0000314203

false

--12-31

0000314203

2023-06-29

2023-06-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): June 29, 2023

McEWEN MINING INC.

(Exact name of registrant as specified in

its charter)

Colorado

(State or other jurisdiction of

incorporation or organization) |

|

001-33190

(Commission File

Number) |

|

84-0796160

(I.R.S. Employer

Identification No.) |

150 King Street West, Suite 2800

Toronto, Ontario, Canada M5H 1J9

(Address of principal executive offices)

(Zip Code)

Registrant’s telephone number including

area code: (866) 441-0690

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock |

|

MUX |

|

New

York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 5.03. |

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

As disclosed below under Item 5.07, McEwen Mining

Inc. (the “Company”) held its annual meeting of shareholders on June 29, 2023, at which the shareholders of the Company

approved, among other things, proposals to amend the Company’s Second Amended and Restated Articles of Incorporation to increase

the number of shares of preferred stock authorized to be issued from 2 to 10,000,000 and to increase the total authorized shares accordingly

(the “Increase in Authorized Preferred Capital Amendment”).

Pursuant to that authority, effective June 30,

2023, the Company filed with the Secretary of State of the State of Colorado Articles of Amendment to the Second Amended and Restated

Articles of Incorporation that served to effect the Increase in Authorized Preferred Capital Amendment.

| Item 5.07. | Submission of Matters to a Vote of Security Holders. |

On June 29, 2023, the Company held its annual

meeting of shareholders. Of the 47,427,584 shares outstanding and entitled to vote at the meeting, 24,913,355 shares were voted, or approximately

52.53% of the outstanding shares entitled to vote.

At the annual meeting, the shareholders: (i) elected

the seven individuals nominated to serve as directors; (ii) authorized and approved the Increase in Authorized Preferred Capital

Amendment; and (iii) ratified the appointment of Ernst & Young LLP (“EY”) as the Company’s independent

registered public accounting firm for the year ending December 31, 2023.

Proposal 1

Election results for the directors nominated at the meeting are as

follows:

| | |

Shares Voted | |

| Name of Nominee | |

For | | |

Withheld | | |

Broker Non-

Votes | |

| Robert R. McEwen | |

| 16,350,537 | | |

| 272,916 | | |

| 8,289,902 | |

| Allen V. Ambrose | |

| 15,829,053 | | |

| 794,400 | | |

| 8,289,902 | |

| Ian Ball | |

| 16,252,313 | | |

| 371,140 | | |

| 8,289,902 | |

| Richard W. Brissenden | |

| 16,271,277 | | |

| 352,176 | | |

| 8,289,902 | |

| Robin E. Dunbar | |

| 16,130,643 | | |

| 492,810 | | |

| 8,289,902 | |

| Merri Sanchez | |

| 16,090,302 | | |

| 533,151 | | |

| 8,289,902 | |

| William M. Shaver | |

| 16,228,570 | | |

| 394,883 | | |

| 8,289,902 | |

Proposal 2

Election results for the proposal for the Increase in Authorized Preferred

Capital Amendment are as follows:

| For | |

Against | |

Abstain | |

Broker Non-Votes |

| 10,473,353 | |

6,043,434 | |

106,666 | |

8,289,902 |

Proposal 3

Election results for the ratification of the appointment of EY as the

independent registered public accounting firm for the year ending December 31, 2023, are as follows:

| For | |

Against | |

Abstain | |

Broker Non-Votes |

| 24,633,031 | |

125,598 | |

154,726 | |

0 |

| Item 7.01 | Regulation FD Disclosure |

At the annual meeting, the Company’s senior

management made a presentation on the Company’s business, exploration, development efforts, and financial results and condition.

A copy of the PowerPoint slides used in connection with the presentation is furnished with this report as Exhibit 99.1.

The information furnished under this Item 7.01,

including the exhibit, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934,

nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth

by reference to such filing.

| Item 9.01 | Financial Statements and Exhibits. |

| (d) | Exhibits. The following exhibits are filed or furnished with

this report: |

| 104 | Cover Page Interactive Data File – the cover page XBRL tags are embedded within the Inline XBRL document (contained

in Exhibit 101) |

SIGNATURE

Pursuant to the requirements of Section 13

or 15(d) of the Securities Exchange Act of 1934, the registrant has caused this report to be signed on its behalf by the undersigned

thereunto duly authorized.

| |

McEWEN MINING INC. |

| |

|

| |

|

| Date: July 3, 2023 |

By: |

/s/ Carmen Diges |

| |

|

Carmen Diges, General Counsel |

Exhibit 3.1

ARTICLES OF AMENDMENT

TO THE

SECOND AMENDED AND RESTATED ARTICLES OF INCORPORATION,

AS AMENDED

OF

MCEWEN MINING INC.

Pursuant to Section 7-110-103

of the Colorado Business Corporation Act, McEwen Mining Inc., a Colorado corporation (the “Corporation”), adopts the

following Articles of Amendment to its Second Amended and Restated Articles of Incorporation, as amended (the “Articles”)

and hereby certifies as follows:

| 1. | The name of the Corporation is MCEWEN MINING INC. |

| 2. | The board of directors of the Corporation duly approved the following amendment to the Articles and recommended

it for approval by the shareholders of the Corporation on April 28, 2023 and the shareholders of the Corporation duly approved said

amendment on June 29, 2023. |

| 3. | Article IV of the Corporation’s Articles is hereby amended and restated to read in its entirety

as follows: |

CAPITAL

A. Classes of Stock. The Corporation

is authorized to issue two classes of stock to be designated, respectively, “Common Stock” and “Preferred Stock.”

The total number of shares which the Corporation is authorized to issue is 210,000,000, of which (i) 200,000,000 shares, no par value,

shall be Common Stock, and (ii) 10,000,000 shares, no par value, shall be Preferred Stock.

B. Common Stock.

(1) Dividends.

Dividends in cash, property, or shares of the Corporation may be paid upon the Common Stock, as and when declared by the board of directors,

out of funds of the Corporation to the extent and in the manner permitted by law.

(2) Distribution

in Liquidation. Upon any liquidation, dissolution or winding up of the Corporation, and after paying or adequately providing for the

payment of all its obligations, the remainder of the assets of the Corporation shall be distributed, either in cash or in kind, pro rata

to the holders of Common Stock. The board of directors may, from time to time, distribute to the shareholders in partial liquidation,

out of stated capital or capital surplus of the Corporation, a portion of its assets, in cash or property, in the manner permitted and

upon compliance with limitations imposed by law.

(3) Voting

Rights; Cumulative Voting. Each outstanding share of Common stock shall be entitled to one vote and each fractional share of Common

Stock shall be entitled to a corresponding fractional vote on each matter submitted to a vote of shareholders. Cumulative voting shall

not be allowed in the election of directors of the Corporation.

C. Preferred Stock. Shares of

Preferred Stock may be divided into such series as may be established, from time to time, by the board of directors. The board of directors,

from time to time, may fix and determine the designation and number of shares of any series, the voting powers, if any, of the shares

of such series and the relative, participating, optional or other rights and preferences of the shares of any series so established as

to distinguish the shares thereof from the shares of all other series. The board of directors is also authorized, within limits and restrictions

stated in any resolution or resolutions of the board of directors originally fixing the number of shares constituting any such series,

to increase or decrease (but not below the number of shares of any such series then outstanding) the number of shares of any such other

series and the designations, relative powers, preferences and rights, and the qualifications, limitations or restrictions of such other

series, including preferences with respect to any other series of Preferred Stock, in each case, so far as not inconsistent with the provisions

of these Second Amended and Restated Articles of Incorporation, as amended, or the Act as then in effect. The powers, preferences and

relative, participating, optional and other special rights of each series of preferred stock, and the qualifications, limitations or restrictions

thereof, if any, may differ from those of any and all other series at any time outstanding.

D. Denial of Preemptive Rights.

No holder of any shares of the Corporation, whether now or hereafter authorized, shall have any preemptive or preferential right to acquire

any shares or securities of the Corporation, including shares or securities held in the treasury of the Corporation.

| 4. | The remainder of the Articles shall remain unchanged and in full force and effect. |

| 5. | The effective date of these Articles of Amendment shall be the date of filing with the Colorado Secretary

of State. |

[Signature Page Follows]

IN WITNESS WHEREOF,

the undersigned has executed these Articles of Amendment this 30th day of June 2023.

| |

MCEWEN MINING INC. |

| |

|

| |

By: |

/s/ Carmen Diges |

| |

Name: |

Carmen Diges |

| |

Title: |

General Counsel and Secretary |

Signature

Page to Articles of Amendment

Exhibit 99.1

MUX 3 Mines Fox Complex (100%) Gold Bar (100%) San José (49%) 1 Development Project El Gallo / Fenix (100%) Los Azules Argentina Fox Complex Timmins, Canada (100%) Gold Bar Nevada (100%) El Gallo – Fenix Project Mexico (100%) San José Argentina ( 49 %) Elder Creek Nevada Au + Ag Cu McEwen Copper (52%) Elder Creek Los Azules 2023 Guidance 150,000 - 170,000 GEOs 1. US $82 Million @ $10/shr 2. ARS $30 Billion + US $30 Million @ ~$19/shr Financings MUX Annual Meeting 2023 'Gold Equivalent Ounces’ – GEOs, are calculated based on 85:1 gold to silver price ratio. 1 - Aug 2022. 2 - Feb - Mar 2023 MUX Properties Asset Rich in Prime Real Estate

MUX MUX Annual Meeting Agenda Formal Part of the Meeting Carmen Diges , General Counsel Company Presentation Annual Meeting 2023 Rob McEwen, Chairman & Chief Owner Financials Perry Ing, Chief Financial Officer Operations William Shaver, Chief Operating Officer Exploration Fox Complex Sean Farrell, Chief Exploration Geologist Exploration Gold Bar Kevin Kunkel, Exploration Manager San José Stefan Spears, VP Corporate Development Los Azules Michael Meding, VP & GM - McEwen Copper Closing Remarks Rob McEwen, Chairman & Chief Owner Q&A MUX Management 3 minutes finance 6 Operations 5 Sean 5 Kevin 3 San Jose 10 Copper

Formal Part of the Meeting NYSE & TSX Carmen Diges General Counsel

Annual Meeting 2023 Rob McEwen Chairman & Chief Owner

MUX Cautionary Statement This presentation and the information included herein do not constitute an offer to buy or the solicitation of an offer to subscribe for or to buy any of the securities described herein, nor shall there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction . This presentation contains certain forward - looking statements and information, including "forward - looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 ("Forward - looking Statements") . The Forward - looking Statements are intended to be subject to the safe harbor provided by Section 27 a of the Securities Act of 1933 , Section 21 e of the Securities Exchange Act of 1934 and Private Securities Litigation Reform Act of 1995 . The Forward - looking Statements express, as at the date of this presentation, McEwen Mining Inc . (the "Company") estimates, forecasts, projections, expectations or beliefs as to future events and results . Forward - looking Statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties, risks and contingencies . There can be no assurance that such statements and information will prove to be accurate . Therefore, actual results and future events could differ materially from those anticipated in such statements and information . Risks and uncertainties that could cause results or future events to differ materially from current expectations expressed or implied by the Forward - looking Statements include, but are not limited to, factors associated with fluctuations in the market price of precious metals, mining industry risks, political, economic, social and security risks associated with foreign operations, the ability of the corporation to receive or receive in a timely manner permits or other approvals required in connection with operations, risks associated with the construction of mining operations and commencement of production and the projected costs thereof, risks related to litigation, the state of the capital markets, environmental risks and hazards, uncertainty as to calculation of mineral resources and reserves, risk of delisting from a public exchange, and other risks . Readers should not place undue reliance on Forward - looking Statements, which speak only as of the date hereof . The Company undertakes no obligation to reissue or update Forward - looking Statements as a result of new information or events after the date hereof, except as required by law . See McEwen Mining's Annual Report on Form 10 - K/A for the fiscal year ended December 31 , 2022 , the Quarterly Report on Form 10 - Q for the quarter ended March 31 , 2023 and other filings with the Securities and Exchange Commission (the “SEC”), under the caption "Risk Factors", for additional information on risks, uncertainties and other factors relating to the Forward - looking Statements . All Forward - looking Statements made in this presentation are qualified by this cautionary statement . Unless otherwise stated, all currency information quoted in this presentation is in U . S . dollars . The technical contents of this presentation, including reserves, have been reviewed and approved by William Shaver, COO ; the exploration technical contents of this presentation including resources content have been reviewed and approved by Luke Willis, P . Geo . , Director of Resource Modelling ; all are Qualified Persons as defined by Canadian Securities Administrators National Instrument 43 - 101 "Standards of Disclosure for Mineral Projects" . Securities and Exchange Commission (“SEC”) . We are subject to the reporting requirements of the Securities and Exchange Act of 1934 , as amended (the “Exchange Act”) and applicable Canadian securities laws, and as a result, we have reported our mineral reserves and mineral resources according to two different standards . U . S . reporting requirements are governed by Item 1300 of Regulation S - K (“S - K 1300 ”), as issued by the U . S . Securities and Exchange Commission (“SEC”) . Canadian reporting requirements for disclosure of mineral properties are governed by National Instrument 43 - 101 Standards of Disclosure for Mineral Projects (“NI 43 - 101 ”), as adopted from the definitions provided by the Canadian Institute of Mining, Metallurgy and Petroleum . Both sets of reporting standards have similar goals in terms of conveying an appropriate level of confidence in the disclosures being reported, but the standards embody slightly different approaches and definitions . All disclosure of mineral resources and mineral reserves in this report are reported in accordance with S - K 1300 . Investors should be aware that the estimation of measured resources and indicated resources involve greater uncertainty as to their existence and economic feasibility than the estimation of proven and probable reserves, and therefore investors are cautioned not to assume that all or any part of measured or indicated resources will ever be converted into S - K 1300 - compliant reserves . The estimation of inferred resources involves far greater uncertainty as to their existence and economic viability than the estimation of other categories of resources, and therefore it cannot be assumed that all or any part of inferred resources will ever be upgraded to a higher category . Therefore, investors are cautioned not to assume that all or any part of inferred resources exist, or that they can be mined legally or economically .

MUX NON - GAAP Measures In this presentation, we have provided information prepared or calculated according to U . S . GAAP, as well as provided some non - U . S . GAAP ("non - GAAP") performance measures . Because the non - GAAP performance measures do not have any standardized meaning prescribed by U . S . GAAP, they may not be comparable to similar measures presented by other companies . Total Cash Costs per GEO, and All - in Sustaining Costs (“AISC”) per GEO . Total cash costs consist of mining, processing, on - site general and administrative costs, community and permitting costs related to current explorations, royalty costs, refining and treatment charges (for both doré and concentrate products), sales costs, export taxes and operational stripping costs . All - in sustaining cash costs consist of total cash costs (as described above), plus environmental rehabilitation costs, amortization of the asset retirement costs related to operating sites, sustaining exploration and development costs, and sustaining capital expenditures . In order to arrive at our consolidated all - in sustaining costs, we also include corporate general and administrative expenses . Depreciation is excluded from both total cash costs and all - in sustaining cash costs . For both total cash costs and all - in sustaining costs we include our attributable share of total cash costs from operations where we hold less than a 100 % economic share in the production, such as MSC, where we hold a 49 % interest . Total cash cost and all - in sustaining cash cost per GEO sold are calculated on a co - product basis by dividing the respective proportionate share of the total cash costs and all - in sustaining cash costs for the period attributable to each metal by the ounces of each respective metal sold . We use and report these measures to provide additional information regarding operational efficiencies both on a consolidated and an individual mine basis, and believe that these measures provide investors and analysts with useful information about our underlying costs of operations . A reconciliation to the nearest U . S . GAAP measure is provided in McEwen Mining's Annual Report on Form 10 - K/A for the year ended December 31 , 2022 . Earnings from Mining Operations The term Earnings from Mining Operations used in this presentation is a non - GAAP financial measure . We use and report this measure because we believe it provides investors and analysts with a useful measure of the underlying earnings from our mining operations . We define Earnings from Mining Operations as Gold and Silver Revenues from our El Gallo Mine, Black Fox Mine, and our 49 % attributable share of the San José Mine's Net Sales, less their respective Production Costs Applicable to Sales . To the extent that Production Costs Applicable to Sales may include depreciation and amortization expense related to the fair value increments on historical business acquisitions (fair value paid in excess of the carrying value of the underlying assets and liabilities assumed on the date of acquisition), we deduct this expense in order to arrive at Production Costs Applicable to Sales that only include depreciation and amortization expense incurred at the mine - site level . The San José Mine Net Sales and Production Costs Applicable to Sales are presented, on a 100 % basis, in Note 5 of McEwen Mining's Annual Report on Form 10 - K/A for the year ended December 31 , 2022 . Cash, Investments and Precious Metals The term cash, investments and precious metals used in this presentation is a non - GAAP financial measure . We report this measure to better understand our liquidity in each reporting period . Cash, investments and precious metals is calculated as the sum of cash, investments and ounces of doré held in inventory, valued at the London P . M . Fix spot price at the corresponding period . A reconciliation to the most directly comparable U . S . GAAP measure, Sales of Gold and Silver, is provided in McEwen Mining's Annual Report on Form 10 - K/A for the year ended December 31 , 2022 . MUX: Cautionary Note Regarding

MUX 3 Mines Fox Complex (100%) Gold Bar (100%) San José (49%) 1 Development Project El Gallo / Fenix (100%) Los Azules Argentina Fox Complex Timmins, Canada (100%) Gold Bar Nevada (100%) El Gallo – Fenix Project Mexico (100%) San José Argentina ( 49 %) Elder Creek Nevada Au + Ag Cu McEwen Copper (52%) Elder Creek Los Azules 2023 Guidance 150,000 - 170,000 GEOs 1. US $82 Million @ $10/shr 2. ARS $30 Billion + US $30 Million @ ~$19/shr Financings MUX Annual Meeting 2023 'Gold Equivalent Ounces’ – GEOs, are calculated based on 85:1 gold to silver price ratio. 1 - Aug 2022. 2 - Feb - Mar 2023 MUX Properties Asset Rich in Prime Real Estate

MUX -50 0 50 100 150 200 250 9/1/22 12/1/22 3/1/23 6/1/23 MUX vs Market Sept 1, 2022 – June 28, 2023 GDX +27% % MUX +130% GDXJ +21% Gold +12% Copper +9% Source: Bloomberg. As of June 28, 2023 2023 - 06 - 28 Nasdaq +15% Dow +7%

MUX Los Azules Video https:// youtu.be /nYjHmHy5 - 4k

MUX Cash Debt Equity Financings Cash Gross Profit Production Increasing working capital Q2 2022 $44.0 M Q1 2023 $190.8 M Strengthening balance sheet Q2 2022 $15.0 M increase to $65.0 M Q2 2023 $25.0 M decrease to $40.0 M No MUX dilution in 2023 Q2 2022 $15.1 M flow - through + $15.0 M McEwen Copper Q1/Q2 2023 $30M USD + $30 B ARS McEwen Copper Targeting cost efficiencies H1 2022 $5.4 M Q1 2023 $11.3 M Operational improvements H1 2022 61.4 K GEOs H1 2023 (est.) 66.0 K GEOs Where We Were (Q2 ‘22) Vs. Where We Are (Q2 ‘23) Financial Results Perry Ing Chief Financial Officer

MUX 2023 Production & Cost Guidance GEO – gold equivalent ounces. 2023 production guidance – December 21, 2022 press release. Q1 2023 production – May 8, 2023 pres s release. Numbers may not add due to rounding. G old:silver ratios: 84:1 for Q1 2023, 83:1 for Q2 2023. Q2 2023 preliminary production based on April and May 2023 actual prod uct ion and estimates for June 2023. Ounces Q1 2023 Q2 2023 Preliminary YTD Preliminary 2023 Guidance Range Fox Complex, Canada GEO 12,700 10,400 23,100 42,000 - 48,000 Gold Bar Mine, Nevada GEO 6,500 8,100 14,600 42,000 - 48,000 San José Mine, Argentina (49%) Gold 6,700 10,400 17,100 39,000 - 43,000 Silver 381,200 564,000 945,200 2,300,000 - 2,600,000 GEO 11,200 17,130 28,330 66,000 - 74,000 Total Production Gold 25,900 28,990 54,890 123,000 - 139,000 Silver 381,200 564,000 945,200 2,300,000 - 2,600,000 GEO 30,400 35,630 66,030 150,000 - 170,000 $/ GEO Sold Cash Costs Q1 2023 Cash Costs 2023 Guidance AISC Q1 2023 AISC 2023 Guidance Fox Complex, Canada $1,088 $1,000 $1,311 $1,320 Gold Bar Mine, Nevada $1,491 $1,400 $1,725 $1,680 San José Mine, Argentina (49%) $1,800 $1,250 $2,234 $1,550

MUX Operational Improvements Led by Safety Operations Bill Shaver Chief Operating Officer Employee safety is key to successful operations and our operations have been safe for more than 18 months although we had an employee sustain a shoulder injury this month in Mexico lifting a bale of hay . He was back at work in a few days . Par t of making Safety work is insuring we have the same attention to the Safety of the Contractors who work for us, and this has also been the case for the last 18 months . We also have the same regard for our day - to - day work environments . The raising of our Fox Tailings Facility last year was completed with no issues and as planned . In Nevada this year we had a particularly cold winter with significan t snow and a wet spring which led to flooding of our access roads and required a 10 M gallons orderly release of clean water from the site . In May our Mine Rescue Team at the Fox Mine participated in the Ontario Mine Rescue Competition . One of our new members was declared the winner of the Rookie of the Year Award .

MUX Operational Improvements Continue at Fox Operations Bill Shaver Chief Operating Officer During 2022 and continuing into 2023 , we made considerable improvements at Fox , in our mining operations and in our budgeting and cost processes, which led to better operations . We are now at 1 , 400 tpd vs . 1 , 000 tpd in 2022 . Fox production will improve , from 36 , 650 oz Au in 2022 to just over 23 , 000 oz Au in H 1 2023 , heading to our objective of 46 , 400 oz Au for 2023 . This improvement over 2022 is 17 % for H 1 and 25 % for the year assuming we continue our trend . Costs are tracking 10 % above budget, mainly due to the extra cost of crushing at the Mine to optimize the throughput of the Mill . The adding of cost is helping maintain the Mill throughput . Our underground exploration and development work will now allow Froome Mine to continue to at least mid 2025 and hopefully beyond . At present we also have a stockpile of ore on surface of over 1 , 000 t . We are also investing $ 14 M in diamond drilling exploration at Stock and Grey Fox, which is slated to be developed after Stock .

MUX Operational Improvements Continue at Gold Bar Operations Bill Shaver Chief Operating Officer At Gold Bar we successfully transferred to a new Mining Contractor in Q 4 2022 - early 2023 . Gold Bar produced 26 , 620 oz Au in 2022 and will produce 14 , 600 oz Au in H 1 2023 . We plan to produce approximately 28 , 000 oz Au in H 2 2023 . Q 1 production ounces and costs were negatively impacted by the poor weather and flooding . We have a plan to recover the gold production & costs over the remainder of the year . With improvements made while managing 10 M gallons of water, we are now operating to that plan . Costs are tracking close to break even currently . AISC costs will improve as we progress over the remainder of 2023 .

MUX The Future Operations Bill Shaver Chief Operating Officer Fox Complex We are planning the Stock Mine , the next after Froome . We will have an updated resource and mine plan for Stock later this year and we are going through processes to start a Ramp access to the Mine in Q 4 2023 . The mineralized material in the upper area of Stock will allow us to start mining in small quantities by mid 2024 . We are planning for continuous processing , by having Stock in production as we complete mining at Froome . El Gallo We plan to reprocess the Leach Pad and recover the remaining gold by sending this material through a conventional mill purchased last year on favourable terms . The Leach Pad contains 10 M tonnes @ ~ 0 . 6 gpt Au . The mill, planned at 1 . 2 M tonnes/ yr , will start in H 2 2024 . We are now fully engaged in Engineering & Design , Permitting & Sampling of the Leach Pad to confirm grades and distribution of the gold .

MUX Fox Complex – Resource Building & Exploration Success Sean Farrell Chief Exploration Geologist Exploration Fox Complex • > 70 M oz Historic Production in the Timmins Camp • > 30 km of Primary & Secondary Structural Controls • 3.3 M oz Historic Production Including 1.0 M oz at Fox East • Gold Resources: 1.9 M oz M+I @ 4.22 g/t Au; 0.5 M oz Inferred @ 3.86 g/t Au • $14 M Exploration Budget for 2023 Fox Complex Timmins, Canada

MUX Stock Exploration & Delineation • Highly prospective mineralization found near surface and proximal to the proposed ramp system to Stock West. This area could provide key revenue & shorten the payback period during the very early phases of ramp development • Key results highlights (all true widths) - SM22 - 110*: 8.0 g/t Au / 5.3 m ; 264.5 g/t Au / 2.7 m - SM22 - 116*: 18.7 g/t Au / 3.0 m - SM23 - 145*: 18.9 g/t Au / 9.4 m • Deeper mineralization (>600m below surface) remains highly prospective for long term growth and the sustainability of the Stock West Project; e.g., DDH S21 - 202**: 4.3 g/t Au / 20.3 m • Geological interpretations have now identified 2 principal mineralized plunge vectors at Stock ('Mine' plunge & 'N2' plunge) • Underexplored areas offer multiple opportunities for resource growth, new prospective mining horizons and continued exploration success * - press release dated May 8 th , 2023; ** - press release dated December 20 th , 2021

MUX Stock Longitudinal – Looking North

MUX Ramp Portal Zone – Right Beside Our Mill & Headframe

MUX Ramp Portal Zone – Abundant Visible Gold SM22 - 110: 1,031.6 g/t Au / 0.8 m CL SM22 - 116: 53.2 g/t Au / 1.0 m CL

MUX Stock Exploration & Delineation • Much of the late 2022 - early 2023 drilling campaigns were focused on delineation and infill drilling at Stock West using optimized AI generated targets (from the current block model); data processing of the success rate is ongoing • Drilling in proximity to the historical Stock Mine also continued in late 2022 and into 2023, designed to augment the 2022 PEA for Stock West by identifying mineralization that could represent early mining horizons close to the proposed ramp system • Key intercepts received for some of these areas include (all true widths): - SM22 - 108: 3.3 g/t Au / 15.6 m * - SM22 - 059: 6.2 g/t Au / 6.1 m ** - SM22 - 070: 3.6 g/t Au / 15.0 m ** - SM22 - 089: 5.4 g/t Au / 12.5 m ** - SM22 - 090: 4.4 g/t Au / 10.5 m ** • A year - end resource for Stock Main (proximal to the historical Stock Mine) has identified 30 K oz Au (Indicated + Inferred) * - press release dated May 8 th , 2023; ** - press release dated December 19 th , 2022

MUX Grey Fox – Over 1,100,000 oz Au Deposit

MUX Using Innovative Technology – LIBS* • Instrument measures density and hardness, helping to better define milling & recovery methods • Knowing where the Au is and isn't makes for more efficient core logging & drill targeting • Can also aid in identifying Au domain distribution & metallurgical sample selection * LIBS - Laser Induced Breakdown Spectroscopy

MUX Gold Bar – Priority Targets Near Mine & Brownfields Kevin Kunkel Exploration Manager Exploration Gold Bar Gold Bar Las Vegas Nevada, USA

MUX Cabin South Exploration Kevin Kunkel Exploration Manager Exploration Gold Bar New geologic model of fold and thrust developed • Phase I drilling identified a thrust fault at top of Lone Mountain Dolomite with thin alteration intercepts • Drilling shifted east to target limb of fold with alteration intercepts of >100 feet • Assays pending • Structural setting analogous to multiple Carlin - Trend deposits

MUX Pot Canyon Targets Kevin Kunkel Exploration Manager Exploration Gold Bar + 1 Million Au Ounce Potential • Known mineralization located on north limb of older west - northwest fold • Younger northwest fold cross - cuts older fold providing traps for mineralizing fluids • Analogous in part to mineralization at Carlin (Genesis) and Cortez (Rush) • Proximal to possible feeder zone (Wall Fault) • No drilling to favorable unit at depth

MUX Wall Fault Corridor Exploration Kevin Kunkel Exploration Manager Exploration Gold Bar • Major fault corridor traced over 5 miles on property • Very strong geochemistry (As, Sb, Hg and Au) • Locally strongly altered • Only 5 legacy holes have intersected the Wall Fault and all 5 intersected mineralization • Initial scout drilling planned for 2023 Pot Canyon

MUX San José Mine Update MSC & McEwen management team visit to San José in April 2023 San José Stefan Spears VP Corporate Development Ian Ball Jeff Chan Rob McEwen Michael Meding Dave Tyler Stefan Spears Bill Shaver Franco Rizzetto Diego Gomez Alfredo Sanchez

MUX San José Mine N Newmont Cerro Negro Mine Production: 5 2022 278,000 oz Au 2023E 330,000 oz Au 2024E 350,000 oz Au 20 k m 12 miles San José Argentina ▪ Narrow Vein Underground Silver / Gold Mine ▪ Large Property Package ▪ Good Grade Mine ▪ Surrounds Newmont’s Cerro Negro Reserve Grade 1 341 gpt Silver 6.4 gpt Gold Mine Life 2 6 Years (est.) 2022 Production 3,4 2.6 M oz Silver & 39 K oz Gold 2023E Production 3,4 2.3 - 2.6 M oz Silver & 39 - 43 K oz Gold Property outline MUX 49% Ownership/ Non - operator 1., 2. Hochschild “Annual Report and Accounts 2022”. 3. Based on 49% MUX ownership basis. 4. MUX March 14, 2023 press release. 5. Newmont 2022 10 - K and Q1 2023 10 - Q San Jos é Mine

MUX San José Mine Update Production Attributable to MUX Q1 2023A Q2 2023E Q/Q Increase H1 2023E 2023 Guidance Range Gold (oz) 6,700 10,400 +55% 17,100 39 - 43 K Silver (oz) 381,200 564,000 +50% 945,200 2,300 - 2,600 K 1. Q1 below expectations, the mine reacted and made corrections. 2. Q2 estimate for a marked improvement versus Q1. 3. Guidance range is maintained for 2023.

MUX San José Exploration

MM0

Our flagship asset is the advanced Los Azules Project in San Juan, Argentina, which was ranked as the 9 th largest undeveloped copper project by Mining Intelligence in 2022. Our second asset is the early - stage Elder Creek Project in Nevada, USA. With a commitment to innovation and sustainability, we seek to contribute to shaping the mining industry’s future . McEwen Copper Michael Meding VP & GM - McEwen Copper CC0

MUX Los Azules Michael Meding VP & GM - McEwen Copper Highlights of 2022 and 2023 YTD Completed financing totaling $267 M, significant value accretion for McEwen Mining and McEwen Copper shareholders, well - financed through 2023 into 2024. Executed two comprehensive drilling campaigns from 2022 to 2023 totaling 53,427 meters, about 49% of the drilled total since inception. Prepared and filed the Environmental Impact Assessment for Construction & Exploitation to the San Juan regulator in Apr 2023 with Knight Piesold. Updated the mineral resource estimate increasing total copper by 27.6%. Published a comprehensive PEA with strong economics, long life of mine and significant upside potential. DT0

MUX Initial financing with lead order by Rob McEwen for $ 40 M and Rio Tinto with $ 25 M closed oversubscribed with $ 82 M in Sep 2022 . Elder Creek 60 % optioned to Rio Tinto by investing $ 18 M over 7 yrs . Second financing round added Stellantis investing 30 B Argentine pesos ( $ 155 M at official FX), 1 st automotive company, 4 th biggest worldwide, investing in a Cu developer . Rio Tinto increased investment by $ 30 M at 90 % higher price . 1 st financing implied valuation of Los Azules at $257 M, 2 nd financing increased implied valuation to $550 M. Attributable value to MUX increased from $175 to $285 M. Los Azules Michael Meding VP & GM - McEwen Copper Highlights of 2022 and 2023 YTD Financing

MUX Drilling Campaign 2022/2023 138 holes completed 39,927 meters drilled 15 drills active To date, the project has a total of 118,940 meters drilled (PTD). The largest drilling campaign in the history of Los Azules, and one of the largest in all of Argentina, has been completed. Los Azules Michael Meding VP & GM - McEwen Copper Drilling Campaign 2021/2022 54 holes completed 13,500 meters drilled 11 drills active FO0

MUX Mineral Resource Improvements Improvements vs 2017 PEA – Since the 2017 PEA, an additional 51 holes for 21,777m of drilling was added to the database for the updated resource estimate. C oupled with an increase in the copper price used for the resource (from $2.75 to $4.00/ lb.) this resulted in an improved resource model with increased tonnage: +28% in Indicated and +69% in Inferred categories. Since the Dec 2022 database cut off , an additional 110 holes for 30,023 m are available to be included in the next resource model update. This includes all drilling to the end of the June 2023 season. Los Azules Michael Meding VP & GM - McEwen Copper The updated resource increases the contained copper by 7.3% in the Indicated and 38.3% in the Inferred categories * Gold and silver grades and contained metals are only reported in the primary mineralization. MM0 LW1

MUX PEA Highlights Reviewed several opportunities – with strategic analysis based on NPV, IRR and payback Base Case – 175,000 tonnes LME Grade A copper cathode production annually Demonstration of Scalability - 125,000 tonnes LME Grade A copper cathode production annually Project defined as a Heap Leach facility using commercially available bioleaching and SXEW technology to recover copper Mining using extensive electrification – trolley - assisted haulage, electric shovels Project Metric Base Case 175k tpa Cu Alt. Case 125k tpa Cu Mine Life 27 yrs 32 yrs Strip Ratio 1.16 1.16 Copper Production – cathode 3,938 Ktonnes 3,938 Ktonnes Initial Capital Cost $2,462 Million $2,153 Million Sustaining Capital Cost $2,243 Million $2,351 Million C1 Costs (Life of Mine) $1.07 / lb Cu $1.11/ lb Cu All - in Sustaining Costs (AISC) $1.64 / lb Cu $1.67 / lb Cu Internal Rate of Return (IRR) 21.2 % 18.4 % Net Present Value (NPV) @ 8% $2,659 Million $1,929 Million Pay Back Period 3.2 yrs 3.4 yrs Los Azules Michael Meding VP & GM - McEwen Copper MM0

MUX Industry - leading Expected Cost in the Lowest Quartile (Source: S&P Capital IQ Mine Economics Market Intelligence 2022 Data, SE Analysis) Los Azules Michael Meding VP & GM - McEwen Copper C1 Cash Cost per lb Cu by AssetMM0

MUX GHG Emissions Expected in Lowest Quartile With Further Improvement Potential Los Azules Michael Meding VP & GM - McEwen Copper 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Total Intensity 12k 11k 10k 9k 8k 7k 6k 5k 4k 3k 2k 1k 0 Los Azules 2023 Base Case 670 KgCO 2 e/ tCu EQ Los Azules 2023 Alt Case 826 KgCO 2 e/ tCu EQ Los Azules 2017 1,560 kgCO 2 e/ tCu EQ

MUX 2023/2024 Program - Feasibility Study Next Steps Los Azules Michael Meding VP & GM - McEwen Copper Drilling program slated to be 45,000 meters in the 2023 - 2024 campaign 01 Resource Model Upgrade Complete infill drilling and incorporate drill results into new model, developing a significant measured mineral resource with focus on the initial 5 yrs of production ; continue to upgrade Inferred to Indicated . 02 Complete Metallurgical Testing Complete comprehensive metallurgical testing program for feasibility. Continue testing Nuton TM Technology for leaching of Primary copper mineralization. 03 Execute Geotechnical, Hydrogeological & Engineering Studies Complete these studies to a feasibility level of definition, including incorporation of sustainability elements to achieve net - zero by 2038 . 04 Complete Basic Engineering Design Update leach pad, processing plant & infrastructure designs to feasibility level development .

MUX Los Azules Org Chart – Executive Team – strong international and local expertise • 180 years of combined experience in mining projects and operations. • Strong team with experience in San Juan Argentina at top tier operations

Closing Remarks Rob McEwen Chairman & Chief Owner

MUX Are we Undervalued? Absolutely, Here is What We Believe Between US $8 and $35 Current Share Price $6.85 Based on recent market valuations / transactions June 28, 2023 MUX’s Underlying Value

MUX Low High McEwen Copper 2 Los Azules $2.47 3 $25.14 4 Elder Creek $0.31 5 $0.31 5 Royalty Portfolio $0.69 6 $0.69 6 Gold & Silver $4.66 7 $9.32 8 $8.15 $35.46 We Believe MUX’s Underlying Value Sum of the Parts @ June 28, 2023 Notes 1. McEwen Mining has 51 million fully diluted shares 2. McEwen Mining owns 51.9% of McEwen Copper which owns 100% of Los Azules and Elder Creek 3. Josemaria purchase price was US $485 million. (US $485M x 50% x 51.9%) / 51M 4. Filo Mining market capitalization US $2.47 billion. (US $2.47 B x 51.9%) / 51M. As of June 2 8 , 2023. 5. Elder Creek value is based on earn - in (($18M / 60%) x 51.9%) / 51M 6. Royalties: 1.25% NSR on Los Azules and Elder Creek, plus three other royalties. Est. $35M / 51M 7. Average peer group EV/GEO x 50% of the high value 8. Average peer group (Jaguar Mining, Silvercorp , Fortitude, Gold Resource, Endeavour Silver) EV/GEO multiple 1.11 x higher than MUX MUX’s Assets Value Range Per MUX Share 1

Q&A NYSE & TSX

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

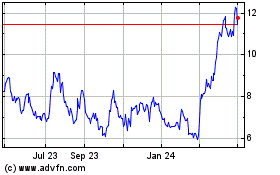

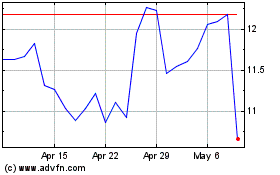

McEwen Mining (NYSE:MUX)

Historical Stock Chart

From Apr 2024 to May 2024

McEwen Mining (NYSE:MUX)

Historical Stock Chart

From May 2023 to May 2024