Mesabi Trust Press Release

April 16 2024 - 4:05PM

Business Wire

Announcement of Mesabi Trust Distribution

The Trustees of Mesabi Trust (NYSE:MSB) declared a distribution

of twenty-nine cents ($0.29) per Unit of Beneficial Interest

payable on May 20, 2024 to Mesabi Trust Unitholders of record at

the close of business on April 30, 2024. This compares to no

distribution declared for the same period last year.

The Trustees’ announcement today of a twenty-nine cents ($0.29)

per Unit distribution, as compared to no distribution announced by

the Trust at the same time last year, reflects an increase in the

distribution compared to the same period in the prior year, and is

primarily attributable to the restart of Northshore operations in

April 2023, and to an increase in the total royalties received by

the Trust in January 2024, as compared to the total royalties

received by the Trust in January 2023. In particular, the Trust’s

receipt of total royalty payments of $6,432,434 on January 30, 2024

from Cleveland-Cliffs Inc. (“Cliffs”), the parent company of

Northshore Mining Company (“Northshore”), was higher than the total

royalty payments of zero dollars ($0.00) received by the Trust from

Cliffs in January 2023.

The distribution announced today also reflects that, until July

30, 2023, the Trust had received no royalties in the Trust’s three

previous fiscal quarters, as well as the current continuing

uncertainties related to previous announcements by Cliffs about its

intention to continue to treat Northshore as a swing operation.

Accordingly, the Trustees’ decision announced today also reflects

their determination to maintain an appropriate level of reserves in

order to make adequate provision to meet current and future

expenses and present and future liabilities (whether fixed or

contingent) that may arise in the future.

The Trustees have received no specific updates on Cliffs’ plans

for the current year concerning Northshore iron ore operations. The

Trustees’ distribution announcement today also takes into account

numerous other factors, including uncertainties resulting from

Cliffs’ prior announcements to increase the use of scrap iron in

its vertical supply chain planning, the potential volatility in the

iron ore and steel industries generally, national and global

economic uncertainties, the cost and expense related to the Trust’s

pending arbitration against Northshore and Cliffs, and further

potential disturbances from global unrest.

Quarterly royalty payments from Northshore for iron ore

production and shipments during the first calendar quarter, which

are payable to Mesabi Trust under the royalty agreement, are due

April 30, 2024, together with the quarterly royalty report. After

receiving the quarterly royalty report, Mesabi Trust plans to file

a summary of the quarterly royalty report with the Securities and

Exchange Commission in a Current Report on Form 8-K.

Forward-Looking Statements

This press release contains certain forward-looking statements

with respect to Northshore operations in 2024 and other matters,

which statements are intended to be made under the safe harbor

protections of the Private Securities Litigation Reform Act of

1995, as amended. Cliffs’ actual utilization of the Northshore

operations could differ materially from current expectations due to

inherent risks and uncertainties such as general adverse business

and industry economic trends, uncertainties arising from war,

terrorist events, recession, potential future impacts of the

coronavirus (COVID-19) pandemic and other global events, higher or

lower customer demand for steel and iron ore, decisions by mine

operators regarding curtailments or idling of production lines or

entire plants, announcements and implementation of trade tariffs,

environmental compliance uncertainties, difficulties in obtaining

and renewing necessary operating permits, higher imports of steel

and iron ore substitutes, processing difficulties, consolidation

and restructuring in the domestic steel market, and other factors.

Although the Mesabi Trustees believe that any such forward-looking

statements are based on reasonable assumptions, such statements are

subject to risks and uncertainties, which could cause actual

results to differ materially. Additional information concerning

these and other risks and uncertainties is contained in the Trust’s

filings with the Securities and Exchange Commission, including its

Annual Report on Form 10-K for the fiscal year ended January 31,

2023, its Quarterly Report on Form 10-Q for the fiscal quarter

ended April 30, 2023 and its Quarterly Report on Form 10-Q for the

fiscal quarter ended October 31, 2023. Mesabi Trust undertakes no

obligation to publicly update or revise any of the forward-looking

statements made herein to reflect events or circumstances after the

date hereof.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240416064125/en/

Mesabi Trust SHR Unit Deutsche Bank Trust Company Americas

904-271-2520

Mesabi (NYSE:MSB)

Historical Stock Chart

From Nov 2024 to Dec 2024

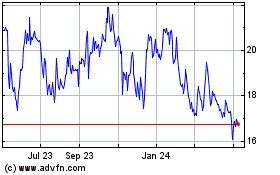

Mesabi (NYSE:MSB)

Historical Stock Chart

From Dec 2023 to Dec 2024