” “aims,” “future,” “intends,” “plans,” “believes,” “estimates,” “confident,” “potential,” “continue” or other similar expressions. Among other things, the business outlook and quotations from management in this announcement, as well as MOGU’s strategic and operational plans, contain forward-looking statements. MOGU may also make written or oral forward-looking statements in its periodic reports to the U.S. Securities and Exchange Commission (the “SEC”), in its annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including but not limited to statements about MOGU’s beliefs and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to the following: MOGU’s growth strategies; its ability to understand buyer needs and provide products and services to attract and retain buyers; its ability to maintain and enhance the recognition and reputation of its brand; its ability to rely on merchants and third-party logistics service providers to provide delivery services to buyers; its ability to maintain and improve quality control policies and measures; its ability to establish and maintain relationships with merchants; trends and competition in China’s ecommerce market; changes in its revenues and certain cost or expense items; the expected growth of China’s ecommerce market; PRC governmental policies and regulations relating to MOGU’s industry, and general economic and business conditions globally and in China and assumptions underlying or related to any of the foregoing. Further information regarding these and other risks is included in MOGU’s filings with

the SEC. All information provided in this press release and in the attachments is as of the date of this press release, and MOGU undertakes no obligation to update any forward-looking statement, except as required under applicable law.

About MOGU Inc.

MOGU Inc. (NYSE: MOGU) is a KOL-driven online fashion and lifestyle destination in China. MOGU provides people with a more accessible and enjoyable shopping experience for everyday fashion, particularly as they increasingly live their lives online. By connecting merchants, KOLs and users together, MOGU’s platform serves as a valuable marketing channel for merchants, a powerful incubator for KOLs, and a vibrant and dynamic community for people to discover and share the latest fashion trends with others, where users can enjoy a truly comprehensive online shopping experience.

For investor and media inquiries, please contact:

MOGU Inc.

Ms. Qi Feng

Phone: +86-571-8530-8201

E-mail: ir@mogu.com

Christensen

In China

Ms. Rachel Xia

Phone: +852-2232-3980

E-mail: rachel.xia@christensencomms.com

In the United States

Ms. Linda Bergkamp

Phone: +1-480-614-3004

Email: linda.bergkamp@christensencomms.com

MOGU INC.

Unaudited Condensed Consolidated Balance Sheets

(All amounts in thousands, except for share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of March 31, |

|

|

September 30, |

|

|

|

2024 |

|

|

2024 |

|

|

|

RMB |

|

|

RMB |

|

|

US$ |

|

ASSETS |

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

358,787 |

|

|

|

84,356 |

|

|

|

12,021 |

|

Restricted cash |

|

|

511 |

|

|

|

511 |

|

|

|

73 |

|

Short-term investments |

|

|

61,312 |

|

|

|

271,525 |

|

|

|

38,692 |

|

Inventories, net |

|

|

98 |

|

|

|

67 |

|

|

|

10 |

|

Loan receivables, net |

|

|

31,564 |

|

|

|

28,759 |

|

|

|

4,098 |

|

Prepayments, receivables and other current assets |

|

|

54,956 |

|

|

|

95,562 |

|

|

|

13,617 |

|

Amounts due from related parties |

|

|

587 |

|

|

|

331 |

|

|

|

47 |

|

Total current assets |

|

|

507,815 |

|

|

|

481,111 |

|

|

|

68,558 |

|

Non-current assets: |

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

|

299,741 |

|

|

|

299,996 |

|

|

|

42,749 |

|

Intangible assets, net |

|

|

949 |

|

|

|

871 |

|

|

|

124 |

|

Right-of-use assets |

|

|

2,576 |

|

|

|

1,650 |

|

|

|

235 |

|

Investments |

|

|

81,808 |

|

|

|

54,058 |

|

|

|

7,703 |

|

Other non-current assets |

|

|

45,473 |

|

|

|

49,411 |

|

|

|

7,041 |

|

Total non-current assets |

|

|

430,547 |

|

|

|

405,986 |

|

|

|

57,852 |

|

Total assets |

|

|

938,362 |

|

|

|

887,097 |

|

|

|

126,410 |

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

|

6,862 |

|

|

|

3,567 |

|

|

|

508 |

|

Salaries and welfare payable |

|

|

6,936 |

|

|

|

5,254 |

|

|

|

749 |

|

Advances from customers |

|

|

207 |

|

|

|

627 |

|

|

|

89 |

|

Taxes payable |

|

|

1,285 |

|

|

|

2,436 |

|

|

|

347 |

|

Amounts due to related parties |

|

|

5,341 |

|

|

|

4,490 |

|

|

|

640 |

|

Current portion of lease liabilities |

|

|

1,888 |

|

|

|

374 |

|

|

|

53 |

|

Accruals and other current liabilities |

|

|

299,317 |

|

|

|

295,641 |

|

|

|

42,129 |

|

Total current liabilities |

|

|

321,836 |

|

|

|

312,389 |

|

|

|

44,515 |

|

Non-current liabilities: |

|

|

|

|

|

|

|

|

|

Non-current lease liabilities |

|

|

773 |

|

|

|

386 |

|

|

|

55 |

|

Deferred tax liabilities |

|

|

1,299 |

|

|

|

— |

|

|

|

— |

|

Total non-current liabilities |

|

|

2,072 |

|

|

|

386 |

|

|

|

55 |

|

Total liabilities |

|

|

323,908 |

|

|

|

312,775 |

|

|

|

44,570 |

|

Shareholders’ equity |

|

|

|

|

|

|

|

|

|

Ordinary shares |

|

|

181 |

|

|

|

181 |

|

|

|

26 |

|

Treasury stock |

|

|

(137,446 |

) |

|

|

(138,269 |

) |

|

|

(19,703 |

) |

Statutory reserves |

|

|

3,331 |

|

|

|

3,331 |

|

|

|

475 |

|

Additional paid-in capital |

|

|

9,489,254 |

|

|

|

9,489,994 |

|

|

|

1,352,313 |

|

Accumulated other comprehensive income |

|

|

89,567 |

|

|

|

72,084 |

|

|

|

10,272 |

|

Accumulated deficit |

|

|

(8,856,494 |

) |

|

|

(8,880,623 |

) |

|

|

(1,265,479 |

) |

Total MOGU Inc. shareholders’ equity |

|

|

588,393 |

|

|

|

546,698 |

|

|

|

77,904 |

|

Non-controlling interests |

|

|

26,061 |

|

|

|

27,624 |

|

|

|

3,936 |

|

Total shareholders’ equity |

|

|

614,454 |

|

|

|

574,322 |

|

|

|

81,840 |

|

Total liabilities and shareholders’ equity |

|

|

938,362 |

|

|

|

887,097 |

|

|

|

126,410 |

|

MOGU INC.

Unaudited Condensed Consolidated Statements of Operations and Comprehensive Loss

(All amounts in thousands, except for share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the six months ended |

|

|

|

September 30, |

|

|

|

2023 |

|

|

2024 |

|

|

|

RMB |

|

|

RMB |

|

|

US$ |

|

Net revenues |

|

|

|

|

|

|

|

|

|

Commission revenues |

|

|

55,619 |

|

|

|

35,275 |

|

|

|

5,027 |

|

Marketing services revenues |

|

|

746 |

|

|

|

63 |

|

|

|

9 |

|

Financing solutions revenues |

|

|

5,403 |

|

|

|

3,827 |

|

|

|

545 |

|

Technology services revenues |

|

|

18,388 |

|

|

|

20,734 |

|

|

|

2,955 |

|

Other revenues |

|

|

3,146 |

|

|

|

1,954 |

|

|

|

278 |

|

Total revenues |

|

|

83,302 |

|

|

|

61,853 |

|

|

|

8,814 |

|

Cost of revenues (exclusive of amortization of intangible assets shown separately below) |

|

|

(49,602 |

) |

|

|

(39,560 |

) |

|

|

(5,637 |

) |

Sales and marketing expenses |

|

|

(37,274 |

) |

|

|

(26,362 |

) |

|

|

(3,757 |

) |

Research and development expenses |

|

|

(13,879 |

) |

|

|

(12,332 |

) |

|

|

(1,757 |

) |

General and administrative expenses |

|

|

(27,914 |

) |

|

|

(27,143 |

) |

|

|

(3,868 |

) |

Amortization of intangible assets |

|

|

(1,826 |

) |

|

|

(75 |

) |

|

|

(11 |

) |

Impairment of intangible assets |

|

|

(9,945 |

) |

|

|

— |

|

|

|

— |

|

Other income, net |

|

|

5,059 |

|

|

|

2,172 |

|

|

|

310 |

|

Loss from operations |

|

|

(52,079 |

) |

|

|

(41,447 |

) |

|

|

(5,906 |

) |

Interest income |

|

|

7,142 |

|

|

|

3,120 |

|

|

|

445 |

|

Gain from investments, net |

|

|

1,267 |

|

|

|

16,468 |

|

|

|

2,347 |

|

Loss before income tax and share of results of equity investees |

|

|

(43,670 |

) |

|

|

(21,859 |

) |

|

|

(3,114 |

) |

Income tax benefits/(expenses) |

|

|

1,662 |

|

|

|

(7 |

) |

|

|

(1 |

) |

Share of results of equity method investees |

|

|

(504 |

) |

|

|

(700 |

) |

|

|

(100 |

) |

Net loss |

|

|

(42,512 |

) |

|

|

(22,566 |

) |

|

|

(3,215 |

) |

Net (loss)/gain attributable to non-controlling interests |

|

|

(7,105 |

) |

|

|

1,563 |

|

|

|

223 |

|

Net loss attributable to MOGU Inc. |

|

|

(35,407 |

) |

|

|

(24,129 |

) |

|

|

(3,438 |

) |

Net loss |

|

|

(42,512 |

) |

|

|

(22,566 |

) |

|

|

(3,215 |

) |

Other comprehensive income/(loss): |

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments, net of nil tax |

|

|

4,970 |

|

|

|

(1,231 |

) |

|

|

(175 |

) |

Unrealized securities holding gains/(losses), net of tax |

|

|

1,702 |

|

|

|

(16,252 |

) |

|

|

(2,316 |

) |

Total comprehensive loss |

|

|

(35,840 |

) |

|

|

(40,049 |

) |

|

|

(5,706 |

) |

Total comprehensive (loss)/gain attributable to non-controlling interests |

|

|

(7,105 |

) |

|

|

1,563 |

|

|

|

223 |

|

Total comprehensive loss attributable to MOGU Inc. |

|

|

(28,735 |

) |

|

|

(41,612 |

) |

|

|

(5,929 |

) |

Net loss per share attributable to ordinary shareholders |

|

|

|

|

|

|

|

|

|

Basic |

|

|

(0.01 |

) |

|

|

(0.01 |

) |

|

|

(0.00 |

) |

Diluted |

|

|

(0.01 |

) |

|

|

(0.01 |

) |

|

|

(0.00 |

) |

Net loss per ADS |

|

|

|

|

|

|

|

|

|

Basic |

|

|

(4.11 |

) |

|

|

(2.76 |

) |

|

|

(0.39 |

) |

Diluted |

|

|

(4.11 |

) |

|

|

(2.76 |

) |

|

|

(0.39 |

) |

Weighted average number of shares used in

computing net loss per share |

|

|

|

|

|

|

|

|

|

Basic |

|

|

2,581,758,960 |

|

|

|

2,620,311,457 |

|

|

|

2,620,311,457 |

|

Diluted |

|

|

2,581,758,960 |

|

|

|

2,620,311,457 |

|

|

|

2,620,311,457 |

|

Share-based compensation expenses included in: |

|

|

|

|

|

|

|

|

|

Cost of revenues |

|

|

415 |

|

|

|

34 |

|

|

|

5 |

|

General and administrative expenses |

|

|

1,763 |

|

|

|

604 |

|

|

|

86 |

|

Sales and marketing expenses |

|

|

419 |

|

|

|

14 |

|

|

|

2 |

|

Research and development expenses |

|

|

192 |

|

|

|

88 |

|

|

|

13 |

|

MOGU INC.

Unaudited Condensed Consolidated Statements of Cash Flows

(All amounts in thousands, except for share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the six months ended |

|

|

|

September 30, |

|

|

|

2023 |

|

|

2024 |

|

|

|

RMB |

|

|

RMB |

|

|

US$ |

|

Net cash used in operating activities |

|

|

(32,907 |

) |

|

|

(28,953 |

) |

|

|

(4,126 |

) |

Net cash used in investing activities |

|

|

(20,779 |

) |

|

|

(244,012 |

) |

|

|

(34,771 |

) |

Net cash used in financing activities |

|

|

— |

|

|

|

(822 |

) |

|

|

(117 |

) |

Effect of foreign exchange rate changes on cash and cash equivalents and restricted cash |

|

|

3,336 |

|

|

|

(644 |

) |

|

|

(92 |

) |

Net decrease in cash and cash equivalents and restricted cash |

|

|

(50,350 |

) |

|

|

(274,431 |

) |

|

|

(39,106 |

) |

Cash and cash equivalents and restricted cash at beginning of period |

|

|

417,011 |

|

|

|

359,298 |

|

|

|

51,200 |

|

Cash and cash equivalents and restricted cash at end of period |

|

|

366,661 |

|

|

|

84,867 |

|

|

|

12,094 |

|

MOGU INC.

Unaudited Reconciliations of GAAP and Non-GAAP Results

(All amounts in thousands, except for share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the six months ended |

|

|

|

|

|

September 30, |

|

|

|

|

|

2023 |

|

|

2024 |

|

|

|

|

|

RMB |

|

|

RMB |

|

|

US$ |

|

|

|

Net loss |

|

|

(42,512 |

) |

|

|

(22,566 |

) |

|

|

(3,215 |

) |

Less: |

|

Income tax (benefits)/expenses |

|

|

(1,662 |

) |

|

|

7 |

|

|

|

1 |

|

Less: |

|

Interest income |

|

|

(7,142 |

) |

|

|

(3,120 |

) |

|

|

(445 |

) |

Add: |

|

Amortization of intangible assets |

|

|

1,826 |

|

|

|

75 |

|

|

|

11 |

|

Add: |

|

Depreciation of property and equipment |

|

|

3,529 |

|

|

|

5,636 |

|

|

|

803 |

|

|

|

EBITDA |

|

|

(45,961 |

) |

|

|

(19,968 |

) |

|

|

(2,845 |

) |

Add: |

|

Impairment of intangible assets |

|

|

9,945 |

|

|

|

— |

|

|

|

— |

|

Add: |

|

Share-based compensation expenses |

|

|

2,789 |

|

|

|

740 |

|

|

|

106 |

|

Add: |

|

Share of result of equity method investees |

|

|

504 |

|

|

|

700 |

|

|

|

100 |

|

Less: |

|

Gain from investments, net |

|

|

(1,267 |

) |

|

|

(16,468 |

) |

|

|

(2,347 |

) |

|

|

Adjusted EBITDA |

|

|

(33,990 |

) |

|

|

(34,996 |

) |

|

|

(4,986 |

) |

|

|

Net loss |

|

|

(42,512 |

) |

|

|

(22,566 |

) |

|

|

(3,215 |

) |

Add: |

|

Gain from investments, net |

|

|

(1,267 |

) |

|

|

(16,468 |

) |

|

|

(2,347 |

) |

Add: |

|

Share-based compensation expenses |

|

|

2,789 |

|

|

|

740 |

|

|

|

106 |

|

Add: |

|

Impairment of intangible assets |

|

|

9,945 |

|

|

|

— |

|

|

|

— |

|

Less: |

|

Adjusted for tax effects |

|

|

(1,755 |

) |

|

|

— |

|

|

|

— |

|

|

|

Adjusted net loss |

|

|

(32,800 |

) |

|

|

(38,294 |

) |

|

|

(5,456 |

) |

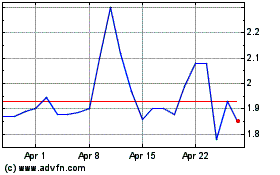

MOGU (NYSE:MOGU)

Historical Stock Chart

From Nov 2024 to Dec 2024

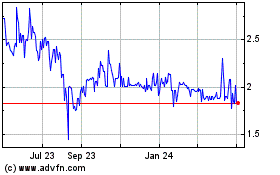

MOGU (NYSE:MOGU)

Historical Stock Chart

From Dec 2023 to Dec 2024