Quarterly Schedule of Portfolio Holdings of Registered Management Investment Company (n-q)

May 28 2013 - 2:40PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-Q

QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED MANAGEMENT

INVESTMENT COMPANY

|

Investment Company Act file number

|

811-4428

|

|

|

|

|

|

Dreyfus U.S. Treasury Intermediate Term Fund

|

|

|

|

(Exact name of Registrant as specified in charter)

|

|

|

|

|

|

|

|

c/o The Dreyfus Corporation

200 Park Avenue

New York, New York 10166

|

|

|

|

(Address of principal executive offices) (Zip code)

|

|

|

|

|

|

|

|

John Pak, Esq.

200 Park Avenue

New York, New York 10166

|

|

|

|

(Name and address of agent for service)

|

|

|

|

|

Registrant's telephone number, including area code:

|

(212) 922-6000

|

|

|

|

|

Date of fiscal year end:

|

12/31

|

|

|

Date of reporting period:

|

3/31/13

|

|

|

|

|

|

|

|

|

|

FORM N-Q

Item 1. Schedule of Investments.

|

|

|

|

|

|

|

|

STATEMENT OF INVESTMENTS

|

|

|

|

|

Dreyfus U.S. Treasury Intermediate Term Fund

|

|

|

|

|

March 31, 2013 (Unaudited)

|

|

|

|

|

|

|

|

|

Coupon

|

Maturity

|

Principal

|

|

|

Bonds and Notes--99.2%

|

Rate (%)

|

Date

|

Amount ($)

|

Value ($)

|

|

U.S. Government Agencies--8.1%

|

|

|

|

|

|

Federal Home Loan Mortgage Corp.,

|

|

|

|

|

|

Notes

|

0.63

|

12/29/14

|

1,430,000

a

|

1,439,089

|

|

Federal Home Loan Mortgage Corp.,

|

|

|

|

|

|

Notes

|

1.00

|

9/29/17

|

4,100,000

a

|

4,133,165

|

|

NCUA Guaranteed Notes,

|

|

|

|

|

|

Gtd. Notes, Ser. A2

|

1.40

|

6/12/15

|

1,840,000

|

1,881,308

|

|

|

|

|

|

7,453,562

|

|

U.S. Government Agencies/Mortgage-Backed--.1%

|

|

|

|

|

Federal Home Loan Mortgage Corp.:

|

|

|

|

|

|

7.50%, 11/1/29

|

|

|

7,516

a

|

7,754

|

|

Government National Mortgage Association I:

|

|

|

|

|

|

6.00%, 1/15/33

|

|

|

39,063

|

44,653

|

|

6.50%, 5/15/26

|

|

|

18,057

|

20,943

|

|

|

|

|

|

73,350

|

|

U.S. Treasury Bonds--2.2%

|

|

|

|

|

|

8.13%, 8/15/21

|

|

|

1,360,000

b

|

2,075,062

|

|

U.S. Treasury Notes--88.8%

|

|

|

|

|

|

0.25%, 2/15/15

|

|

|

6,720,000

b

|

6,720,786

|

|

0.63%, 7/15/14

|

|

|

3,855,000

b

|

3,876,534

|

|

0.88%, 1/31/17

|

|

|

11,175,000

b

|

11,323,415

|

|

1.50%, 3/31/19

|

|

|

10,395,000

b

|

10,701,164

|

|

2.13%, 12/31/15

|

|

|

11,990,000

|

12,577,330

|

|

2.38%, 10/31/14

|

|

|

2,900,000

|

2,998,556

|

|

2.63%, 7/31/14

|

|

|

5,420,000

|

5,595,939

|

|

2.63%, 8/15/20

|

|

|

8,490,000

b

|

9,274,663

|

|

3.00%, 9/30/16

|

|

|

4,615,000

|

5,020,977

|

|

3.13%, 5/15/21

|

|

|

6,355,000

|

7,156,823

|

|

3.88%, 5/15/18

|

|

|

5,980,000

b

|

6,909,705

|

|

|

|

|

|

82,155,892

|

|

Total Bonds and Notes

|

|

|

|

|

|

|

|

|

|

|

|

|

(cost $90,339,431)

|

|

|

91,757,866

|

|

|

|

Short-Term Investments--.1%

|

|

|

|

|

U.S. Treasury Bills;

|

|

|

|

|

|

0.09%, 7/25/13

|

|

|

|

|

|

(cost $54,983)

|

55,000

|

c

|

54,988

|

|

|

|

Other Investment--.2%

|

Shares

|

|

Value ($)

|

|

Registered Investment Company;

|

|

|

|

|

Dreyfus Institutional Preferred

|

|

|

|

|

|

Plus Money Market Fund

|

|

|

|

|

|

(cost $198,580)

|

198,580

|

d

|

198,580

|

|

Total Investments

(cost $90,592,994)

|

99.5

|

%

|

92,011,434

|

|

Cash and Receivables (Net)

|

.5

|

%

|

446,548

|

|

Net Assets

|

100.0

|

%

|

92,457,982

|

|

|

|

a

|

The Federal Housing Finance Agency ("FHFA") placed Federal Home Loan Mortgage Corporation and Federal National

|

|

|

|

|

Mortgage Association into conservatorship with FHFA as the conservator. As such, the FHFA oversees the continuing

|

|

|

|

|

affairs of these companies.

|

|

|

|

|

b

|

Security, or portion thereof, on loan. At March 31, 2013, the value of the fund's securities on loan was $38,107,368

|

|

|

|

|

and the value of the collateral held by the fund was $40,023,440, consisting of U.S. Government and agency

|

|

|

|

|

securities.

|

|

|

|

|

c

|

Held by or on behalf of a counterparty for open financial futures positions.

|

|

|

|

|

d

|

Investment in affiliated money market mutual fund.

|

|

|

|

|

|

|

At March 31, 2013, net unrealized appreciation on investments was $1,418,440 of which $1,557,947 related to appreciated investment

|

|

|

|

securities and $139,507 related to depreciated investment securities. At March 31, 2013, the cost of investments for federal income

|

|

|

|

tax purposes was substantially the same as the cost for financial reporting purposes.

|

|

|

|

|

|

|

Portfolio Summary (Unaudited) †

|

|

|

Value (%)

|

|

U.S. Government & Agencies/Mortgage-Backed

|

|

|

99.2

|

|

Short-Term/Money Market Investments

|

|

|

.3

|

|

|

|

|

|

99.5

|

|

† Based on net assets.

|

|

|

|

|

|

|

|

|

|

|

|

|

STATEMENT OF FINANCIAL FUTURES

|

|

|

|

|

|

|

|

March 31, 2013 (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

Market Value

|

|

|

Unrealized

|

|

|

|

|

Covered by

|

|

|

(Depreciation)

|

|

|

|

Contracts

|

Contracts ($)

|

|

Expiration

|

at 3/31/2013

|

($)

|

|

|

|

Financial Futures Short

|

|

|

|

|

|

|

|

U.S. Treasury 10 Year Notes

|

2

|

(263,969

|

)

|

June 2013

|

(875

|

)

|

The following is a summary of the inputs used as of March 31, 2013 in valuing the fund's investments:

|

|

|

|

|

|

|

|

|

|

|

|

Level 3 -

|

|

|

|

|

Level 1 -

|

Level 2 - Other

|

Significant

|

|

|

|

|

Unadjusted Quoted

|

Significant

|

Unobservable

|

|

|

|

Assets ($)

|

Prices

|

Observable Inputs

|

Inputs

|

Total

|

|

|

Investments in Securities:

|

|

|

|

|

|

|

Mutual Funds

|

198,580

|

-

|

-

|

198,580

|

|

|

U.S. Government Agencies/Mortgage-Backed

|

-

|

7,526,912

|

-

|

7,526,912

|

|

|

U.S. Treasury

|

-

|

84,285,942

|

-

|

84,285,942

|

|

|

Liabilities ($)

|

|

|

|

|

|

|

Other Financial Instruments:

|

|

|

|

|

|

|

Financial Futures++

|

(875

)

|

-

|

-

|

(875

|

)

|

|

+ See Statement of Investments for additional detailed categorizations.

|

|

|

|

|

|

++ Amount shown represents unrealized (depreciation) at period end.

|

|

|

|

|

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) is the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”)

recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the Securities and Exchange

Commission (“SEC”) under authority of federal laws are also sources

of authoritative GAAP for SEC registrants. The fund's financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions. Actual results could differ from those estimates.

Portfolio valuation: The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e. the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value. This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

Various inputs are used in determining the value of the fund’s investments

relating to fair value measurements. These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for

identical investments.

Level 2—other significant observable inputs (including quoted

prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s

own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. Valuation techniques

used to value the fund’s investments are as follows:

Investments in debt securities excluding short-term investments (other than U.S. Treasury Bills) are valued each business day by an independent

pricing service (the “Service”) approved by the Board of Trustees.

Investments for which quoted bid prices are readily available and are representative of the bid side of the market in the judgment of the Service

are valued at the mean between the quoted bid prices (as obtained by the Service from dealers in such securities) and asked prices (as calculated by the Service based upon its evaluation of the market for such securities). Other investments are valued as determined by the Service, based on methods which include consideration of the following: yields or prices of securities of comparable quality, coupon, maturity and type; indications as to values from dealers; and general market conditions. These securities are generally categorized within Level 2 of the fair value hierarchy.

U.S. Treasury Bills are valued at the mean price between quoted bid prices and asked prices by the Service. These securities are generally categorized within Level 2 of the fair value hierarchy.

The Service’s procedures are reviewed by Dreyfus under the general

supervision of the Board of Trustees.

Pursuant to a securities lending agreement with The Bank of New York Mellon, the fund may lend securities to qualified institutions. It

is the fund’s policy that, at origination, all loans are secured by collateral

of at least 102% of the value of U.S. securities loaned and 105% of the value of foreign securities loaned. Collateral equivalent to at least 100% of the market value of securities on loan is maintained at all times. Collateral is either in the form of cash, which can be invested in certain money market mutual funds managed by the Manager, U.S. Government and Agency securities or letters of credit. The fund is entitled to receive all income on securities loaned, in addition to income earned as a result of the lending transaction. Although each security loaned is fully collateralized, the fund bears the risk of delay in recovery of, or loss of rights in, the securities loaned should a borrower fail to return the securities in a timely manner.

Derivatives: A derivative is a financial instrument whose performance is derived from the performance of another asset. Each type of derivative instrument that was held by the fund during the period ended March 31, 2013 is discussed below.

Futures Contracts: In the normal course of pursuing its investment objective, the fund is exposed to market risk, including interest rate risk as a result of changes in value of underlying financial instruments. The fund invests in financial futures contracts in order to manage its exposure to or protect against changes in the market. A futures contract represents a commitment for the future purchase or a sale of an asset at a specified date. Upon entering into such contracts, these investments require initial margin deposits with a broker, which consist of cash or cash equivalents. The amount of these deposits is determined by the exchange or Board of Trade on which the contract is traded and is subject to change. Accordingly, variation margin payments are received or made to reflect daily unrealized gains or losses which are recorded in the Statement of Operations. When the contracts are closed, the fund recognizes a

realized gain or loss. There is minimal counterparty credit risk to the

fund with futures since futures are exchange traded, and the exchange’s

clearinghouse guarantees the futures against default.

Additional investment related disclosures are hereby incorporated by reference to the annual and semi-annual reports previously filed with the Securities and Exchange Commission on Form N-CSR.

Item 2. Controls

and Procedures.

(a) The

Registrant's principal executive and principal financial officers have

concluded, based on their evaluation of the Registrant's disclosure controls

and procedures as of a date within 90 days of the filing date of this report, that

the Registrant's disclosure controls and procedures are reasonably designed to

ensure that information required to be disclosed by the Registrant on Form N-Q

is recorded, processed, summarized and reported within the required time

periods and that information required to be disclosed by the Registrant in the

reports that it files or submits on Form N-Q is accumulated and communicated to

the Registrant's management, including its principal executive and principal

financial officers, as appropriate to allow timely decisions regarding required

disclosure.

(b) There

were no changes to the Registrant's internal control over financial reporting

that occurred during the Registrant's most recently ended fiscal quarter that

have materially affected, or are reasonably likely to materially affect, the

Registrant's internal control over financial reporting.

Item 3. Exhibits.

(a) Certifications of principal executive and

principal financial officers as required by Rule 30a-2(a) under the Investment

Company Act of 1940.

FORM N-Q

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934 and the Investment

Company Act of 1940, the Registrant has duly caused this Report to be signed on

its behalf by the undersigned, thereunto duly authorized.

Dreyfus U.S. Treasury

Intermediate Term Fund

|

By:

/s/ Bradley J.

Skpayak

|

|

Bradley J.

Skapyak

President

|

|

Date:

|

May 17, 2013

|

|

|

|

Pursuant

to the requirements of the Securities Exchange Act of 1934 and the Investment

Company Act of 1940, this Report has been signed below by the following

persons on behalf of the Registrant and in the capacities and on the dates

indicated.

|

|

|

|

By:

/s/ Bradley J.

Skapyak

|

|

Bradley J.

Skapyak

President

|

|

Date:

|

May 17, 2013

|

|

|

|

By:

/s/ James

Windels

|

|

James Windels

Treasurer

|

|

Date:

|

May 17, 2013

|

|

|

EXHIBIT INDEX

(a) Certifications of principal executive and principal

financial officers as required by Rule 30a-2(a) under the Investment Company

Act of 1940. (EX-99.CERT)

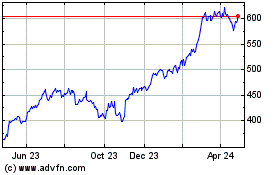

Martin Marietta Materials (NYSE:MLM)

Historical Stock Chart

From Jun 2024 to Jul 2024

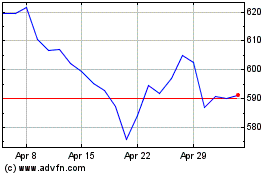

Martin Marietta Materials (NYSE:MLM)

Historical Stock Chart

From Jul 2023 to Jul 2024